How the US Dollar Could Be Crucial to Oil Investors

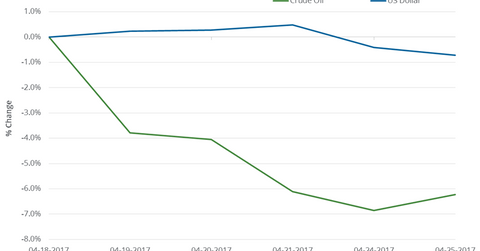

US crude oil futures contracts for June delivery fell 6.2% between April 18, 2017, and April 25, 2017. Meanwhile, the US Dollar Index fell 0.7%.

Nov. 20 2020, Updated 3:04 p.m. ET

Crude oil and the US Dollar Index

US crude oil (DBO) (USL) (OIIL) futures contracts for June delivery fell 6.2% between April 18, 2017, and April 25, 2017. Meanwhile, the US Dollar Index (UUP) (USDU) (UDN) fell 0.7% during the same period.

In the past five trading sessions, crude oil and the US dollar have moved in opposite directions in four instances. The correlation between crude oil and the US dollar in the past five trading sessions was -54.3%, which shows an inverse relationship between the US dollar and oil prices.

Remember, a weaker dollar makes crude oil cheaper for oil importers, which can have a positive impact on prices. Though crude oil fell in the trailing week, the drop in the US dollar would have provided some support to prices.

However, the Fed has stated that it might hike interest rates two more times by the end of 2017, and rising rates could boost the dollar and pressure crude oil prices. The Fed last hiked the interest rate on March 15, 2017.

The long-term correlation between crude oil and the dollar

Between September 2007 and June 2013, the one-month correlation between crude oil and the US dollar was positive in only a few instances. The correlation was largely negative during that period.

However, from June 2013 to now, the correlation between crude oil and the US dollar has been more bidirectional. During that period, the one-month correlations have fluctuated between -64.0% and 43.0%.

The correlations during that period could mean that the following fundamental drivers sometimes had a greater impact on crude oil than the US dollar:

- Saudi Arabia’s production decisions

- US shale oil producers’ cost and production dynamics

- OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC production and supply data

- US inventory data

- rig count data

- other news regarding fundamentals

At the same time, the Trump Administration’s energy and climate policies could mean increased crude oil, natural gas, and coal production in the US, which could mean lower crude oil prices.

So while fundamental factors still dominate, the US dollar’s impact on crude oil prices could be limited in the long term. Global crude oil demand could be the biggest driver of crude oil prices in the long term.

ETFs and crude oil

Notably, ETFs such as the Direxion Daily Energy Bear 3X ETF (ERY), the First Trust Energy AlphaDEX ETF (FXN), the United States Brent Oil ETF (BNO), the Direxion Daily S&P Oil & Gas Exploration & Production Bear 3X ETF (DRIP), and the United States Oil ETF (USO) are also impacted by movements in crude oil.