WisdomTree Bloomberg US Dllr Bullish ETF

Latest WisdomTree Bloomberg US Dllr Bullish ETF News and Updates

Have We Seen a Short-Term Bottom for the Dollar?

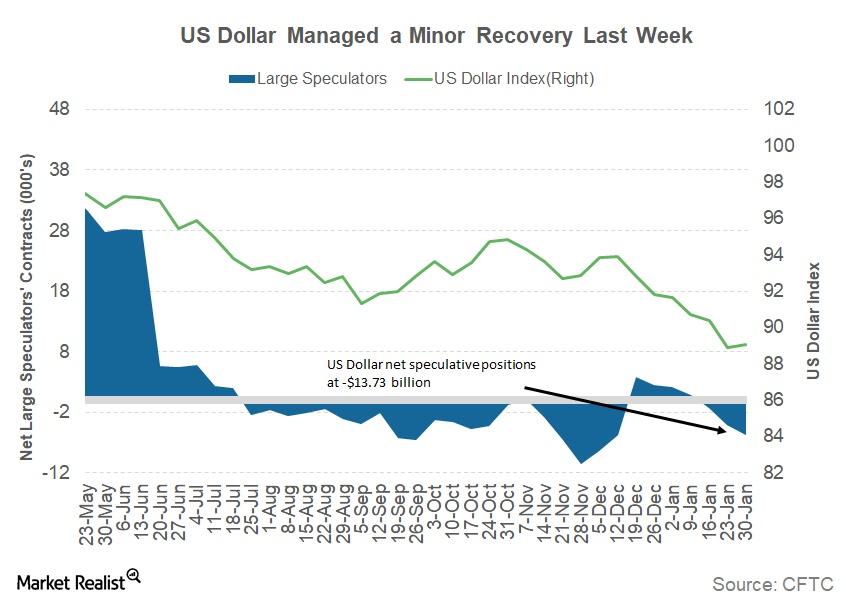

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

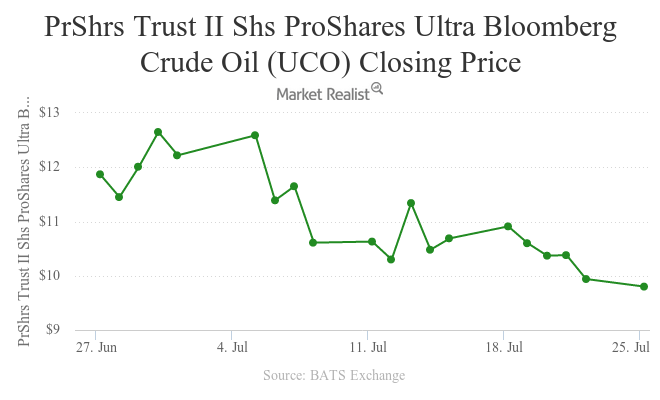

Sharp Fall in Crude Oil Price Dictate the Currencies Markets

Looking at the performance of the major commodity-driven currencies on July 25, the Nigerian naira was the biggest casualty.

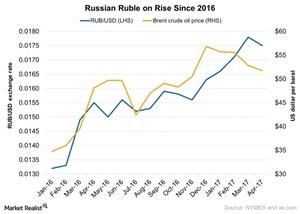

Why the Ruble Is on the Rise

The recovery of oil prices in the latter half of 2016 has helped the Russian ruble to appreciate along with improved exports.

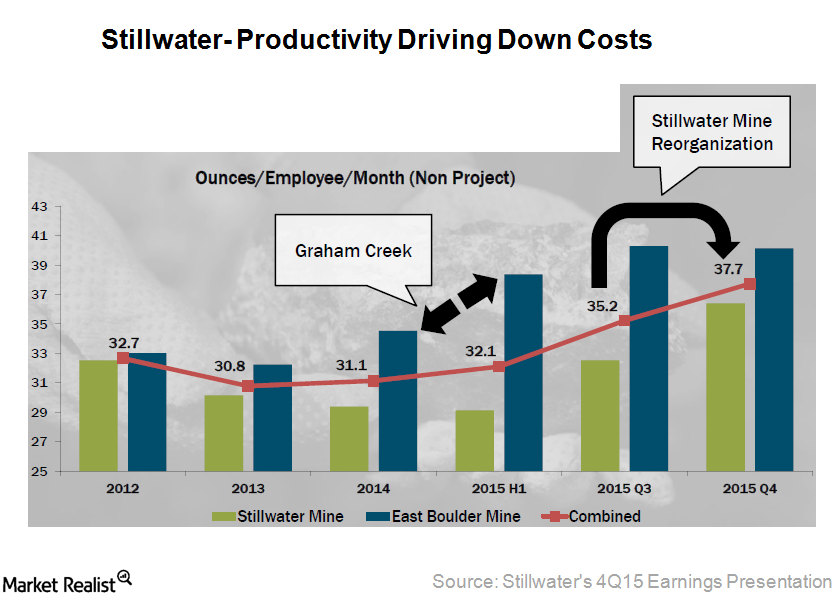

How Is Stillwater Cutting Costs to Stay Ahead of Platinum Prices?

Stillwater Mining (SWC) has seen a significant increase in recovery rates, which is one of the best in the PGM (platinum group metals) industry.

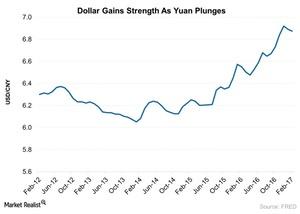

How Much Is China Really Devaluing Its Currency?

China had pegged its currency, the yuan, to the US dollar as it was a developing nation.

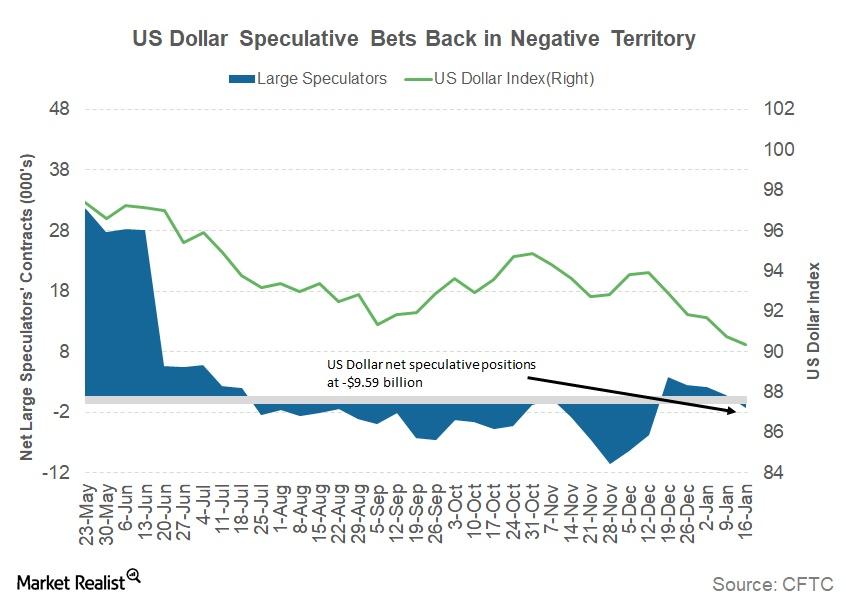

How the US Dollar Could React to a US Government Shutdown

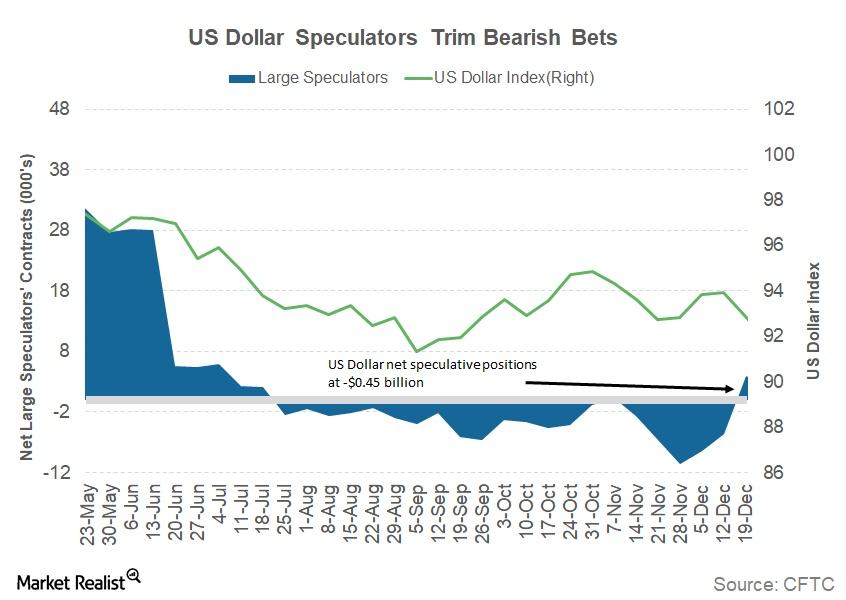

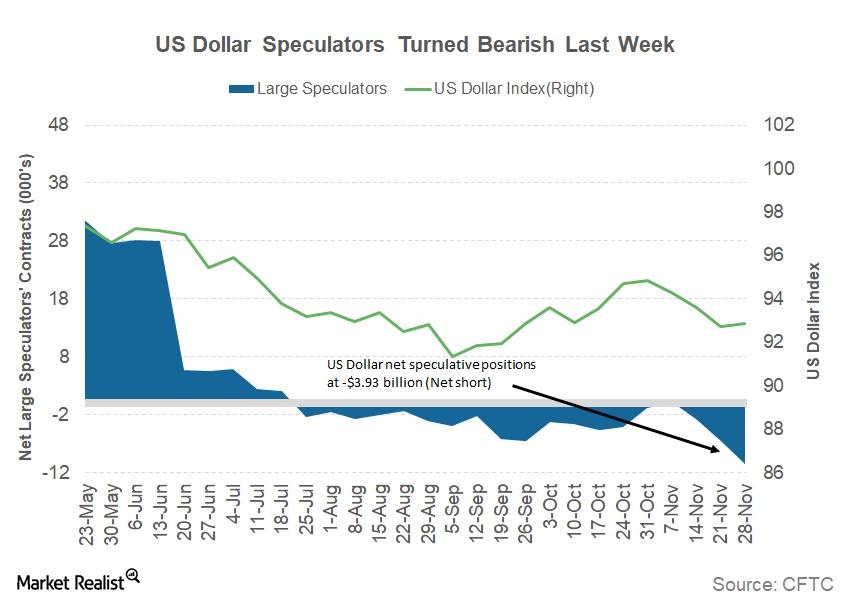

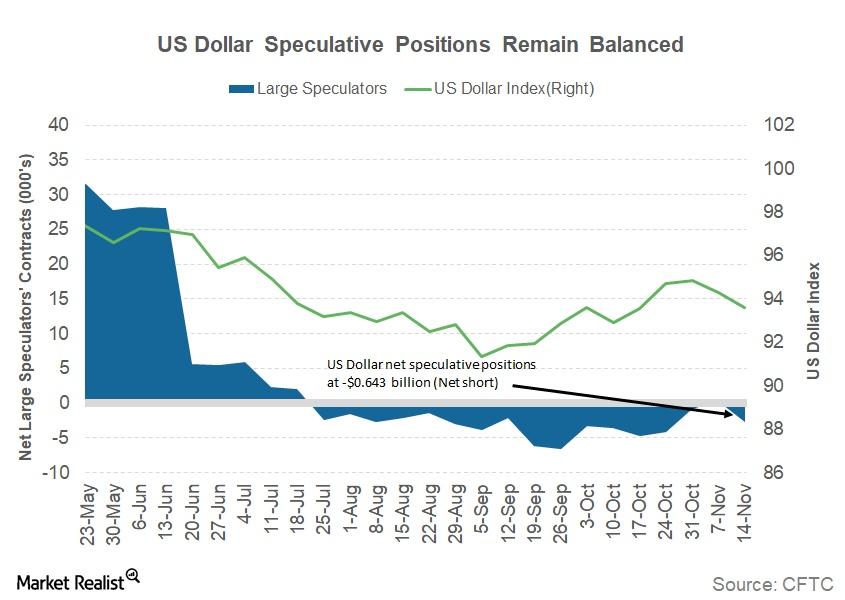

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

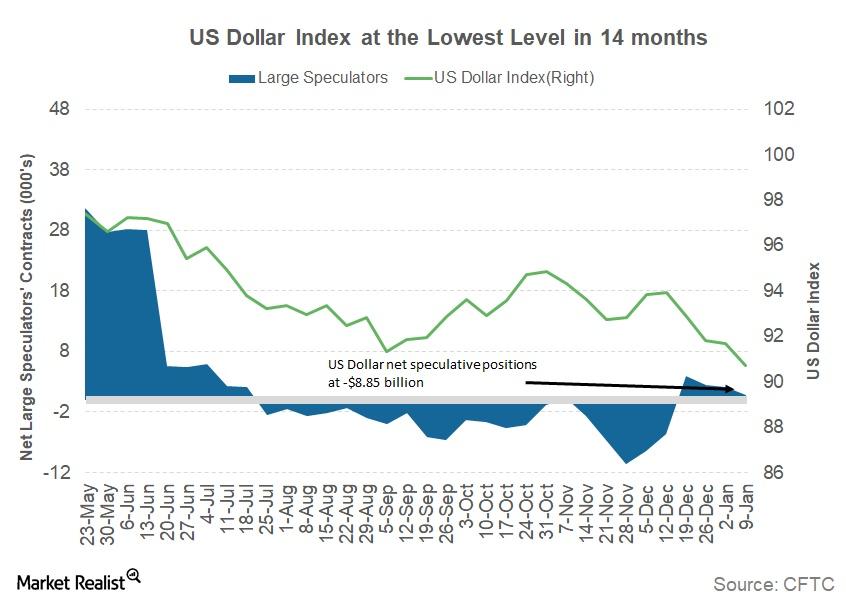

Why the US Dollar Is Losing Its Appeal

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

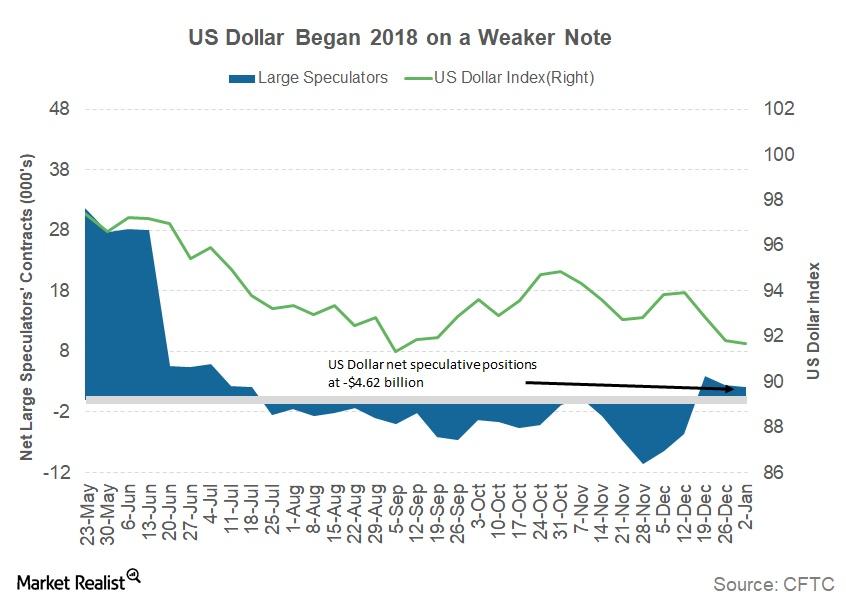

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

Can the US Dollar Gain Back Lost Ground This Week?

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

Why the US Dollar Resisted the Fed’s Latest Rate Hike

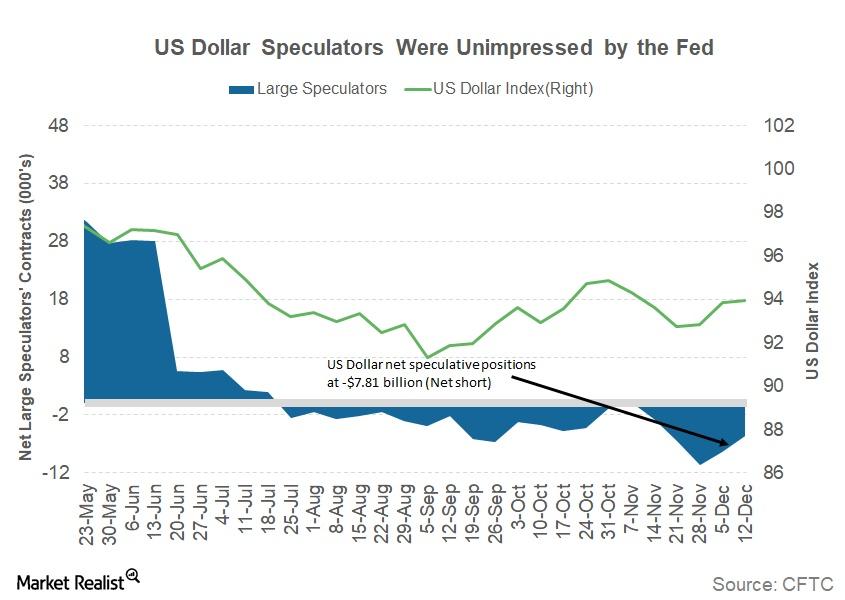

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

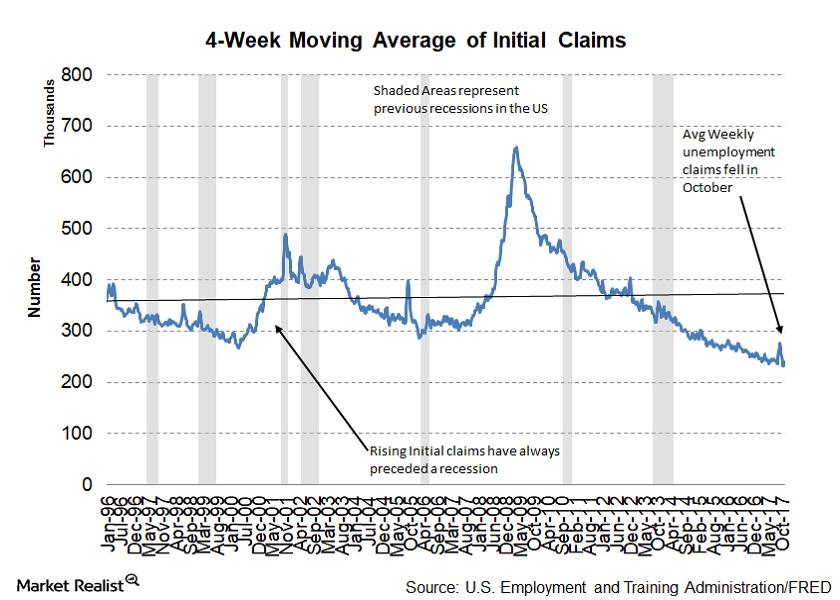

What Decreasing Weekly Unemployment Claims Say about the US Economy

In the Conference Board Leading Economic Index, the average weekly unemployment claims have 3.0% weight.

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

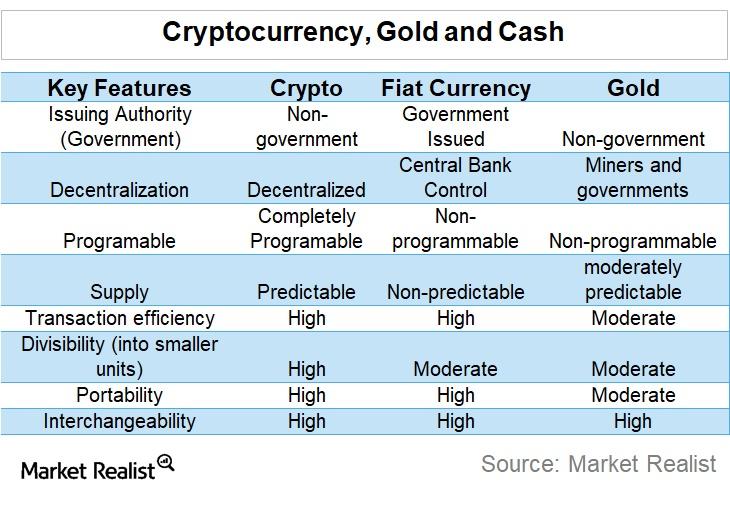

How Bitcoin Differs from Other Currencies

Bitcoin has been rallying for the past year, with some proponents advocating that it could replace fiat currencies in the future.

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

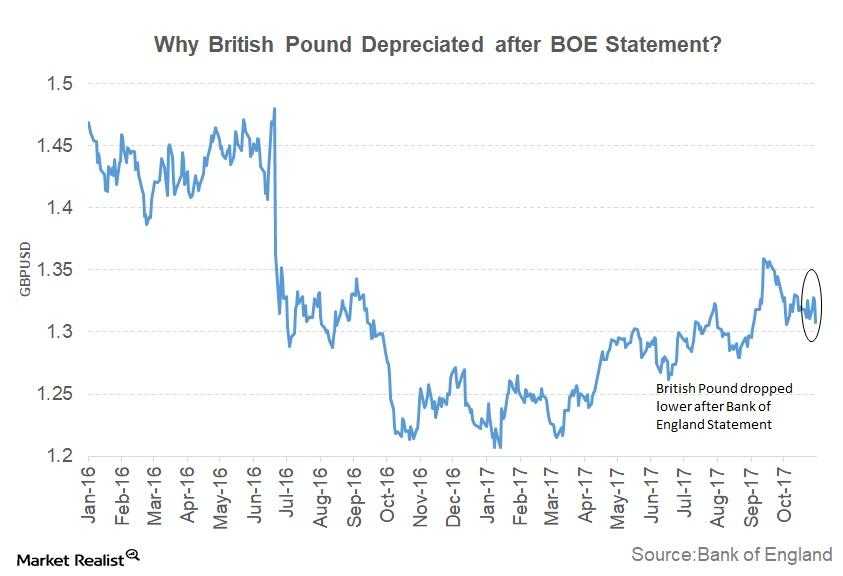

Why the British Pound Fell—Despite the Bank of England’s Rate Hike

The British pound depreciated 1.41% against the US dollar after the policy statement from the BOE (Bank of England) on November 2.

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

Has the US Dollar Rally Ended for Now?

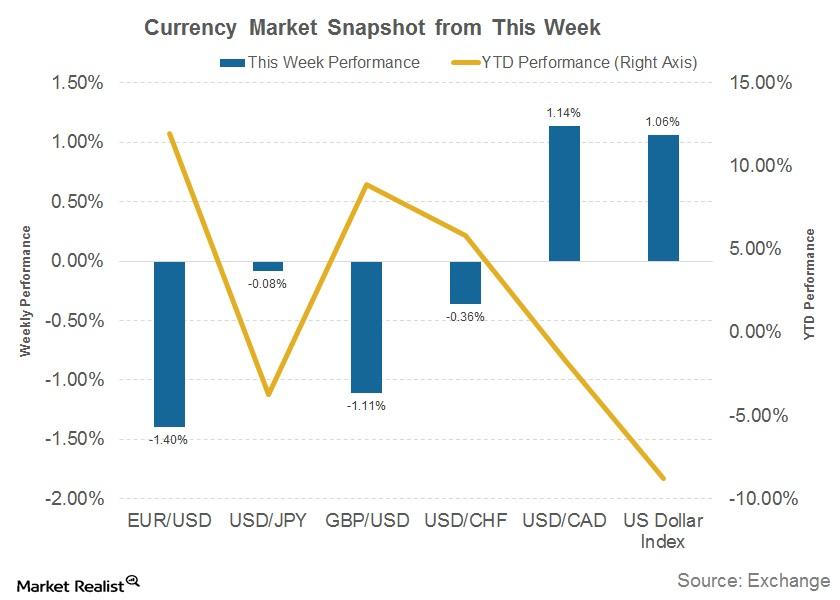

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

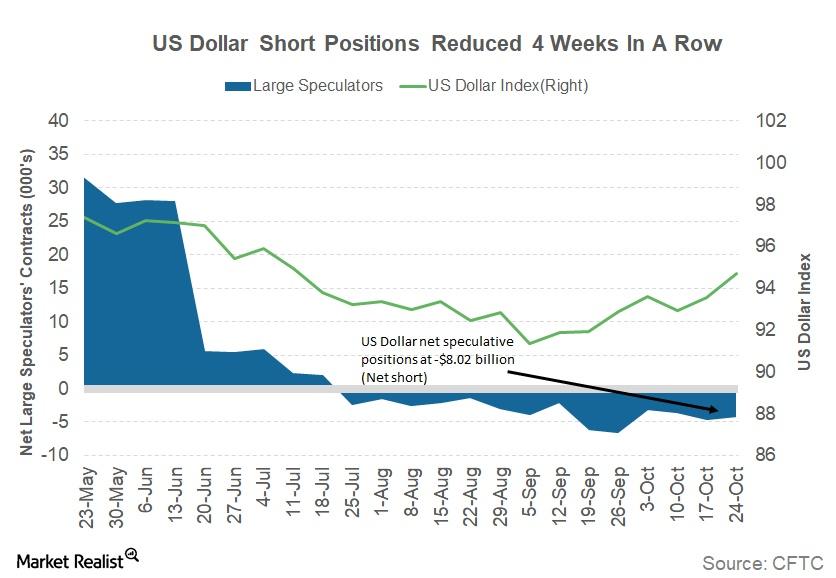

Are Investors Positioning for a US Dollar Rally?

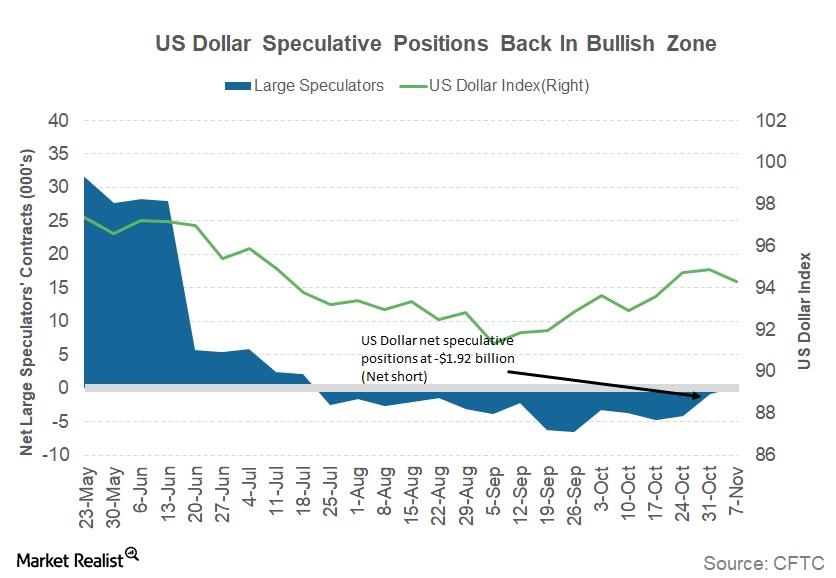

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

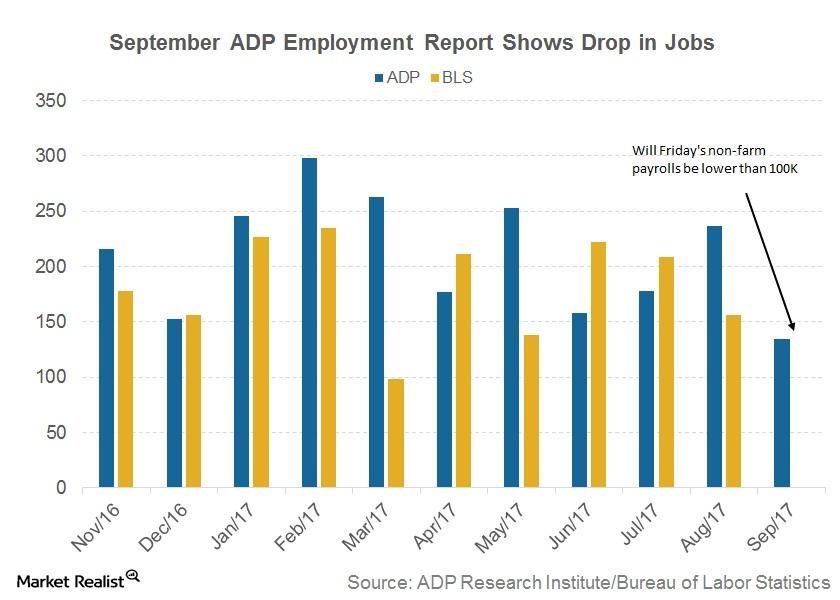

ADP Jobs Data Dragged Lower by Hurricanes in September

As per the September ADP National Employment Report, the US private sector added 135,000 jobs during the month. The figure is a sharp decrease from 228,000 in August.

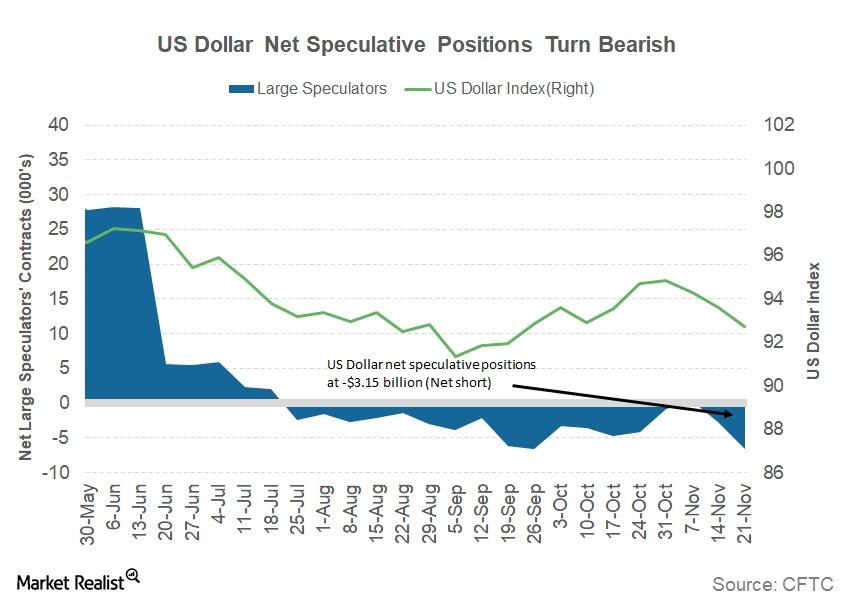

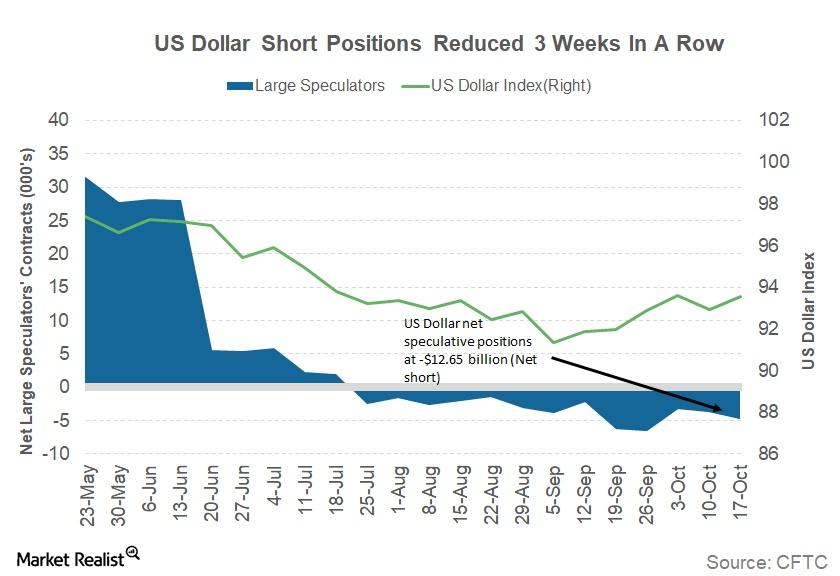

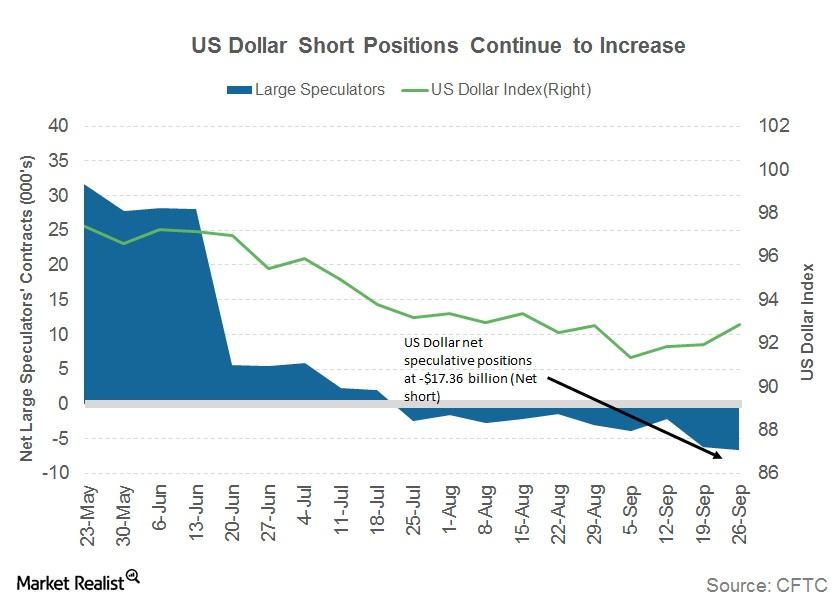

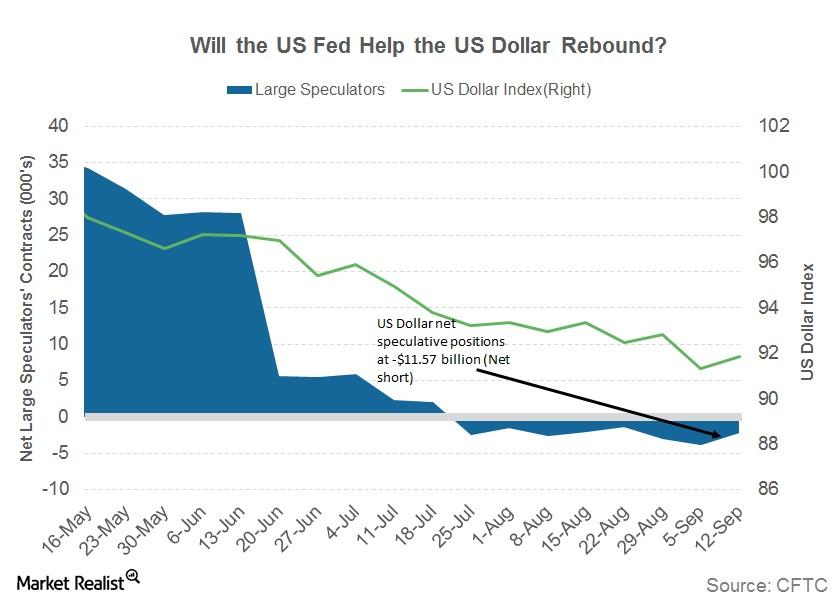

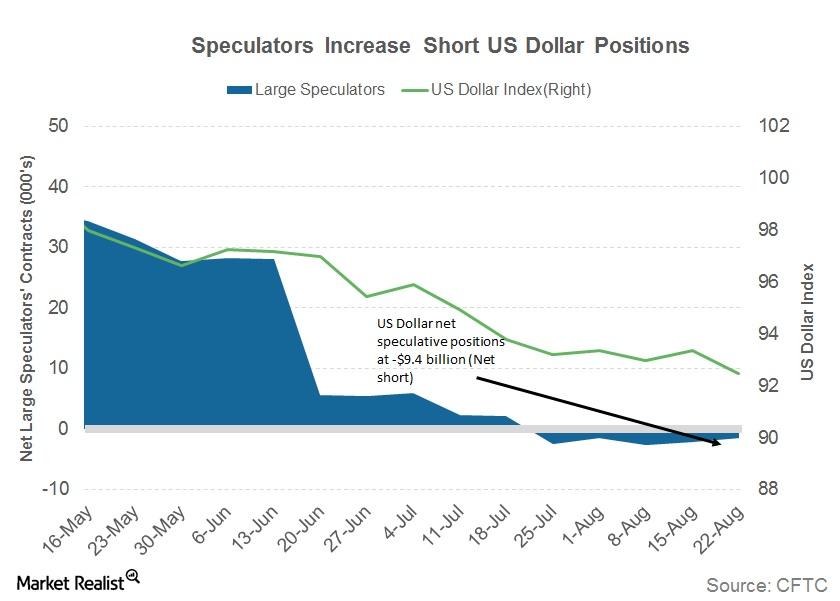

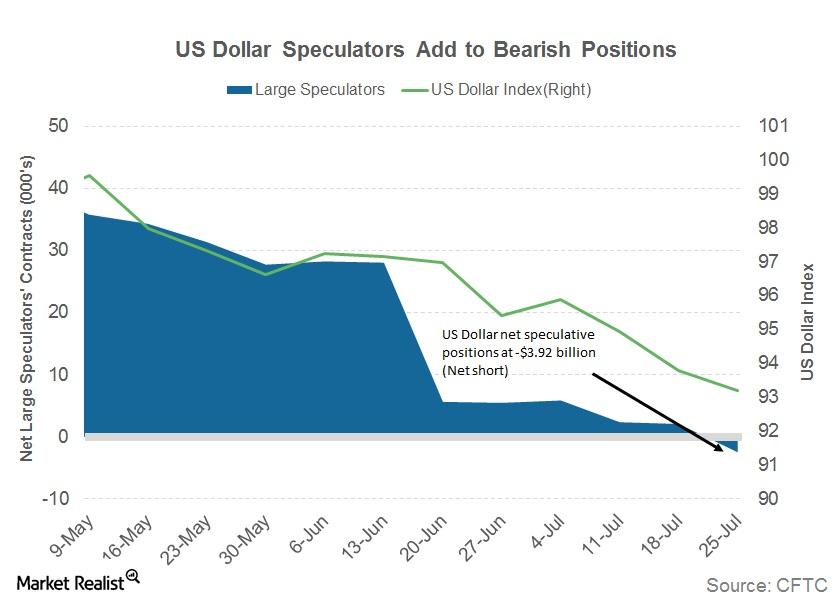

Why Speculators Continue to Bet against the US Dollar

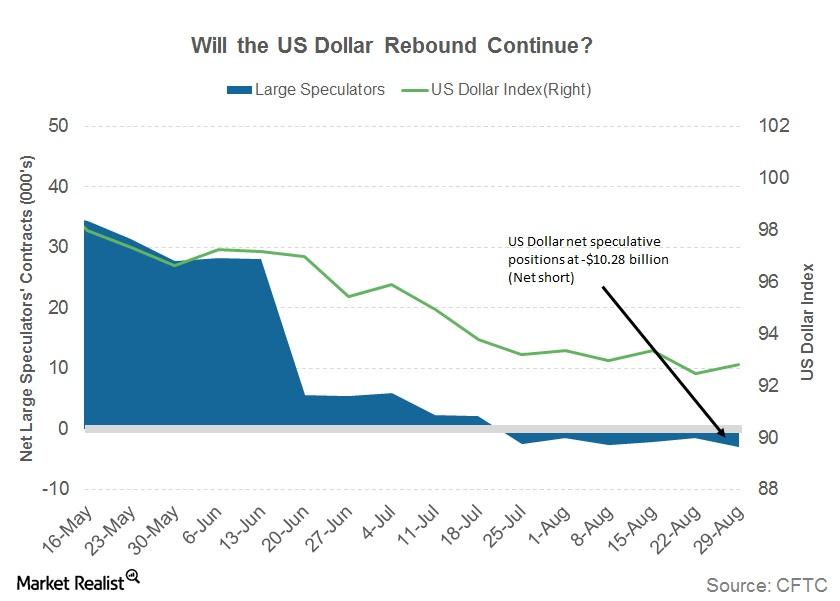

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

Could Rising Interest Rates Help the US Dollar?

Double dose of optimism for the US dollar The US dollar (UUP) was being written off before the beginning of September, as the Fed was expected to stay on hold and other major central banks were expected to start policy normalization. However, the Fed had a surprise in store for the market. The FOMC’s (Federal Open […]

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

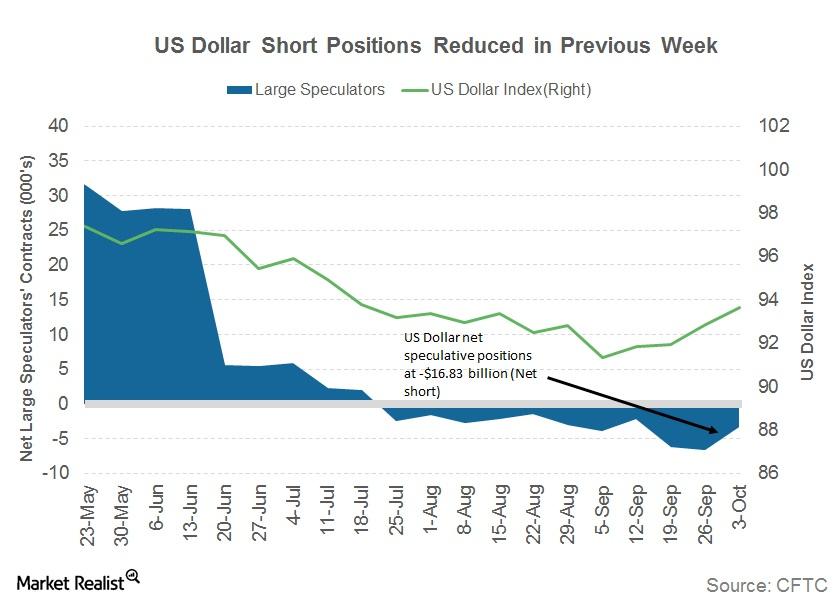

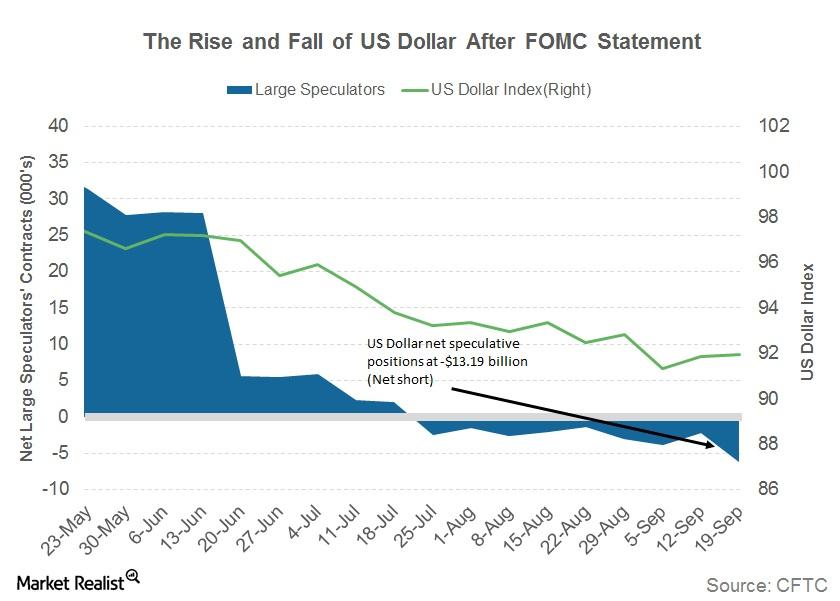

Assessing the US Dollar’s Rally after the Latest Hawkish Fed Statement

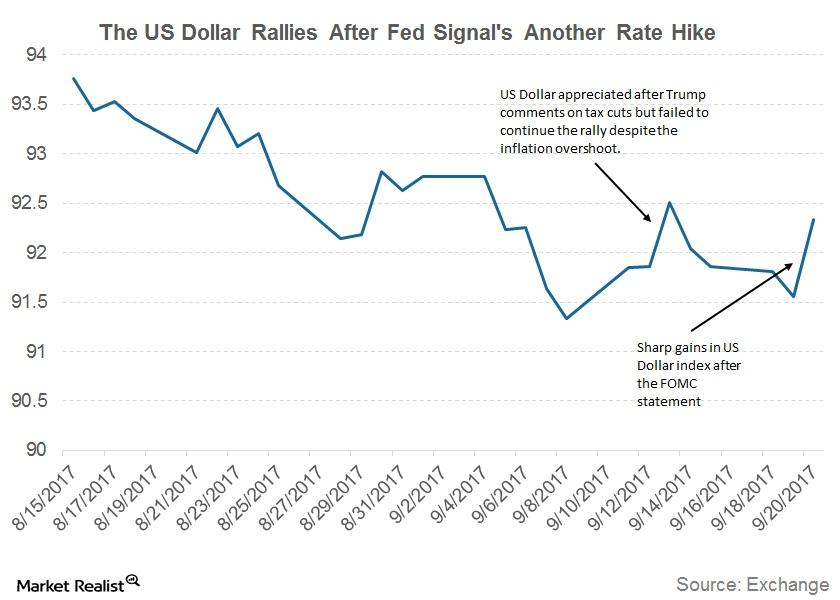

The US dollar rallied after the latest FOMC (Federal Open Market Committee) meeting statement was released on September 20.

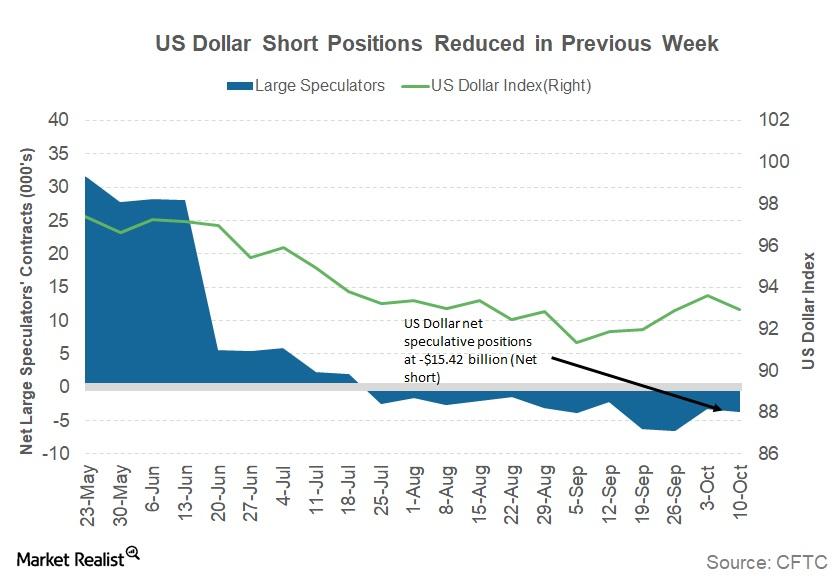

Why the US Dollar Saw a Sharp Rebound

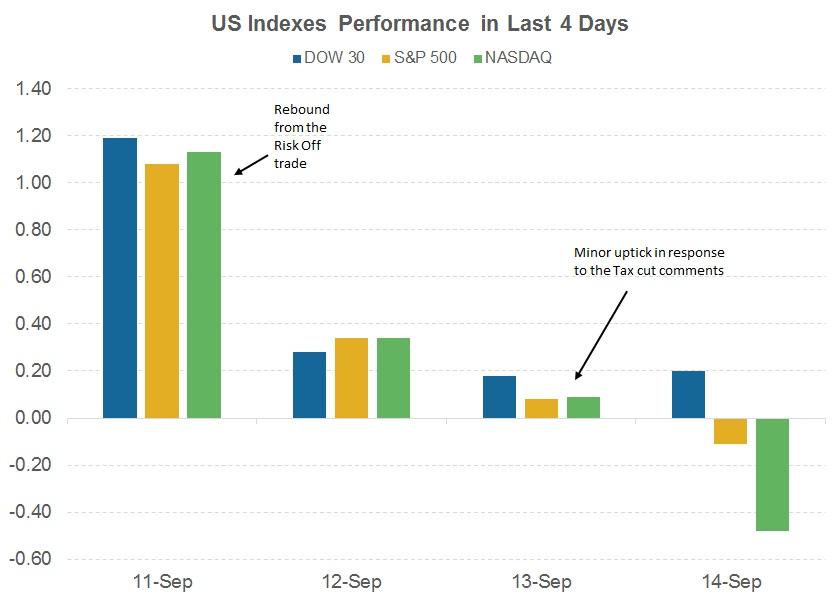

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

Understanding the Ups and Downs of the US Dollar

The US dollar has been on a roller coaster ride over the last ten trading sessions. The US dollar (UUP) index hit a low of 90.99 on September 8.

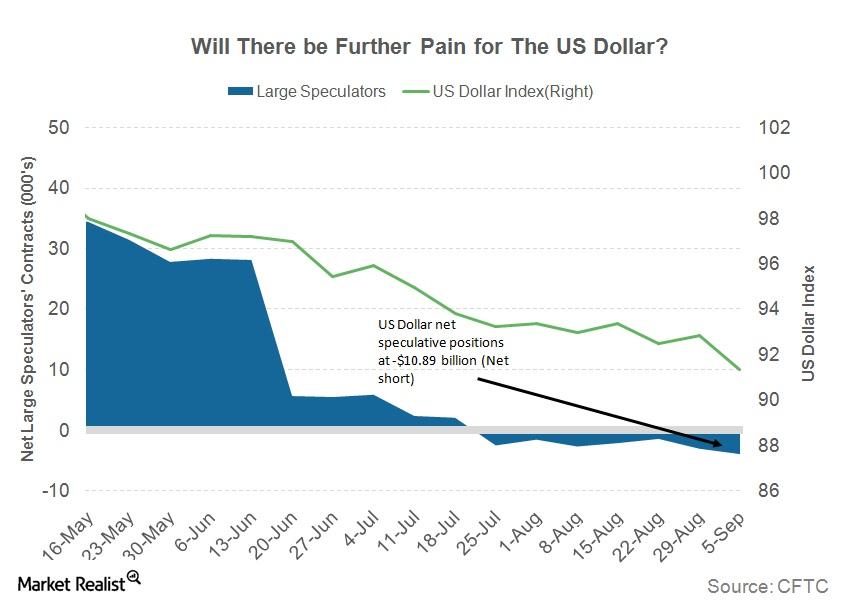

Why the US Dollar Could Be Poised for Further Losses

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

Could the Federal Reserve Surprise the Markets in September?

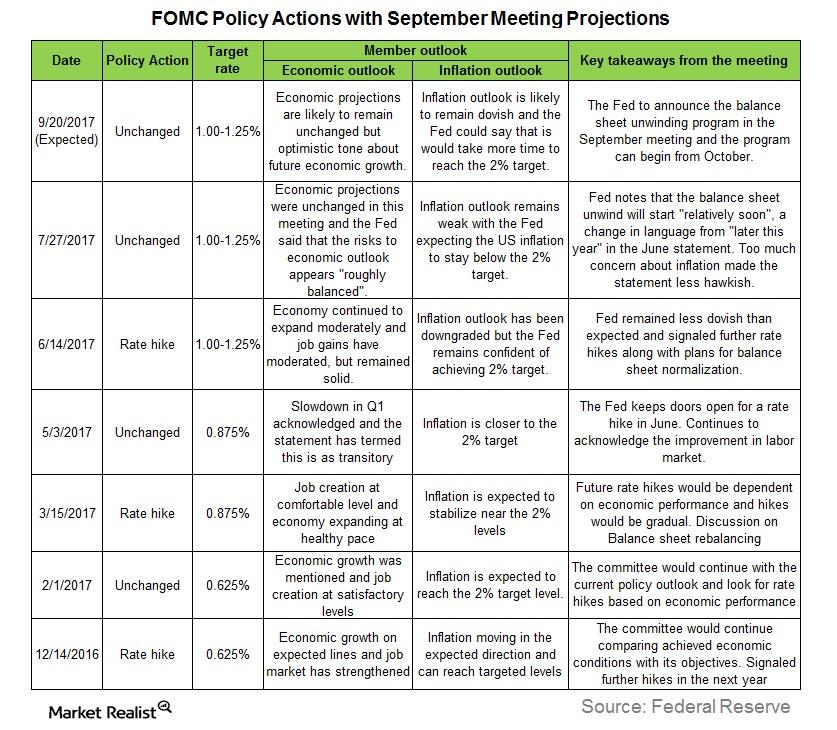

The US Federal Open Market Committee (or FOMC) is scheduled to meet on September 19 and 20 to discuss the current economic climate in the US and to decide whether any monetary policy adjustments are necessary.

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

Is the US Dollar Dying a Slow Death?

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

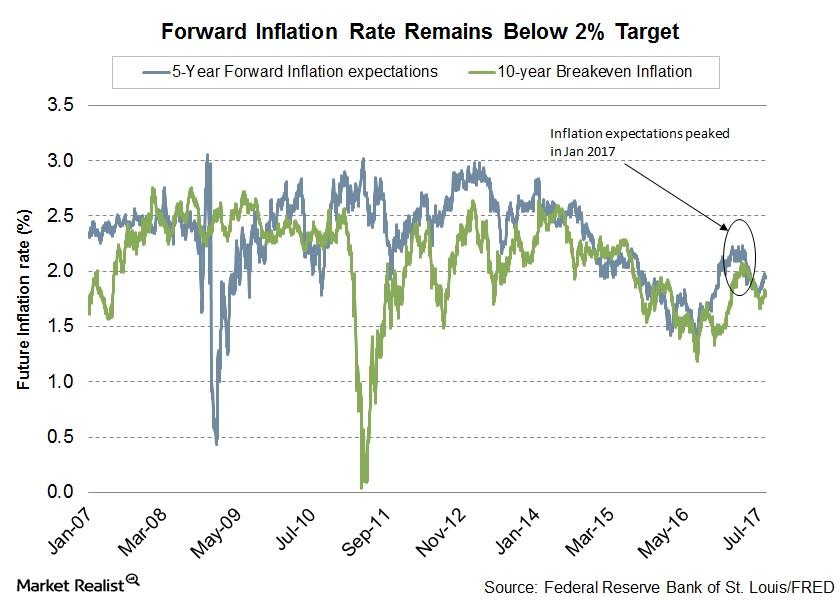

New York Fed President William Dudley Discussed Inflation

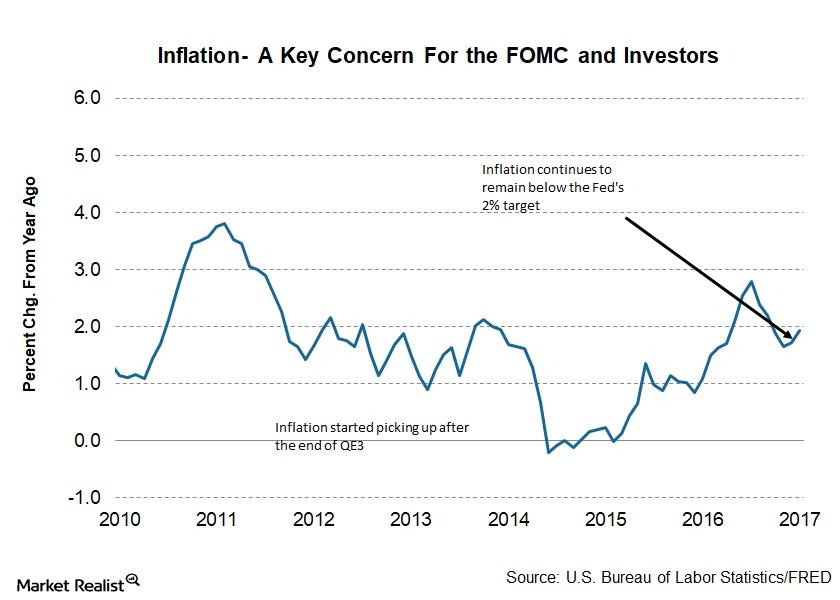

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

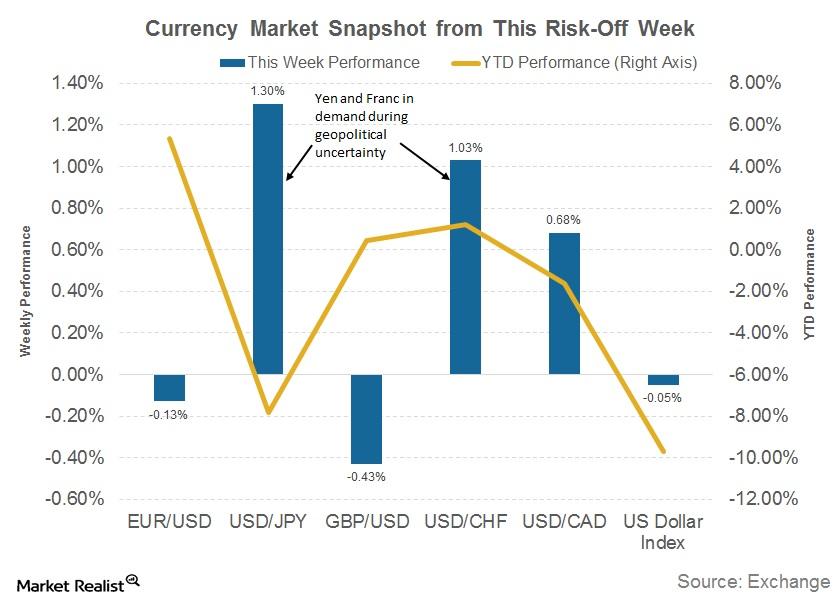

A Lesson from Currency Markets during Geopolitical Tensions

Last week’s rising geopolitical tensions between the United States and North Korea turned the tide for the yen. The Swiss franc also appreciated.

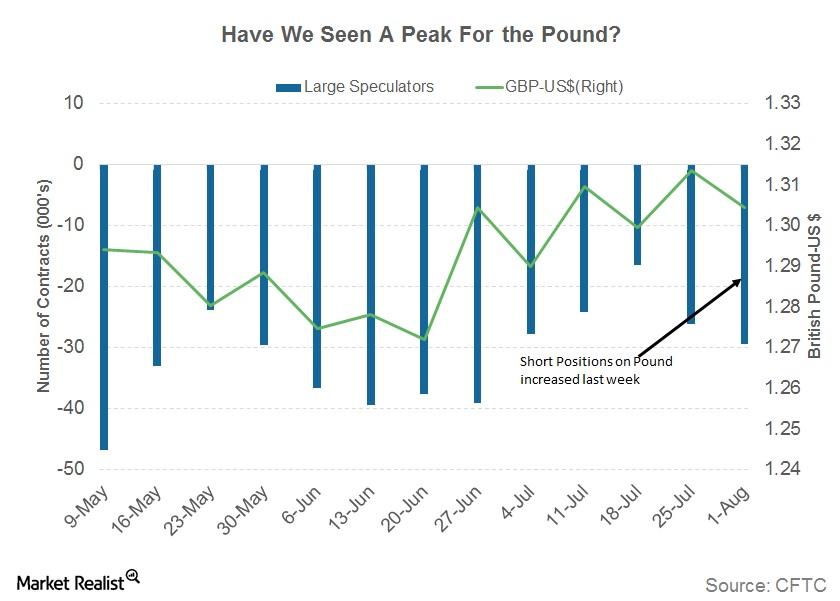

Chart in Focus: A Look at the British Pound

The British pound recorded another multi-month high of 1.3266 against the US dollar before the Bank of England announced its inflation report and interest rate decision on August 3.

What to Expect from the US Dollar

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

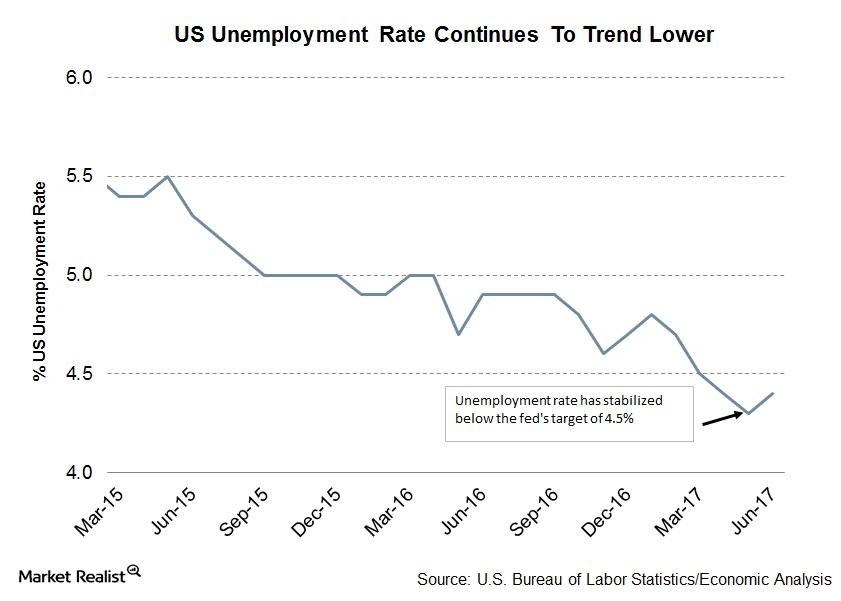

US Unemployment: The Fed’s Favorite Metric Continues to Improve

In a statement following the conclusion of its two-day monetary policy meeting, the FOMC stated that US labor market growth was solid.

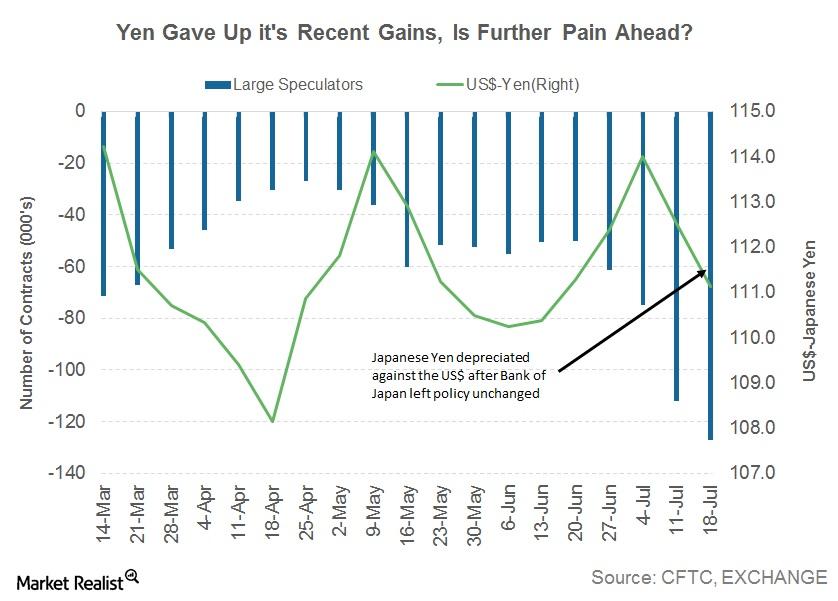

The Japanese Yen Could Keep the US Dollar Company

Another week of appreciation The Japanese yen (JYN) had another positive week, posting gains of 1.3% and closing at 111.12 against the US dollar (UUP). The previous week’s close for the currency pair was 112.53. This strength was primarily driven by the US dollar, rather than positive news from the Japanese economy. Most of the […]

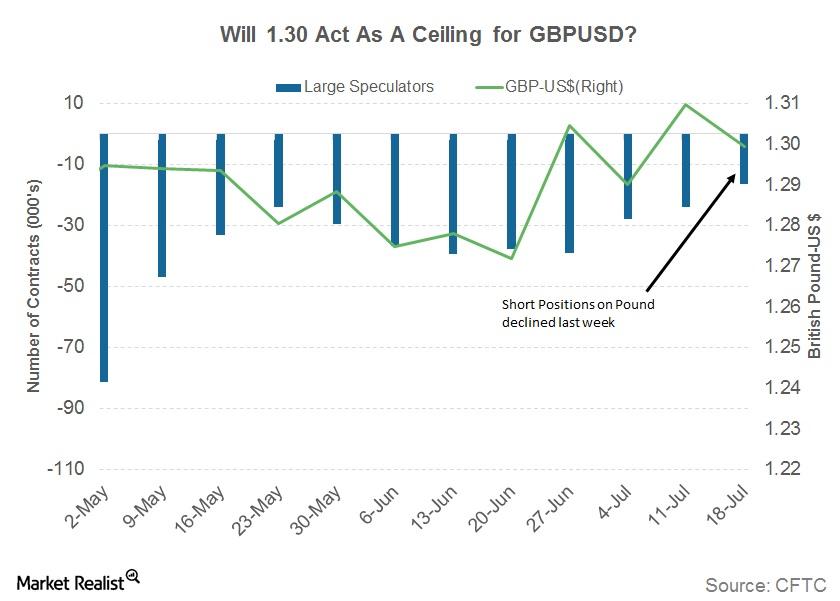

Why the British Pound Failed to Stay above 1.30

Investors not confident the Bank of England will raise rates The British pound (FXB) has had a roller coaster ride over the last few weeks, as mixed signals were given by the Bank of England. After a hawkish tone at its June meeting, the Bank of England has turned dovish in recent weeks. The British pound […]

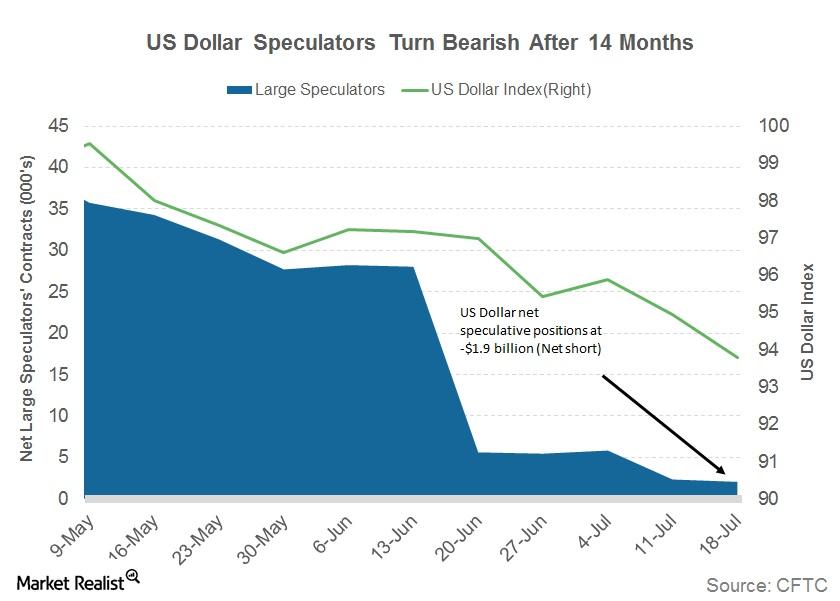

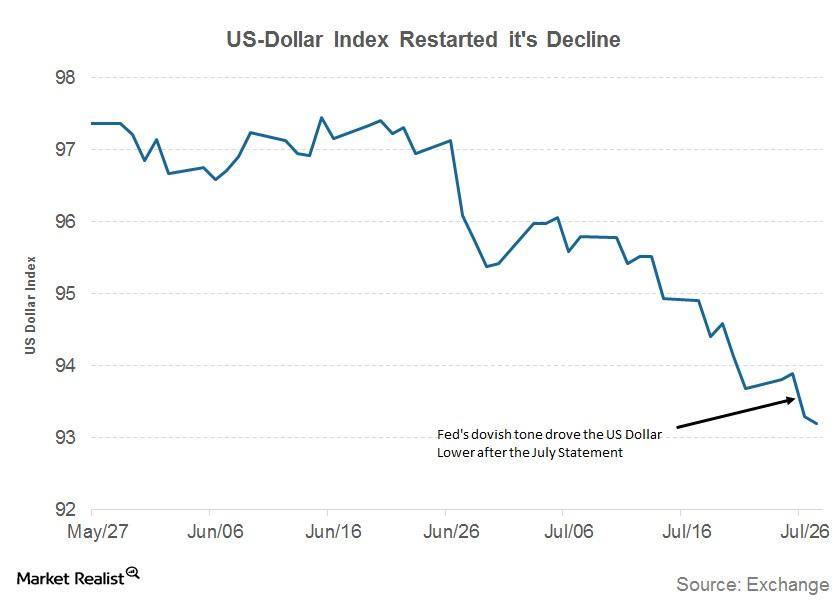

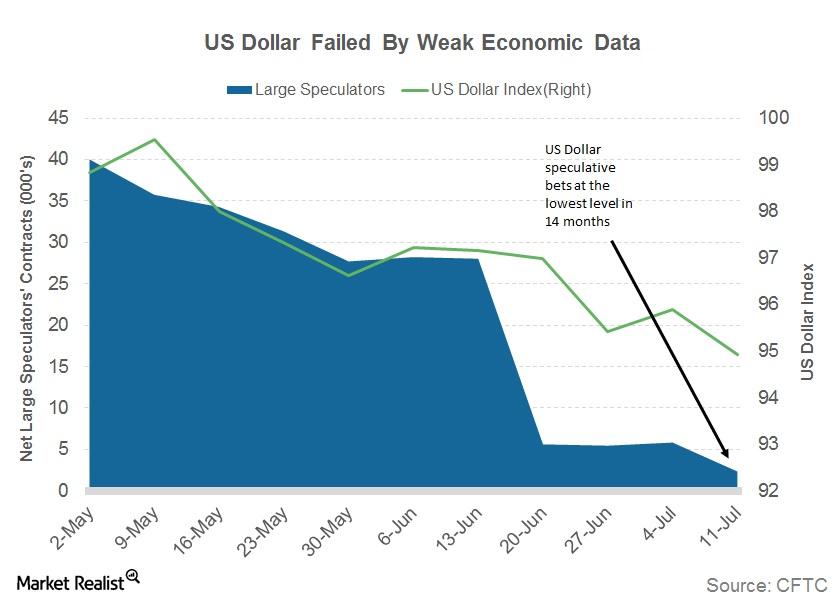

This Is Why the US Dollar Could Slide Further

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

Why the US Dollar Took a Hit after the FOMC’s July Statement

Most of the statement released by the Federal Open Market Committee (or FOMC) following its two-day monetary policy meeting was in line with the market’s expectations.

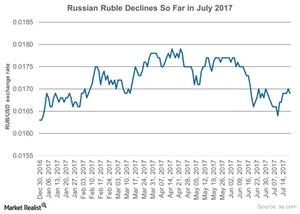

How Has the Ruble Performed in July 2017?

The Russian ruble (ERUS) tends to move in line with crude oil prices (USO) (UCO).

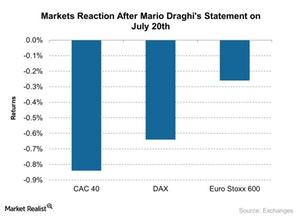

Euro Surged, Market Fell after Draghi’s Statement

When ECB president Mario Draghi announced that the interest rate remained unchanged at 0.0%, the euro fell nearly 0.30% against the US dollar.

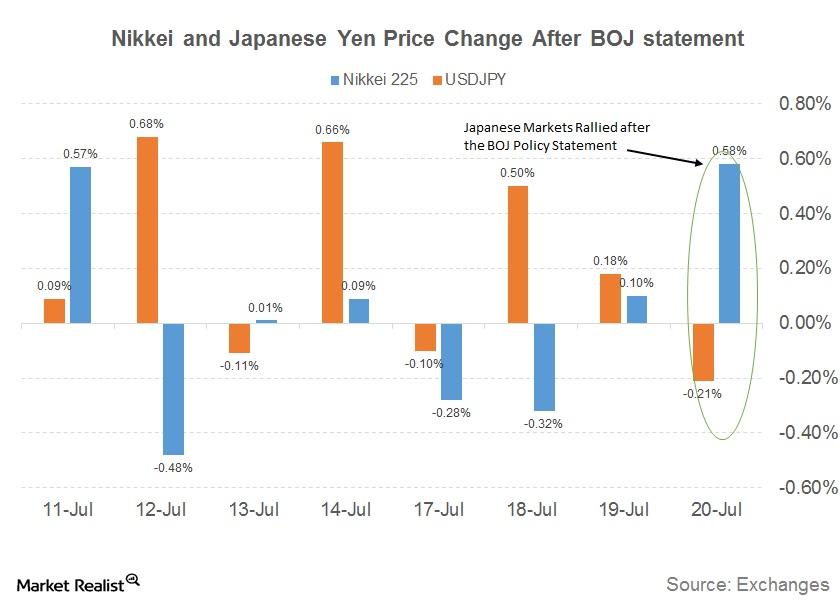

Why Japanese Markets Surged after the Bank of Japan’s Inaction

In its July 2017 monetary policy statement on July 20, 2017, the Bank of Japan reported that it had left interest rates unchanged at -0.1%.

Have Yellen and US Economy Failed the US Dollar?

The US Dollar Index (UUP) closed at 94.9, depreciating by 0.90% last week.

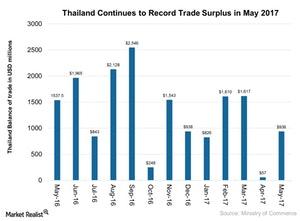

Why Thailand’s Trade Surplus Rose in June 2017

Thailand’s trade balance continues to expand due to improvement in external demand and tourism in May 2017.Macroeconomic Analysis Is the British Pound Facing the Risk of Stagnation?

Economic data from the United Kingdom showed unexpected signs of a slowdown last week, with weaker-than-expected data reported in trade, production, and house prices.