W&T Offshore Inc

Latest W&T Offshore Inc News and Updates

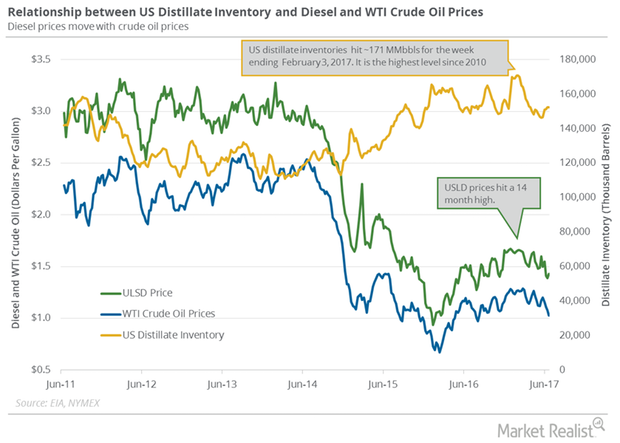

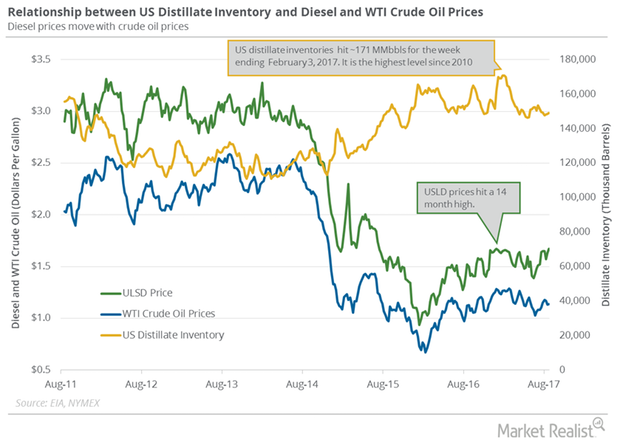

US Distillate Inventories Fell for the First Time in 5 Weeks

The fall in distillate inventories supported diesel and crude oil futures on June 28, 2017. US diesel futures rose 1.4% to $1.43 per gallon on June 28.

Airline Stocks in Focus as US Airstrike Lifts Oil Prices

The US airline stocks are in focus as crude oil prices soar after the US assassinated a top Iranian military commander last Thursday night.

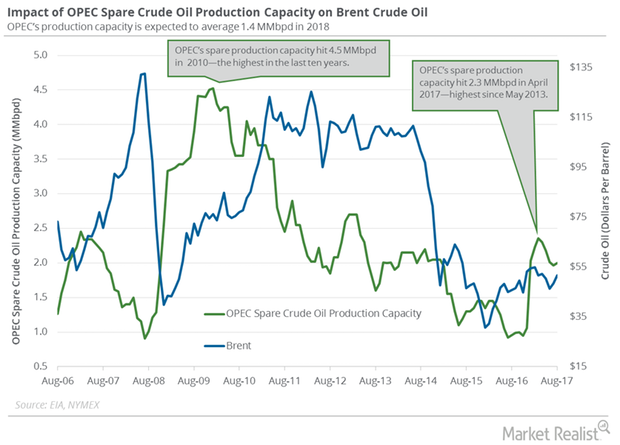

How OPEC’s Spare Crude Oil Production Capacity Is Recovering

The EIA estimates that OPEC’s spare crude oil production capacity rose 35,000 bpd (barrels per day) to 2 MMbpd (million barrels per day) in August 2017.

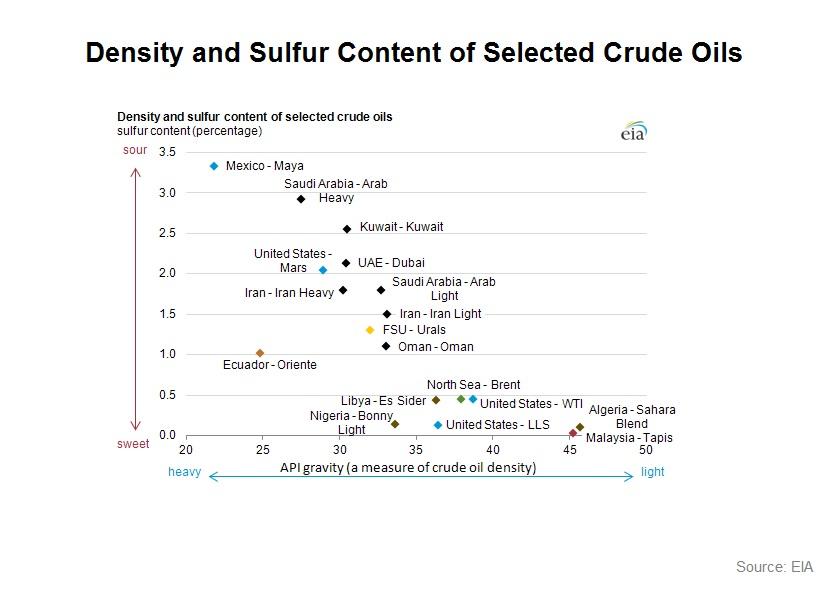

All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.

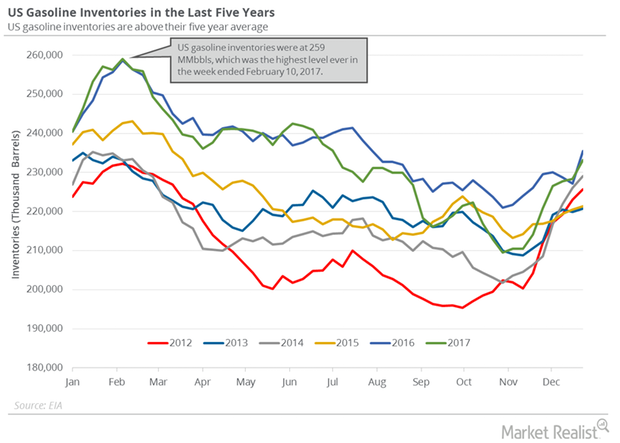

US Gasoline Inventories Could Pressure Crude Oil Prices

The EIA estimated that US gasoline inventories increased by 4.8 MMbbls (million barrels) or 2.1% to 233.1 MMbbls on December 22–29, 2017.

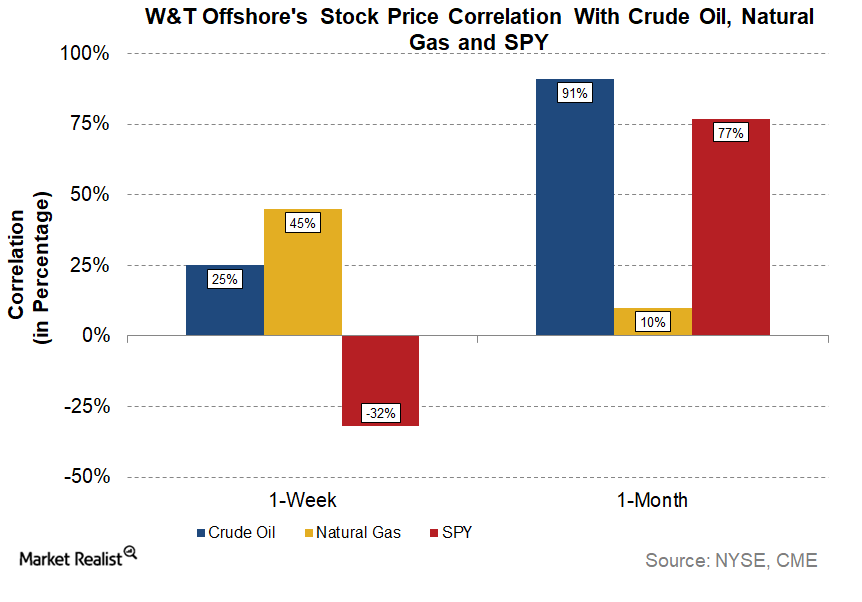

What Really Moved W&T Offshore Stock Last Week?

W&T Offshore (WTI) stock rose ~7% last week (ended September 29), while crude oil and the SPDR S&P 500 ETF (SPY) rose ~2% and ~0.7%, respectively.

US Distillate Inventories Rise for a Third Week

US distillate inventories On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories […]

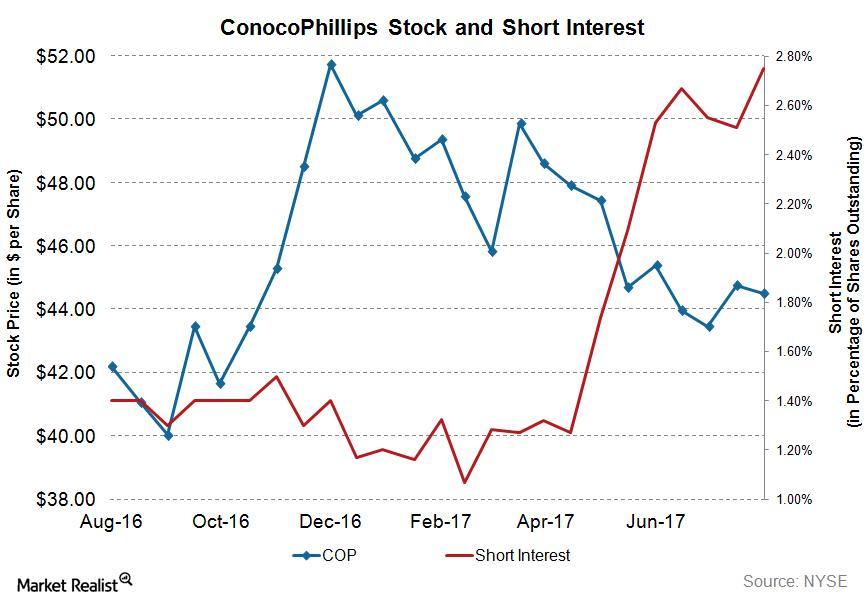

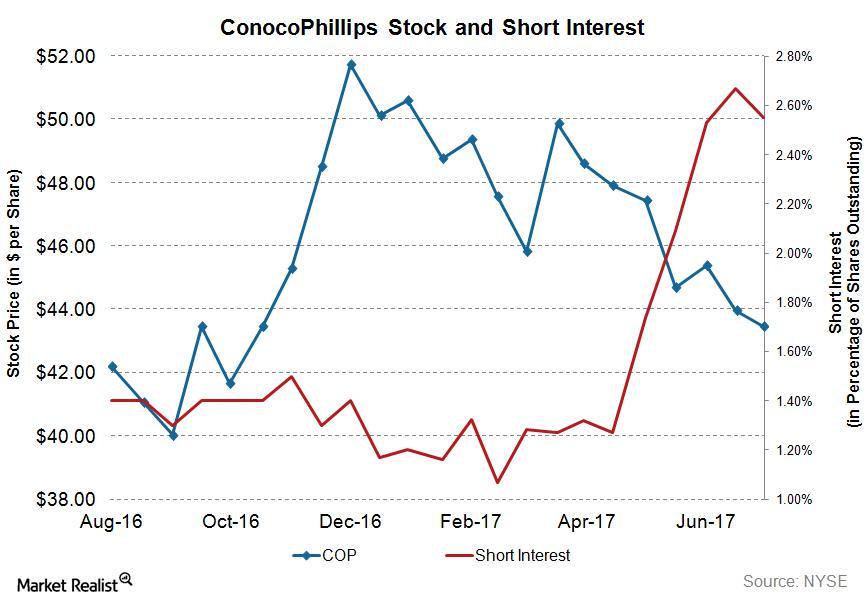

Who’s Shorting COP: Reading the Short Interest in ConocoPhillips’s Stock

Short interest in COP On August 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~33.4 million, while its average daily volume was ~8.02 million. This means the short interest ratio for COP’s stock was ~4.6x. COP’s average daily volume is calculated for the short interest reporting period from August 1, 2017, […]

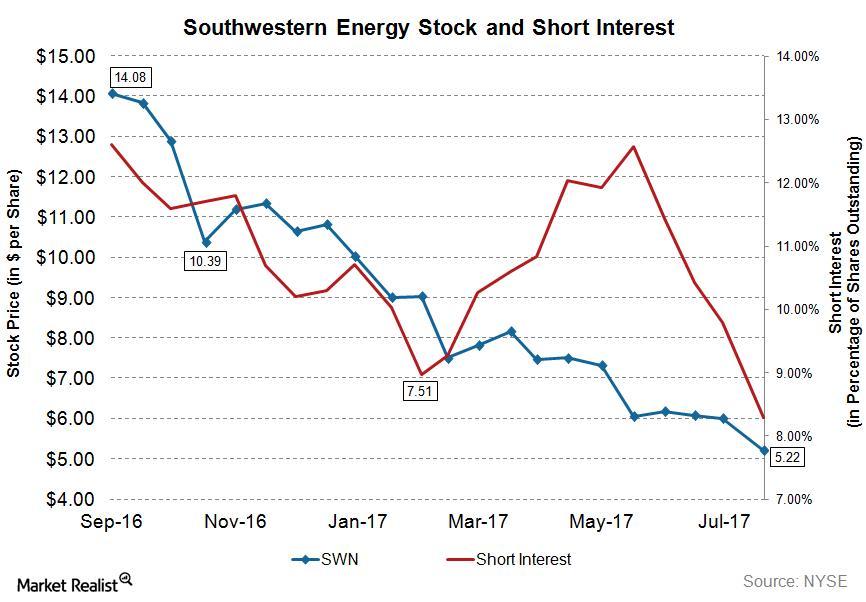

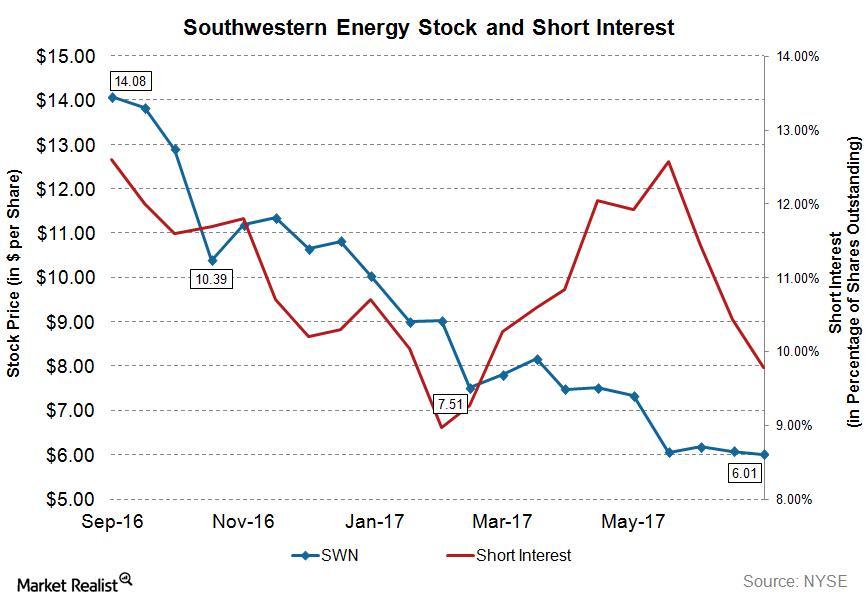

Analyzing the Short Interest in Southwestern Energy Stock

As of August 14, Southwestern Energy’s total shares shorted (or short interest) stood at ~45.89 million, while its average daily volume is ~17.44 million.

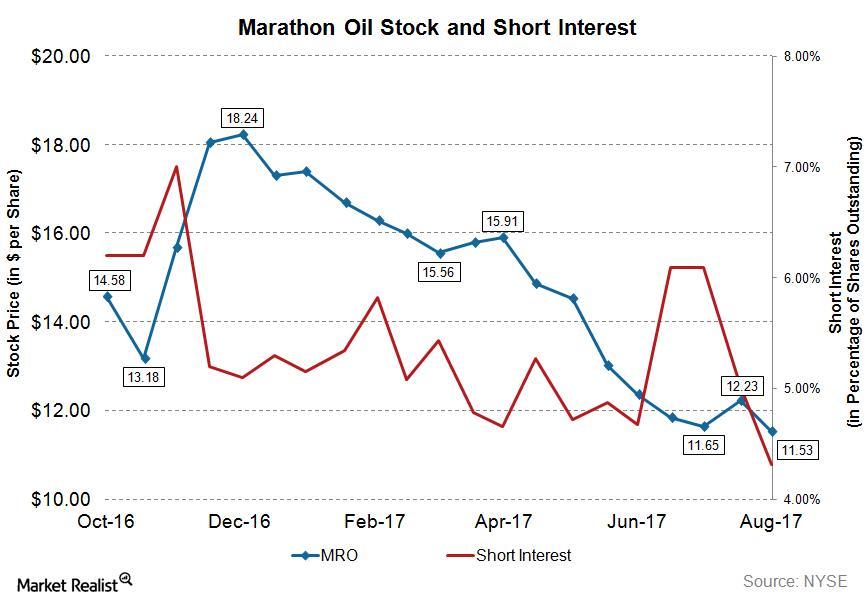

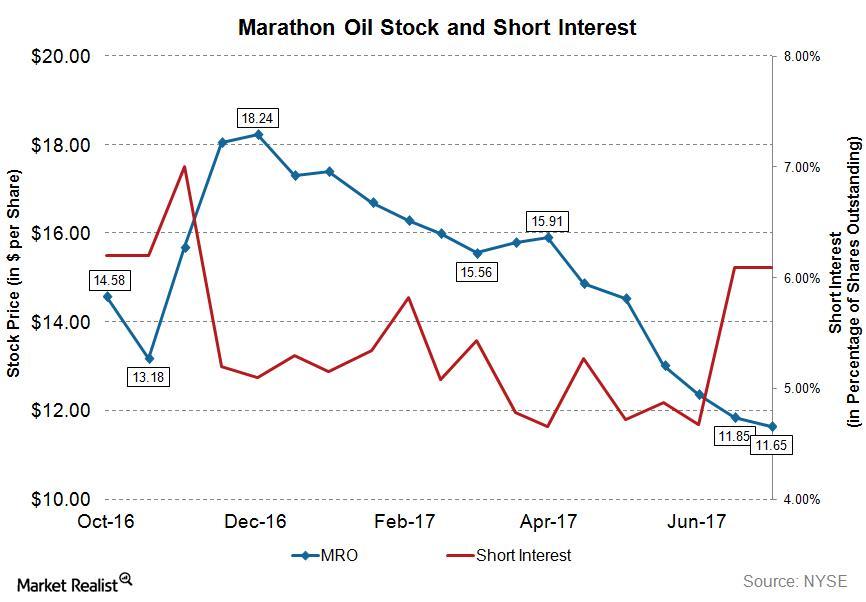

Short Interest in Marathon Oil Stock Remains at Lower Levels

As of August 14, 2017, Marathon Oil’s total shares shorted (or short interest) stood at ~36.65 million, while its average daily volume is ~15.94 million.

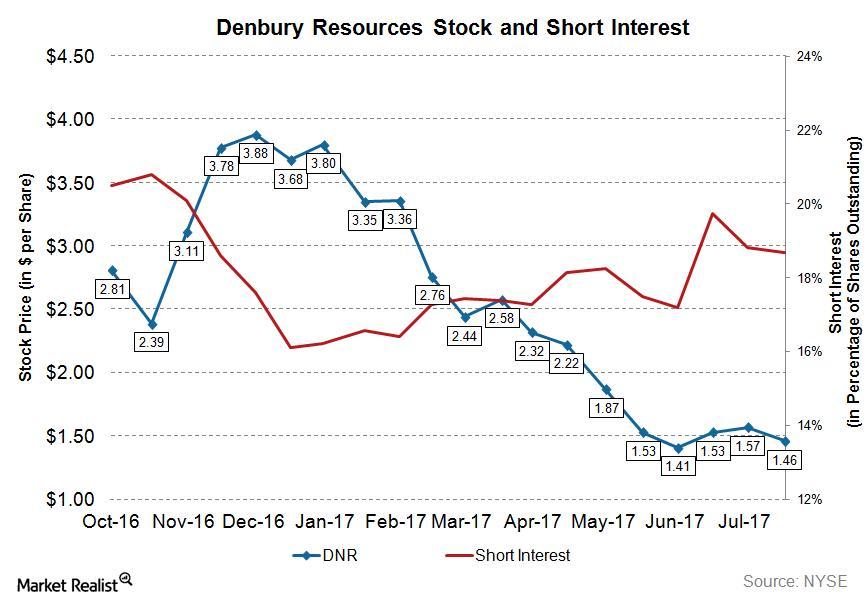

Analyzing Short Interest in Denbury Resources Stock

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x.

What’s the Short Interest in Southwestern Energy Stock?

As of July 14, 2017, Southwestern Energy’s (SWN) total shares shorted (or short interest) stood at ~49.5 million, whereas its average daily volume was ~18.4 million.

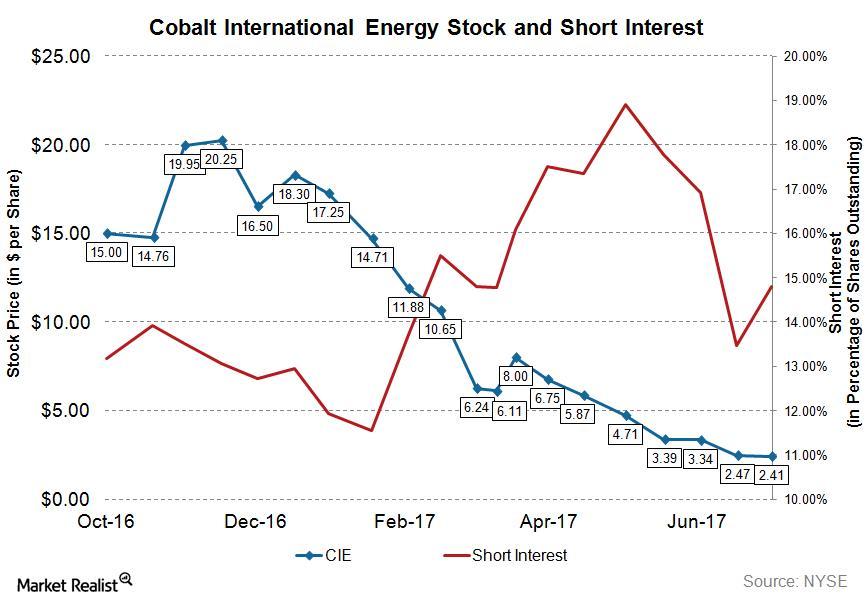

Analyzing Short Interest in Cobalt International Energy’s Stock

As of July 14, 2017, Cobalt International Energy’s (CIE) total shares shorted (or short interest) was 4.37 million, whereas its average daily volume is 1.03 million.

Analyzing Short Interest in Occidental Petroleum Stock

On July 14, 2017, Occidental Petroleum’s (OXY) total shares shorted (or short interest) stood at ~10.9 million, and its average daily volume was ~4.8 million.

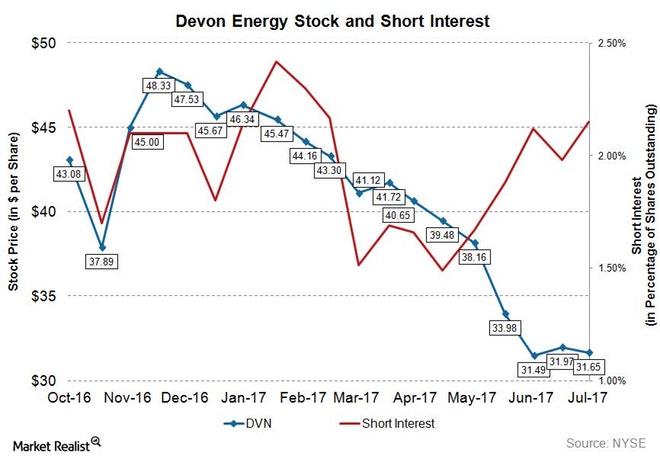

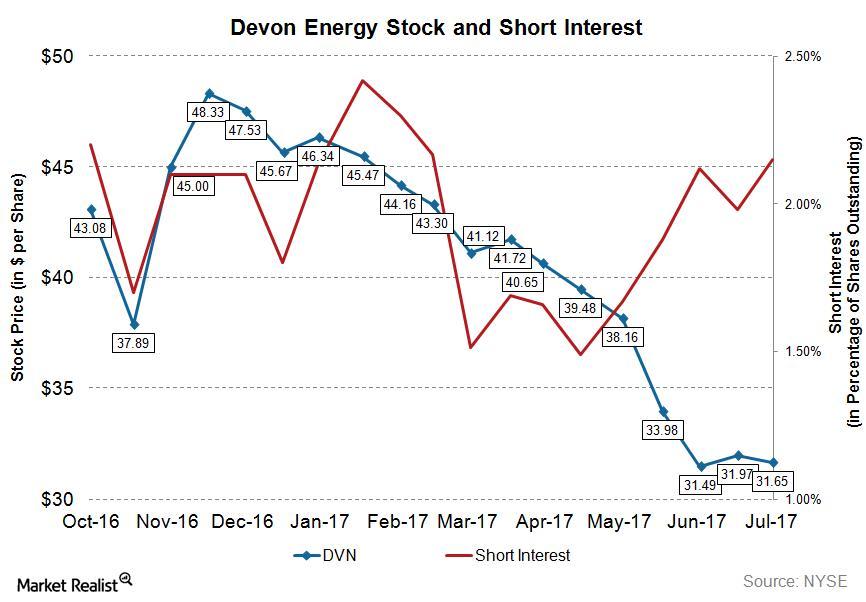

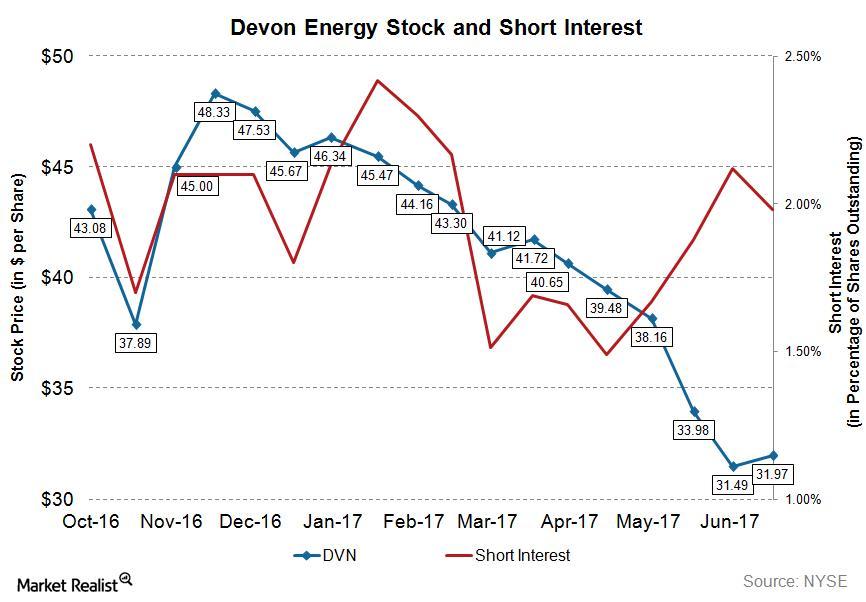

Chart of the Week: What’s the Short Interest in Devon Energy?

As of July 14, 2017, short interest in Devon Energy (DVN) is ~11.3 million shares, while its average daily volume is ~6.2 million shares.

Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.

Analyzing Short Interest Trends in ConocoPhillips’s Stock

As of July 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~31.48 million, whereas its average daily volume is ~5.91 million.

What’s the Short Interest in Marathon Oil Stock?

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million.

Analyzing Short Interest in Devon Energy Stock

As of June 30, 2017, Devon Energy’s (DVN) total shares shorted (or short interest) stood at ~10.4 million, whereas its average daily volume was ~5.9 million.