Will the Dollar’s Recovery Affect Crude Oil?

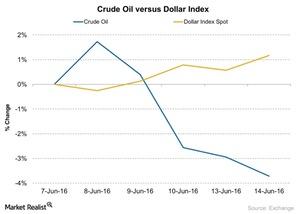

Between June 7 and June 14, 2016, crude oil (USO) fell by ~3.7% while the US dollar index (UUP) rose by around 1.2%.

June 16 2016, Updated 9:06 a.m. ET

Crude oil and the US dollar index in the last six trading sessions

Between June 7 and June 14, 2016, crude oil (USO) fell by ~3.7% while the US Dollar Index (UUP) rose by around 1.2%. The US Dollar Index initially fell after weak US non-farm payroll data were released on June 3, 2016. This could delay the timing of the next interest rate hike.

However, after making a low of $93.59 on June 8, the dollar index started to recover. On June 8, crude oil touched its 2016 high of $51.23.

The correlation between crude oil and the dollar index in the last six trading sessions was approximately -80.6%. This shows the degree of the inverse relationship between the two assets. Apart from mainstream news, recent movements in crude oil have also been fueled by the fall in the dollar index.

Correlation of crude oil and the US Dollar Index since 2007

Between September 2007 and April 2013, crude oil (USO) and the US Dollar Index’s (UUP) one-month correlations were positive in only a few instances. Their correlation coefficients were largely negative for these five and a half years.

What’s the correlation between crude oil and the US dollar index?

Crude oil’s negative correlation with the US dollar index between September 2007 and April 2013 clearly implies that crude oil had an inverse relationship with the US Dollar Index.

However, from April 2013 to date, crude oil and the dollar index’s one-month correlations have been more bidirectional. In the last three years, these one-month correlations have fluctuated between -64% and 43%. This fluctuation could indicate that fundamental drivers such as Saudi Arabia’s decision not to cut production, US shale oil producers’ cost and production dynamics, US inventory data, and other fundamental news sometimes had greater impacts on crude oil than on the dollar.

Oil-weighted stocks and ETFs

The above analysis is important for oil-weighted stocks such as Abraxas Petroleum (AXAS), Triangle Petroleum (TPLM), and Denbury Resources (DNR).

The Direxion Daily Energy Bear 3X ETF (ERY), the First Trust Energy AlphaDEX ETF (FXN), the United States Brent Oil ETF (BNO), and the United States Oil ETF (USO) are also impacted by the correlation of crude oil with the US Dollar Index.