Direxion Dialy Energy Bull 3x Shares

Latest Direxion Dialy Energy Bull 3x Shares News and Updates

Is this Summer a Good Time to Invest in Energy?

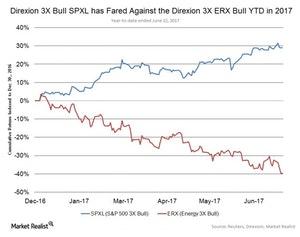

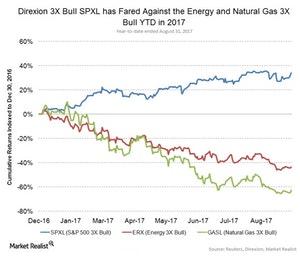

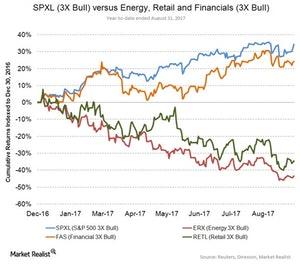

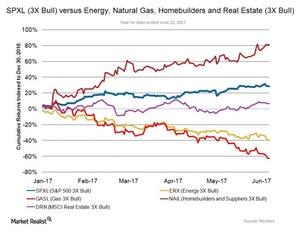

So far this year, the S&P 500 energy sector has struggled mightily, down 12% versus an almost 9.5% gain in the S&P500 this year.

Will US Crude Oil Futures Surpass their 200-Day Moving Average?

Let’s track some important events for oil and gas traders from August 14 to 18, 2017.

Traders Focus on the API and EIA’s Crude Oil Inventories

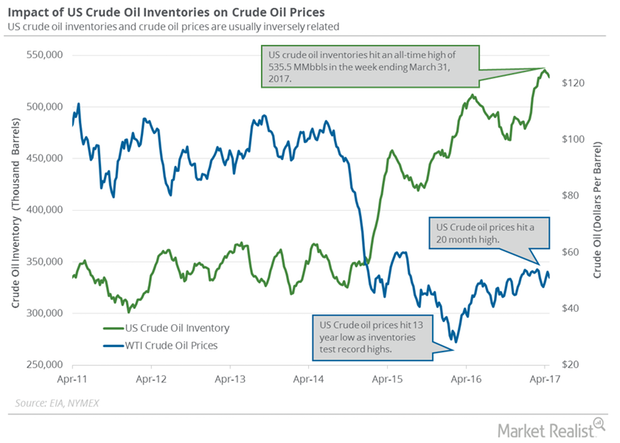

On May 16, 2017, the API released its weekly crude oil inventory report. US crude oil inventories rose by 0.8 MMbbls (million barrels) on May 5–12, 2017.

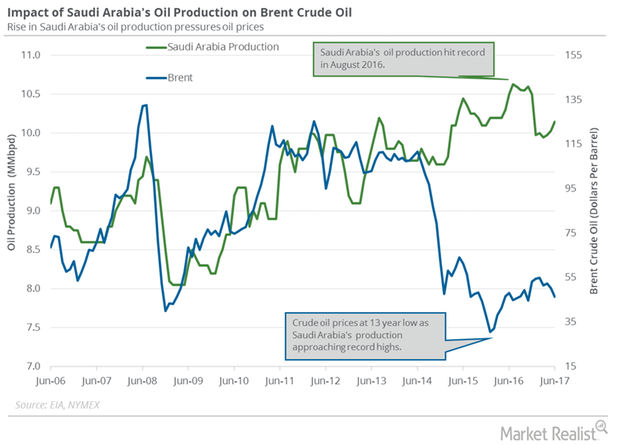

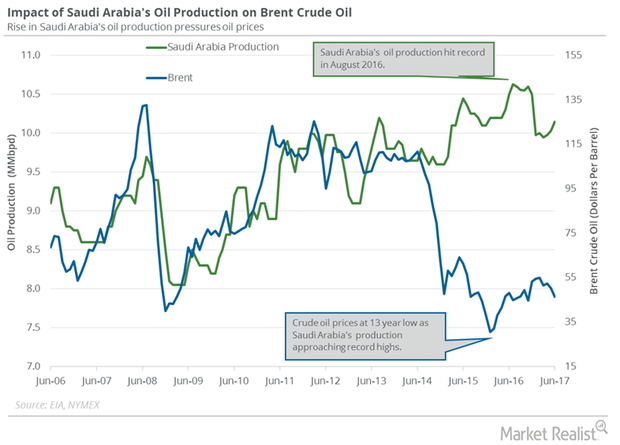

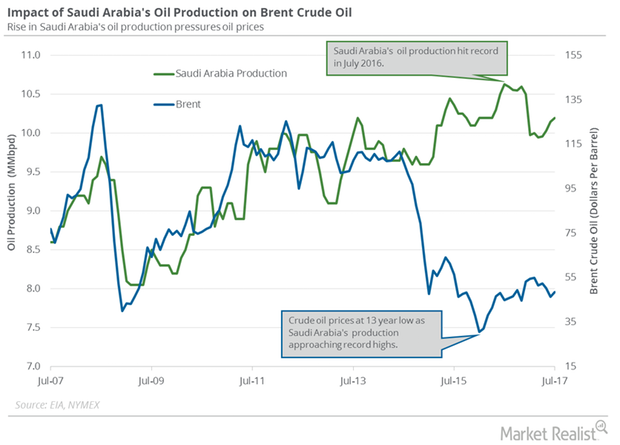

Will Saudi Arabia Remove Excess Oil from the Market?

Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to OPEC’s production cut deal.

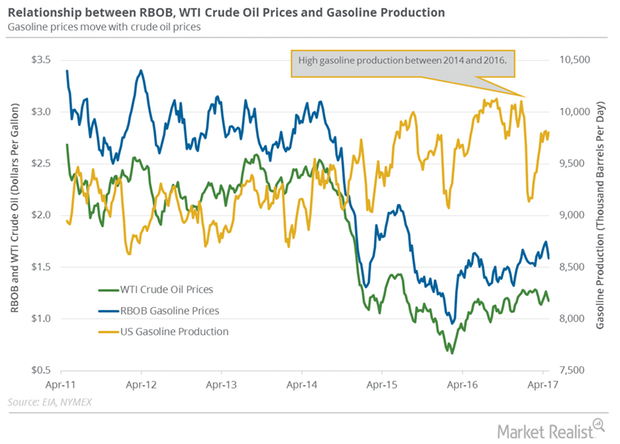

US Crude Oil and Gasoline Futures Moved Together

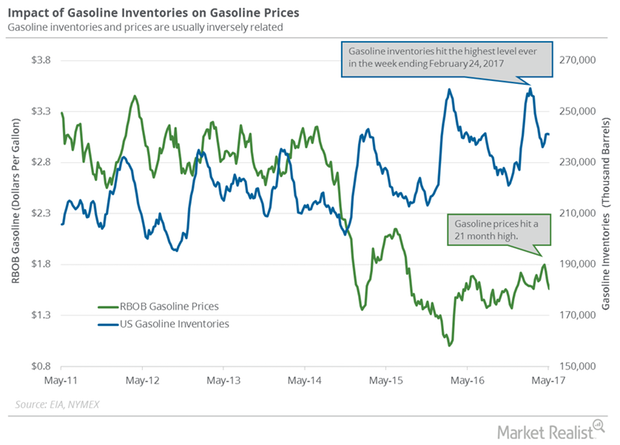

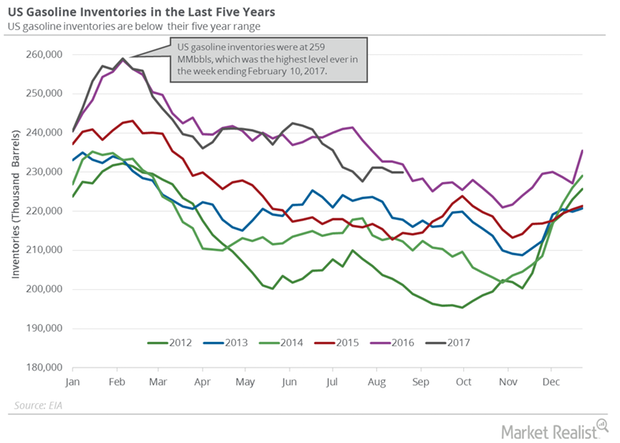

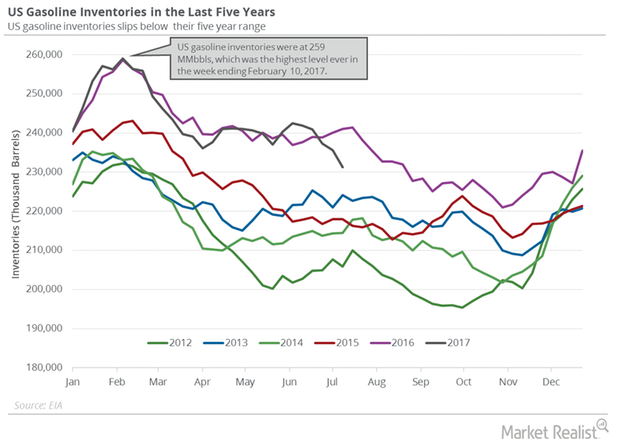

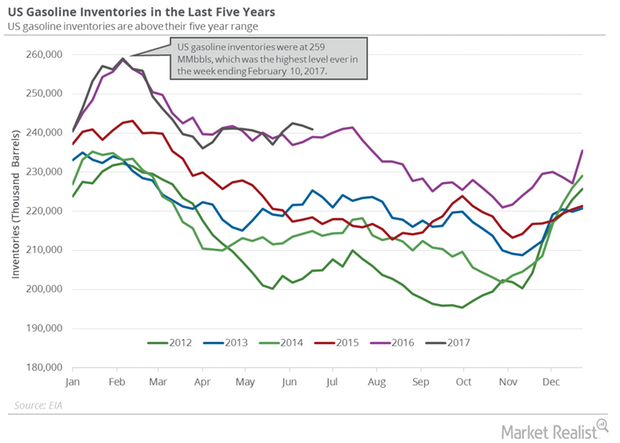

June gasoline futures contracts rose 1.3% to $1.53 per gallon on May 3, 2017. Prices rose due to the less-than-expected rise in US gasoline inventories.

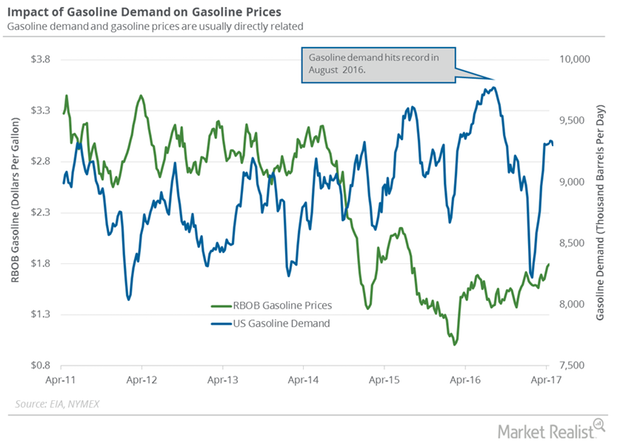

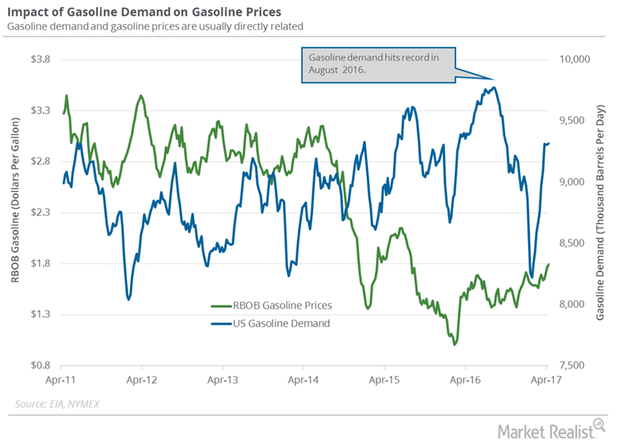

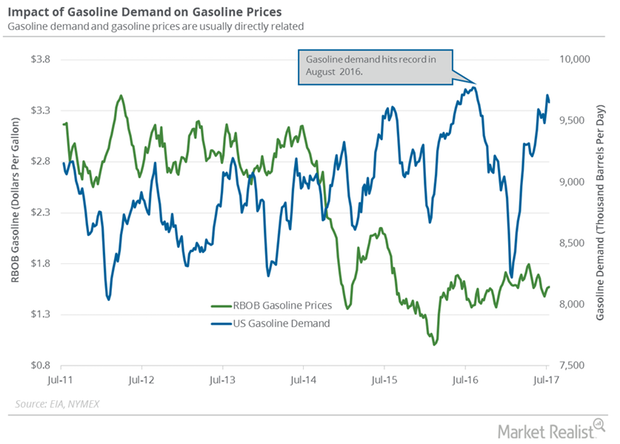

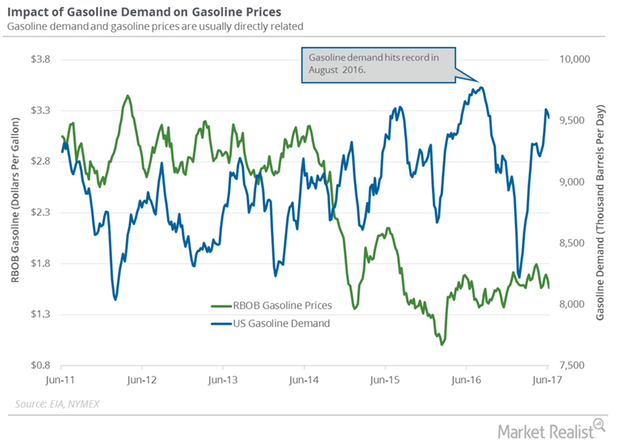

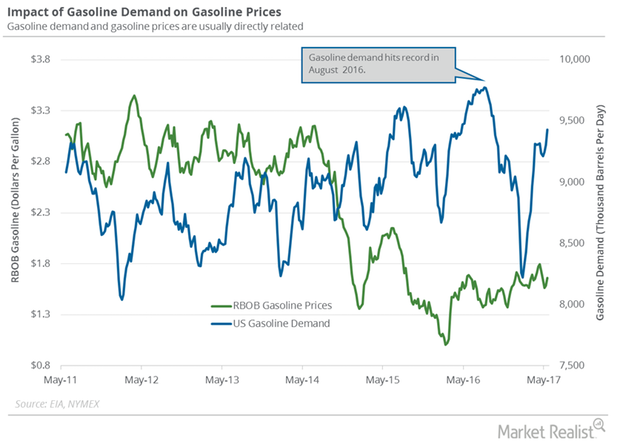

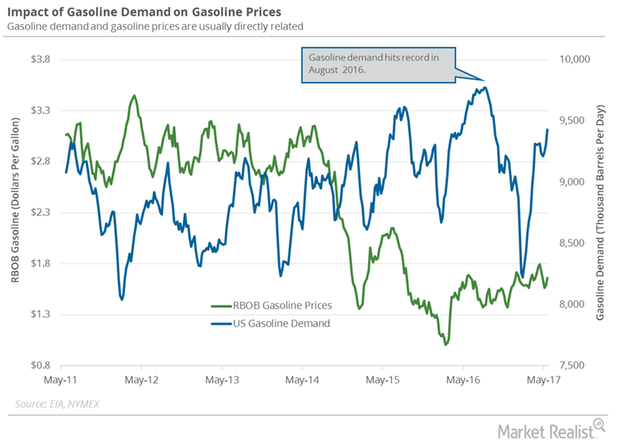

Why Investors Are Tracking US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand fell by 80,000 bpd to 9,237,000 bpd on April 14–21.

Will US Crude Oil Futures Rise above $50 per Barrel This week?

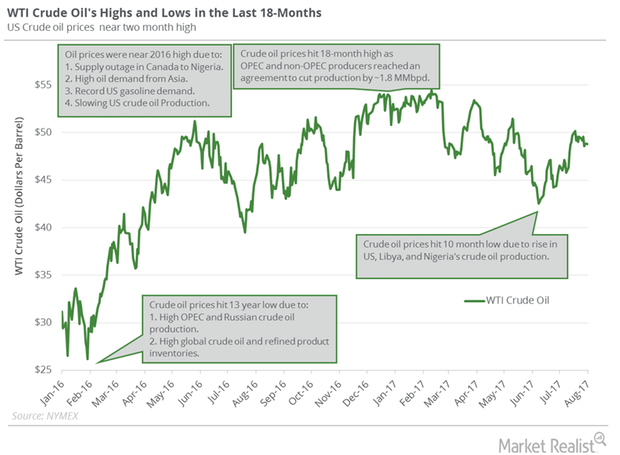

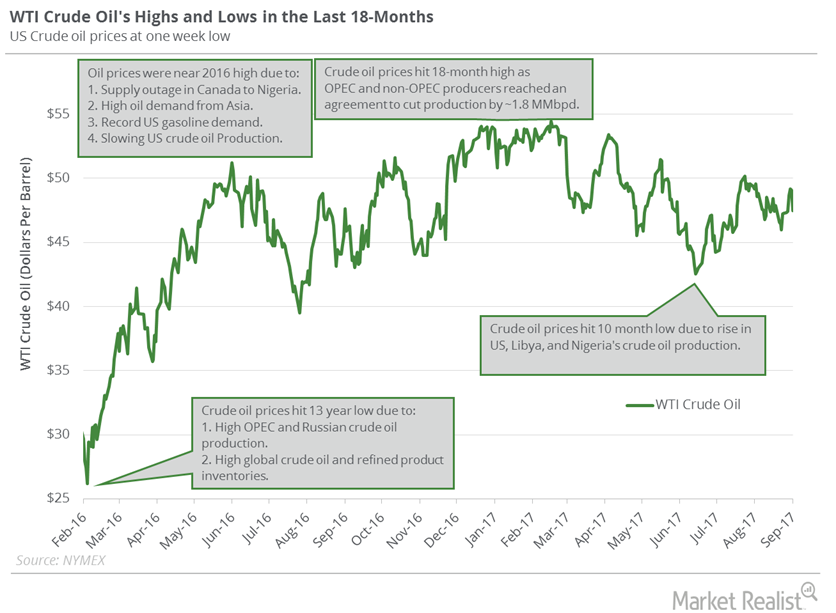

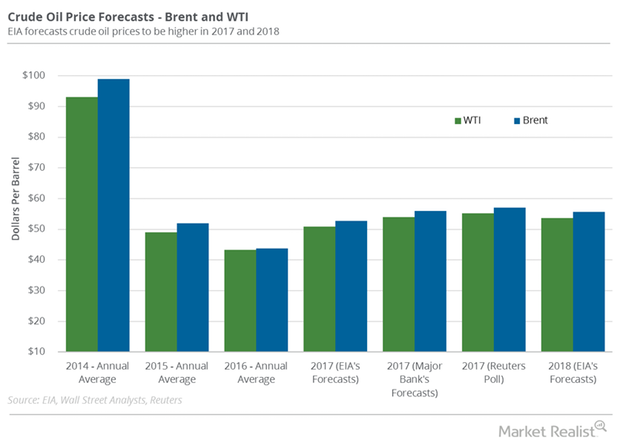

September US crude oil prices are on a rollercoaster ride in 2017 due to bullish and bearish drivers. US crude oil prices are near a two-month high.

Near-Record US Crude Oil Inventory: Will Oil Blood Bath Continue?

June WTI crude oil futures contracts fell 0.40% and were trading at $48.68 per barrel in electronic trade at 2:35 AM EST on May 2, 2017.

Will Saudi Arabia’s Crude Oil Export Plans Rescue Oil Prices?

Saudi Arabia is the largest crude oil producer and exporter among the OPEC (Organization of the Petroleum Exporting Countries) member countries.

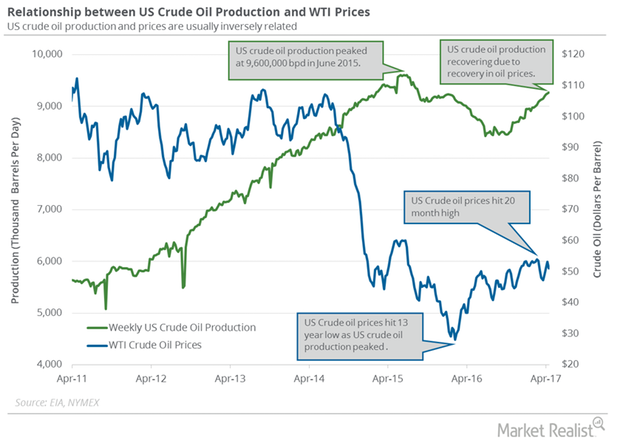

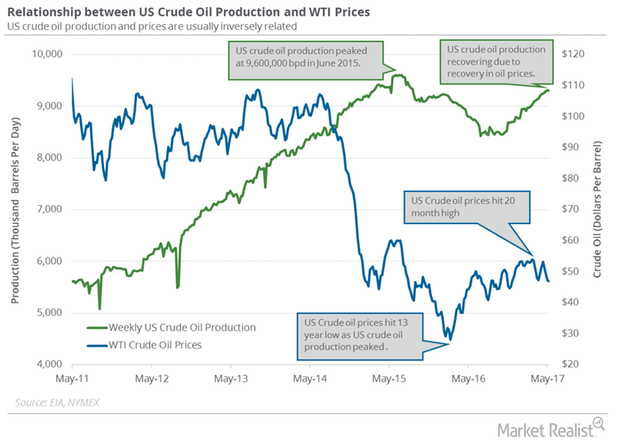

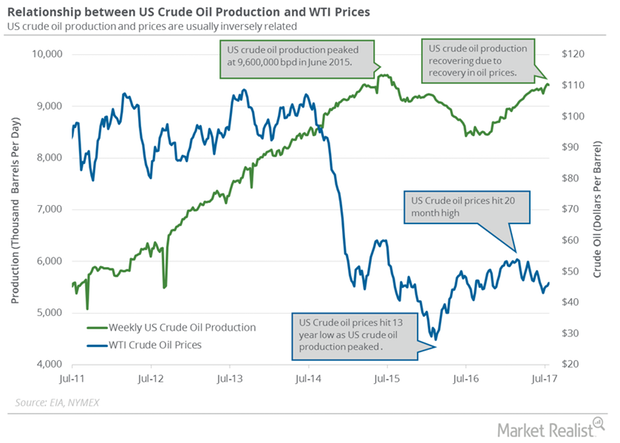

US Crude Oil Production Is near August 2015 High

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

US Gasoline Demand: Bullish or Bearish for Oil Prices?

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand rose by 6,000 bpd to 9,317,000 bpd on April 7–14.

Will Saudi Arabia’s Production and Exports Support Crude Oil Futures?

The EIA (U.S. Energy Information Administration) estimates that Saudi Arabia’s crude oil production rose by 50,000 bpd (barrels per day) to 10.20 MMbpd (million barrels per day) in July 2017 compared to the previous month.

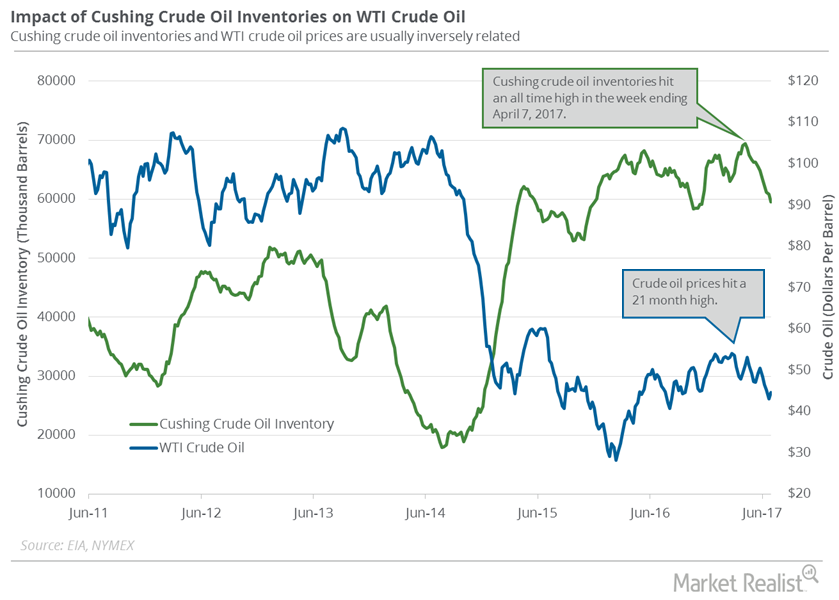

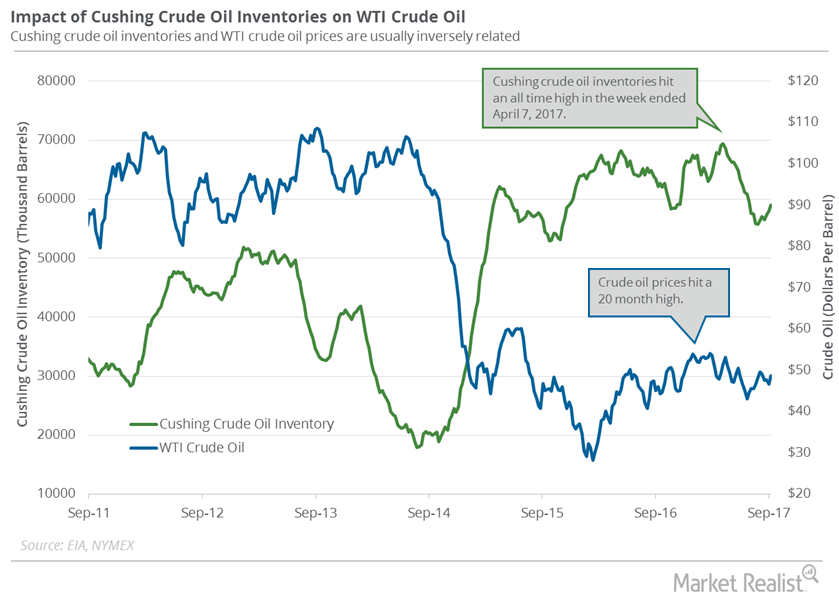

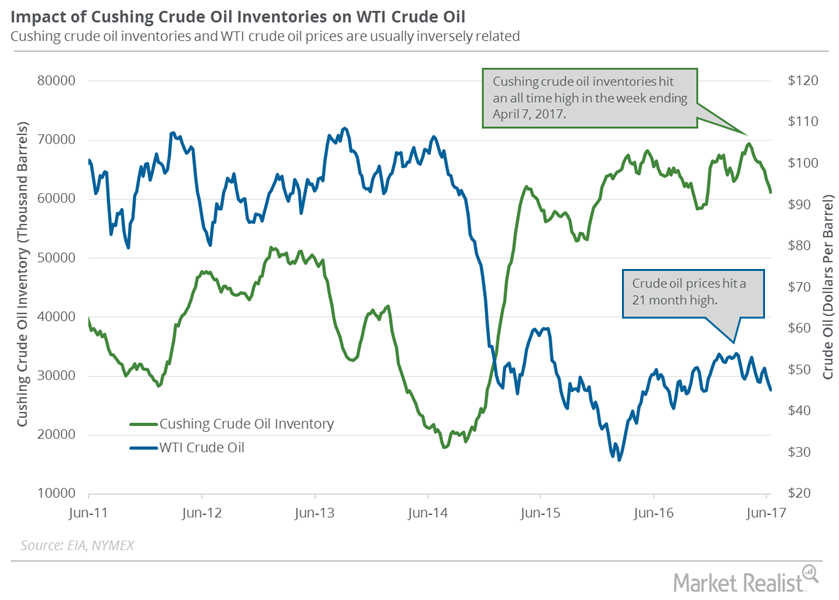

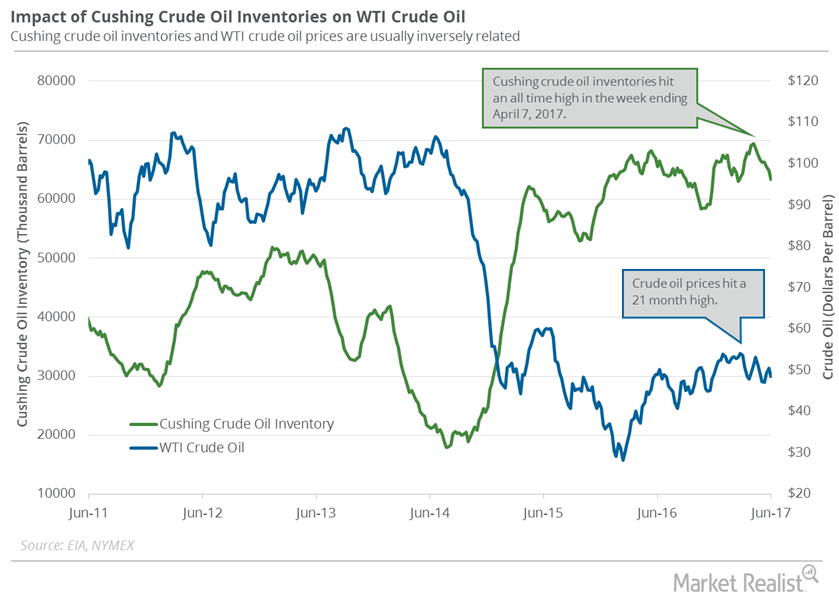

Cushing Inventories: Lowest Level since November 2016

Cushing inventories could have fallen on June 30–July 7, 2017. Crude oil inventories at Cushing have fallen for the seventh straight week.

US Crude Oil Production Fell for the First Time since February

US crude oil production fell by 9,000 bpd to 9,305,000 bpd on May 5–12, 2017. Production fell 0.1% week-over-week, but rose 5.8% year-over-year.

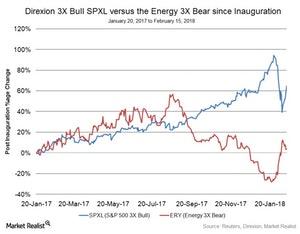

Could Energy Continue Its Wild Ride in 2018?

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time.

Should Energy Stocks Go in Your Back-to-School Shopping Basket?

The energy sector, as tracked by the Energy Select Sector SPDR Fund (XLE), has lost ~17.0% year-to-date as of August 31.

How Did Markets Fare in the Summer of 2017?

Summer months have a tendency to be unfavorable for the stock market. Empirical evidence has shown that average returns for the S&P 500 are negative during summer months.

OPEC’s Crude Oil Production and Exports Impact Crude Oil Prices

The EIA estimates that OPEC’s crude oil production fell by 150,000 bpd to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017.

Cushing Inventories: Bullish or Bearish for Crude Oil Prices?

A market survey estimates that Cushing crude oil inventories has risen between September 8 and September 15.

What to Watch: This Week’s Key Crude Oil Price Drivers

Let’s track some important events for crude oil and natural gas traders from September 11 to 15, 2017.

US Gasoline Futures Hit 2-Year High despite Inventory Rise

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

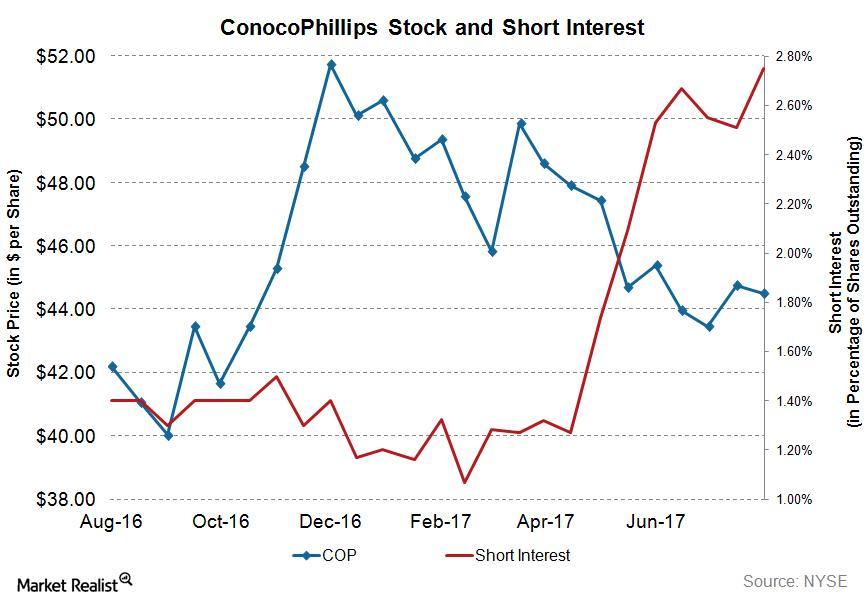

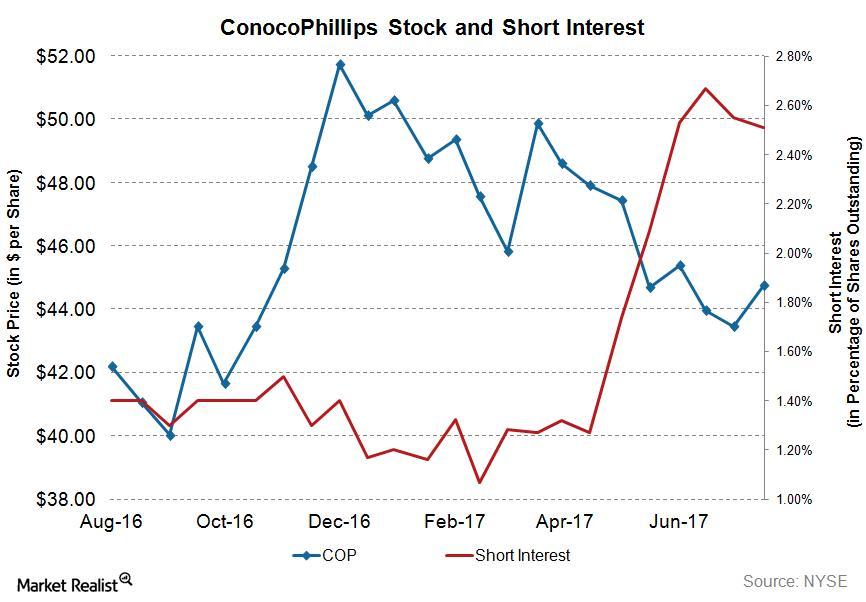

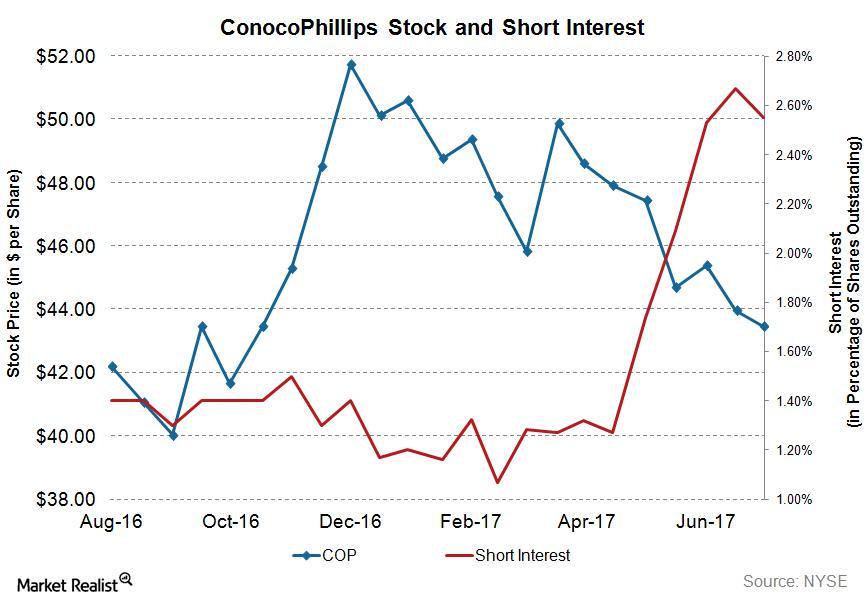

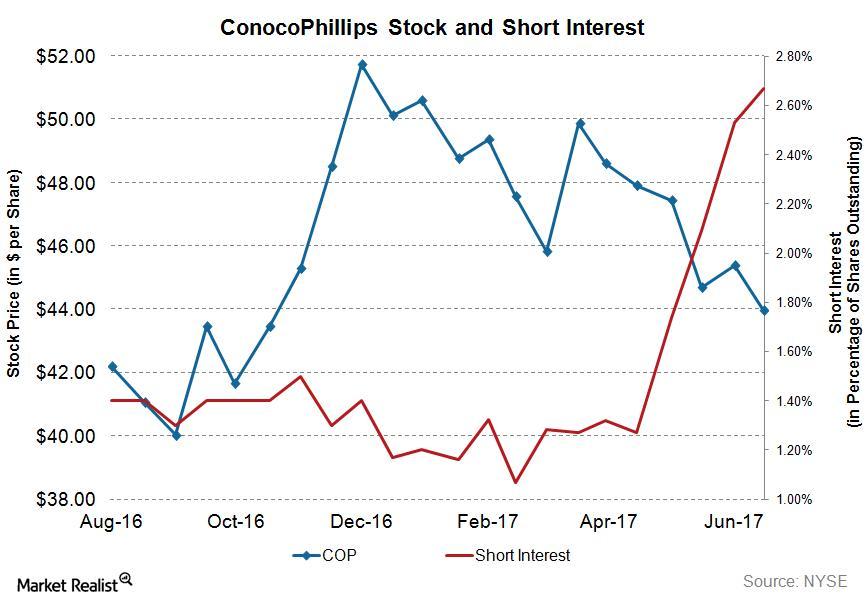

Who’s Shorting COP: Reading the Short Interest in ConocoPhillips’s Stock

Short interest in COP On August 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~33.4 million, while its average daily volume was ~8.02 million. This means the short interest ratio for COP’s stock was ~4.6x. COP’s average daily volume is calculated for the short interest reporting period from August 1, 2017, […]

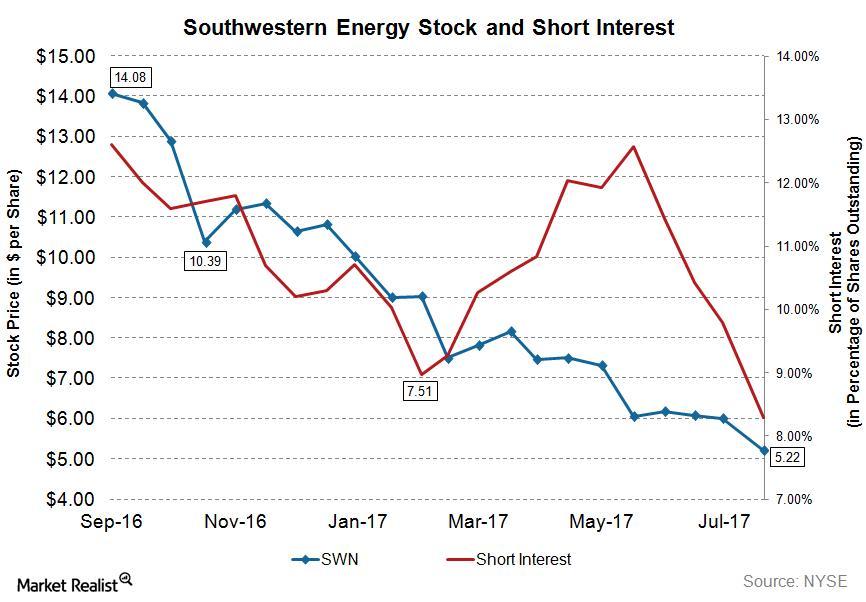

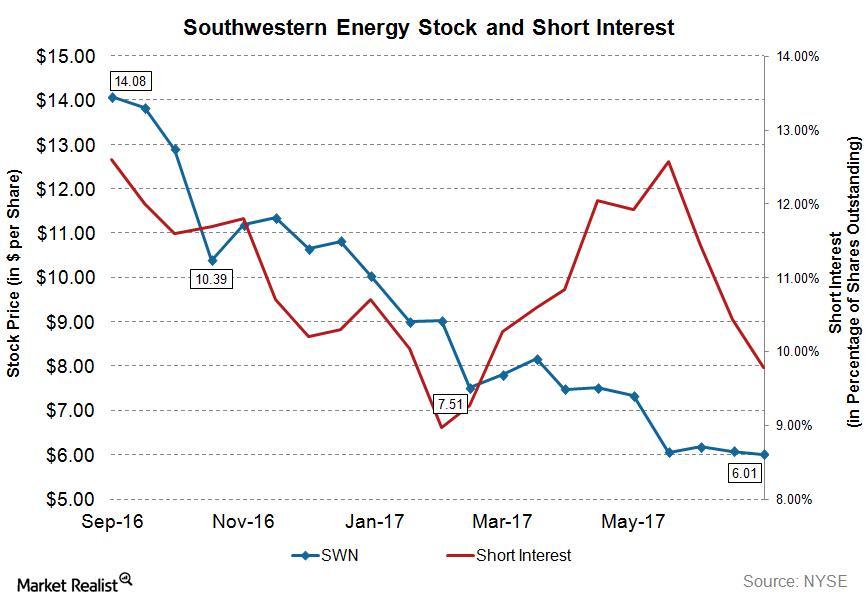

Analyzing the Short Interest in Southwestern Energy Stock

As of August 14, Southwestern Energy’s total shares shorted (or short interest) stood at ~45.89 million, while its average daily volume is ~17.44 million.

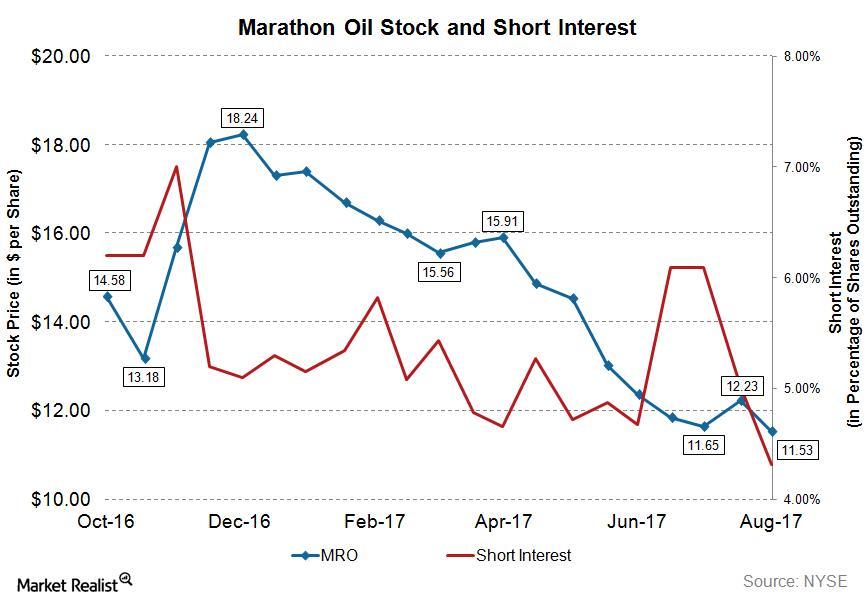

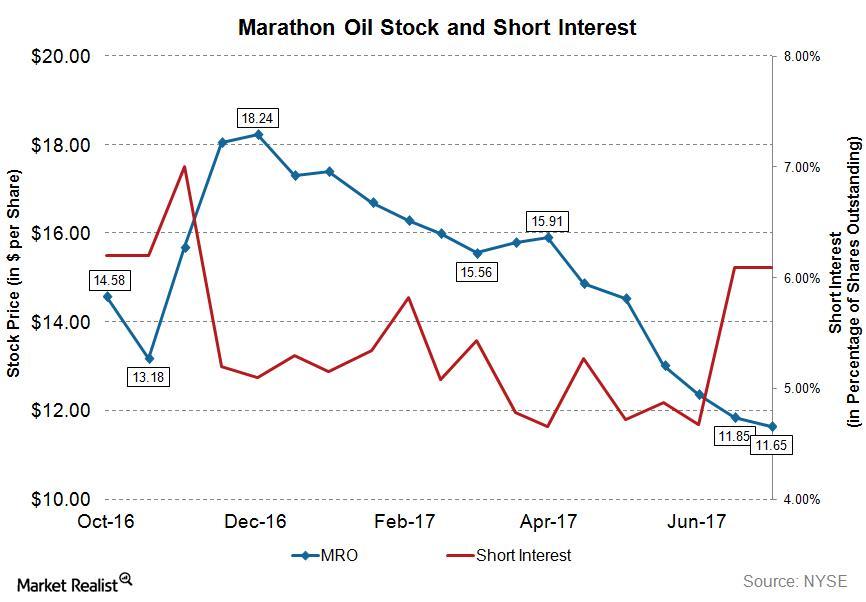

Short Interest in Marathon Oil Stock Remains at Lower Levels

As of August 14, 2017, Marathon Oil’s total shares shorted (or short interest) stood at ~36.65 million, while its average daily volume is ~15.94 million.

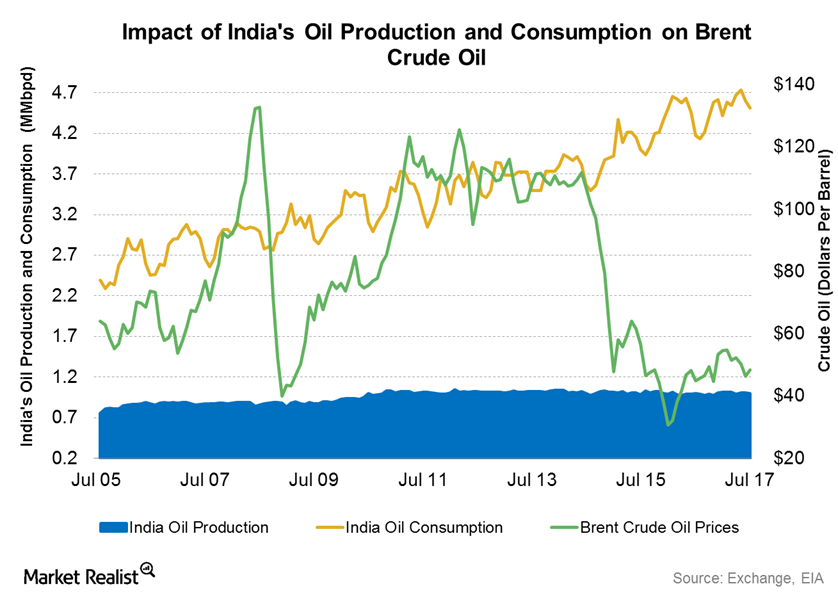

How India’s Crude Oil Imports, Production, Demand Impact Prices

India’s Petroleum Planning and Analysis Cell estimated that the country’s crude oil imports rose 0.60% to 4.2 MMbpd in July 2017 from July 2016.

Analyzing the Short Interest in ConocoPhillips Stock

As of July 31, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) was ~31.6 million, and its average daily volume was ~8.0 million.

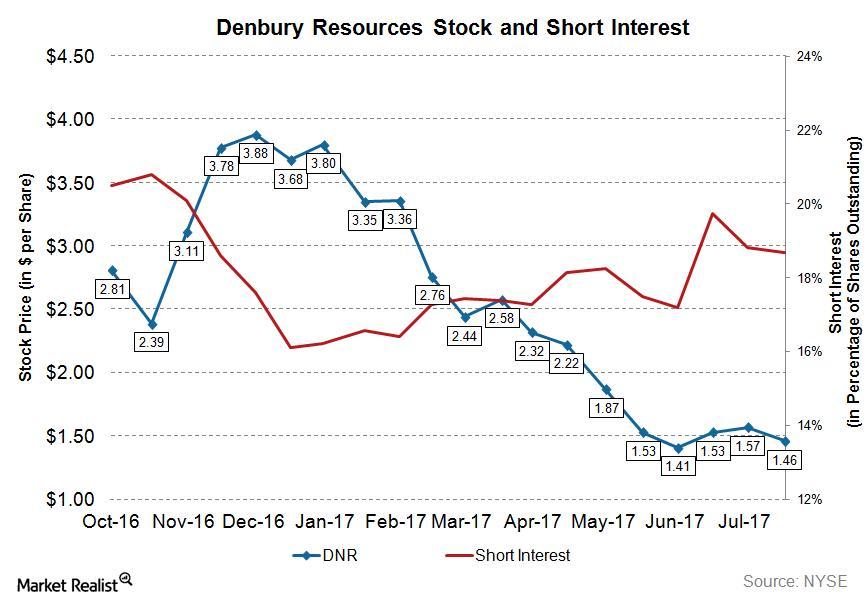

Analyzing Short Interest in Denbury Resources Stock

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x.

What’s the Short Interest in Southwestern Energy Stock?

As of July 14, 2017, Southwestern Energy’s (SWN) total shares shorted (or short interest) stood at ~49.5 million, whereas its average daily volume was ~18.4 million.

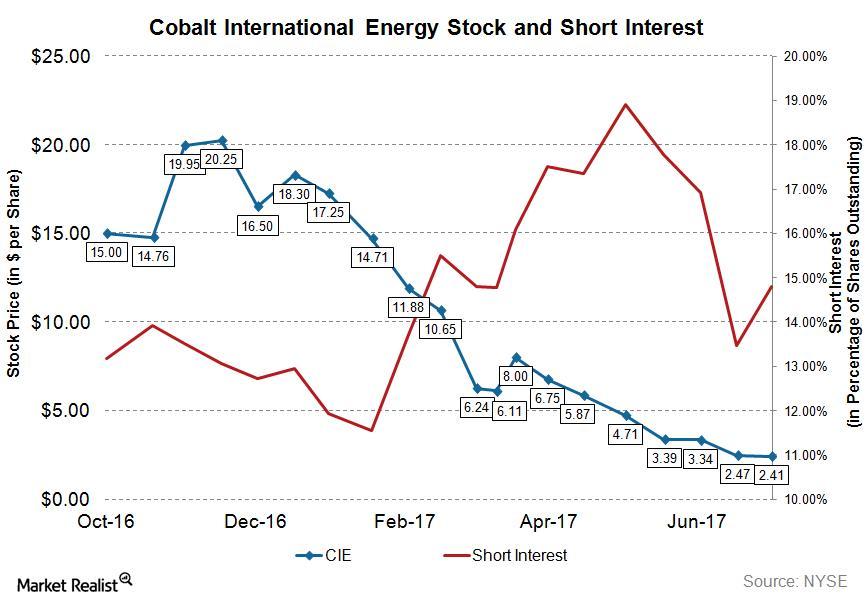

Analyzing Short Interest in Cobalt International Energy’s Stock

As of July 14, 2017, Cobalt International Energy’s (CIE) total shares shorted (or short interest) was 4.37 million, whereas its average daily volume is 1.03 million.

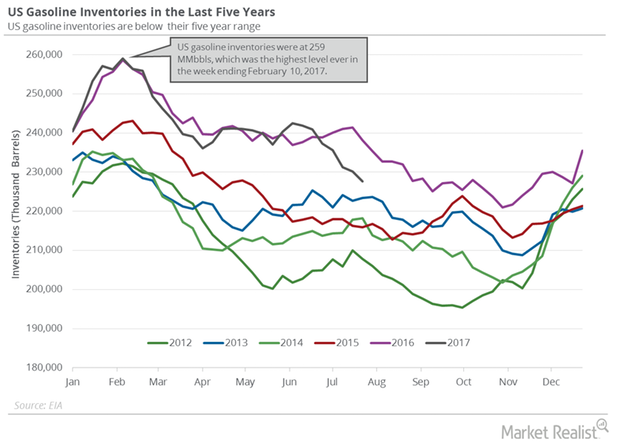

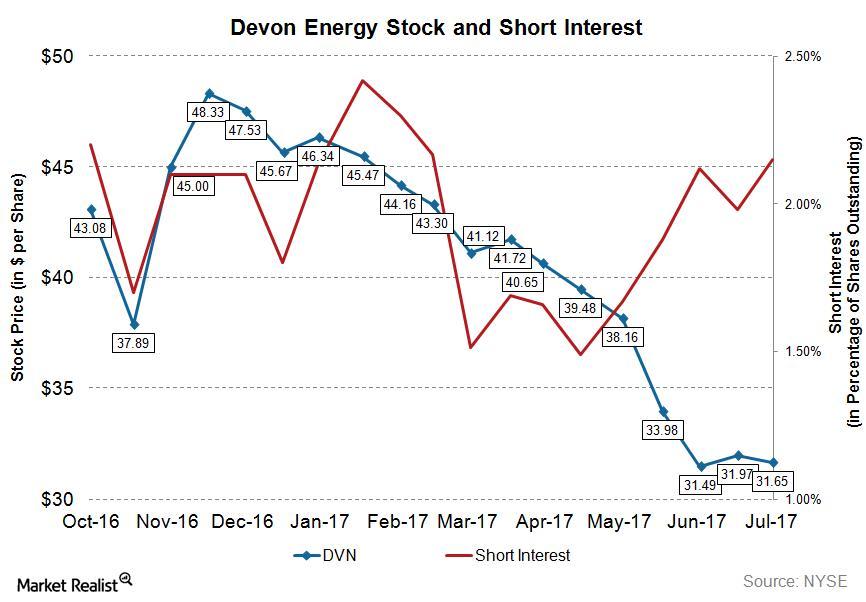

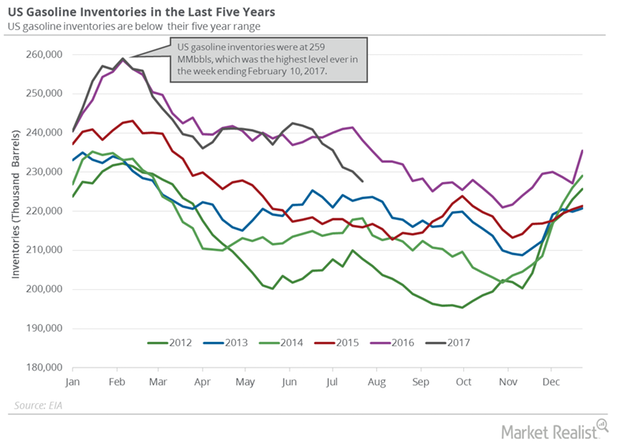

US Gasoline Inventories Limit the Upside for Crude Oil Futures

US gasoline inventories rose by 3.4 MMbbls to 231.1 MMbbls on July 28–August 4, 2017. Inventories rose for the third time in the last ten weeks.

Analyzing Short Interest in Occidental Petroleum Stock

On July 14, 2017, Occidental Petroleum’s (OXY) total shares shorted (or short interest) stood at ~10.9 million, and its average daily volume was ~4.8 million.

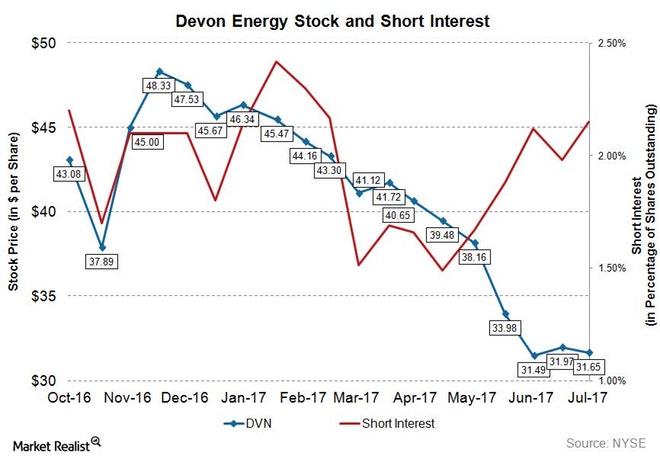

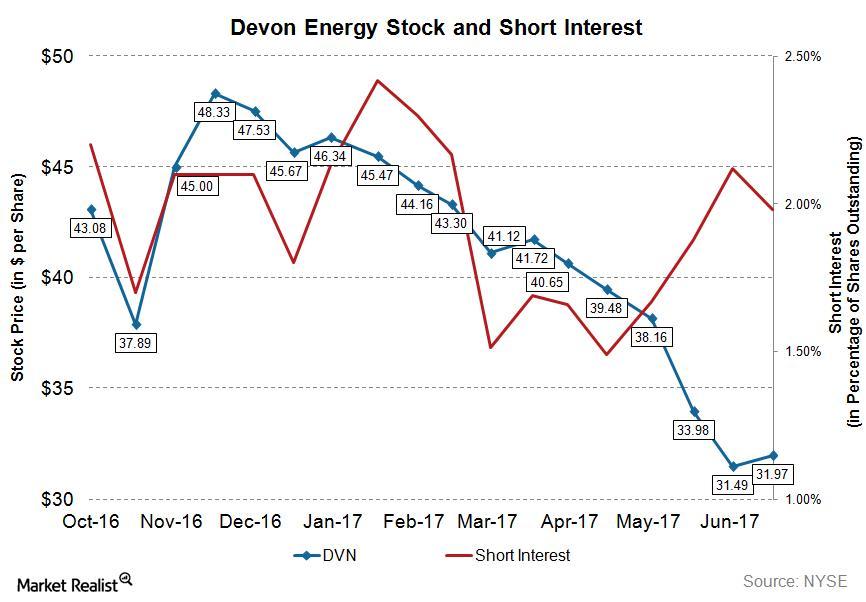

Chart of the Week: What’s the Short Interest in Devon Energy?

As of July 14, 2017, short interest in Devon Energy (DVN) is ~11.3 million shares, while its average daily volume is ~6.2 million shares.

Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.

US Gasoline Inventories Fell, Supported Gasoline Oil Prices

The EIA reported that US gasoline inventories fell 1.1% or by 2.5 MMbbls (million barrels) to 227.7 MMbbls on July 21–28, 2017.

Analyzing Short Interest Trends in ConocoPhillips’s Stock

As of July 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~31.48 million, whereas its average daily volume is ~5.91 million.

Why US Gasoline Demand Rose for 2nd Consecutive Month

The EIA (US Energy Information Administration) estimates that US gasoline demand rose 1.5% to 9.6 MMbpd (million barrels per day) in May 2017 compared to May 2016.

What’s the Short Interest in Marathon Oil Stock?

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million.

Analyzing Short Interest in Devon Energy Stock

As of June 30, 2017, Devon Energy’s (DVN) total shares shorted (or short interest) stood at ~10.4 million, whereas its average daily volume was ~5.9 million.

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

Analyzing Short Interest in ConocoPhillips Stock

On March 31, 2017, 1,282 13F filers held ConocoPhillips (COP) stock in their portfolios. However, only 19 filers featured COP in their top ten holdings.

Analyzing Hedge Funds’ Net Long Position on US Crude Oil

Hedge funds increased their net long positions in US crude oil futures and options by 16,345 contracts to 149,951 contracts on June 27–July 4, 2017.

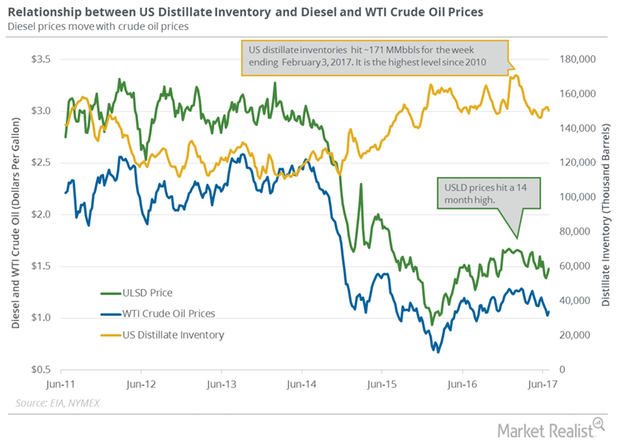

US Distillate Inventories Fell for the Second Straight Week

The EIA reported that US distillate inventories fell by 1.8 MMbbls (million barrels) or 1.2% to 150.4 MMbbls on June 23–30, 2017.

Interesting Options for Summer Investments

Summer is finally here after only nine months of waiting. Now might be a good time to look at investments that have to do with the summer months.

How Long Can US Gasoline Inventories Support Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls to 241 MMbbls on June 16–23, 2017.

US Gasoline Demand: Positive or Negative for Crude Oil?

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd or 6% to 9,816,000 bpd on June 9–16, 2017.

Cushing Inventories Fell for the Ninth Time in 10 Weeks

The EIA (U.S. Energy Information Administration) will release weekly data on crude oil and gasoline inventories on June 28, 2017.

Cushing Crude Oil Inventories Fell Again

A recent survey estimated that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in ten weeks.

US Gasoline Consumption Rose in May

The EIA estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016.

US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.