Analyzing EOG Resources’ 3Q15 Earnings Call

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.”

Jan. 19 2016, Published 10:39 a.m. ET

EOG Resources’ 3Q15 earnings call

EOG Resources’ (EOG) goal in 2015 was to transition the company to adapt to a low commodity price environment. On the company’s 3Q15 earnings call, EOG’s chairman and CEO, William R. Thomas, noted, “To achieve this goal, our 2015 game plan is focused on the following objectives; one, maximize return on capital invested; two, improve well performance through technology and innovation; three, achieve significant cost reductions through sustainable efficiency gains; four, take advantage of opportunities to add drilling inventory; and five, maintain a strong balance sheet.” Thomas also assured that EOG was “right on track with our plan.”

EOG’s increased Delaware potential

On the 3Q15 earnings call, EOG’s president and chief operating officer, Lloyd W. Helms, noted that EOG increased its Delaware Basin’s net resource potential by 1 billion boe (barrels of oil equivalent), which is an increase of ~74% from the resource estimates just two years ago.

Helms also noted, “The expanded resource provides 2,200 additional net locations adding to what was already decades of drilling inventory.”

EOG to live within cash flow in 2016

On the 3Q15 earnings call, Thomas confirmed that EOG will try to live within its cash flow in 2016. In order to achieve this objective, EOG plans to focus on its uncompleted well inventory in 2016.

Thomas stated, “For 2016 with the very large uncompleted well inventory certainly the focus of the CapEx and that will be the highest return thing we can invest in next year.”

Wall Street ratings for EOG

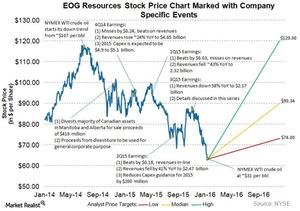

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.” The median price target from these recommendations is $90.34, which is ~30% higher than the January 15, 2016, closing price of $62.97.

Based on the median price targets of recommendations from Wall Street analysts, S&P 500 (SPY) upstream companies Range Resources (RRC), Noble Energy (NBL), and Pioneer Natural Resources (PXD) have potential upsides of ~50%, ~37%, and ~32%, respectively, from their January 15, 2016, closing prices.