Is this Summer a Good Time to Invest in Energy?

So far this year, the S&P 500 energy sector has struggled mightily, down 12% versus an almost 9.5% gain in the S&P500 this year.

Nov. 20 2020, Updated 5:05 p.m. ET

Direxion

Road trips and energy investments

So far this year, the S&P 500 energy sector has struggled mightily, down 12% versus an almost 9.5% gain in the S&P500 this year. The main issue has been the huge glut in the oil inventory, which is just off all-time highs at over 511 million barrels. OPEC has been trying to get supplies down but agreeing to cap output, yet countries like Iran want to produce and sell as much as possible. Plus, but the United States has massively added to its own rig count. Since bottoming in June 2016, Baker Hughes estimates that the US rig count has risen from just over 400 to 933.

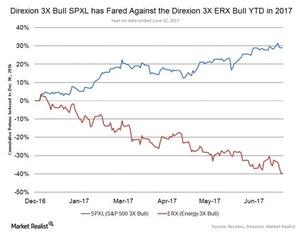

Take a look at how the Direxion 3X Bull SPXL has fared against the Direxion 3X ERX Bull this year in the chart below.

Unlike other market sectors, energy is not at highs. In fact, it’s closer to one-year lows. But do all the summer drivers help? Is it a good time to look at energy for the summer? Interestingly, the answer may be no. In the last ten years, the returns for the S&P500 have averaged -0.45%, -1.71%, and -0.93% in July, August, and September. Apparently, all those road trips either aren’t enough or are already discounted in energy prices as we get into the summer. So are we seeing a bounce-back low with inventories shrinking or an inventory glut and a seasonally bad time to invest? Either way, Direxion has you covered with ERX (3X Bull) and ERY (3X Bear).

Market Realist

Is energy at its worst?

The Energy Select Sector SPDR Fund (XLE) tracks the performance of the S&P 500 Energy Index. The sector has been at its worst this year, losing 15% year-to-date (or YTD) as of June 22. The Daily Energy Bull 3X ETF (ERX) has also underperformed the 3X Bull S&P500 (SPXL)(SPY) (SPX-Index) year-to-date.

Oversupply in the crude oil market has been weighing on crude oil prices, pulling down energy returns. The Organization of the Petroleum Exporting Countries (OPEC) had announced production cuts of 1.2 million barrels a day for the next six months. Recently, OPEC extended its production cut to nine months by 1.8 million barrels per day. The purpose of this cut is mainly to eliminate oil oversupply and boost prices.

The increase in US crude oil production is adding to the pressure on oil prices. US Energy Information Administration (or EIA) data forecasts that US crude oil production will reach 9.3 million barrels per day in 2017 and 10 million barrels per day in 2018 on average, which is higher than 2016 production levels. This change could mean extensive damage to crude oil prices.

Historical data from Direxion have shown that the energy sector underperforms in summer, delivering returns of -0.35% on average. OPEC’s production cut and President Trump’s proposal of easing regulatory restrictions on crude oil could help the supply and demand balance, benefitting the energy sector.

Moreover, other factors also determine oil prices and affect the energy sector. They include global economic growth, geopolitical and economic events, and unplanned supply disruptions. In any case, investors can be ready with Direxion’s Daily Energy 3X Bull (ERX) and Bear 3X ETF (ERY).