Direxion Daily S&P500® Bull 3X ETF

Latest Direxion Daily S&P500® Bull 3X ETF News and Updates

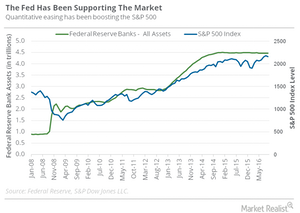

Jeffrey Gundlach: The Fed Has Been Supporting the S&P 500

Gundlach also believes it’s interesting to look at the correlation between the size of the Fed’s balance sheet and the S&P 500 (SPY) (SPXS) (SPXL) level.

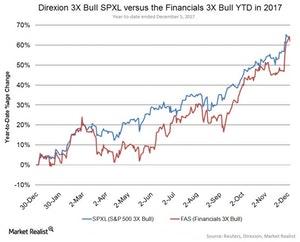

What Helped the Financial Sector in 2017?

Interestingly for all the talk about financials this year, the S&P 500 GICS Level 1 Financial Sector is only up 19% vs. 17%+ for the S&P500 as a whole.

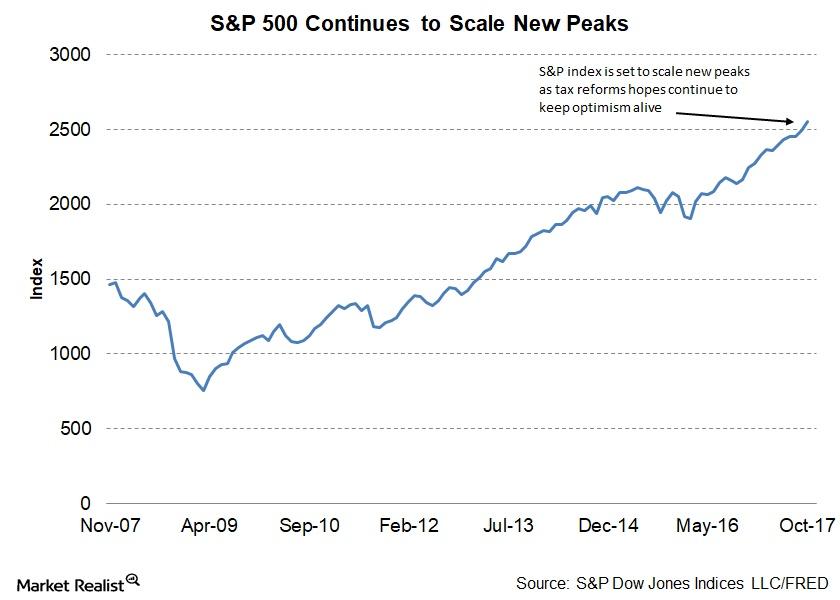

Why the S&P 500 Index Is Considered a Leading Indicator

The S&P 500 Index has risen 2.2% in October and is en route to its eighth straight positive monthly close.

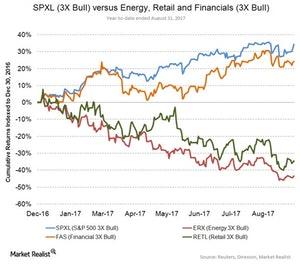

How Did Markets Fare in the Summer of 2017?

Summer months have a tendency to be unfavorable for the stock market. Empirical evidence has shown that average returns for the S&P 500 are negative during summer months.

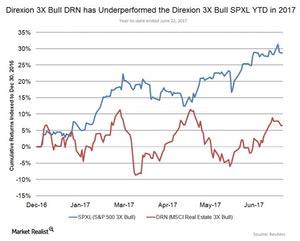

Will the Real Estate Sector Shine Thrive this Summer?

Another important summer activity is shopping for a new home. Realtors often talk of curb appeal, and there’s no better time than summer.

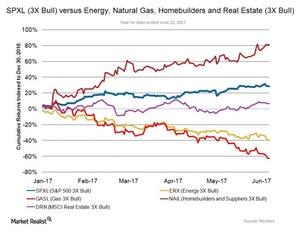

Interesting Options for Summer Investments

Summer is finally here after only nine months of waiting. Now might be a good time to look at investments that have to do with the summer months.

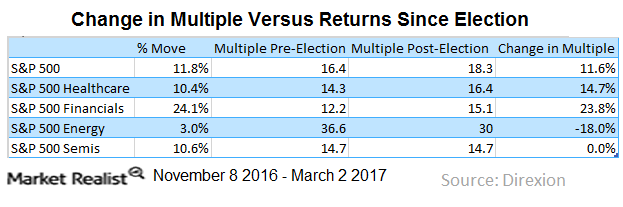

How Trump’s Proposed Policies Have Caused Sector Divergence

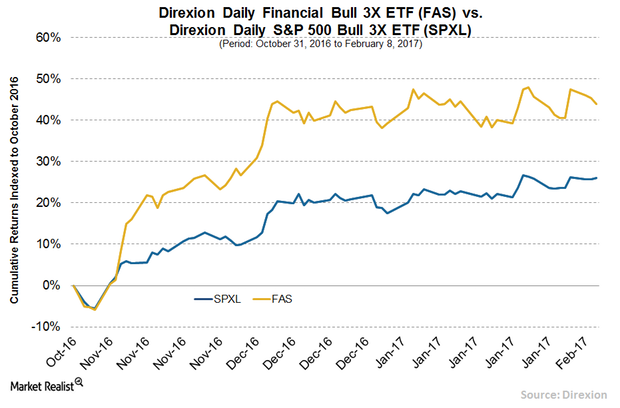

Despite the stellar run that financials (FAS) have had since the US elections in November 2016, financials are trading at very reasonable levels.

How the Removal of Dodd-Frank Could Affect Banks

While the Dodd-Frank Act was passed to avoid another financial crisis, it has crippled banks’ profitabilities over the years due to higher capital requirements.

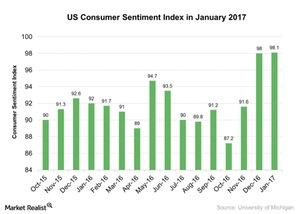

What Does the Rising US Consumer Sentiment Index Mean for the Economy?

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

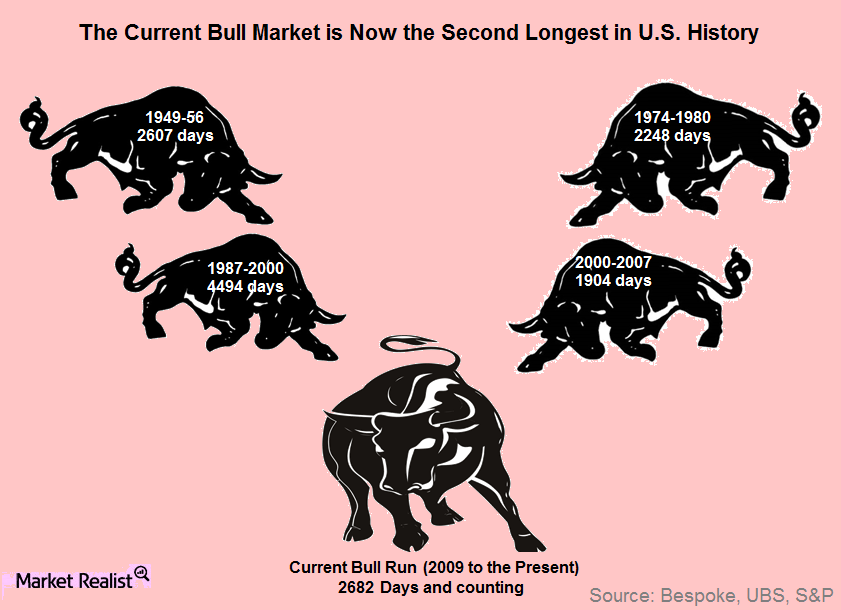

Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

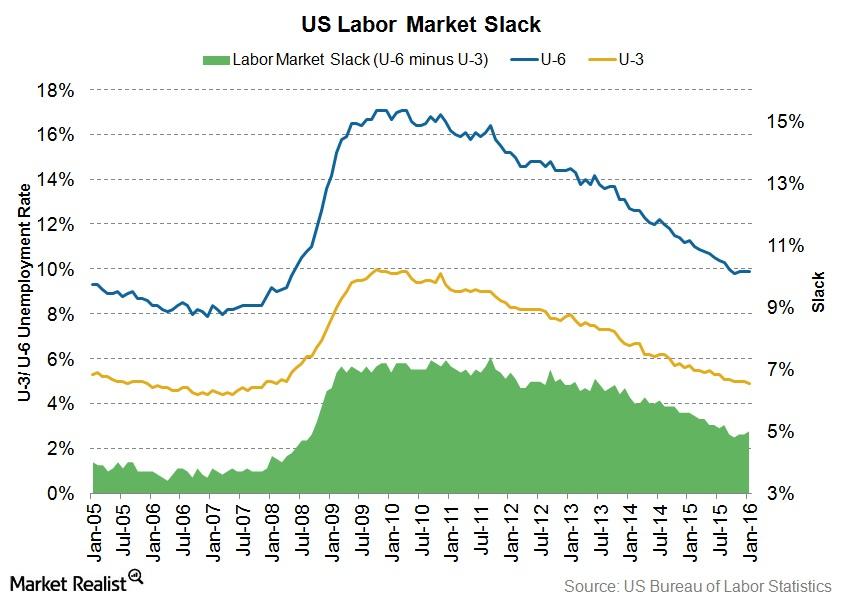

What Is Labor Market Slack?

The unemployment rate doesn’t help us gauge the extent of labor market slack. The actual employment gap that exists also consists of a slack component.