Range Resources Corp

Latest Range Resources Corp News and Updates

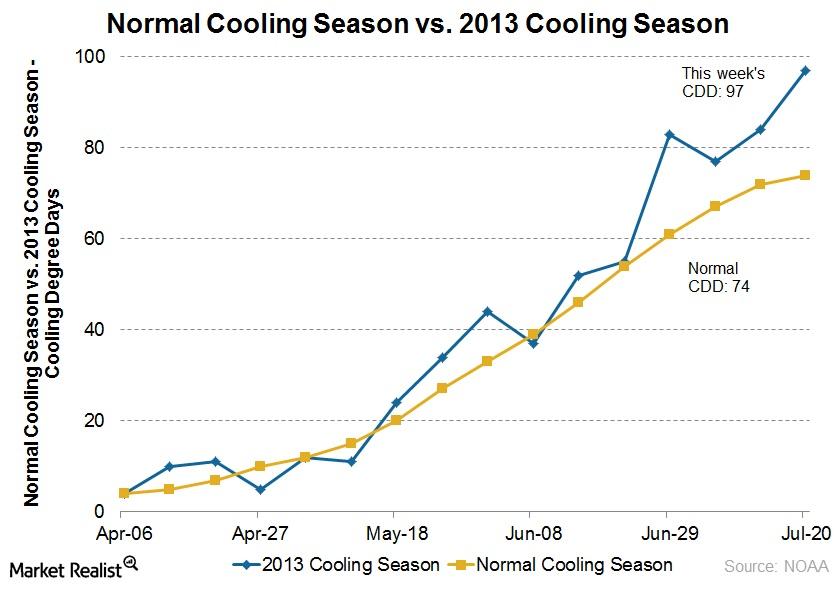

Why the summer heat wave supports natural gas prices

A heat wave that has persisted in the US has helped to lift natural gas prices.

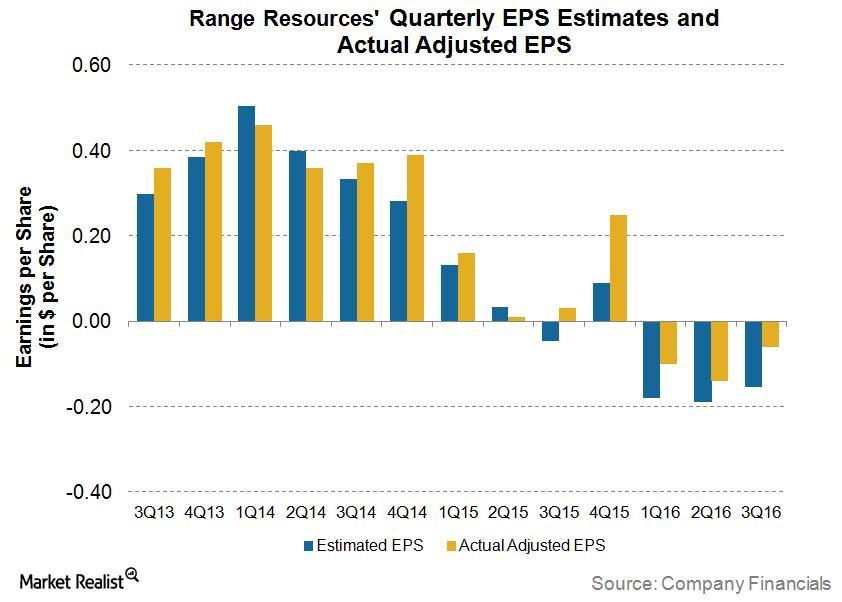

Inside Range Resources’ 3Q16 Earnings

For 3Q16, Range Resources reported an adjusted loss per share of $0.06—$0.09 better than the Wall Street analyst consensus estimate of $0.15 loss per share.

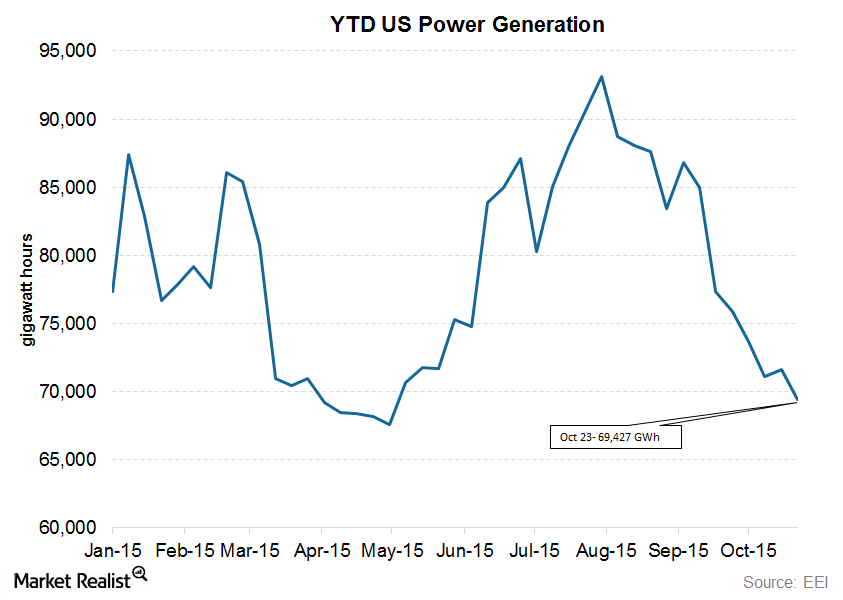

US Power Generation Down Again: An Analysis of Trends

An increase in US power generation numbers is expected for the week ended October 30, 2015.

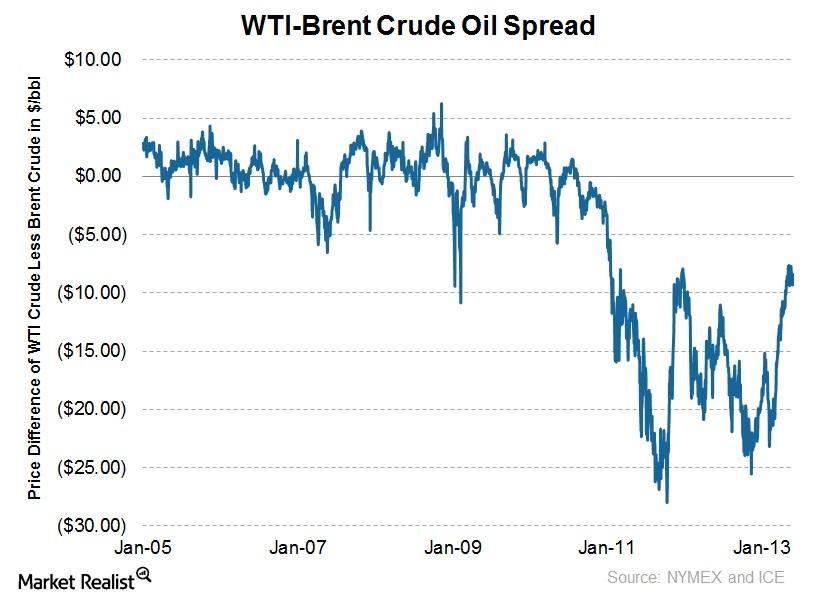

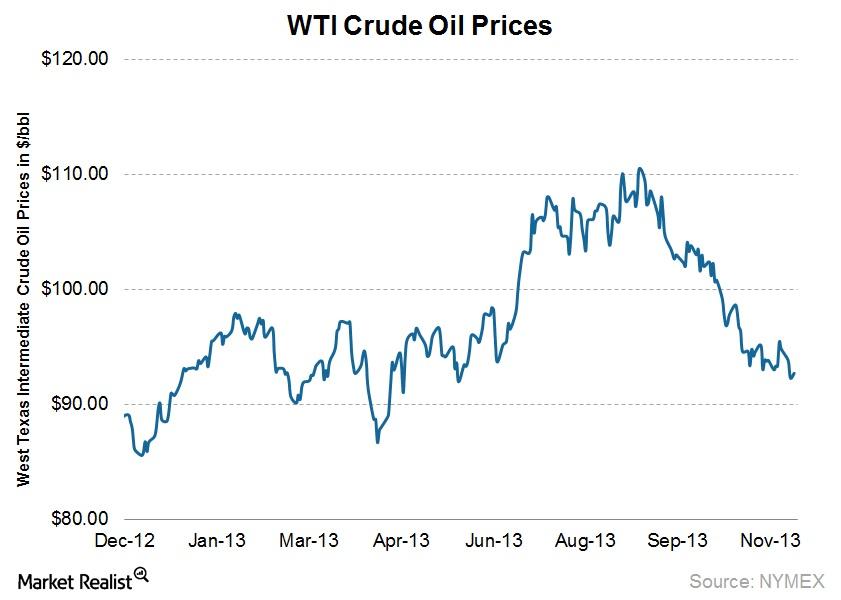

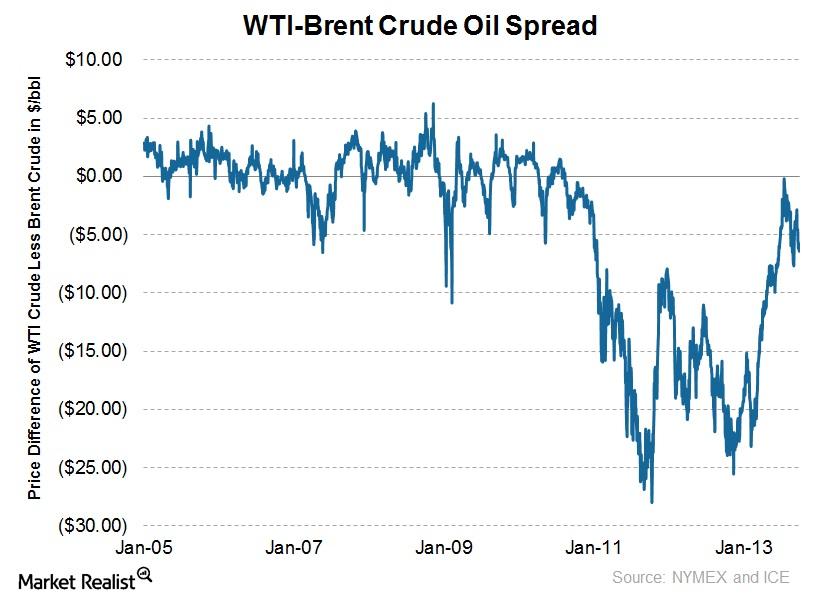

Spread between WTI crude oil and Brent oil has closed in significantly since YE2012

The WTI-Brent spread remained relatively unchanged last week, but has closed in significantly since year-end 2012.

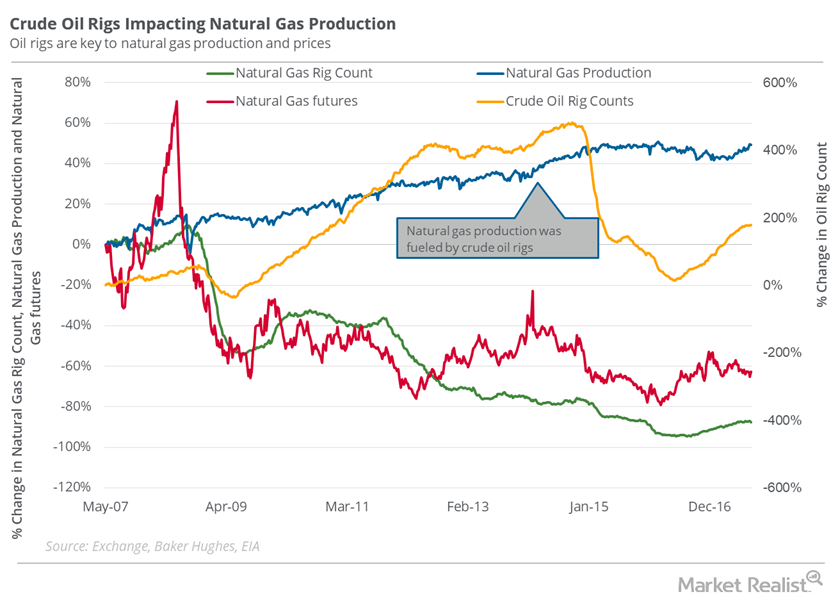

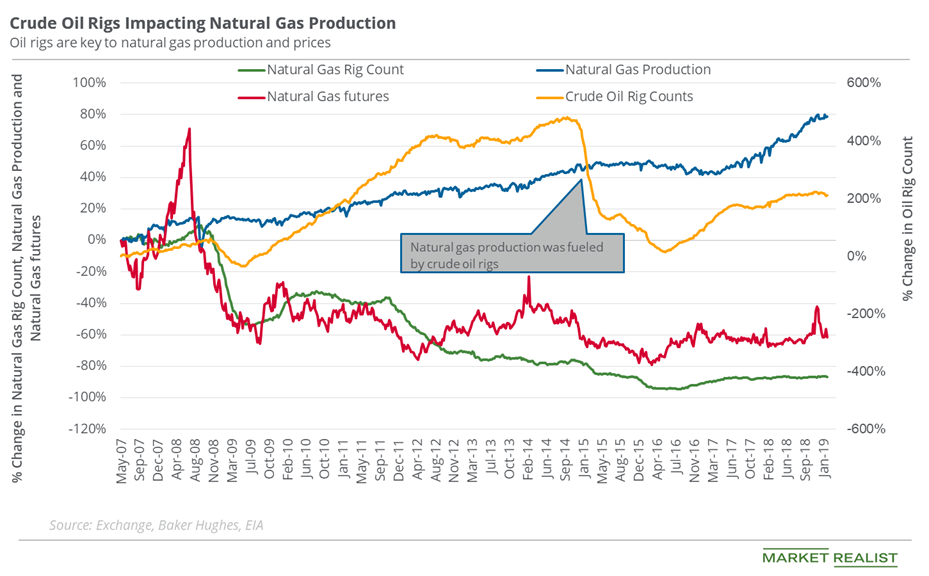

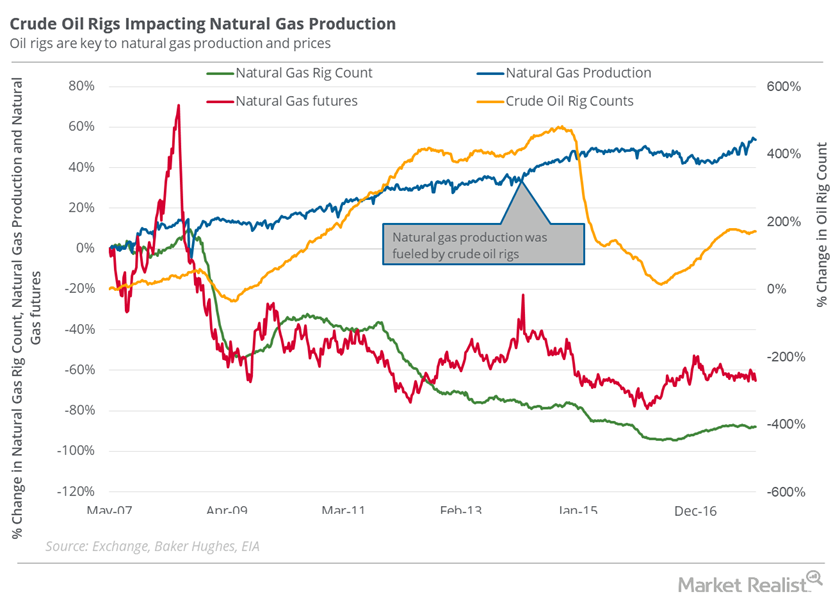

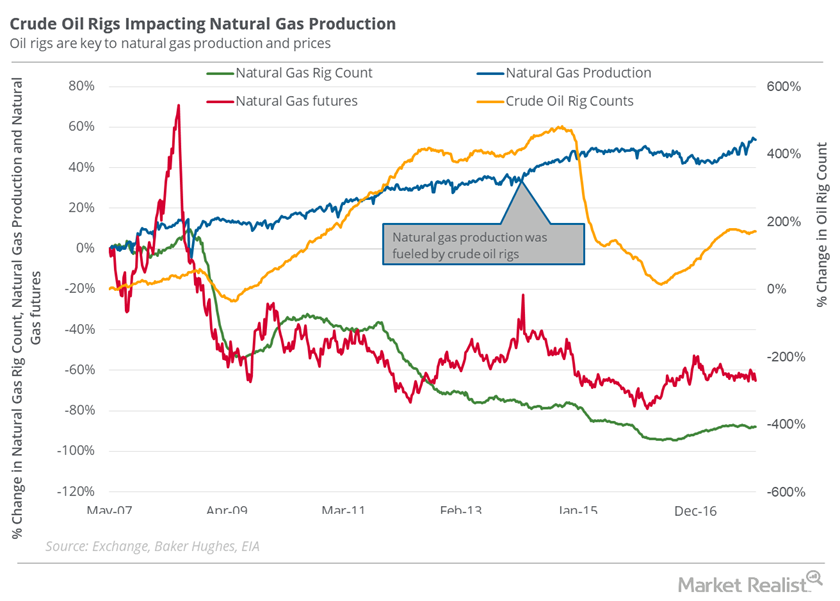

Will the Oil Rig Count Increase Natural Gas Downside Risk?

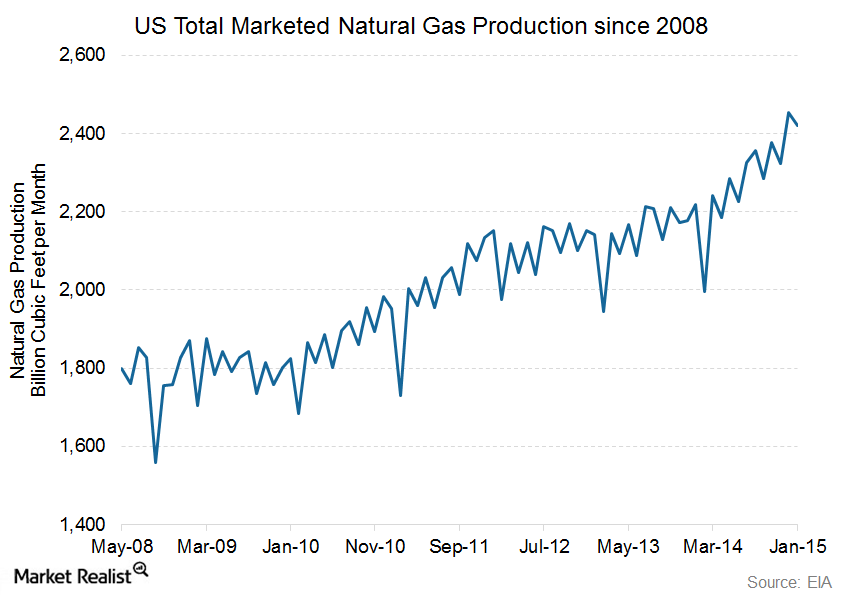

Since 2008, the natural gas rig count has fallen ~89% from its record high. But the fall was unable to stop the rise in natural gas supplies.

An overview of the natural gas compression industry

Natural gas compression is essential for transporting natural gas. Compression is used several times during the natural gas production and transportation cycle.

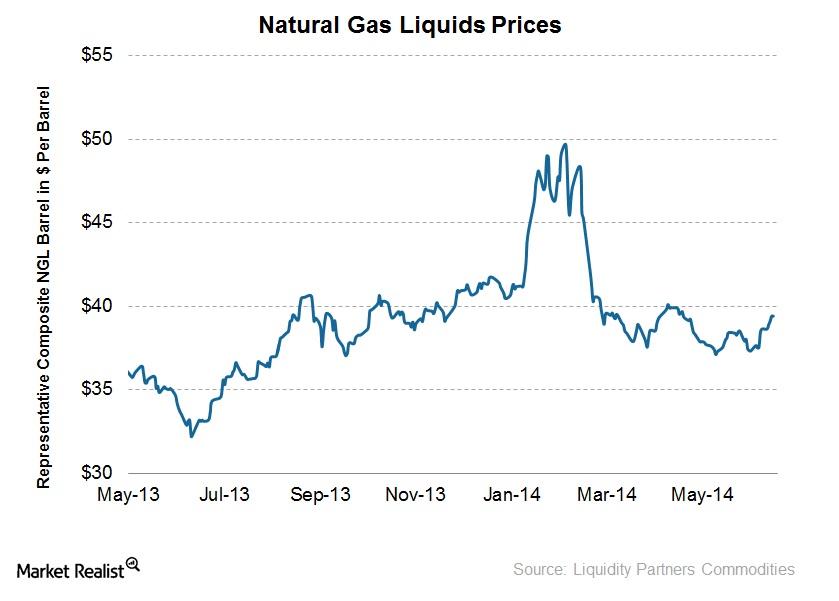

Natural gas liquids prices rise, boosted by propane prices

The representative NGL barrel reached highs of up to ~$50 per barrel in early February, given the strength in propane prices due to a cold winter as well as natural gas prices that pushed ethane prices up.

How Oil Rigs Impact Natural Gas Production

The natural gas rig count was at 187 last week. The natural gas rig count has fallen ~88.4% from its record level of 1,606 in 2008.

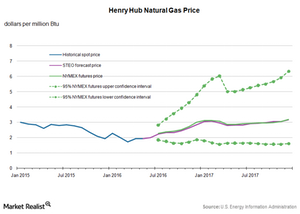

Natural Gas Prices Are Trading above Key Moving Averages

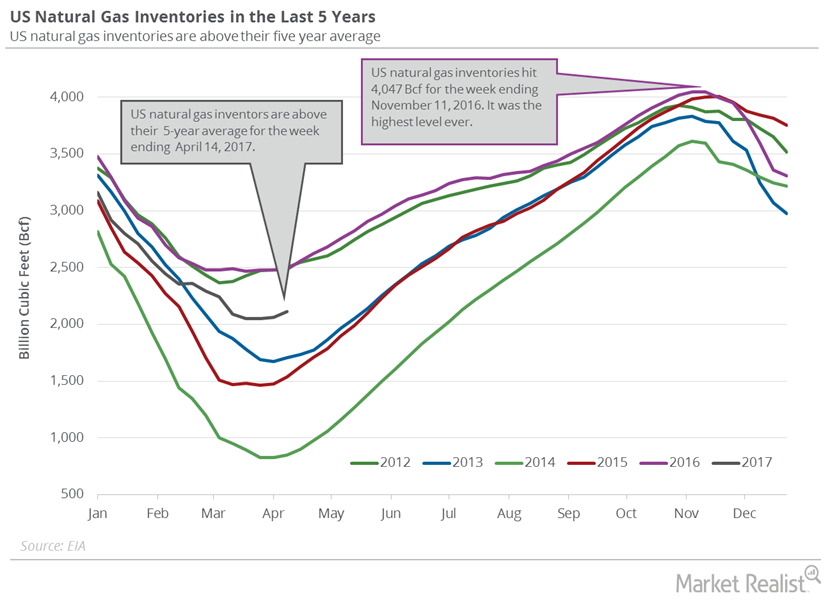

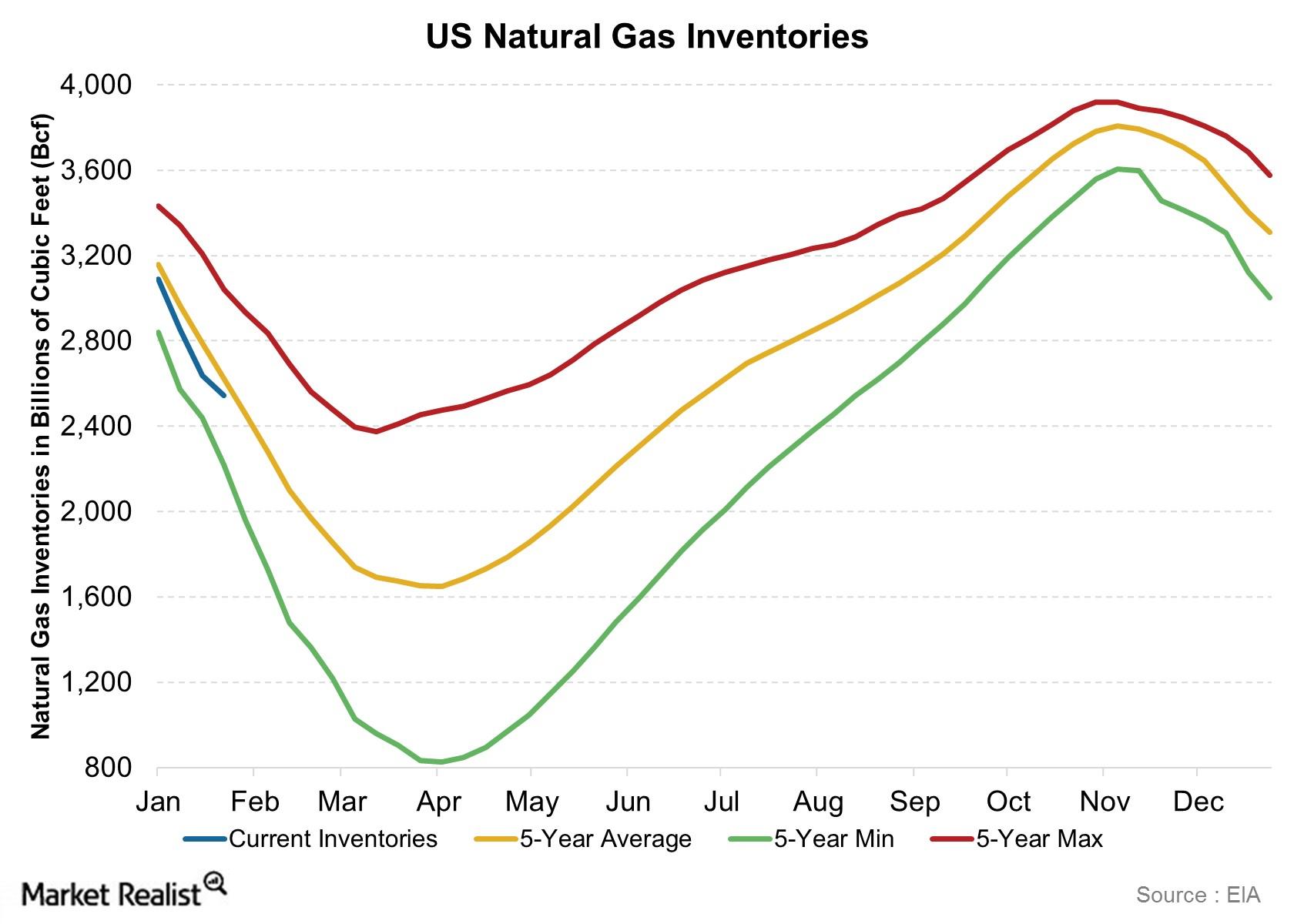

US natural gas inventories are 25% higher than their five-year average. High natural gas inventories could also limit the upside for US natural gas prices.

A Look at the Rig Count and Natural Gas

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008.

Will Natural Gas Rise This Week?

On April 18–26, natural gas active futures rose 1.8%. Natural gas to closed at $2.58 per MMBtu on April 26.Energy & Utilities Why the triple top and triple bottom patterns are important

The triple top pattern is formed in the uptrend. In this pattern, three consecutive peaks are formed. The peaks have roughly the same price level.

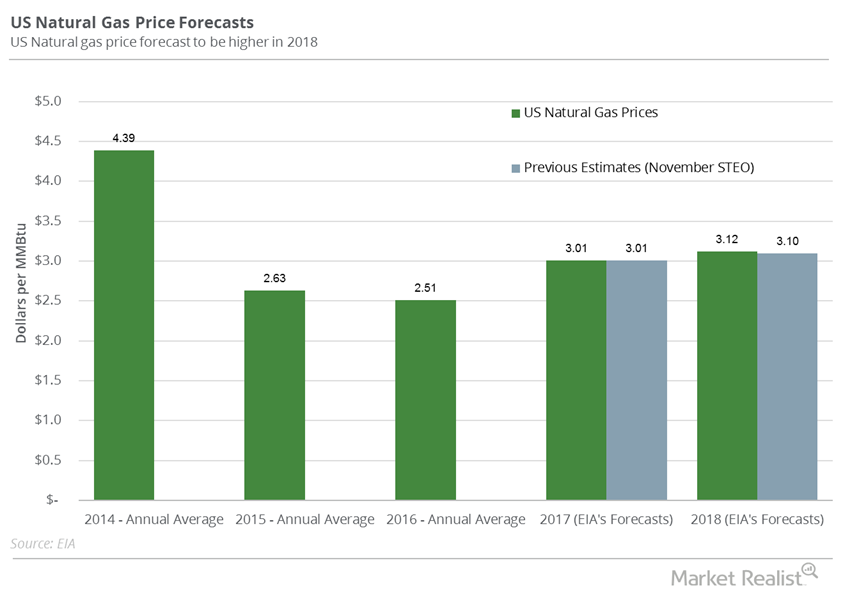

US Natural Gas Consumption Could Help the Prices

US natural gas consumption fell 0.17% to 57.1 Bcf/d (billion cubic feet per day) on October 12–18, 2017. It rose 3.1% from the same period in 2016.

Will US Natural Gas Futures End 2017 on a Low Note?

January US natural gas (UGAZ) futures contracts were below their 100-day, 50-day, and 20-day moving averages on December 21, 2017.

Why WTI crude oil prices are down over 15% in 3 months

WTI crude oil prices continued to slide as U.S. crude inventories continued to grow, with domestic production surging.

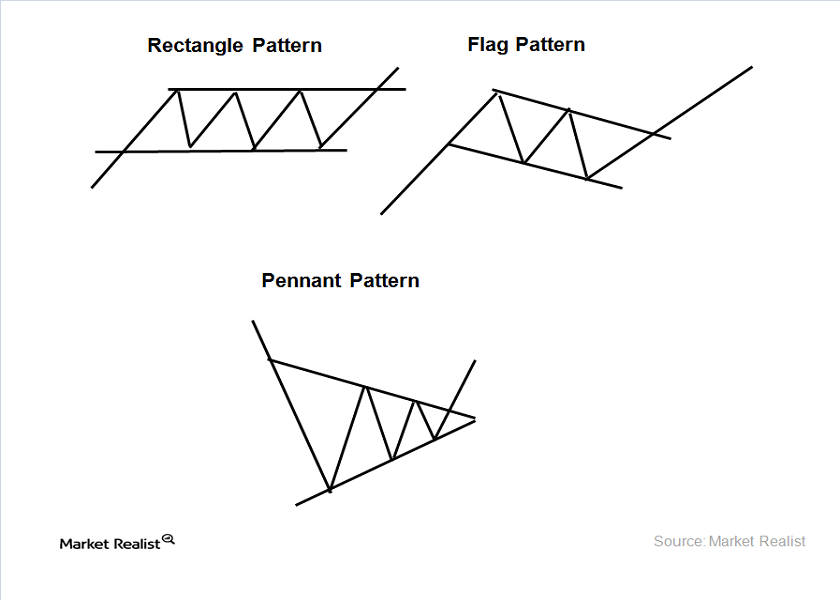

Technical analysis—the rectangle, flag, and pennant patterns

In the rectangle pattern, it’s advisable to buy stock at support and sell at resistance. This pattern is formed in the uptrend and downtrend.

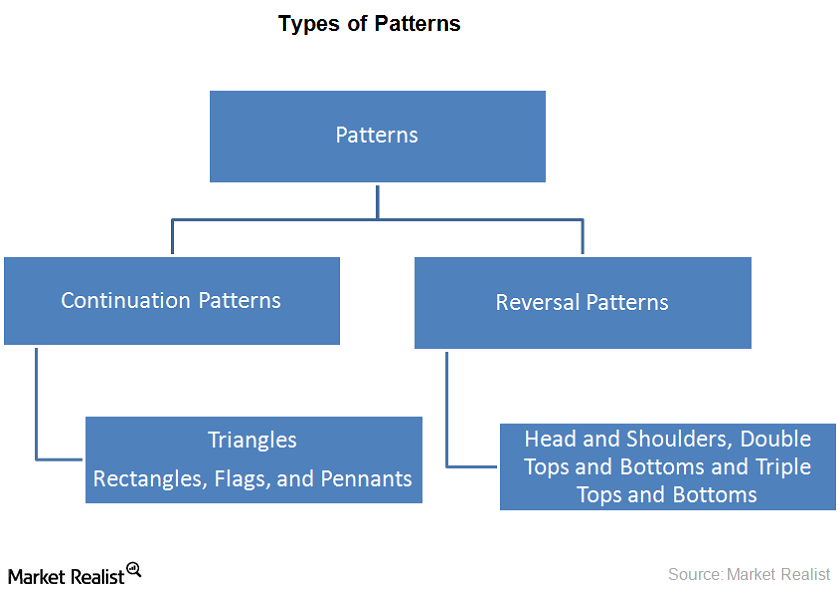

Why technical analysis uses price patterns

Price patterns are trends that occur in stock charts. The charts are used in technical analysis. The pattern forms recognizable shapes. Price patterns are used to forecast the prices.

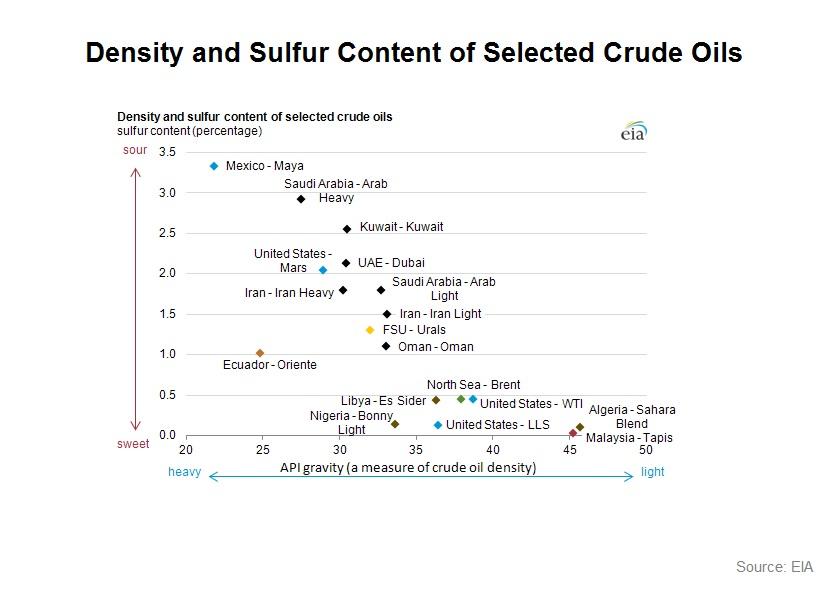

All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.

Will API Inventory Data Impact Energy Stocks?

Today, the API plans to release its oil inventory data for the week ended August 30. Gasoline inventories are expected to fall by 1.8 MMbbls.

Range Resources: What Do Analysts Recommend?

On June 14, BMO reduced its target price on Range Resources by $2 to $6. On June 12, Citigroup reduced its target price by $4.5 to $7.5.

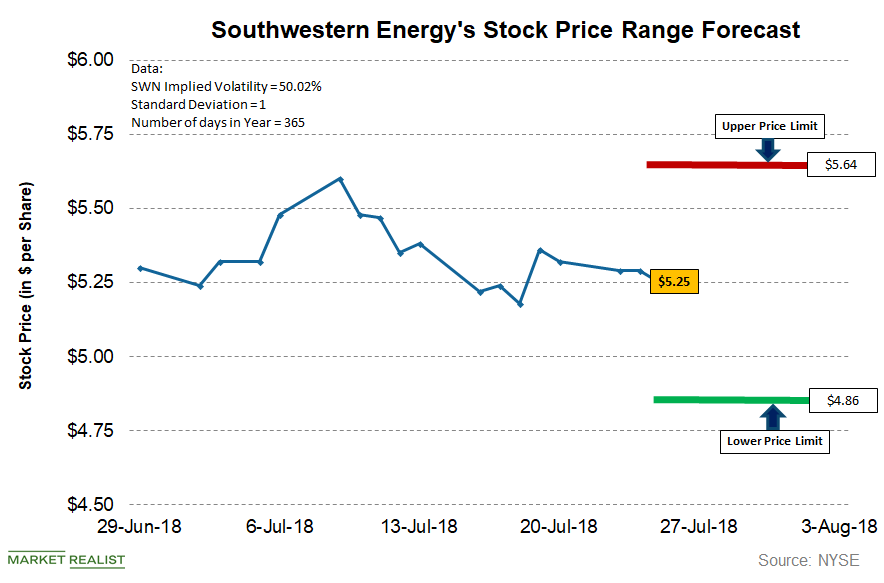

What’s the Forecast for Southwestern Energy Stock?

As of July 25, Southwestern Energy (SWN) had an implied volatility of ~50.0%, which is lower when compared with its implied volatility of ~50.9% at the end of the second quarter of 2018.

Analysts’ Price Targets for Cabot Oil & Gas’s Next 12 Months

Approximately 66.66% of analysts covering Cabot Oil & Gas (COG) recommend “buy,” and 33.33% recommend “hold.”

Why the Oil Rig Count Could Be a Concern for Natural Gas Bulls

In the week ended December 22, the natural gas rig count was 88.5% below its record high of 1,606 in 2008.

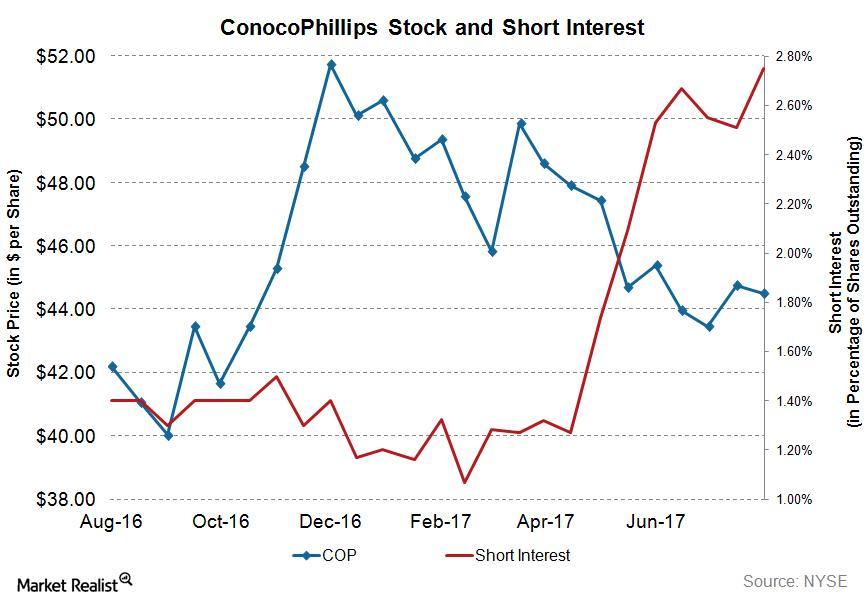

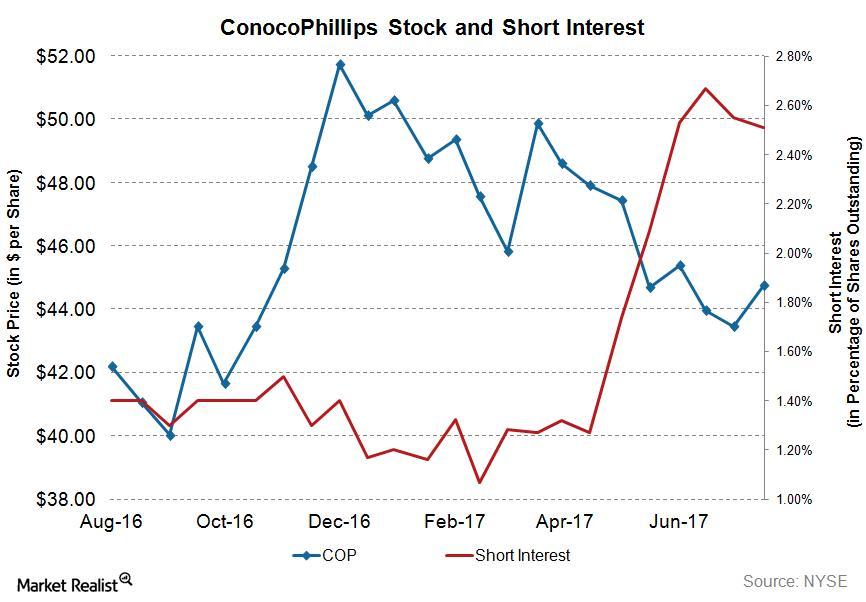

Who’s Shorting COP: Reading the Short Interest in ConocoPhillips’s Stock

Short interest in COP On August 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~33.4 million, while its average daily volume was ~8.02 million. This means the short interest ratio for COP’s stock was ~4.6x. COP’s average daily volume is calculated for the short interest reporting period from August 1, 2017, […]

Analyzing the Short Interest in ConocoPhillips Stock

As of July 31, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) was ~31.6 million, and its average daily volume was ~8.0 million.

US Natural Gas Inventories Pressure Prices

The EIA reported that US natural gas inventories rose by 54 Bcf to 2,115 Bcf on April 7–14, 2017. Inventories rose 2.6% week-over-week but fell 14.8% YoY.

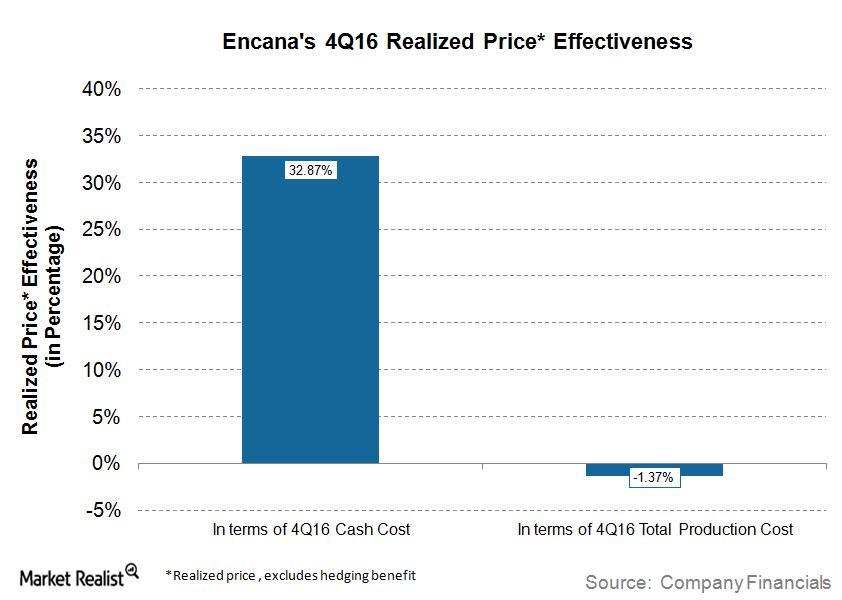

Analyzing Encana’s Realized Price Effectiveness

Encana’s (ECA) production cash cost has increased on a year-over-year basis. For 4Q16, Encana’s production cash cost was $17.92 per boe, higher than $17.74 per boe in 4Q15.

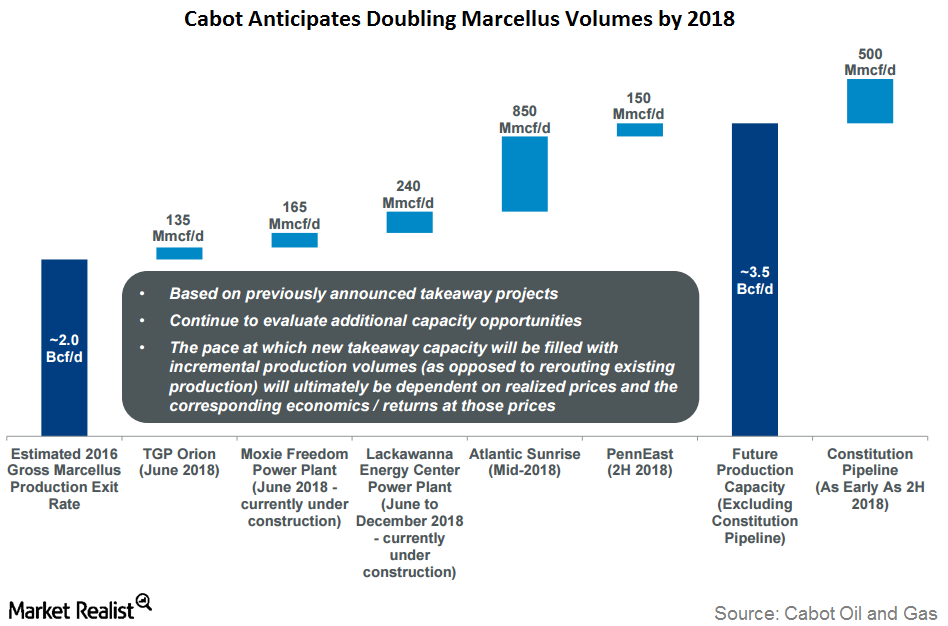

Why Cabot Awaits the Atlantic and Constitution Pipeline Projects

Cabot Oil & Gas’s stock price momentum has slowed, but its stock has recently been rising, mirroring natural gas prices.

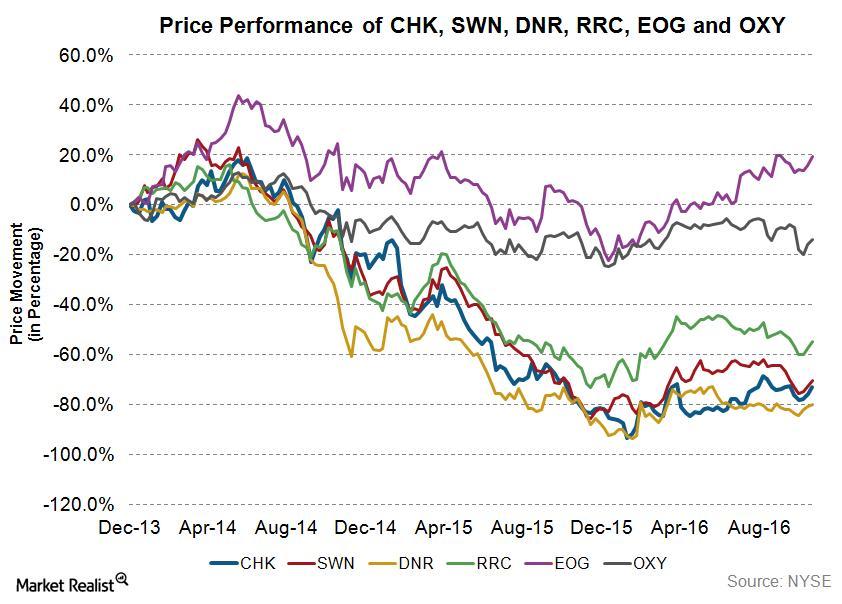

Are Companies That Have Done Acquisitions Outperforming?

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]

How Range Resources Stock Reacted after Past Earnings Beats

In March 2016, Range Resources stock made a higher high for the first time in almost two years. Since January 2016, Range Resources stock has risen a whopping 112%.

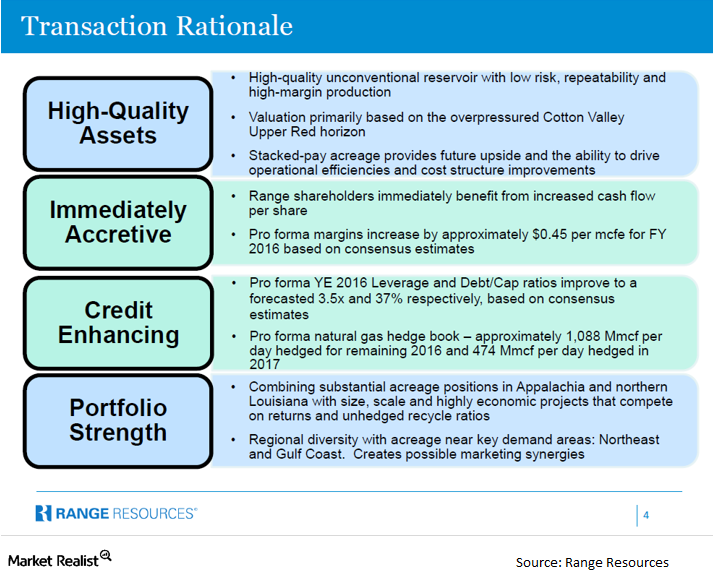

Rationale for the Memorial Resource-Range Resources Transaction

Range Resources is growing its portfolio in the Southeast US. Natural gas exports seem to be a promising growth area. The deal will enhance its credit profile.

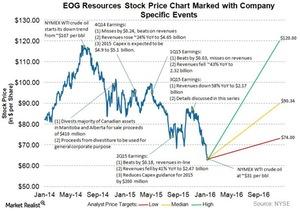

Analyzing EOG Resources’ 3Q15 Earnings Call

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.”

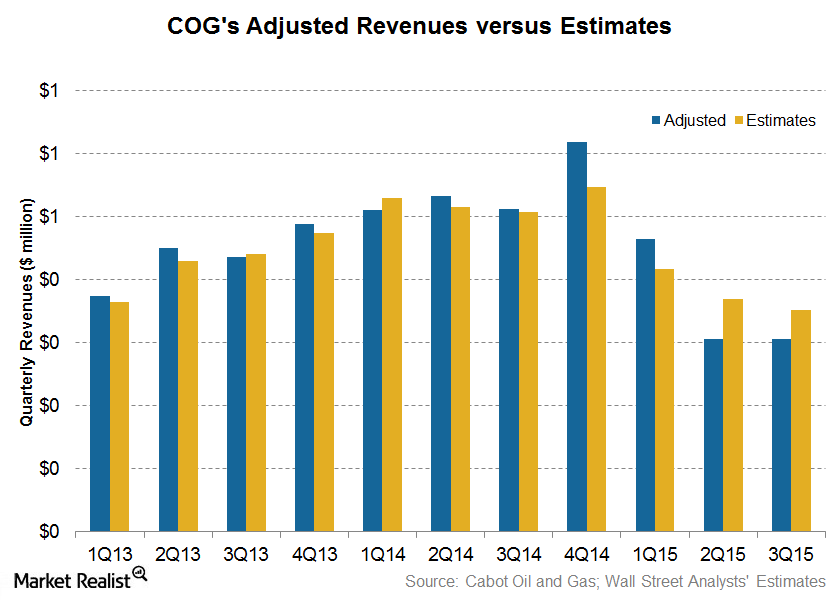

3Q15 Earnings: Cabot Oil and Gas’s Revenue Missed Estimates

Wall Street analysts’ estimate for Cabot Oil and Gas’s revenue was ~$352 million for 3Q15. The company announced adjusted revenue of ~$305 million.

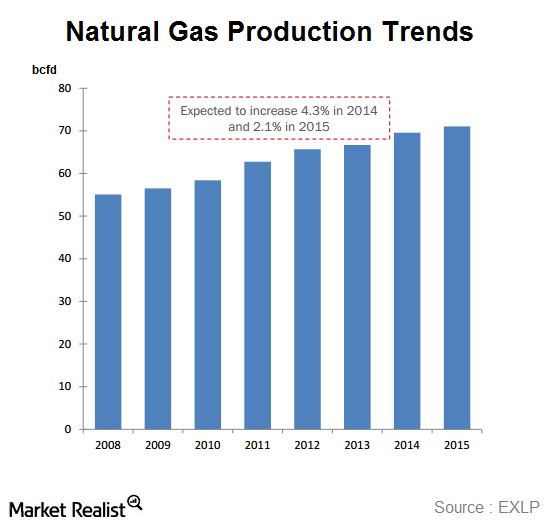

EIA Reports a Slight Decline in Natural Gas Production

Continued production growth set a grim scenario for natural gas prices. High production levels are bearish for natural gas prices.

The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.

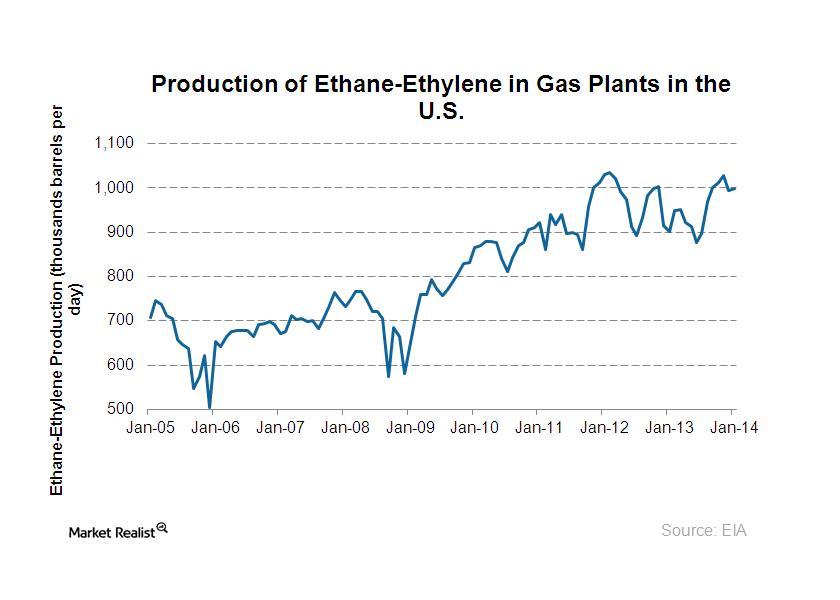

Why ethane production has increased a lot over the past few years

Ethane is the largest component of the natural gas liquids stream, and the increased wet gas production caused a large increase in ethane production.

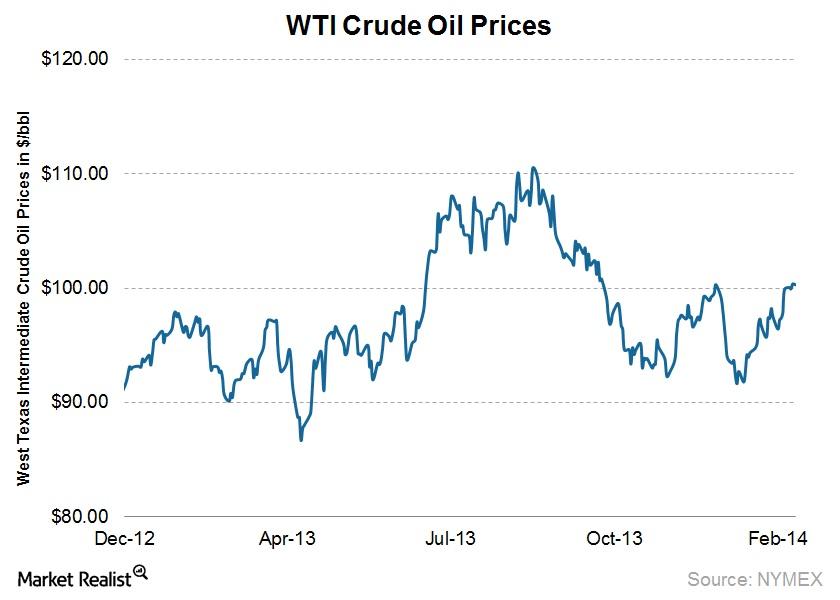

WTI crude prices break $100 per barrel for the 1st time in 2014

WTI traded flat last week, but firstly traded up $100 per barrel since December 27. This past week’s upward movement in prices was a short-term positive for the sector.

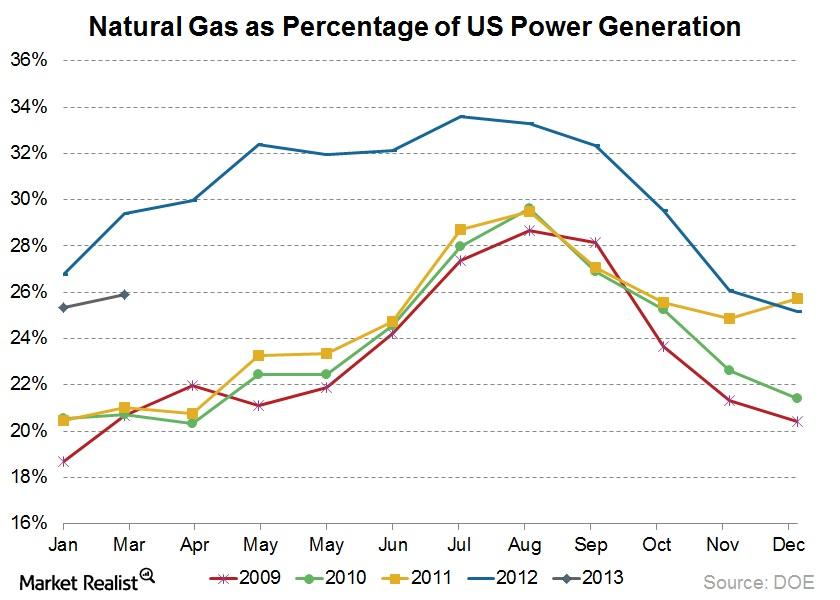

Why has natural gas gained popularity among power generators?

Natural gas has gained market share for use in power generation. Learn about the drivers of this trend and the consequences of increased natural gas use.

Why the spread between WTI and Brent oil drifted wider

The spread between WTI and Brent closed through most of 2013, but it has experienced some volatility in recent months, given events in Libya and Syria.