PowerShares DB US Dollar Bearish ETF

Latest PowerShares DB US Dollar Bearish ETF News and Updates

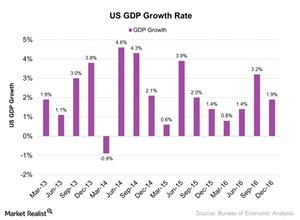

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

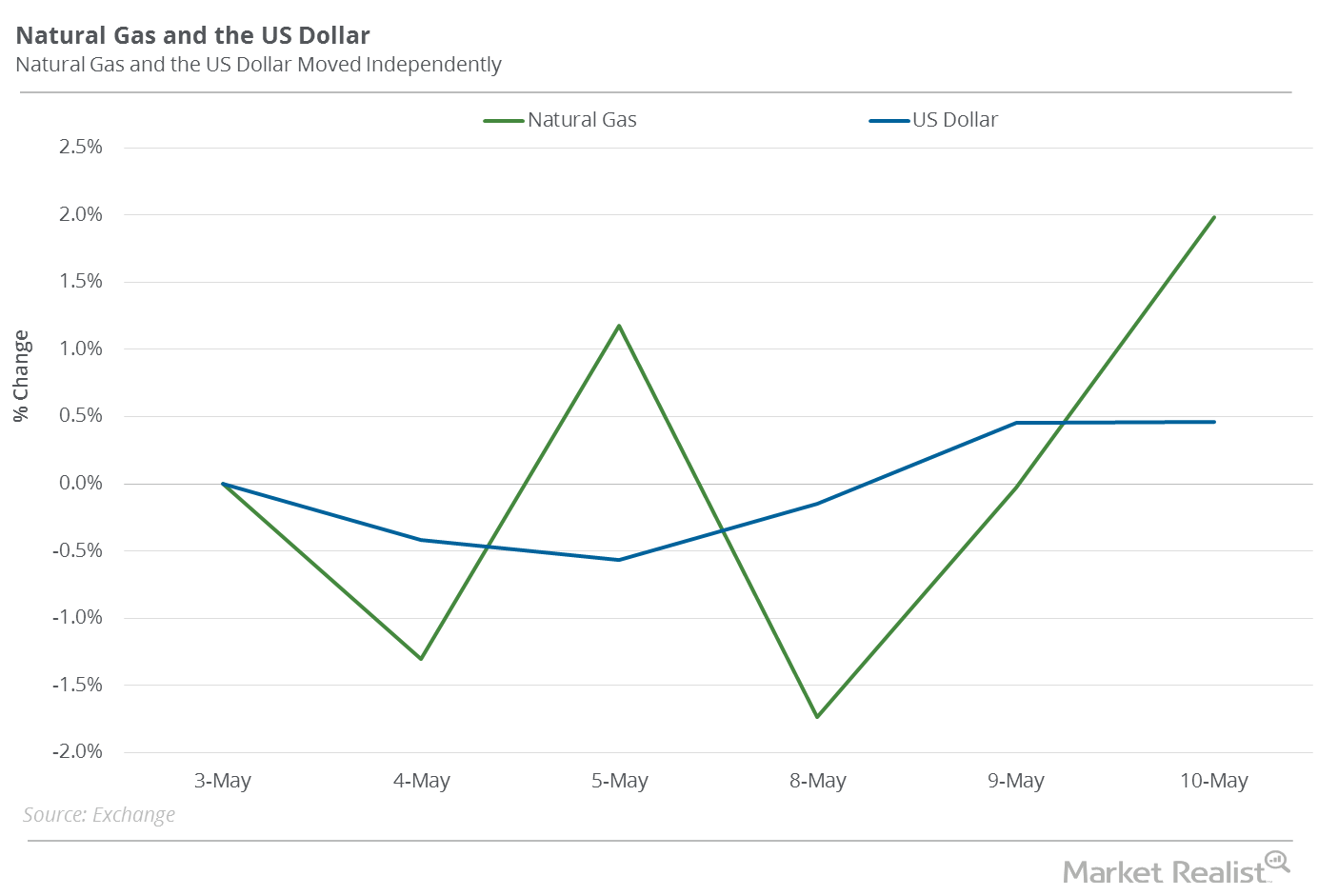

Natural Gas Prices Are Impacted by the US Dollar

Between May 3 and May 10, 2017, natural gas (GASX) (FCG) (GASL) June futures rose 2%. The US dollar (UUP) (UDN) (USDU) rose 0.5% during that period.

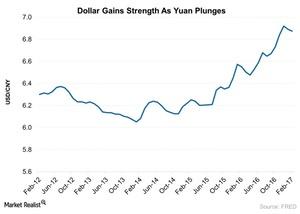

How Much Is China Really Devaluing Its Currency?

China had pegged its currency, the yuan, to the US dollar as it was a developing nation.

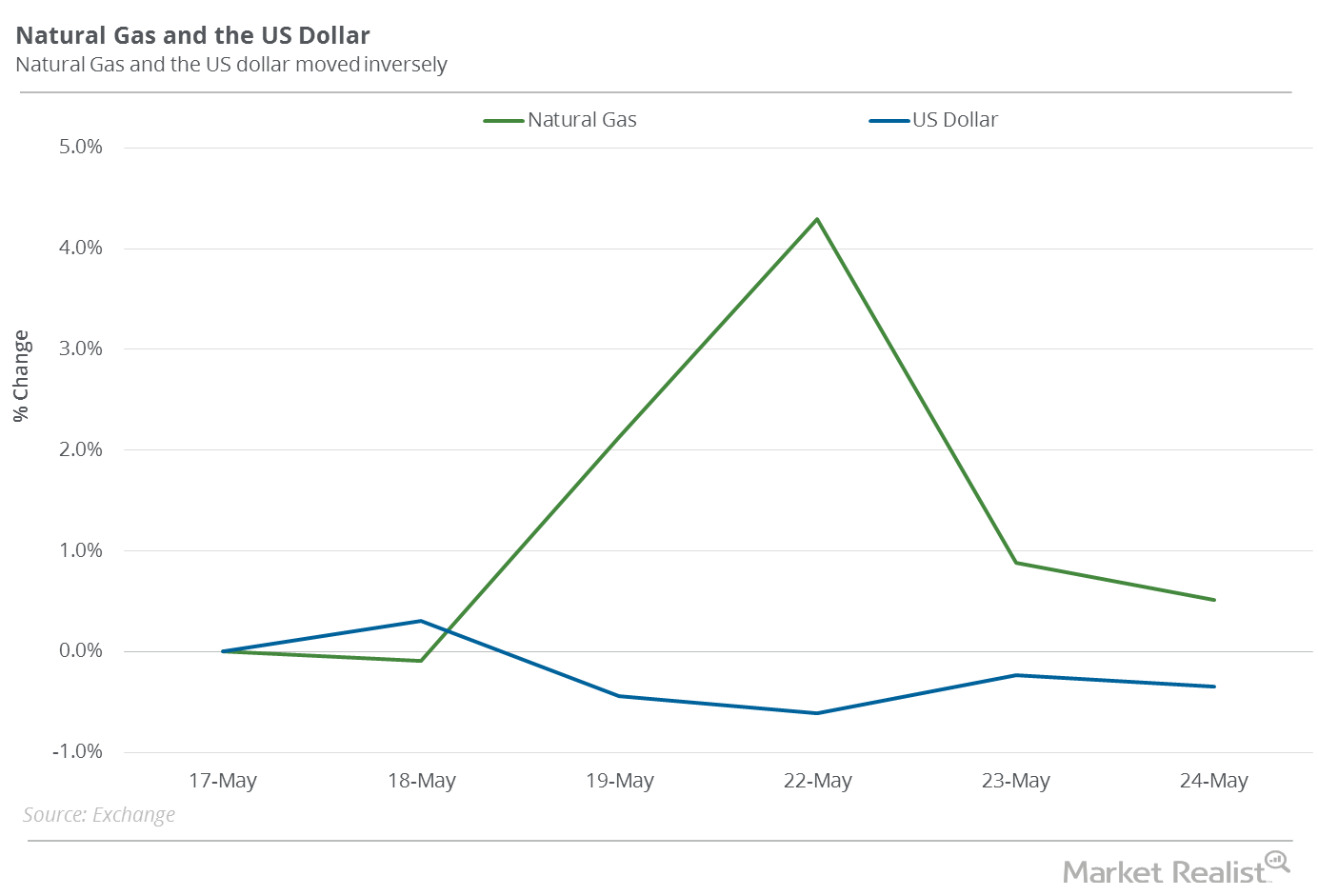

Recent Fall in the US Dollar: Crucial for Natural Gas?

Natural gas (GASX) (FCG) (GASL) July futures rose 0.5% on May 17–May 24, 2017. During this period, the US dollar (UUP) (UDN) (USDU) fell 0.3%.

Could Rising Interest Rates Help the US Dollar?

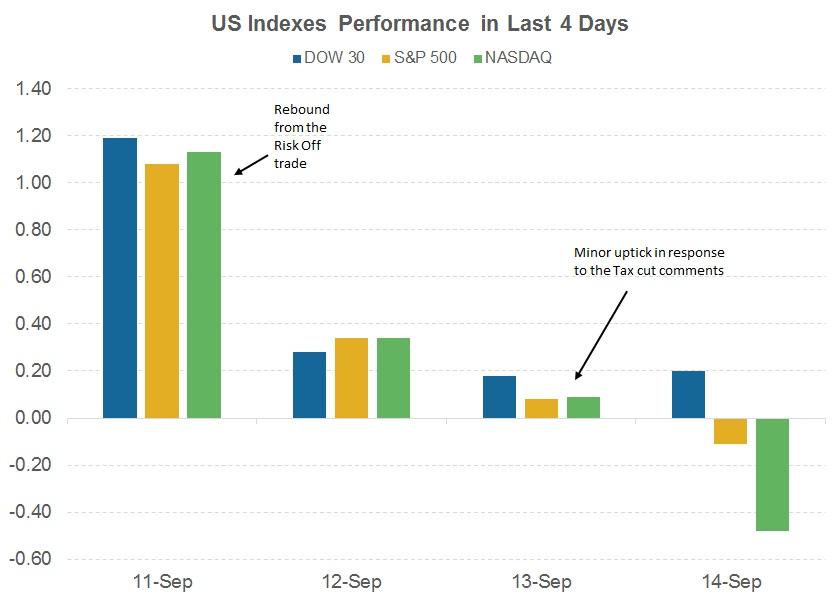

Double dose of optimism for the US dollar The US dollar (UUP) was being written off before the beginning of September, as the Fed was expected to stay on hold and other major central banks were expected to start policy normalization. However, the Fed had a surprise in store for the market. The FOMC’s (Federal Open […]

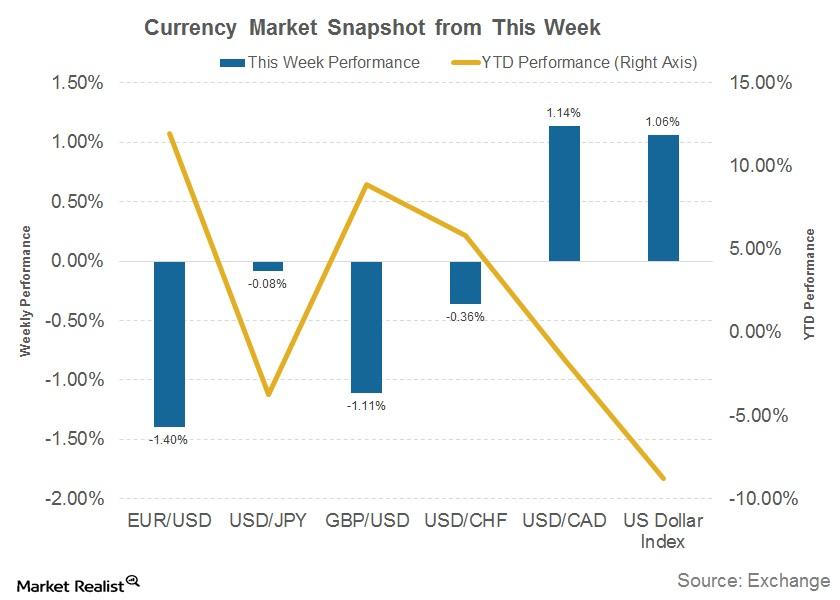

Understanding the Ups and Downs of the US Dollar

The US dollar has been on a roller coaster ride over the last ten trading sessions. The US dollar (UUP) index hit a low of 90.99 on September 8.

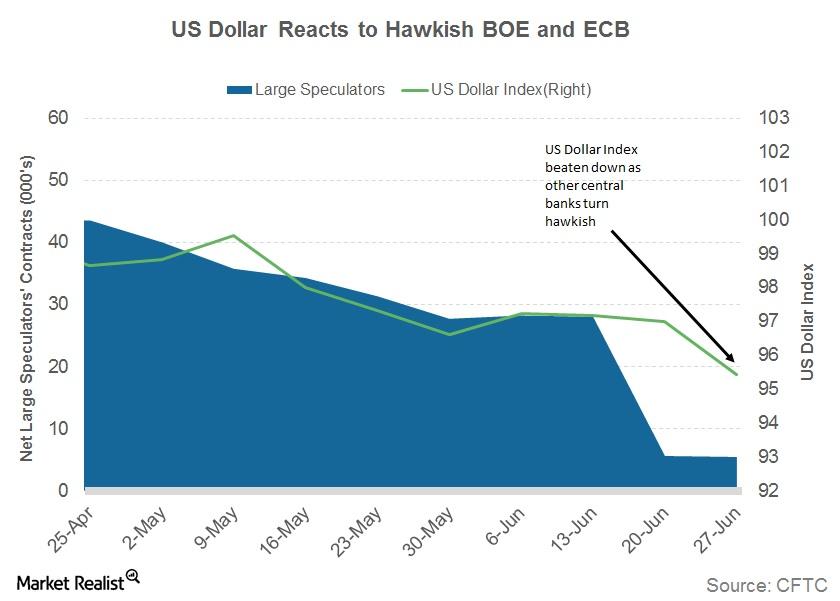

Did the BOE and ECB Pressure the US Dollar This Week?

The currency markets are anticipating the June FOMC’s meeting minutes, which are expected to be hawkish.

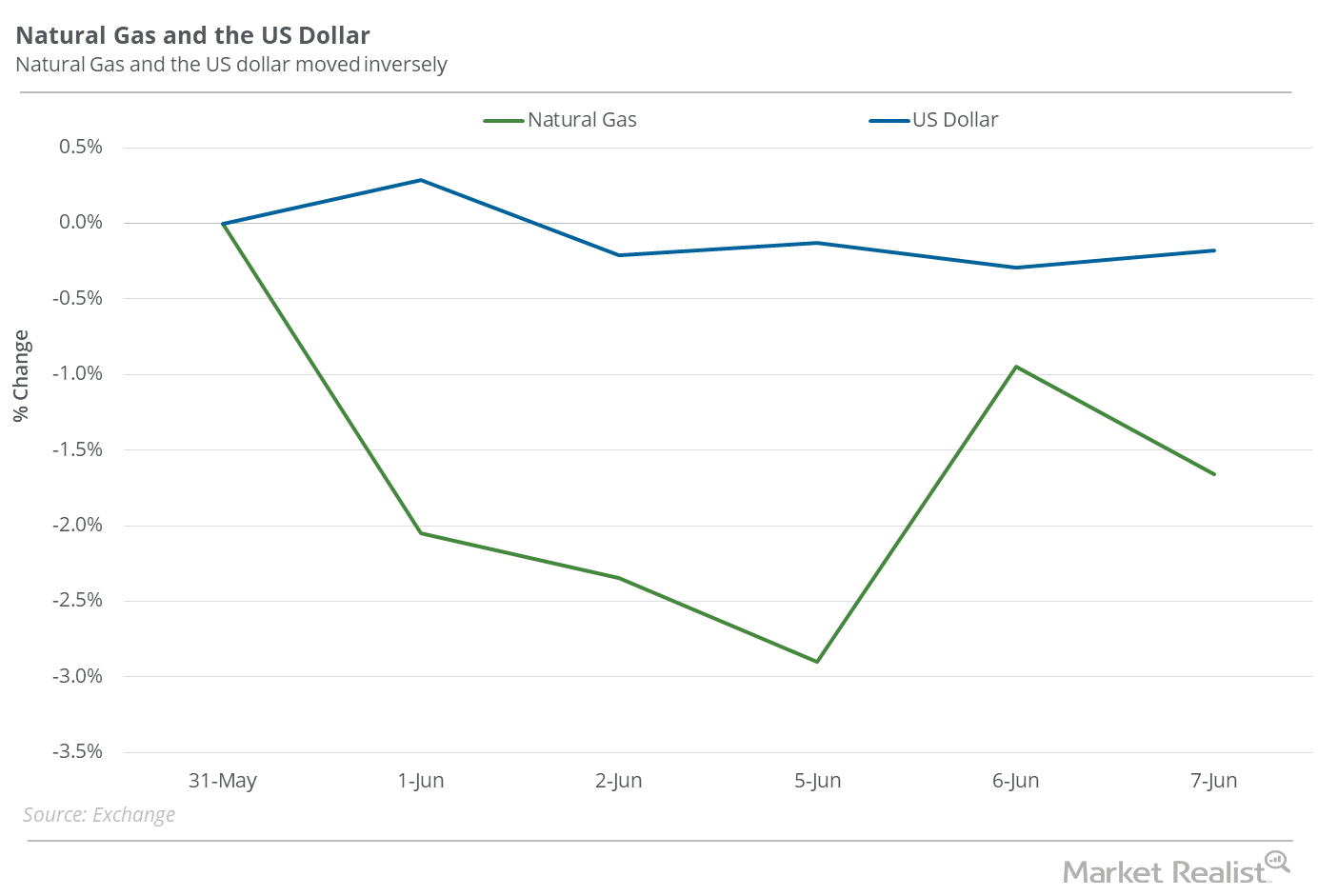

Is Natural Gas Reacting to the US Dollar?

Between March 3, 2016–June 7, 2017, natural gas active futures rose 84.1% while the US dollar fell 0.8%.

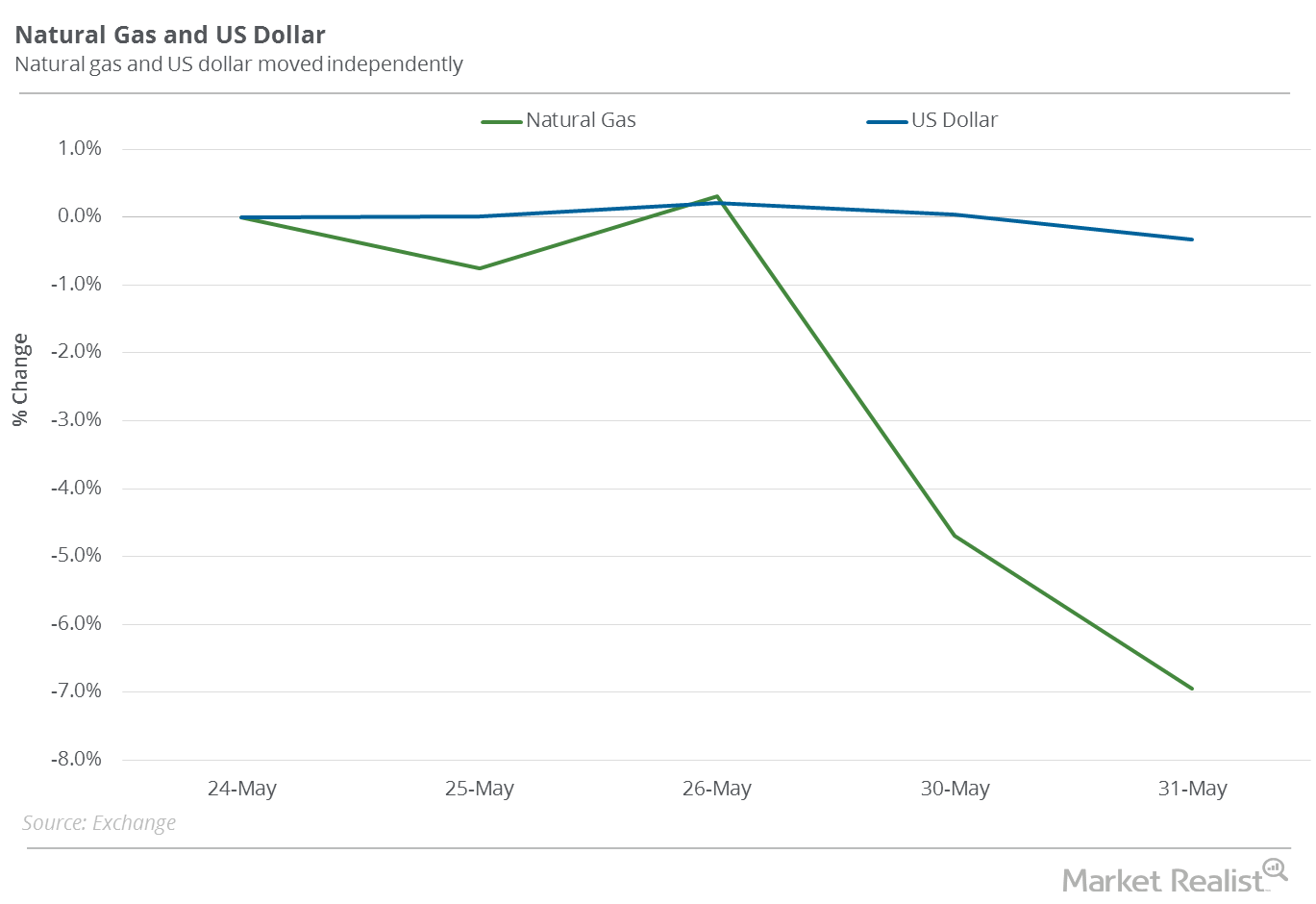

Is the US Dollar a Factor in Natural Gas’s Current Downturn?

The US dollar (UUP) (UDN) (USDU) fell 0.3% between May 24 and May 31, 2017.

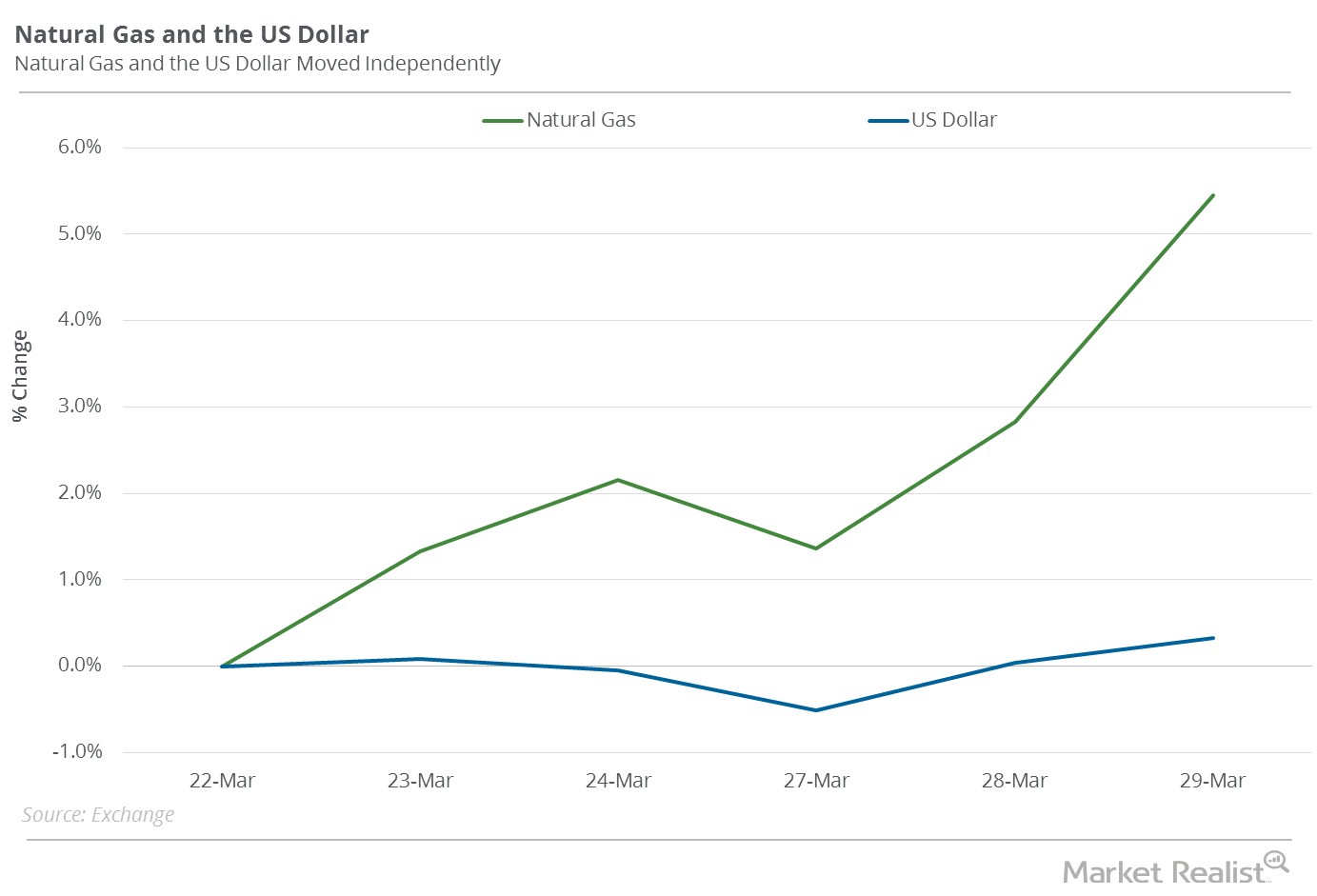

US Dollar Could Impact Natural Gas Prices

Between March 22 and March 29, 2017, natural gas (GASX) (FCG) (GASL) May futures rose 5.4%. The US dollar rose 0.3% during that period.

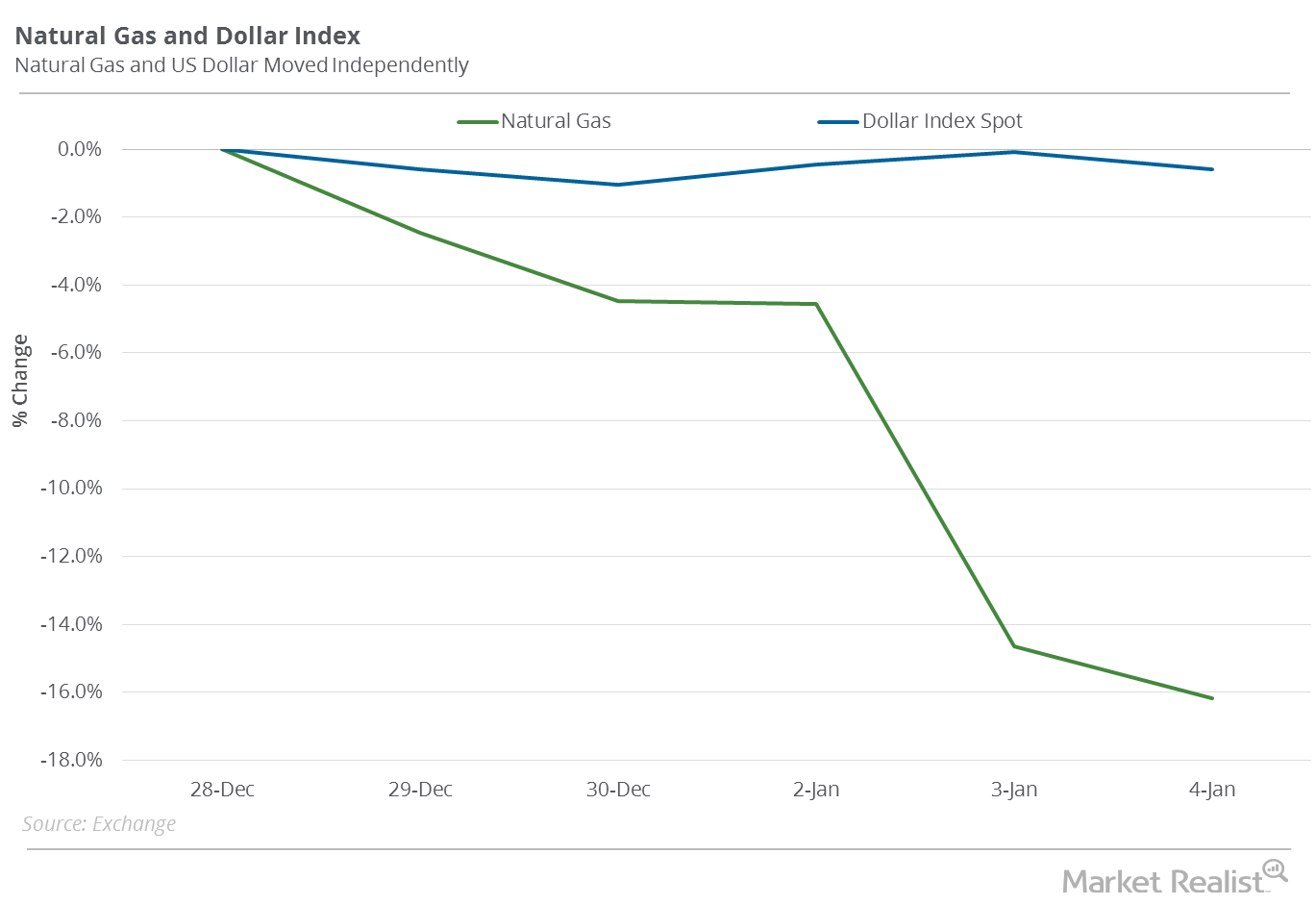

Does the US Dollar Impact Natural Gas Prices?

In the past four trading sessions, natural gas futures and the US Dollar Index moved in opposite directions one out of four times.

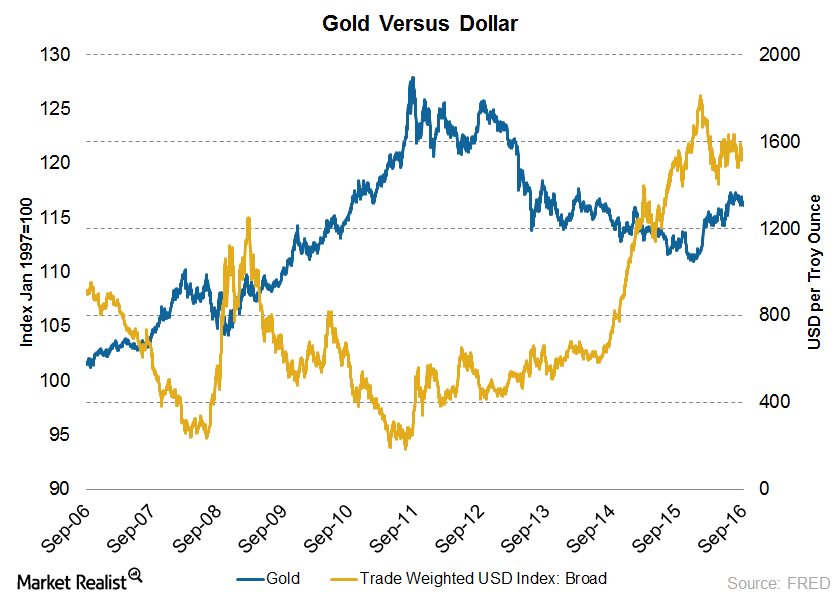

How Did the Dollar’s Move Affect the Price of Gold?

Gold is valued in dollars. As a result, the stronger dollar, driven by the recovery of the US economy, is pushing the gold prices further down.