Rabindra Samanta

I have been working at Market Realist since August 2015. My primary area of expertise includes qualitative and quantitative analysis of crude oil and the natural gas market. This focus also includes tracking macroeconomic indicators. But, later into my career, I also started covering global markets, hedge fund manager commentary, and other macro developments.

I completed the PGDBM degree in 2014. Prior to Market Realist, I worked with one of India's largest brokerage house, Kotak Securities. My primary responsibilities include market analysis, portfolio advisory, and investor presentations.

After my graduate degree, I worked as an Associate at Vedanta Resources CPP (captive power plant) and IPP (Independent Power plant) project at Jharsuguda Odisha.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rabindra Samanta

Oil Market Could Be Pricing in a Supply Deficit

The rise in the premium, along with the rise in oil prices in the trailing week, could mean that the market expects a supply deficit in the oil market.

What Were the Top Holdings of Citadel Advisors in Q3?

In Q3 2019, Citadel Advisors’ portfolio of publicly traded securities was worth $212.04 billion. In Q2 2019, its portfolio was worth $155.1 billion.

Chesapeake Energy: ‘Buy’ or ‘Sell’ after Its Q4 Earnings?

On February 27, Chesapeake Energy might report an adjusted net income of $0.18 per diluted share based on analysts’ consensus estimates.

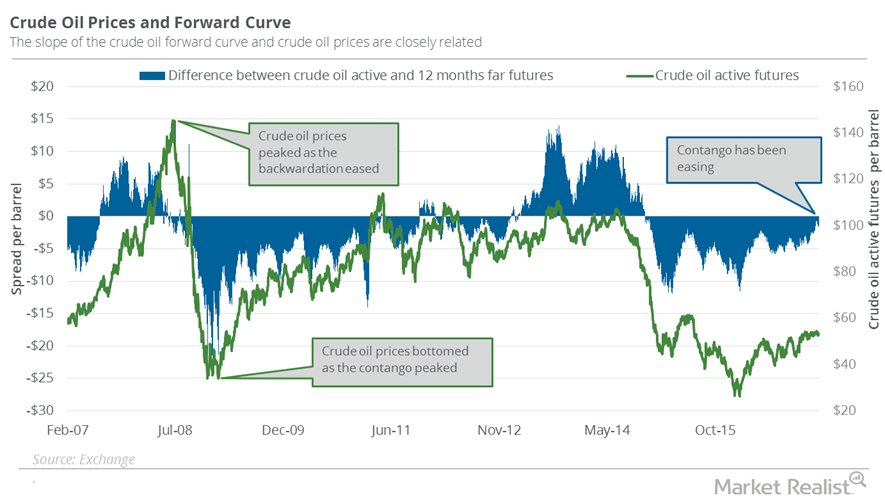

The Crude Oil Futures Spread, and Why It Could Worry Oil Longs

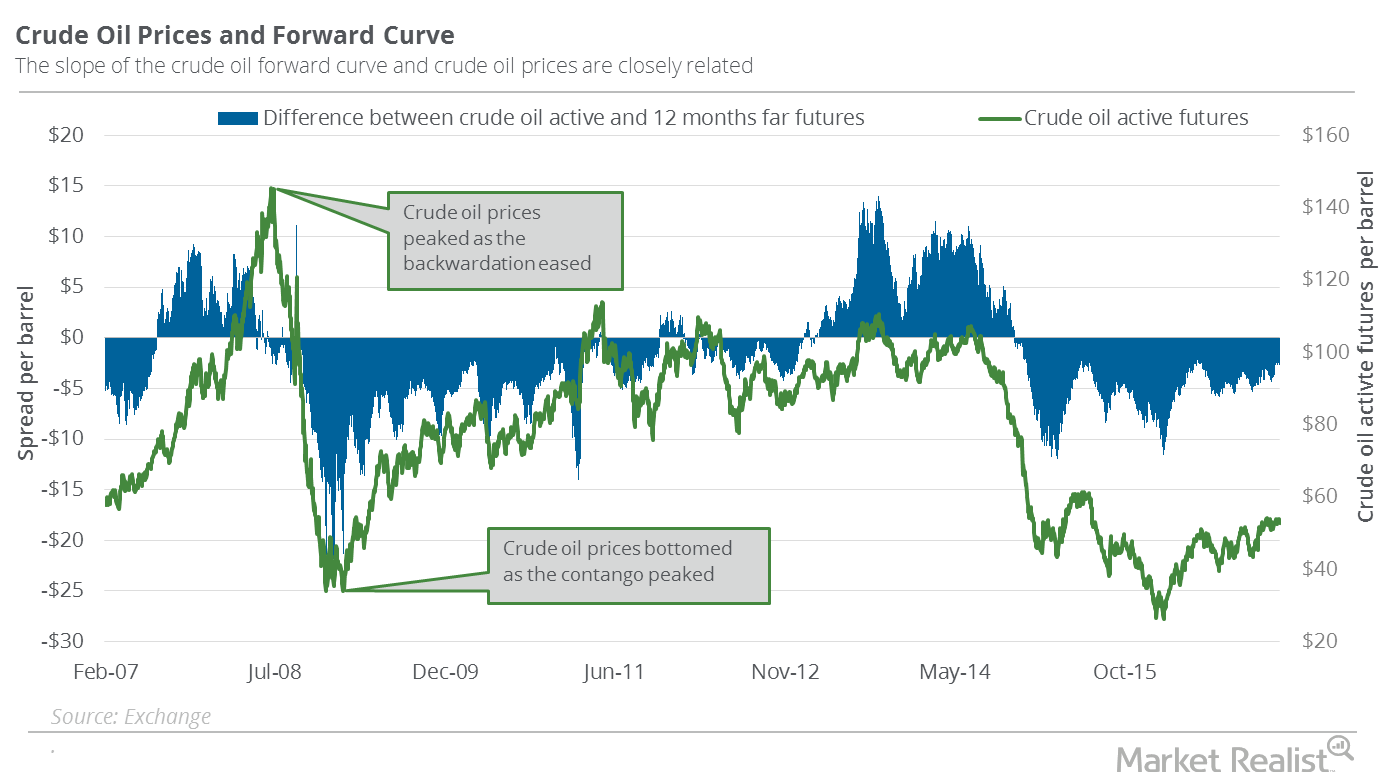

Active crude oil futures are now trading at a discount of $1.56 to futures contracts 12 months from now—a situation known as “contango.”

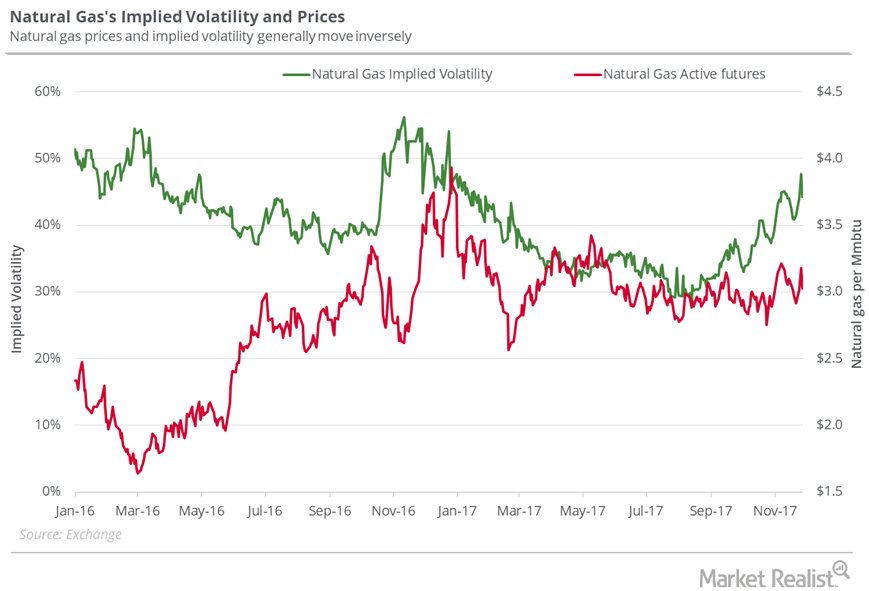

Can Natural Gas Stay above $3 Next Week?

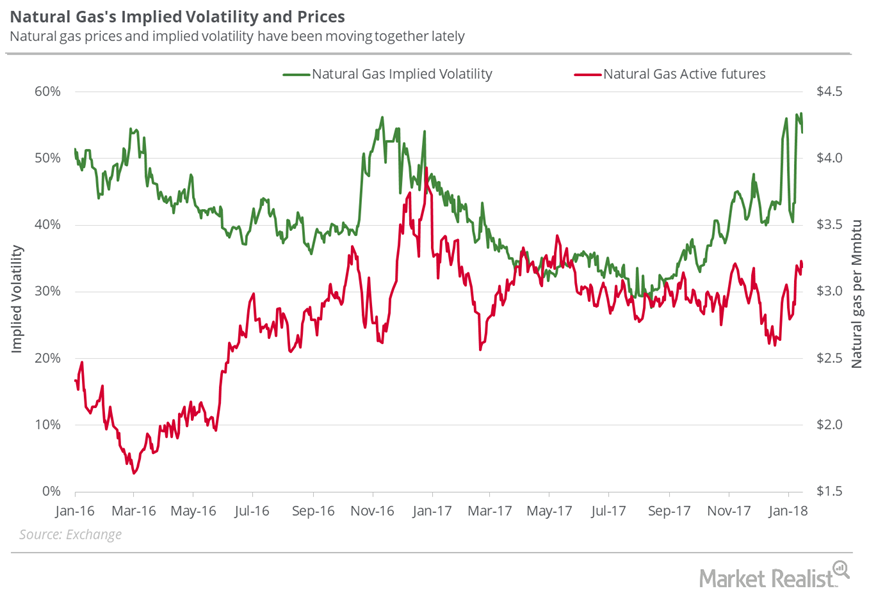

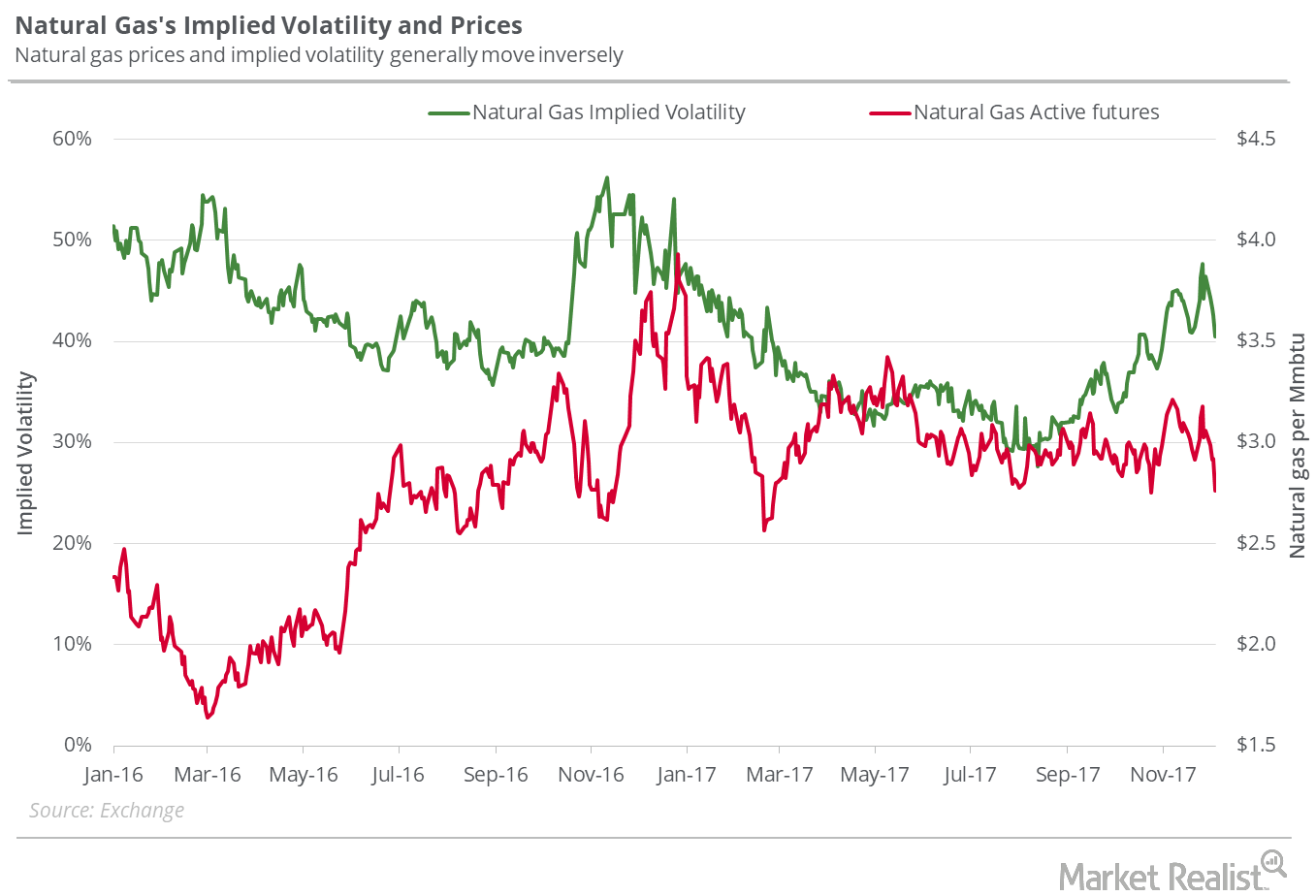

On November 30, 2017, natural gas’s implied volatility was 44.3%, about 1% above its 15-day average.

These S&P 500 Stocks Have the Most ‘Sell’ Ratings

Among S&P 500 stocks, Franklin Resources, Inc. (BEN) has the highest percentage of “sell” ratings based on a FactSet report released on December 23. In 2019, BEN fell by 12.4%. Franklin Resources is a financial services stock. The Financial Select Sector SPDR Fund rose by 29.2% in the last year. BEN price target and institutional […]

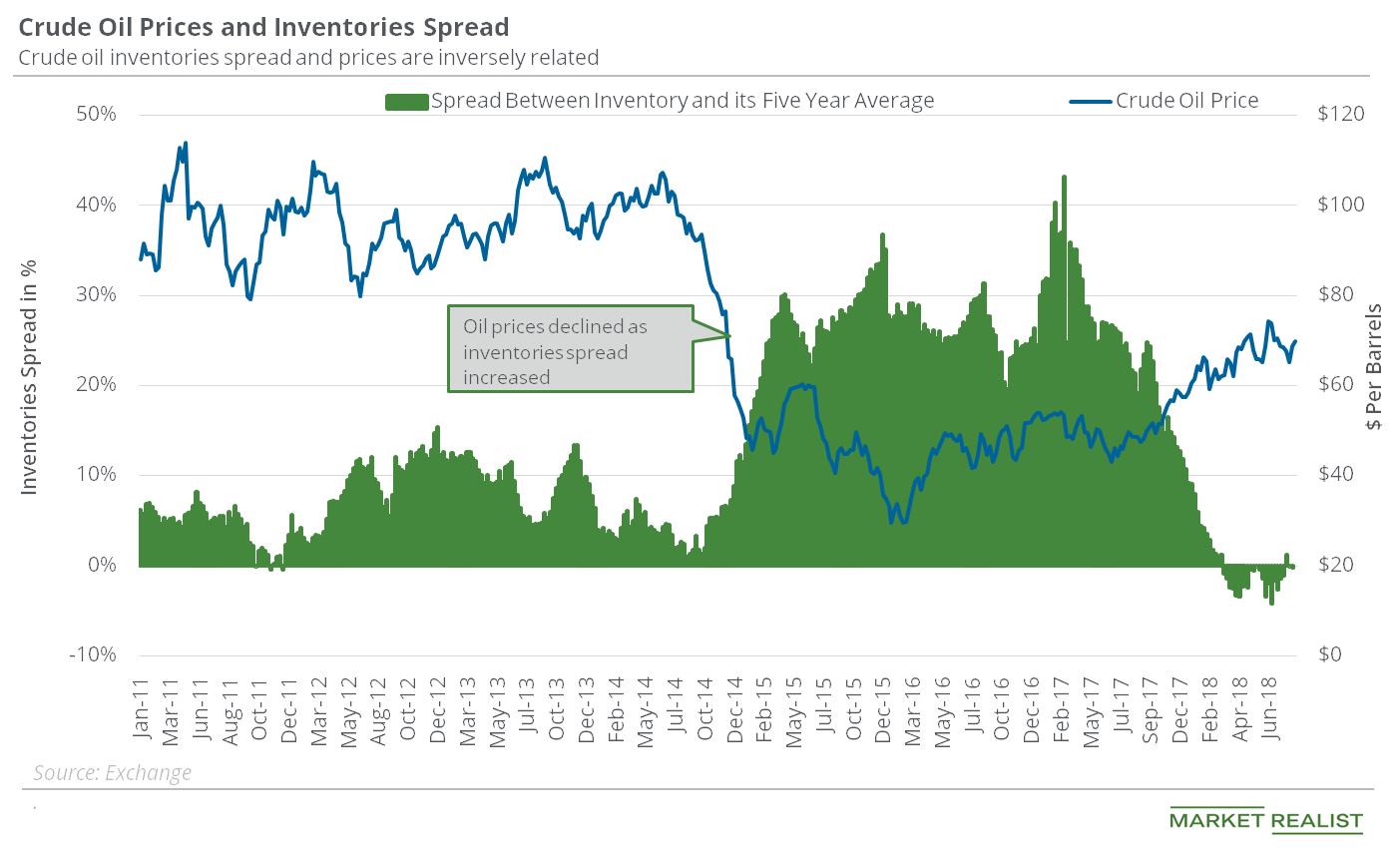

Why Inventory Data Might Boost Oil Prices

In the week ended August 31, 2018, US crude oil inventories were almost on par with their five-year average.

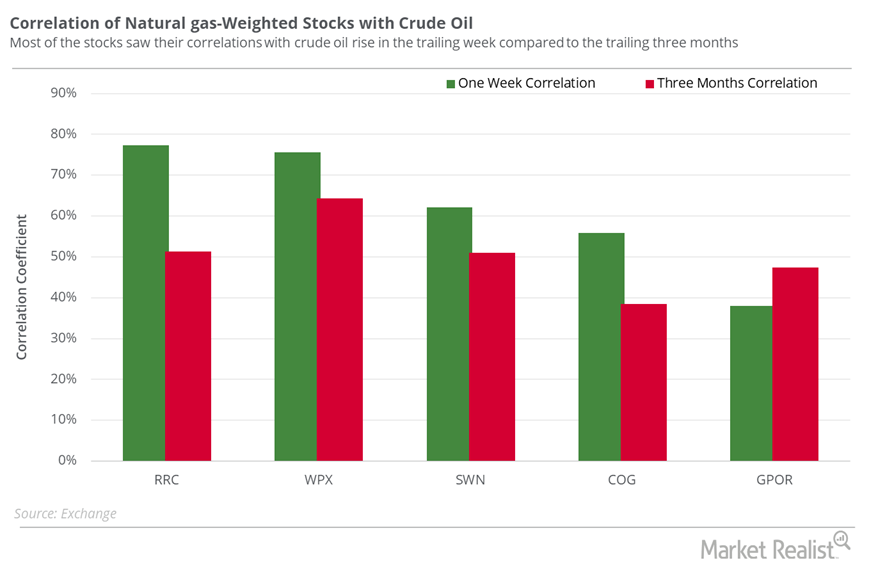

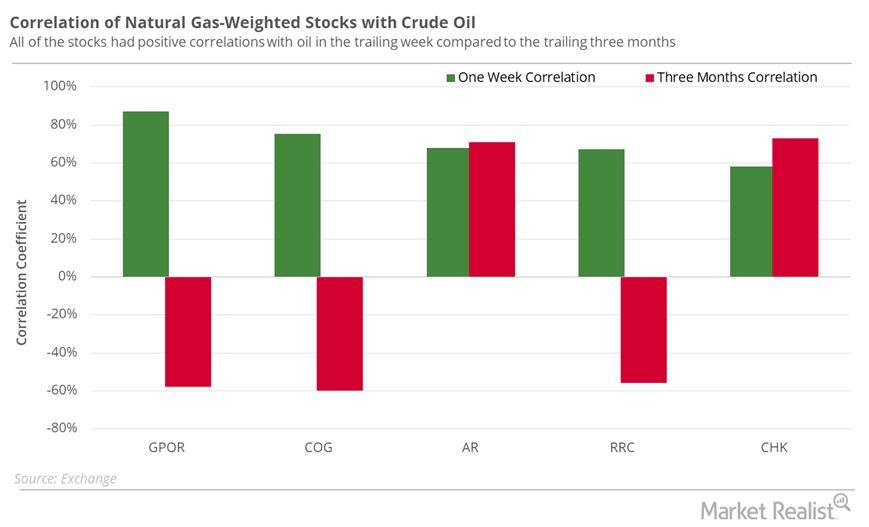

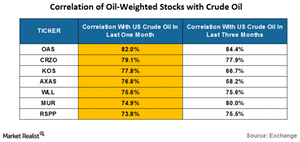

Are Natural Gas–Weighted Stocks Following Oil?

Range Resources had the highest correlation of 77.4% with US crude oil active futures in the last five trading sessions among natural gas–weighted stocks.

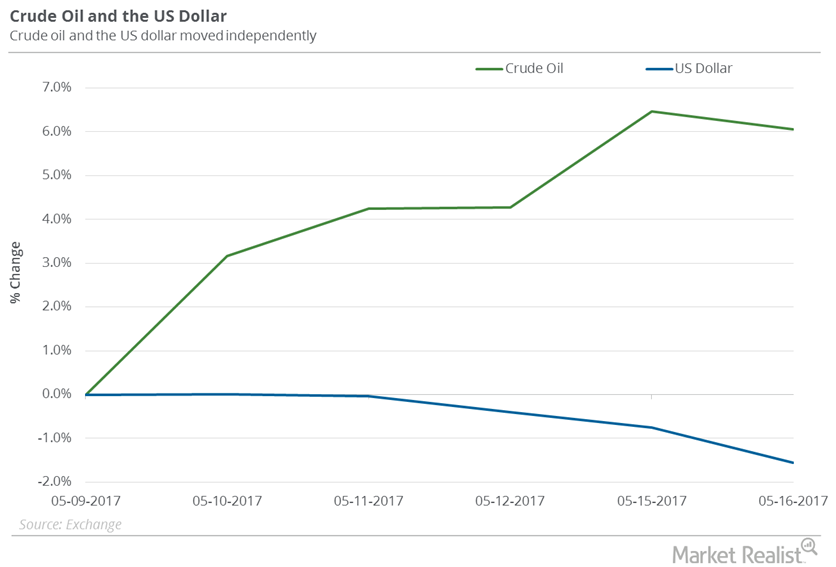

How the Dollar Could Impact Oil’s Recovery

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery rose 3.7% between May 10 and May 17, 2017.

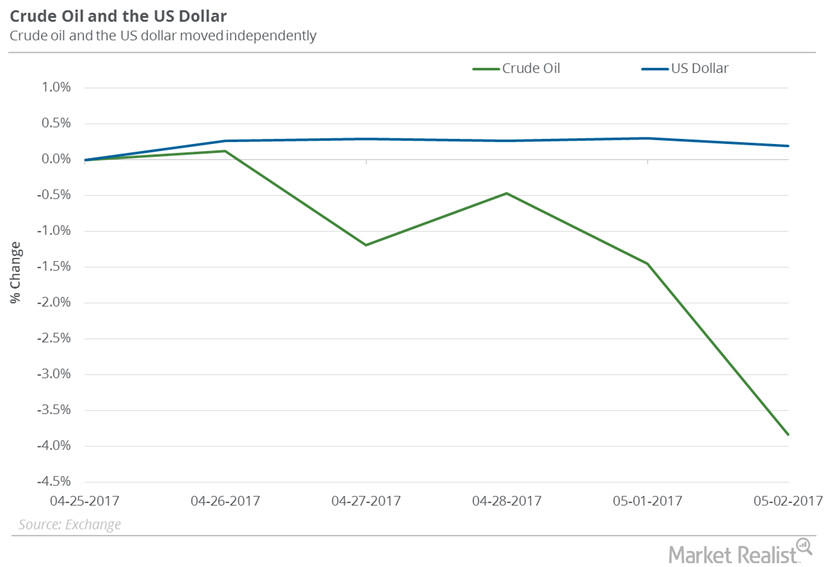

Did the US Dollar Impact Oil Prices Last Week?

US crude oil (DBO) (USL) (OIIL) futures contracts for June 2017 delivery fell 3.8% between April 25, 2017, and May 2, 2017.

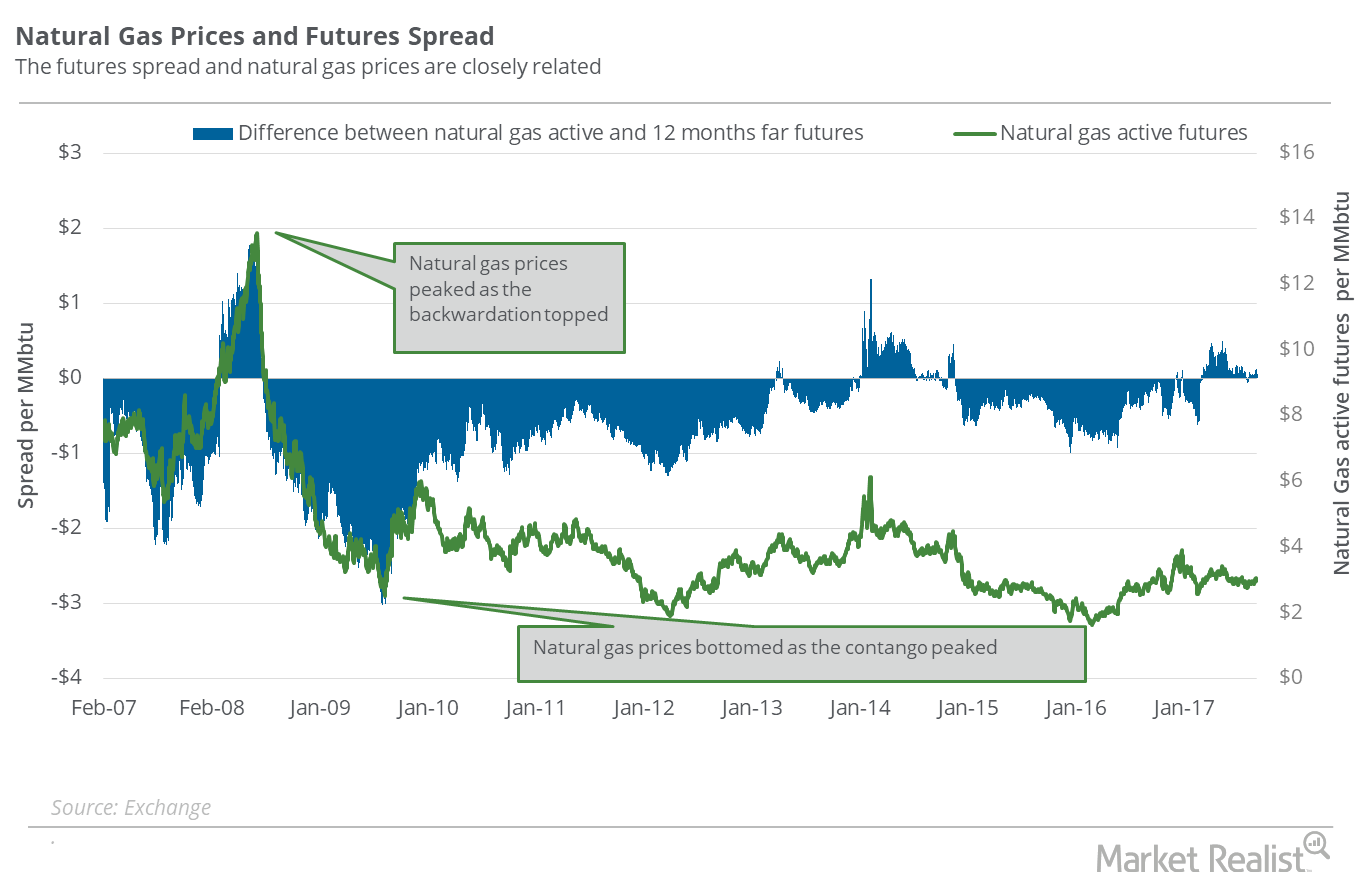

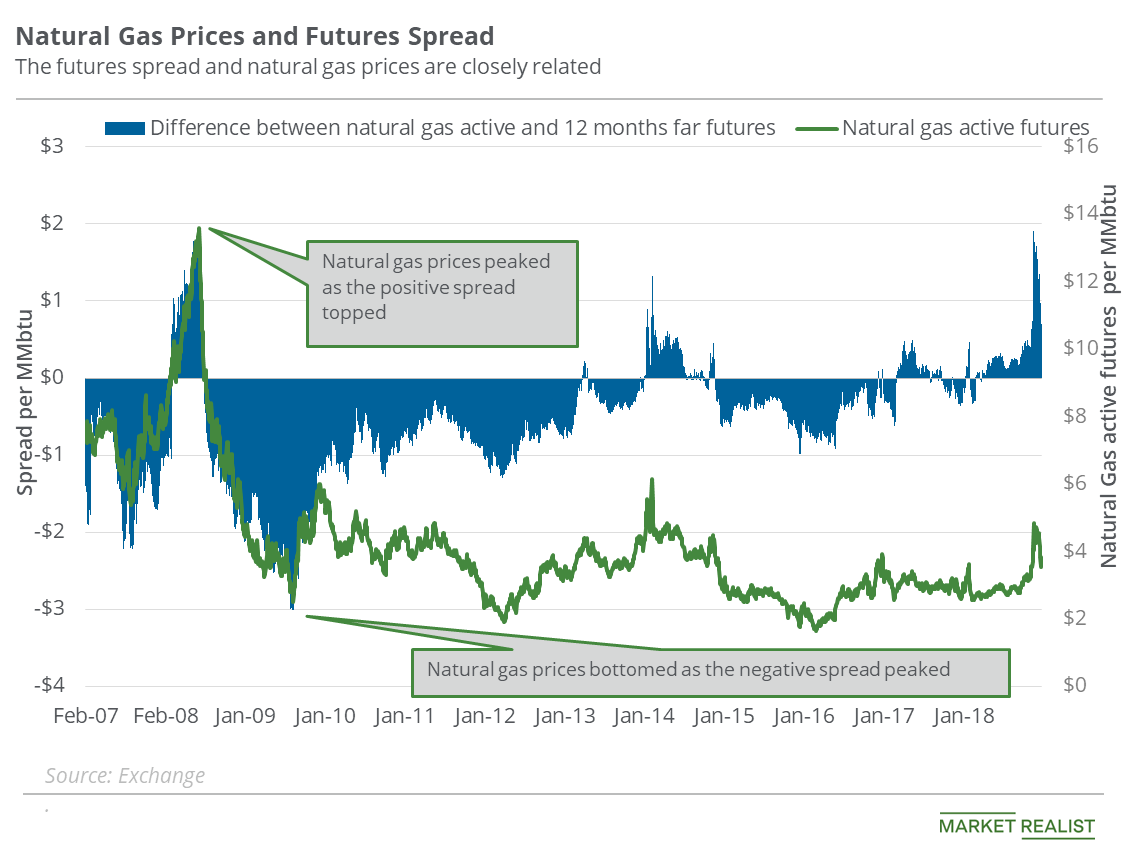

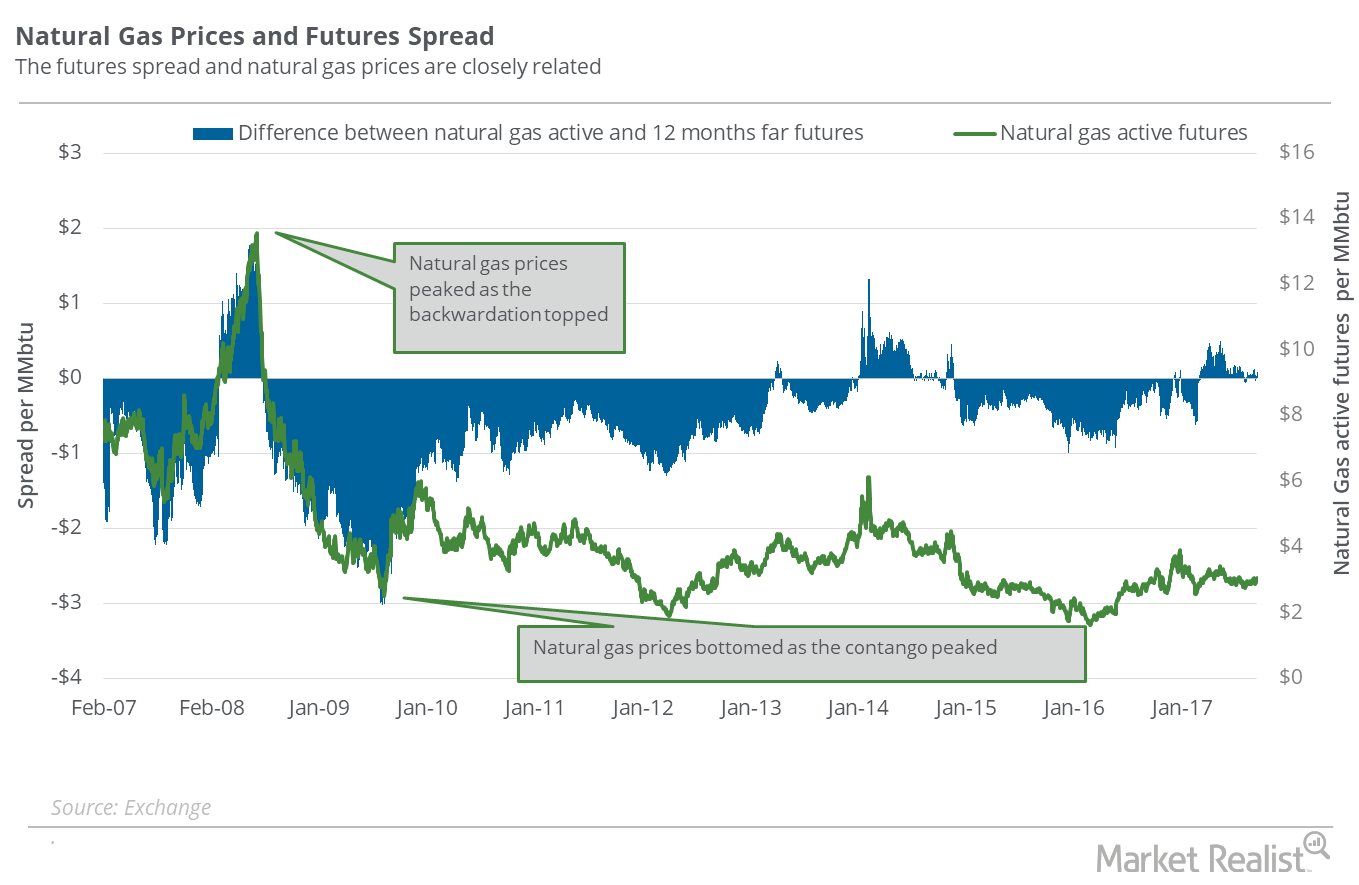

Futures Spread: Is the Natural Gas Market Turning Bullish?

On September 20, 2017, natural gas (FCG) (BOIL) October 2018 futures closed $0.10 below its October 2017 futures.

US Crude Oil Could Hold the $57 Level This Week

On December 1–8, 2017, US crude oil (USO) (USL) January futures fell 1.7%. On December 8, 2017, US crude oil January futures settled at $57.36 per barrel.

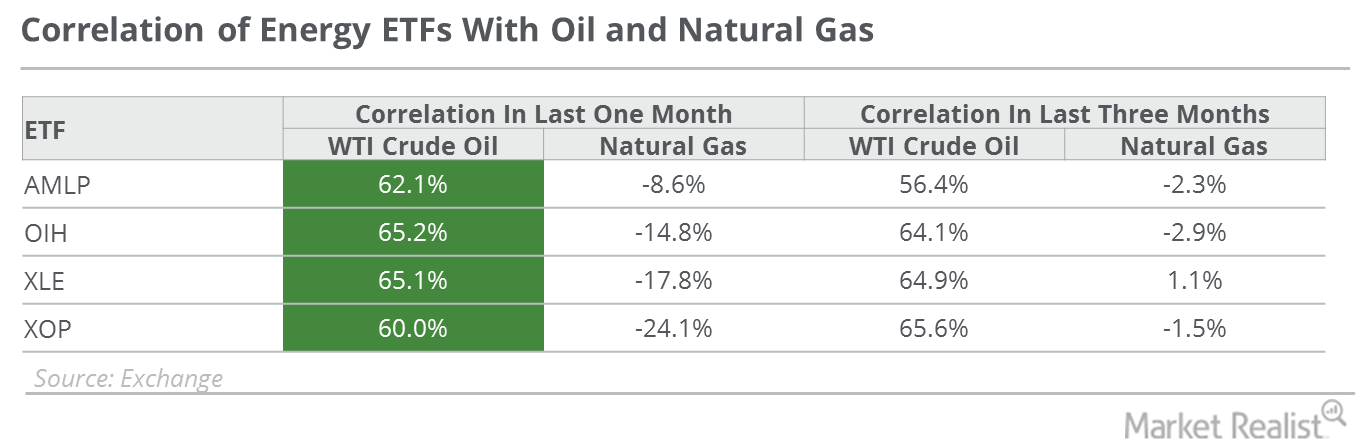

Why Oil Is More Vital than Natural Gas to Natural-Gas-Weighted Stocks

Natural gas supplies depend on US crude oil prices. In fact, the energy sector as a whole can follow trends set by crude oil.

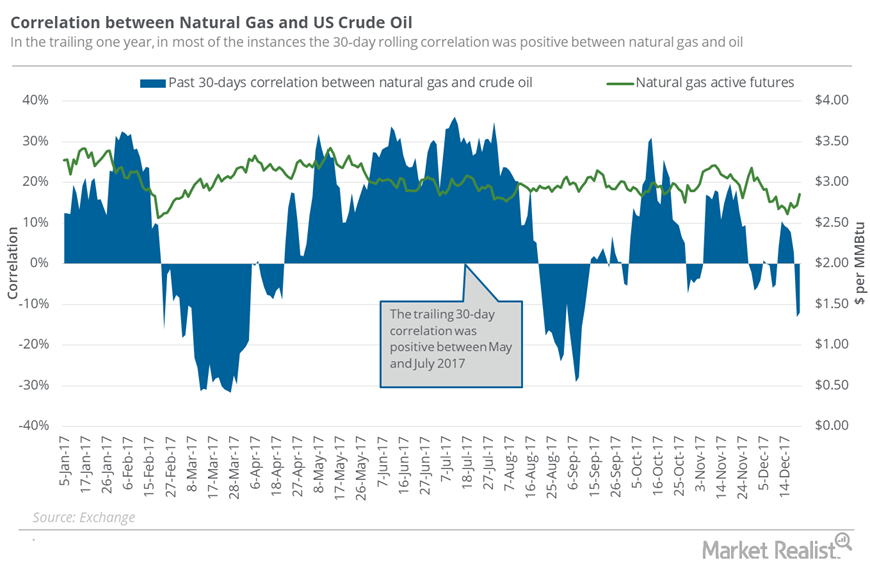

Is Natural Gas Moving with Oil Prices?

The correlation between natural gas (GASL)(GASX)(FCG) active futures with US crude oil active futures was 99.8% between December 12 and December 19.

Could US Crude Oil Fall More?

On May 31, US crude oil July futures fell 1.7% and closed at $67.04 per barrel. That day, the United States Oil ETF (USO) fell 2%.

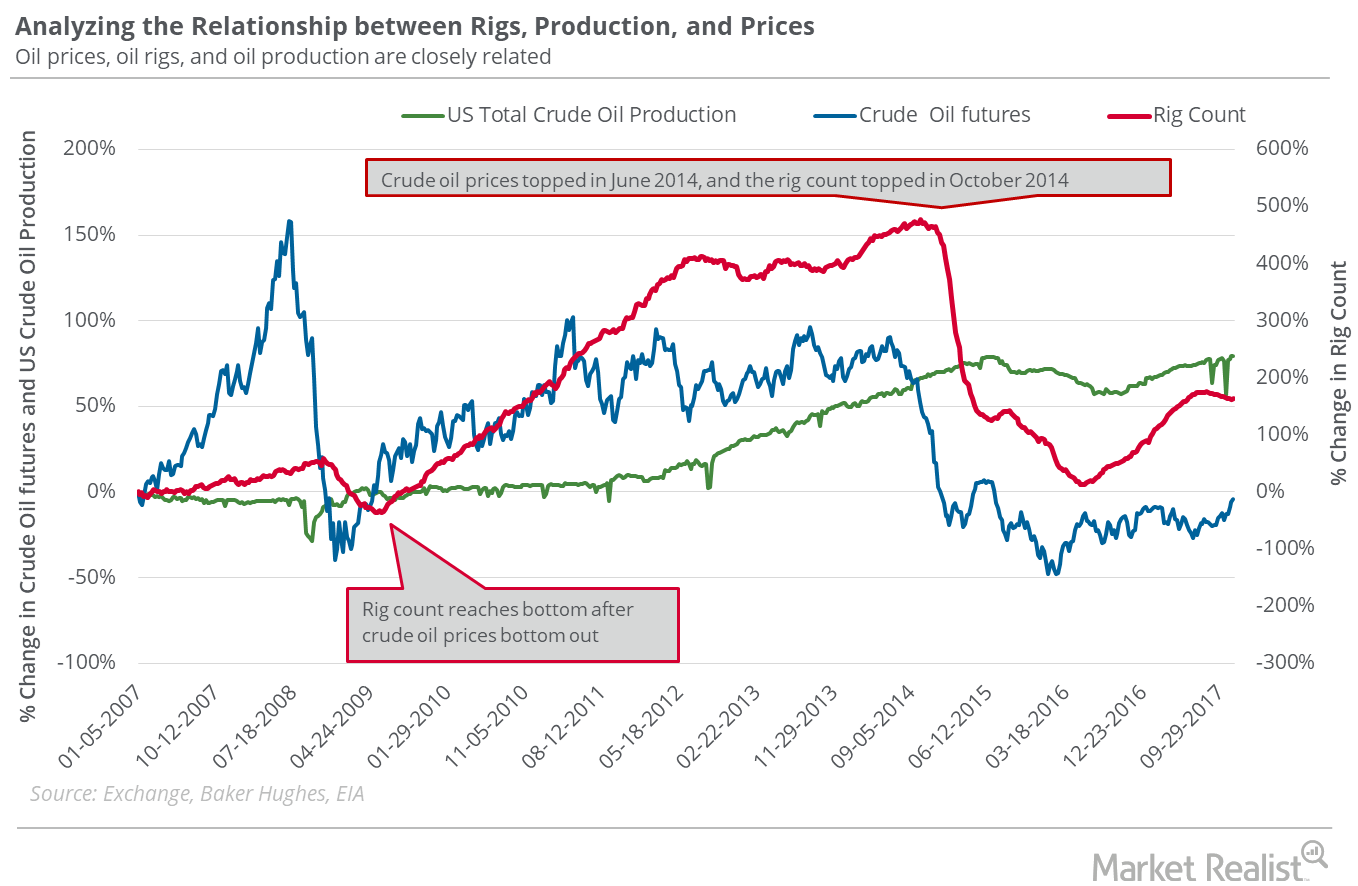

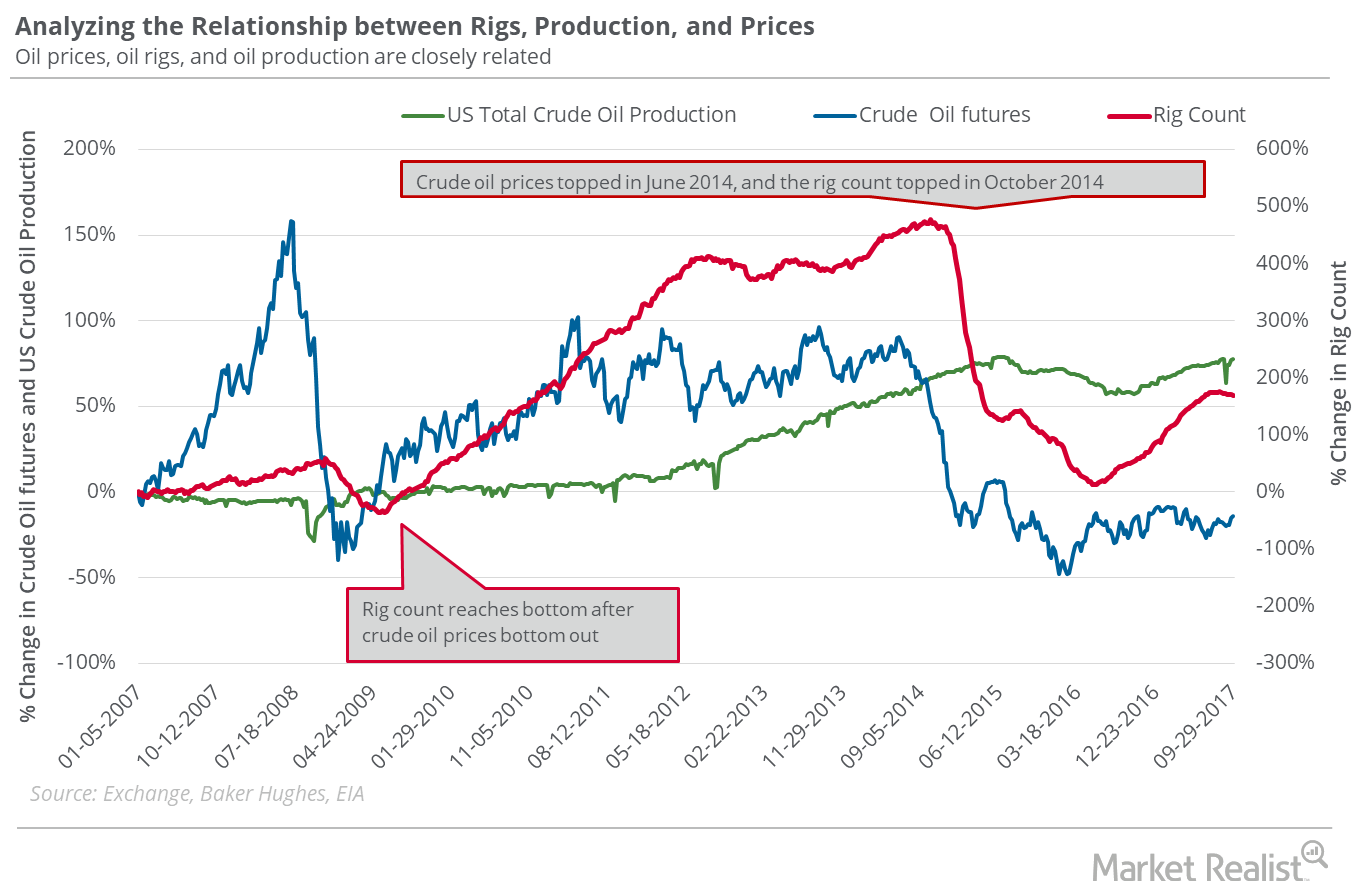

Bullish Oil Traders Must Count the Oil Rigs

On November 24, 2017, US crude oil settled at the highest closing price in 2017. The oil rig count could be at a three-year high by May 2018.

Is It Worth Risking Long Trades in Oil?

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, US crude oil January futures closed at $58.36 per barrel.

What’s Holding US Crude Oil below $60?

On December 11, US crude oil January 2018 futures rose 1.1%. The 2% rise in Brent crude oil prices could have supported the gain in US crude oil prices.

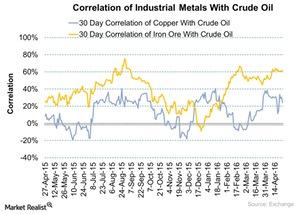

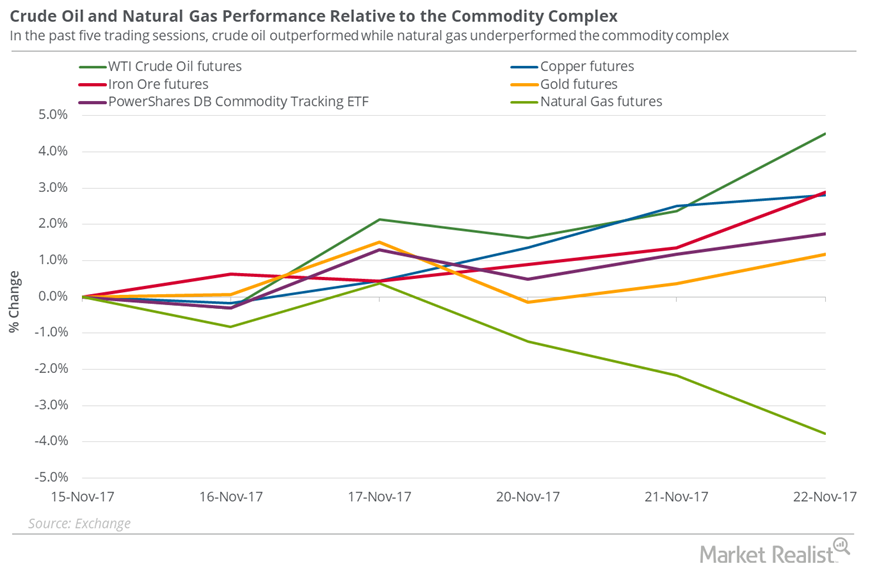

Analyzing the Correlation of Crude Oil and Industrial Metals

In the past year, US crude oil was more correlated with iron ore than copper. In August 2015, the correlation between crude oil and iron ore touched 75.5%.

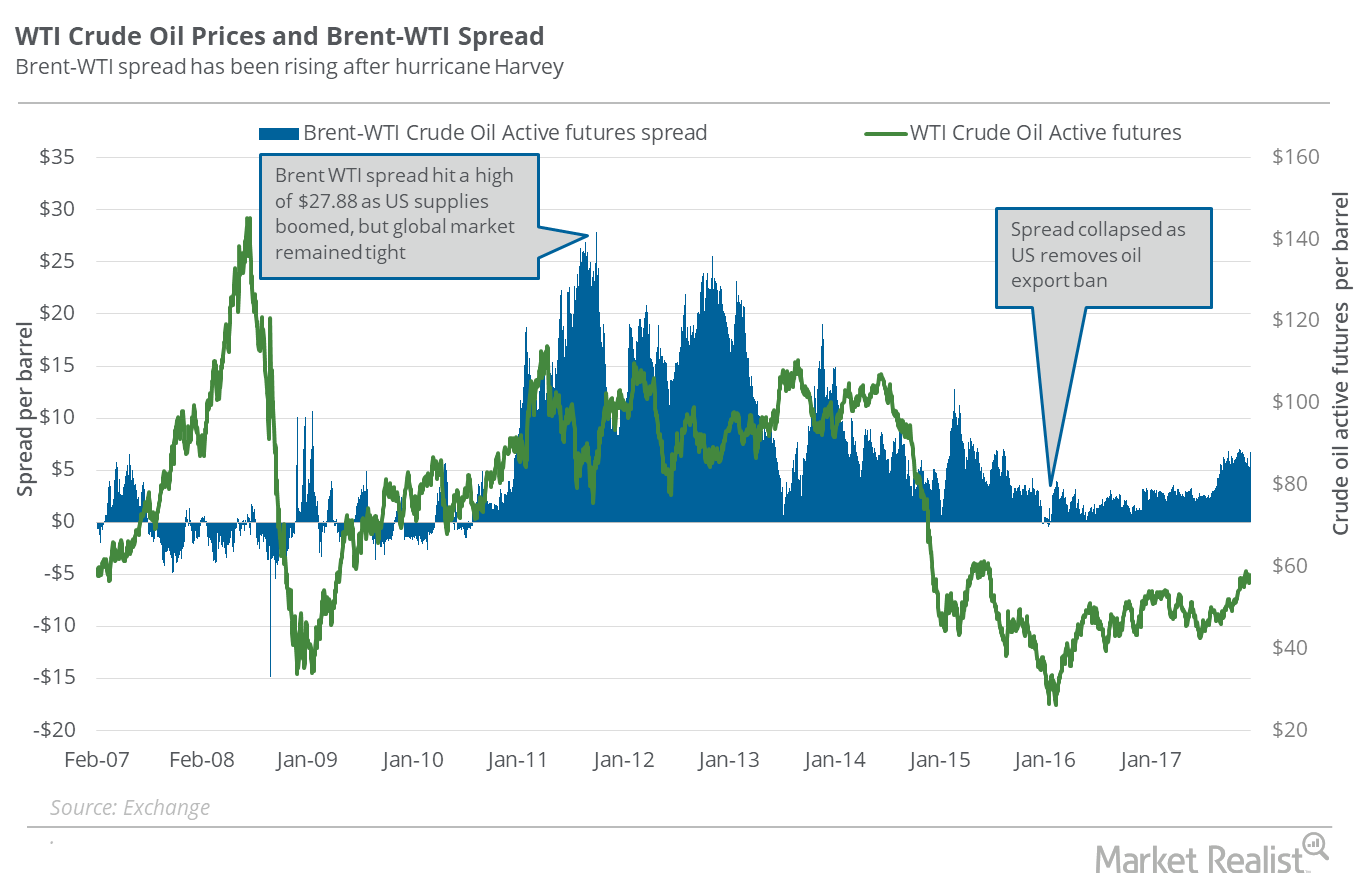

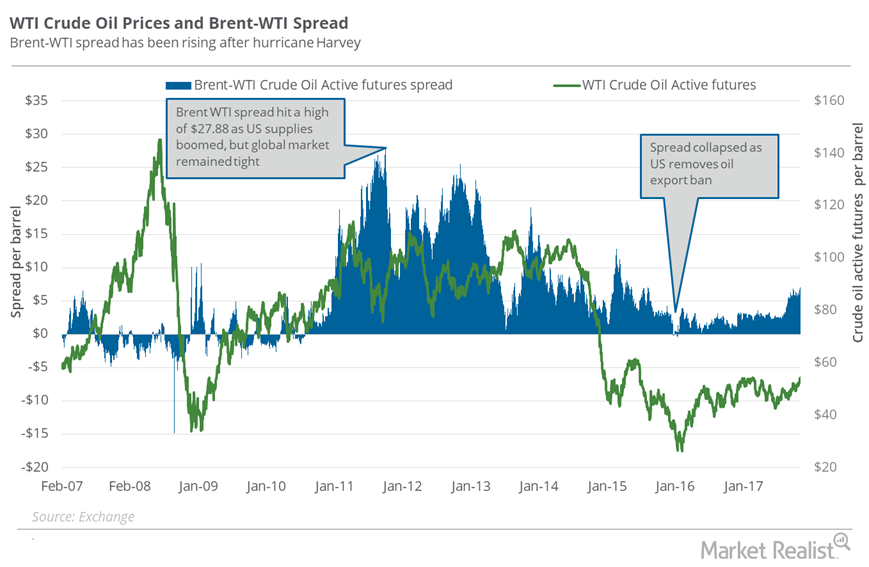

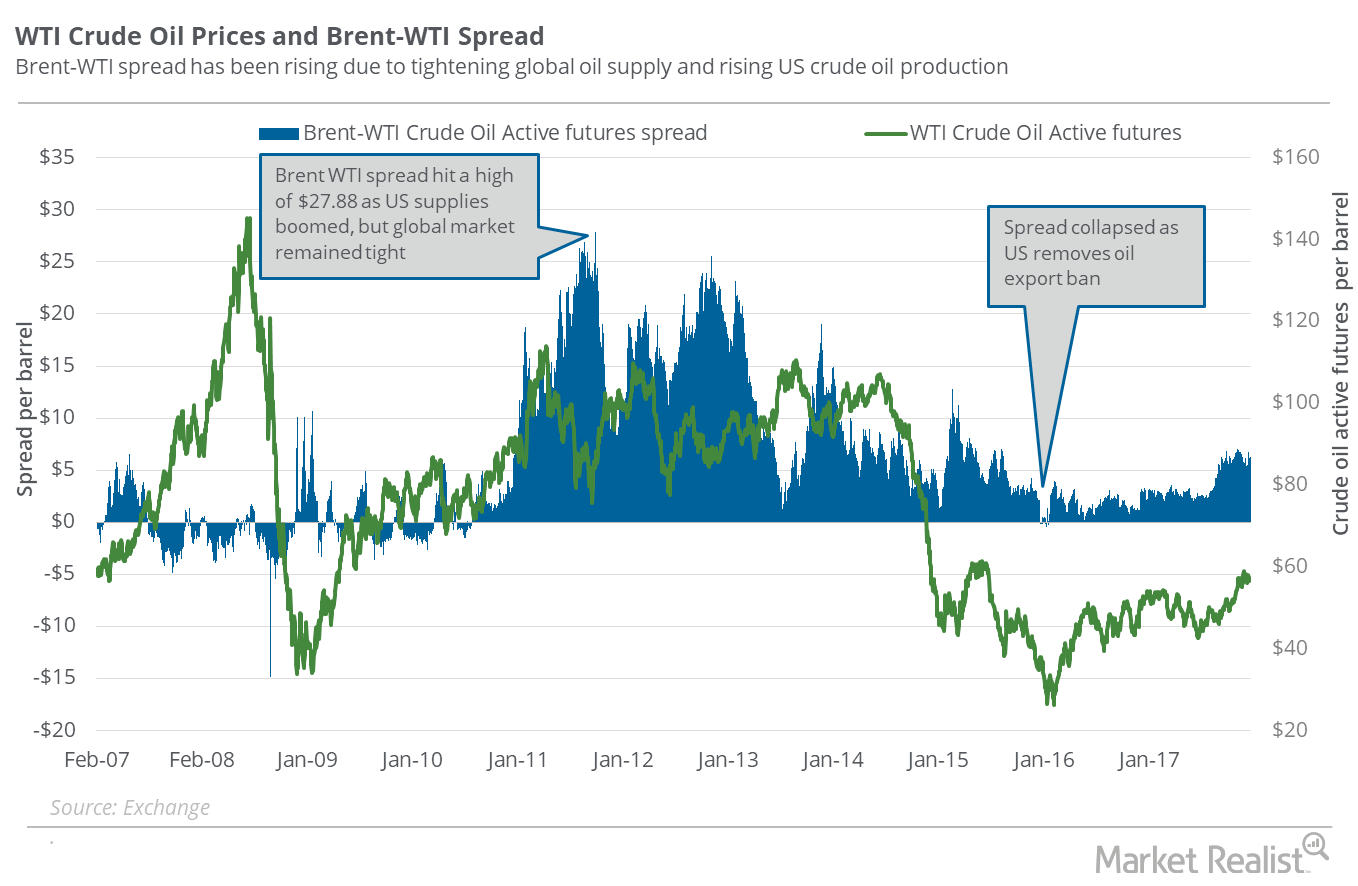

Is WTI Crude Oil Outdoing Brent?

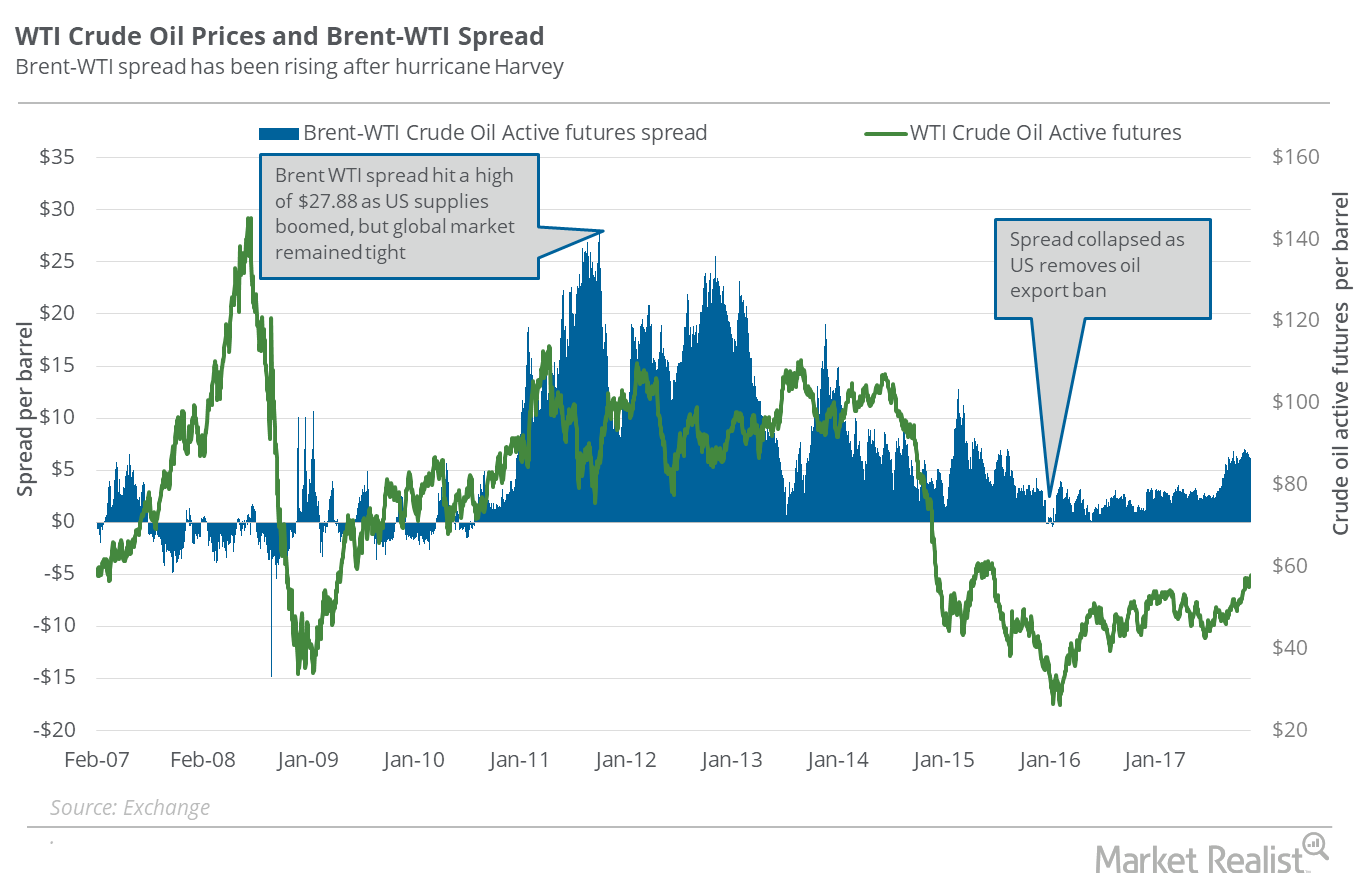

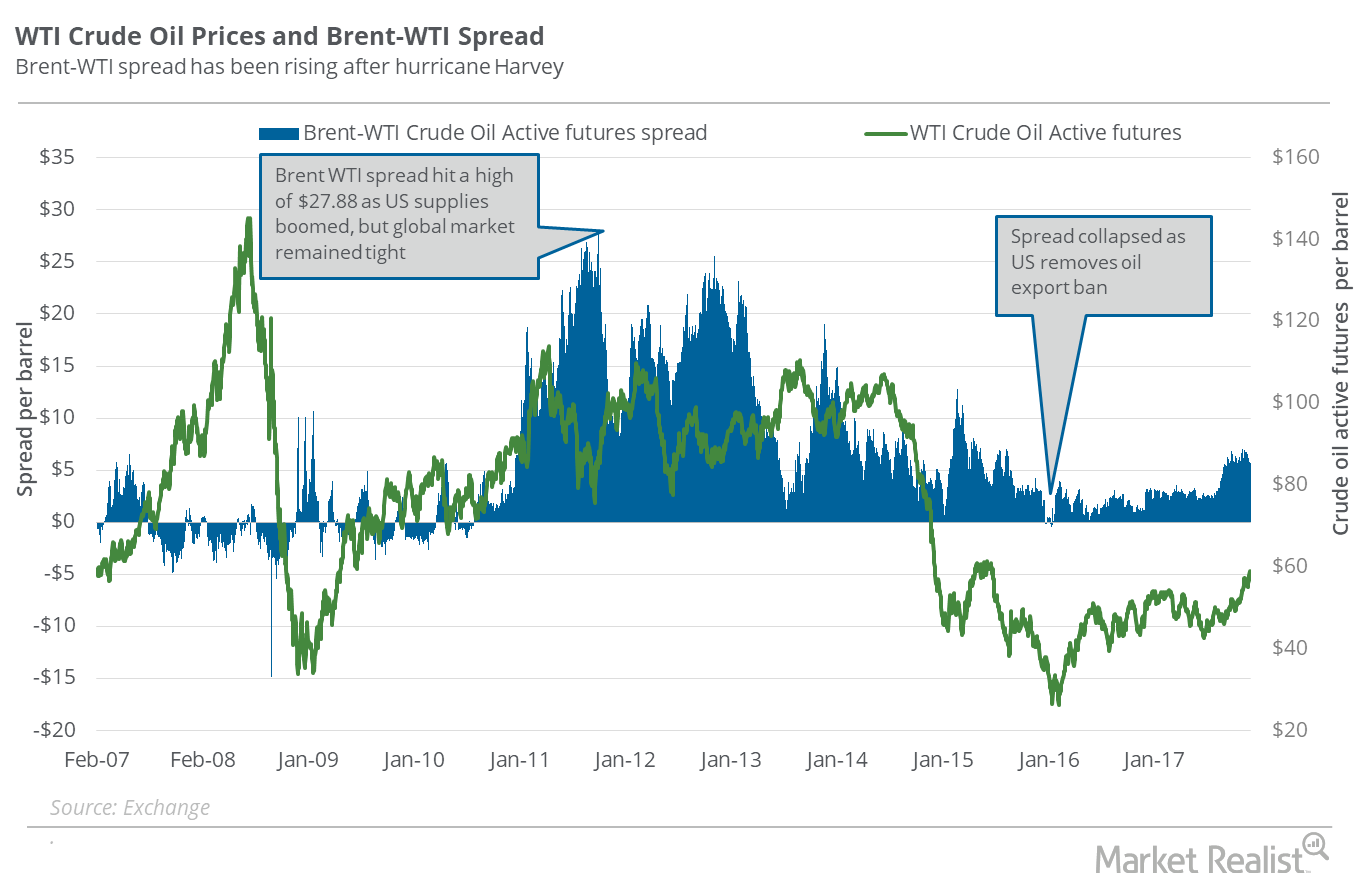

On November 21, Brent crude oil (BNO) active futures closed $5.74 above US crude oil (USO)(UCO) active futures. In other words, the Brent-WTI (West Texas Intermediate) spread was $5.74.

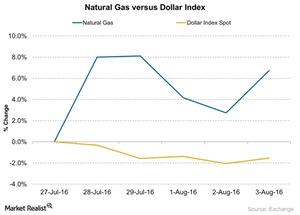

Analyzing the Relationship between the US Dollar and Natural Gas

Between July 27 and August 3, 2016, natural gas futures rose by ~6.7%, and the US Dollar Index fell by ~1.5%.

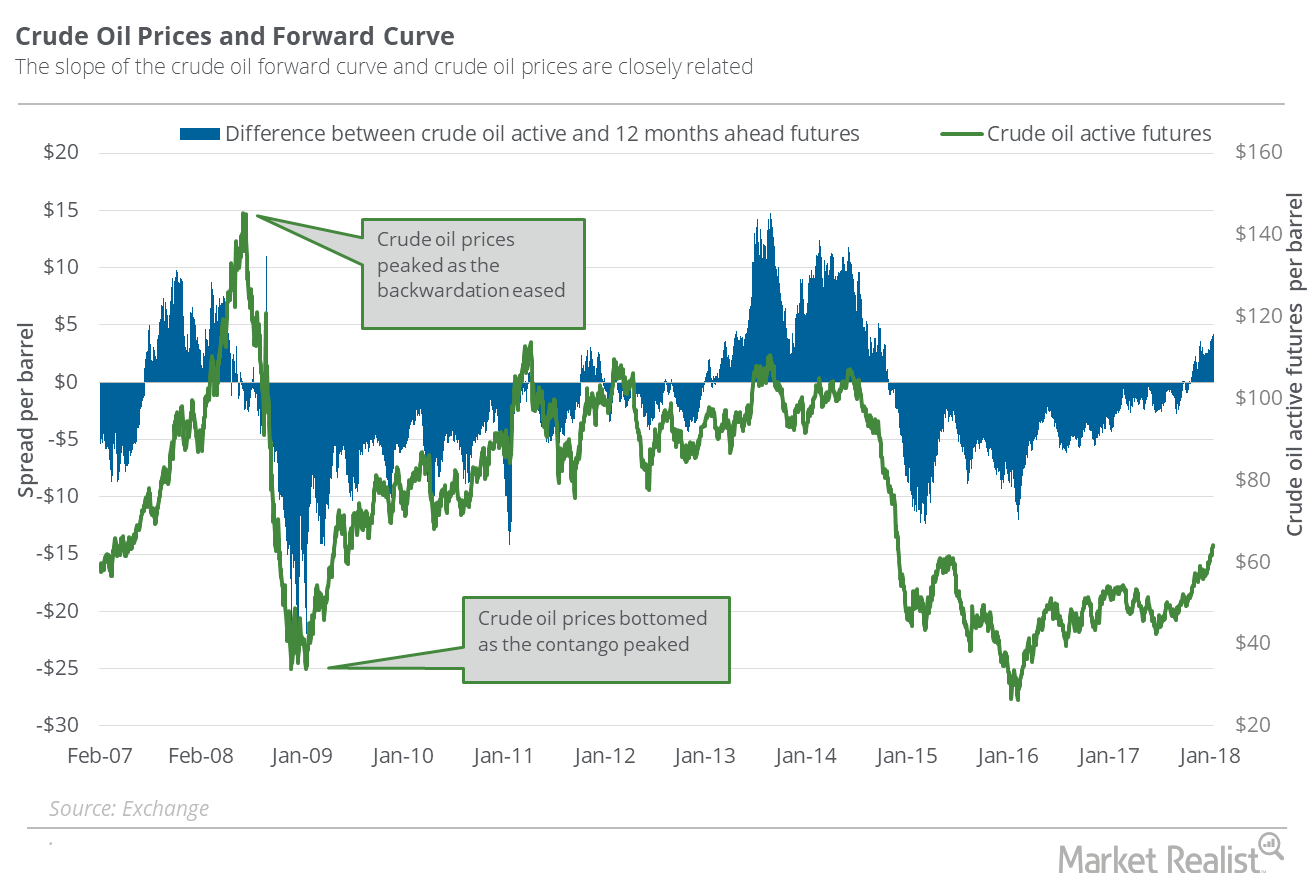

What to Watch when Oil’s at a 3-Year High

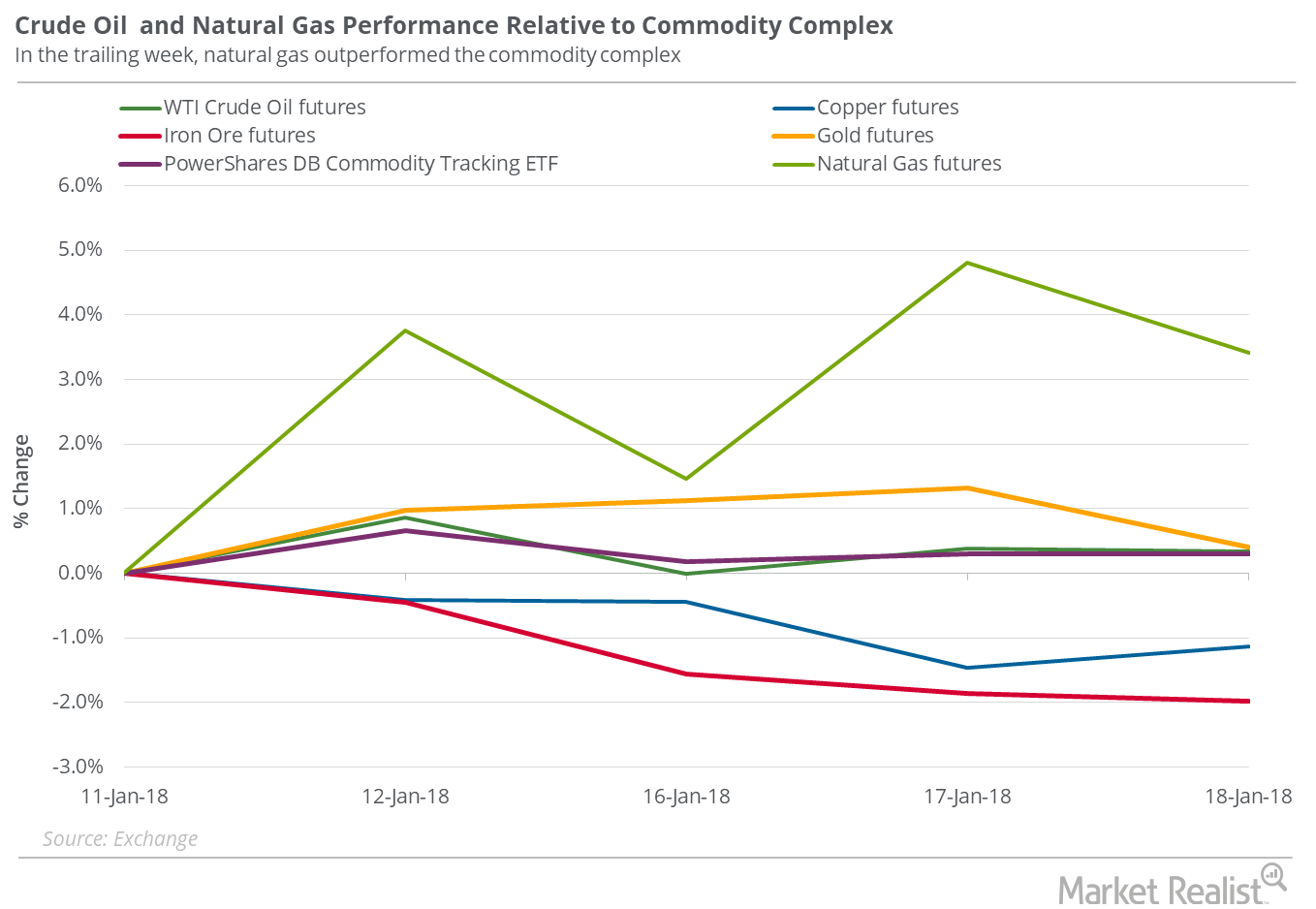

From January 5 to January 12, 2018, US crude oil February futures rose 4.7%. On January 12, US crude oil futures closed at $64.3 per barrel, their highest closing price since December 8, 2014.

Is Oil at the End of Its Rise?

On November 22, 2017, US crude oil (USO) (USL) January futures rose 2.1% and closed at $58.02 per barrel—the highest closing price in 2017.

Why Oil Prices Have Been Relatively Flat

On January 18, 2018, US crude oil (USO) (USL) March 2018 futures were almost unchanged at $63.89 per barrel.

Why US Crude Oil Prices Are Steady

On June 14, Russia and Saudi Arabia announced a bilateral framework to increase cooperation and manage the oil market.

Tesla Institutional Investors: Who All Sold Too Early?

In 2019, Tesla (TSLA) rose 29.3%. The S&P 500 Index gained 29.2%. The top institutional investors were bullish on the electric car manufacturer in Q3 2019.

WTI Crude Oil Is Rising Faster than Brent

On November 28, 2017, Brent crude oil (BNO) active futures closed at $5.62 higher than US WTI crude oil (USO) (UCO) active futures.

How Energy ETFs Are Correlated to Falling Oil Prices

At ~65.2%, the VanEck Vectors Oil Services ETF (OIH) showed the highest correlation with US crude oil between April 4–May 4, 2017.

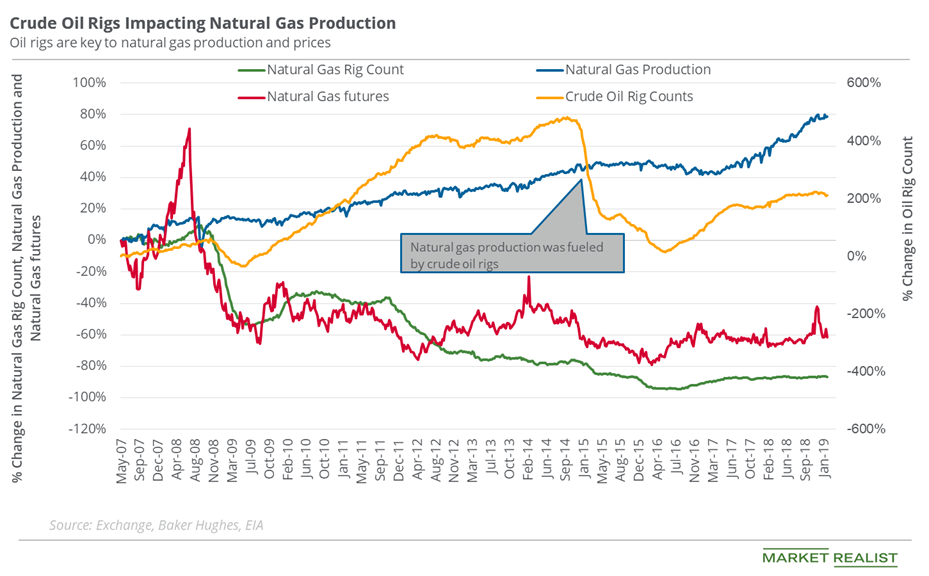

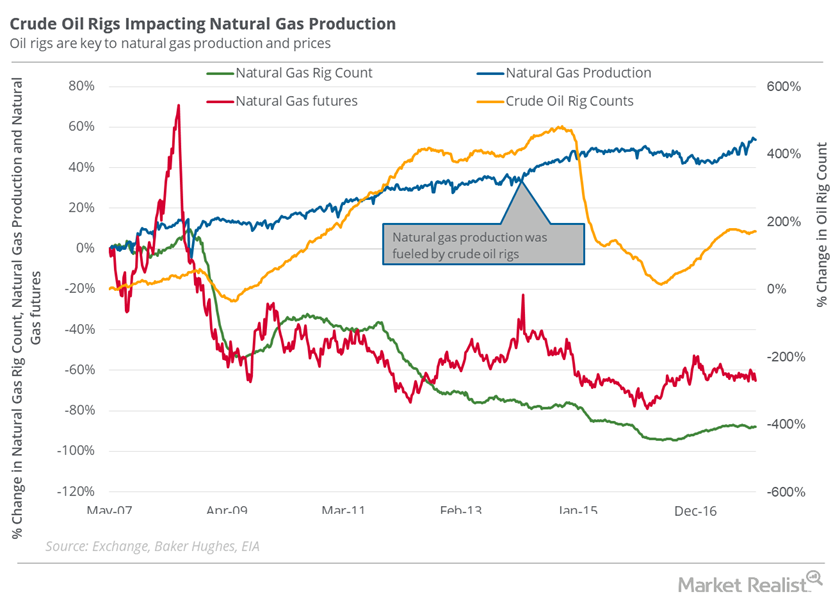

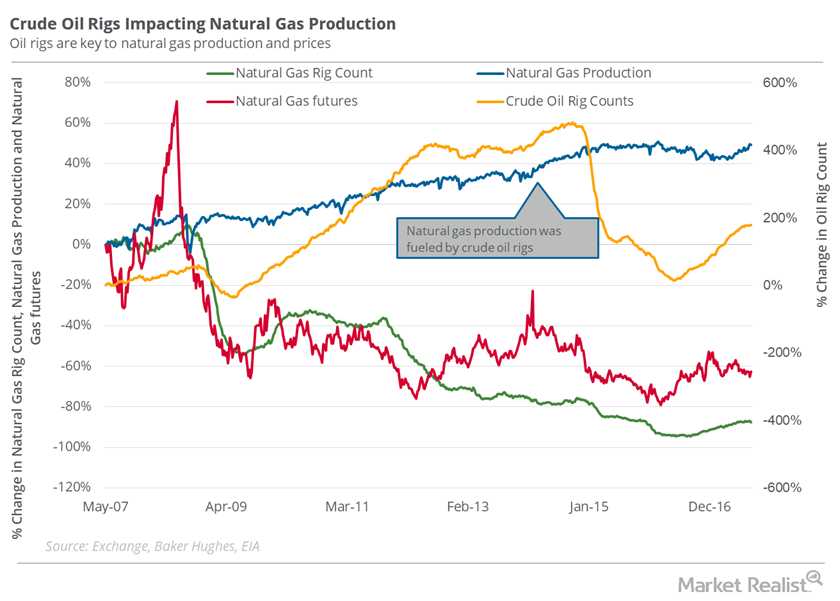

How Oil Rigs Impact Natural Gas Production

The natural gas rig count was at 187 last week. The natural gas rig count has fallen ~88.4% from its record level of 1,606 in 2008.

Crude Oil’s Comeback: Analyzing Oil-Weighted Stocks

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price.

Brent Is Outperforming WTI Crude Oil

On December 11, 2017, Brent crude oil (BNO) active futures settled $6.7 more than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

Oil Traders Should Watch US Oil Exports

On December 5, 2017, Brent crude oil (BNO) active futures were priced $5.24 higher compared to WTI crude oil (USO) (UCO) active futures.

Analyzing the Natural Gas Futures Spread

On December 18, the natural gas futures for January 2019 closed at a premium of ~$0.7 to the January 2020 futures.

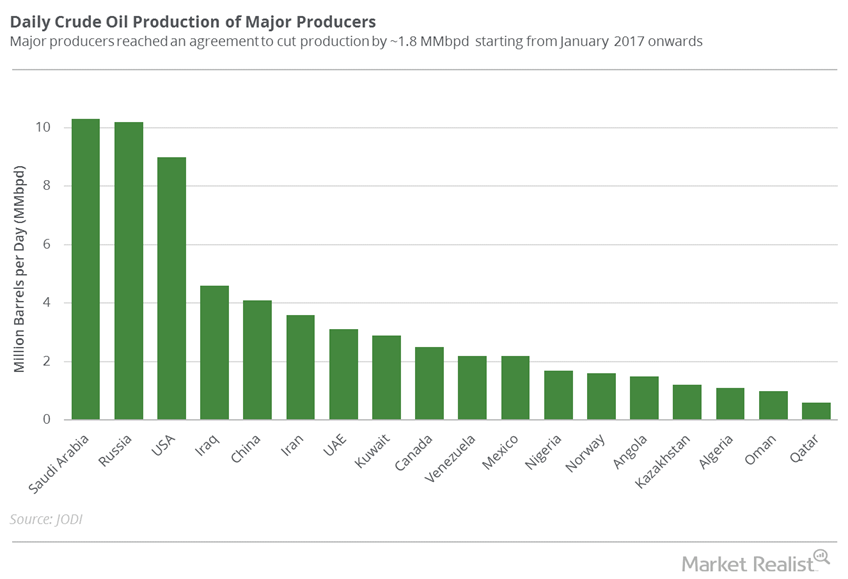

Chart of the Week: Crude Oil Production of Global Majors

Crude oil (OIIL) (DBO) (USL) prices fell on June 5, 2017, due to geopolitical tensions.

A Look at the Rig Count and Natural Gas

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008.

Will Natural Gas Rise This Week?

On April 18–26, natural gas active futures rose 1.8%. Natural gas to closed at $2.58 per MMBtu on April 26.

Oil: Famous Recession Indicator Might Be a Concern

On January 2, US crude oil active futures settled at $46.54 per barrel—2.5% higher than the last closing level due to short covering.

Why Oil Prices Could Move Higher

On January 12, 2018, US crude oil (USO) (USL) February 2018 futures gained 0.8% and settled at $64.3 per barrel—a three-year high.

Futures Spread: Does It Signal End of Oil’s Oversupply Concern?

On October 17, 2017, US crude oil (USO) (OIIL) December 2018 futures traded $0.46 below the December 2017 futures.

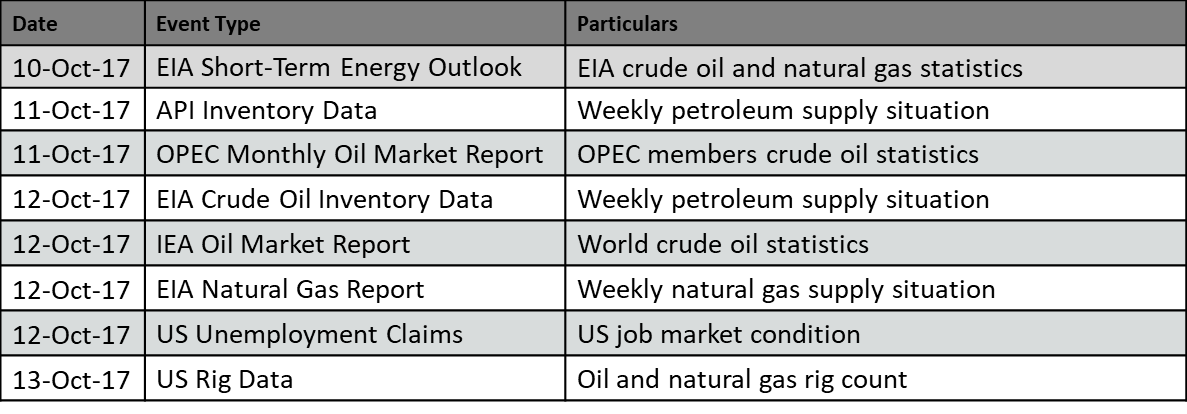

Key Energy Events for October 9–13, 2017

The EIA’s STEO (Short-Term Energy Outlook) Report is scheduled to be released on October 10, 2017, and could impact crude oil and natural gas prices.

What the Natural Gas Futures Spread Tells Us about the Current Sentiment

On September 6, 2017, the futures spread was at a discount of $0.06, but on September 8, 2017, the futures spread shifted to a premium.

What to Expect from Natural Gas Next Week

On January 18, 2018, natural gas’s implied volatility was 53.9%, 10.2% above its 15-day average.

US Crude Oil Exports Could Be at a Tipping Point

On October 31, 2017, Brent crude oil (BNO) active futures were ~$7 above US crude oil (UCO) futures.

Could La Niña Save Natural Gas Bulls?

On October 4, 2017, natural gas (UNG) November futures closed at $2.94 per MMBtu (million British thermal units), a rise of 1.6% from the last trading session.

Possibilities for Natural Gas Prices Next Week

On December 7, 2017, natural gas’s implied volatility was 40.5% or ~7.5% less than its 15-day average. On November 29, the implied volatility rose to 47.7%.

Could Oil Rig Count Stop Natural Gas Fall?

In the week ended October 6, 2017, the natural gas rig count fell by two to 187.

Comparing WTI’s and Brent’s Performance

The Brent-WTI spread On December 18, 2017, Brent crude oil (BNO) active futures’ premium to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.30. On December 11, 2017, the Brent-WTI spread was $6.70. On December 11, 2017, the shutdown of the Forties Pipeline System boosted Brent oil prices. That day, the spread expanded […]

What to Expect from the Weather Forecast and Natural Gas Prices

On July 21, the EIA announced a 34 Bcf (billion cubic feet) addition to natural gas (UNG) (GASL) (GASX) (BOIL) inventory levels for the week ending July 15.

Are Supply Concerns Pushing Oil Higher?

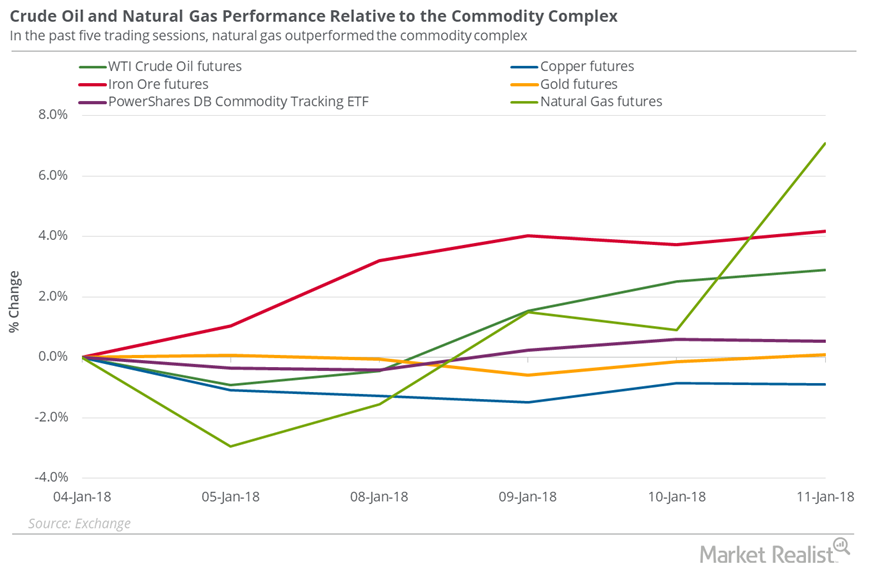

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

What Could Backwardation Mean for Oil Traders?

Due to the contango structure in the oil market lately, USO underperformed crude oil prices. It could change if the oil market switched to backwardation.