OPEC, Russia, and the US Could Pressure Crude Oil Futures

US crude oil (RYE) (VDE) (SCO) futures contracts for August delivery fell 2.8% and settled at $44.23 per barrel on July 7. Prices are near a ten-month low.

Nov. 20 2020, Updated 10:46 a.m. ET

US crude oil futures

US crude oil (RYE) (VDE) (SCO) futures contracts for August delivery fell 2.8% and settled at $44.23 per barrel on July 7, 2017. Prices are near a ten-month low.

Brent crude oil futures for September delivery fell 2.9% and closed at $46.7 per barrel on July 7, 2017. US and Brent crude oil futures fell 3.9% and 4.2% last week. Prices fell due to the following:

- US crude oil rigs rose by seven to 763 for the week ending July 7, 2017—17.4% higher than the same period in 2016.

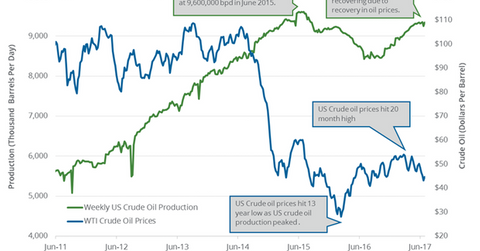

- US crude oil production rose by 88,000 bpd (barrels per day) to 9,338,000 bpd on June 23–30, 2017. It has risen ~10% year-over-year.

- President Trump’s energy plans could pressure the oil market. On July 6, 2017, US Interior Secretary Ryan Zinke signed an order to increase lease sales and to speed up approval permits to explore for oil and gas on government lands.

Lower crude oil prices have a negative impact on oil and gas producers like ConocoPhillips (COP), Chevron (CVX), Stone Energy (SGY), and Denbury Resources (DNR). Read Crude Oil Prices Rise: Is It Time for a Collapse? for more on bearish drivers.

OPEC and Russia

Reuters surveys show that OPEC’s crude oil production rose by 280,000 bpd (barrels per day) to 32.71 MMbpd (million barrels per day) in June 2017—compared to May 2017. It’s the highest level so far in 2017. Likewise, OPEC’s crude oil exports rose by 450,000 bpd to 25.92 MMbpd in June 2017—compared to the previous month. High OPEC production and exports would pressure oil prices.

Russia might not support deeper or longer production cuts. Likewise, Saudi Arabia’s production has risen in recent months. It would pressure oil prices.

OPEC and non-OPEC meeting

The OPEC and non-OPEC monitoring committee meeting will be on July 22, 2017, in Russia. The meeting might cap production levels for Nigeria and Libya. Nigeria and Libya were exempt from production cut in OPEC’s previous meeting.

Crude oil price performance

Prices have fallen 6.3% from the recent high on July 10, 2017. US crude oil prices have fallen 17.5% in the last three months. Fundamentals are still weak and prices could trade lower in the short term.

In this series, we’ll discuss crude oil price drivers in more detail.