Are Natural Gas–Weighted Stocks Following Oil?

Range Resources had the highest correlation of 77.4% with US crude oil active futures in the last five trading sessions among natural gas–weighted stocks.

Nov. 20 2020, Updated 2:29 p.m. ET

Correlation with oil prices

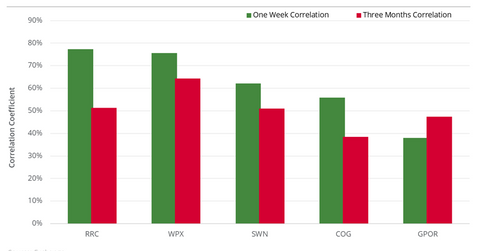

Range Resources (RRC) had the highest correlation of 77.4% with US crude (USO) (DBO) oil active futures in the last five trading sessions among natural gas–weighted stocks. These stocks operate with a minimum production mix of 60% in natural gas. They’re part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

Below are the natural gas–weighted stocks that had the highest correlations with crude oil futures during the last five trading days.

- WPX Energy (WPX) – 75.5%

- Southwestern Energy (SWN) – 62.1%

- Cabot Oil & Gas (COG) – 55.9%

- Gulfport Energy (GPOR) – 38.1%

Below are the natural gas–weighted stocks that had the lowest correlations with oil prices in the seven calendar days to July 31, 2017.

Why is oil vital?

Oil prices are important for the entire energy sector. Therefore, gas-weighted stocks could also be impacted by oil prices. Oil prices could influence natural gas prices. In the long term, natural gas could be important for these natural gas–weighted stocks’ profitability.

In the next part, we’ll analyze the returns of these natural gas–weighted stocks. We’ll discuss the importance of natural gas and crude oil’s impact on these stocks’ returns.