Analyzing Short Interest in Denbury Resources Stock

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x.

Aug. 14 2017, Updated 10:37 a.m. ET

Short interest in Denbury Resources stock

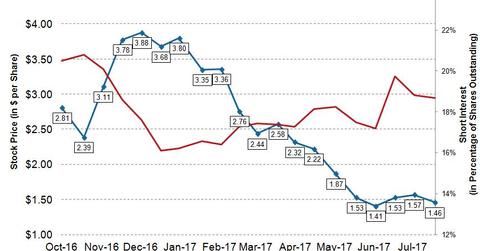

On July 31, 2017, Denbury Resources’ (DNR) total shares shorted (or short interest) stood at ~74.4 million, and its average daily volume is ~6.2 million. So, the short interest ratio for DNR stock is ~12.0x. The average daily volume is calculated for the short interest reporting period of July 16–July 31, 2017.

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x. Denbury Resources’ short interest readings as a percentage of its 20-day average volume, 90-day average volume, and 180-day average volume are ~14.1x, ~12.0x, and ~9.6x, respectively.

When analyzed from the perspective of shares outstanding, current short interest in Denbury Resources stock as a percentage of shares outstanding is ~18.7%. Short interest in Denbury Resources stock as a percentage of shares outstanding is on the higher side when compared with other upstream stocks from the SPDR S&P Oil and Gas Exploration & Production ETF (XOP).

As seen in the chart above, year-to-date short interest in Denbury Resources stock as a percentage of shares outstanding has increased from ~16.1% to ~18.7% in 2017, despite an ~60% decline in DNR’s stock price during the same period.

Other upstream players

Among DNR’s oil and gas exploration and production peers, Devon Energy (DVN), W&T Offshore (WTI), and California Resources (CRC) have short interest as a percentage of shares outstanding of ~1.9%, ~6.0%, and ~39.1%, respectively.

However, W&T Offshore (WTI) and California Resources (CRC) saw an increase in their short interest in the last one-month period. The Direxion Daily Energy Bull 3X ETF (ERX) is a leveraged ETF that invests in domestic companies from the energy sector.