Denbury Resources Inc

Latest Denbury Resources Inc News and Updates

Are Oil’s Supply Concerns Rising?

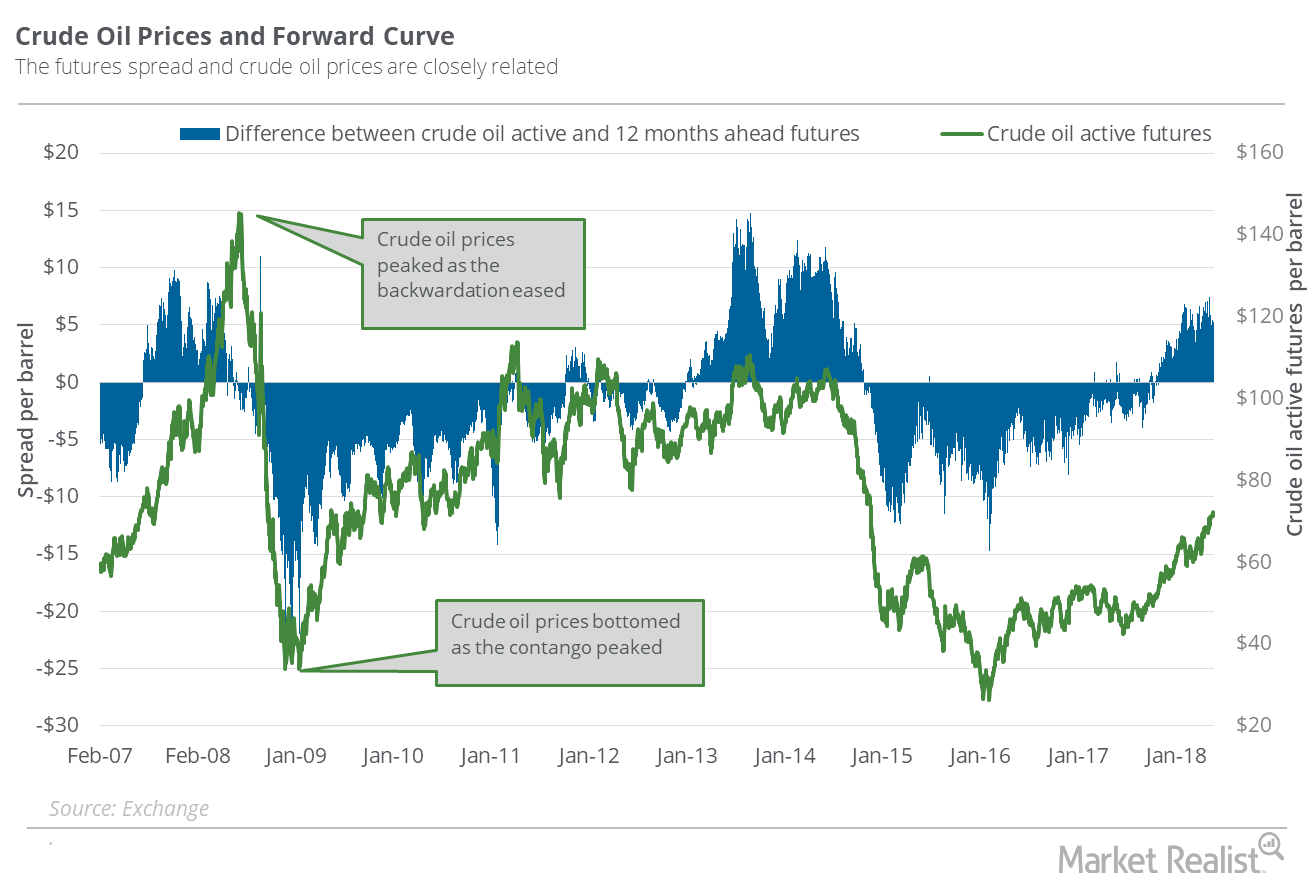

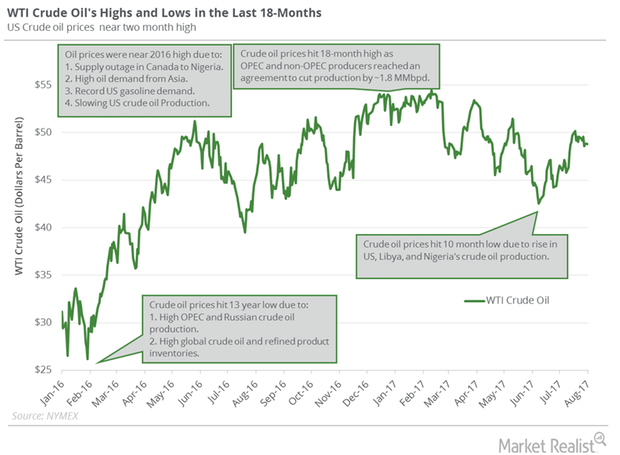

On May 21, US crude oil July futures closed $5.97 above the July 2019 futures contract. On May 14–21, US crude oil July futures rose 1.9%.

Analyzing Denbury Resources’ 1Q16 Earnings Call

For 1Q16, Denbury Resources (DNR) reported an adjusted EBITDA of ~$105 million with an EBITDA margin of ~40%. Its EBITDA margin is only ~20% lower.

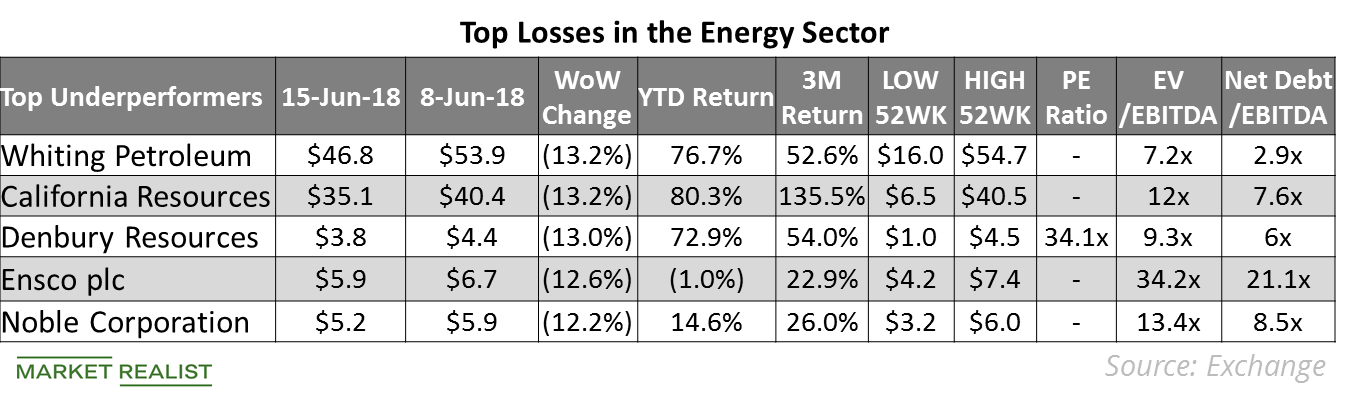

Top Energy Losses Last Week

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

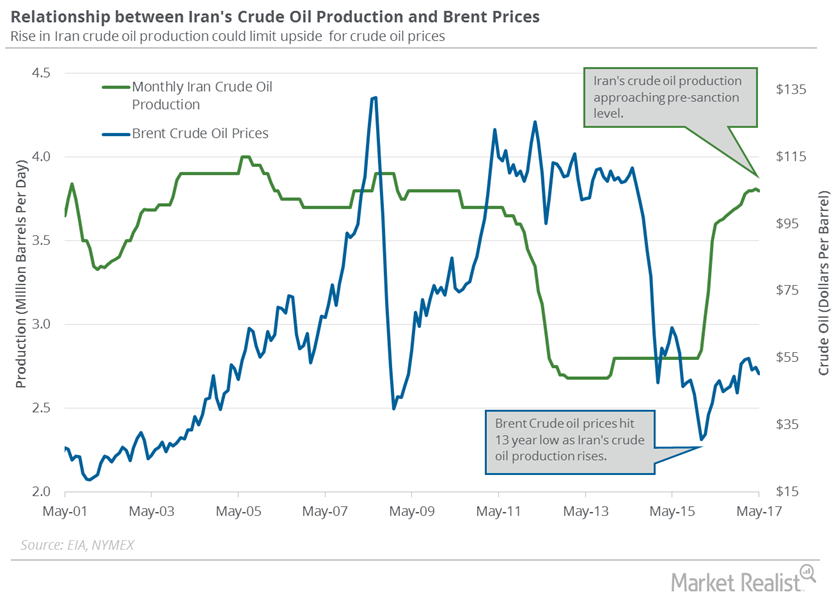

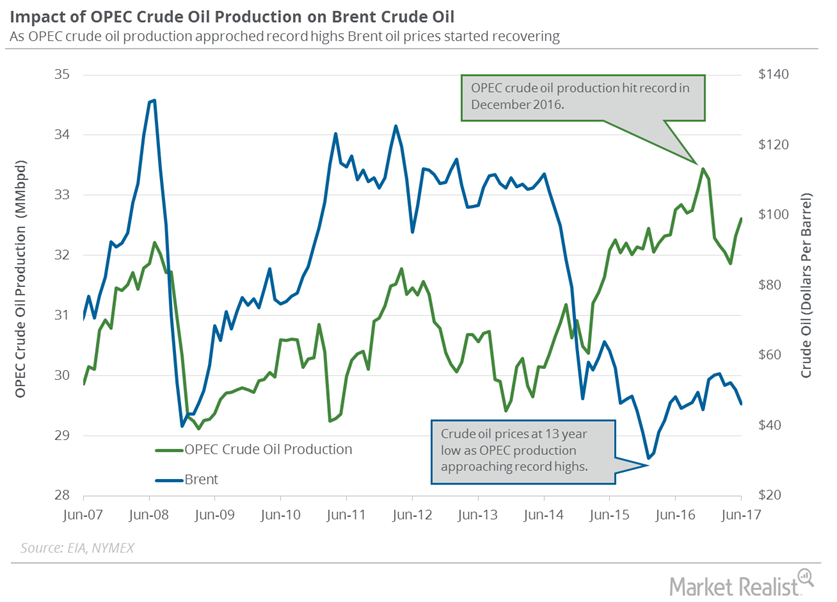

Iran’s Crude Oil Exports Could Impact Crude Oil Prices

The rise in crude oil export capacity suggests that Iran’s getting ready for a massive increase in crude oil production in 2018.

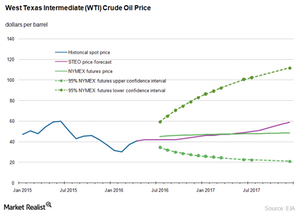

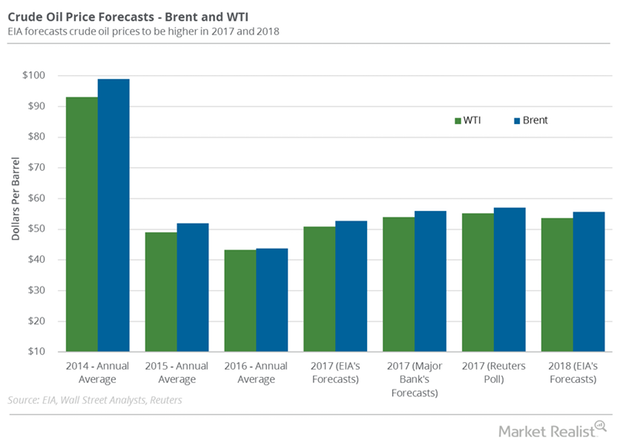

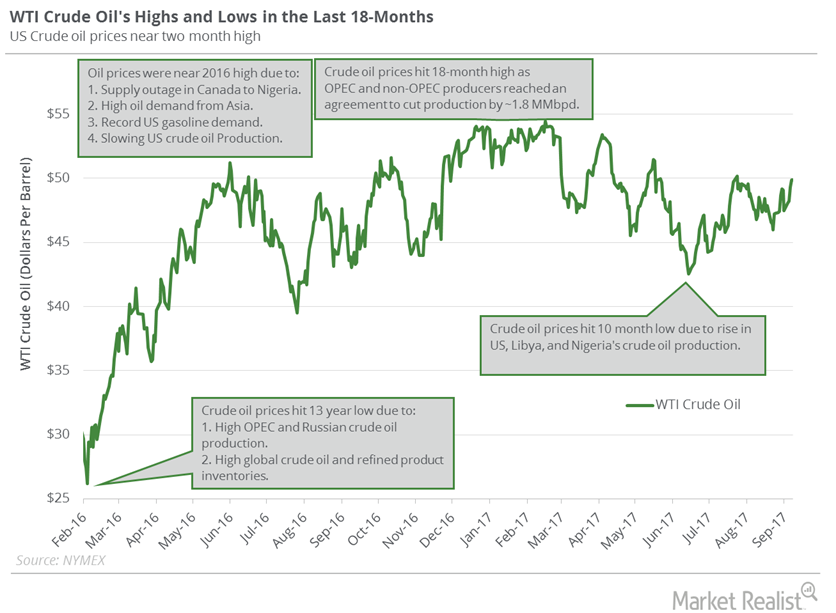

Why Goldman Sachs Revised Its Crude Oil Price Forecast

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages.

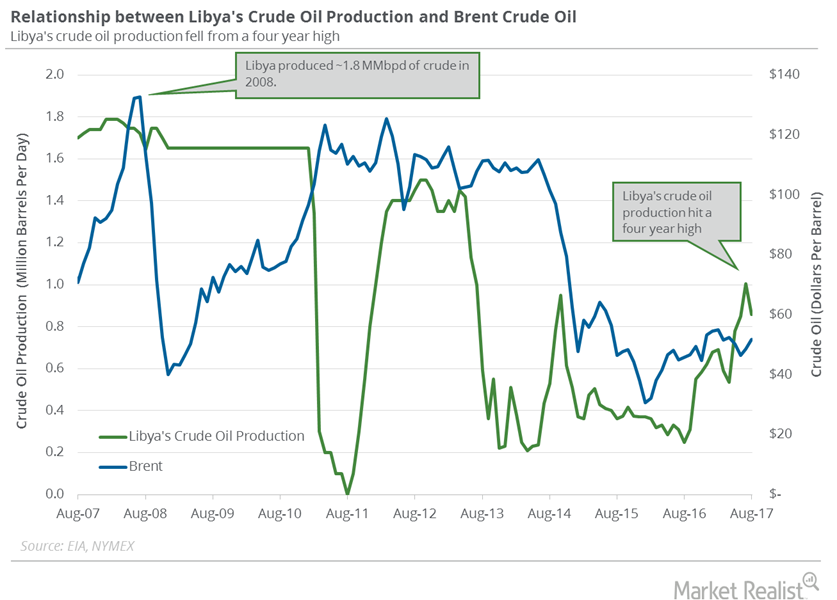

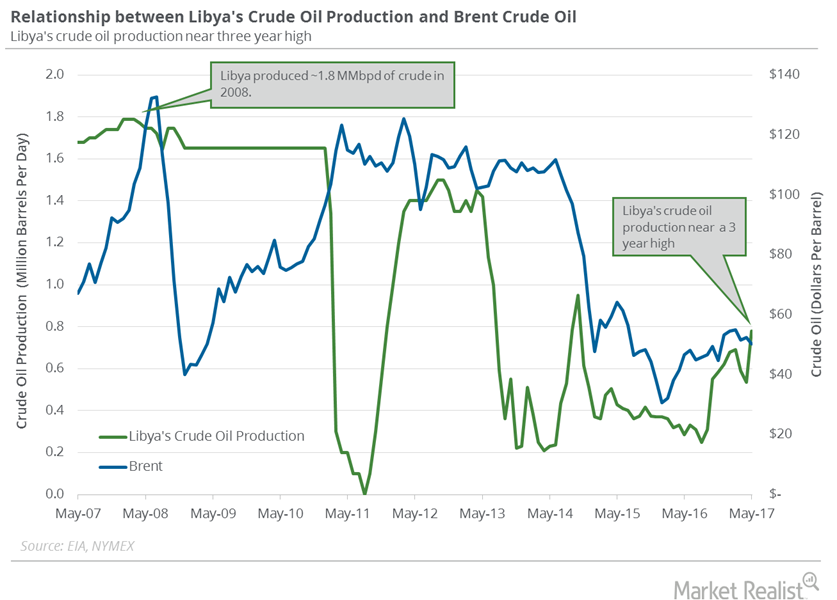

What to Expect from Libya’s Crude Oil Production in September

The EIA estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

Will US Crude Oil Futures Surpass their 200-Day Moving Average?

Let’s track some important events for oil and gas traders from August 14 to 18, 2017.

Traders Focus on the API and EIA’s Crude Oil Inventories

On May 16, 2017, the API released its weekly crude oil inventory report. US crude oil inventories rose by 0.8 MMbbls (million barrels) on May 5–12, 2017.

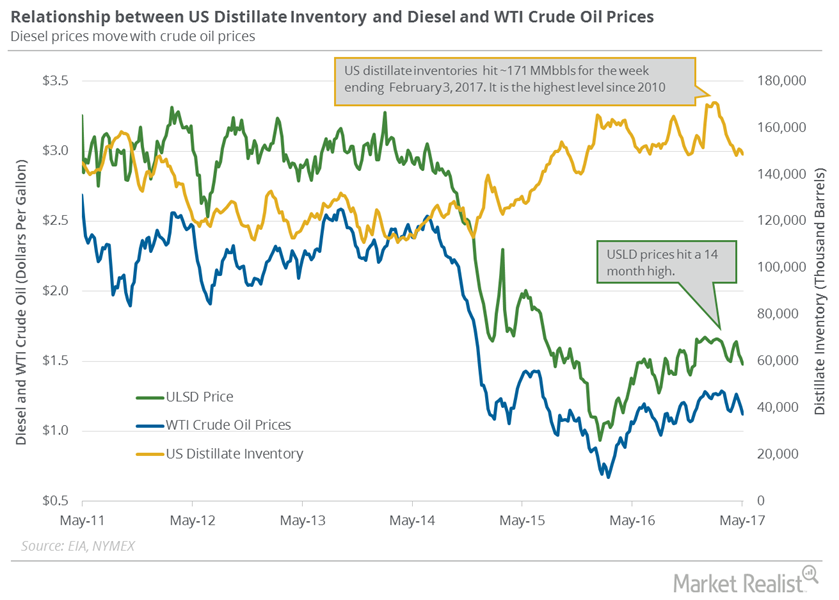

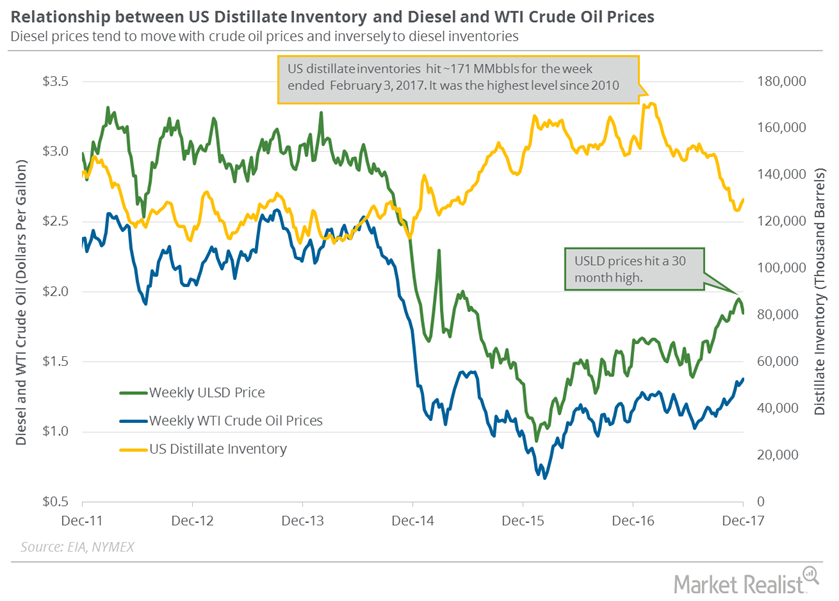

Why Did US Distillate Inventories Fall Again?

June diesel futures contracts rose 2.1% to $1.47 per gallon on May 10, 2017. Prices rose due to the larger-than-expected fall in distillate inventories.

Kurdistan Referendum: Time to Buy Crude Oil Futures?

On September 25, 2017, the people in Kurdistan voted in a referendum for independence. As a result, Turkey blocked 500,000 bpd of crude oil exports.

Why Did Oil Prices Fall?

On March 22, natural gas April 2018 futures declined 0.8% and settled at $2.62 per million British thermal units.

US Crude Oil and Gasoline Futures Moved Together

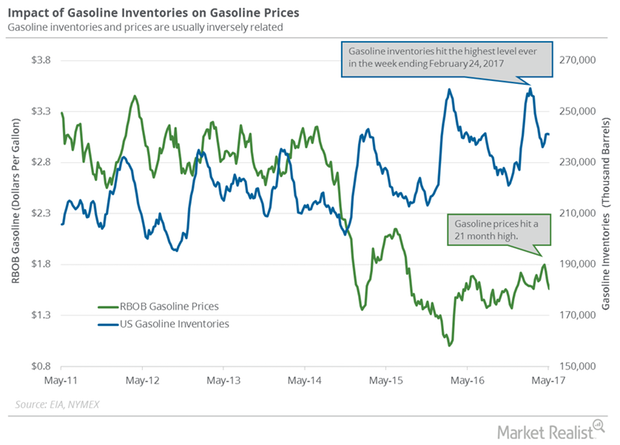

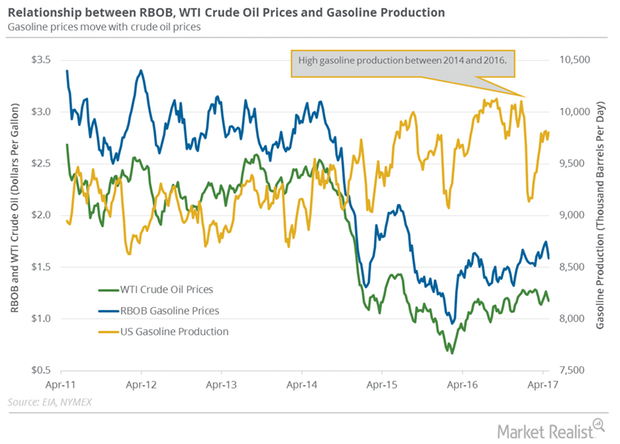

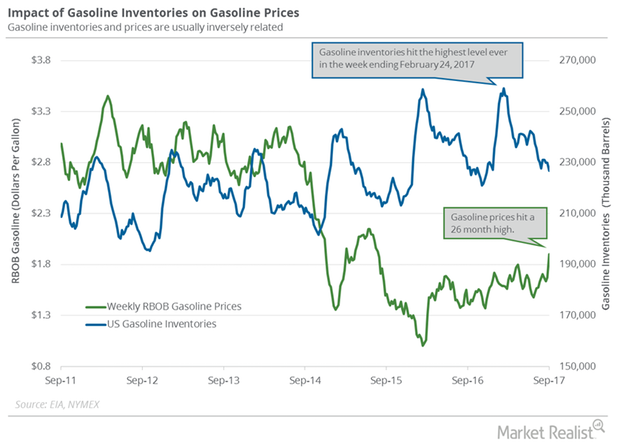

June gasoline futures contracts rose 1.3% to $1.53 per gallon on May 3, 2017. Prices rose due to the less-than-expected rise in US gasoline inventories.

US Gasoline Inventories Fell Less, Pressured Gasoline Prices

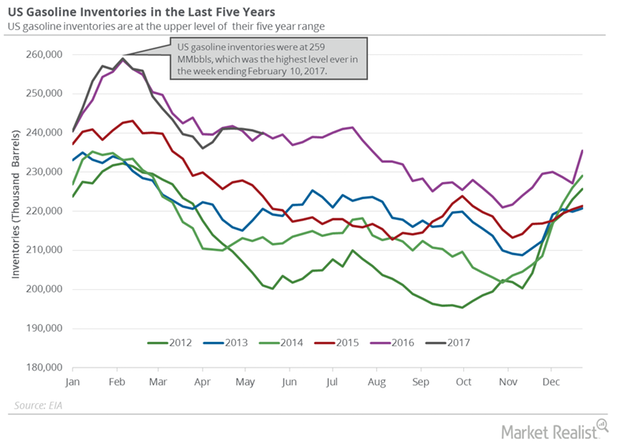

The EIA released its weekly crude oil report on May 24, 2017. US gasoline inventories fell by 0.8 MMbbls to 239.9 MMbbls on May 12–19, 2017.

Will Russia’s Oil Production Fall in the Coming Months?

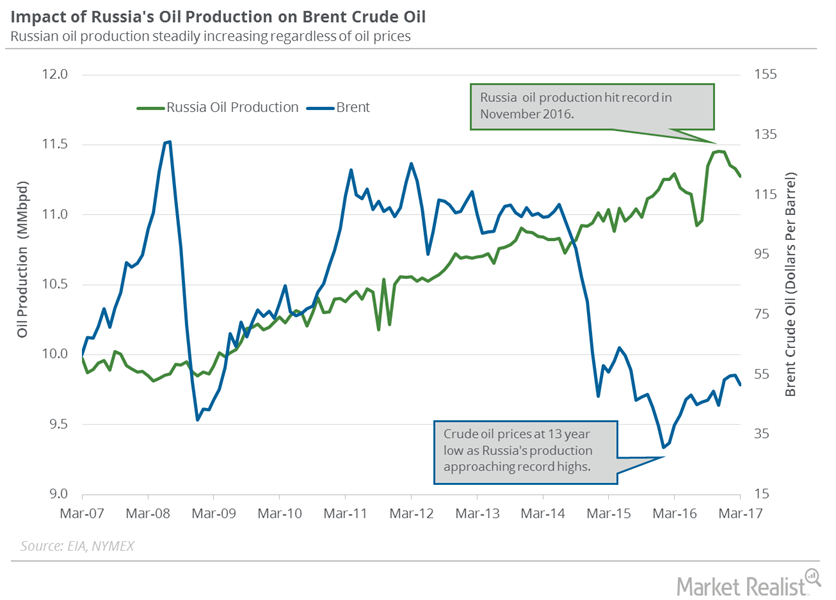

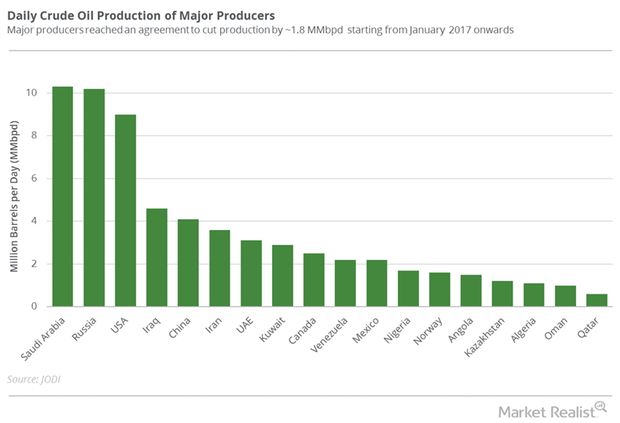

Russia’s Energy Ministry reported that its oil production fell in the first half of April 2017 due to major producers’ production cut deal.

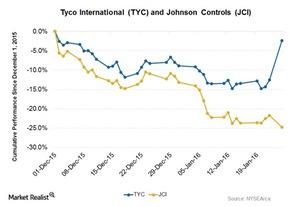

Tyco International to Tie Up with Johnson Controls

Tyco International (TYC) and Johnson Controls (JCI) revealed on Monday, January 25, 2016, that they are going to merge. The news raised TYC stocks that day, while JCI fell 3.9%.

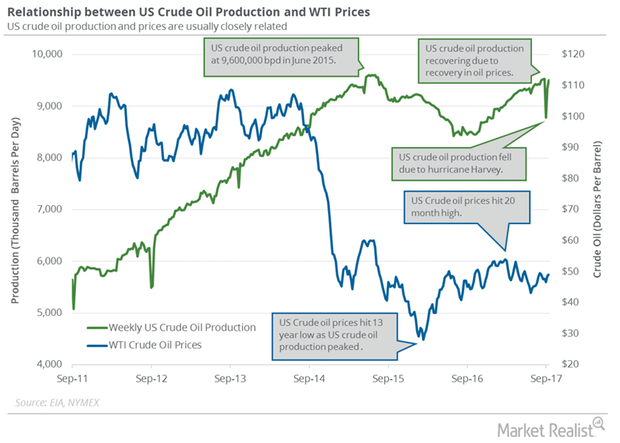

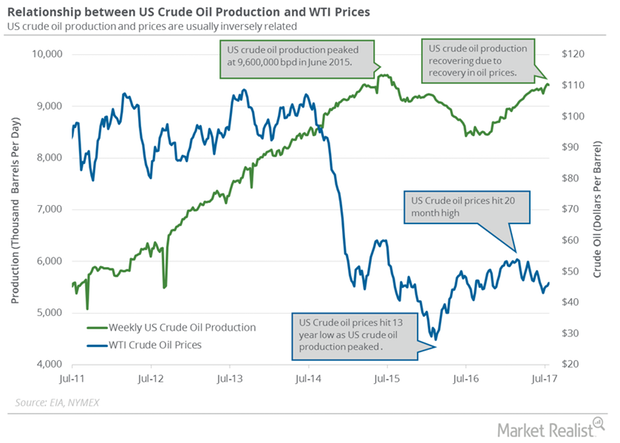

Traders Track US Crude Oil Production and Exports

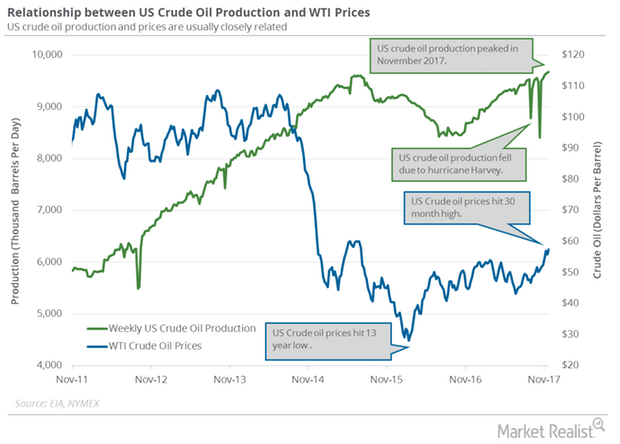

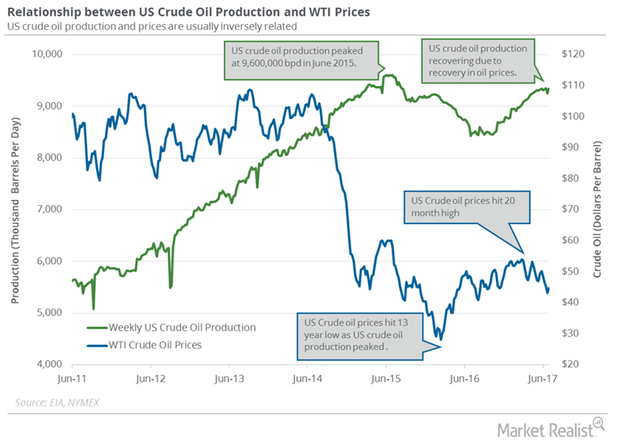

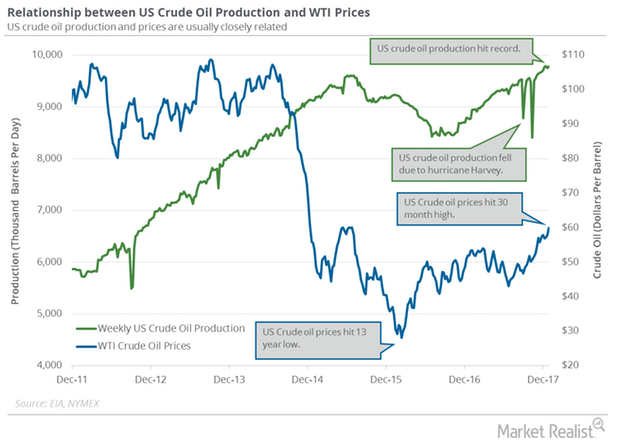

US crude oil production rose by 290,000 bpd (barrels per day) or 3.1% to 9,481,000 bpd in September 2017—compared to the previous month.

Hedge Funds’ Net Bullish Positions on US Crude Oil

Hedge funds reduced their net bullish positions in US crude oil futures and options by 1,136 contracts to 133,606 contracts on June 20–27, 2017.

Are US Distillate Inventories Bearish for Oil Prices?

US distillate inventories rose by 1,667,000 barrels or 1.3% to 129.4 MMbbls (million barrels) on November 24–December 1, 2017.Energy & Utilities Must-know: An overview of Athlon Energy

Athlon is an independent oil and gas exploration and production company. Its activities include the acquisition, exploration, and development of oil and liquids-heavy gas resources in the Permian Basin.

Will OPEC and Russia Announce Deeper Production Cuts?

The OPEC and non-OPEC monitoring committee meeting will be held on July 24, 2017, in Russia. The meeting will discuss production cut deal compliance.

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.

OPEC, Russia, and the US Could Pressure Crude Oil Futures

US crude oil (RYE) (VDE) (SCO) futures contracts for August delivery fell 2.8% and settled at $44.23 per barrel on July 7. Prices are near a ten-month low.

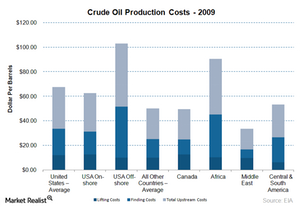

How does the production cost of crude oil affect oil prices?

Recent consensus says the production cost of crude oil could range from $20 to $25 per barrel.

Will US Crude Oil Production Undermine Crude Oil Futures?

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

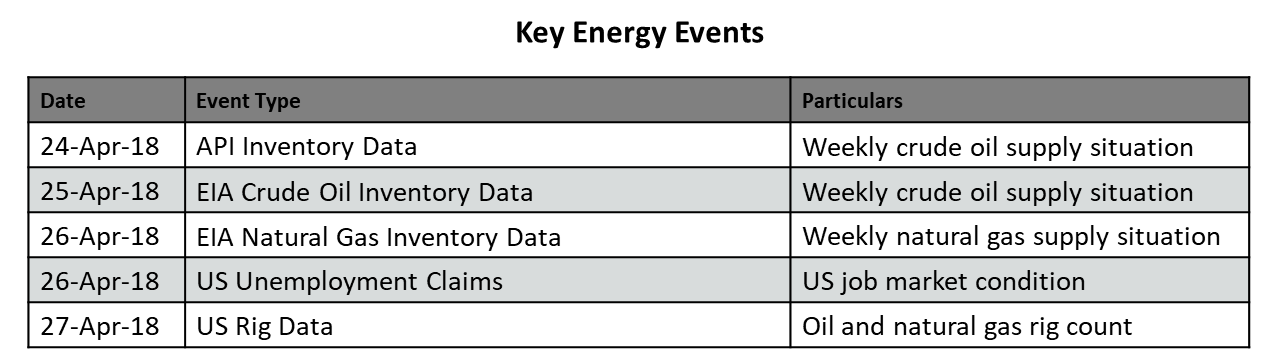

Key Energy Events This Week

The EIA’s crude oil and natural gas inventory data are scheduled to be released on April 25 and April 26, 2018, respectively.

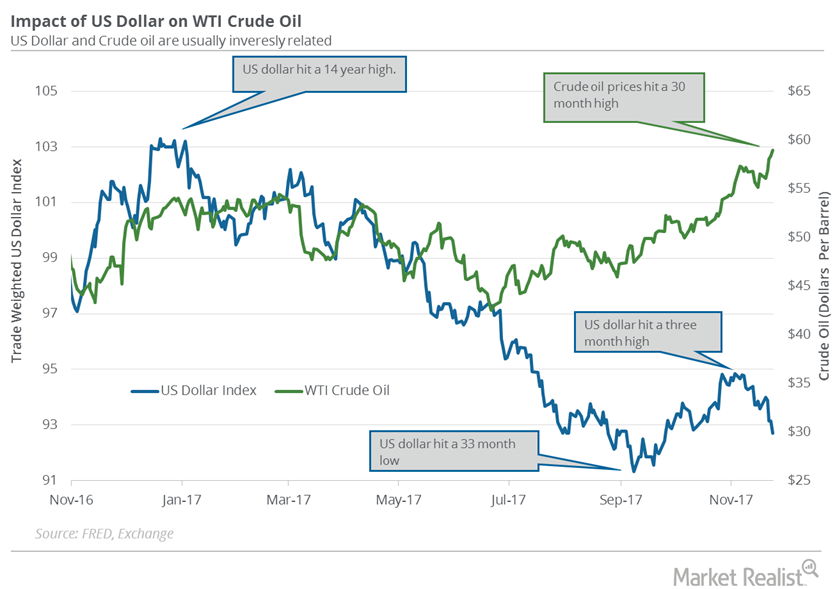

US Dollar Is near a 2-Month Low

The US Dollar Index fell 0.5% to 92.7 on November 24, 2017—the lowest level in almost two months. The US dollar (UUP) fell 1.27% last week.

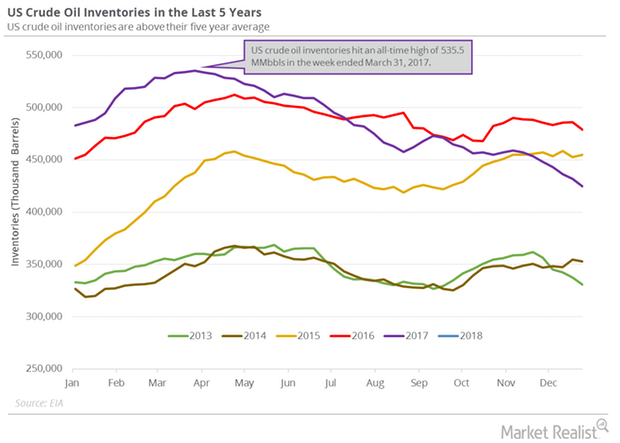

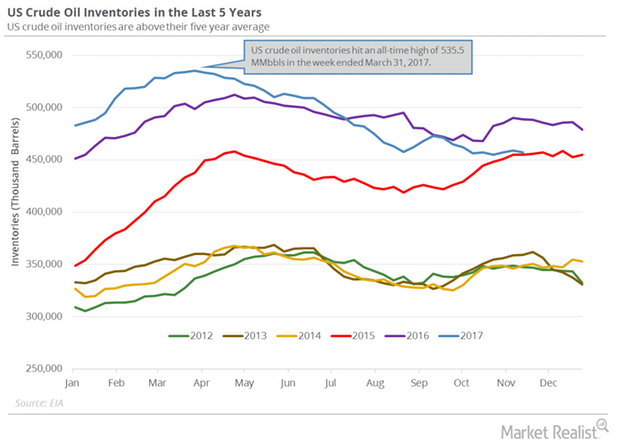

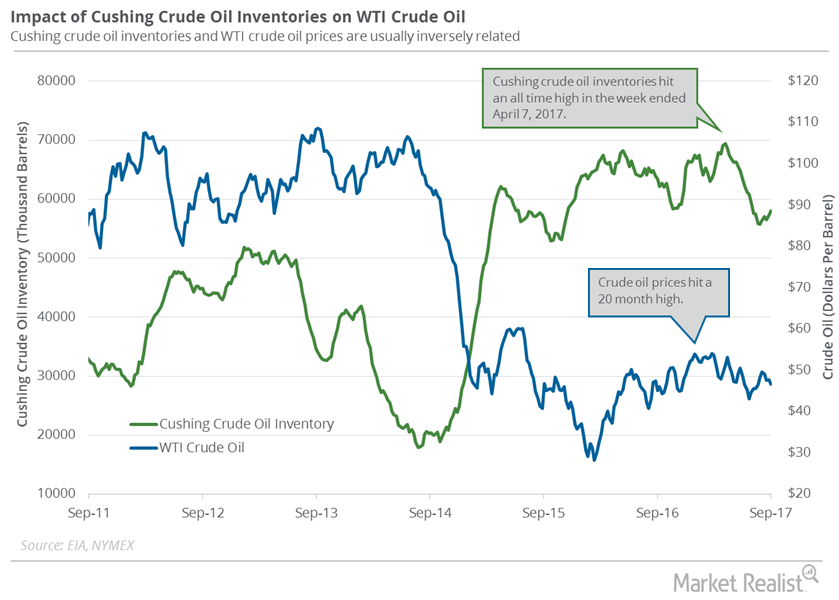

The Relationship between US Crude Oil Inventories and Oil Prices

Estimates for US crude oil inventories The EIA (U.S. Energy Information Administration) released its Weekly Petroleum Status Report on November 22, 2017. It reported that US crude oil inventories fell 1.9 MMbbls (million barrels) to 457.1 MMbbls between November 10 and 17, 2017. Inventories were 31.8 MMbbls (6.5%) lower than in the same period in 2016. The market anticipated […]

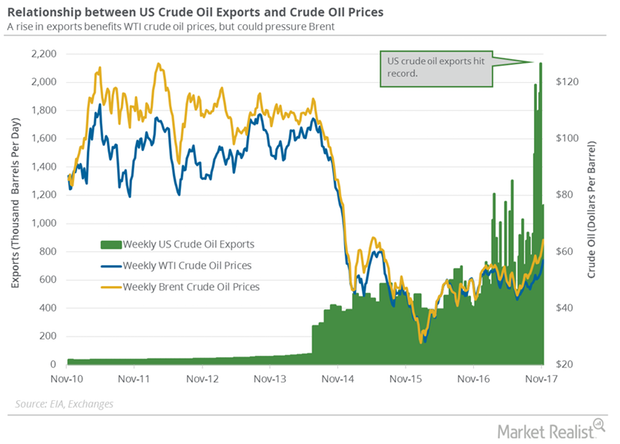

US Crude Oil Exports and Drilling Activity Impact OPEC

According to the EIA, US crude oil exports rose by 260,000 bpd to 1,129,000 bpd on November 3–10, 2017. Exports rose 30% week-over-week.

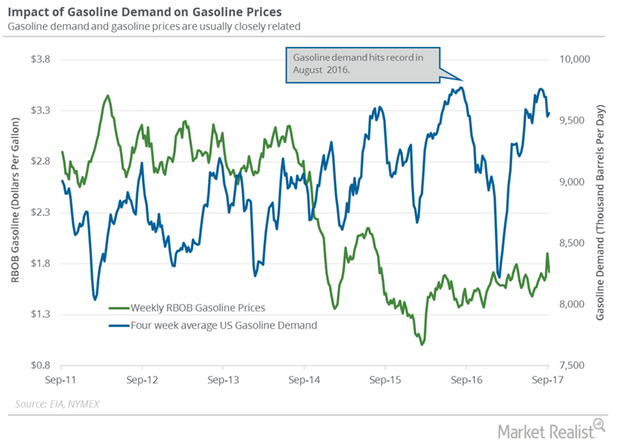

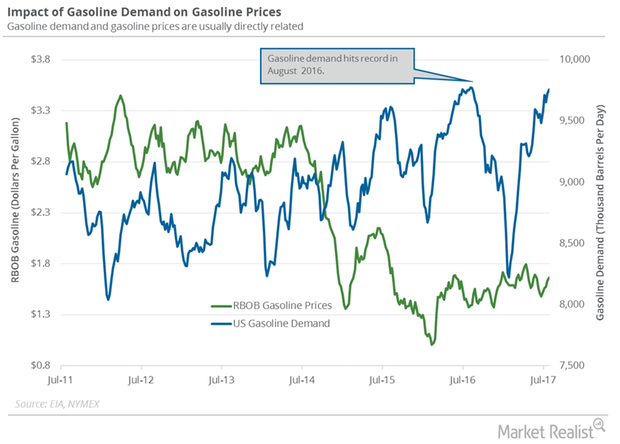

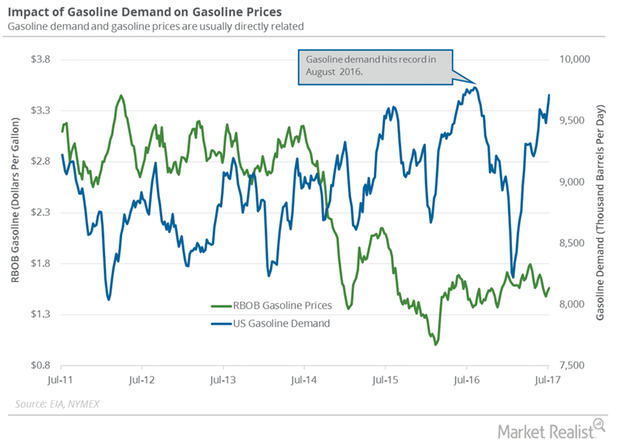

US Gasoline Demand Today: Bullish or Bearish for Crude?

The EIA estimates that weekly US gasoline demand fell 178,000 bpd (barrels per day) to 9.4 MMbpd between September 8 and September 15.

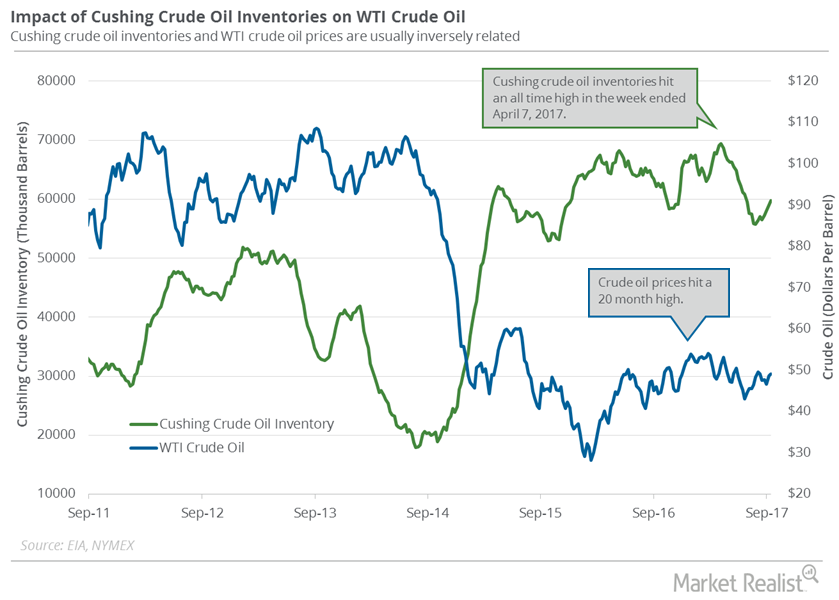

Cushing Crude Oil Inventories Rose for the Fourth Week

Cushing crude oil inventories rose on September 15–22, 2017. A rise in Cushing crude oil inventories is bearish for crude oil (UWT) (DWT) (USO) prices.

US Crude Oil Production Near 4-Week High: Another Bearish Factor

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017.

Are Crude Oil Futures Signaling a Breakout?

November US crude oil (UWT) (DWT) (USO) futures contracts rose 0.8% to $50.3 per barrel in electronic trading at 2:10 AM EST on September 20, 2017.

Will US Crude Oil Futures Break $50 per Barrel?

Let’s track some important events for crude oil and natural gas traders between September 18 and September 22.

Why Cushing Crude Inventories Rose for the 4th Time in 5 Weeks

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks.

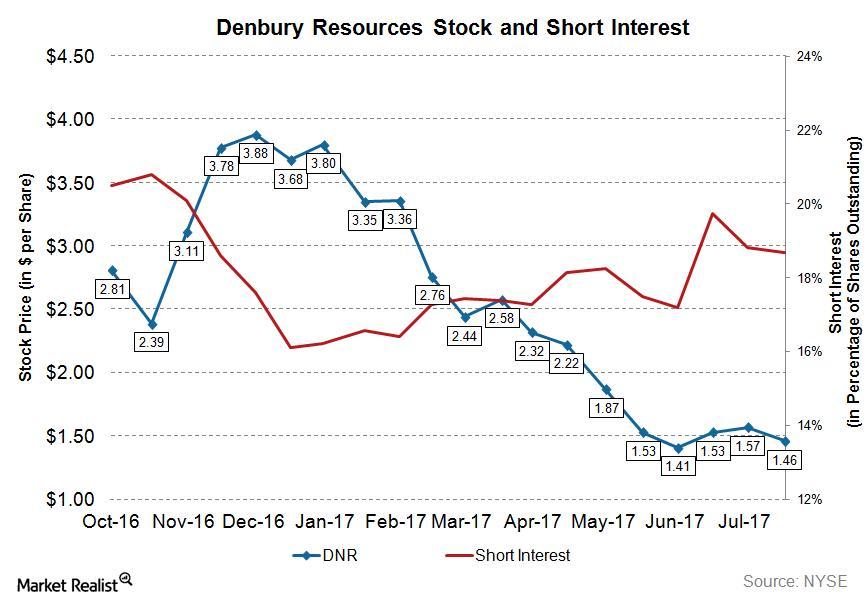

Analyzing Short Interest in Denbury Resources Stock

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x.

US Gasoline Demand Hit a Record: What’s Next?

The EIA estimates that weekly US gasoline demand rose by 21,000 bpd (barrels per day) to 9,842,000 bpd on July 21–28, 2017. It’s the highest level ever.

Problems for Crude Oil Bulls as OPEC Production Hits 2017 High

September US crude oil futures contracts rose 0.20% and were trading at $50.29 per barrel in electronic trading at 1:35 AM EST on August 1, 2017.

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

Near Record US Gasoline Demand: Are the Bulls Taking Control?

The EIA estimates that the four-week average for US gasoline demand rose 129,000 bpd (barrels per day) to 9.7 MMbpd (million barrels per day) from July 7 to 14, 2017.

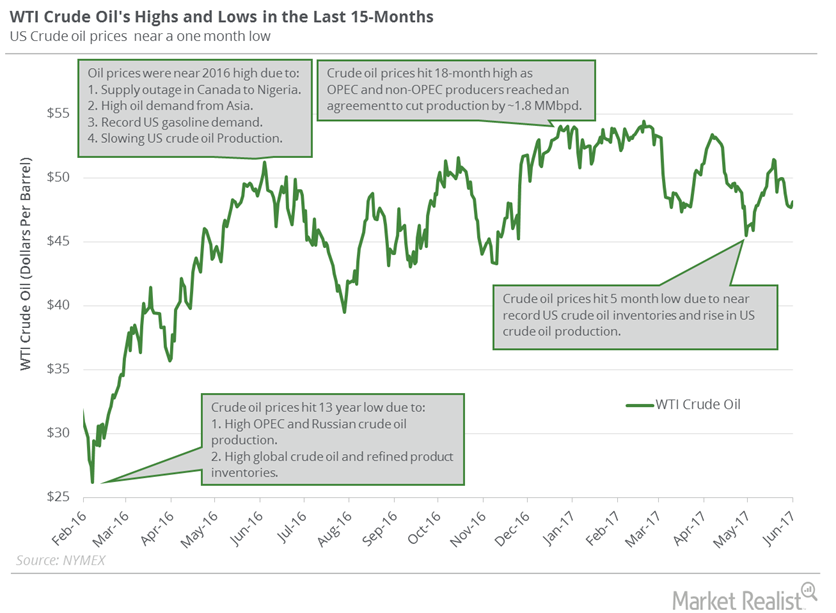

What to Expect from Crude Oil Futures This Week

US crude oil (USO) (IXC) (IYE) (PXI) prices are near their one-month low. Lower crude oil prices have a negative impact on oil producers’ earnings.

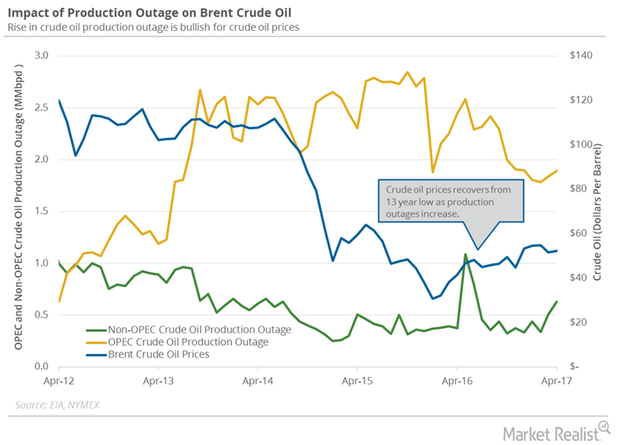

Global Crude Oil Supply Outages Could Help Crude Oil Bulls

The EIA estimated that global crude oil supply outages rose by 181,000 bpd (barrels per day) to 2.52 MMbpd in April 2017—compared to March 2017.

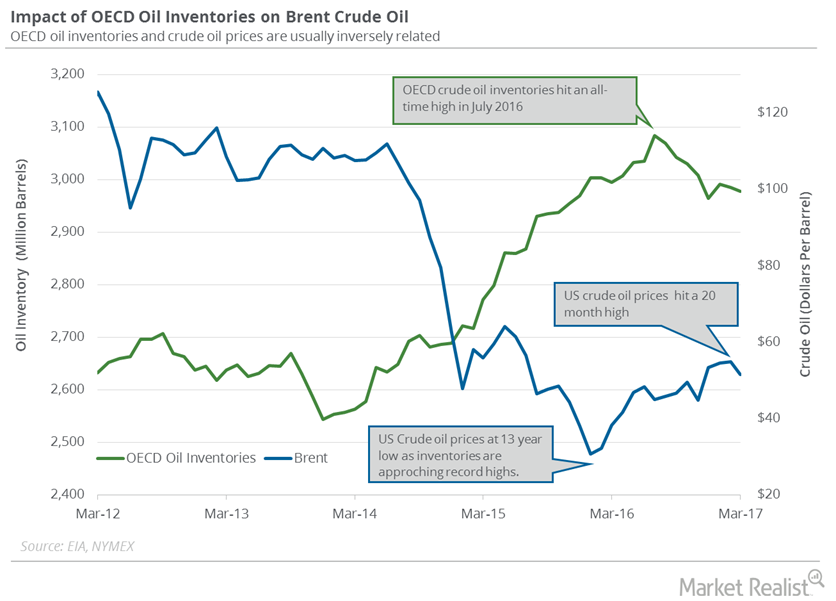

OECD’s Crude Oil Inventories Impact Crude Oil Futures

The EIA estimates that OECD’s crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month.

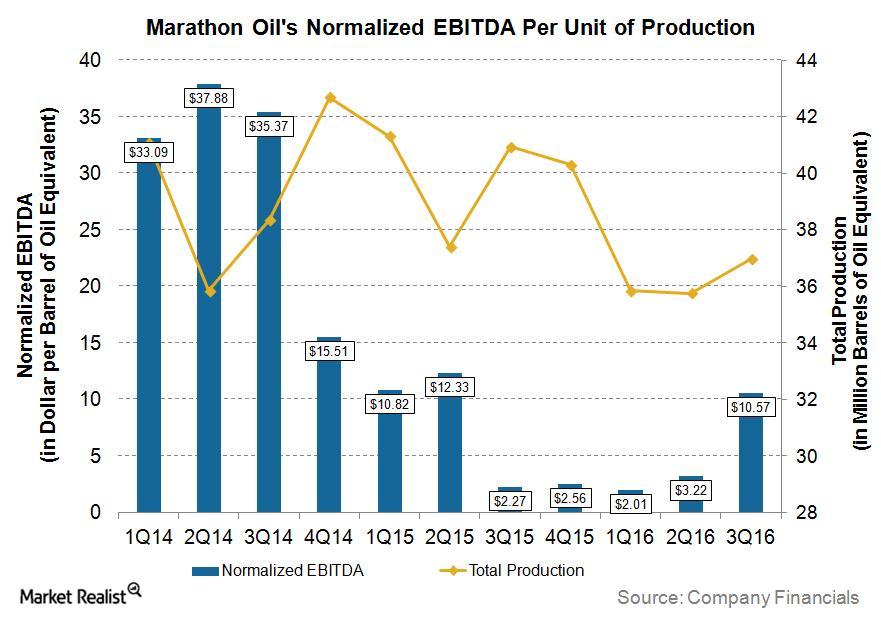

Understanding Marathon Oil’s EBITDA Normalized to Production

In 3Q16, Marathon Oil (MRO) reported normalized EBITDA per unit of production of ~$10.57 per boe, which was ~366% higher than in 3Q15.

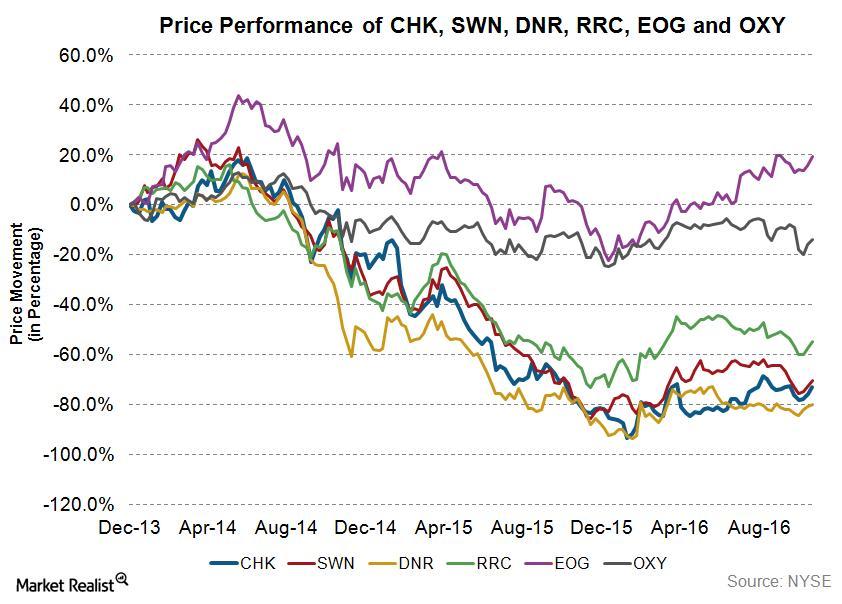

Are Companies That Have Done Acquisitions Outperforming?

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

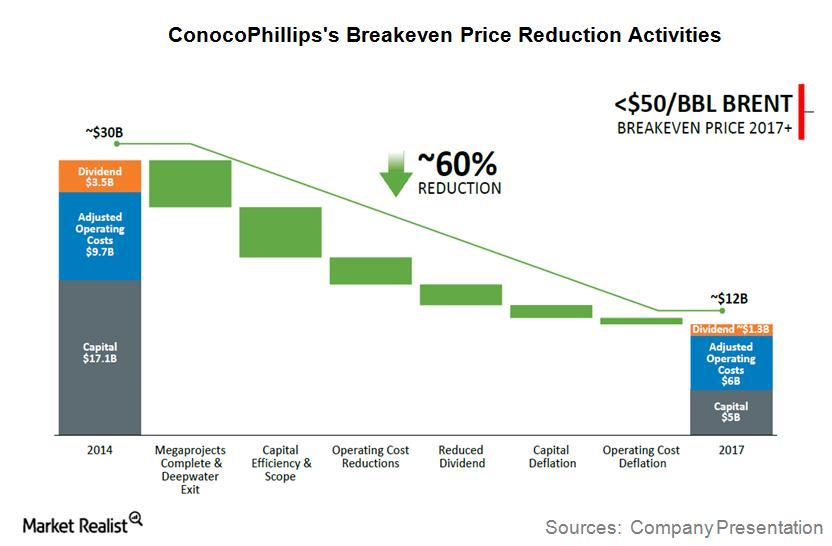

ConocoPhillips’s Steps to Reduce Its Break-Even Price

Since 2014, ConocoPhillips (COP) has been focusing on reducing its break-even price.

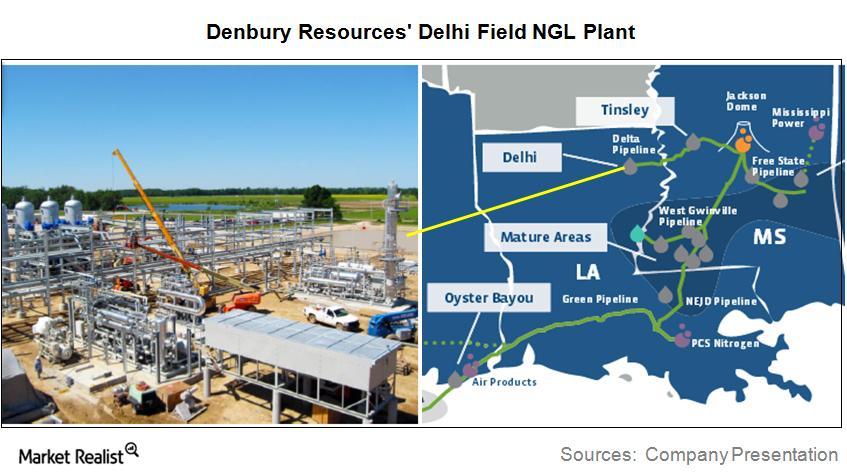

Why Denbury Resources’ Delhi Field Plant Is So Significant

Denbury Resources (DNR) is constructing an NGL (natural gas liquids) plant at its Delhi Field on the Gulf Coast.

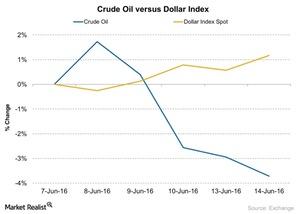

Will the Dollar’s Recovery Affect Crude Oil?

Between June 7 and June 14, 2016, crude oil (USO) fell by ~3.7% while the US dollar index (UUP) rose by around 1.2%.

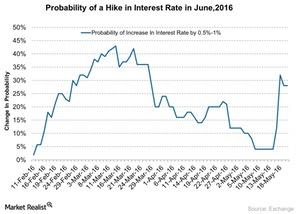

How Did the Consumer Price Index Affect Crude Oil Prices?

The US (SPY) (VOO) CPI (consumer price index) rose 0.4% on a month-over-month basis in April, according to a US Department of Labor report on May 17, 2016.

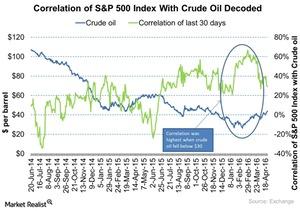

How Are Crude Oil Prices and the S&P 500 Correlated?

Historically, crude oil prices and the S&P 500 index have influenced each other.