Direxion Daily Energy Bear 3x Shares

Latest Direxion Daily Energy Bear 3x Shares News and Updates

Is this Summer a Good Time to Invest in Energy?

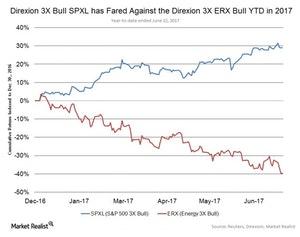

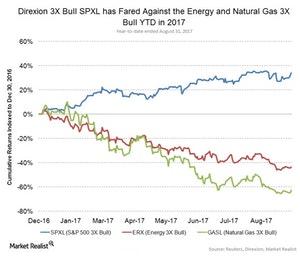

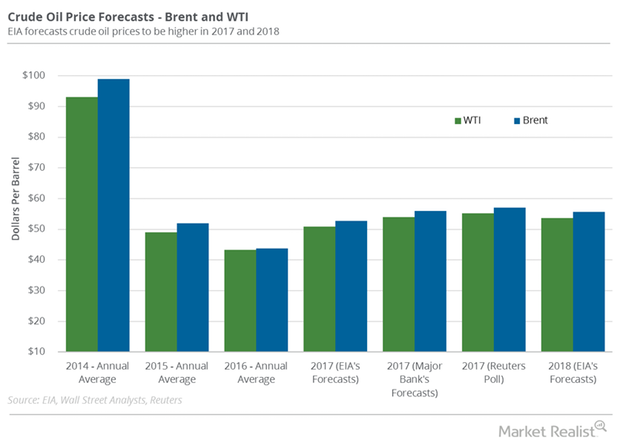

So far this year, the S&P 500 energy sector has struggled mightily, down 12% versus an almost 9.5% gain in the S&P500 this year.

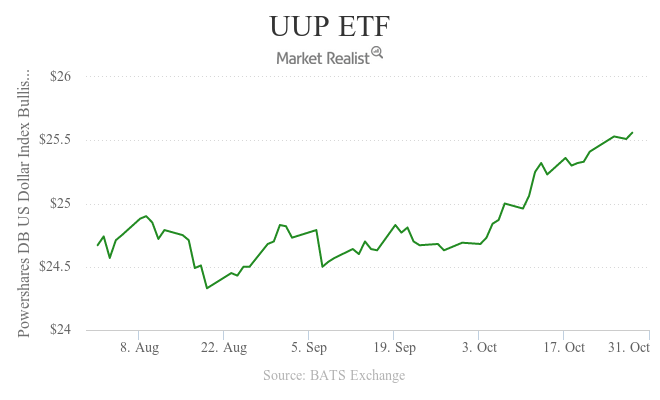

US Dollar Index Fell: How Will It Impact Crude Oil Prices?

The US Dollar Index fell 0.5% to 98.3 on October 28, 2016. It fell due to political uncertainty in the US. It had risen earlier in the morning on October 28.

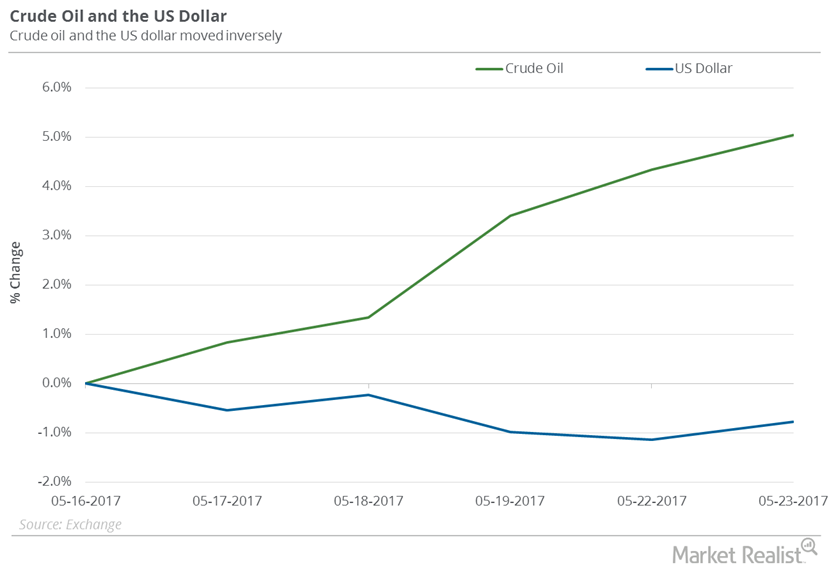

How the Dollar Is Affecting Oil

US crude oil (DBO) (USL) (OIIL) July futures rose 5% between May 16 and May 23, 2017.

Will US Crude Oil Futures Surpass their 200-Day Moving Average?

Let’s track some important events for oil and gas traders from August 14 to 18, 2017.

Traders Focus on the API and EIA’s Crude Oil Inventories

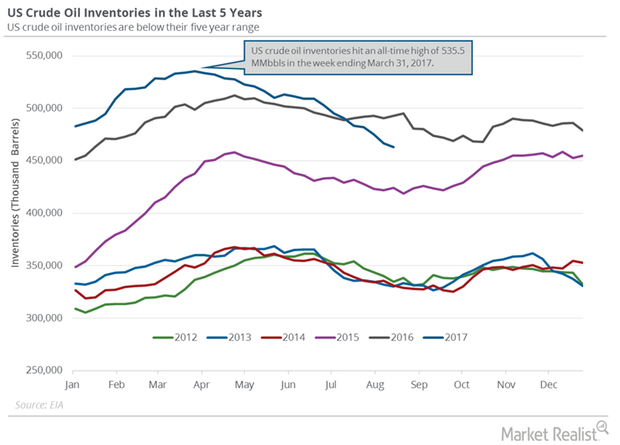

On May 16, 2017, the API released its weekly crude oil inventory report. US crude oil inventories rose by 0.8 MMbbls (million barrels) on May 5–12, 2017.

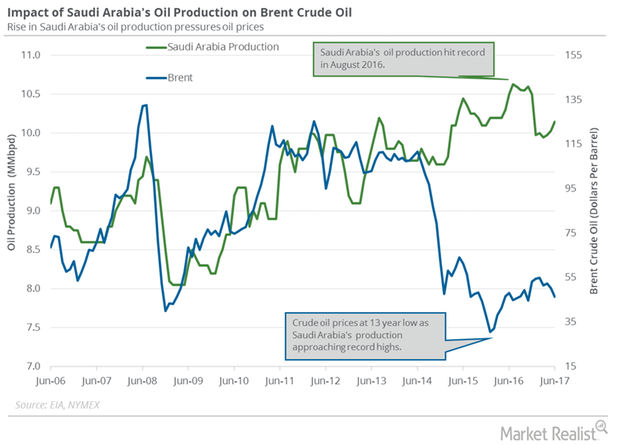

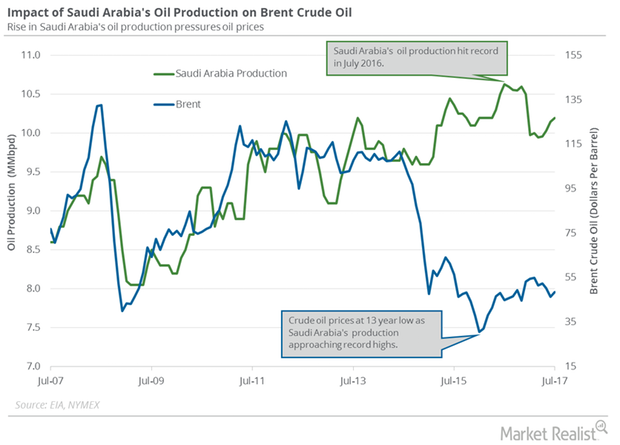

Will Saudi Arabia Remove Excess Oil from the Market?

Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to OPEC’s production cut deal.

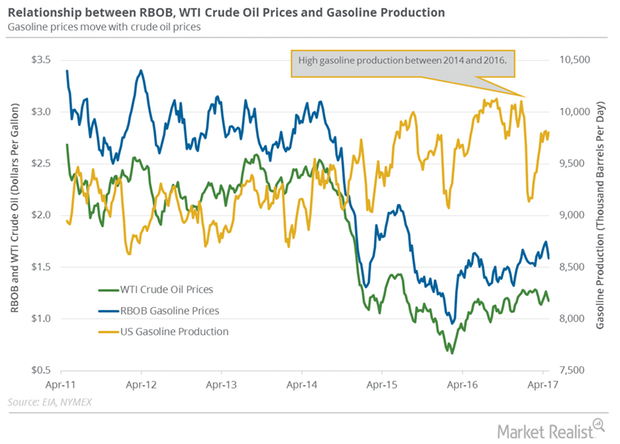

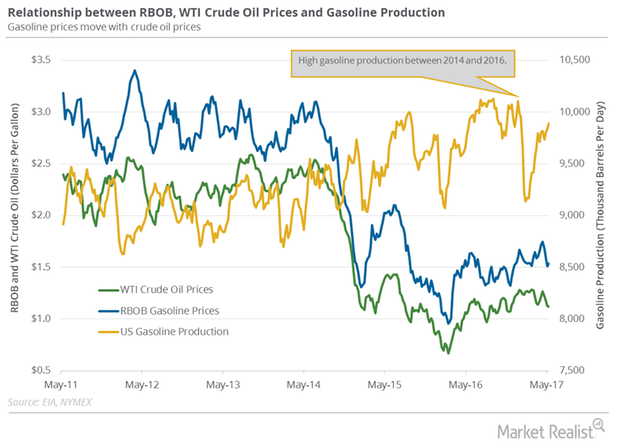

US Crude Oil and Gasoline Futures Moved Together

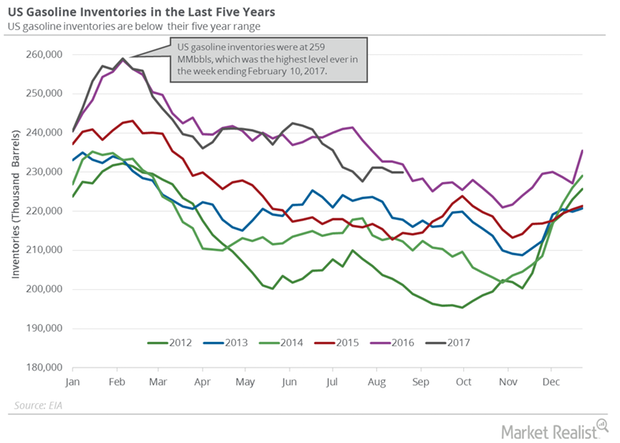

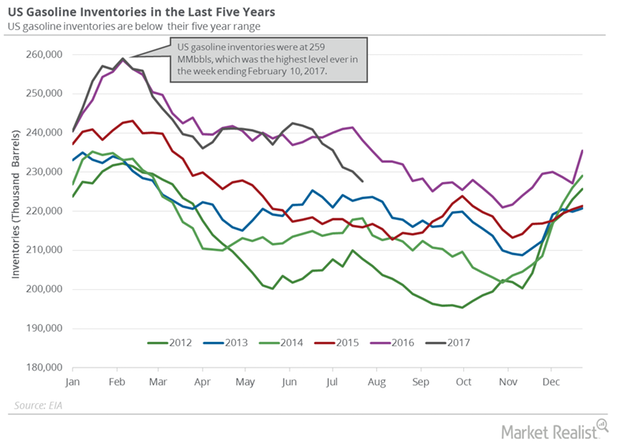

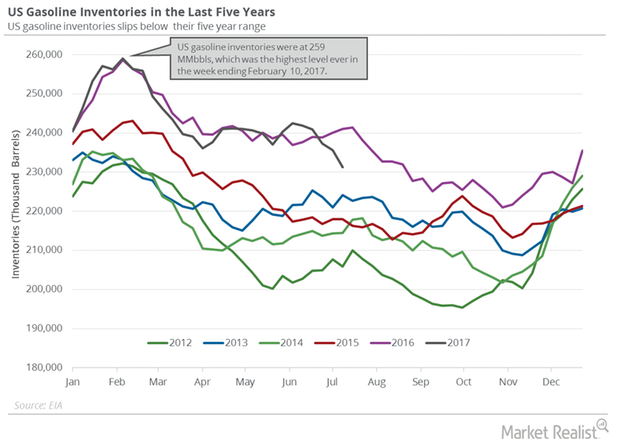

June gasoline futures contracts rose 1.3% to $1.53 per gallon on May 3, 2017. Prices rose due to the less-than-expected rise in US gasoline inventories.

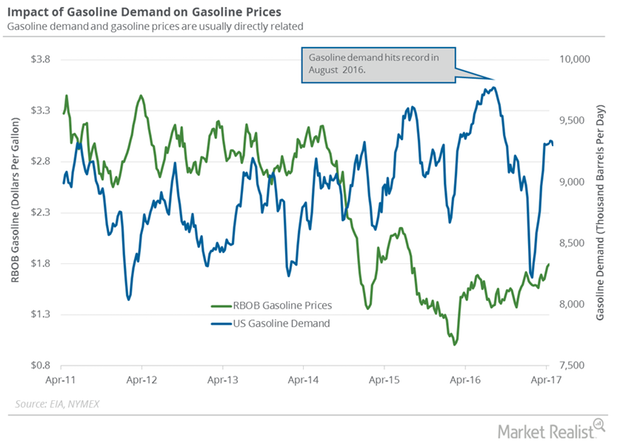

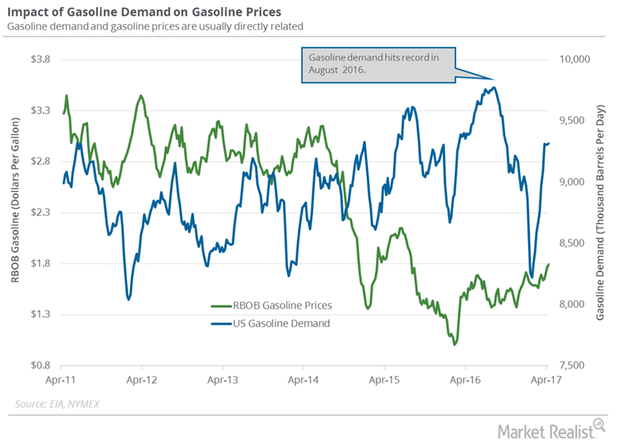

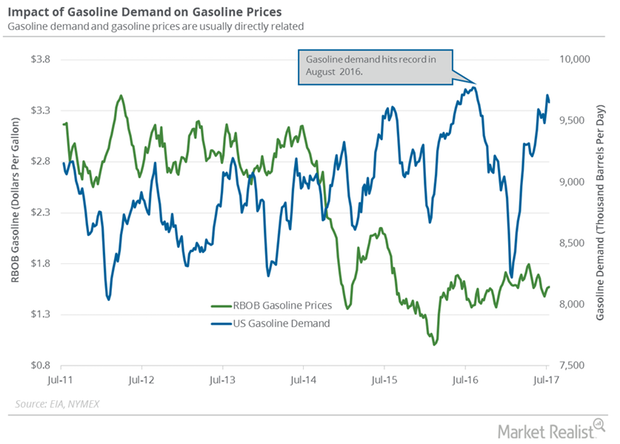

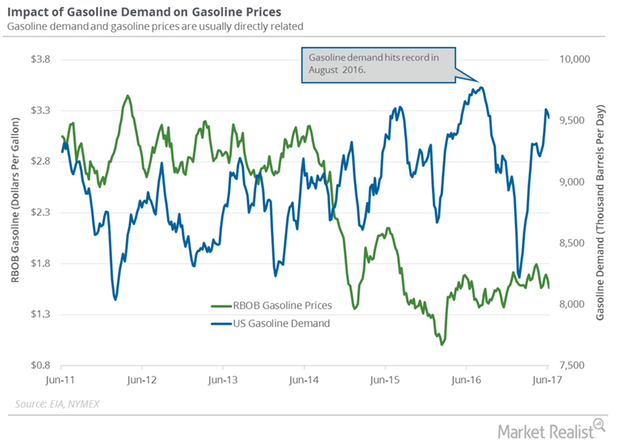

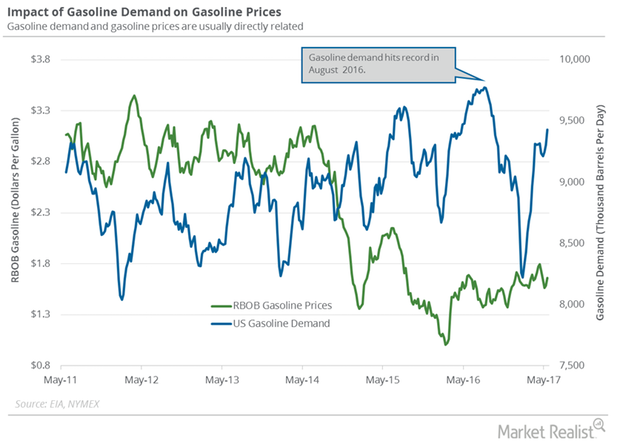

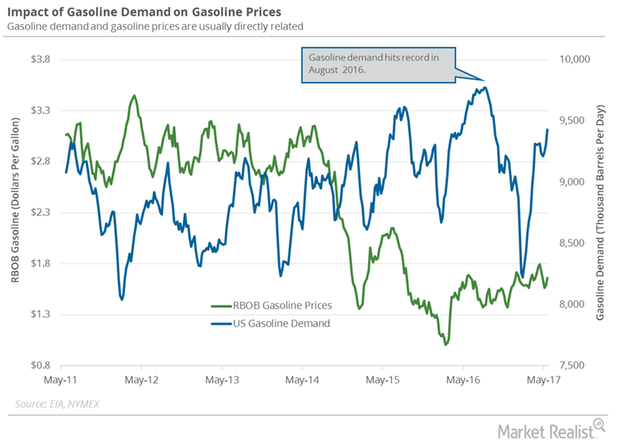

Why Investors Are Tracking US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 80,000 bpd to 9,237,000 bpd on April 14–21.

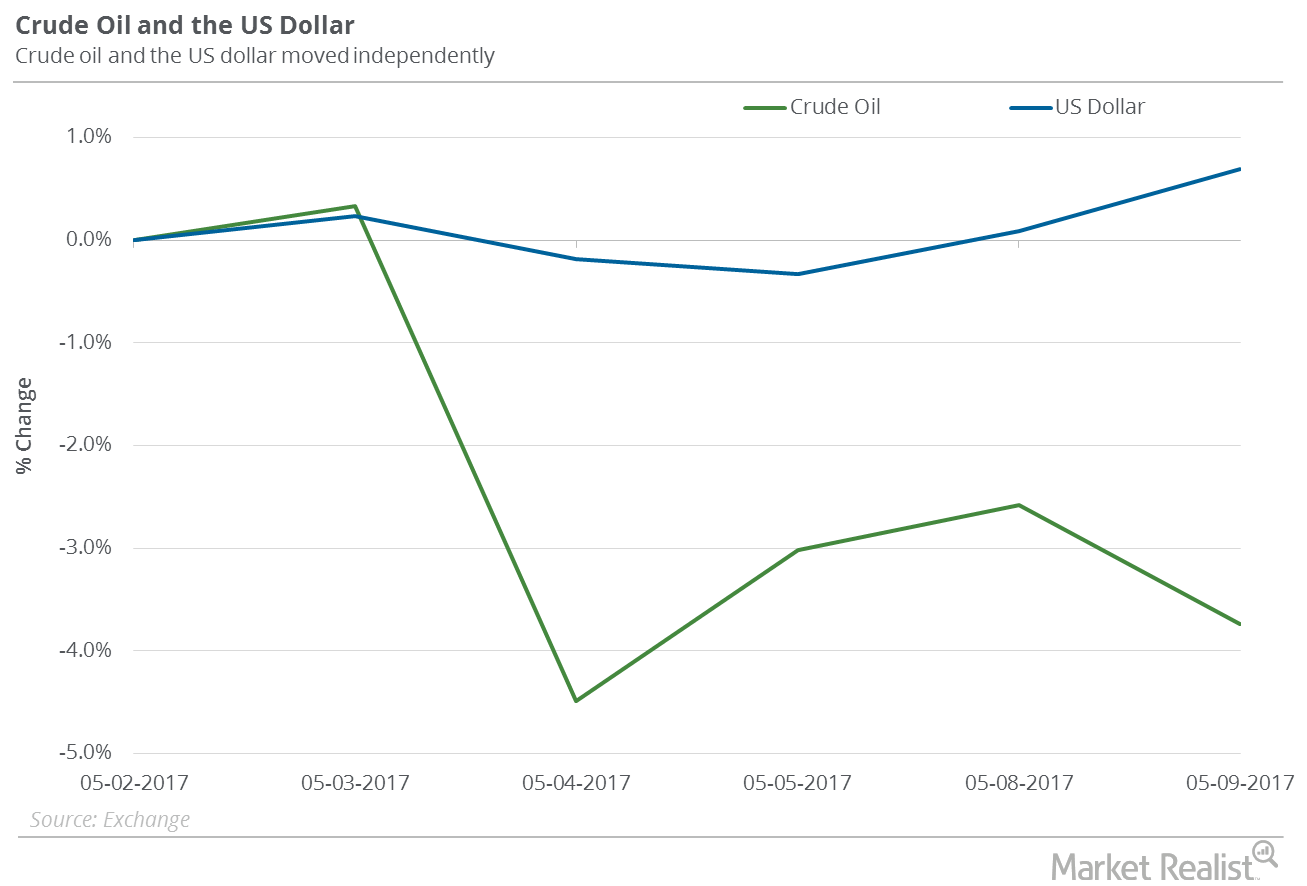

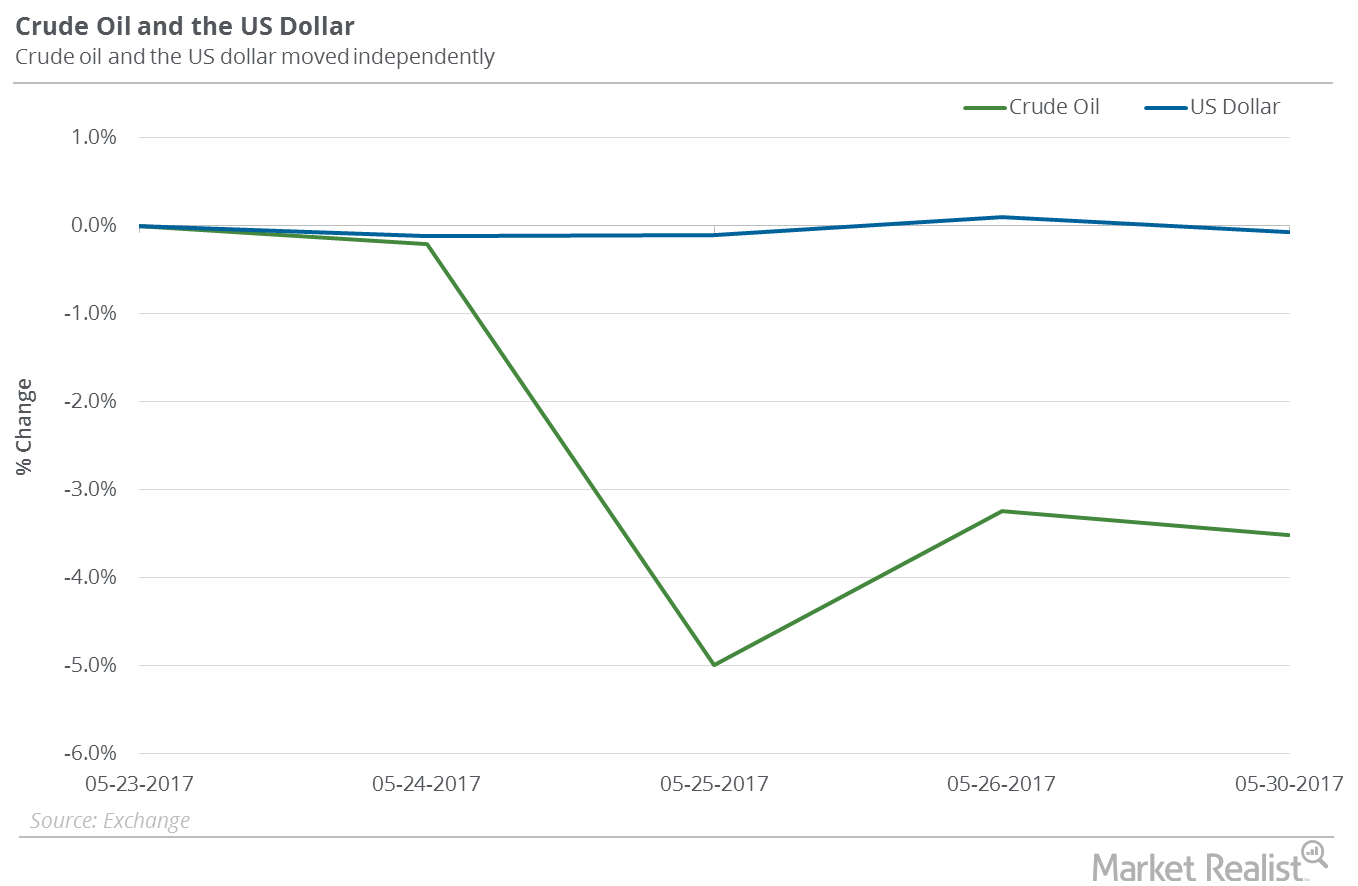

Oil Bulls, Don’t Worry About the Rising US Dollar

US crude oil futures contracts for June 2017 delivery fell 3.7% between May 2, and May 9, 2017, while the US Dollar Index rose 0.7%.

Hedge Funds’ Net Long Positions in US Crude Oil Rose Again

Hedge funds increased their net bullish positions in US crude oil futures and options rose by 36,834 contracts to 215,488 contracts on July 11–18, 2017.

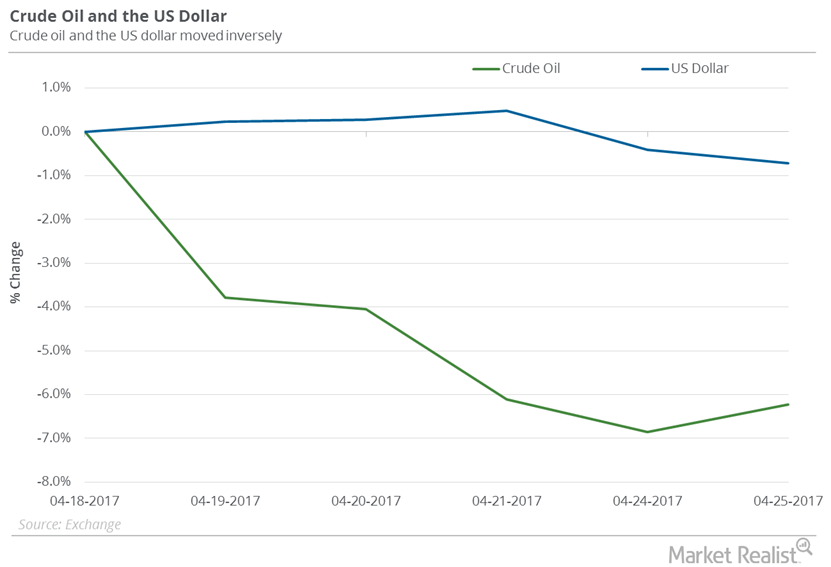

How the US Dollar Could Be Crucial to Oil Investors

US crude oil futures contracts for June delivery fell 6.2% between April 18, 2017, and April 25, 2017. Meanwhile, the US Dollar Index fell 0.7%.

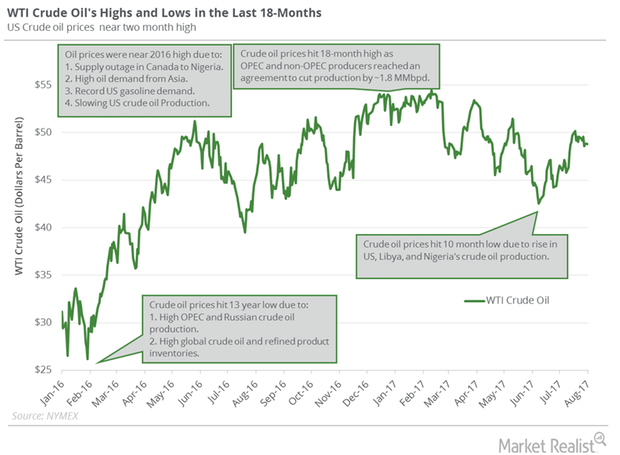

Will US Crude Oil Futures Rise above $50 per Barrel This week?

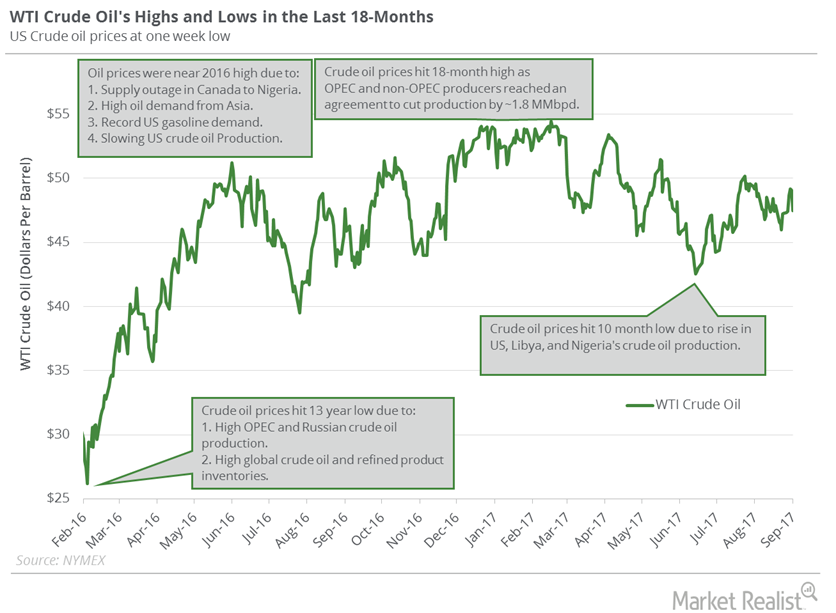

September US crude oil prices are on a rollercoaster ride in 2017 due to bullish and bearish drivers. US crude oil prices are near a two-month high.

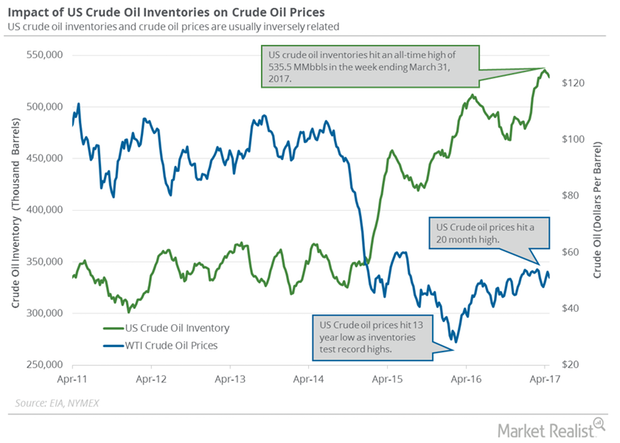

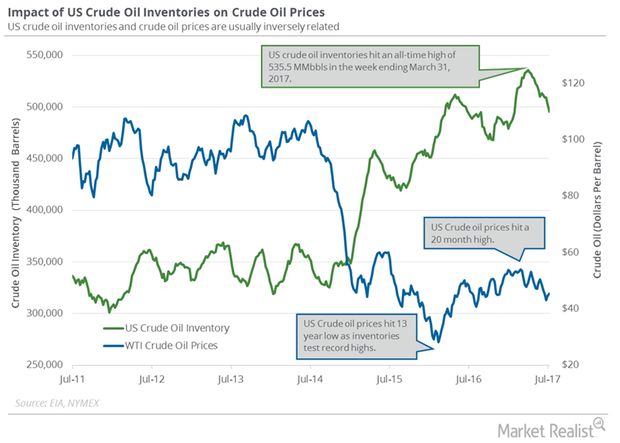

Near-Record US Crude Oil Inventory: Will Oil Blood Bath Continue?

June WTI crude oil futures contracts fell 0.40% and were trading at $48.68 per barrel in electronic trade at 2:35 AM EST on May 2, 2017.

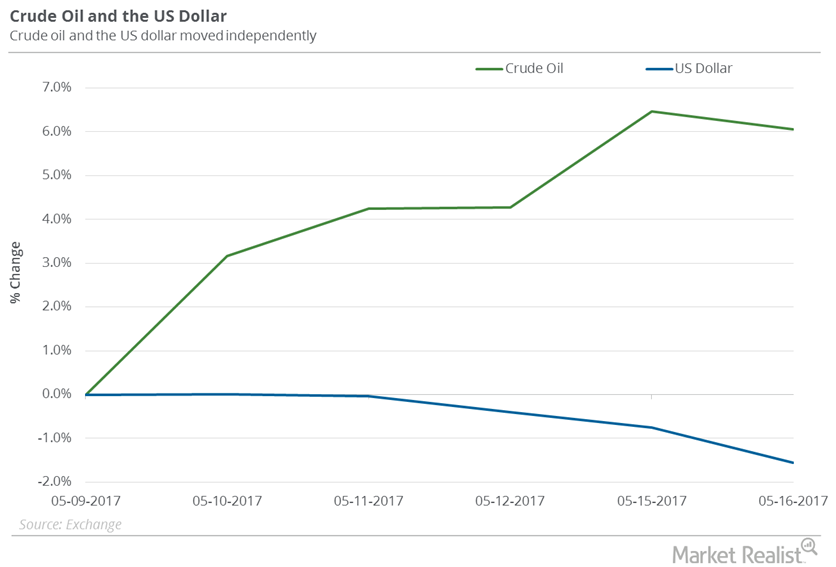

How the Dollar Could Impact Oil’s Recovery

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery rose 3.7% between May 10 and May 17, 2017.

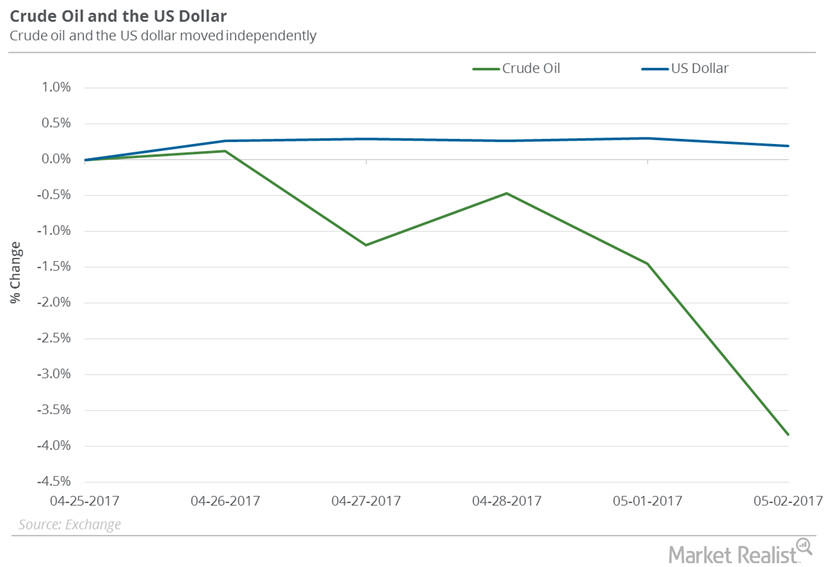

Did the US Dollar Impact Oil Prices Last Week?

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery fell 3.8% between April 25, 2017, and May 2, 2017.

Supply, Demand: Will Crude Oil Futures Rally Be Short-Lived?

August WTI (West Texas Intermediate) crude oil futures contracts rose 1.0% and closed at $45.49 per barrel on Wednesday, July 12, 2017.

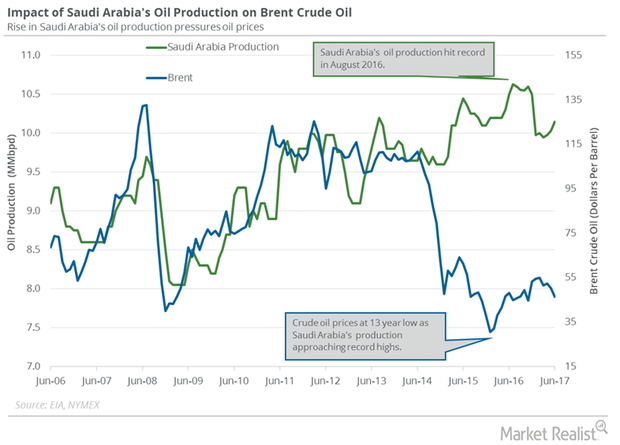

Will Saudi Arabia’s Crude Oil Export Plans Rescue Oil Prices?

Saudi Arabia is the largest crude oil producer and exporter among the OPEC (Organization of the Petroleum Exporting Countries) member countries.

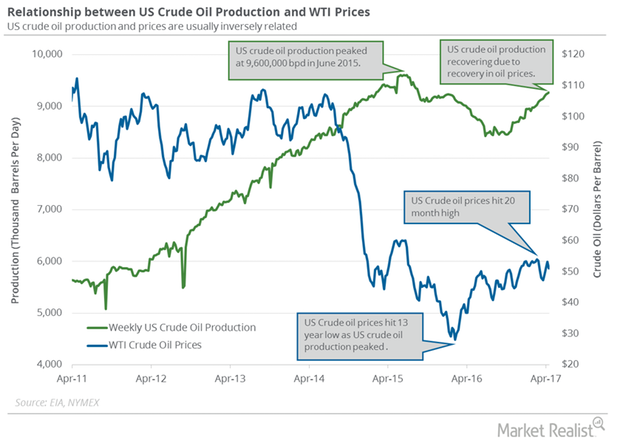

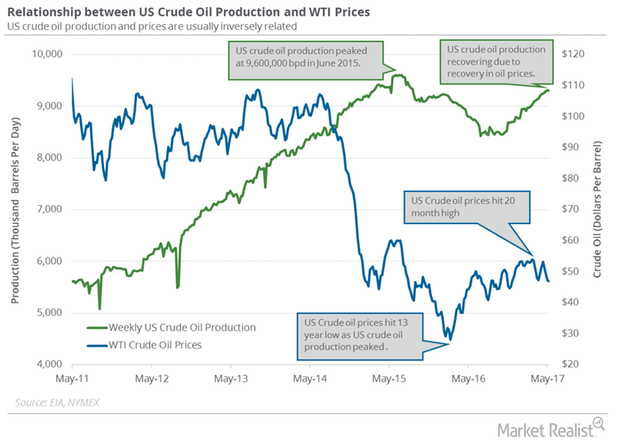

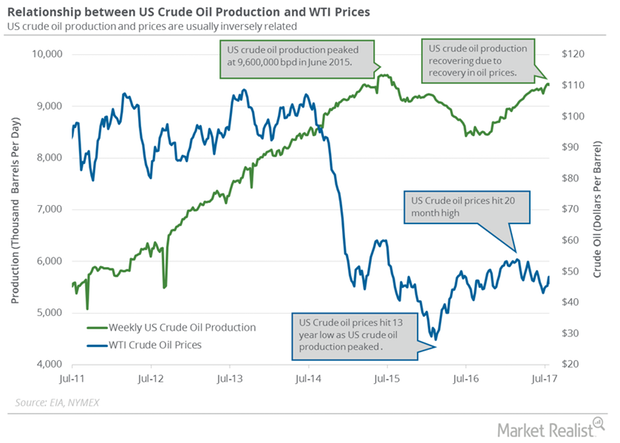

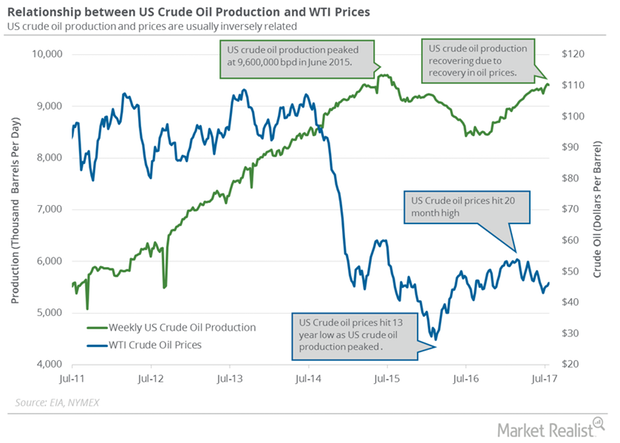

US Crude Oil Production Is near August 2015 High

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

US Gasoline Demand: Bullish or Bearish for Oil Prices?

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand rose by 6,000 bpd to 9,317,000 bpd on April 7–14.

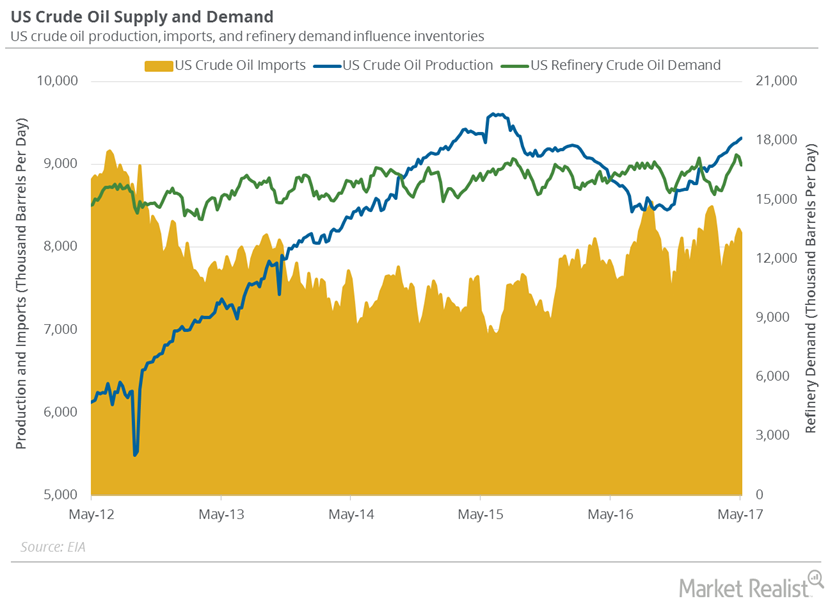

Fall in US Refinery Demand and Imports Impacted Inventories

US refineries operated at 91.5% of their operable capacity in the week ending May 5, 2017. The US refinery demand fell for the second consecutive week.

Will Saudi Arabia’s Production and Exports Support Crude Oil Futures?

The EIA (U.S. Energy Information Administration) estimates that Saudi Arabia’s crude oil production rose by 50,000 bpd (barrels per day) to 10.20 MMbpd (million barrels per day) in July 2017 compared to the previous month.

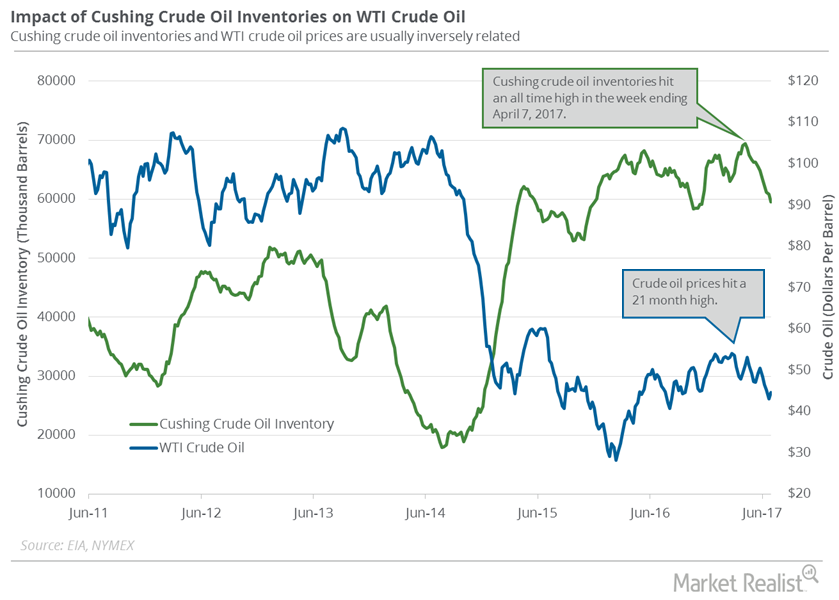

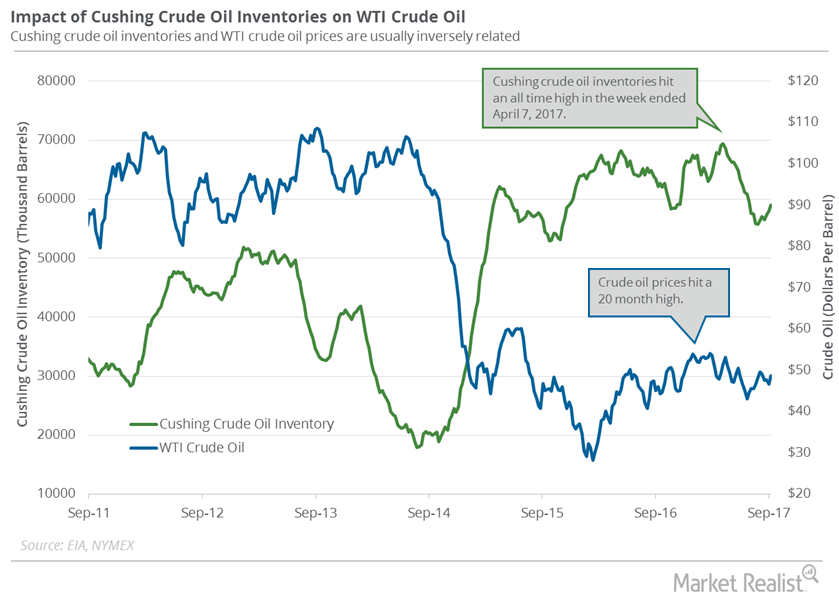

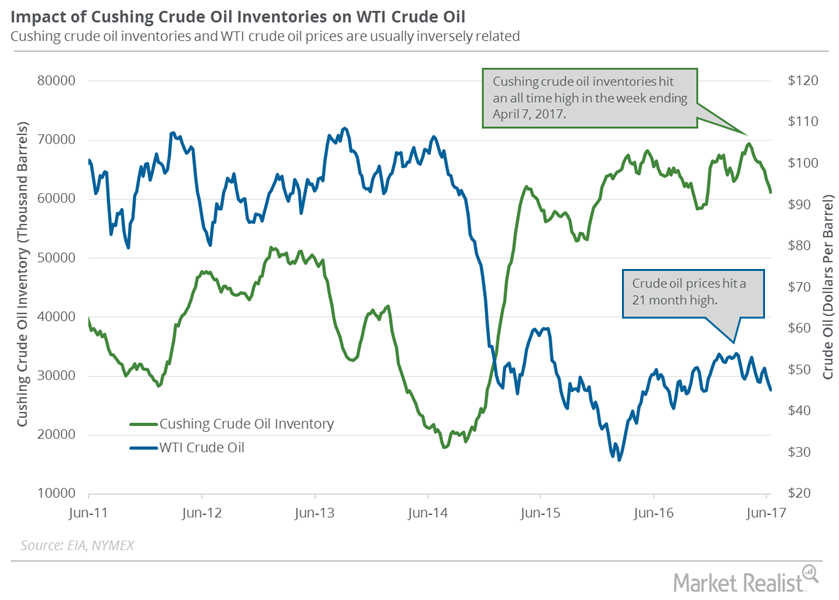

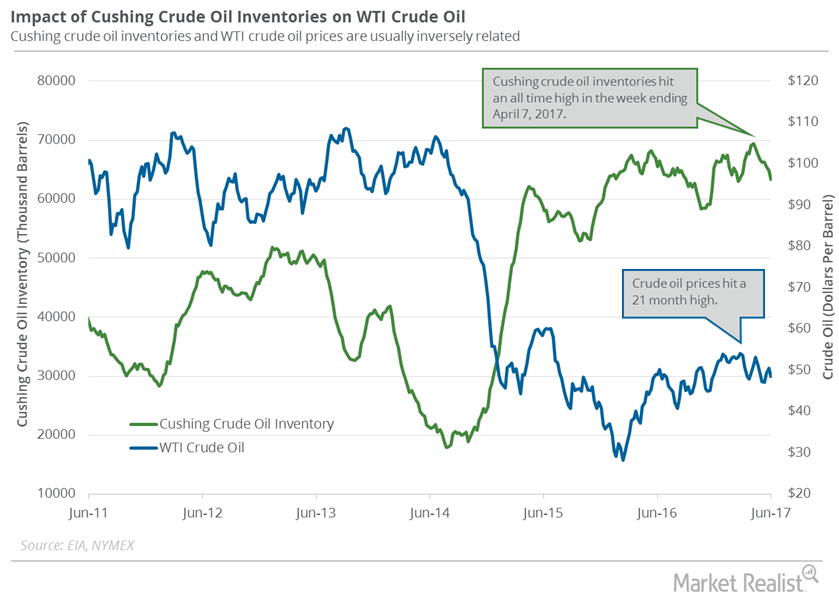

Cushing Inventories: Lowest Level since November 2016

Cushing inventories could have fallen on June 30–July 7, 2017. Crude oil inventories at Cushing have fallen for the seventh straight week.

US Crude Oil Production Fell for the First Time since February

US crude oil production fell by 9,000 bpd to 9,305,000 bpd on May 5–12, 2017. Production fell 0.1% week-over-week, but rose 5.8% year-over-year.

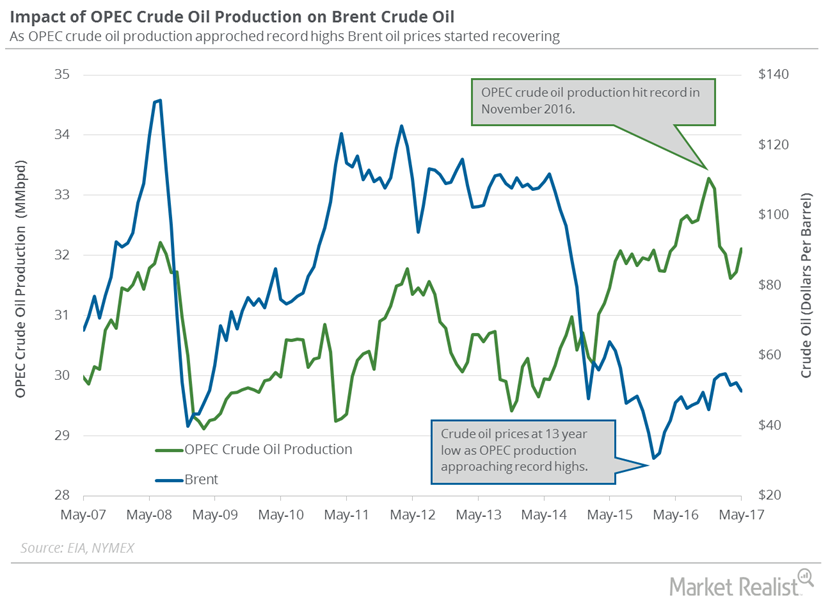

OPEC’s Monthly Report Could Pressure Oil Prices

OPEC will release its Monthly Oil Market Report on July 12, 2017. OPEC’s crude oil production rose in June 2017.

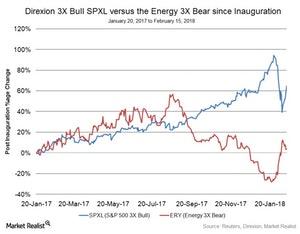

Could Energy Continue Its Wild Ride in 2018?

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time.

Should Energy Stocks Go in Your Back-to-School Shopping Basket?

The energy sector, as tracked by the Energy Select Sector SPDR Fund (XLE), has lost ~17.0% year-to-date as of August 31.

OPEC’s Crude Oil Production and Exports Impact Crude Oil Prices

The EIA estimates that OPEC’s crude oil production fell by 150,000 bpd to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017.

Cushing Inventories: Bullish or Bearish for Crude Oil Prices?

A market survey estimates that Cushing crude oil inventories has risen between September 8 and September 15.

What to Watch: This Week’s Key Crude Oil Price Drivers

Let’s track some important events for crude oil and natural gas traders from September 11 to 15, 2017.

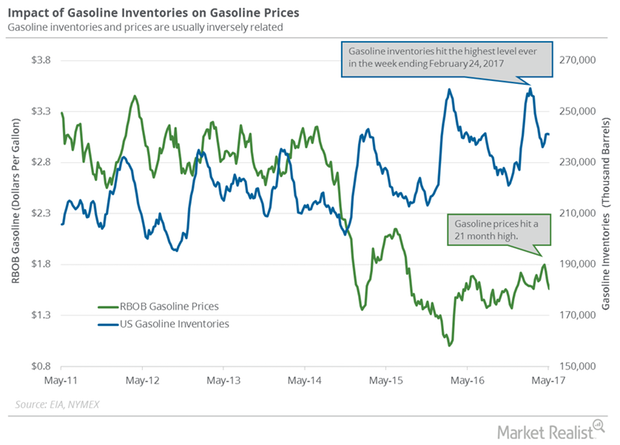

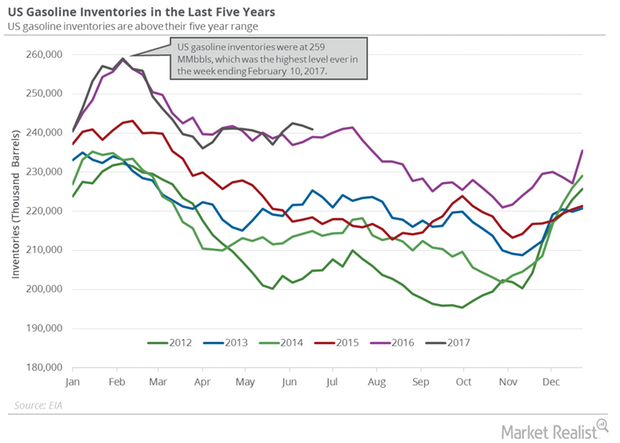

US Gasoline Futures Hit 2-Year High despite Inventory Rise

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

US Crude Oil Inventories Fall in Line with Market Expectations

A Reuters survey estimated that US crude oil inventories would fall 3.5 MMbbls between August 11, 2017, and August 18, 2017.

EIA Upgrades US Crude Oil Production Estimates for 2017 and 2018

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017.

US Gasoline Inventories Fell, Supported Gasoline Oil Prices

The EIA reported that US gasoline inventories fell 1.1% or by 2.5 MMbbls (million barrels) to 227.7 MMbbls on July 21–28, 2017.

Why US Gasoline Demand Rose for 2nd Consecutive Month

The EIA (US Energy Information Administration) estimates that US gasoline demand rose 1.5% to 9.6 MMbpd (million barrels per day) in May 2017 compared to May 2016.

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

US Gasoline Inventories Support Gasoline, Crude Oil Futures

The EIA reported that US gasoline inventories fell 1.6 MMbbls (million barrels) to 235.6 MMbbls between June 30, 2017, and July 7, 2017.

Analyzing Hedge Funds’ Net Long Position on US Crude Oil

Hedge funds increased their net long positions in US crude oil futures and options by 16,345 contracts to 149,951 contracts on June 27–July 4, 2017.

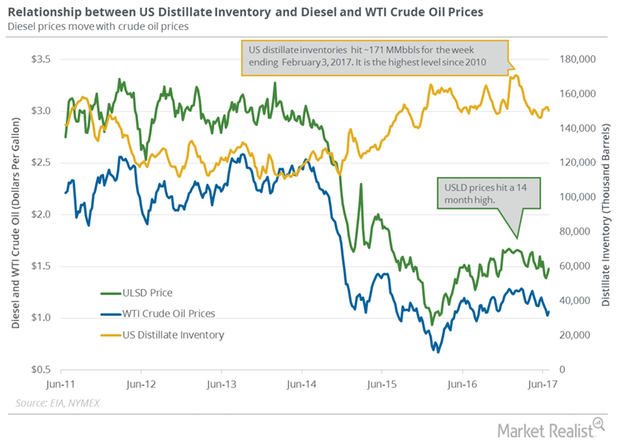

US Distillate Inventories Fell for the Second Straight Week

The EIA reported that US distillate inventories fell by 1.8 MMbbls (million barrels) or 1.2% to 150.4 MMbbls on June 23–30, 2017.

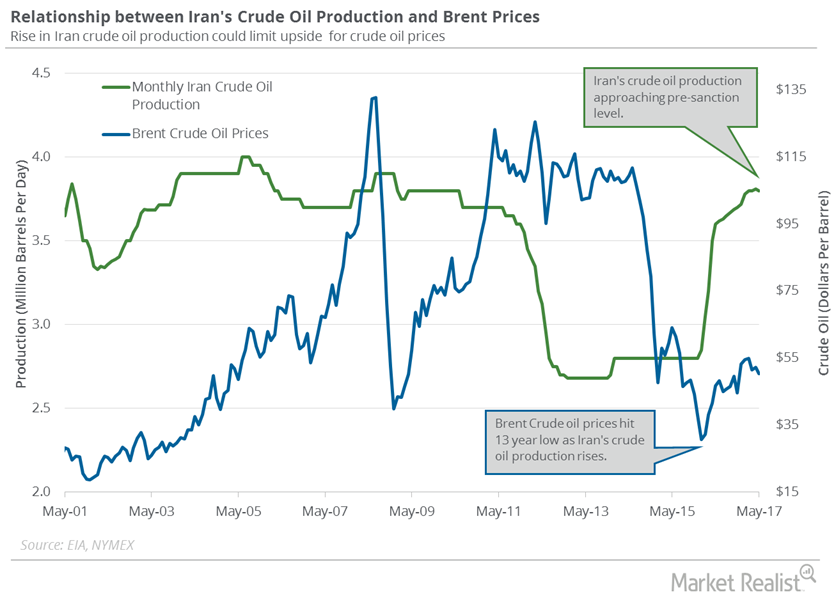

Iran’s Crude Oil Exports and Production: Crucial for Oil Prices

Iran’s crude oil exports are expected to fall 7% in July 2017, according to Reuters. Exports are expected to fall to 1.86 MMbpd in July 2017.

How Long Can US Gasoline Inventories Support Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls to 241 MMbbls on June 16–23, 2017.

US Gasoline Demand: Positive or Negative for Crude Oil?

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd or 6% to 9,816,000 bpd on June 9–16, 2017.

Cushing Inventories Fell for the Ninth Time in 10 Weeks

The EIA (U.S. Energy Information Administration) will release weekly data on crude oil and gasoline inventories on June 28, 2017.

Cushing Crude Oil Inventories Fell Again

A recent survey estimated that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in ten weeks.

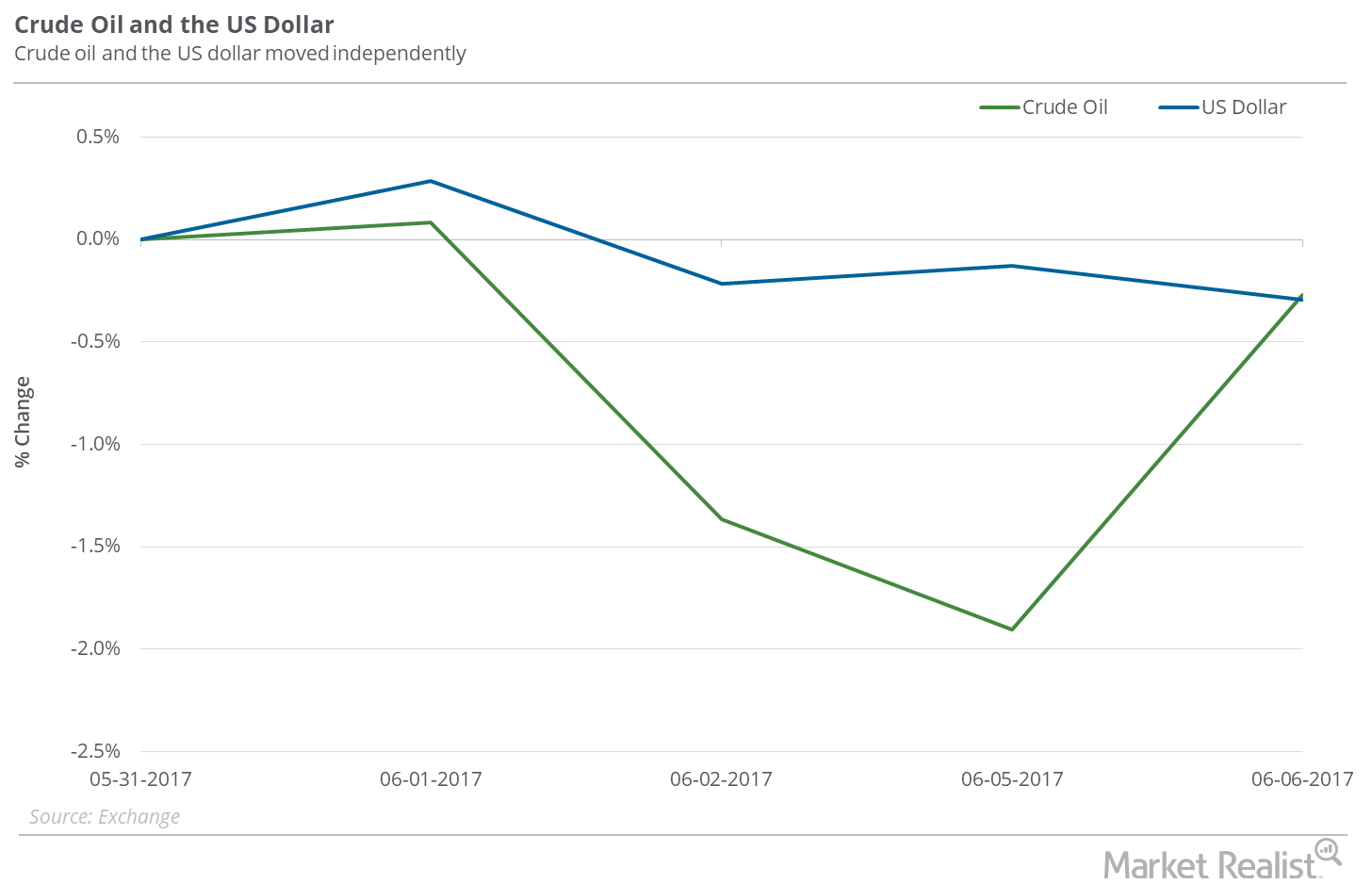

Is Crude Oil Ignoring the Falling Dollar?

Between May 30 and June 6, 2017, the US dollar (UUP) (USDU) (UDN) fell 0.7%, and crude oil (USO) (OIIL) July futures fell 3%.

US Gasoline Consumption Rose in May

The EIA estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016.

US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.

Is the US Dollar Impacting Oil’s Downturn?

In the trailing week, the US dollar fell 0.1%. Despite a fall in the US dollar, crude oil July futures fell 3.5% between May 23 and May 30, 2017.

Will the Energy Sector Lag in Summer Months?

2016 proved fruitful for the energy sector (XLE) with an improvement in oil prices (USO) (USL).

WTI Crude Oil and Gasoline Futures Diverge

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to a lower fall in US gasoline inventories.