Top Investments Made Renaissance Technologies and Its Founder Filthy Rich

Renaissance Technologies is best known for its Medallion Fund. The firm manages roughly $50 billion in assets. Here are its top investments.

May 3 2023, Updated 3:02 p.m. ET

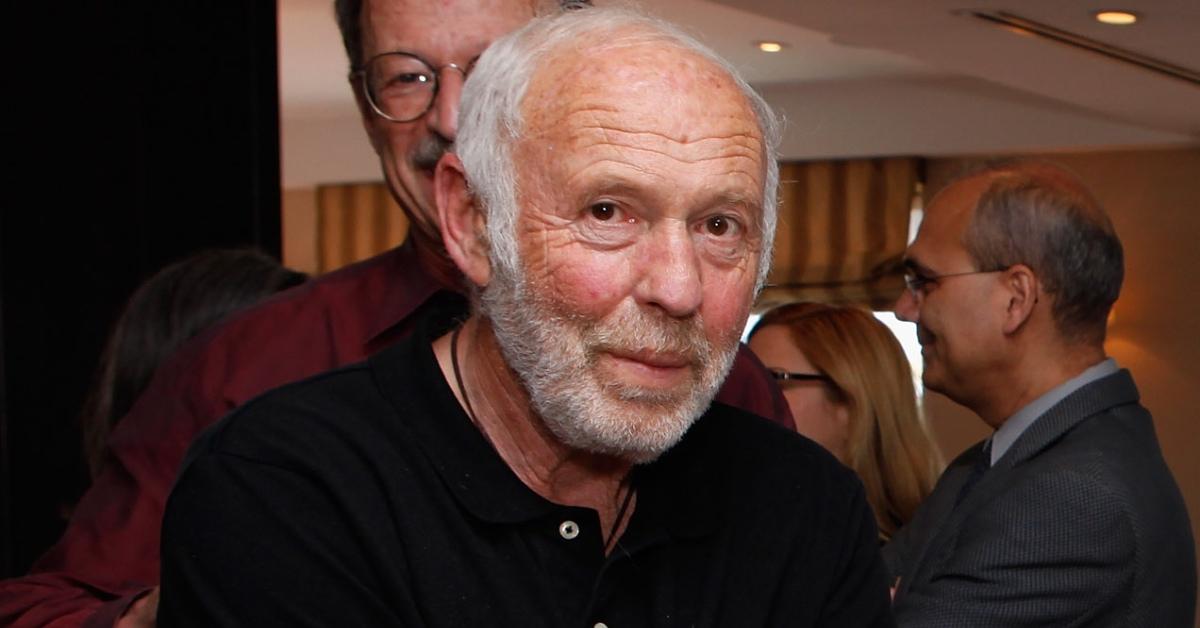

Jim Simons founded his investment firm Renaissance Technologies (RIEF)(RIDA) in 1982 in New York. The billionaire hedge fund manager is well-known in the industry because of his quantitative investment strategies. In April 2023, Forbes named Simons as the second-richest hedge fund manager on the planet, with a net worth of $28.1 billion.

So, what has Renaissance Technologies invested in to make it one of the world's top 10 hedge funds?

If you've ever wondered what Renaissance Technologies's portfolio looks like and which hedge fund sits in the top spot, then get cozy and keep reading. We're diving deep into Renaissance Technologies's top investments and taking a look at just how much money the Jim Simon-founded firm is managing in 2023.

What are Renaissance Technologies's top investments?

One way to learn about Renaissance Technologies’s assets is to look at their SEC Form 13F, a quarterly report filed by investment managers. During the second quarter of 2019, Renaissance Technologies had a strong investment in the healthcare sector. At the time, the healthcare sector made up 18.16 percent of the firm’s total portfolio.

The healthcare sector generally performs the role of a defensive sector in the economy. When any economic turmoil arises in the country, investors turn towards the defensive sector. Defensives protect their portfolio from downside risk.

Since then, Renaissance Technologies has continued to keep its involvement in the healthcare quite high. WhaleWisdom's analysis of the firm's Q4 2022 report revealed that its largest investment is Novo-Nordisk, best known for diabetes care, with shares held of 12,604,288 ($1,705,864,000 market value).

Renaissance Technologies's other top investments include:

- Amazon (11,347,000 shares held)

- Apple (7,099,648 shares held)

- Gilead Sciences Inc. (9,202,568 shares held)

- Airbnb (8,602,746 shares held)

- United Therapeutics Corp. (2,344,492 shares held)

- Vertex Pharmaceuticals, Inc. (2,246,752 shares held)

Overall, the Renaissance Technologies's portfolio is balanced between cyclical and defensive stocks. But, other top hedge fund managers like Warren Buffett and Kenneth Fisher usually prefer cyclical stocks. At the same time, Nelson Peltz’s Trian Fund has invested the majority of the corpus in the consumer staple sector.

What are Renaissance Technologies's top sells?

Renaissance is constantly making moves to ensure it is able to provide its investors with recurring profits. In February 2023, Renaissance Technologies sold all of its AT&T Inc. (9,931,986) and Comcast Corp. (6,211,676) shares. It also dumped all of the shares it held with Microsoft, JPMorgan Chase & Co., and Nike.

What is the most successful hedge fund Renaissance Technologies manages?

Renaissance Technologies is best known for its Medallion Fund, which is "a $10 billion black-box strategy that is only open to Renaissance owners and employees," according to Forbes. In total, however, Renaissance reportedly manages roughly $50 billion in assets, although it's still far behind its competitor, Citadel, which has watched its net gains reach an impressive $65 billion since its inception, Forbes noted.

As successful as Renaissance has been with its Medallion Fund, it did bring the firm some notoriety in 2021. According to Forbes, the hedge fund ultimately agreed to pay the IRS $7 billion in order settle a tax dispute that arose "over trades made by the Medallion Fund."

Does Jim Simons still run Renaissance Technologies?

Simons retired from Renaissance Technologies in 2010, although he is reportedly still involved with the firm and making money from it. During his time at the firm, Simons worked as the CEO.

Although Simons is no longer at the helm of Renaissance Technologies, Celebrity Net Worth reports that he still holds a position as trustee for various entities including:

- Brookhaven National Laboratory

- Mathematical Research Institute in Berkeley

- Institute for Advanced Study at Rockefeller University

Simons is also said to be a member of the board at MIT Corporation and has been known to donate to philanthropic causes.

The former Renaissance Technologies CEO is the founder of Math For America and donated $4 billion to important causes, per Forbes. So, even though he has retired, he's still very active.