Nicholas Chapman

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Nicholas Chapman

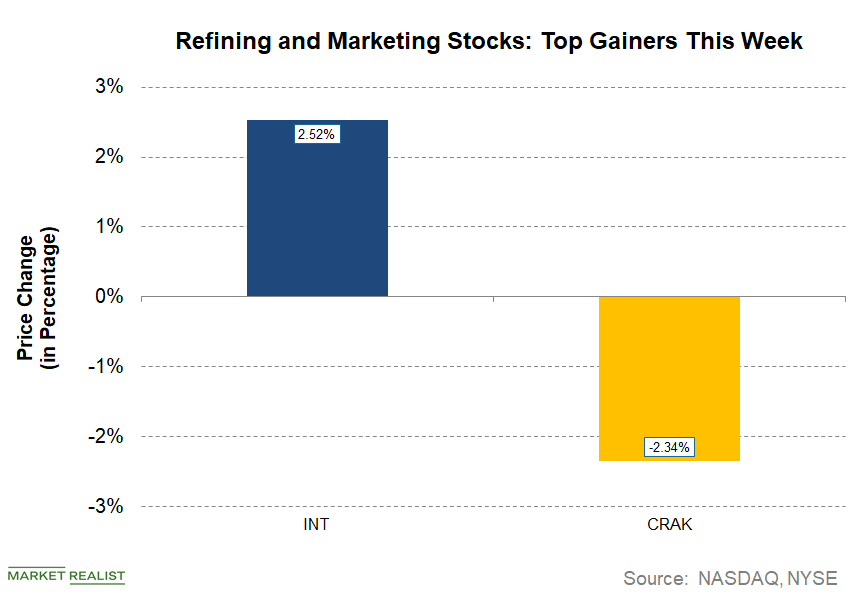

Which Refining and Marketing Energy Stocks Are Rising This Week?

World Fuel Services (INT) increased from last week’s close of $21.80 to $22.35 on June 14—an increase of more than 2.5%.

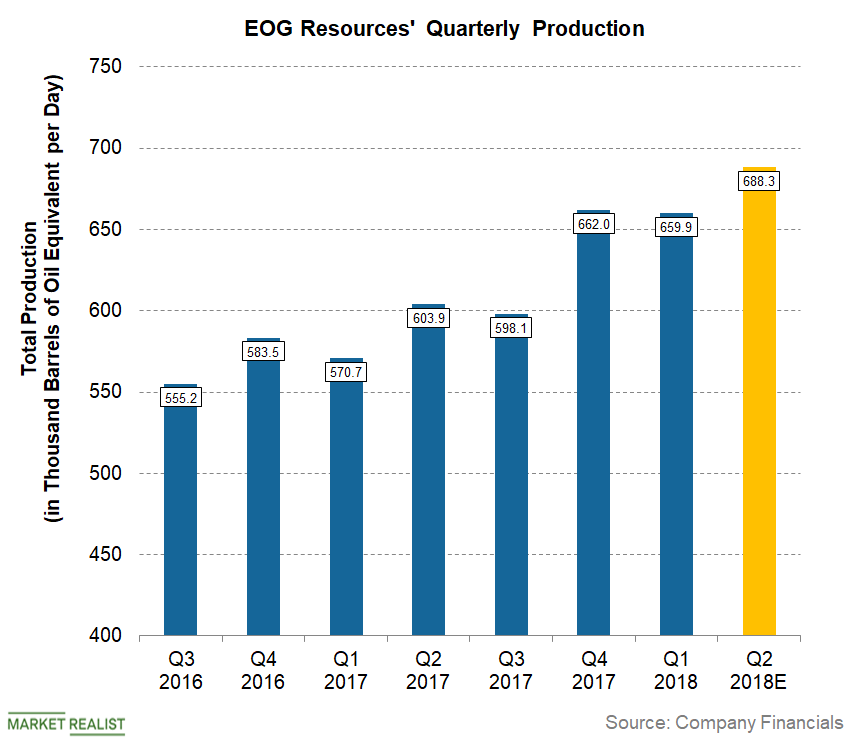

Understanding EOG Resources’ Q2 2018 Production Guidance

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

Analyzing Denbury Resources’ 1Q16 Earnings Call

For 1Q16, Denbury Resources (DNR) reported an adjusted EBITDA of ~$105 million with an EBITDA margin of ~40%. Its EBITDA margin is only ~20% lower.

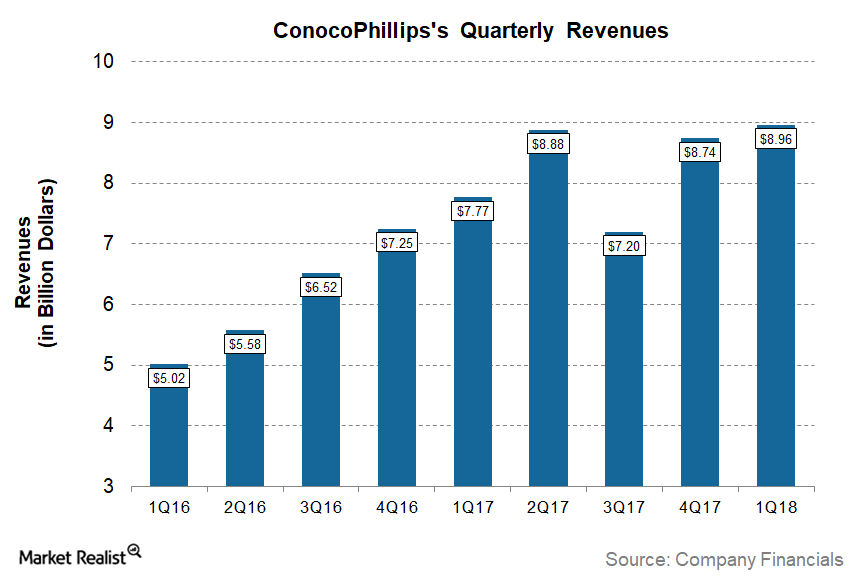

Why Did ConocoPhillips’s Revenue Grow in 1Q18?

For 1Q18, ConocoPhillips (COP) reported revenues of ~$9.0 billion—higher than analysts’ consensus of ~$8.8 billion.

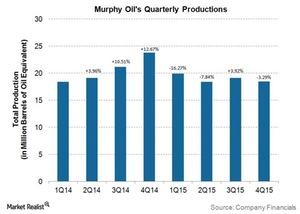

Murphy Oil’s 4Q15 Operational Performance, Management Strategies

Along with its 4Q15 earnings, Murphy Oil announced the divestiture of its Montney midstream assets located in Canada. The transaction includes the sale of existing infrastructure capable of processing up to 320 million cubic feet per day.

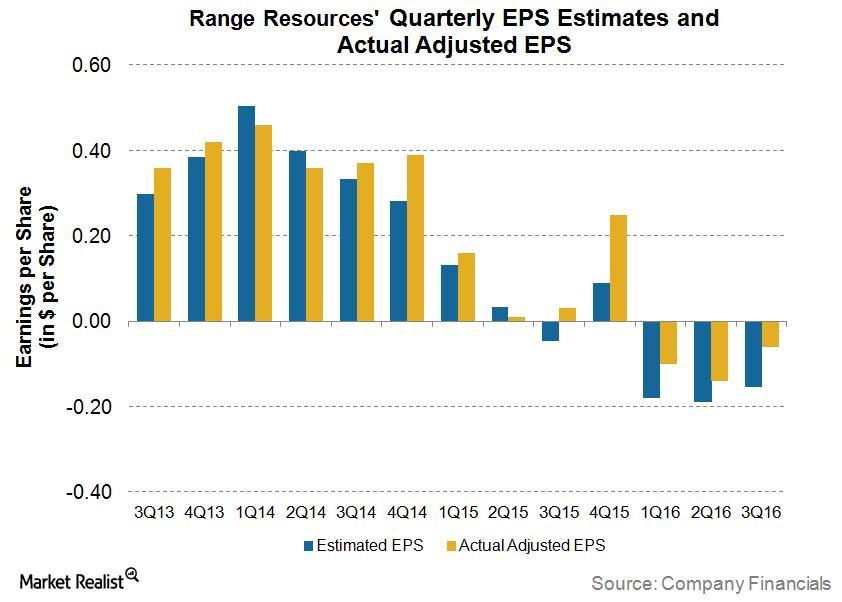

Inside Range Resources’ 3Q16 Earnings

For 3Q16, Range Resources reported an adjusted loss per share of $0.06—$0.09 better than the Wall Street analyst consensus estimate of $0.15 loss per share.

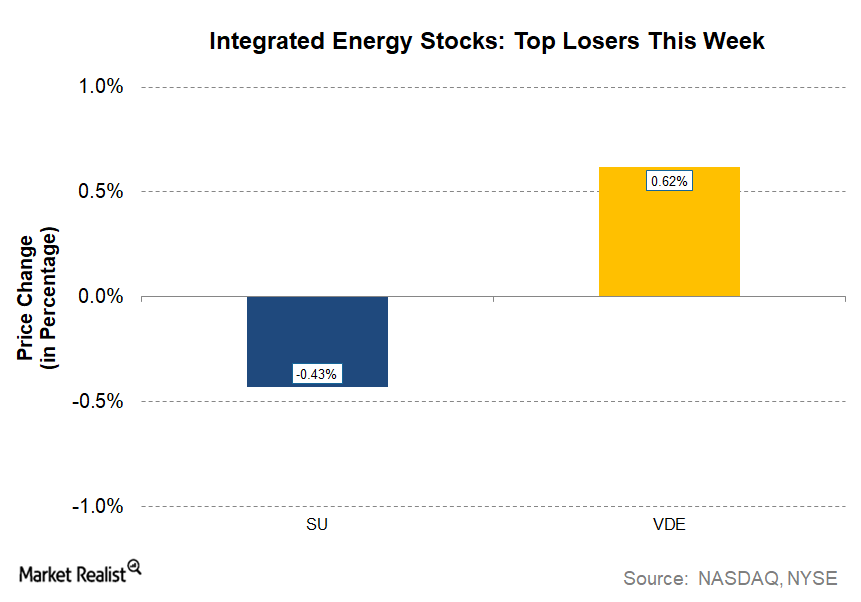

Suncor Energy: The Only Integrated Energy Loser This Week

Suncor Energy (SU) is the only losing stock in the current week from the integrated energy sector. It fell from last week’s close of $34.67 to $34.52 on October 11, 2017.

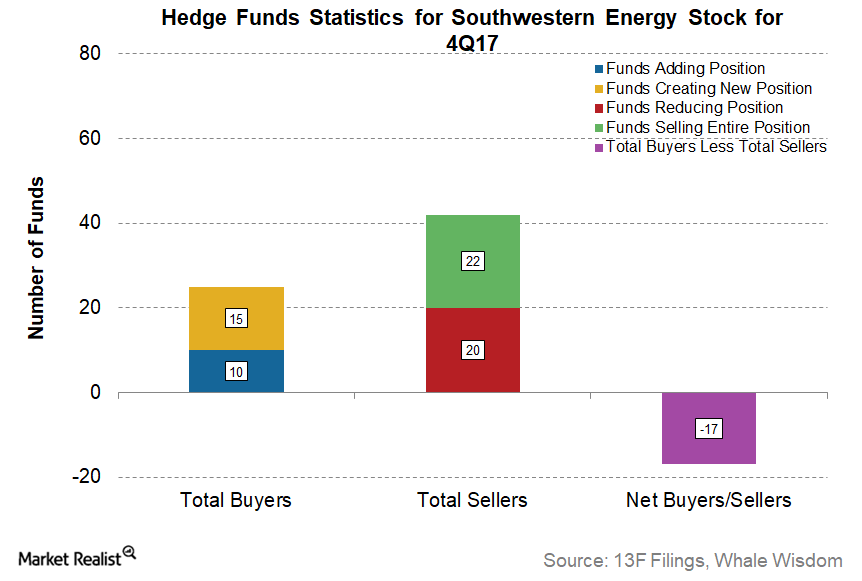

Are Hedge Funds Accumulating Southwestern Energy Stock?

In 4Q17, 25 hedge funds were buyers of Southwestern Energy (SWN) stock, and 42 hedge funds were sellers.

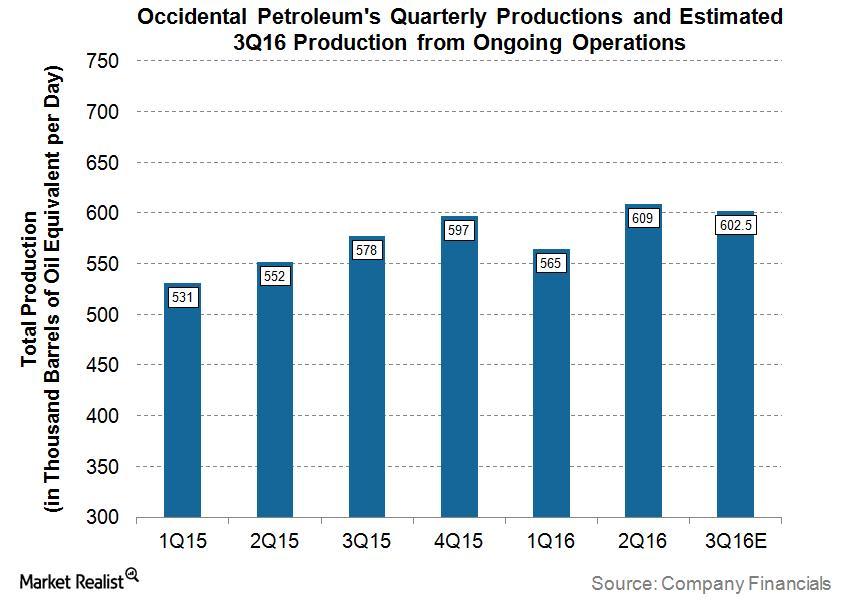

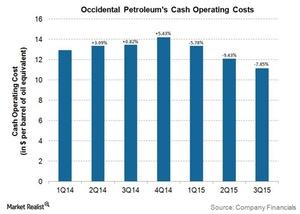

Did Occidental Petroleum Set a High Bar for 3Q16 Production?

For 3Q16, Occidental Petroleum expects its total production from ongoing operations to be in the range of 600–605 Mboe per day.

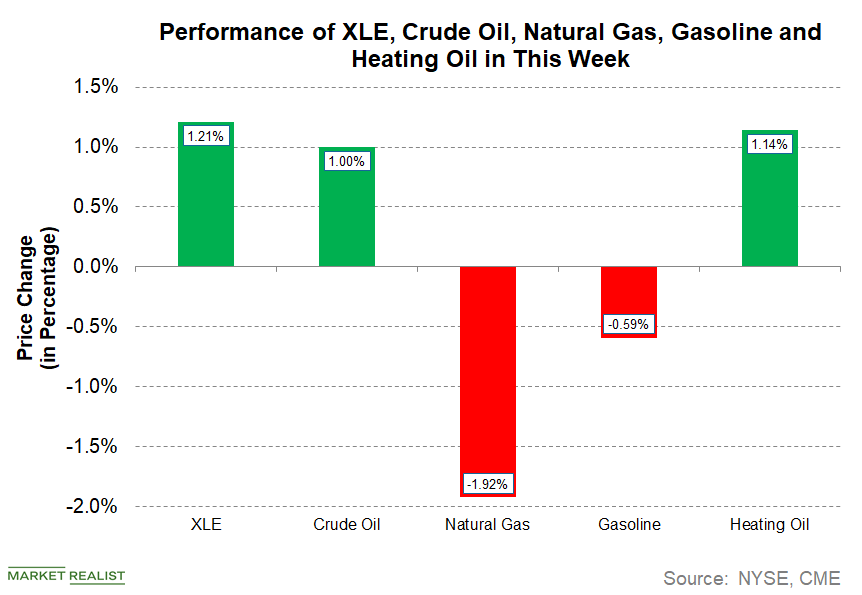

How Energy Commodities Performed from June 18–20

Energy stocks are rising this week. The Energy Select Sector SPDR ETF (XLE) has risen 1.2% from June 18–20.

What’s Been Driving Diamondback Energy’s Stock Price Movement?

Diamondback Energy’s stock price saw uptrend from October 2012 to June 2014. When NYMEX WTI crude oil started falling in June 2014, FANG’s stock peaked.

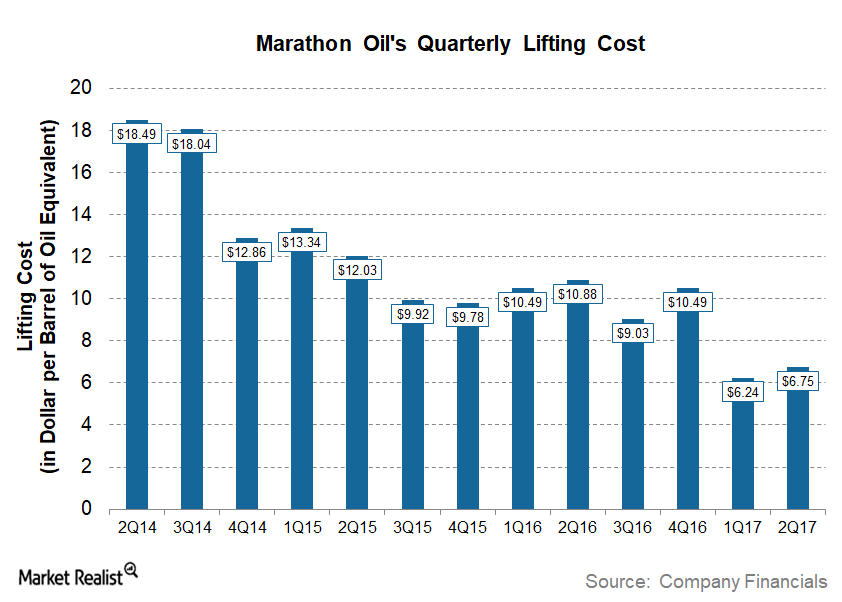

Marathon Oil’s Lifting Costs

In 2Q17, Marathon Oil’s (MRO) reported a lifting cost of ~$6.75 per boe (barrel of oil equivalent), which is ~28.0% lower than its 2Q16 lifting cost of ~$10.88.

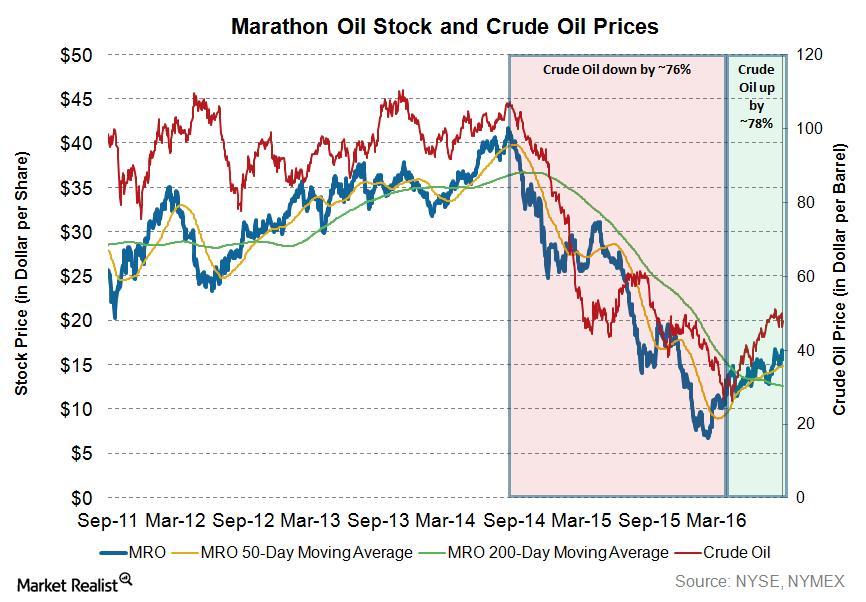

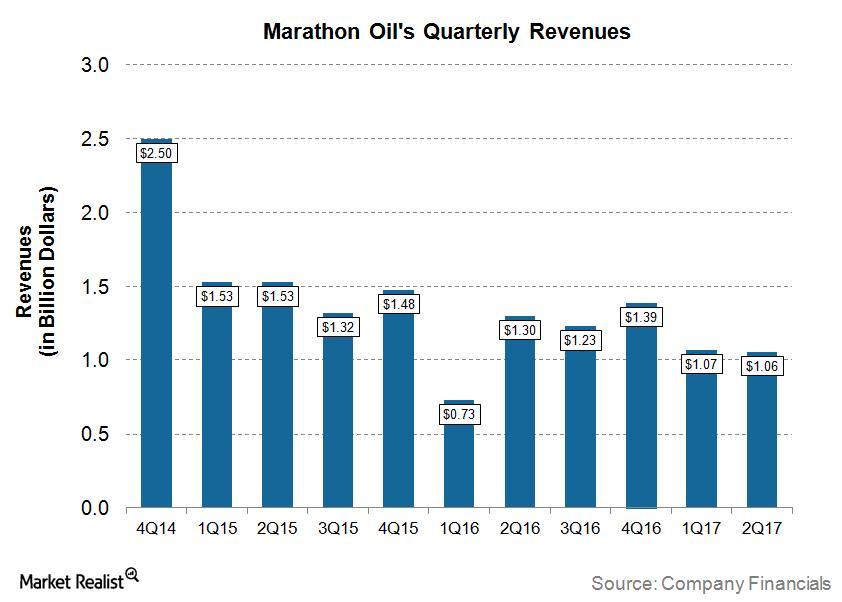

How the Decline in Crude Oil Prices Affected Marathon Oil

Although crude oil prices have rallied ~78% from their lows in February 2016, crude is still trading ~57% lower than its high two years ago.

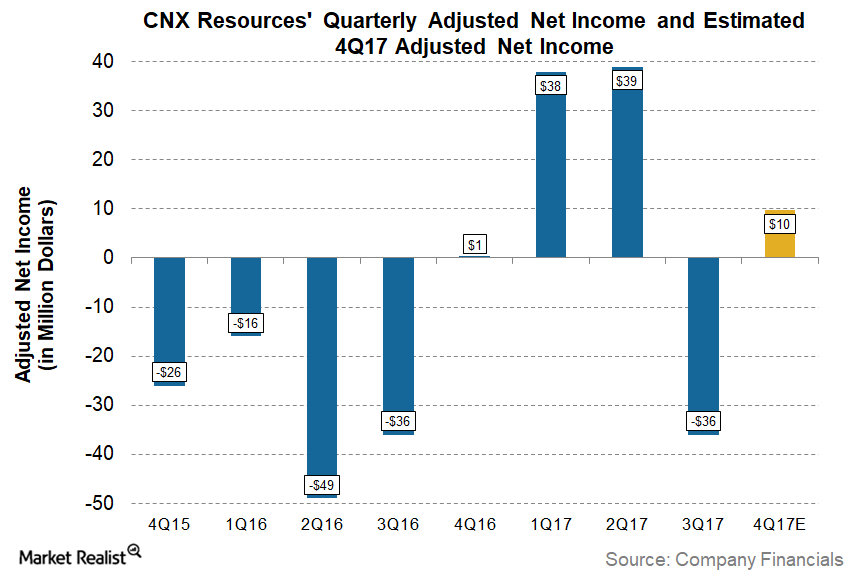

Can CNX Resources Report Higher Profits in 4Q17?

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. CNX is expected to report 1,000% higher profits YoY than 4Q16.

How Is Occidental Petroleum Managing the Falling Energy Prices?

According to Occidental Petroleum’s 3Q15 form 10Q filing, changes in energy prices affected its quarterly earnings by $30 million in crude oil.

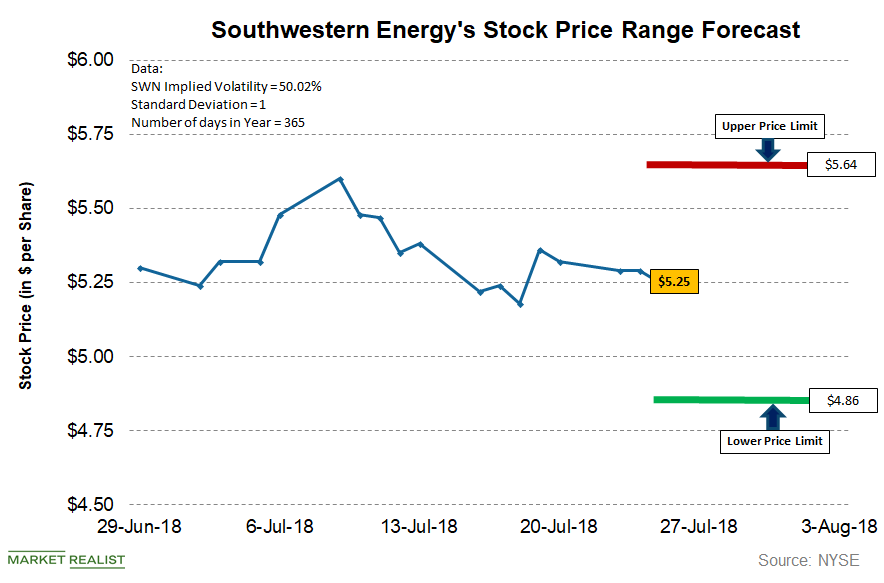

What’s the Forecast for Southwestern Energy Stock?

As of July 25, Southwestern Energy (SWN) had an implied volatility of ~50.0%, which is lower when compared with its implied volatility of ~50.9% at the end of the second quarter of 2018.

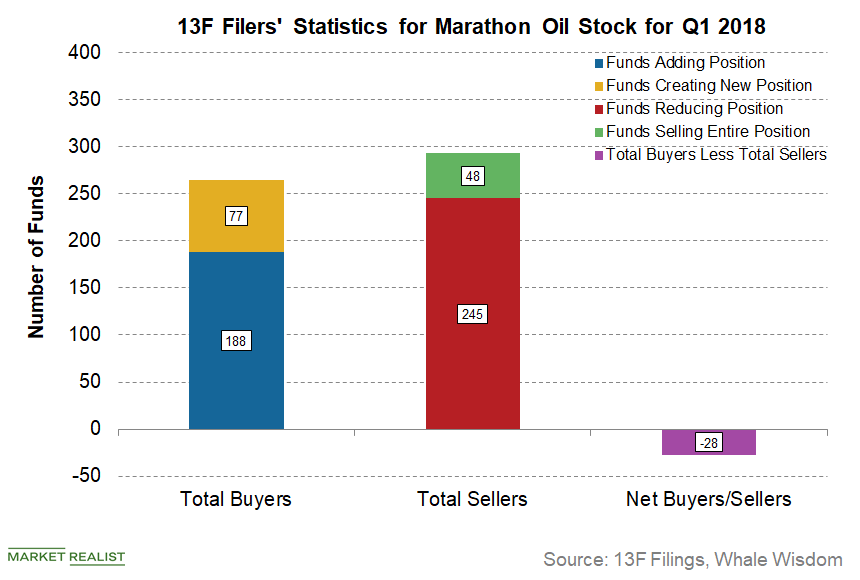

Are Institutional Investors Selling Marathon Oil Stock?

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

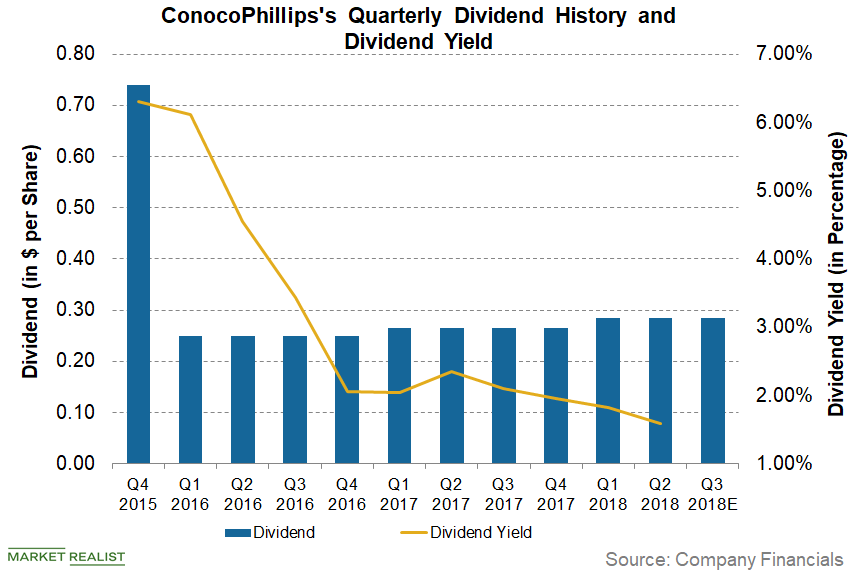

Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

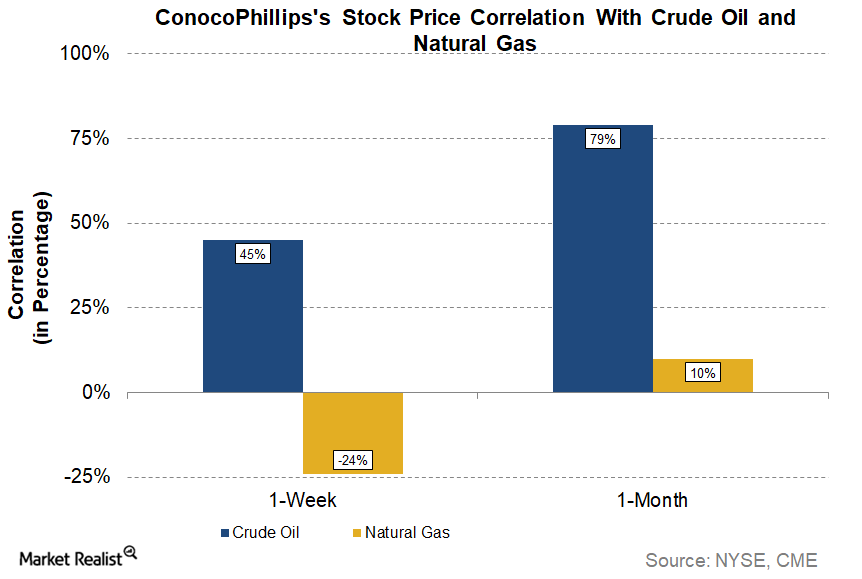

Understanding ConocoPhillips Stock’s Correlation with Crude Oil

ConocoPhillips’s stock performance As we saw in the previous part of this series, ConocoPhillips’s (COP) stock price rose ~2% in the week ended March 9, while crude oil (UWT) (SCO) (DWT) rose ~1%, suggesting that COP stock followed crude oil. In this part, we’ll try to quantify this correlation between COP stock and crude oil. ConocoPhillips’s stock […]

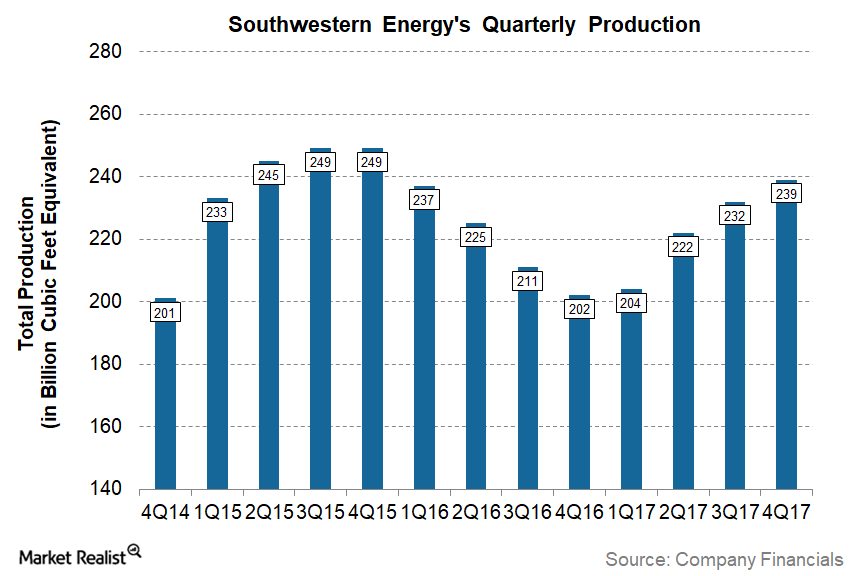

Southwestern Energy Reported Higher Production in 4Q17

Sequentially, Southwestern Energy’s 4Q17 production is ~3% higher compared to its production of 232 Bcfe in 3Q17.

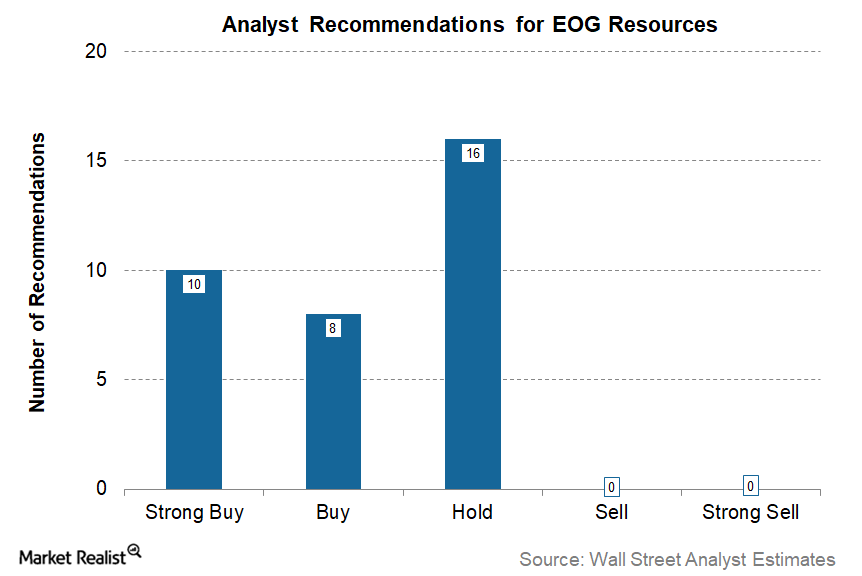

EOG Resources: Post-Earnings Wall Street Ratings

As of March 1, 2018, a total of 34 analysts have made recommendations on EOG Resources (EOG) stock, according to Reuters.

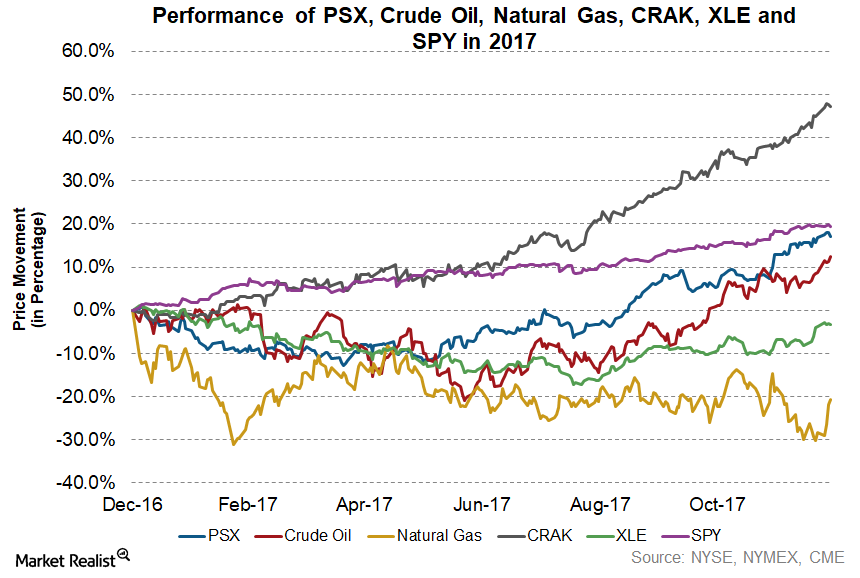

Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

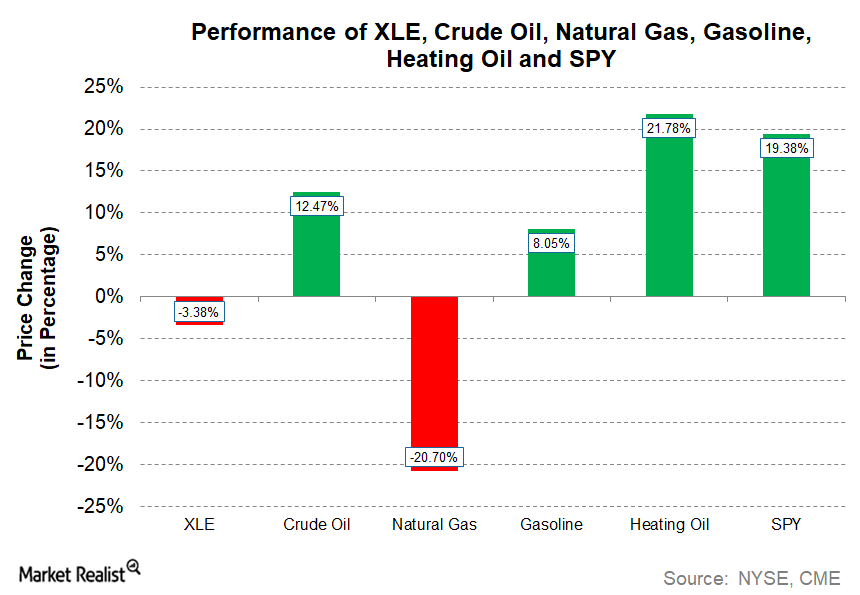

How the Energy Sector Performed in 2017

In this series, we’ll look at the best-performing and worst-performing stocks of the Energy Select Sector SPDR ETF (XLE) and analyze the earnings and developments behind the movements.

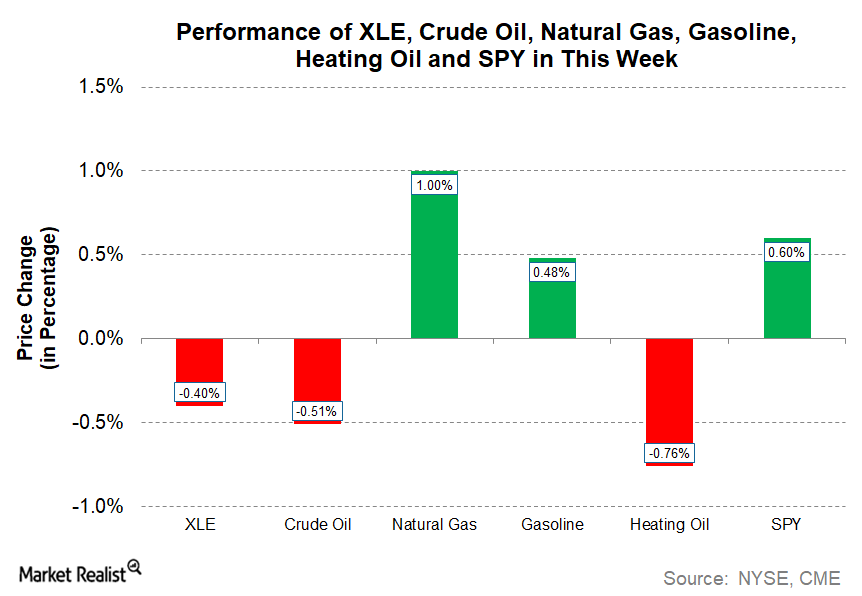

These Energy Commodities Rose This Week

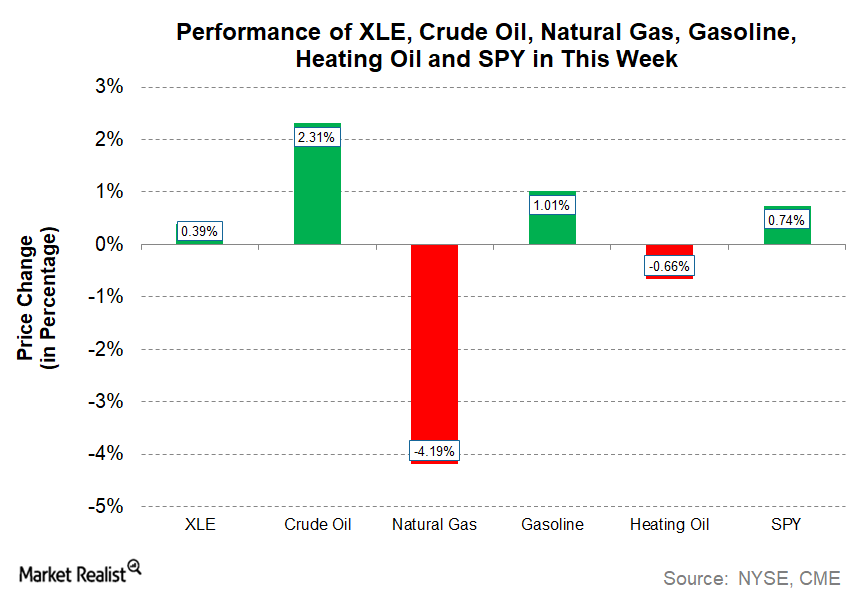

With the mixed performance from energy commodities, energy stocks are down this week. As of January 17, the Energy Select Sector SPDR Fund (XLE) has fallen ~0.4% this week.

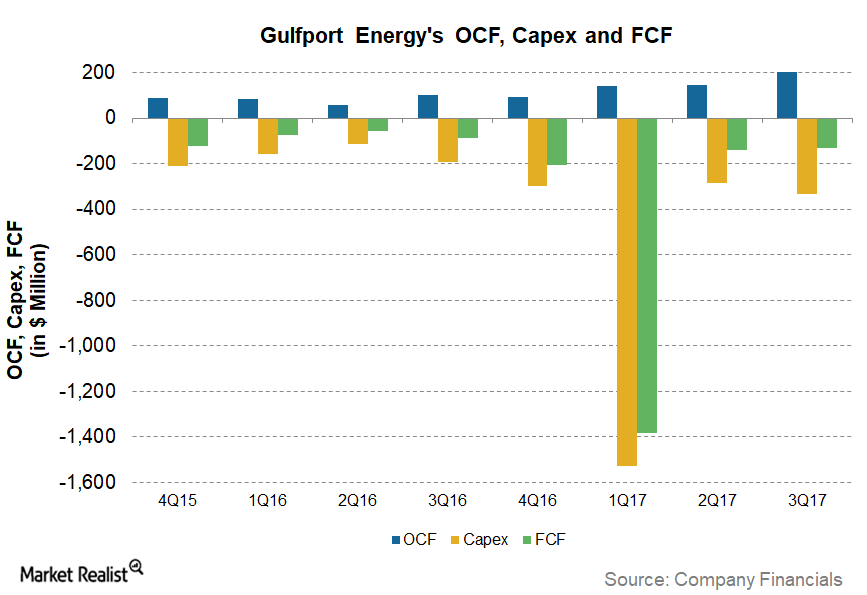

Is Gulfport Energy’s Normalized Free Cash Flow Trending Up?

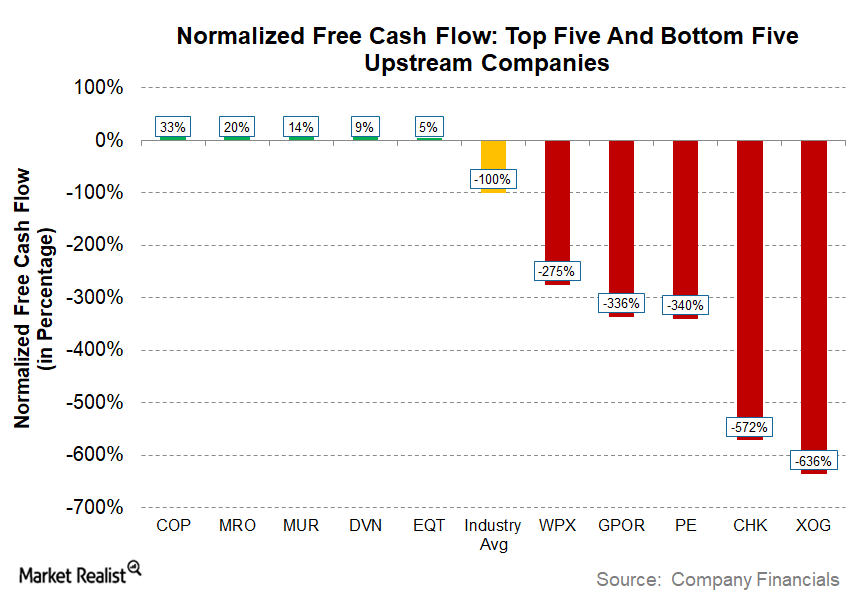

For 9M17 (the first nine months of 2017), Gulfport Energy (GPOR) had normalized FCF (free cash flow) of -336%, the fourth lowest among the upstream producers we have been tracking.

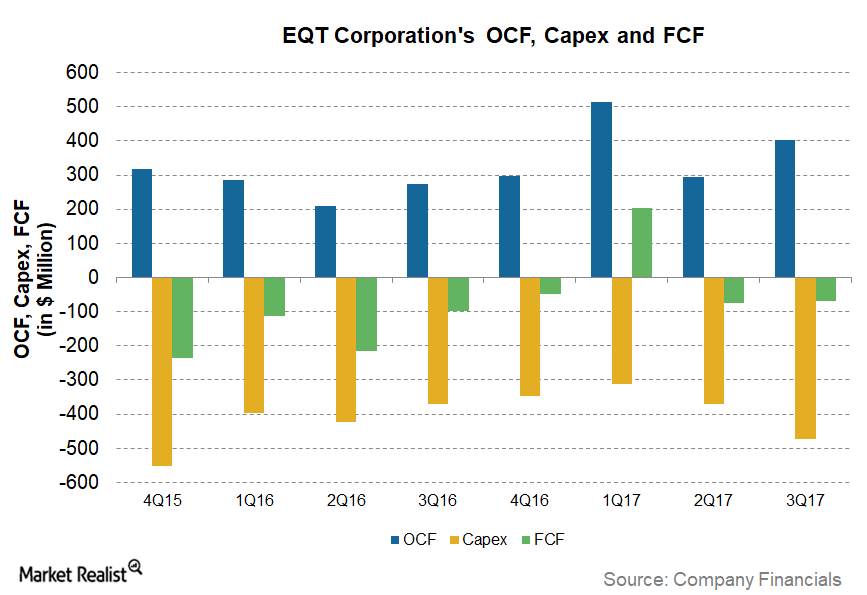

Why EQT’s Normalized Free Cash Flow Is Improving

As we saw in part one of this series, EQT (EQT) had normalized free cash flows of ~5% in the first nine months of 2017, the fifth highest among crude oil (USO) and natural gas (UNG) (UGAZ) producers we have been tracking.

Upstream Energy’s Best and Worst Free Cash Flow Companies

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector.

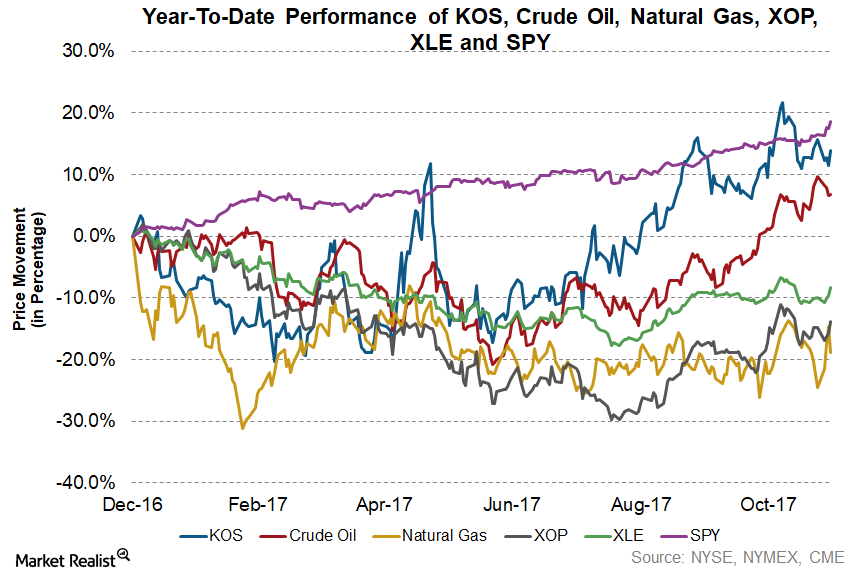

The Fourth-Best-Performing Upstream Stock Year-to-Date

In 9M17, KOS’s production increased ~107.0% to ~7.8 million barrels when compared with 9M16.

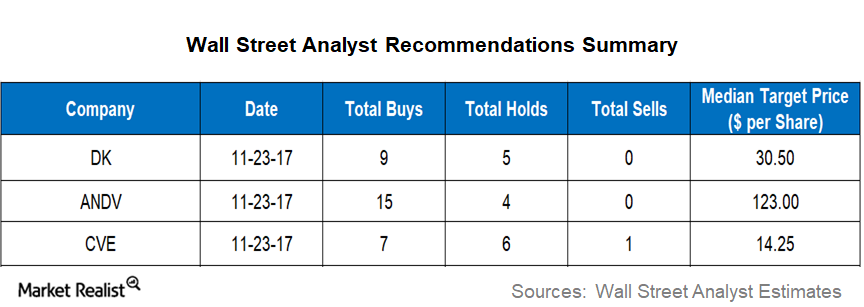

Analyzing Wall Street Targets for DK, ANDV, and CVE

As of November 23, 2017, four of the 14 analysts covering Delek US Holdings (DK) stock gave it a “strong buy” recommendation, and five gave it a “buy.”

Energy Sector Saw a Mixed Performance This Week

With the mixed performance from natural gas and crude oil, the energy sector is showing a modest increase this week.

Did Occidental Petroleum Generate Positive Free Cash Flow in 3Q17?

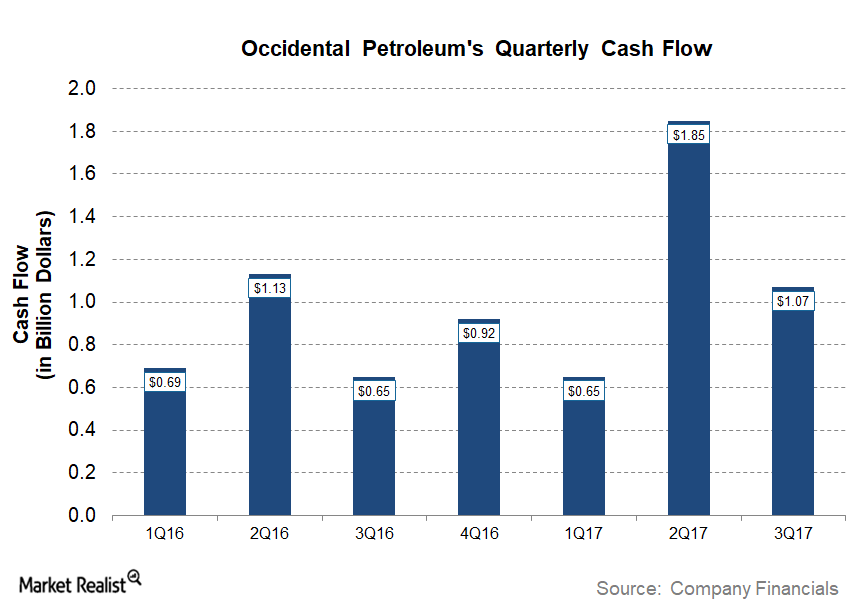

On a year-over-year basis, OXY’s 3Q17 operating cash flow was ~65% higher than the ~$650 million it generated in 3Q16.

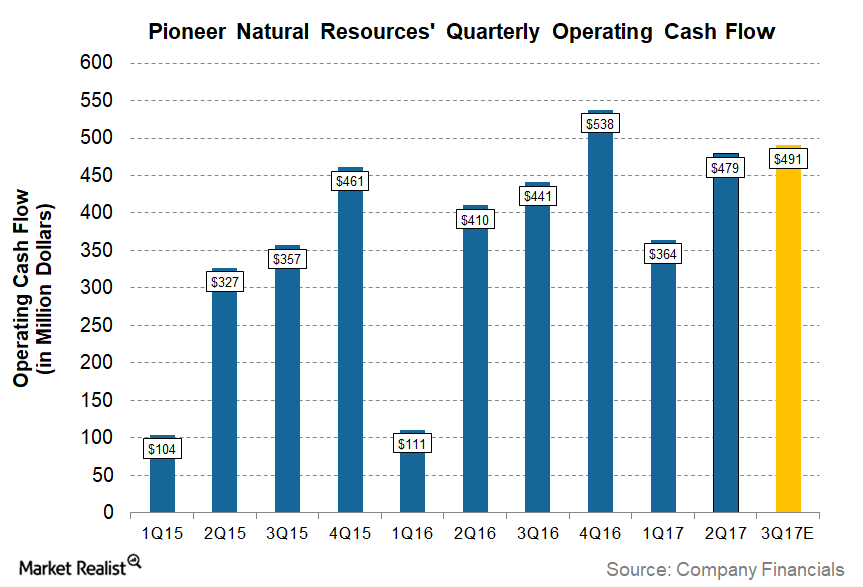

What to Expect from Pioneer Natural Resources’ Cash Flow in 3Q17

Wall Street analysts expect Pioneer Natural Resources (PXD) to report year-over-year higher cash flow of ~$491 million in 3Q17 compared to ~$441 million in 3Q16.

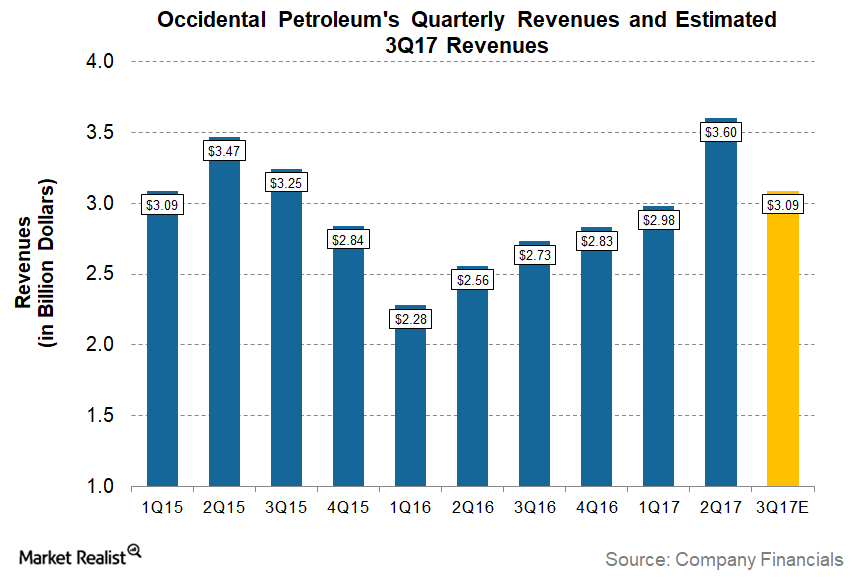

What to Expect from Occidental Petroleum’s 3Q17 Revenues

For 3Q17, Wall Street analysts expect Occidental Petroleum (OXY) to report revenues of ~$3.1 billion.

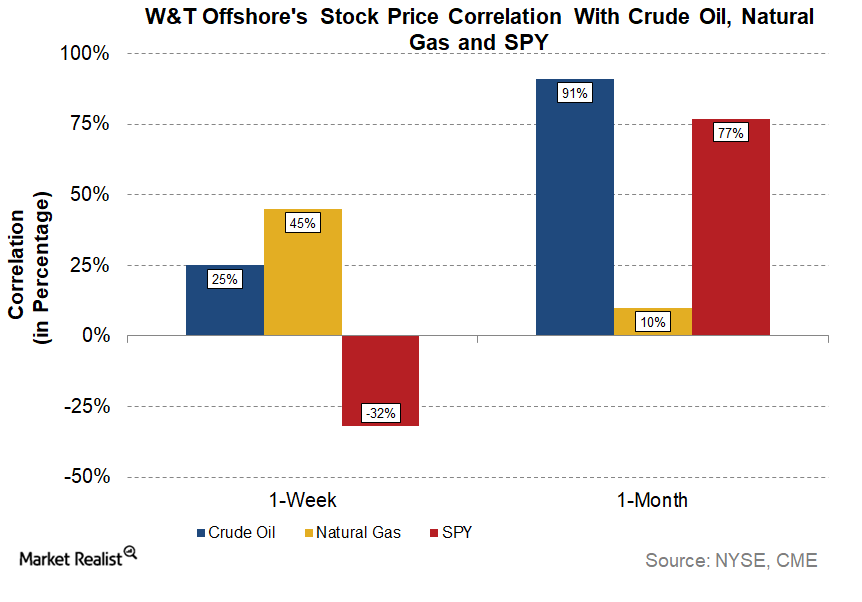

What Really Moved W&T Offshore Stock Last Week?

W&T Offshore (WTI) stock rose ~7% last week (ended September 29), while crude oil and the SPDR S&P 500 ETF (SPY) rose ~2% and ~0.7%, respectively.

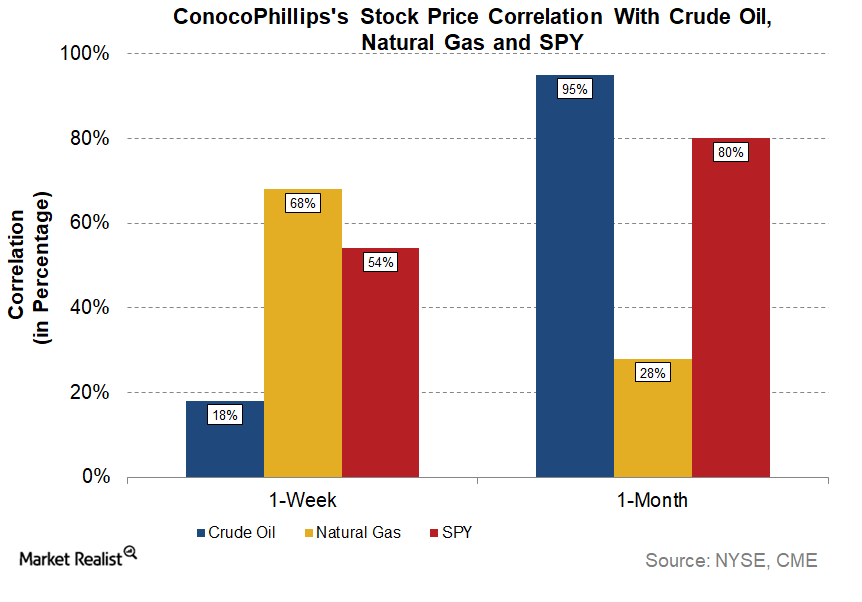

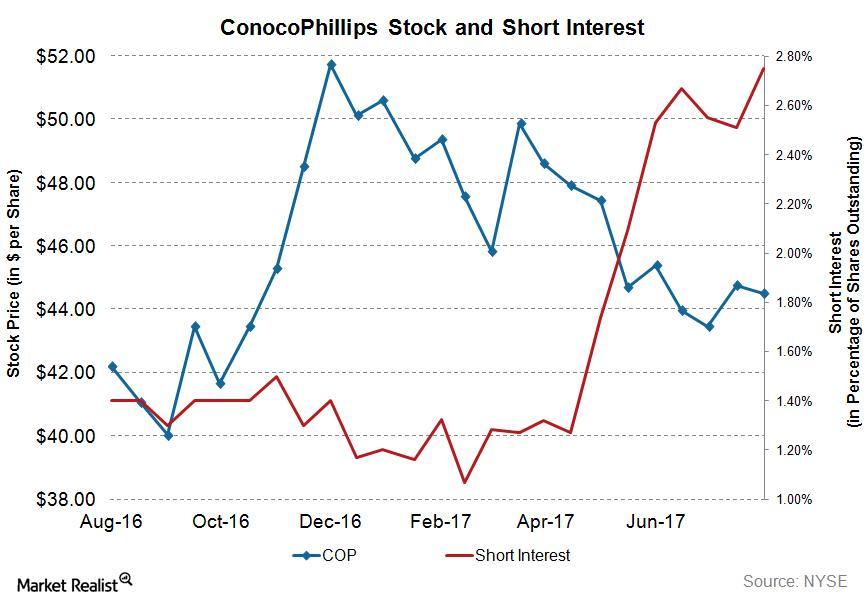

Why ConocoPhillips Stock Moved Last Week

For the week ending September 29, 2017, ConocoPhillips stock had a correlation of ~18% with crude oil (USO) (SCO).

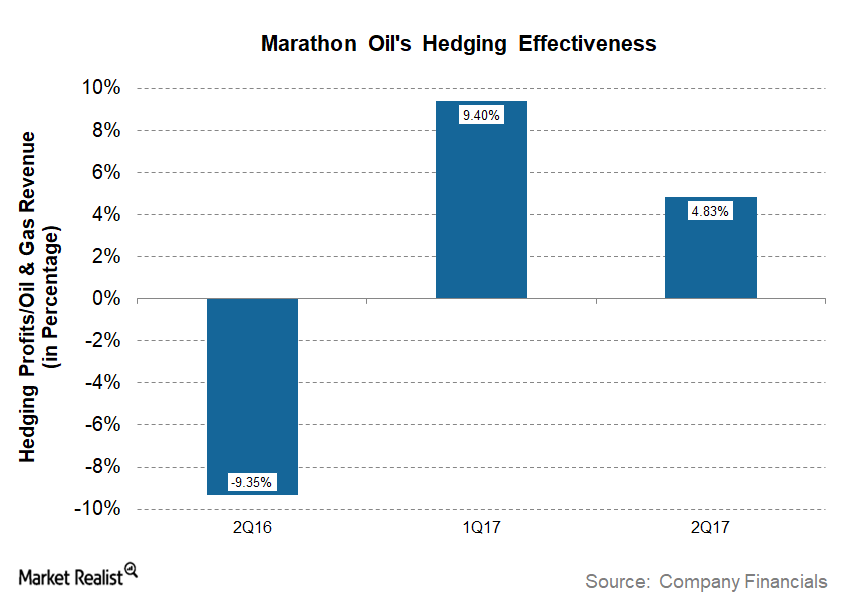

Chart in Focus: Marathon Oil’s Hedging Effectiveness

According to Marathon Oil’s (MRO) financials, MRO reported total (non-cash and cash) gains of ~$43.0 million on its 2Q17 crude oil and natural gas derivatives.

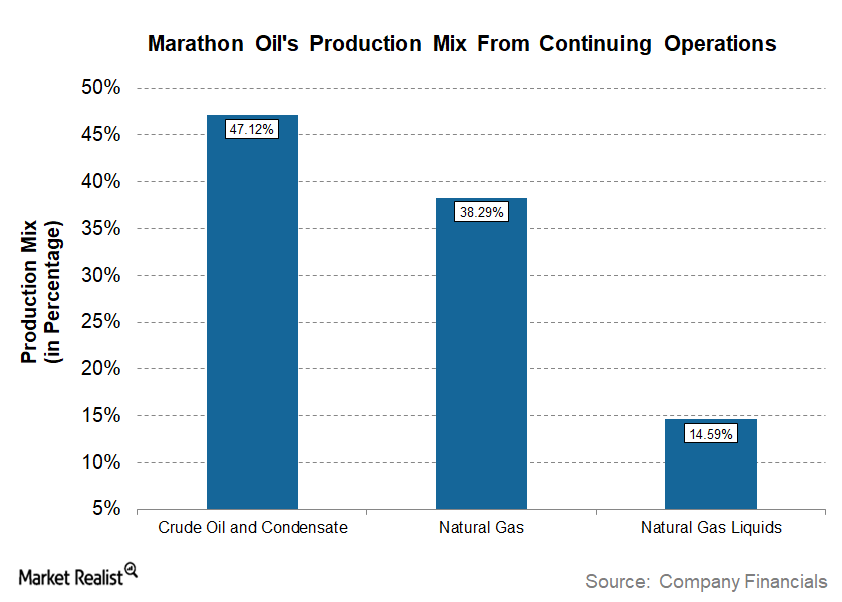

How Marathon Oil’s Divestiture Affected Its Production Mix

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas.

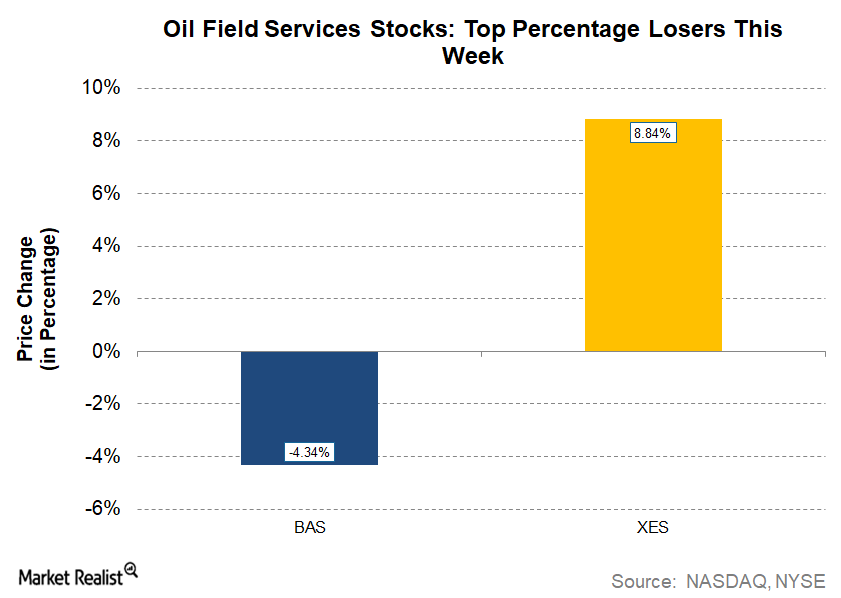

Basic Energy Services: The Only Declining Oilfield Services Stock

In the week starting September 11, Basic Energy Services (BAS) fell from $15.66 to $14.98—a decrease of ~4%.

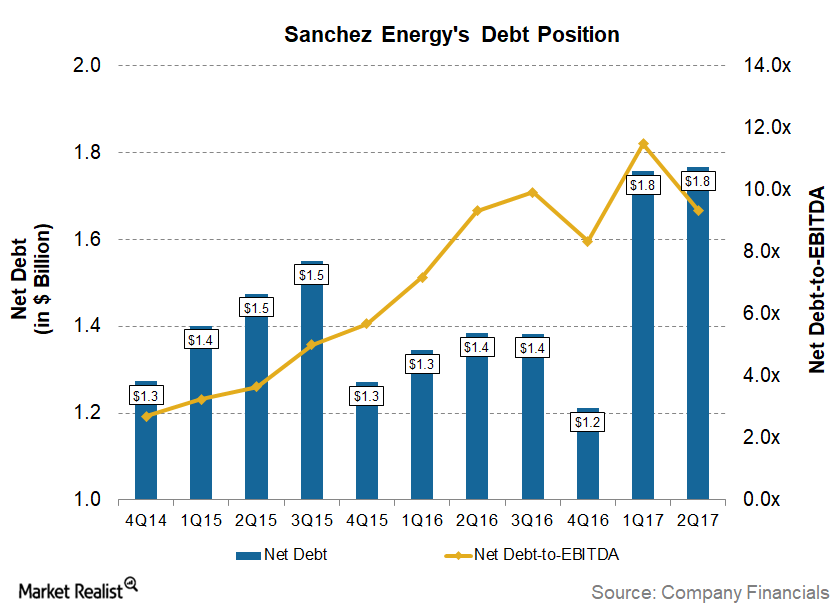

Is Sanchez Energy Repeating an Old Debt Mistake?

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

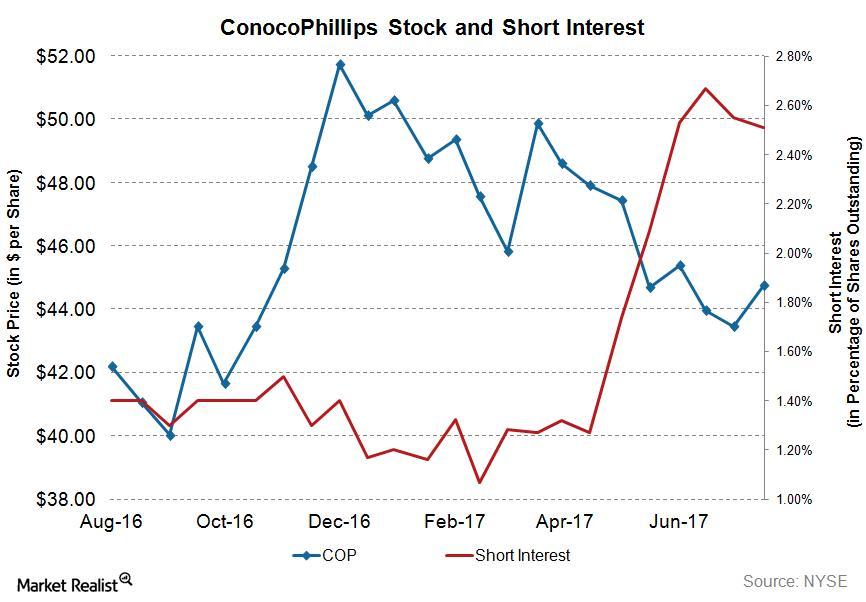

Who’s Shorting COP: Reading the Short Interest in ConocoPhillips’s Stock

Short interest in COP On August 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~33.4 million, while its average daily volume was ~8.02 million. This means the short interest ratio for COP’s stock was ~4.6x. COP’s average daily volume is calculated for the short interest reporting period from August 1, 2017, […]

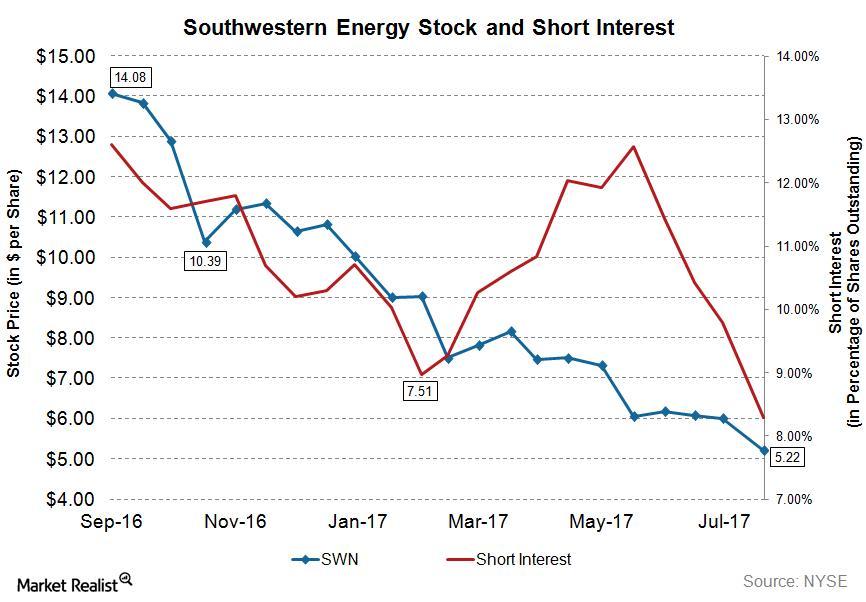

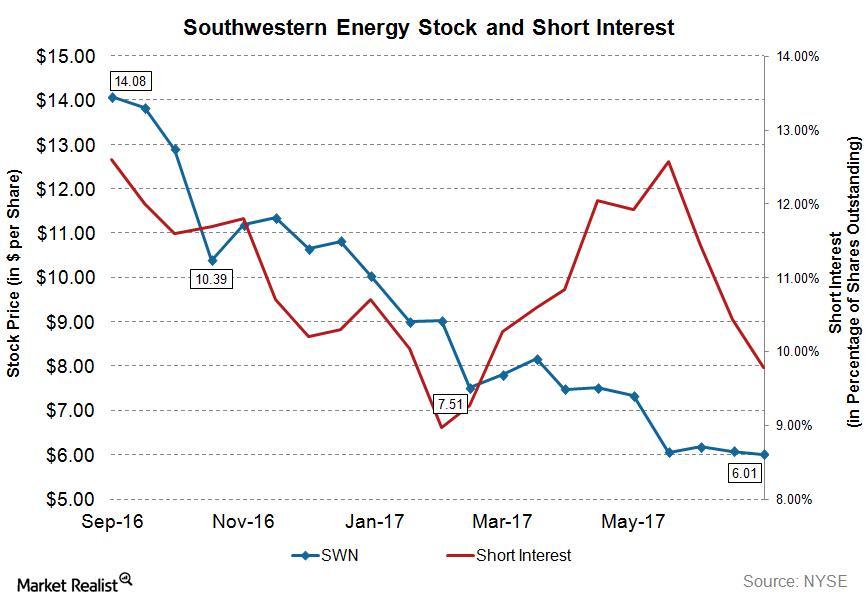

Analyzing the Short Interest in Southwestern Energy Stock

As of August 14, Southwestern Energy’s total shares shorted (or short interest) stood at ~45.89 million, while its average daily volume is ~17.44 million.

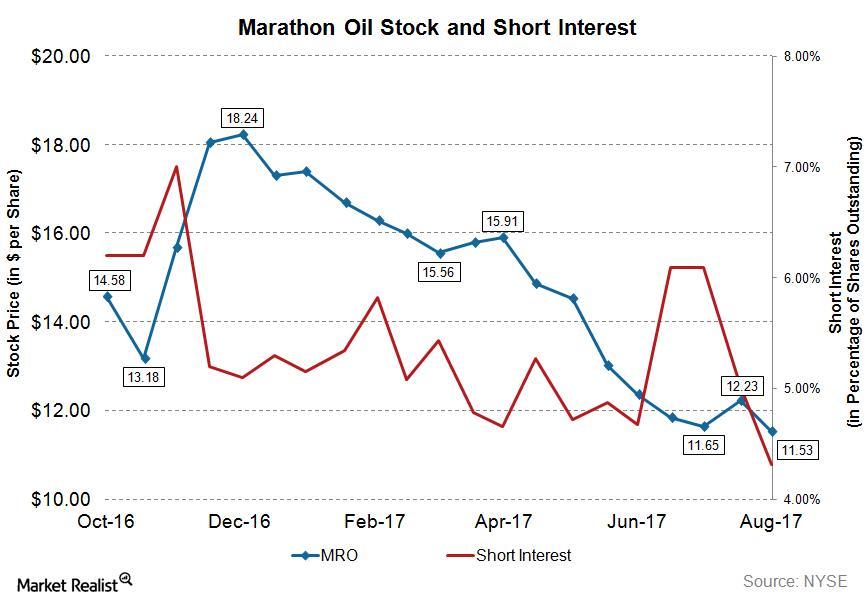

Short Interest in Marathon Oil Stock Remains at Lower Levels

As of August 14, 2017, Marathon Oil’s total shares shorted (or short interest) stood at ~36.65 million, while its average daily volume is ~15.94 million.

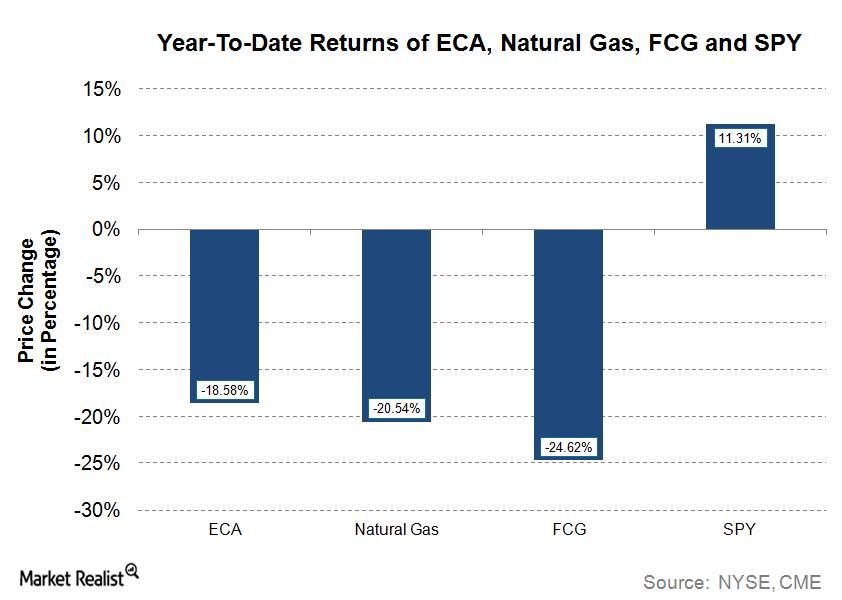

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

Analyzing the Short Interest in ConocoPhillips Stock

As of July 31, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) was ~31.6 million, and its average daily volume was ~8.0 million.

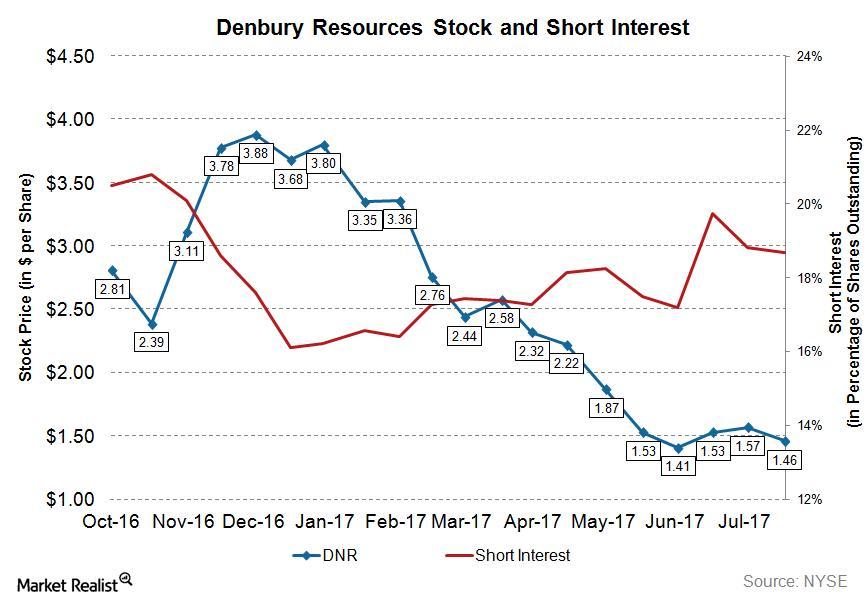

Analyzing Short Interest in Denbury Resources Stock

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x.

What’s the Short Interest in Southwestern Energy Stock?

As of July 14, 2017, Southwestern Energy’s (SWN) total shares shorted (or short interest) stood at ~49.5 million, whereas its average daily volume was ~18.4 million.

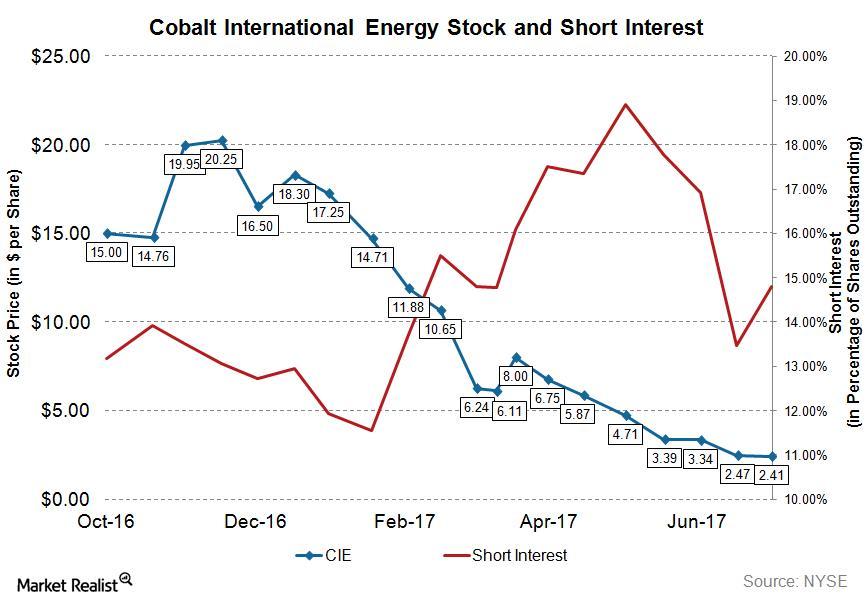

Analyzing Short Interest in Cobalt International Energy’s Stock

As of July 14, 2017, Cobalt International Energy’s (CIE) total shares shorted (or short interest) was 4.37 million, whereas its average daily volume is 1.03 million.

Analyzing Short Interest in Occidental Petroleum Stock

On July 14, 2017, Occidental Petroleum’s (OXY) total shares shorted (or short interest) stood at ~10.9 million, and its average daily volume was ~4.8 million.

Analyzing Marathon Oil’s 2Q17 Revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

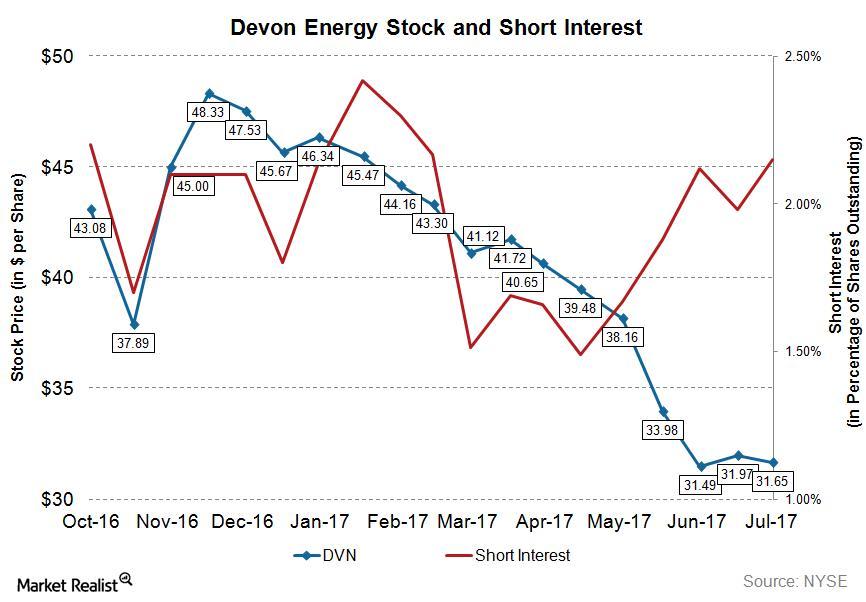

Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.