Rabindra Samanta

I have been working at Market Realist since August 2015. My primary area of expertise includes qualitative and quantitative analysis of crude oil and the natural gas market. This focus also includes tracking macroeconomic indicators. But, later into my career, I also started covering global markets, hedge fund manager commentary, and other macro developments.

I completed the PGDBM degree in 2014. Prior to Market Realist, I worked with one of India's largest brokerage house, Kotak Securities. My primary responsibilities include market analysis, portfolio advisory, and investor presentations.

After my graduate degree, I worked as an Associate at Vedanta Resources CPP (captive power plant) and IPP (Independent Power plant) project at Jharsuguda Odisha.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rabindra Samanta

Top Investments Made Renaissance Technologies and Its Founder Filthy Rich

Renaissance Technologies is best known for its Medallion Fund. The firm manages roughly $50 billion in assets. Here are its top investments.

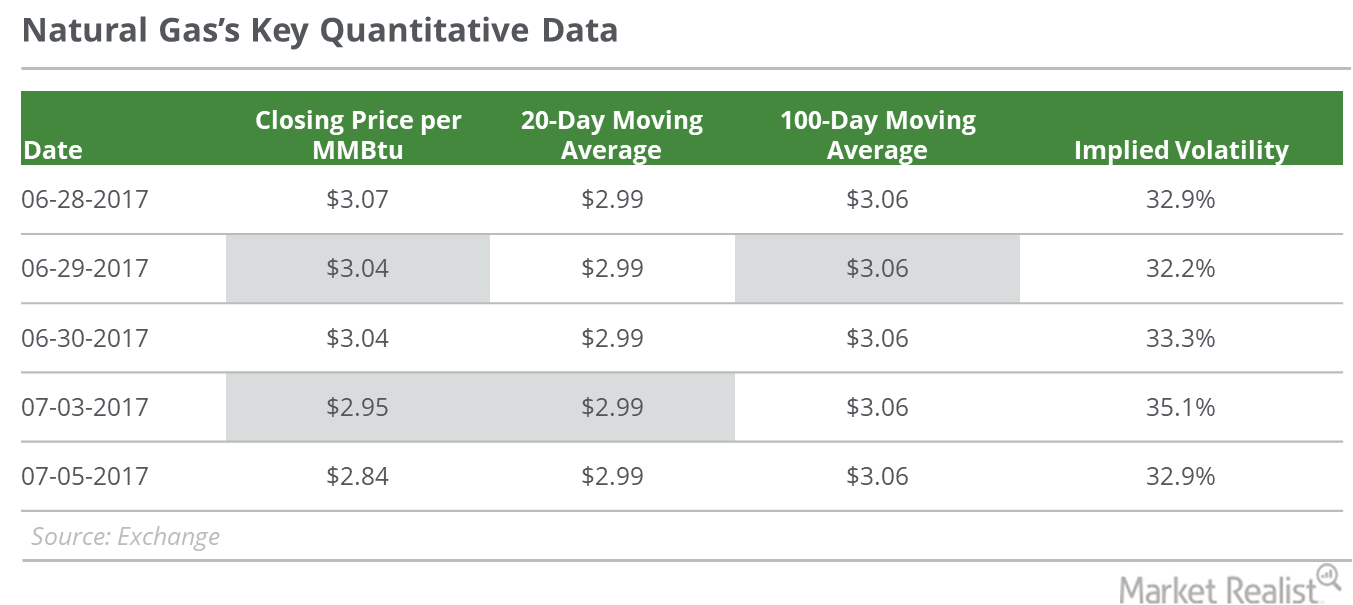

Natural Gas’s ‘Death Cross’ and Why the Bear Market Isn’t Far

On July 5, 2017, natural gas (UNG) active futures fell 3.8% and settled at $2.84 per MMBtu (million British thermal units), their lowest level since March 8, 2017.

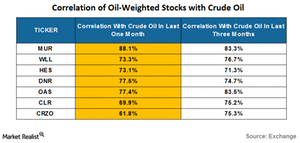

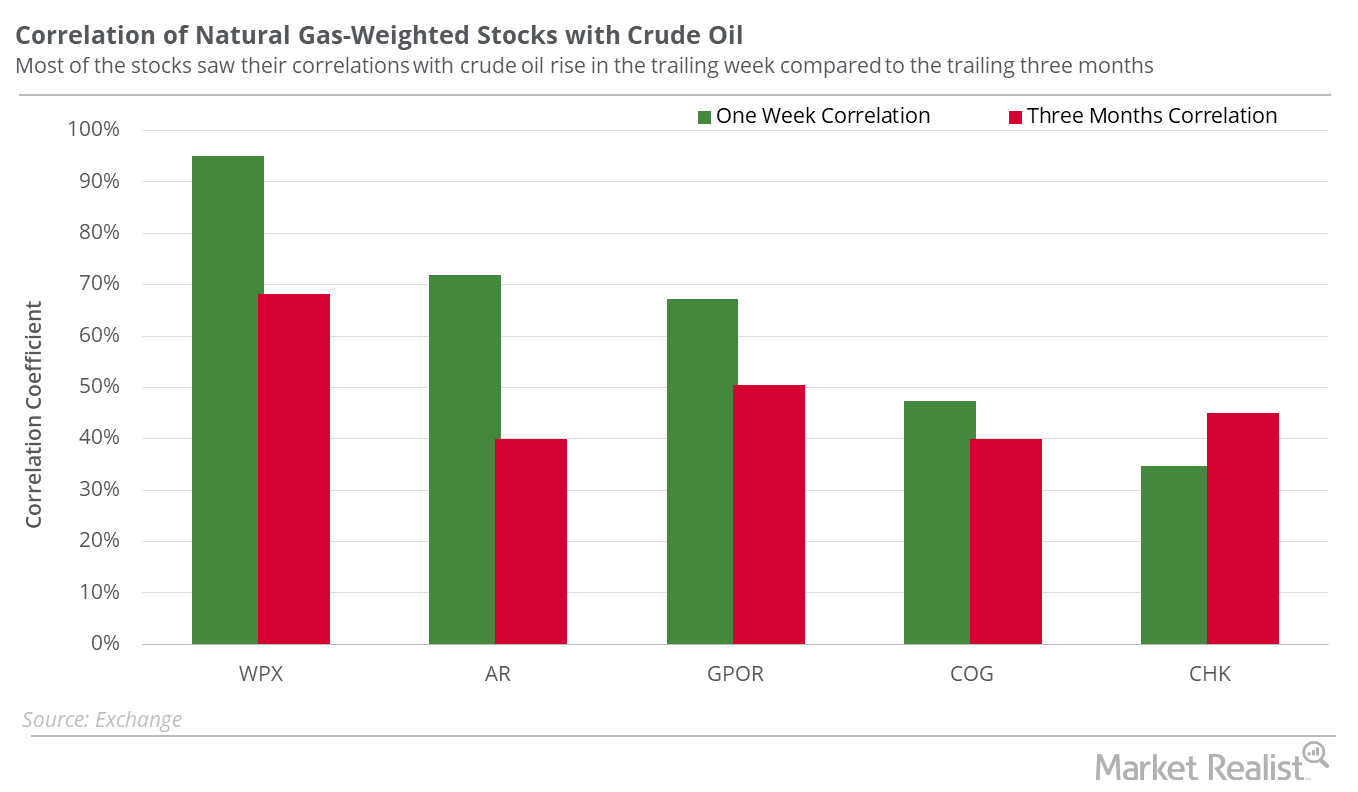

Which Energy Stocks Are Impacted More by Crude Oil?

On September 12, WTI crude oil (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) active contracts closed at $46.29 per barrel—0.9% above the previous closing price.

Are Oil’s Supply Concerns Rising?

On May 21, US crude oil July futures closed $5.97 above the July 2019 futures contract. On May 14–21, US crude oil July futures rose 1.9%.

Natural Gas’s Surge in November 2017

Between October 30 and November 6, 2017, US crude oil futures rose 5.9%.

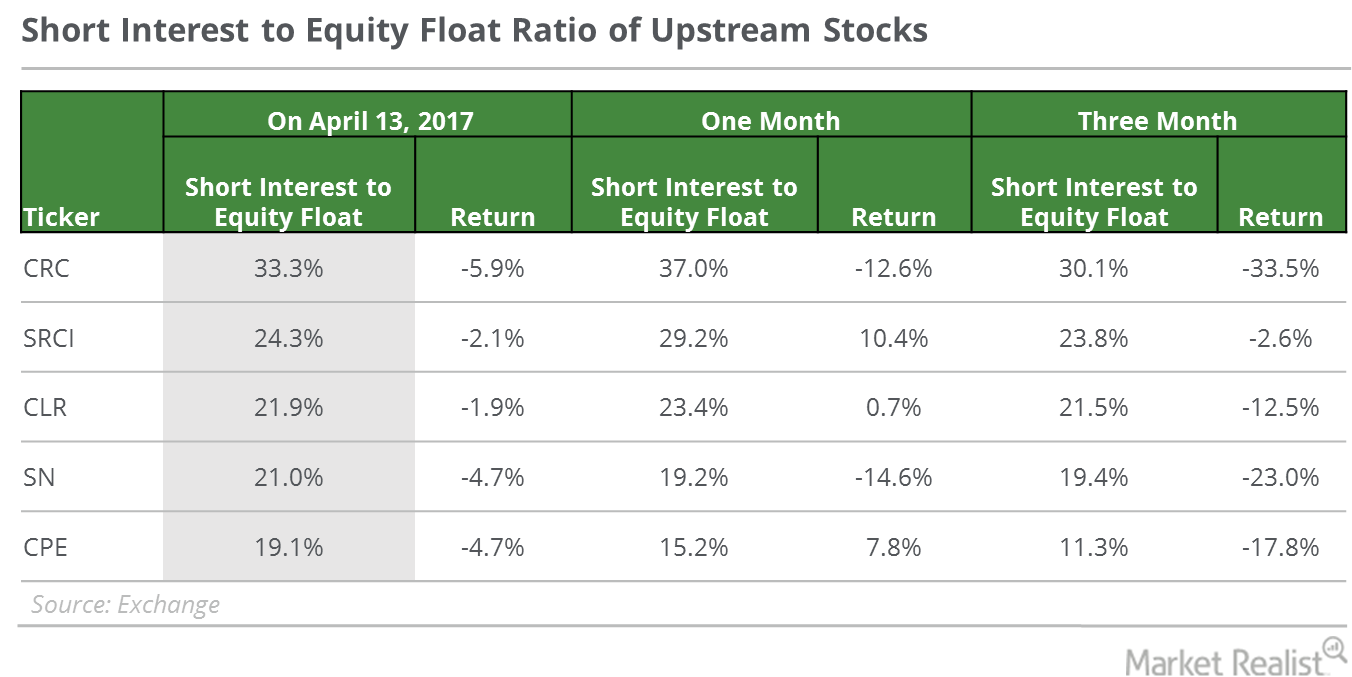

Why the Numbers Look Bearish for These Upstream Stocks

All these upstream companies have seen the short interest in their stocks rise—an potential indication of market skepticism in these companies’ abilities to profit from oil’s recent gains.

ConocoPhillips: Investors’ Confidence Is Rising

Since ConocoPhillips (COP) reported its fourth-quarter earnings results on January 31, the stock has fallen 1.7%.

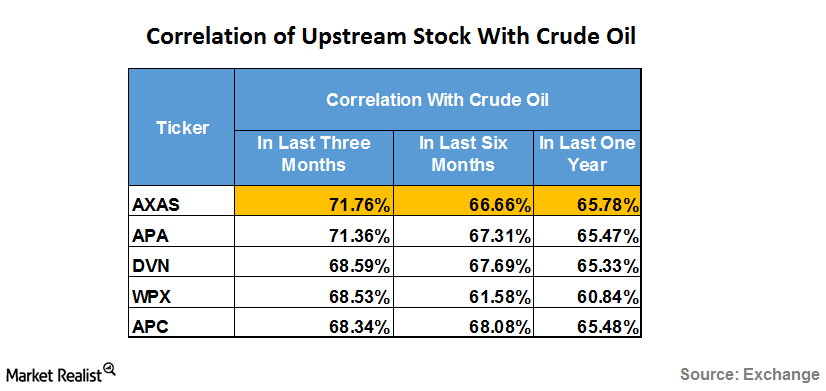

Which Upstream Stocks Are More Sensitive to Crude Oil?

In the last three months, Abraxas Petroleum (AXAS) has had the highest positive correlation with WTI crude oil among upstream companies that are part of XOP.

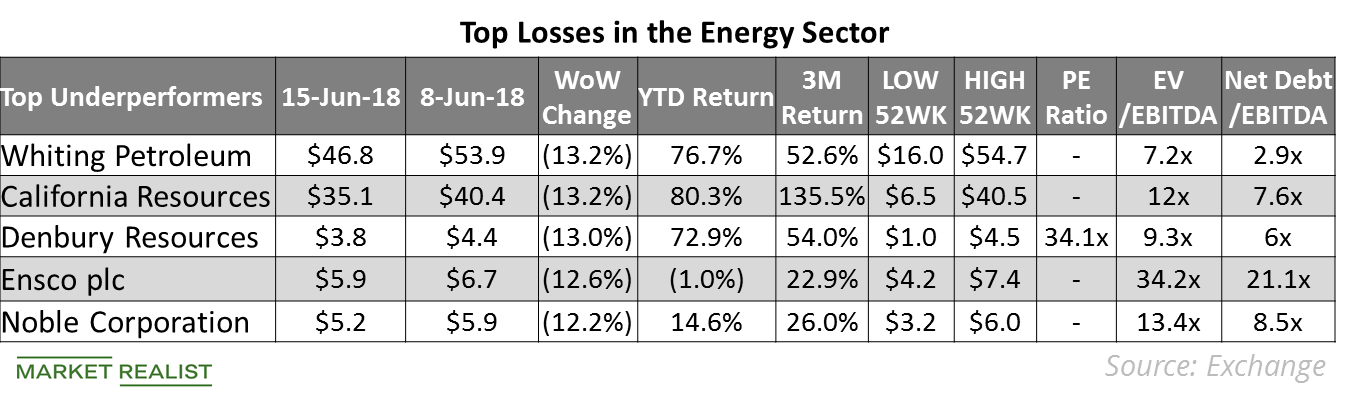

Top Energy Losses Last Week

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

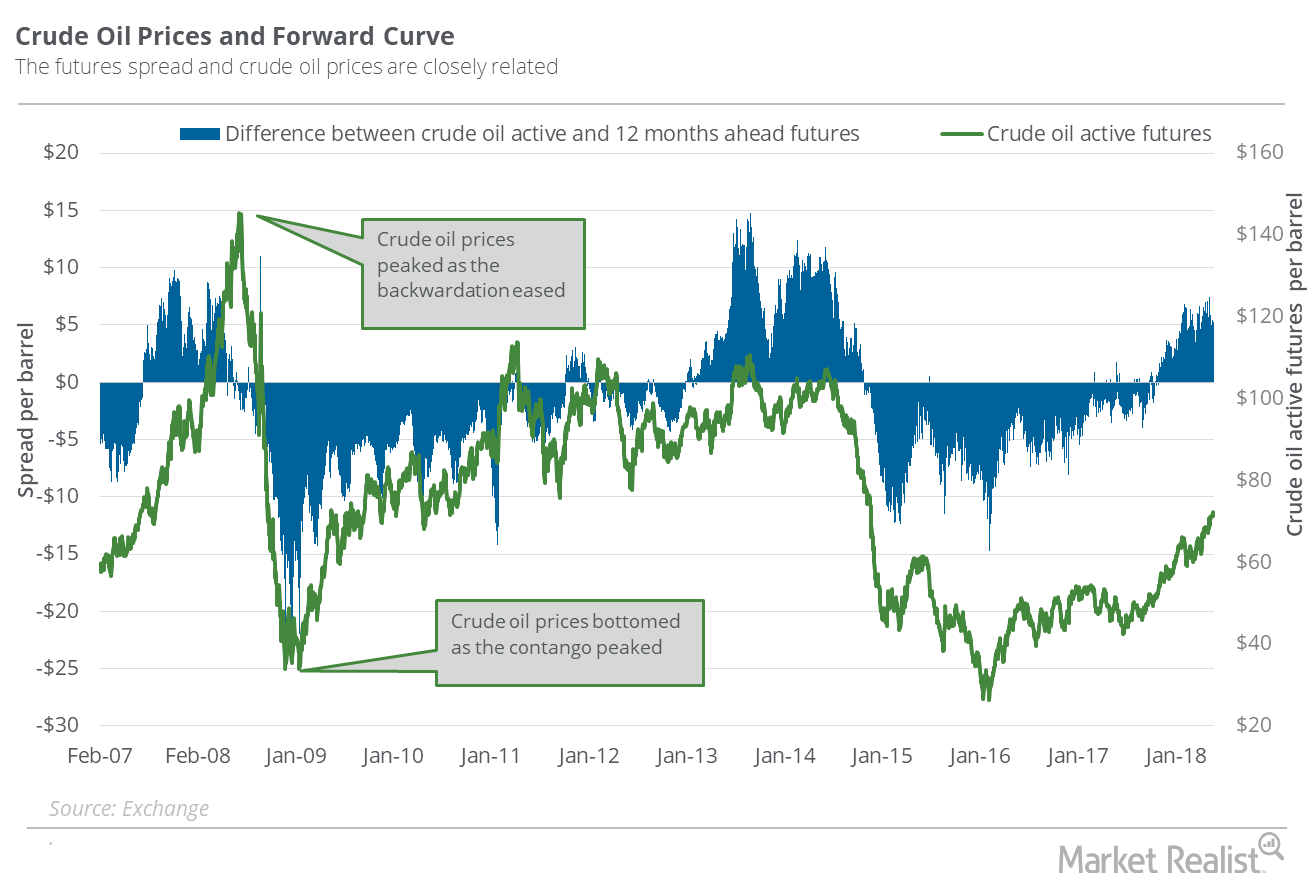

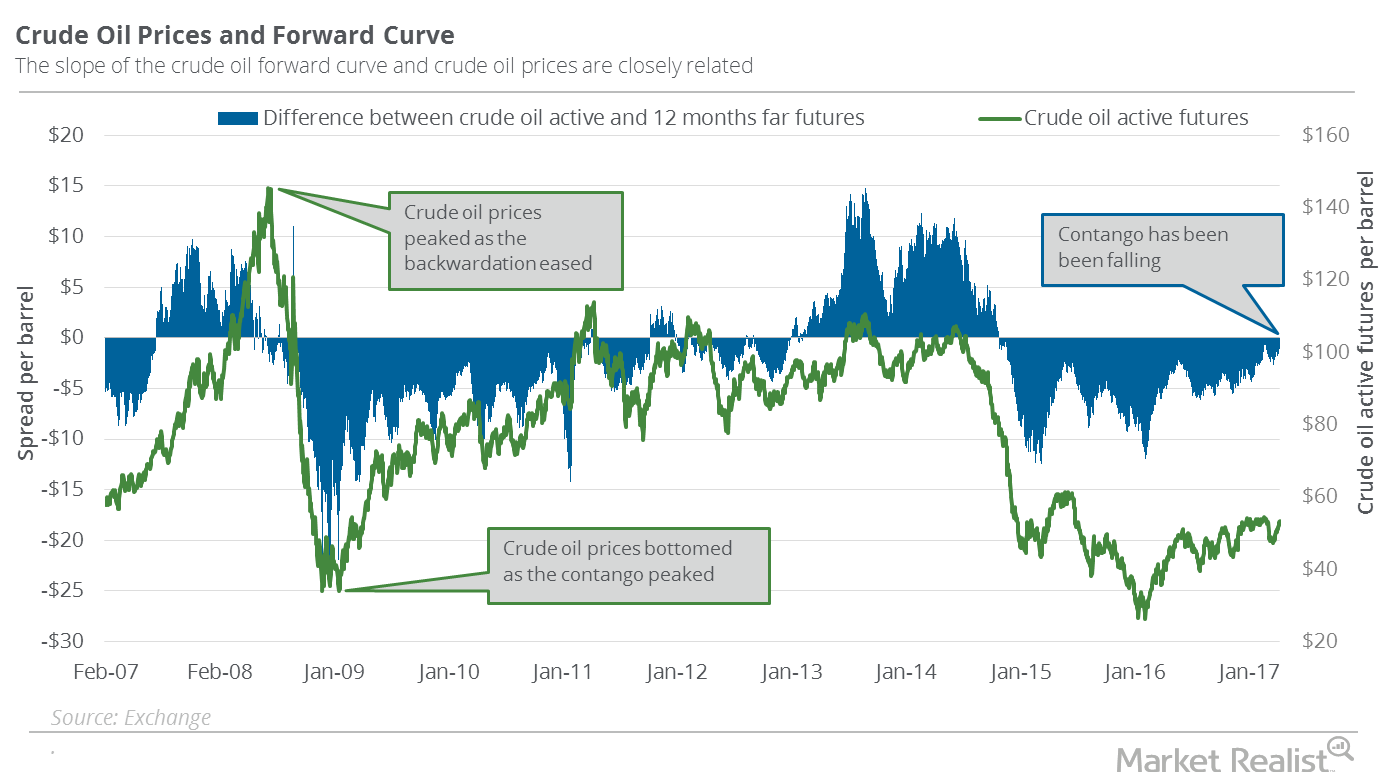

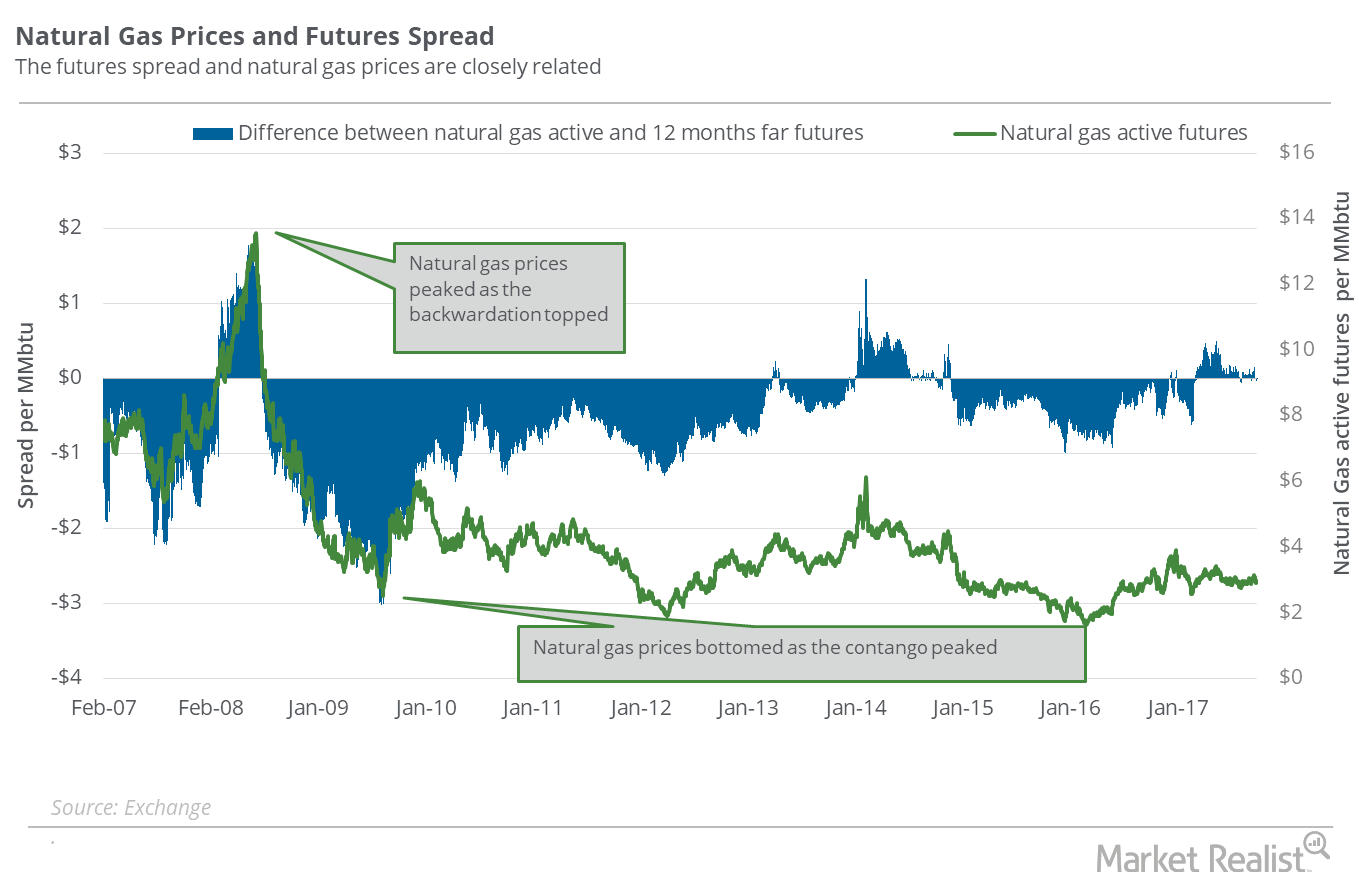

Oil Contango: What It Means for Investors

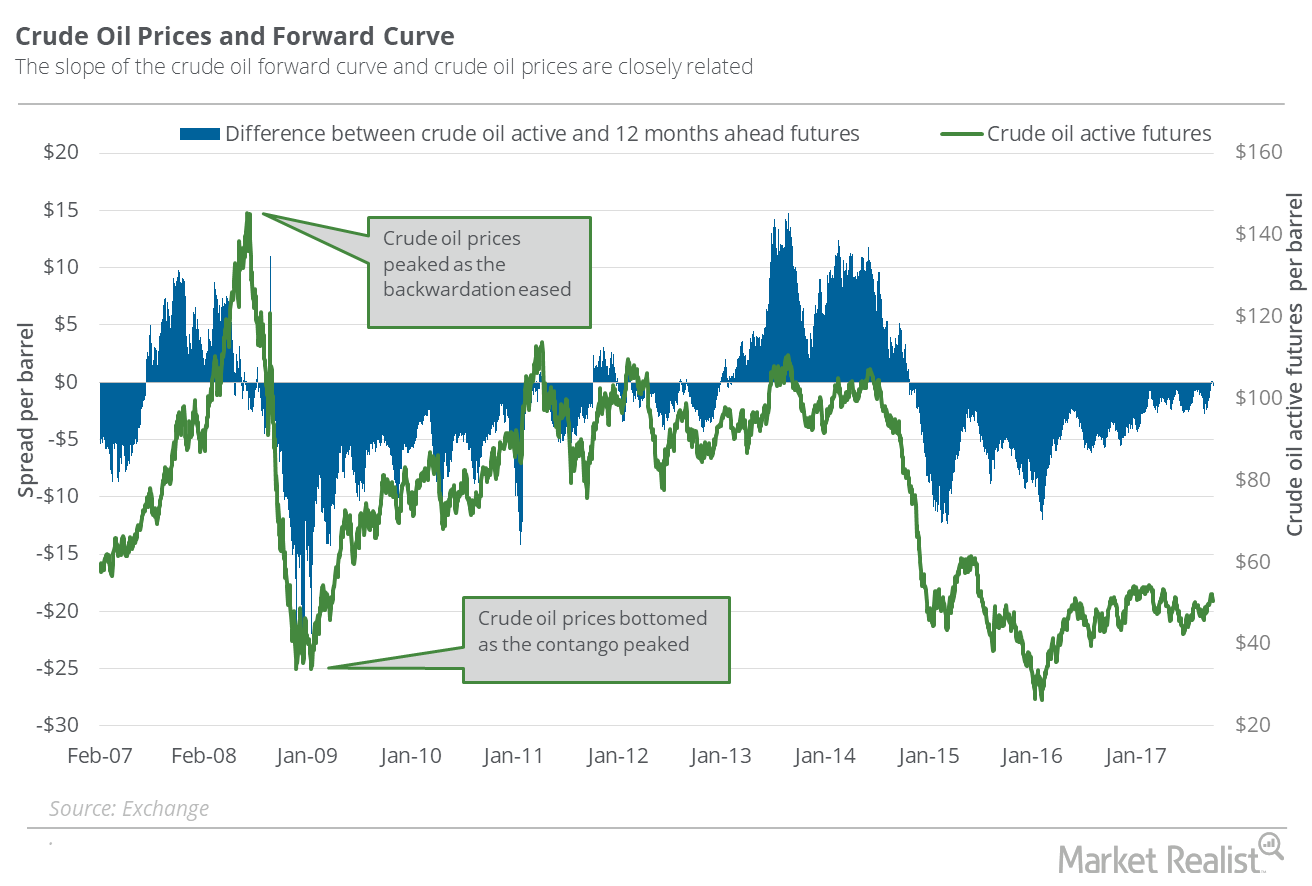

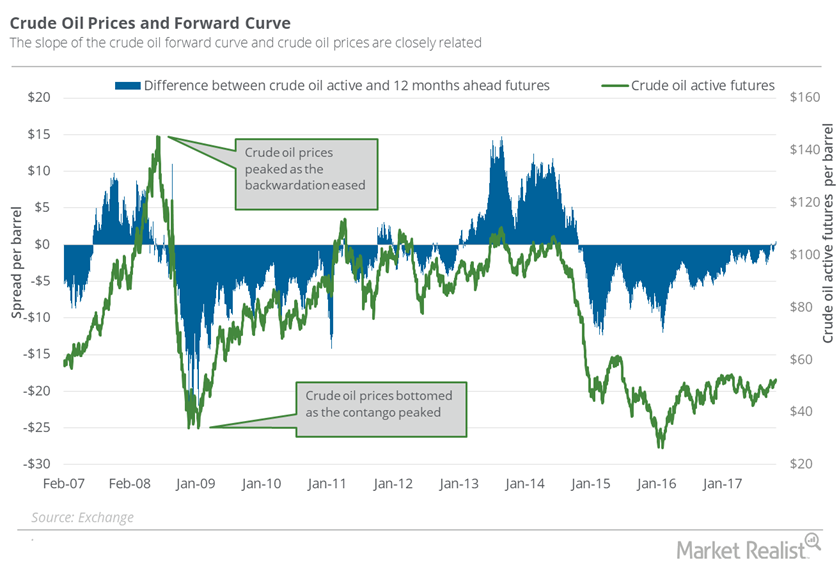

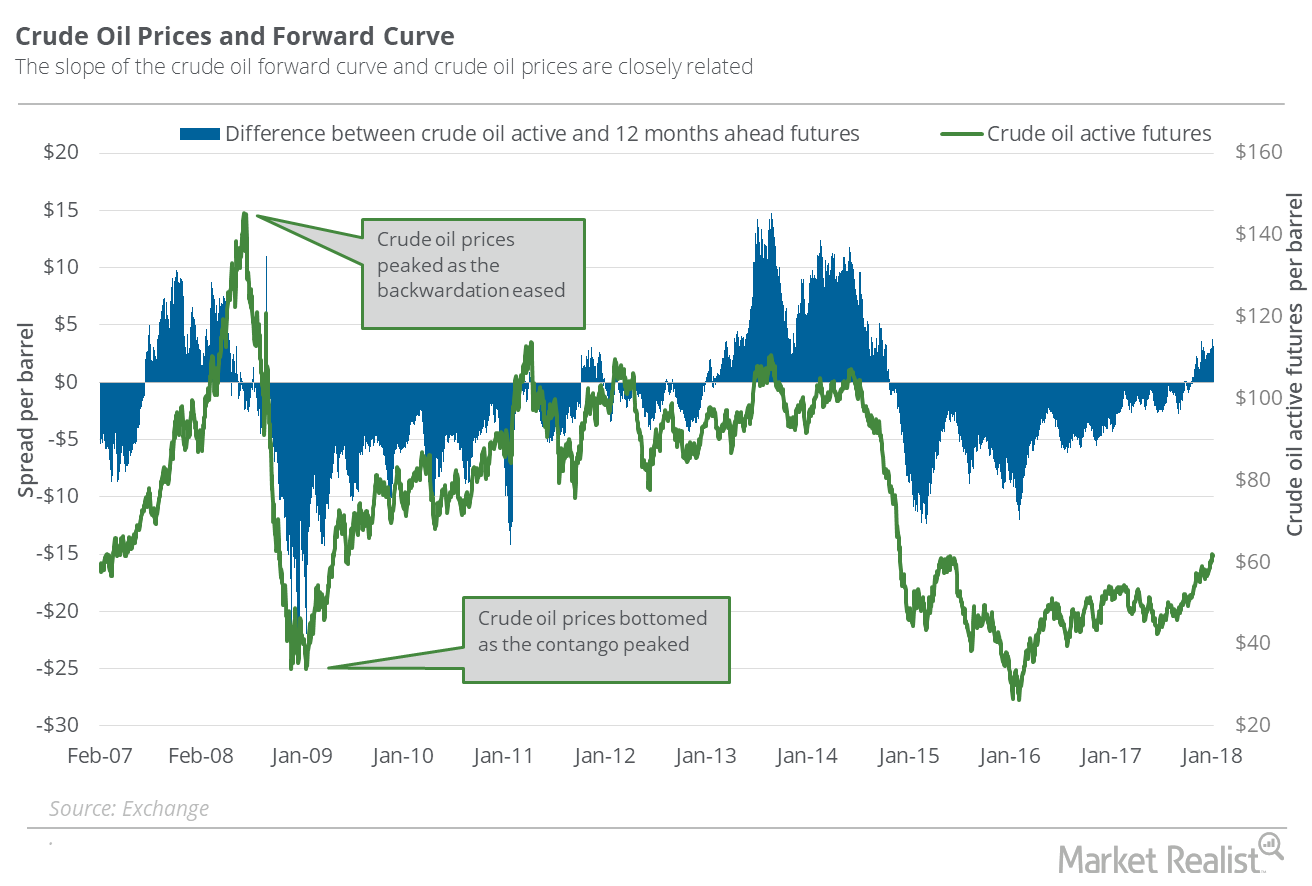

On April 11, 2017, May 2017 crude oil (DBO) (OIIL) (USL) futures were trading at a discount of $1.15 to May 2018 futures contracts.

Backwardation: What It Could Mean for Crude Oil Prices

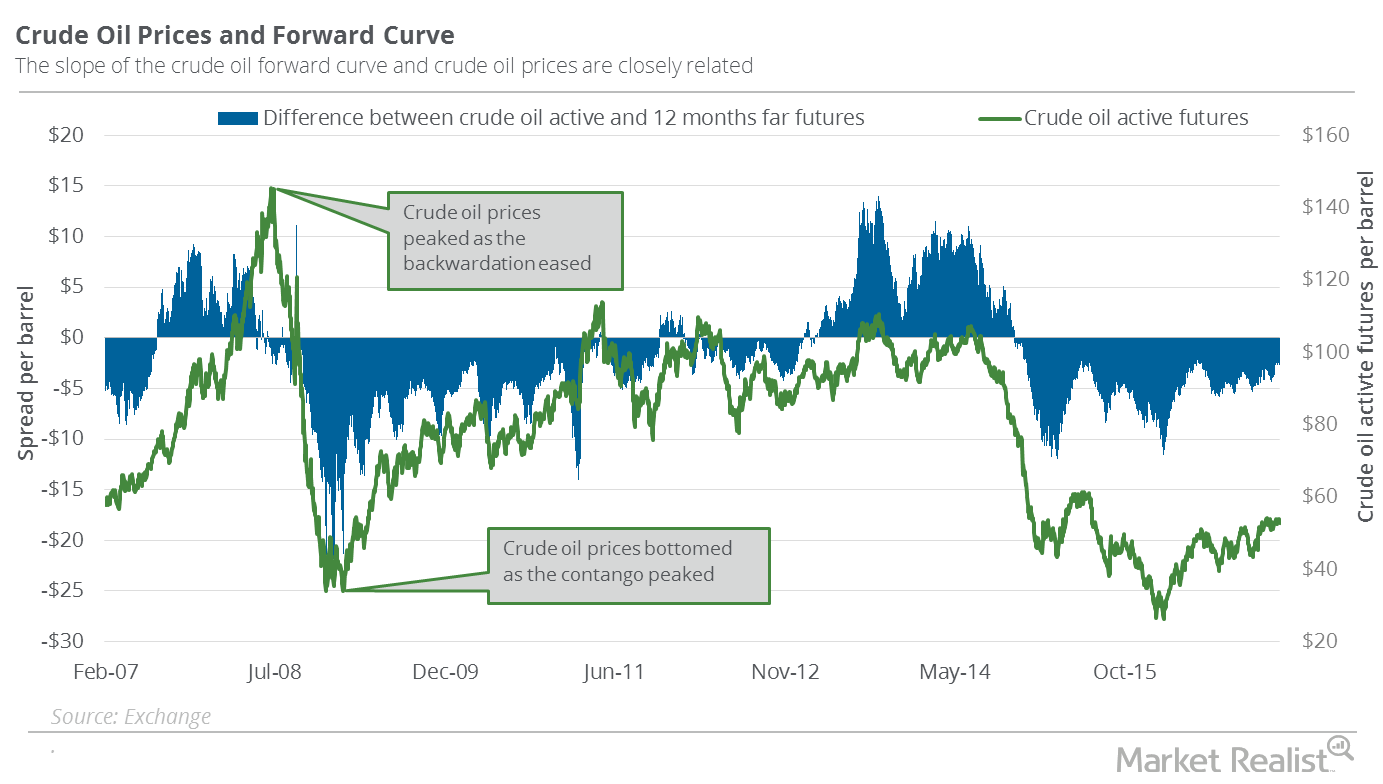

When the crude oil futures forward curve to slopes downwards, the situation in the crude oil futures market is called “backwardation.”

How Much Natural Gas Could Fall Next Week

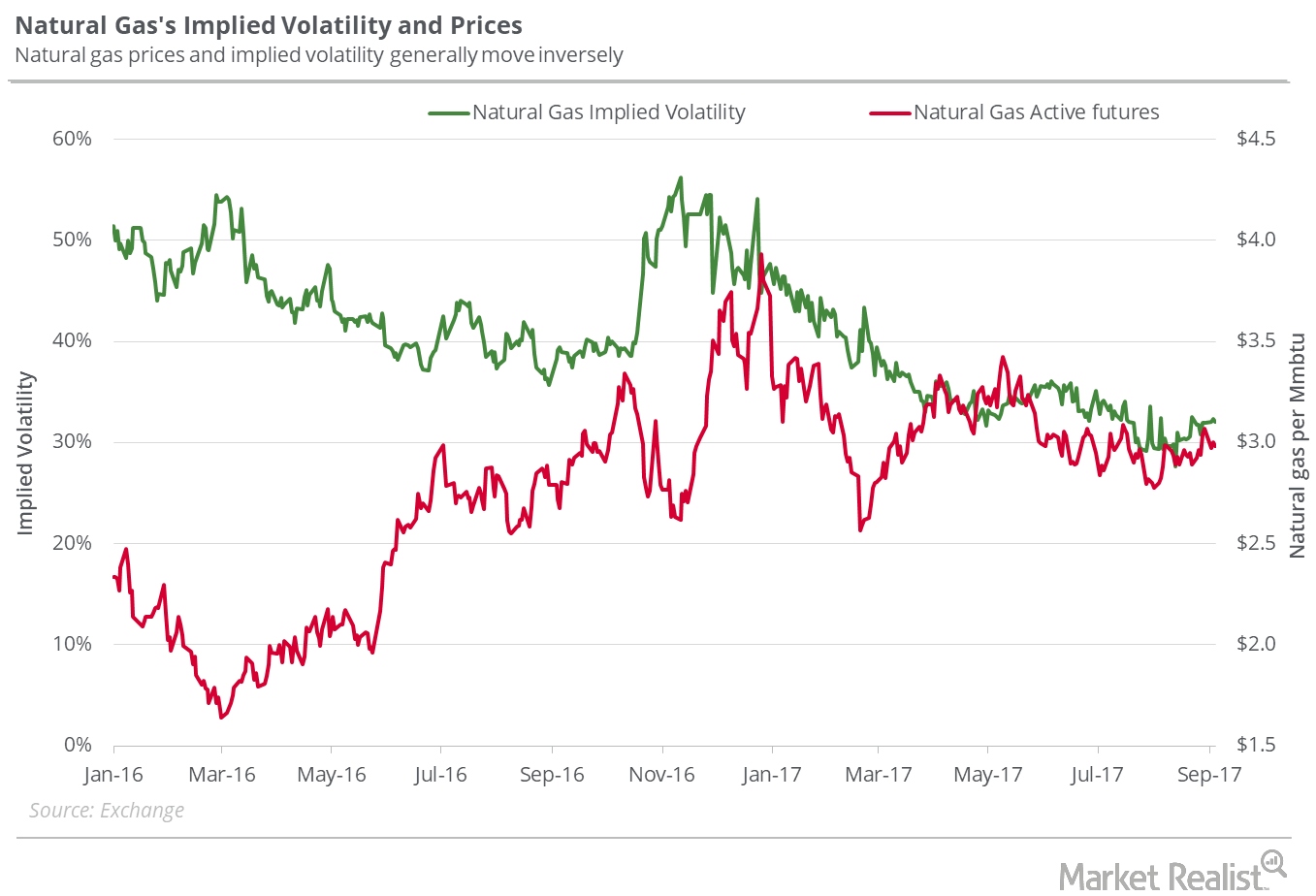

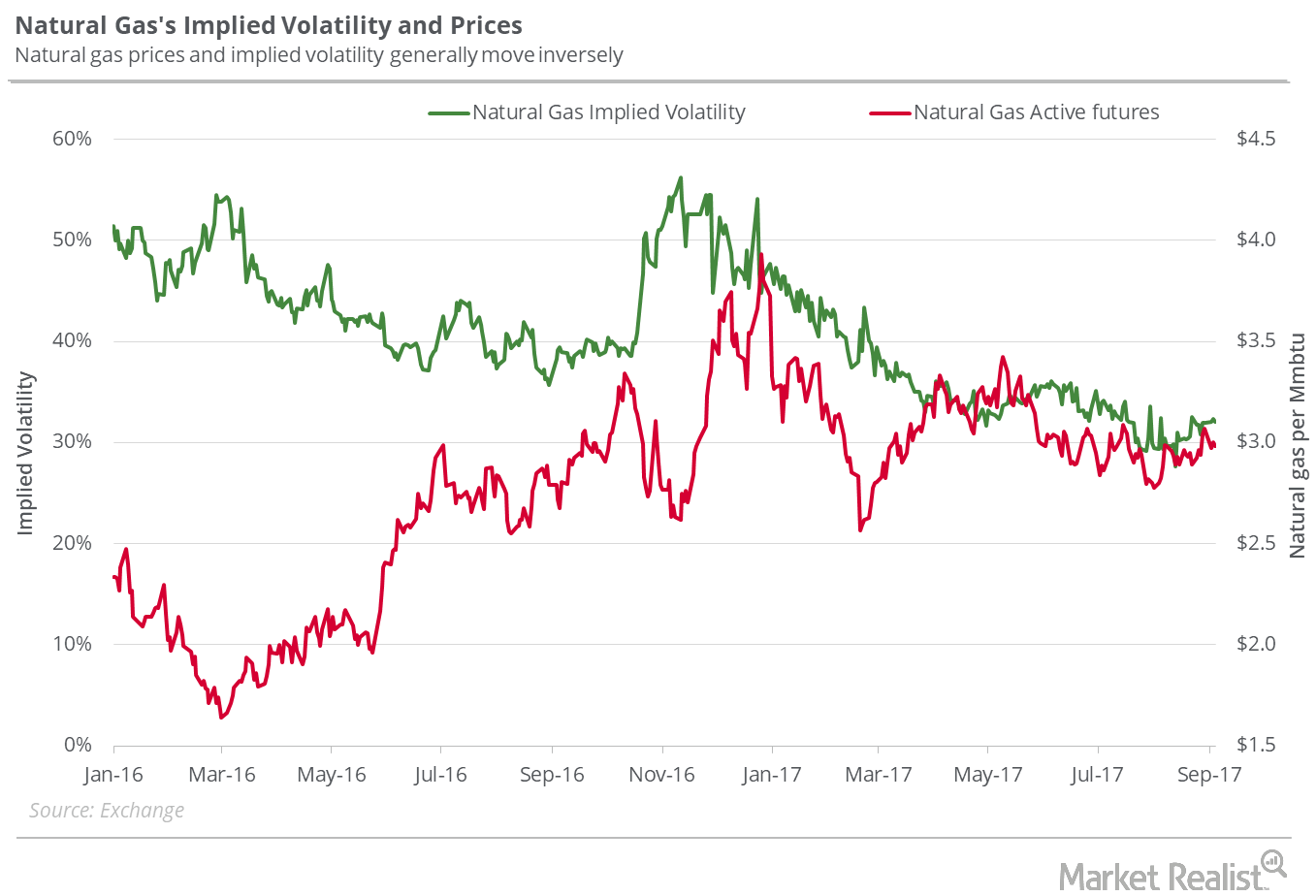

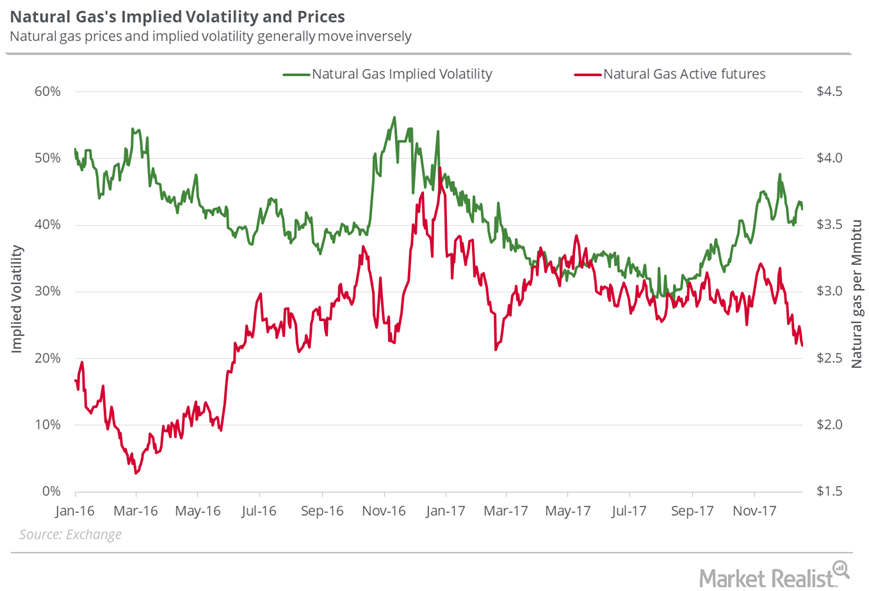

On November 16, 2017, the implied volatility of natural gas was 44%—6.4% above its 15-day average.

Why Oil Prices Could Increase More

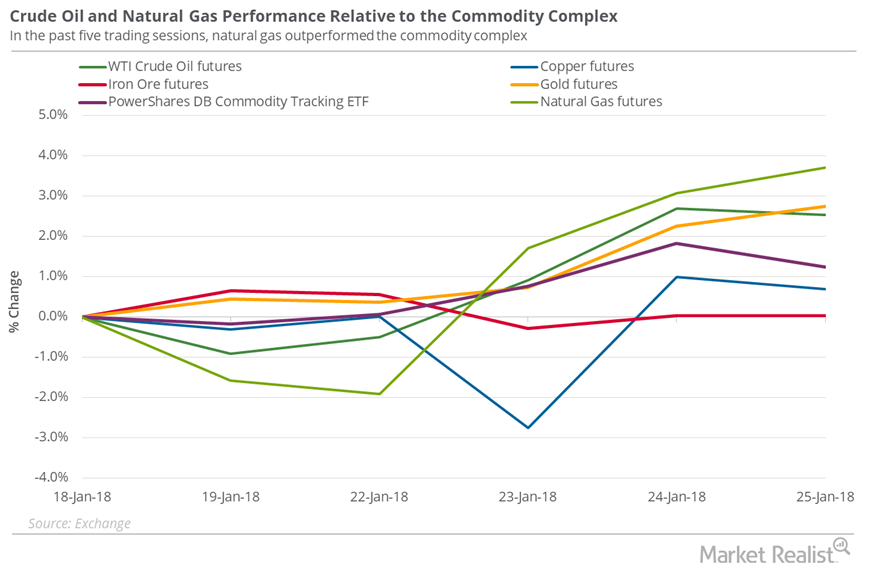

On January 22, 2018, US crude oil active futures were 3.1%, 7.8%, 15.8%, and 23.7% above their 20-day, 50-day, 100-day, and 200-day moving averages.

Oil’s Contango: Supply–Demand Fears Could Impact the Market

On October 3, 2017, US crude oil (USL) (OIIL) November 2018 futures settled $0.33 higher than the November 2017 futures.

Will Natural Gas Prices Fall to $2.8 Next Week?

On November 2, 2017, natural gas’s (GASL) (GASX) implied volatility was 38.2%, 1.8% below its 15-day average.

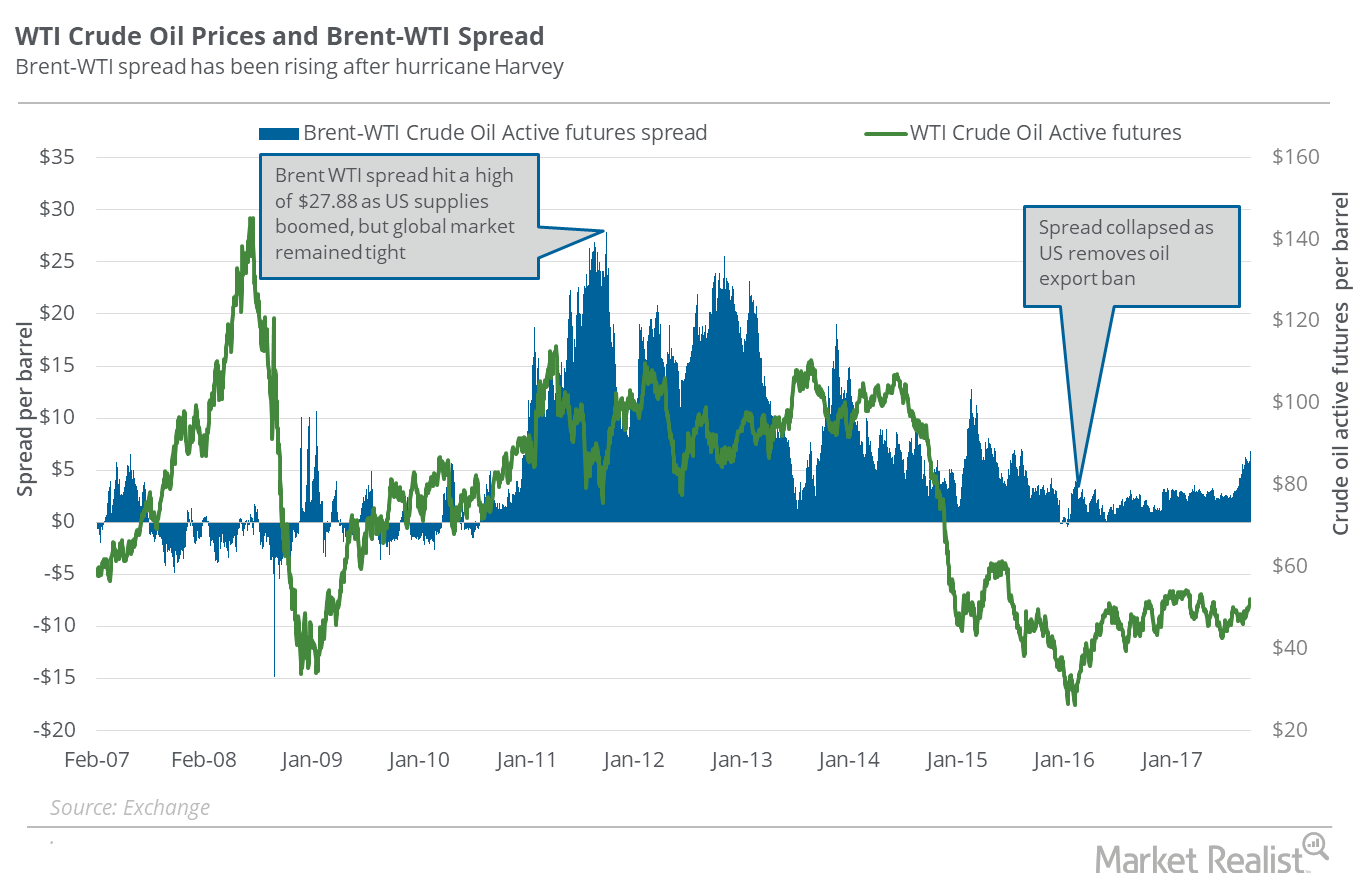

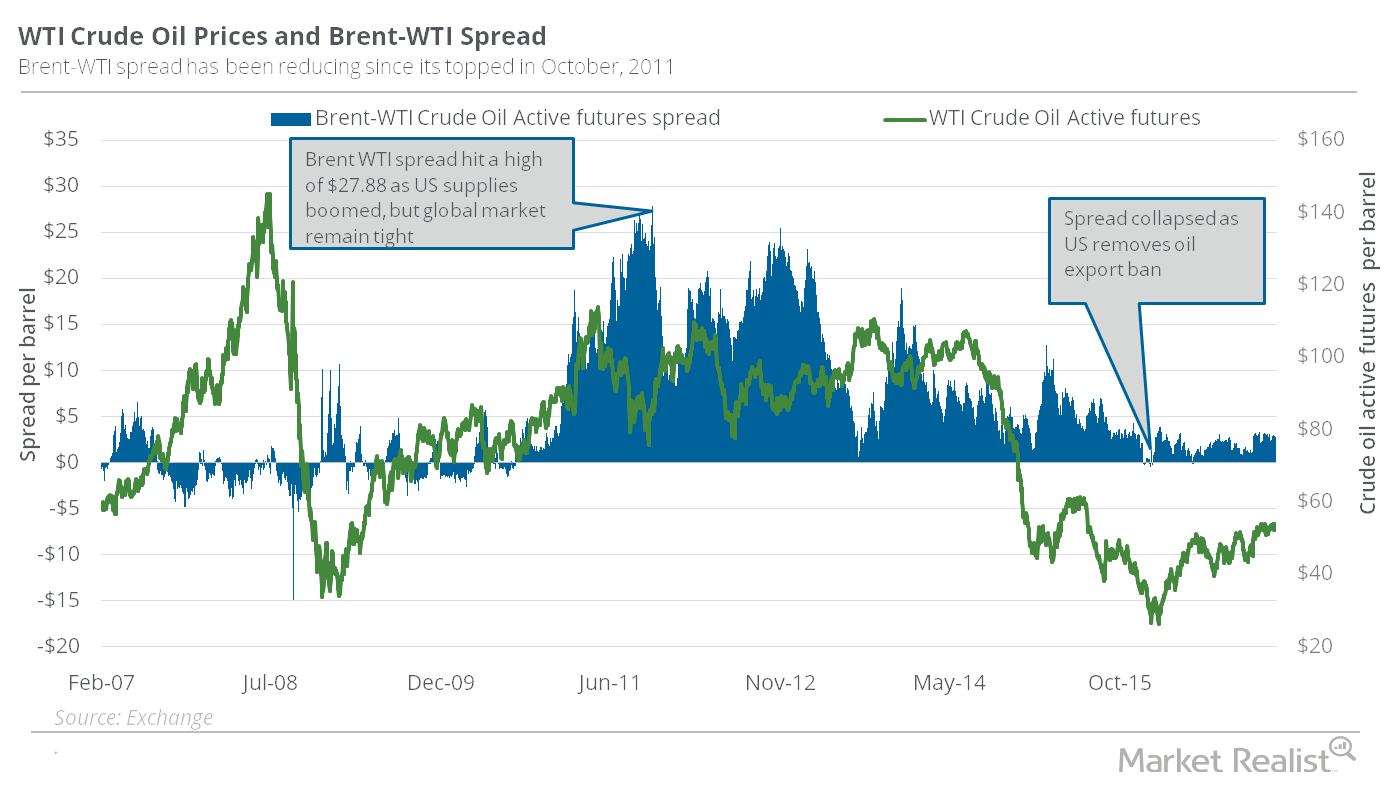

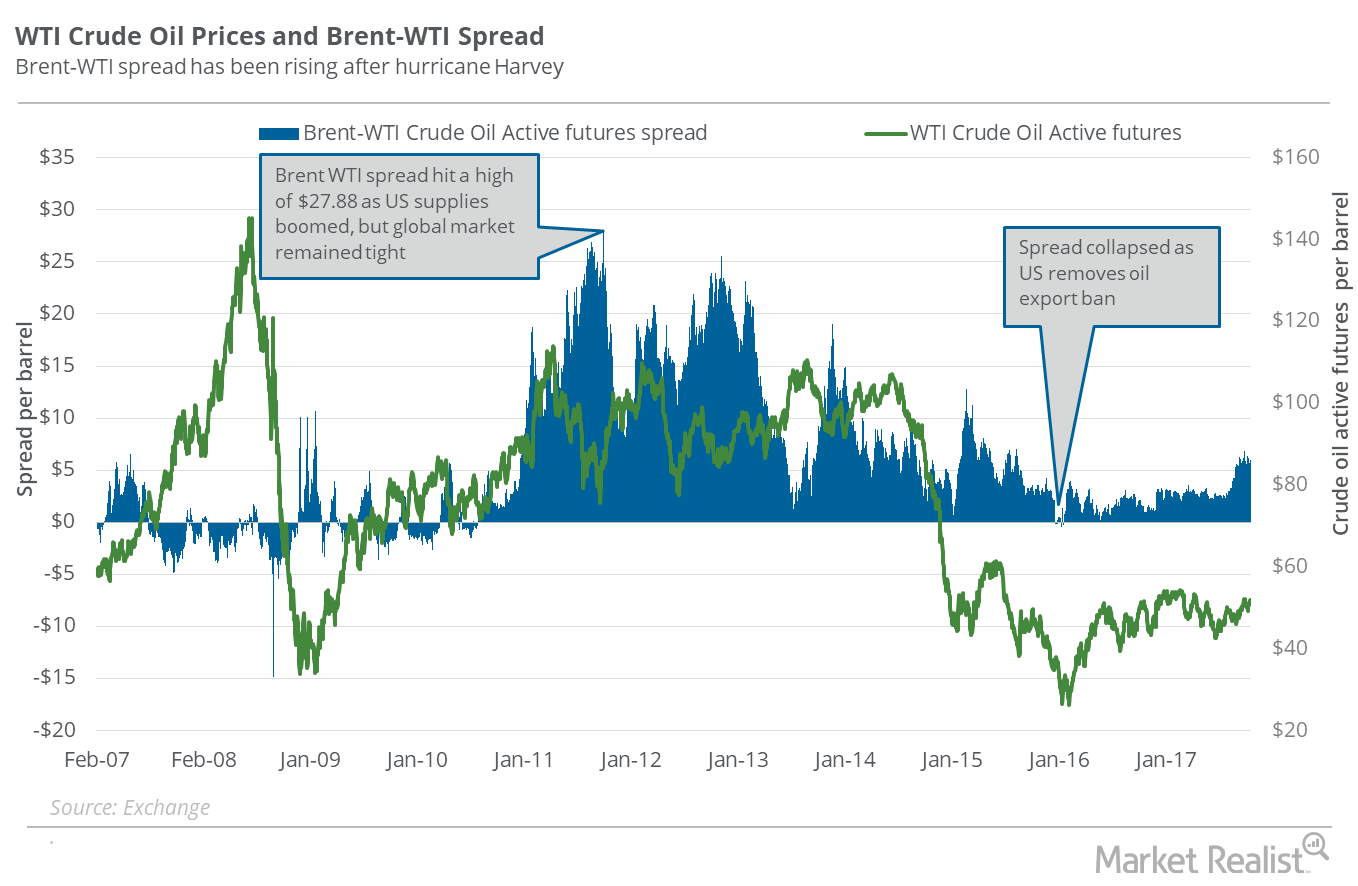

Brent-WTI Spread: Will US Oil Exports Rise Further?

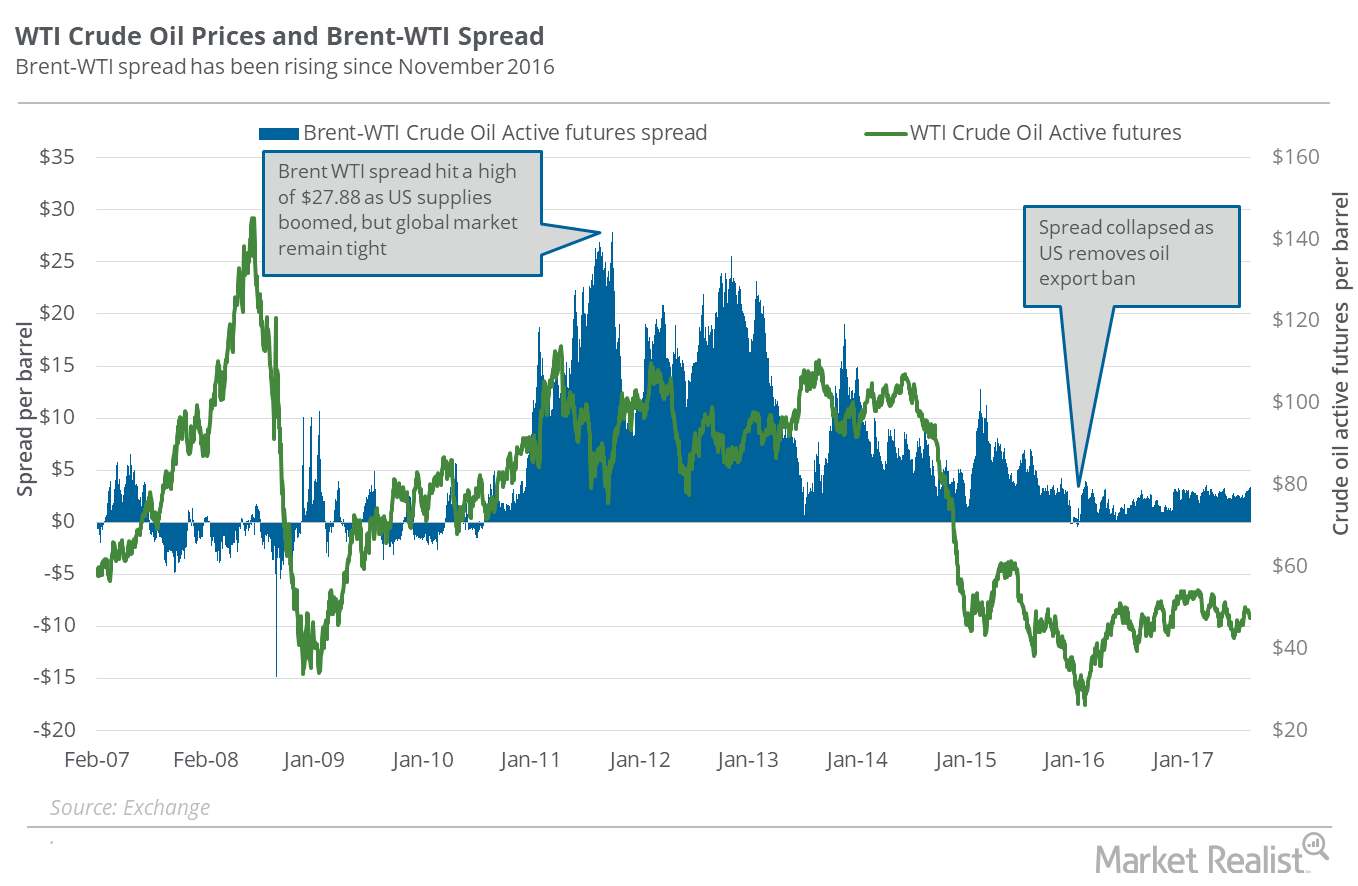

On October 24, 2017, Brent crude oil (BNO) active futures were $5.86 above WTI crude oil active futures.

Why Did Oil Prices Move Higher?

On February 22, 2018, US crude oil’s April 2018 futures rose 1.8% and closed at $62.77 per barrel.

Are Traders Confident about the Oil Supply-Demand Balance?

Between December 29, 2017, and January 8, 2018, the premium and the oil prices rose. The market expects a tightening supply-demand balance for oil in 2018.

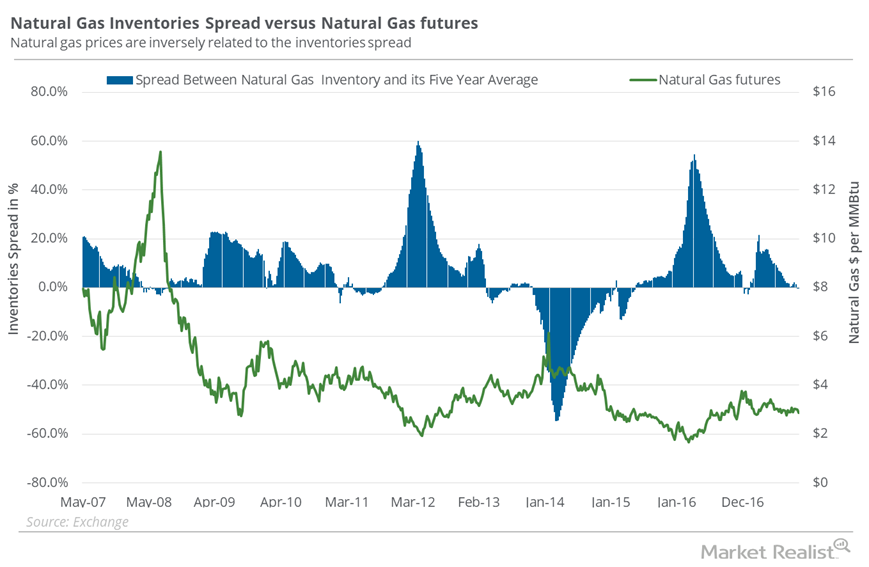

How the Inventory Spread Could Boost Natural Gas Prices

In the week ended October 6, natural gas inventories rose by 87 Bcf (billion cubic feet) to 3,595 Bcf—13 Bcf more than the market expected inventories to rise.

Natural Gas: Are Winter Demand Fears Rising?

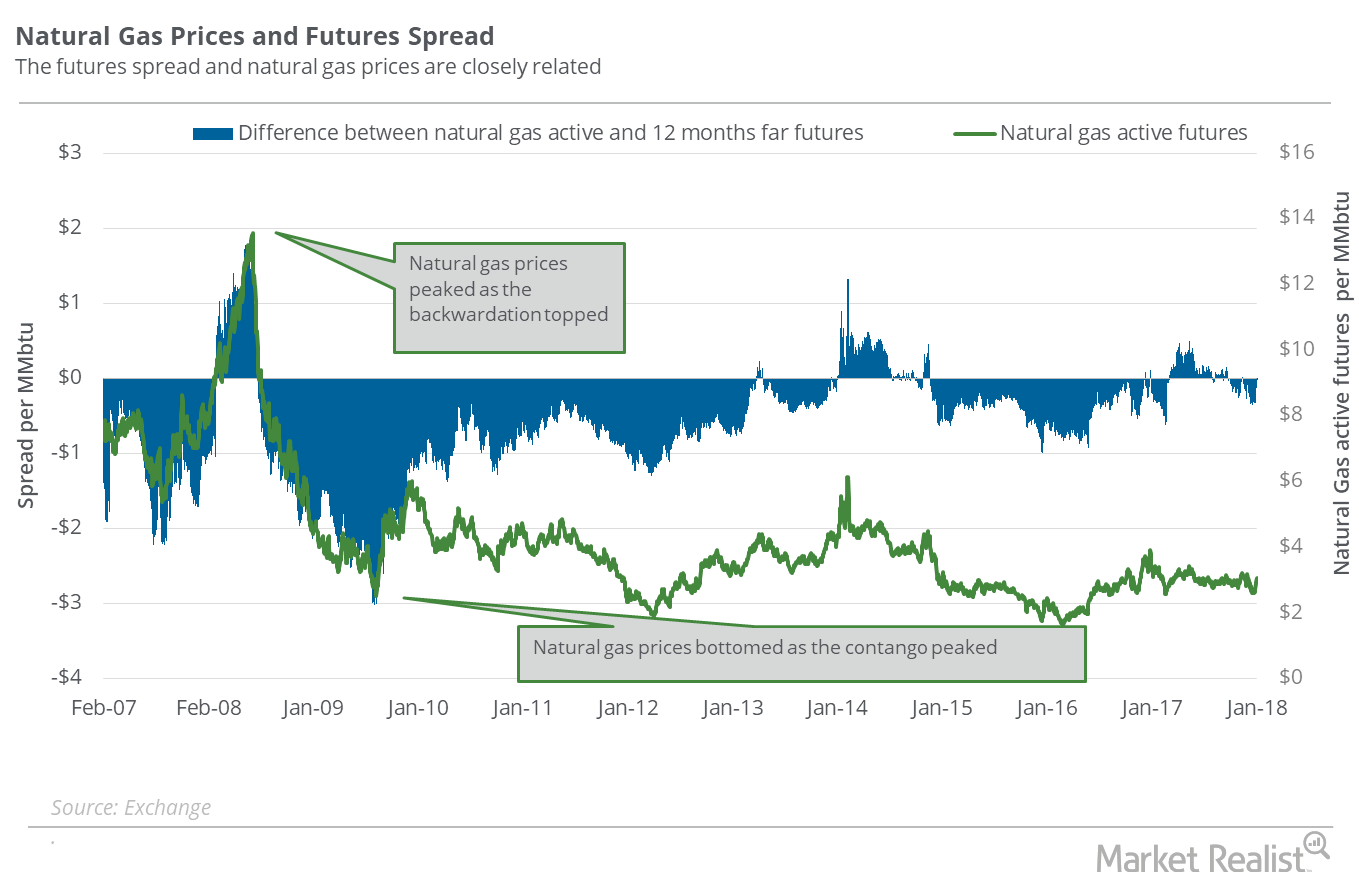

On January 2, 2018, natural gas (UNG) (BOIL) (FCG) February 2018 futures settled $0.025 less than February 2019 futures.

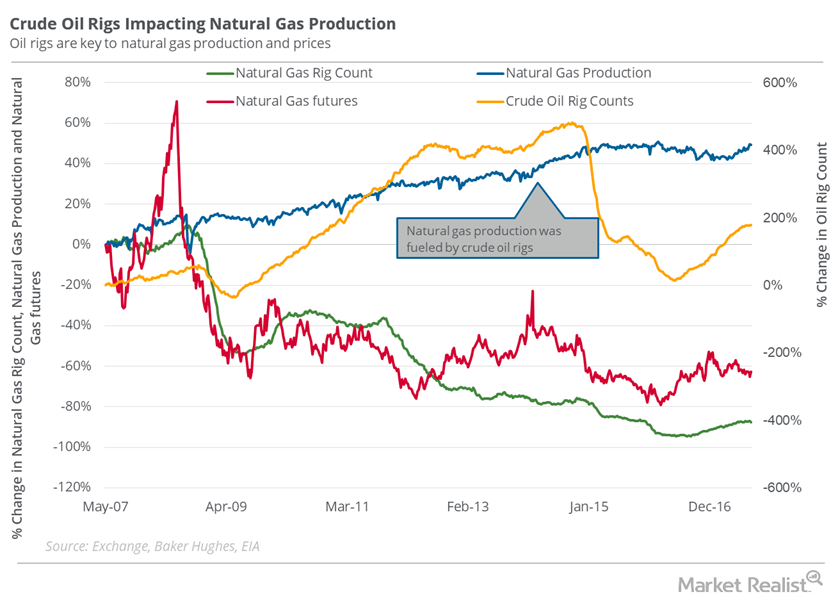

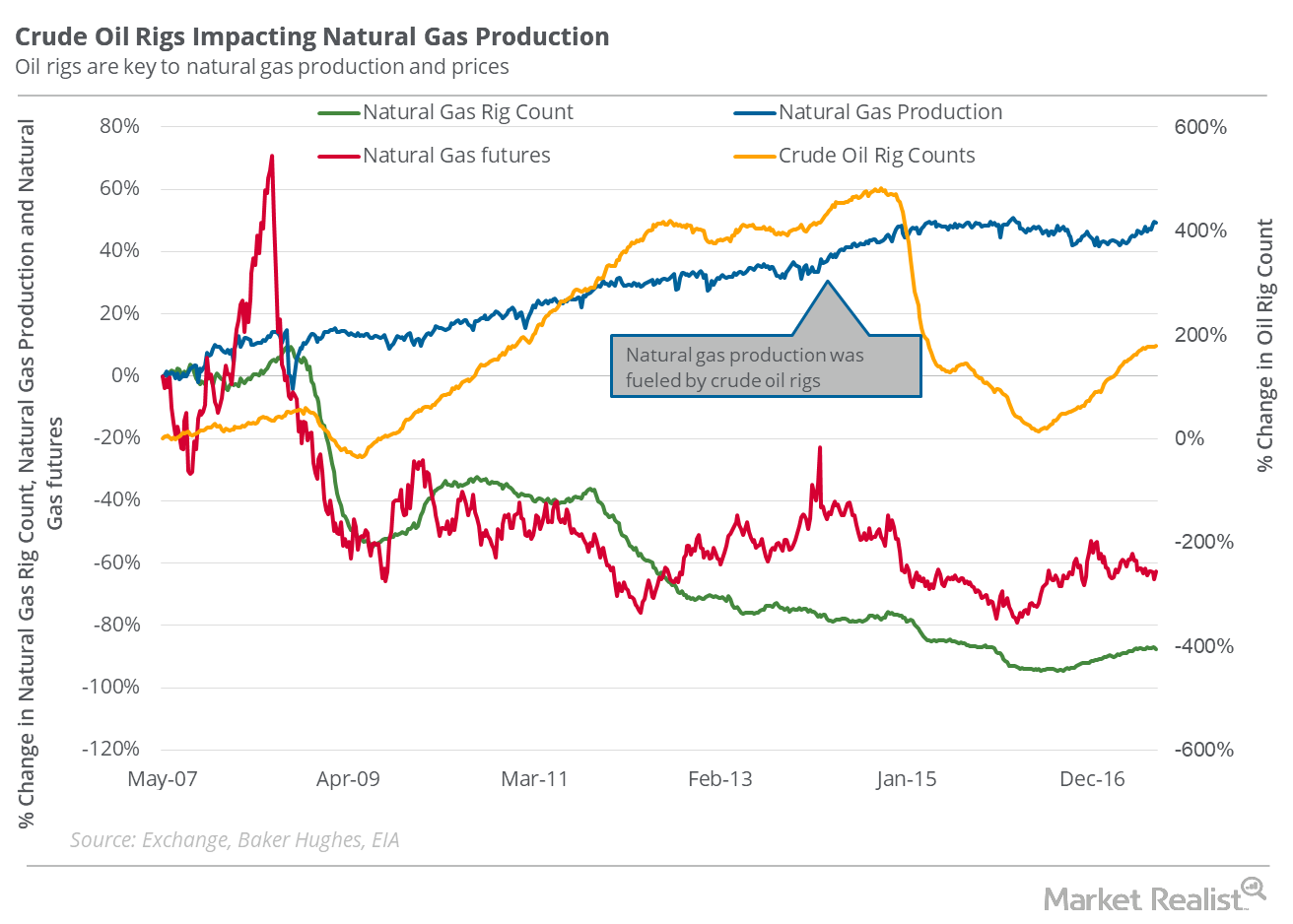

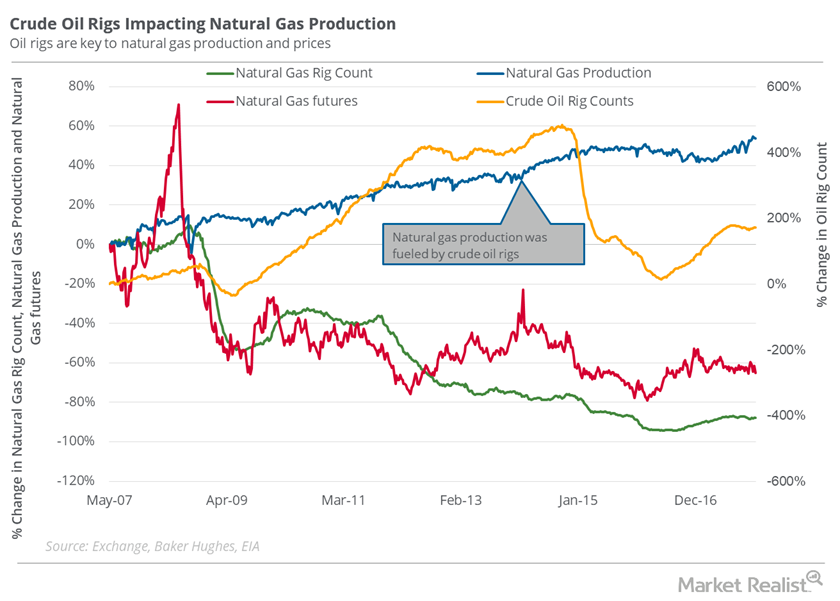

Will the Oil Rig Count Increase Natural Gas Downside Risk?

Since 2008, the natural gas rig count has fallen ~89% from its record high. But the fall was unable to stop the rise in natural gas supplies.

Why Did Crude Oil Prices Rise?

On February 9, 2017, US crude oil futures contracts for March delivery closed at $53.00 per barrel—an ~1.3% rise compared to the previous trading session.

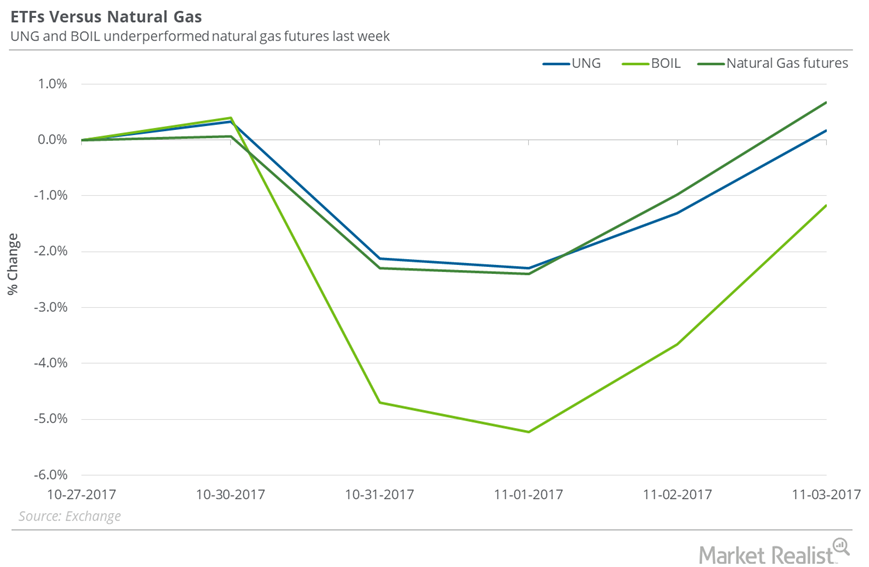

How Natural Gas ETFs Fared Last Week

Between October 27 and November 3, 2017, the United States Natural Gas Fund LP (UNG) rose just 0.2%, and natural gas December futures rose 0.7%.

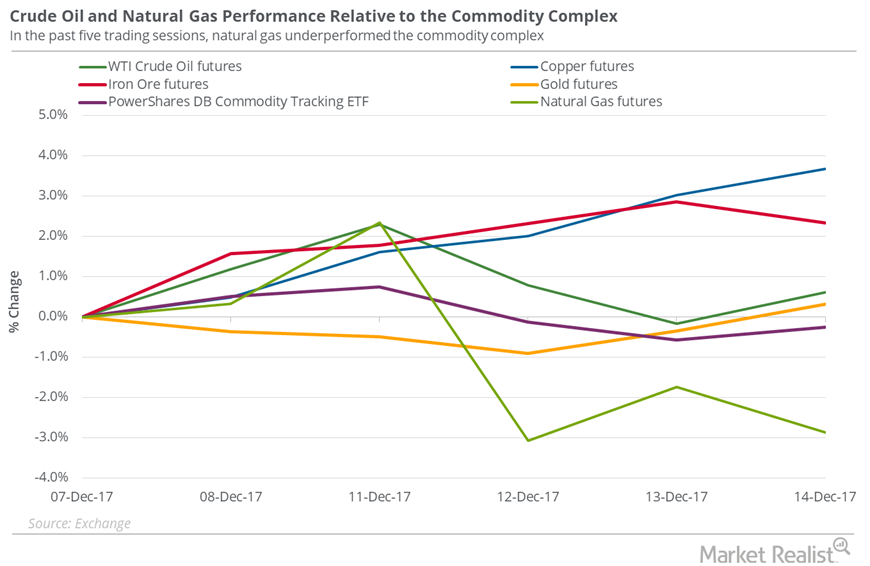

China’s Economic Data Might Drag Oil Prices

On December 14, China reported the November industrial output growth at 5.4% on a year-over-year basis—the lowest growth since early 2016.

Are You Looking at the Right Oil-Weighted Stocks?

On May 16, US crude oil June futures rose 0.3% and closed at $71.49 per barrel, a more-than-three-year high.

Behind the Natural Gas Rig Count: Will Production Rise?

The natural gas rig count rose by four to 187 in the week ended September 8, 2017. On a YoY basis, the natural gas rig count more than doubled that week.

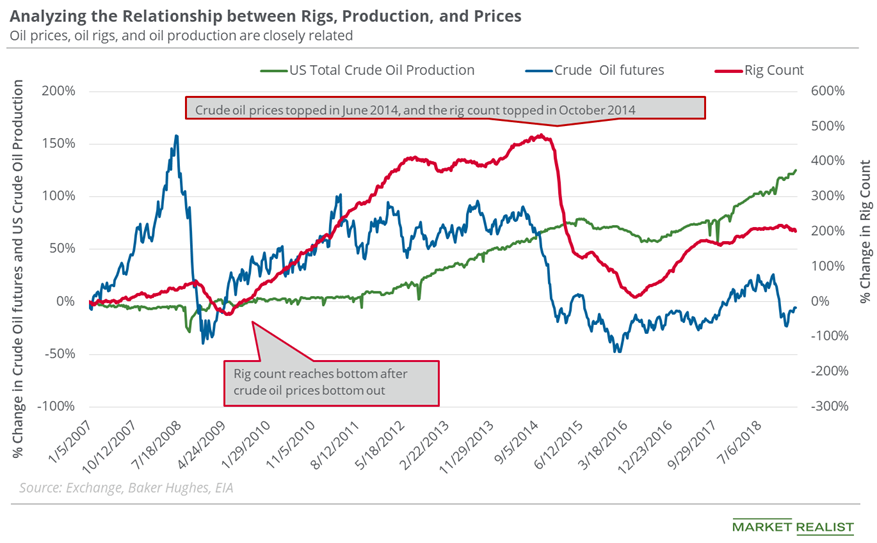

Analyzing US Crude Oil Production

In the week ending March 1, the US crude oil production was 12.1 MMbpd (million barrels per day)—a record level.

Where Natural Gas Prices Could Go Next Week

On September 21, 2017, natural gas implied volatility was 35.1%, or 5.1% above the 15-day average.

What the Brent–WTI Spread Indicates

On August 15, Brent crude oil active futures were trading $3.25 more than the WTI crude oil active futures. On August 8, the spread stood at $2.97.

Natural Gas Prices: What Could Happen on January 24?

On January 24, at 5:39 AM EST, natural gas prices have risen 1.7% from the last closing level.

Why Oil Prices Could Lose Momentum

On January 25, 2018, US crude oil’s (USO) (USL) March 2018 futures fell 0.2% and settled at $65.51 per barrel.

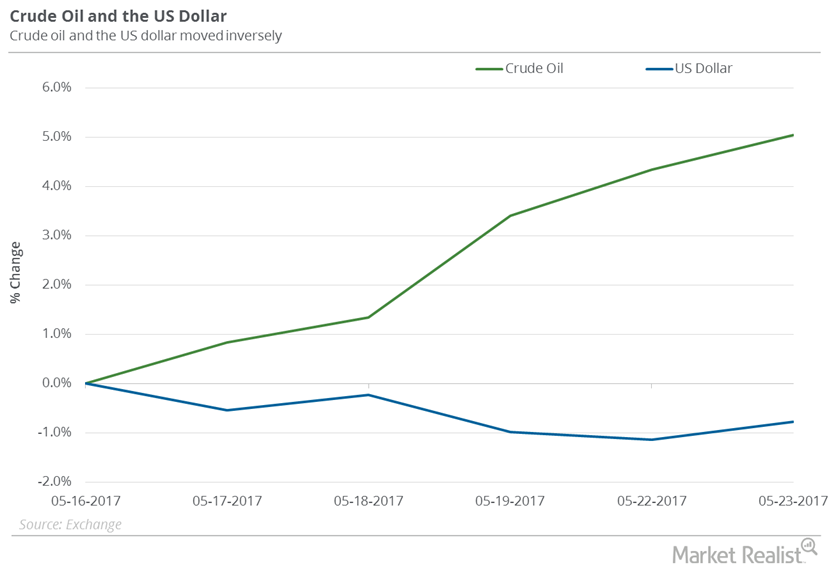

How the Dollar Is Affecting Oil

US crude oil (DBO) (USL) (OIIL) July futures rose 5% between May 16 and May 23, 2017.

Why Is the Risk in Oil Prices Rising?

On December 5, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.3%. The API’s oil inventory data might have supported oil prices on the same day.

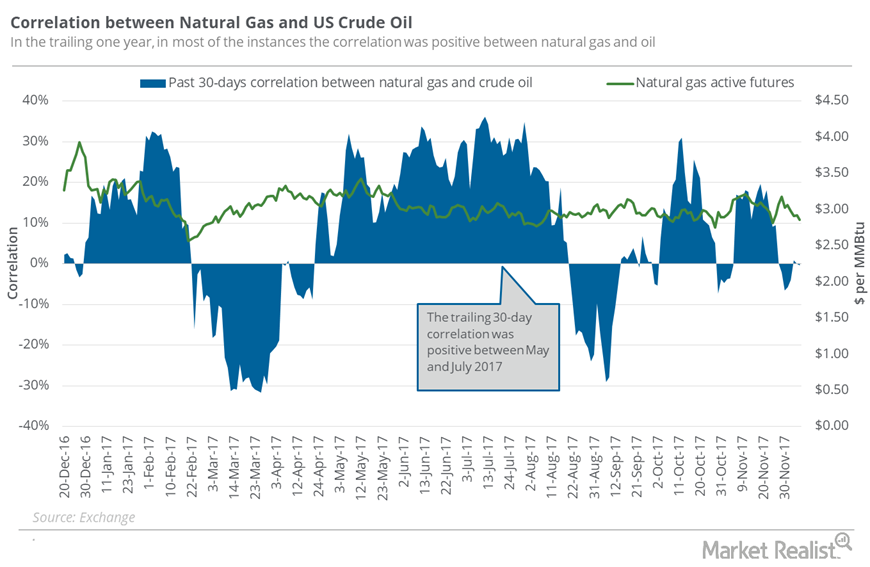

Does the Natural Gas Fall Relate to Oil’s Decline?

Between November 29 and December 6, natural gas (GASL)(GASX)(FCG) January 2018 futures had a correlation of -1.6% with US crude oil January futures.

Brent Underperforming US Crude Oil: Impact on US Oil Exports

In 2017 year-to-date, US crude oil exports averaged ~782,700 barrels per day, based on weekly data from the EIA (Energy Information Administration).

Are Natural Gas Supplies Overtaking Demand?

Futures spread On September 27, 2017, natural gas (FCG) (GASL) (BOIL) 2018 November futures traded $0.04 lower than November 2017 futures. That is, the futures spread was at a discount of $0.04. On September 20, 2017, the futures spread was at a discount of $0.10. Between September 20 and 27, 2017, natural gas November futures […]

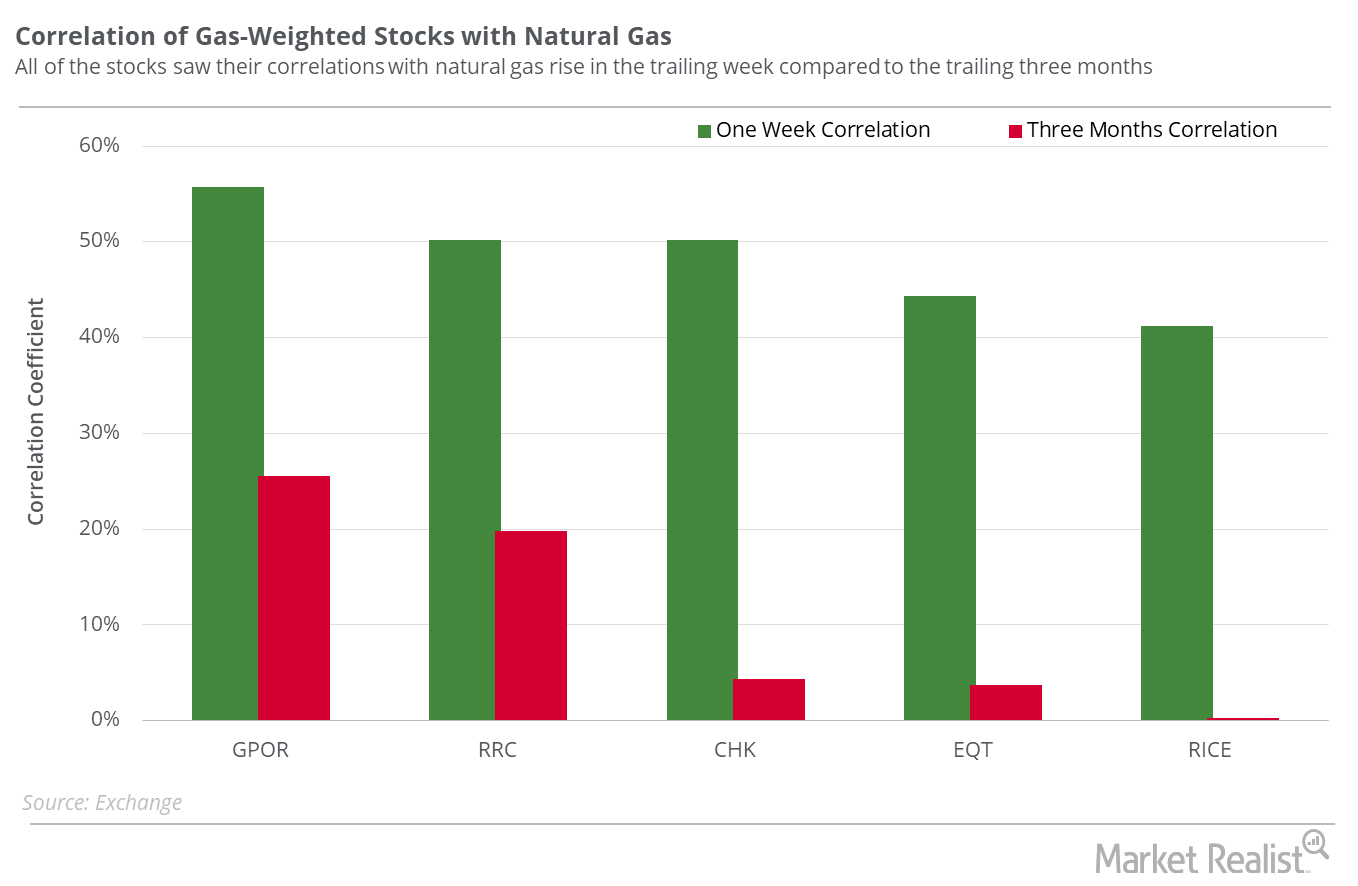

Which Natural Gas–Weighted Stocks Could Follow Oil?

WPX Energy had the lowest correlation with natural gas prices in the past five trading sessions. Southwestern Energy had among the highest correlations.

Why Did Oil Prices Fall?

On March 22, natural gas April 2018 futures declined 0.8% and settled at $2.62 per million British thermal units.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).

Natural Gas Traders Should Stay Cautious of Oil Rigs

On December 29, the natural gas rig count was 88.7% below its record high of 1,606 in 2008. However, natural gas supplies have risen drastically since 2008.

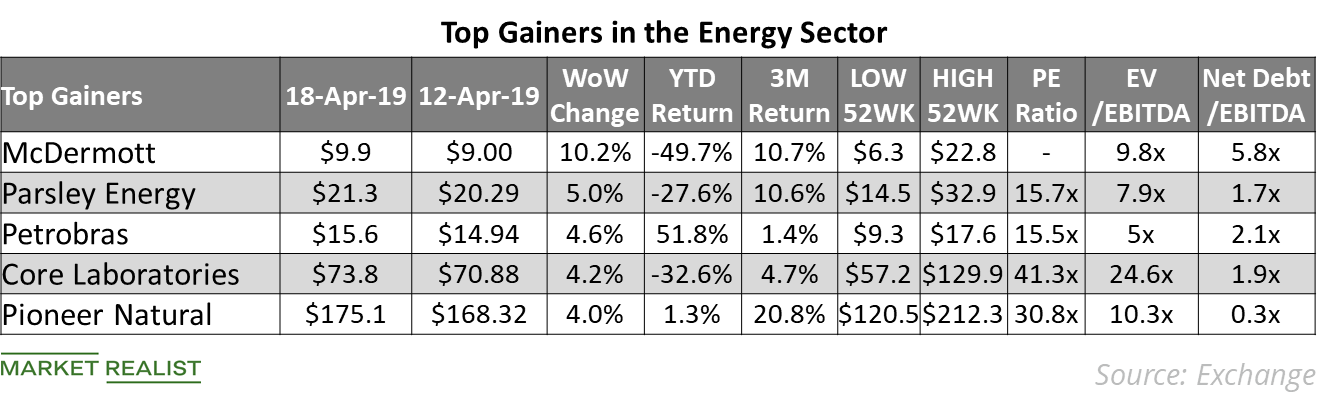

Top Energy Gains Last Week

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29.

Brent-WTI Spread Impacts Your Oil-Related Investments

On February 14, WTI crude oil (USO) (USL) (OIIL) (SCO) active futures traded at a discount of $2.84 per barrel compared to Brent crude oil active futures.

Why the Brent-WTI Spread Could Make Global Oil Supplies Rise

On October 17, 2017, Brent crude oil (BNO) active futures closed $6 above the WTI (West Texas Intermediate) crude oil futures.

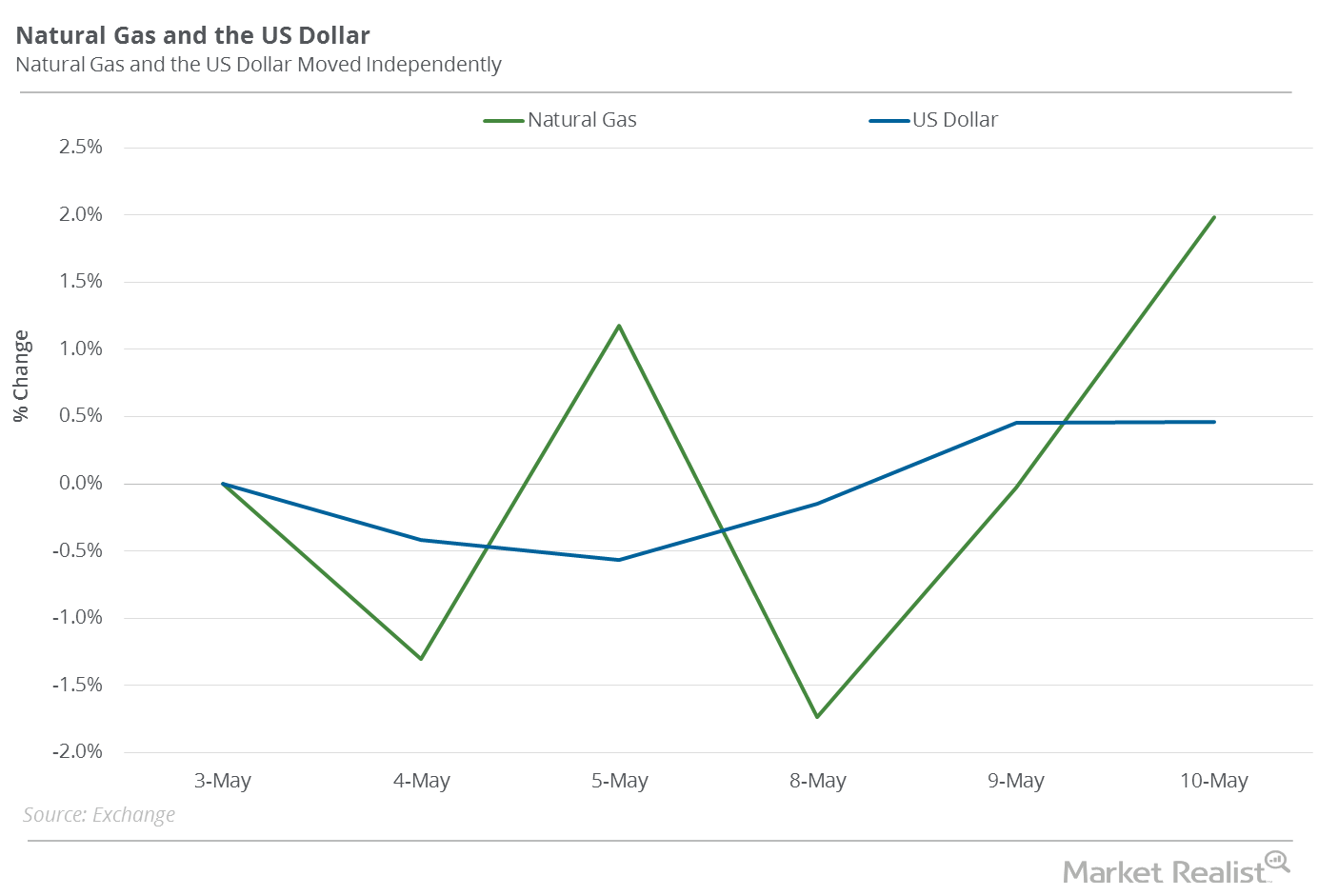

Natural Gas Prices Are Impacted by the US Dollar

Between May 3 and May 10, 2017, natural gas (GASX) (FCG) (GASL) June futures rose 2%. The US dollar (UUP) (UDN) (USDU) rose 0.5% during that period.

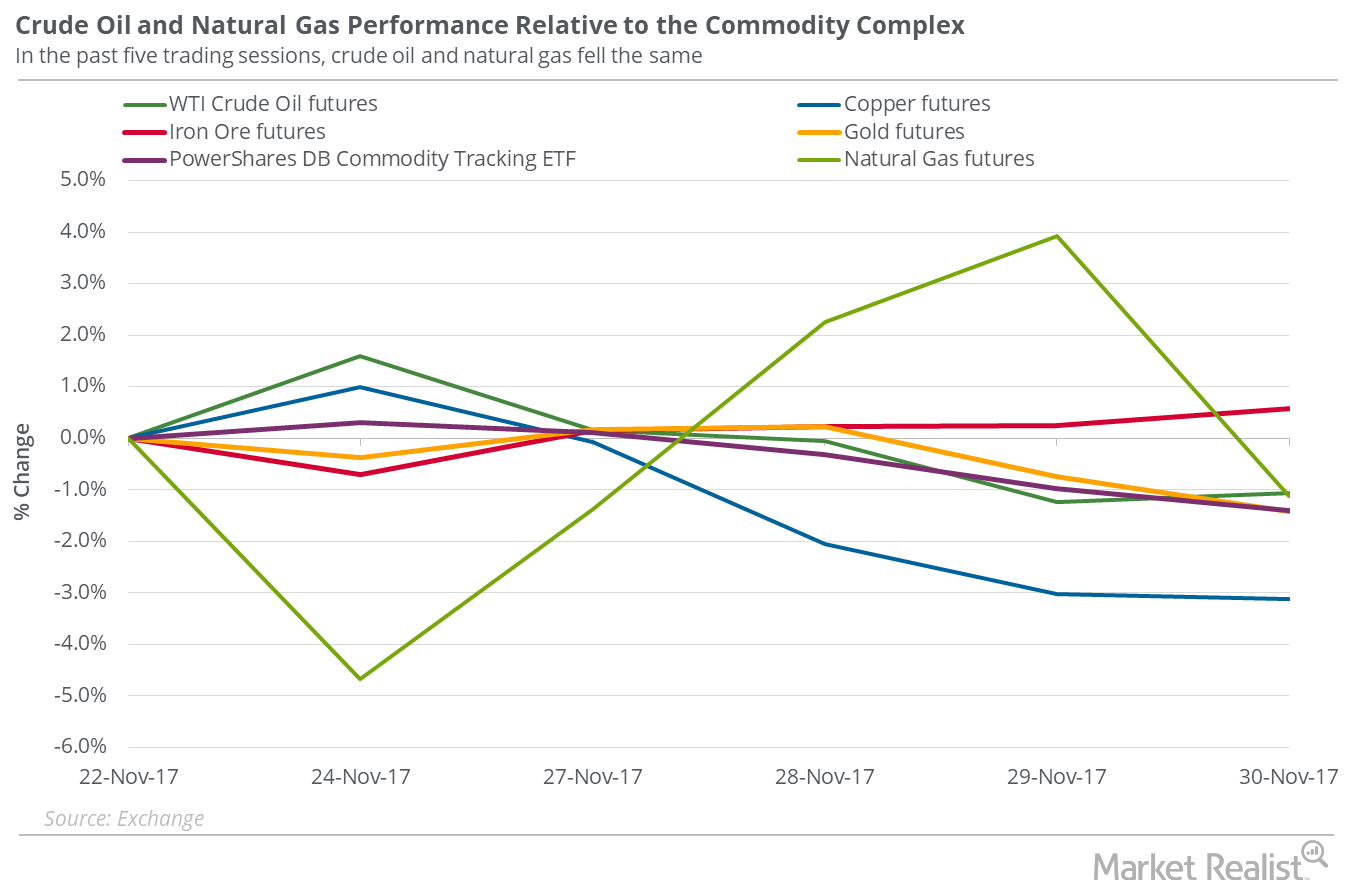

Why Oil Traders Should Stay Cautious after OPEC Meeting

On November 30, 2017, US crude oil (USO) (USL) active futures rose just 0.2% and closed at $57.4 per barrel.

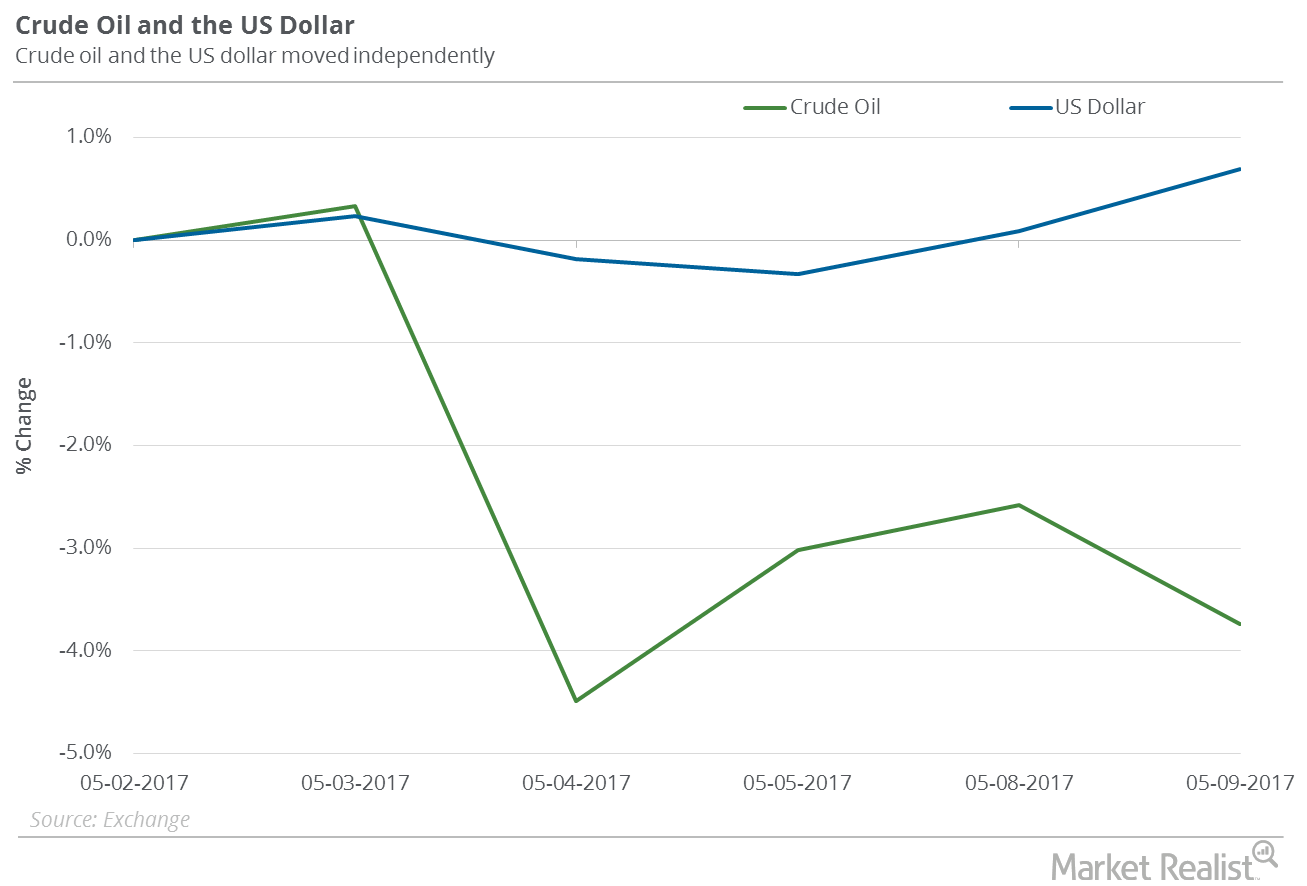

Oil Bulls, Don’t Worry About the Rising US Dollar

US crude oil futures contracts for June 2017 delivery fell 3.7% between May 2, and May 9, 2017, while the US Dollar Index rose 0.7%.

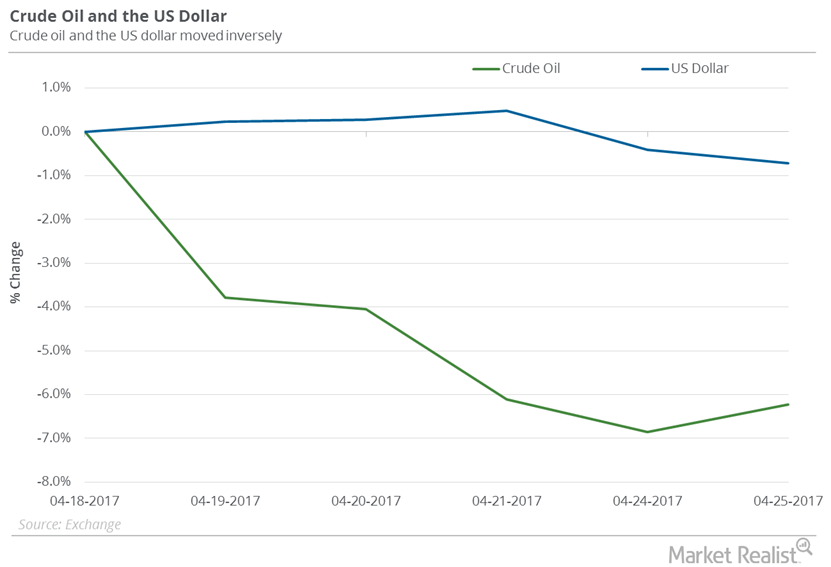

How the US Dollar Could Be Crucial to Oil Investors

US crude oil futures contracts for June delivery fell 6.2% between April 18, 2017, and April 25, 2017. Meanwhile, the US Dollar Index fell 0.7%.

Will Non-OPEC Oil Supply Dominate Oil Prices in 2018?

On December 14, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.8% and closed at $57.04 per barrel.

Could Natural Gas Reach a New 2017 Low Next Week?

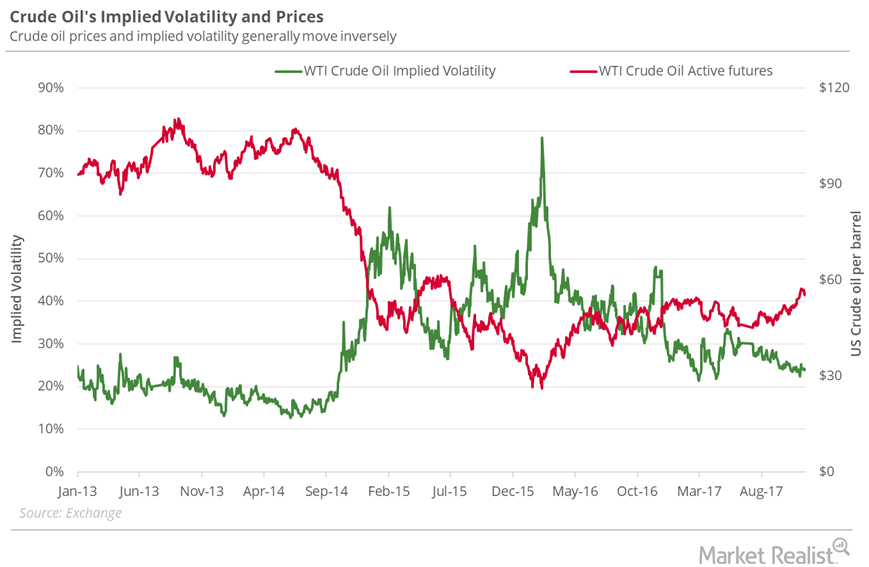

Implied volatility On December 21, 2017, natural gas futures’ implied volatility was 42.4%. In the last trading session, their implied volatility was on par with the 15-day average. Supply-glut concerns pushed natural gas (UNG) (BOIL) futures to a 17-year low on March 3, 2016, with an implied volatility of 53.8%. From this multiyear low, natural gas prices […]