EQT Corp

Latest EQT Corp News and Updates

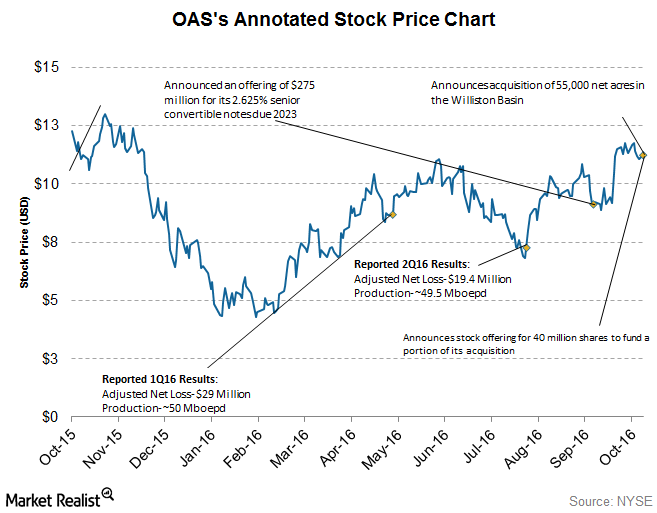

How Has Oasis Petroleum’s Stock Performed This Year?

Oasis Petroleum’s (OAS) stock has shown an uptrend for the most part of 2016. Its stock dipped between June 2016 and August 2016….

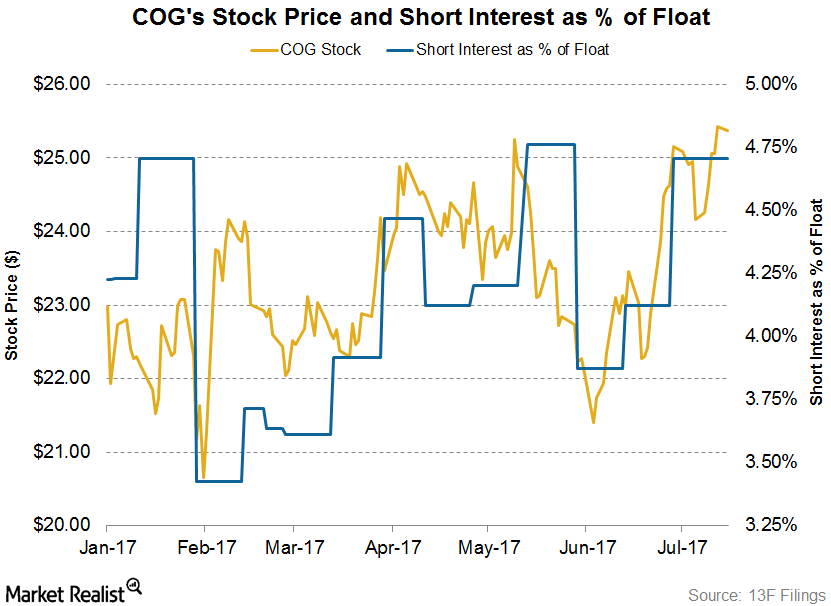

Cabot Oil & Gas: Short Interest Trends in Its Stock

On July 18, 2017, Cabot Oil & Gas’s (COG) short interest ratio was ~4.7%. At the beginning of the year, its short interest ratio was 4.2%.

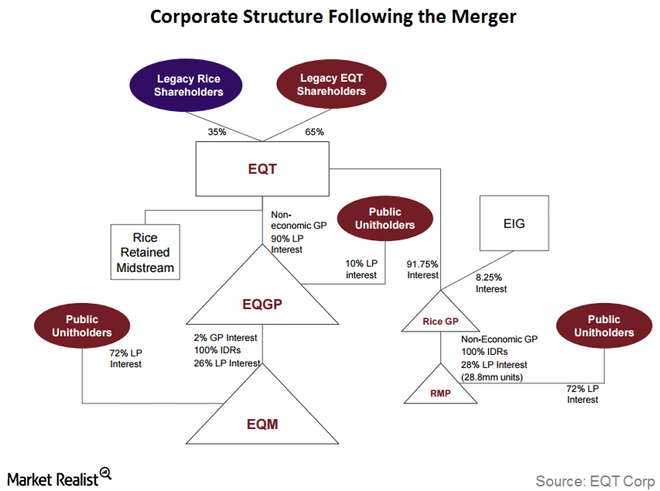

Key Updates on the EQT-RICE Merger

Under EQT Corporation’s (EQT) existing ownership, the company owns a 90% limited partner interest and non-economic general partner interest in EQT GP Holdings (EQGP).

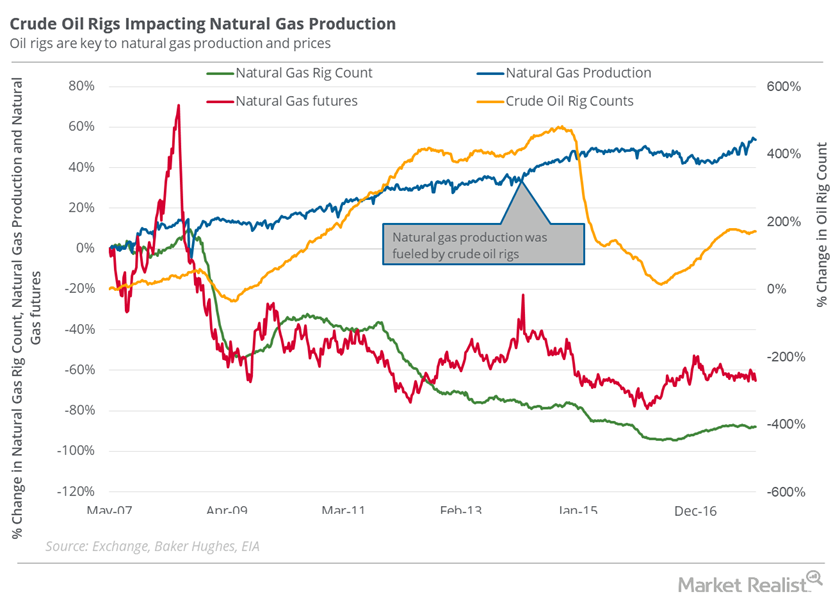

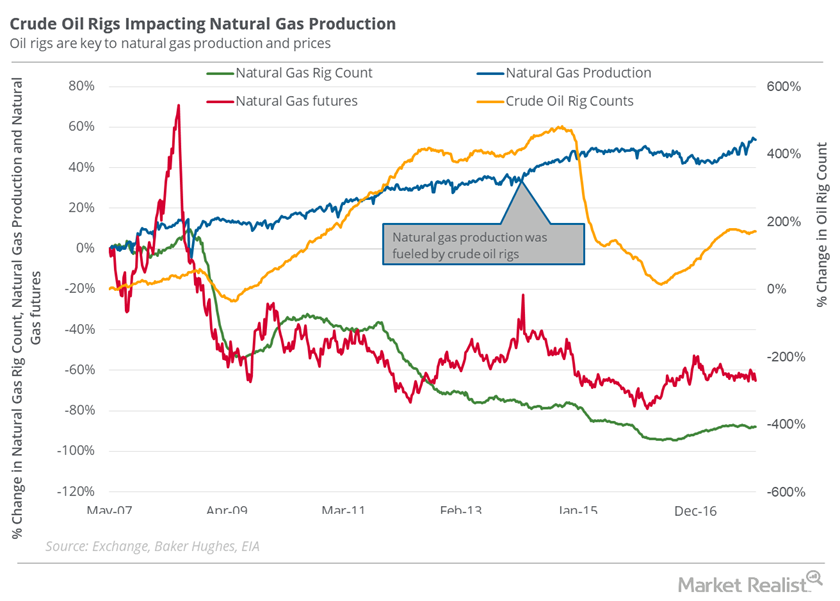

A Look at the Rig Count and Natural Gas

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008.

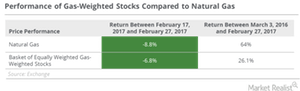

Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.

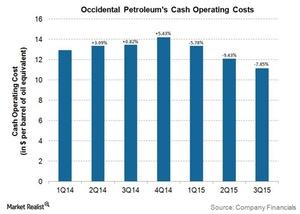

How Is Occidental Petroleum Managing the Falling Energy Prices?

According to Occidental Petroleum’s 3Q15 form 10Q filing, changes in energy prices affected its quarterly earnings by $30 million in crude oil.

Where Is US Crude Oil Headed? An Energy Update

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

Range Resources: What Do Analysts Recommend?

On June 14, BMO reduced its target price on Range Resources by $2 to $6. On June 12, Citigroup reduced its target price by $4.5 to $7.5.

Analysts’ Price Targets for Cabot Oil & Gas’s Next 12 Months

Approximately 66.66% of analysts covering Cabot Oil & Gas (COG) recommend “buy,” and 33.33% recommend “hold.”

Why the Oil Rig Count Could Be a Concern for Natural Gas Bulls

In the week ended December 22, the natural gas rig count was 88.5% below its record high of 1,606 in 2008.

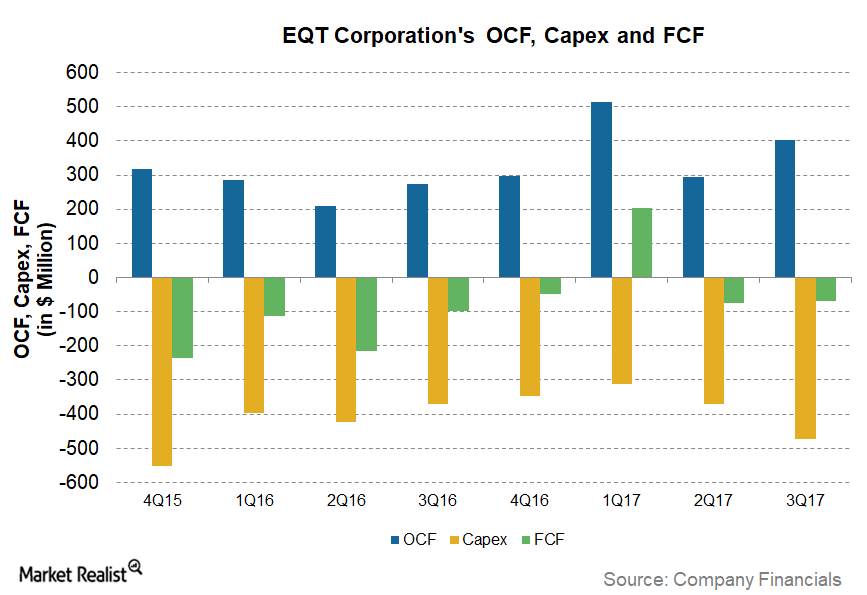

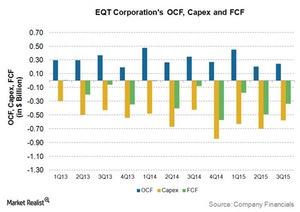

Why EQT’s Normalized Free Cash Flow Is Improving

As we saw in part one of this series, EQT (EQT) had normalized free cash flows of ~5% in the first nine months of 2017, the fifth highest among crude oil (USO) and natural gas (UNG) (UGAZ) producers we have been tracking.

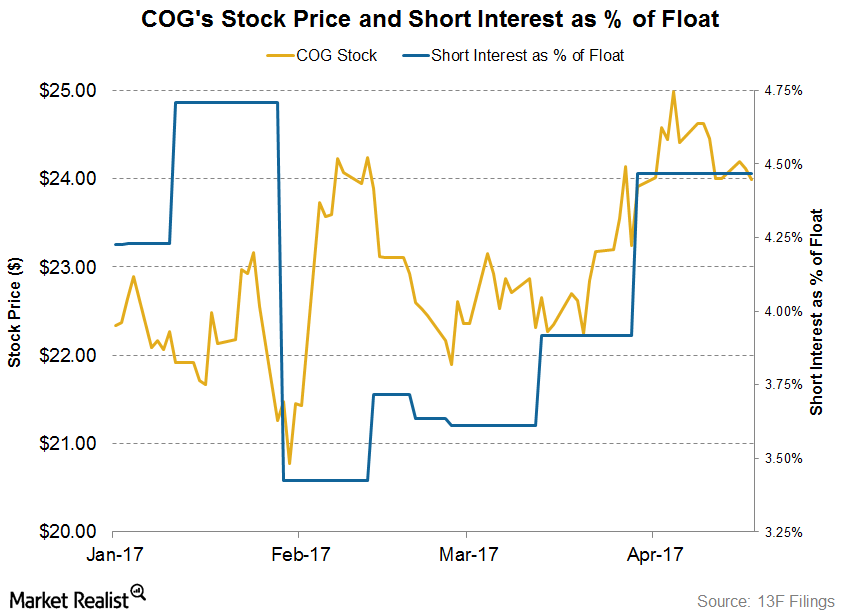

Short Interest Trends in Cabot Oil & Gas Stock

On April 19, Cabot Oil and Gas’s short interest as a percentage of its float was ~4.5%. At the beginning of the year, its short interest ratio was 4.2%.

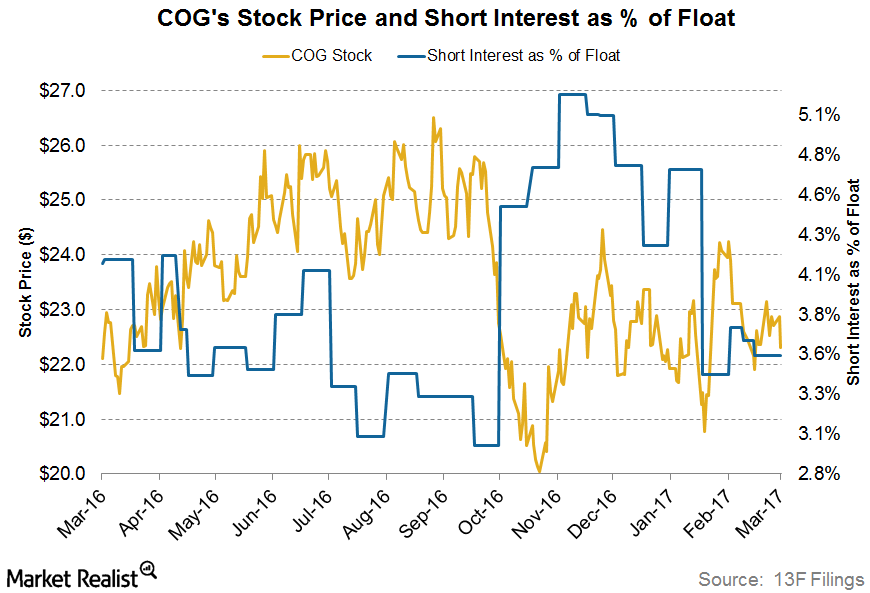

How Short Interest in COG Stock Has Been Trending

On March 14, 2017, Cabot Oil and Gas’s (COG) short interest as a percentage of its float (or its short interest ratio) was ~3.5%.

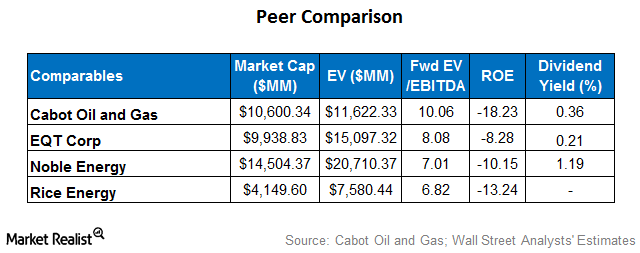

How Cabot Oil and Gas’s Relative Valuation Compares to Peers

A peer group comparison shows that Cabot’s forward EV-to-EBITDA multiple of ~10.1x is higher than that of its peers.

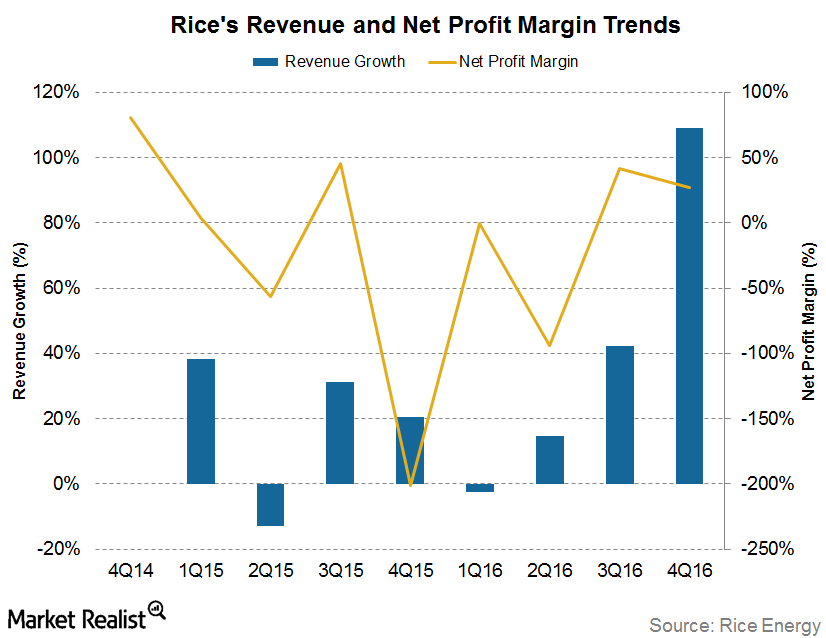

Rice Energy’s Revenue Growth and Net Profit Margin Trends

Rice Energy’s (RICE) 4Q16 revenue rose ~109.0% YoY (year-over-year).

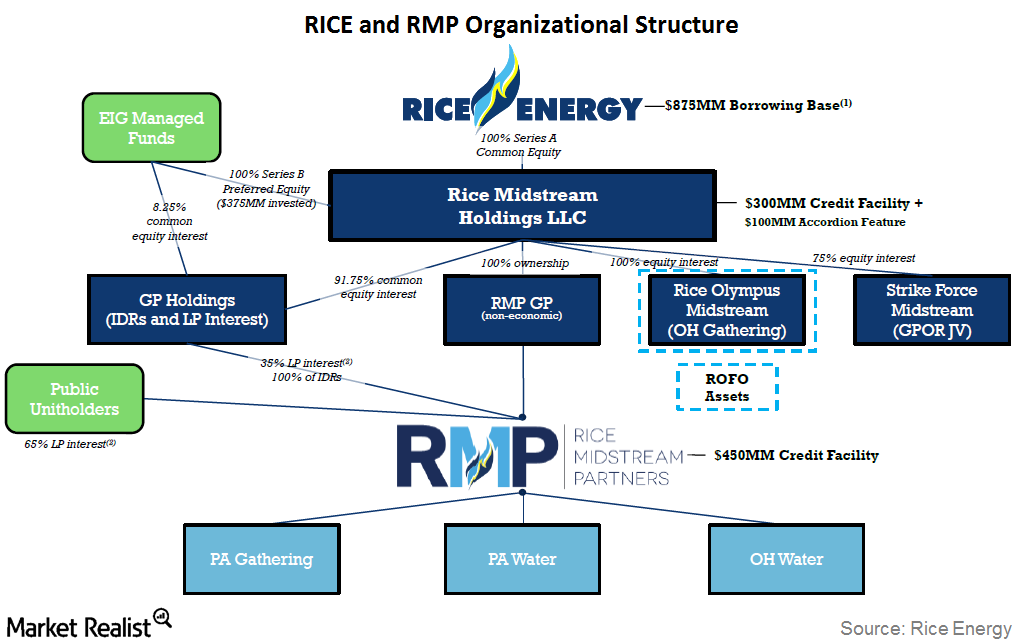

Rice Energy’s Organizational Structure: A Brief Overview

In its organizational structure, Rice Energy, through its GP Holdings subsidiary, and the public hold 35% and 65% limited partner interest, respectively, in Rice Midstream Partners.

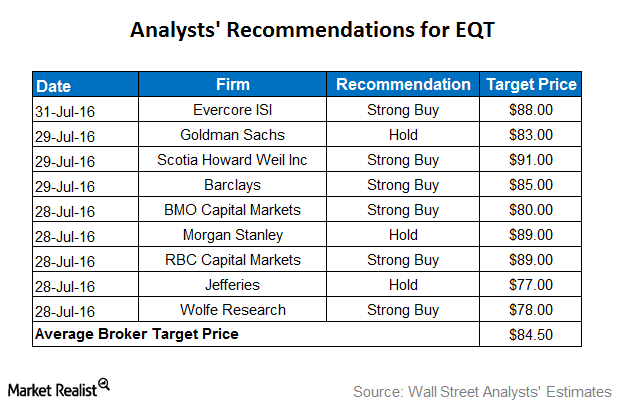

What Analysts Recommend for EQT after 2Q16 Earnings

Approximately 65% of analysts rate EQT (EQT) a “buy,” and 30% rate it a “hold.” The remaining 5% rate it a “sell.”

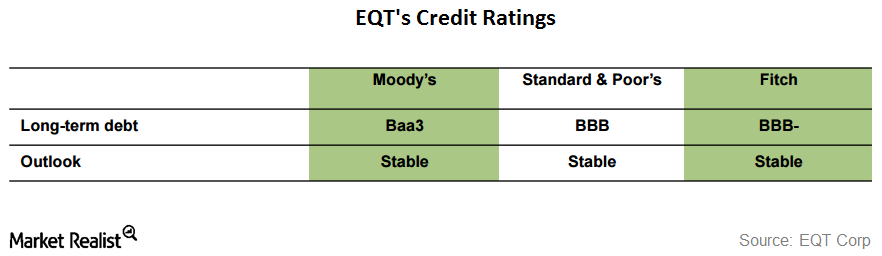

What Are Credit Rating Agencies Saying about EQT?

For EQT (EQT), Moody’s has provided a Baa3 rating. Standard & Poor’s has given it a BBB credit rating, and Fitch has given it a BBB- rating.

The Downward Trend of EQT’s Free Cash Flow

EQT has been reporting negative free cash flows since 2Q13. In 3Q15, EQT’s free cash flow was -$334 million.

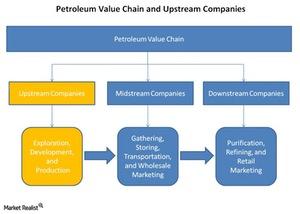

Where Do Upstream Energy Companies Sit along the Petroleum Value Chain?

Upstream energy companies are the starting point of the petroleum value chain and are involved in exploration, appraisal, development, and production.

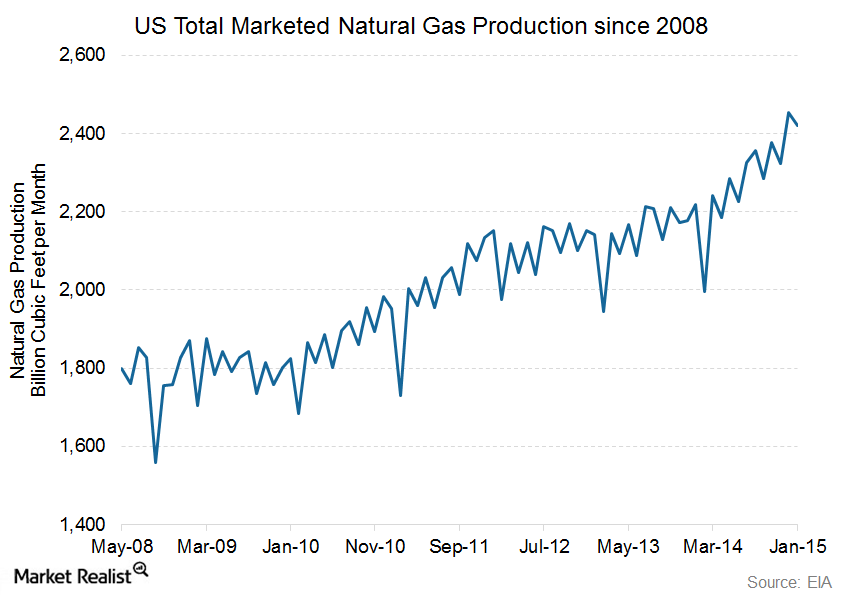

EIA Reports a Slight Decline in Natural Gas Production

Continued production growth set a grim scenario for natural gas prices. High production levels are bearish for natural gas prices.

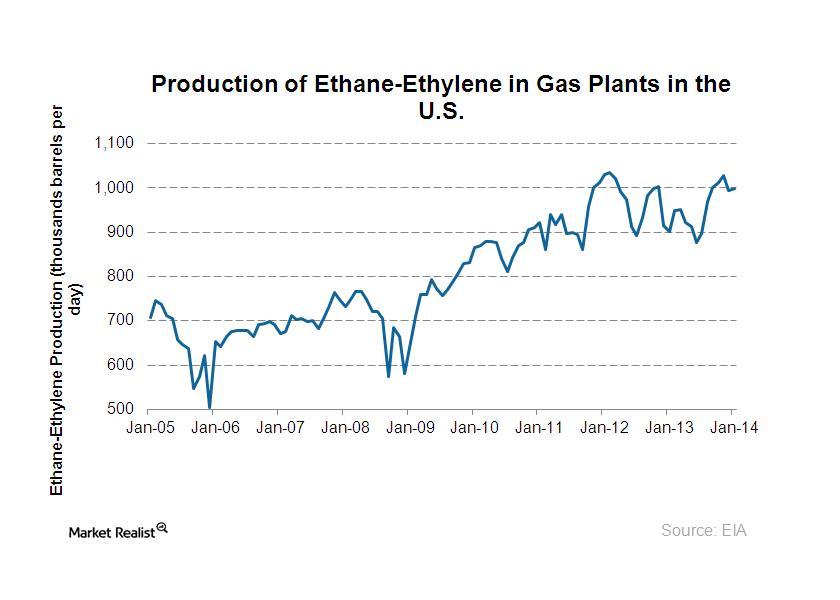

Why ethane production has increased a lot over the past few years

Ethane is the largest component of the natural gas liquids stream, and the increased wet gas production caused a large increase in ethane production.