Stone Energy Corp

Latest Stone Energy Corp News and Updates

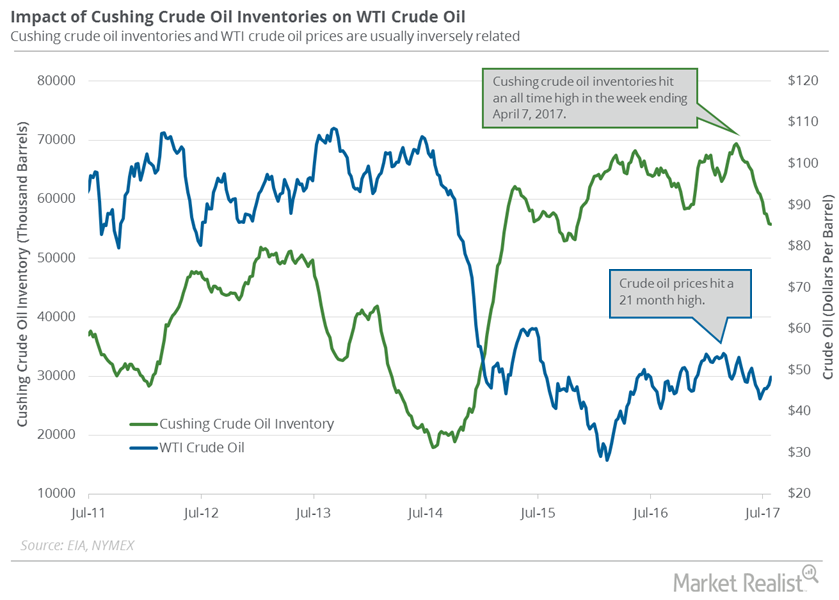

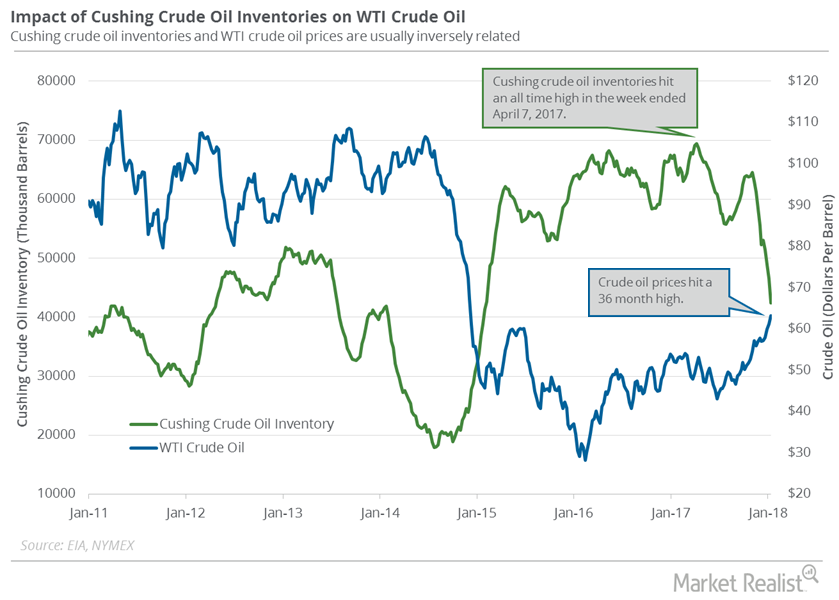

Cushing Inventories Rise for the First Time in 12 Weeks

Cushing is the largest crude oil storage hub in the United States. A market survey estimates that Cushing inventories fell from August 4 to August 11.

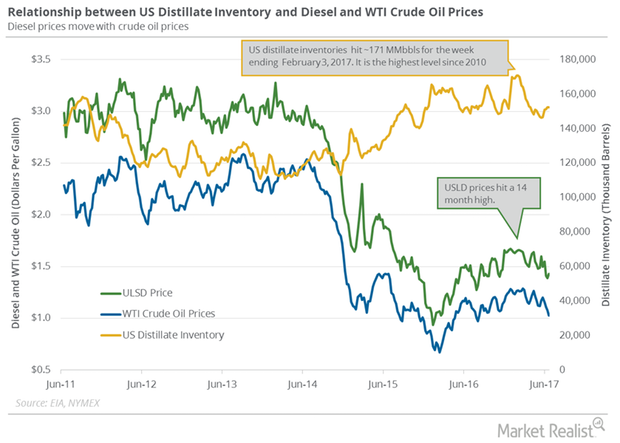

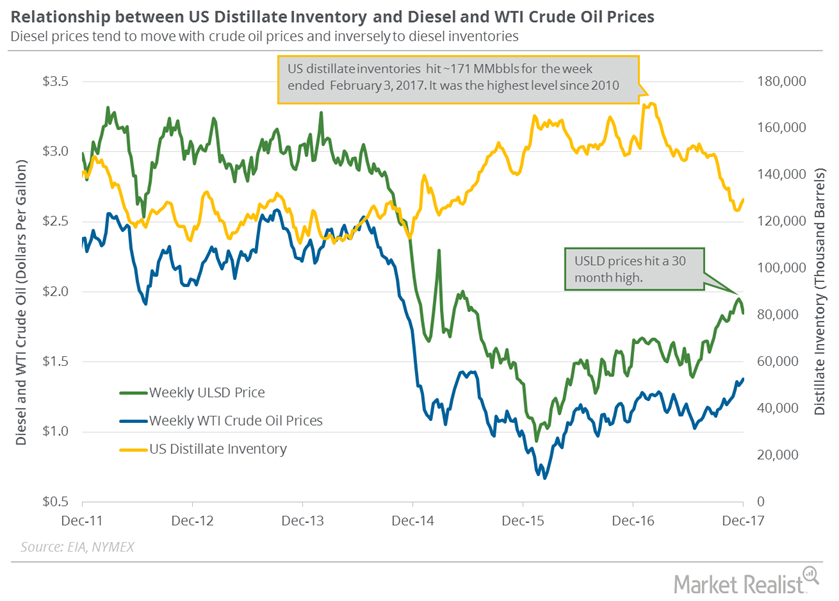

US Distillate Inventories Fell for the First Time in 5 Weeks

The fall in distillate inventories supported diesel and crude oil futures on June 28, 2017. US diesel futures rose 1.4% to $1.43 per gallon on June 28.

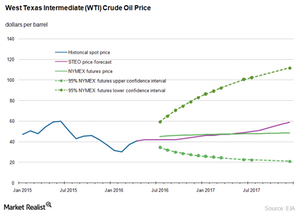

Why Goldman Sachs Revised Its Crude Oil Price Forecast

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages.

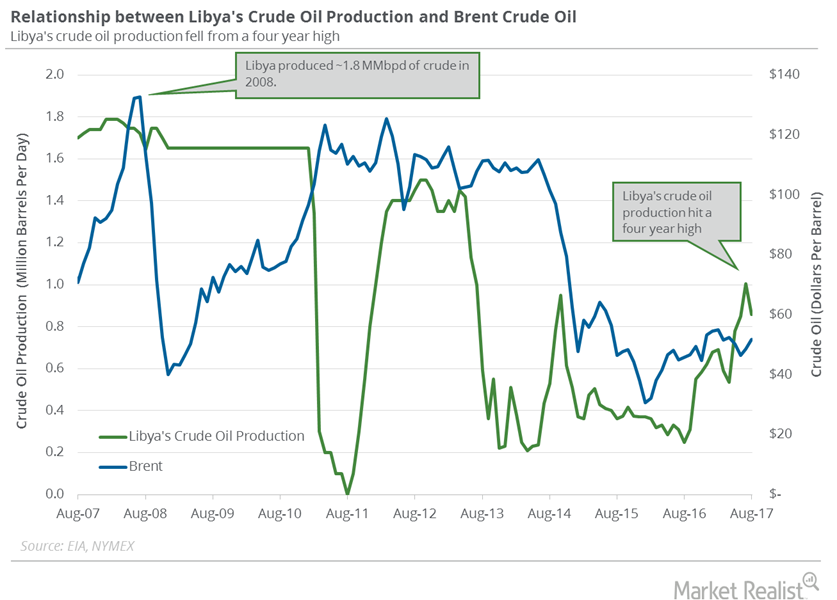

What to Expect from Libya’s Crude Oil Production in September

The EIA estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

Traders Focus on the API and EIA’s Crude Oil Inventories

On May 16, 2017, the API released its weekly crude oil inventory report. US crude oil inventories rose by 0.8 MMbbls (million barrels) on May 5–12, 2017.

Kurdistan Referendum: Time to Buy Crude Oil Futures?

On September 25, 2017, the people in Kurdistan voted in a referendum for independence. As a result, Turkey blocked 500,000 bpd of crude oil exports.

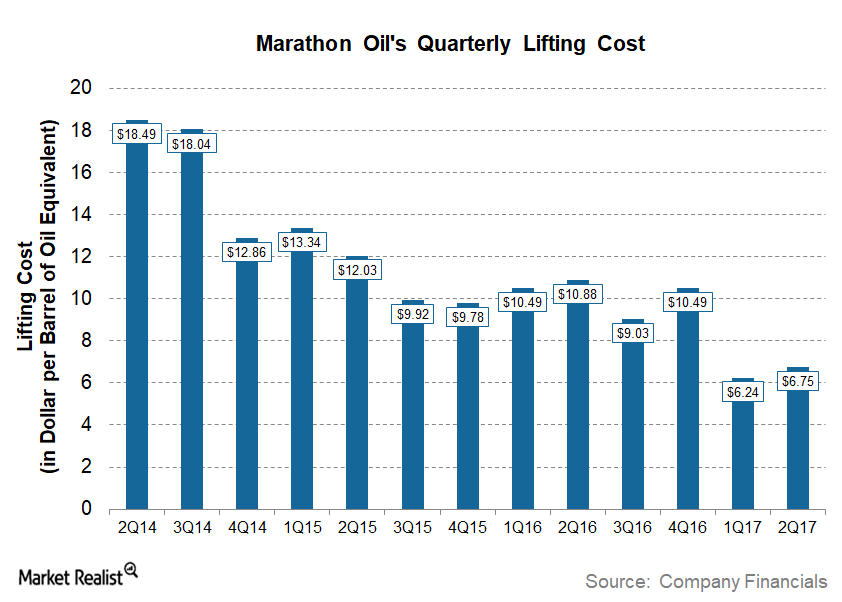

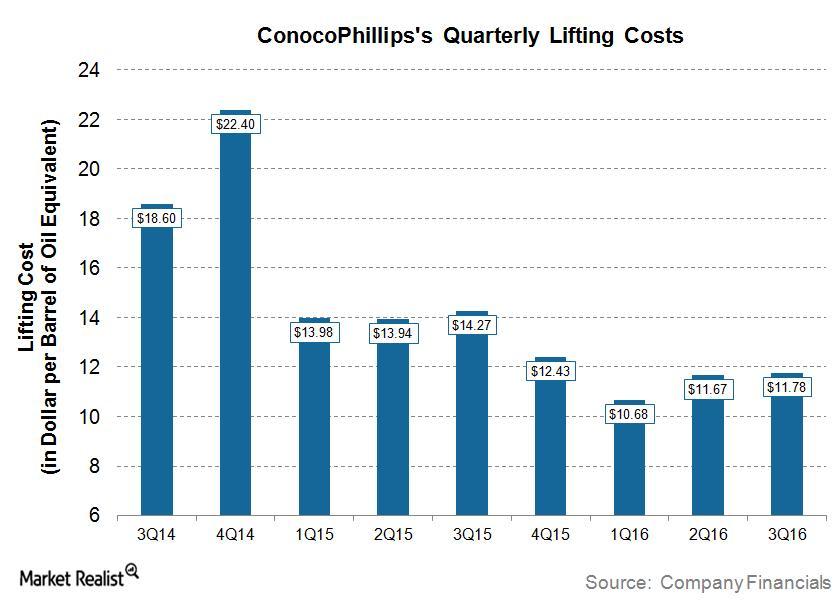

Marathon Oil’s Lifting Costs

In 2Q17, Marathon Oil’s (MRO) reported a lifting cost of ~$6.75 per boe (barrel of oil equivalent), which is ~28.0% lower than its 2Q16 lifting cost of ~$10.88.

Geopolitical Tensions Impact Crude Oil Prices

On October 3, 2017, Iraq banned selling dollars to Kurdistan’s banks due to the vote in the referendum. Geopolitical tensions could impact crude oil prices.

Are US Distillate Inventories Bearish for Oil Prices?

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017.

Cushing Inventories Hit January 2015 Low

A Bloomberg survey estimates that the crude oil inventories at Cushing could have declined by 2.3 MMbbls (million barrels) on January 12–19, 2018.

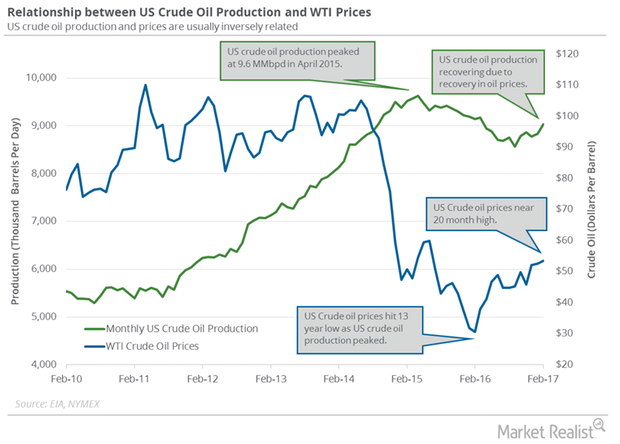

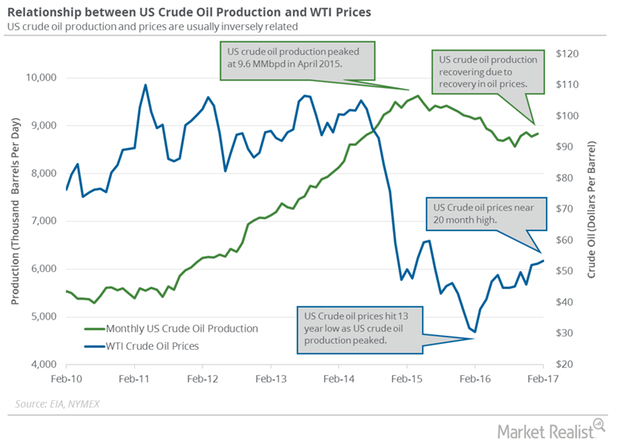

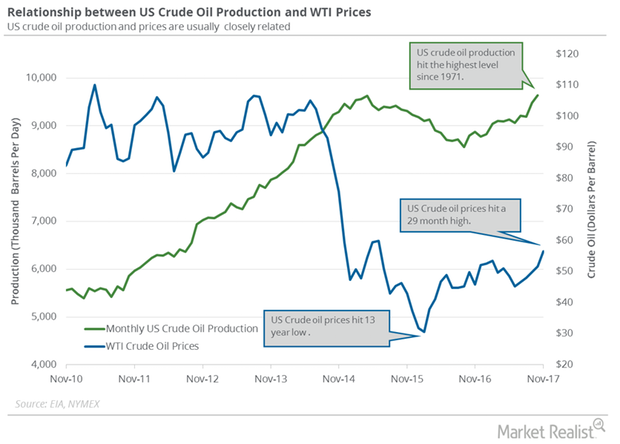

Could US Crude Oil Production Push Production Cut Deal Past 2017?

The EIA reported that monthly US crude oil production rose 196,000 bpd to 9.0 MMbpd in February 2017.

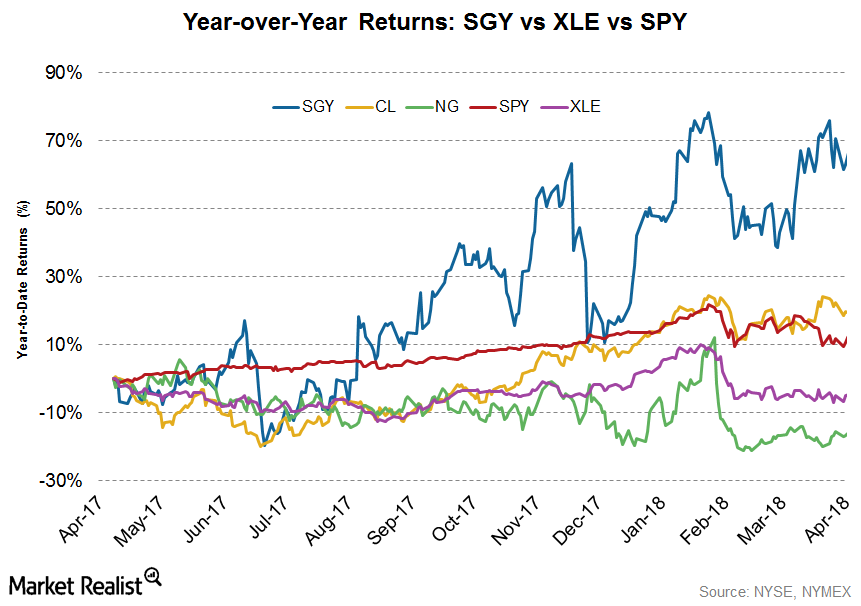

Stone Energy’s Stock Performance in 2018

Stone Energy stock has increased the most among our top five companies. Stone Energy stock has risen 60% YoY (year-over-year).

Monthly US Crude Oil Production Hit May 2016 High

The EIA reported that monthly US crude oil production rose by 60,000 bpd (barrels per day) to 8.8 MMbpd in January 2017—compared to the previous month.

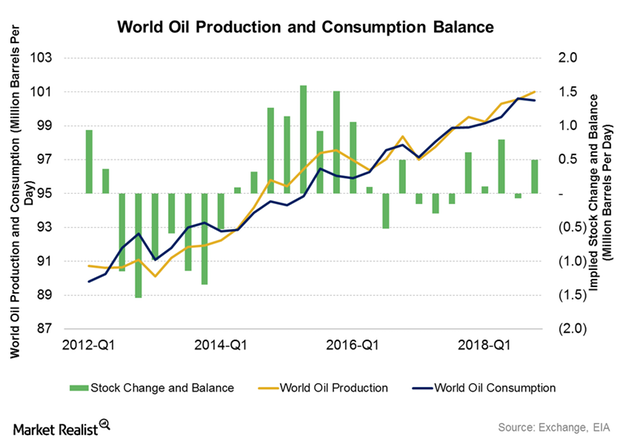

Inside the Global Crude Oil Supply-Demand Gap

The EIA estimated that the global crude oil supply-demand gap averaged 0.58 MMbpd (million barrels per day) in 1H16.

OPEC, Russia, and the US Could Pressure Crude Oil Futures

US crude oil (RYE) (VDE) (SCO) futures contracts for August delivery fell 2.8% and settled at $44.23 per barrel on July 7. Prices are near a ten-month low.

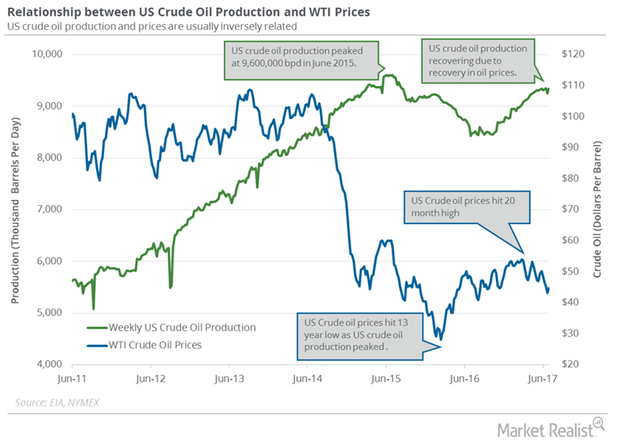

Will US Crude Oil Production Undermine Crude Oil Futures?

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

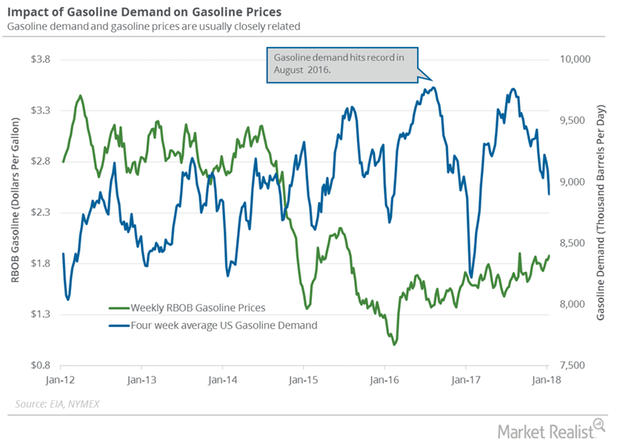

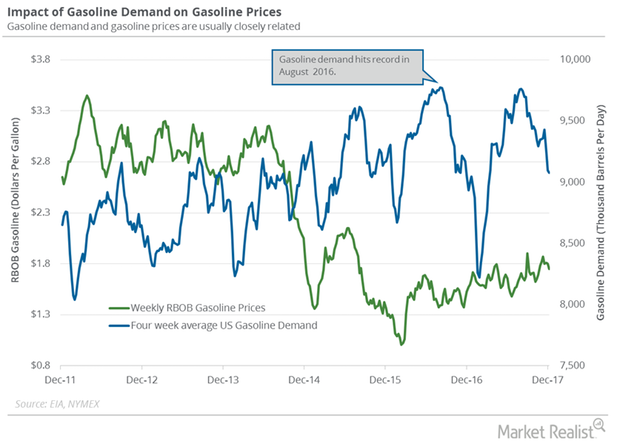

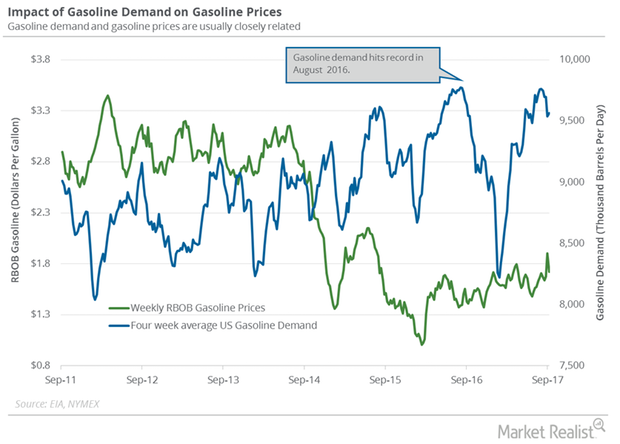

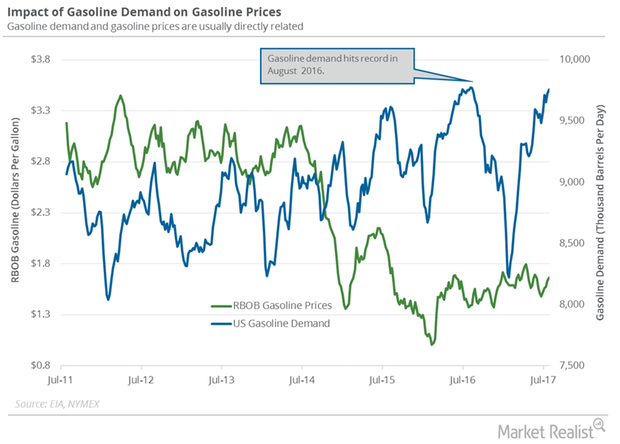

US Gasoline Demand Could Extend the Crude Oil Price Rally

The EIA estimated that four-week average US gasoline demand decreased by 190,000 bpd (barrels per day) to 8,904,000 bpd on January 5–12, 2018.

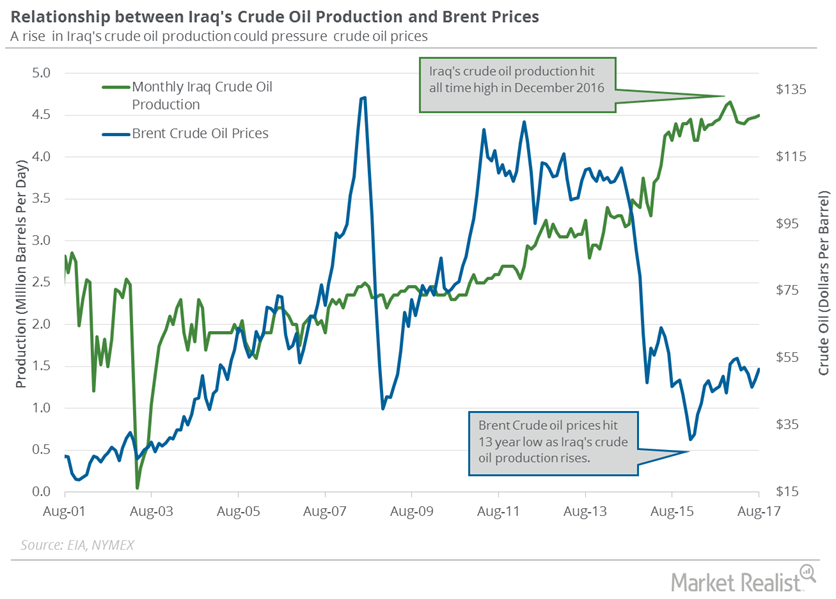

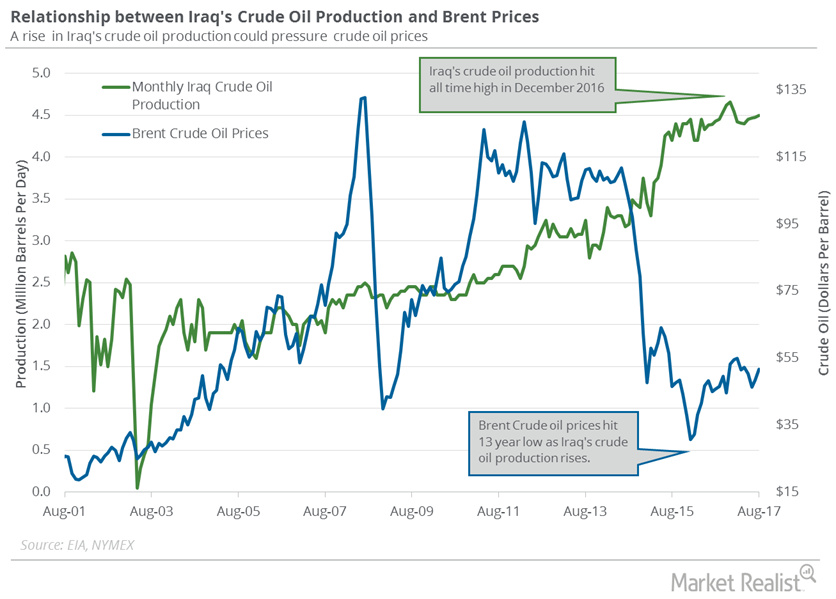

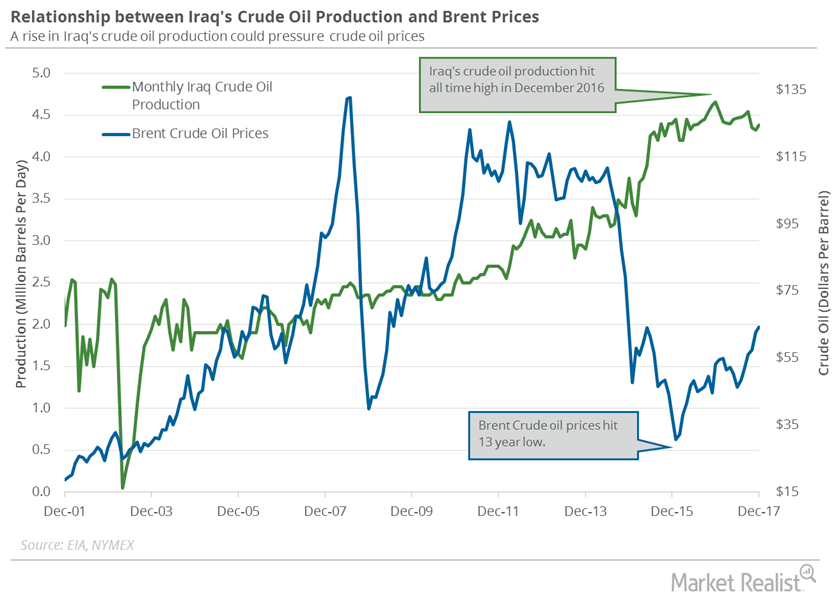

Iraq’s Crude Oil Production Capacity Could Hit 5 MMbpd

The EIA estimated that Iraq’s crude oil production increased by 60,000 bpd to 4,380,000 bpd in December 2017—compared to the previous month.

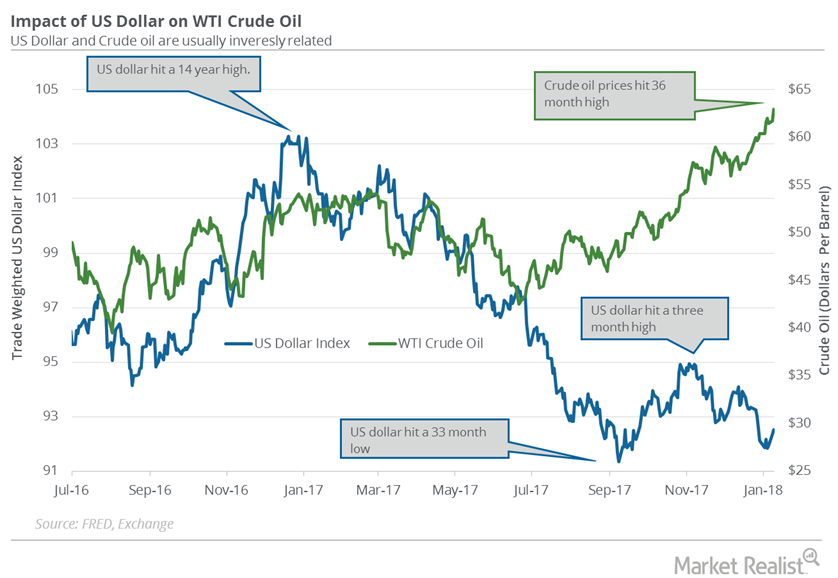

US Dollar Recovering from 3-Month Low: Bearish for Crude Oil?

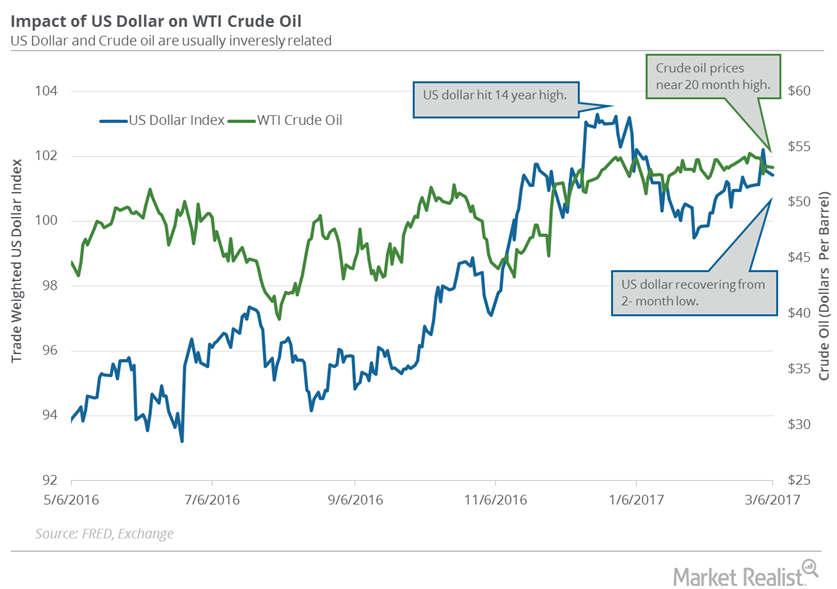

The US Dollar Index fell ~9.8% in 2017. The dollar fell partly due to the improving economy outside the US. It was the worst annual drop since 2003.

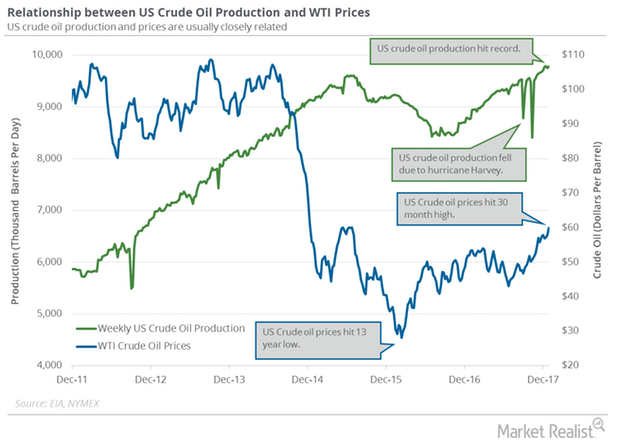

US Crude Oil Output Hit the Highest Level since May 1971

US crude output increased by 167,000 bpd to 9.64 MMbpd in October 2017—compared to the previous month. It was the highest level since May 1971.

US Gasoline’s Demand Trend Is Changing

The EIA estimates that four-week average US gasoline demand fell by 21,000 bpd (barrels per day) to 9.1 MMbpd on December 1–8, 2017.

US Gasoline Demand Could Fall in 2018

The EIA estimates that weekly US gasoline demand rose by 456,000 bpd (barrels per day) to 9.6 MMbpd (million barrels per day) on September 1–8, 2017.

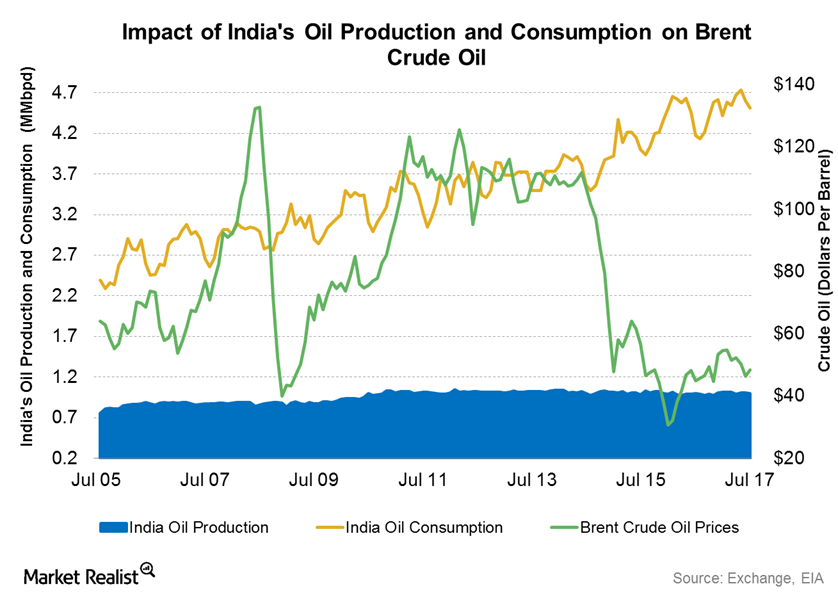

How India’s Crude Oil Imports, Production, Demand Impact Prices

India’s Petroleum Planning and Analysis Cell estimated that the country’s crude oil imports rose 0.60% to 4.2 MMbpd in July 2017 from July 2016.

US Gasoline Demand Hit a Record: What’s Next?

The EIA estimates that weekly US gasoline demand rose by 21,000 bpd (barrels per day) to 9,842,000 bpd on July 21–28, 2017. It’s the highest level ever.

US Dollar Is near a 13-Month Low: What’s Next?

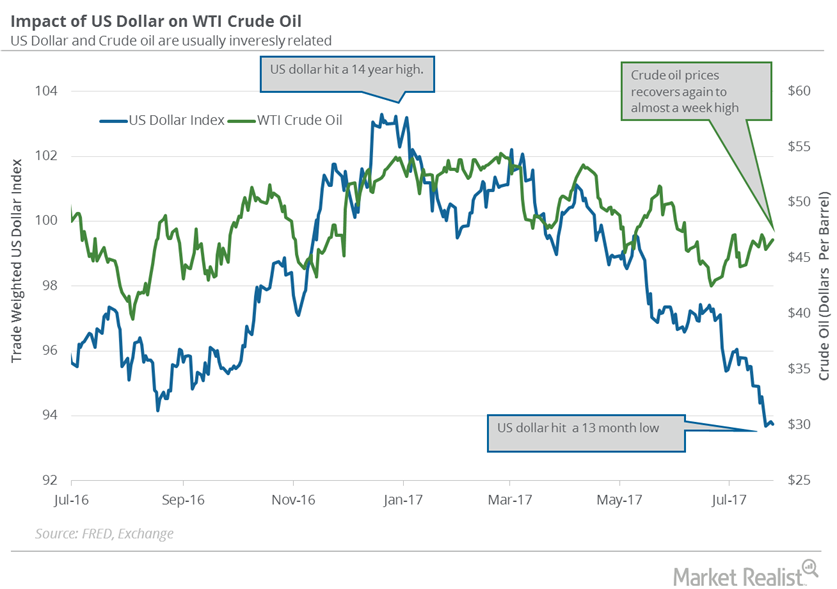

The US dollar hit 93.68 on July 21, 2017—the lowest level in 13 months. The US dollar has fallen more than 8% in 2017.

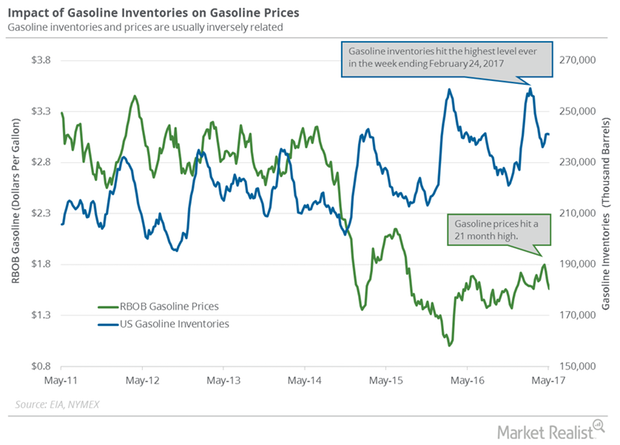

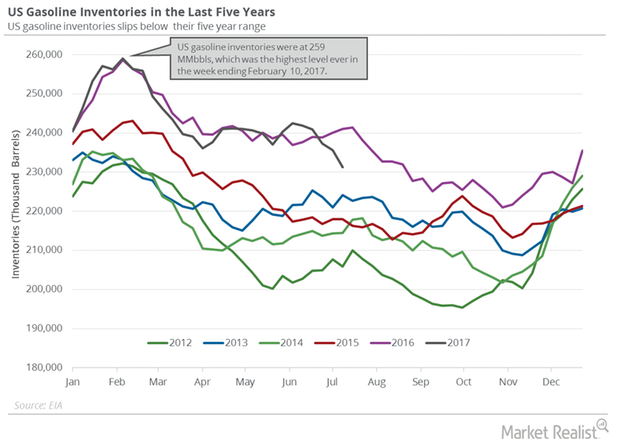

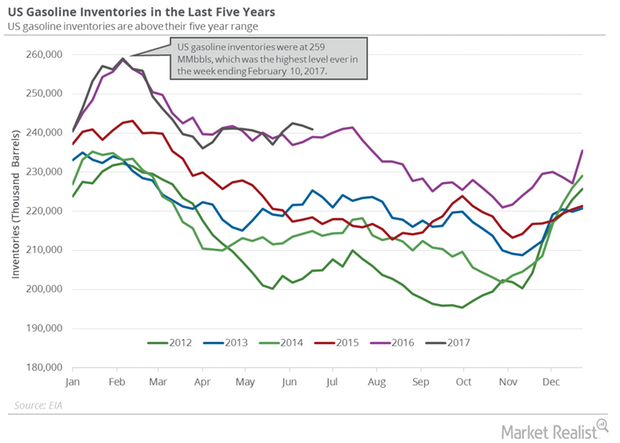

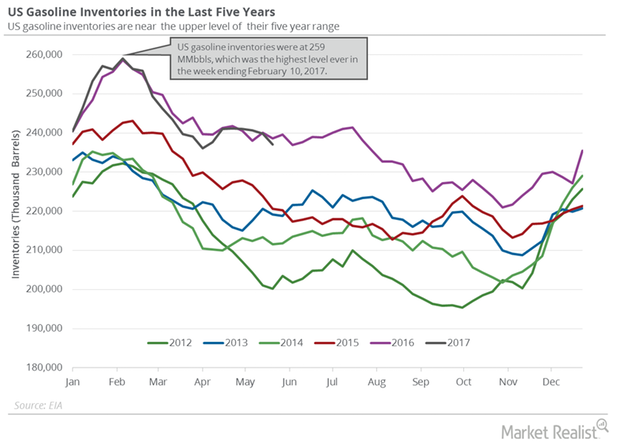

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

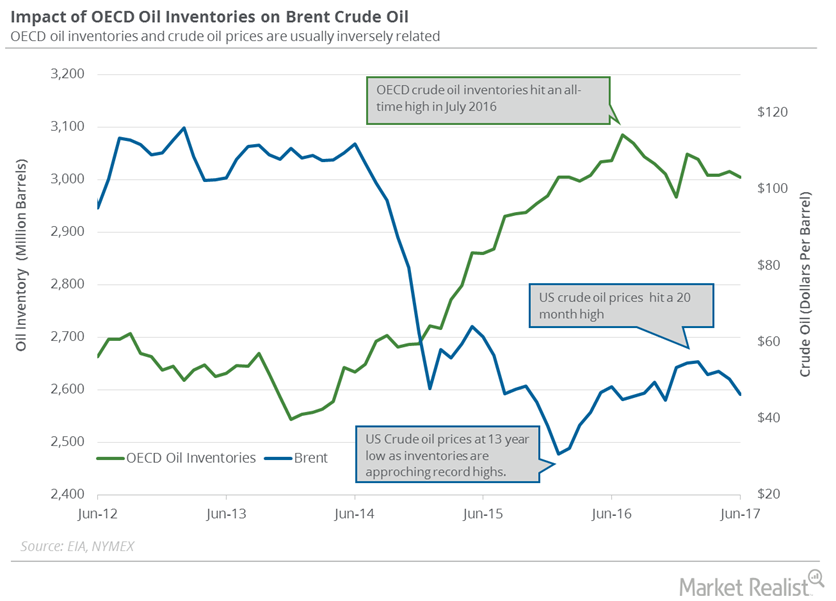

Will OECD’s Crude Oil Inventories Fall below the 5-Year Average?

The EIA estimates that OECD’s crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017.

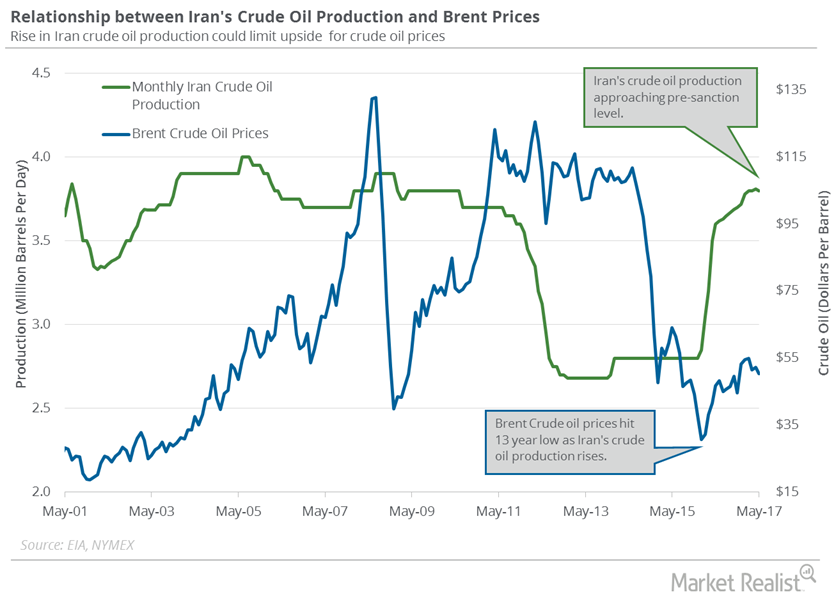

Iran’s Crude Oil Exports and Production: Crucial for Oil Prices

Iran’s crude oil exports are expected to fall 7% in July 2017, according to Reuters. Exports are expected to fall to 1.86 MMbpd in July 2017.

How Long Can US Gasoline Inventories Support Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls to 241 MMbbls on June 16–23, 2017.

US Gasoline Inventories: More Concerns for Crude Oil Prices

US gasoline inventories are 7.2% below their all-time high. The expectation of a fall in gasoline inventories could support gasoline prices.

Janet Yellen and the US Dollar Impacted Crude Oil Prices

The US dollar and crude oil (ERY) (ERX) (DIG) (XES) are usually inversely related. A weaker US dollar makes crude oil more affordable for oil importers.

Analyzing ConocoPhillips’s Lifting Costs

In 3Q16, ConocoPhillips (COP) reported lifting costs of ~$11.78 per boe (barrel of oil equivalent), which is ~17.0% lower than 3Q15.

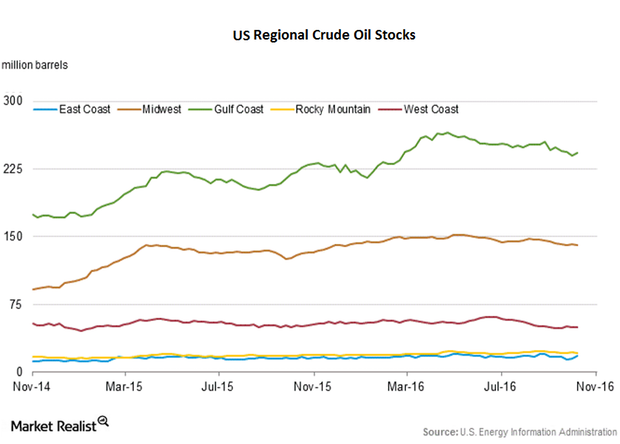

Analyzing US Crude Oil Inventories by Region: The Latest

The EIA divides the United States into five storage regions. Let’s assess the changes in crude oil inventories for these regions between September 30 and October 7.