What Helped the Financial Sector in 2017?

Interestingly for all the talk about financials this year, the S&P 500 GICS Level 1 Financial Sector is only up 19% vs. 17%+ for the S&P500 as a whole.

By Direxion

Dec. 25 2017, Updated 9:03 a.m. ET

Direxion

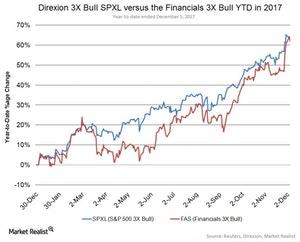

Interestingly, with much talk about financials this year, the S&P 500 GICS Level 1 Financial Sector is only up 19% vs. 17%+ for the S&P 500® Index as a whole. That translates to a solid 62% for the Direxion Daily Financial Bull 3X Shares (FAS), but look how closely that tracks SPXL. 2017 has been a good solid long trade this year, but could it have been better and can it continue in 2018? Again, financials have benefitted from a solid economy. Furthermore, there is still the specter of decreased regulations unleashing the power of banks’ balance sheets. Finally, tax cuts would also be beneficial to the space. and stocks are relatively cheap. The S&P 500 GICS Level 1 Financial Sector is trading at only 15.4X FTM earnings estimates, however. So what has gone wrong? One of the big issues for banks has been low volatility and continued double-digit drops in trading volume. Also as rates creep up, refis tend to slow down, even if home purchases have not. With financials at a ten-year high, should you follow the trend or bet the other way? Both FAS and FAZ 3X Bear Financial from Direxion give you a tool to express your investing view. Market Realist Financials going the right way? The US financial sector (XLF) has enjoyed good returns in 2017. Donald Trump’s victory in the presidential election led to hopes of lighter regulations for the sectors. Plus, President Trump’s proposal to abolish the Dodd-Frank Act and Consumer Protection Act and replace it with new policies proved advantageous to the sector. The Fed’s gradual rate hike process and stronger earnings also contributed to the performance. As of December 12, the sector has risen 20% year-to-date. The chart below shows the performance of the financial sector in 2017. In a note to clients in October, Credit Suisse strategist Jonathan Golub stated that he sees more potential in the financial sector and that deregulation could benefit the sector, leading it to outperform the broader market (SPY)(SPX-INDEX). The strategist gave “overweight” ratings to financial stocks. Expectations from the financial sector According to a December 8 Factset report, the financial sector is expected to show year-over-year earnings growth of 12.3% for 4Q17. Plus, President Trump’s proposed reduction of the corporate tax rate from 35% to 20% could be advantageous for the financial sector. With a fall in the tax rate, lending activity could increase in banks, leading to an increase in banks’ net interest income. The possibility of another rate hike in December is also making the financial sector more attractive to investors. The Direxion Daily Financial Bull 3X ETF (FAS) aims to magnify the daily performance of the Russell 1000 Financial Services Index. It had fruitful returns this year. As of December 5, the ETF has returned 62.2%, compared to a 61% gain for the S&P 500 3X Bull (SPXL). Whether or not the financial sector can sustain the heat in 2018 depends on easing regulations, Fed rate hikes, and earnings growth. Either way, Direxion has options to choose from with the Daily Financial 3X Bull (FAS) and the Daily Financial 3X Bear (FAZ).

Article continues below advertisement