Devon Energy Corp

Latest Devon Energy Corp News and Updates

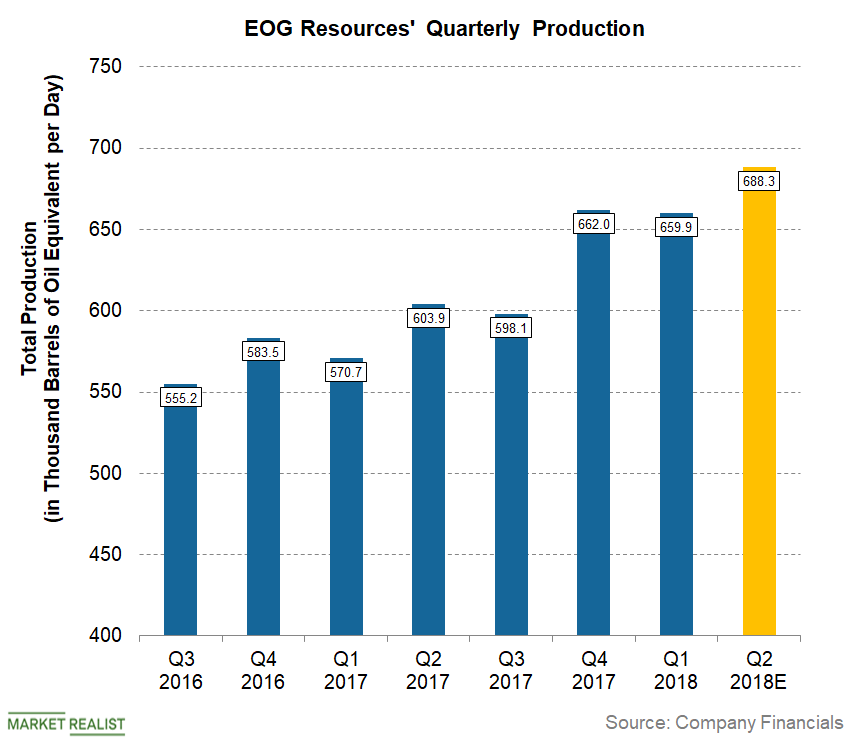

Understanding EOG Resources’ Q2 2018 Production Guidance

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

Analyzing Denbury Resources’ 1Q16 Earnings Call

For 1Q16, Denbury Resources (DNR) reported an adjusted EBITDA of ~$105 million with an EBITDA margin of ~40%. Its EBITDA margin is only ~20% lower.

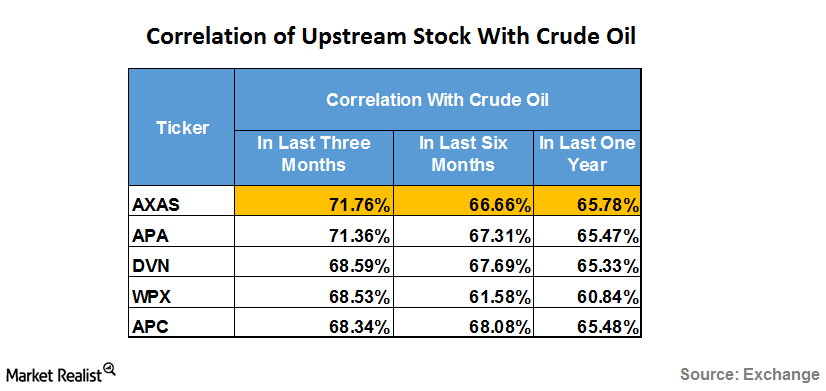

Which Upstream Stocks Are More Sensitive to Crude Oil?

In the last three months, Abraxas Petroleum (AXAS) has had the highest positive correlation with WTI crude oil among upstream companies that are part of XOP.

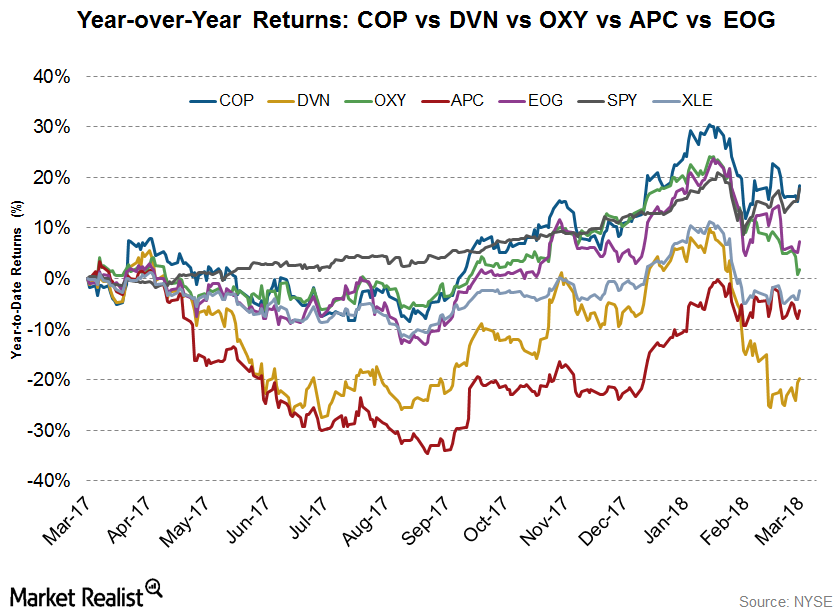

Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

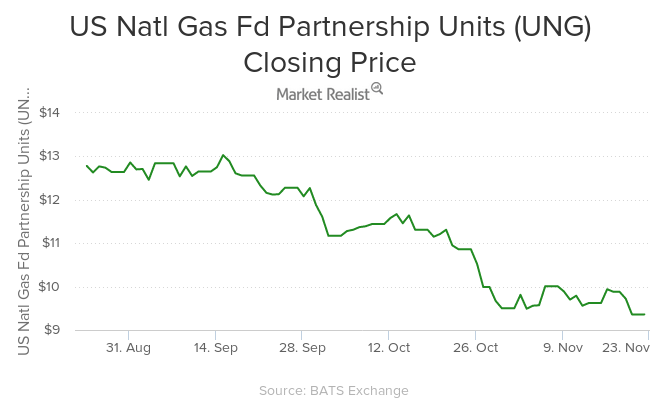

Natural Gas Prices Slump 9.4% for the Week

ETFs like the United States Natural Gas—UNG—ETF fell in the direction of natural gas prices on November 20, 2015. UNG fell by 4.7% on the day.Financials What’s the Dow Theory?

The Dow Theory was developed by Charles Dow. It identifies and signals the change in the stock market trends. It’s useful for trading and investing. The Dow Theory has six components.Financials Technical indicators and the Relative Strength Index

The Real Strength Index (or RSI) is a measure of a stock’s overbought and oversold position. The commonly used RSI is a 14-day RSI. It refers to the 14-day stock price that’s used to calculate the RSI.Financials Double top and double bottom patterns in technical analysis

The double top pattern forms in the uptrend. In this pattern, two consecutive peaks are formed. The peaks both have roughly the same price level.

What Devon Energy’s Technical Indicators Tell Us

Devon Energy (DVN) continues to trade below its short-term (50-day) moving average.

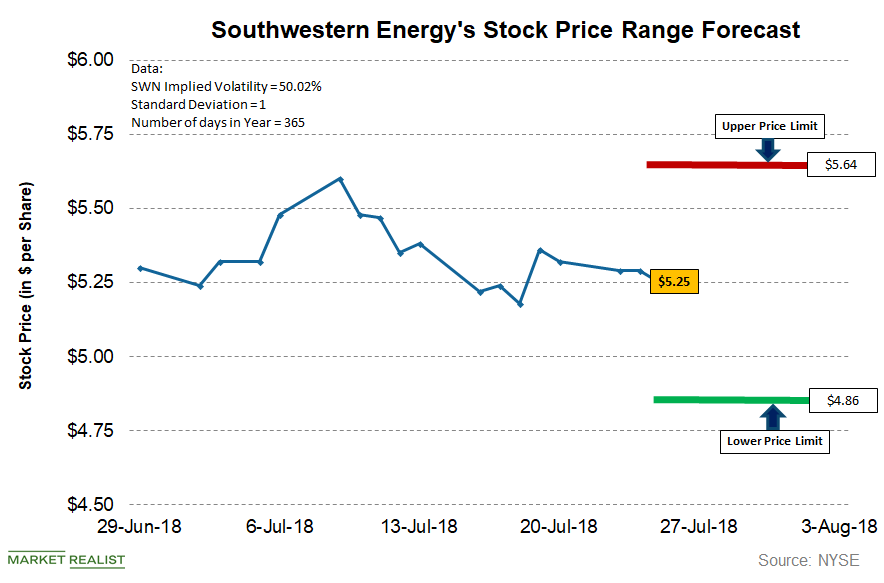

What’s the Forecast for Southwestern Energy Stock?

As of July 25, Southwestern Energy (SWN) had an implied volatility of ~50.0%, which is lower when compared with its implied volatility of ~50.9% at the end of the second quarter of 2018.

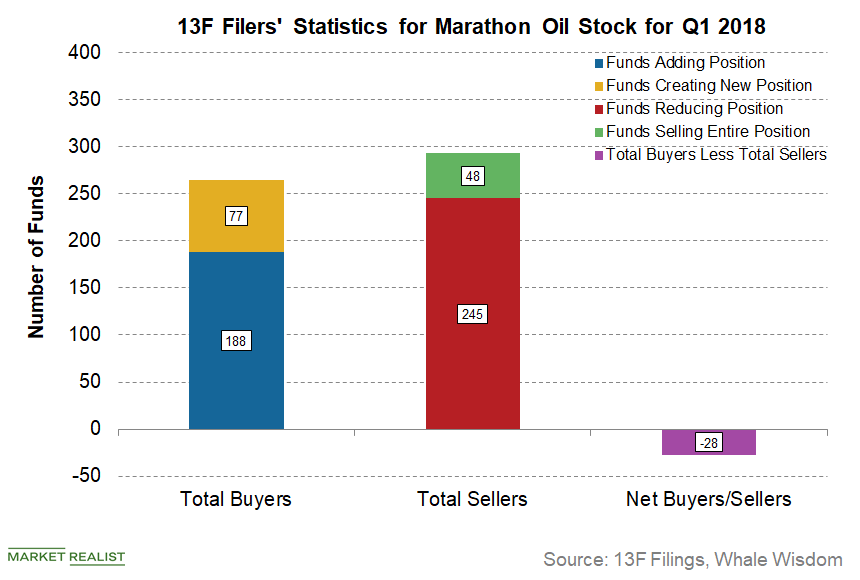

Are Institutional Investors Selling Marathon Oil Stock?

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

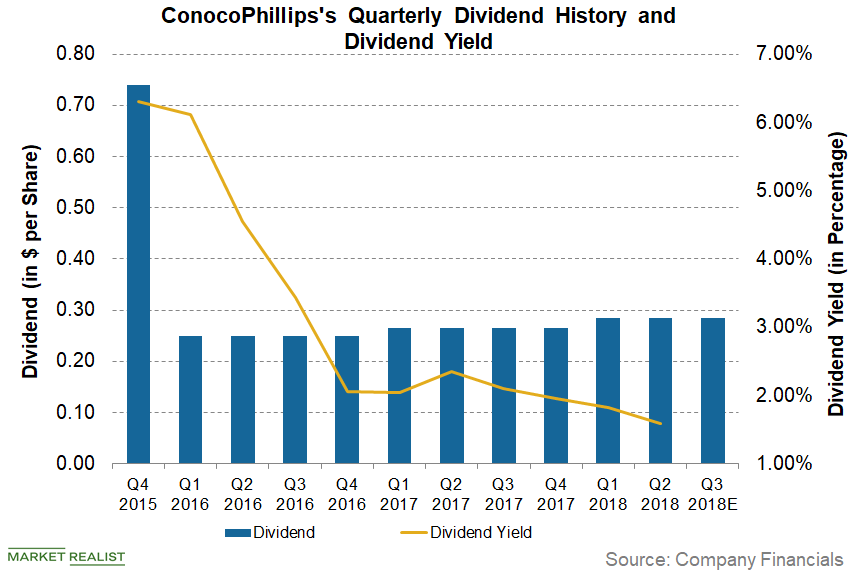

Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

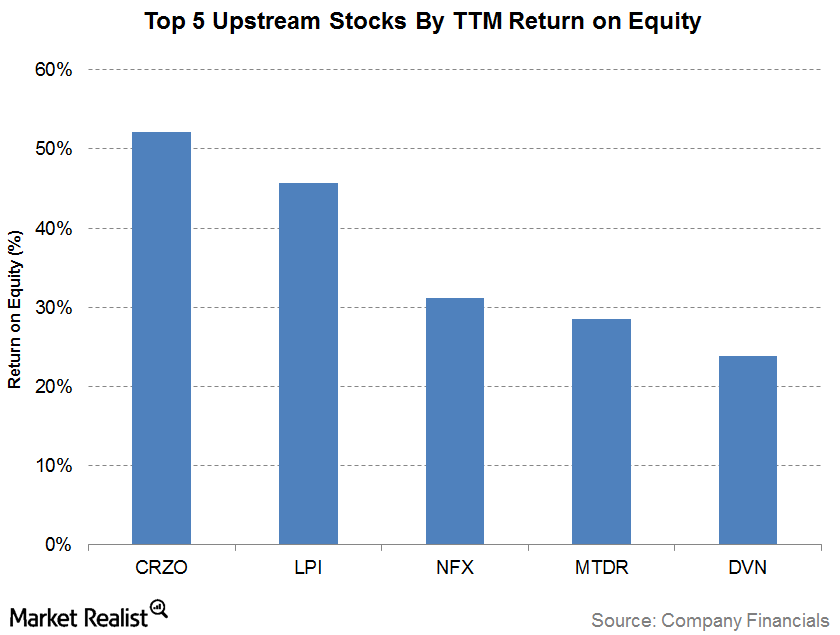

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

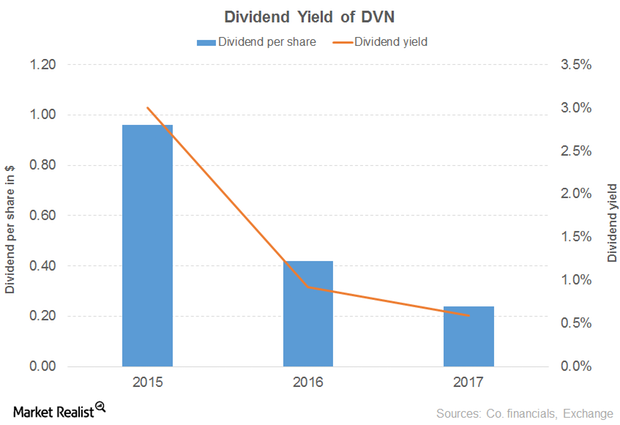

How Did DVN’s Dividend Cut Affect Its Dividend Yield?

Devon Energy Corporation’s 56.0% dividend cut in 2016 was followed by a 43.0% cut in 2017.

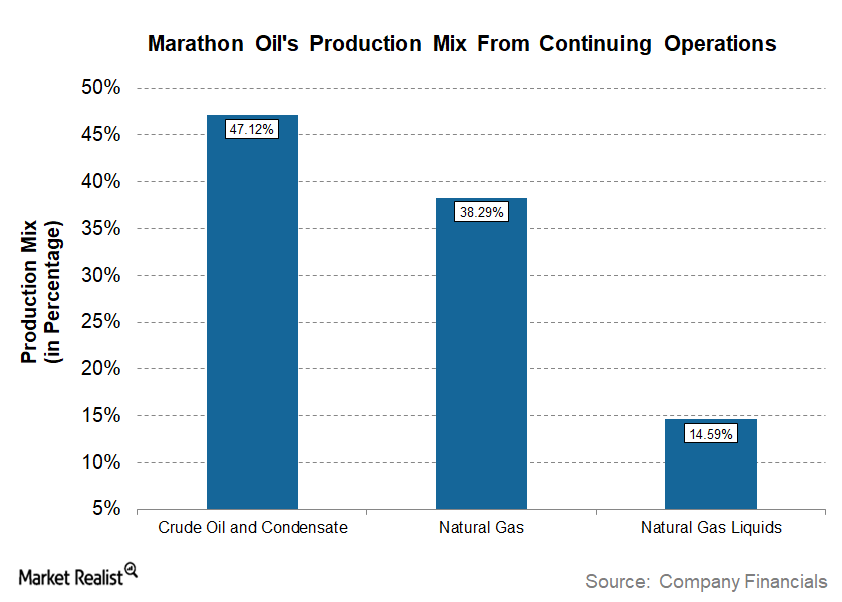

How Marathon Oil’s Divestiture Affected Its Production Mix

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas.

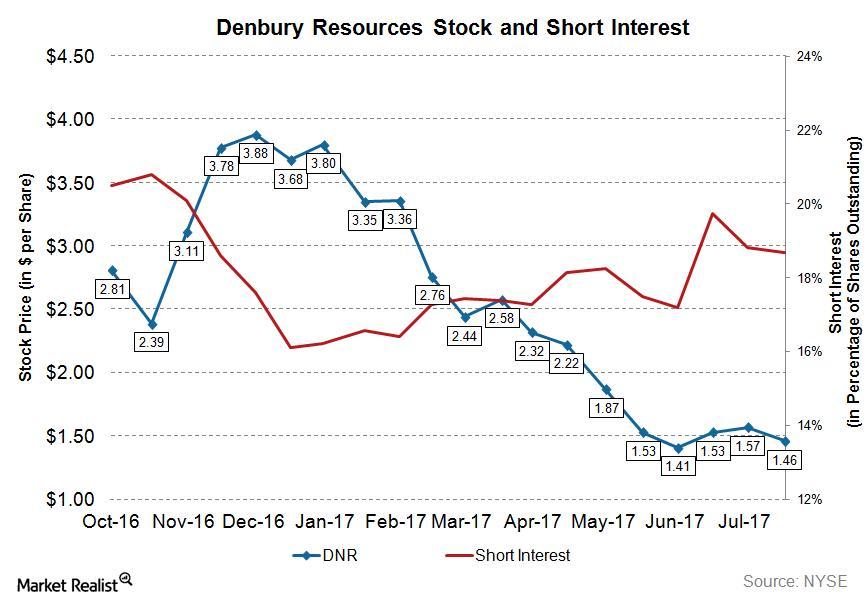

Analyzing Short Interest in Denbury Resources Stock

Denbury Resources’ short interest ratio has a 52-week high of ~12.3x and a 52-week low of 5.8x.

Analyzing Short Interest in Occidental Petroleum Stock

On July 14, 2017, Occidental Petroleum’s (OXY) total shares shorted (or short interest) stood at ~10.9 million, and its average daily volume was ~4.8 million.

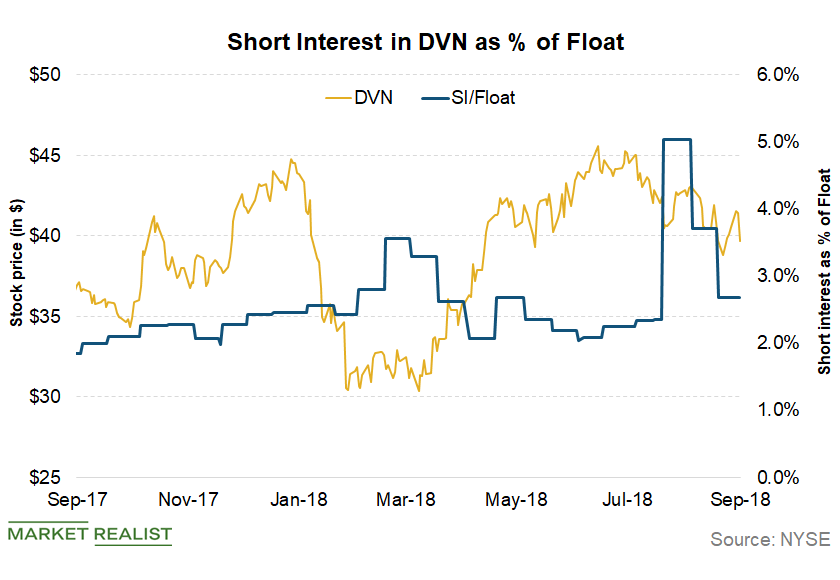

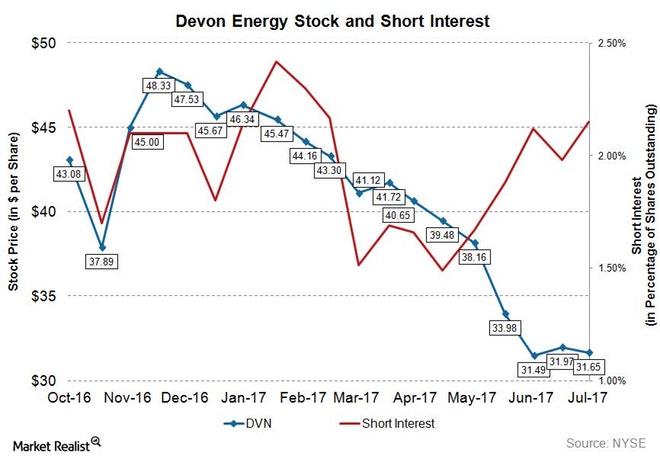

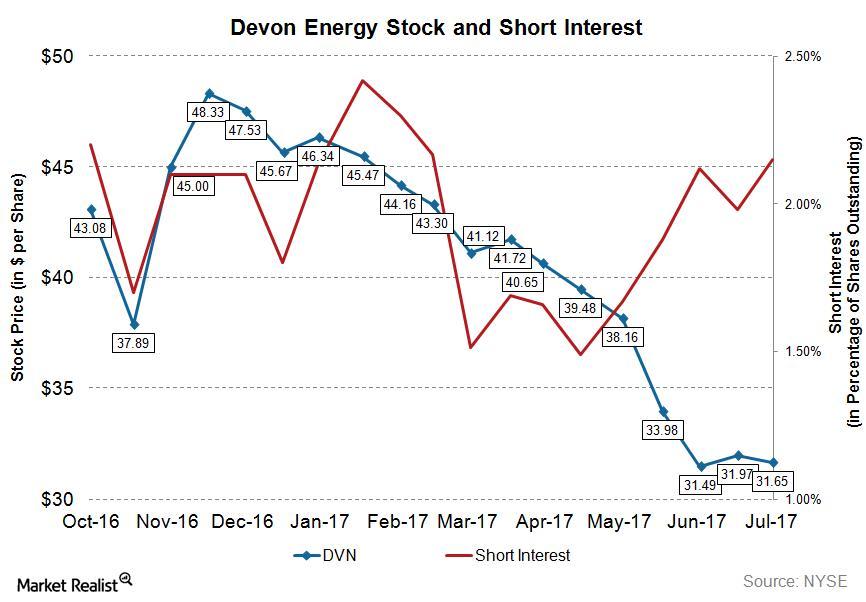

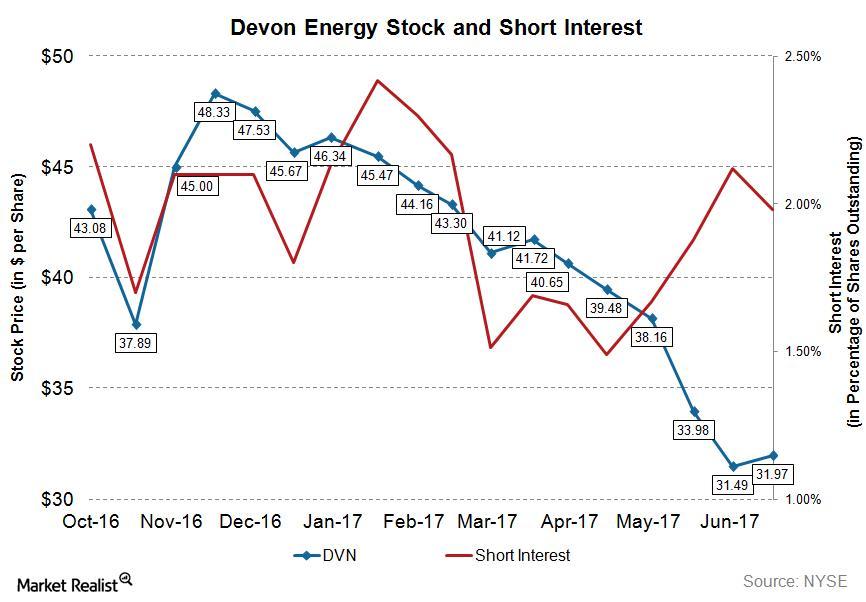

Chart of the Week: What’s the Short Interest in Devon Energy?

As of July 14, 2017, short interest in Devon Energy (DVN) is ~11.3 million shares, while its average daily volume is ~6.2 million shares.

Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.

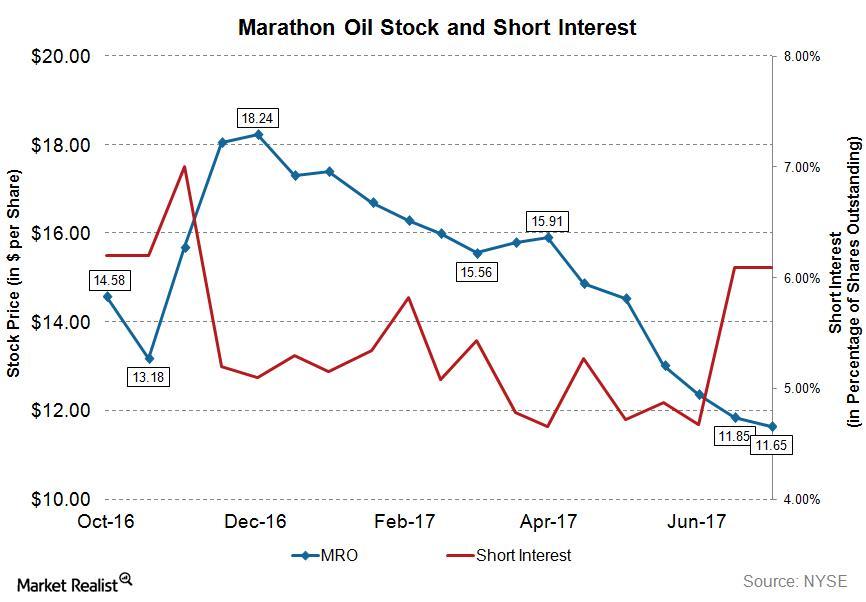

What’s the Short Interest in Marathon Oil Stock?

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million.

Analyzing Short Interest in Devon Energy Stock

As of June 30, 2017, Devon Energy’s (DVN) total shares shorted (or short interest) stood at ~10.4 million, whereas its average daily volume was ~5.9 million.

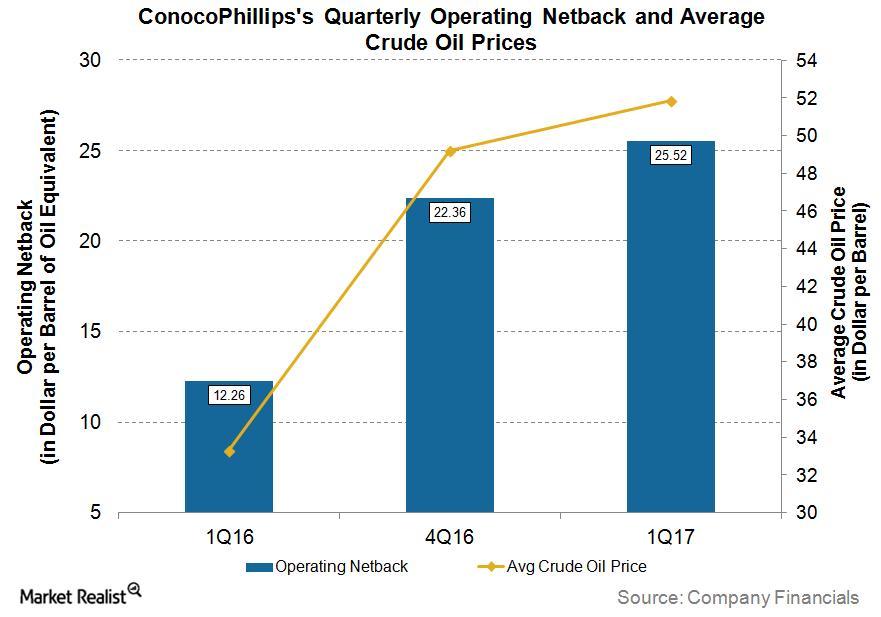

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

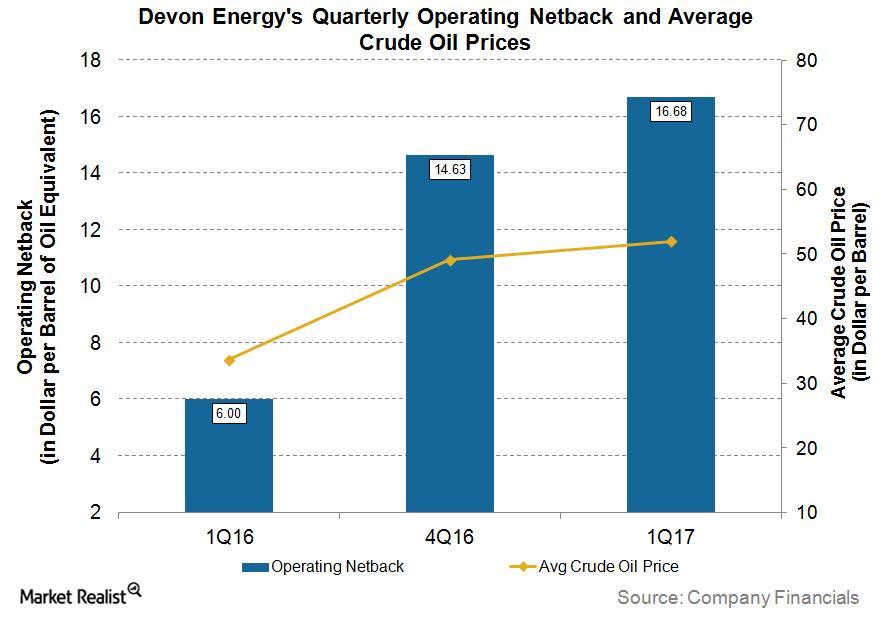

Devon Energy’s Operating Netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16.

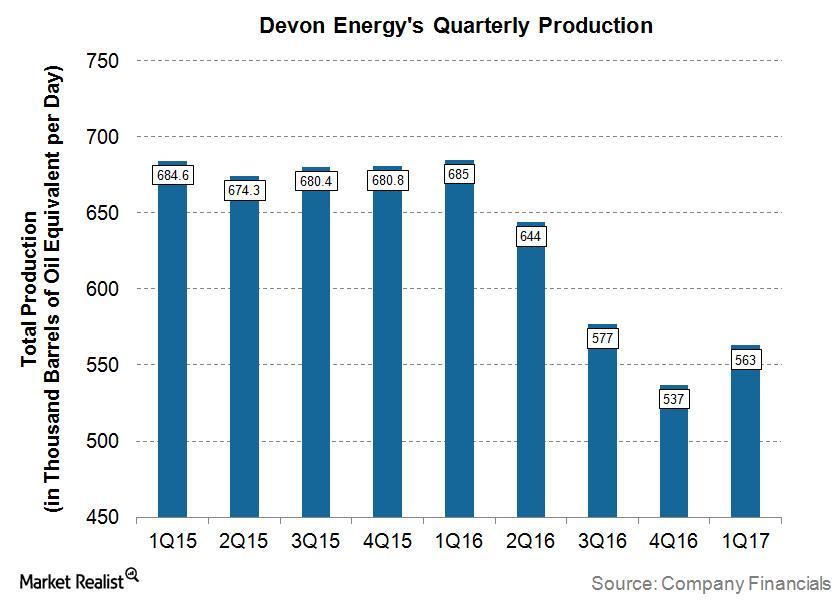

Understanding Devon Energy’s Production Volumes

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

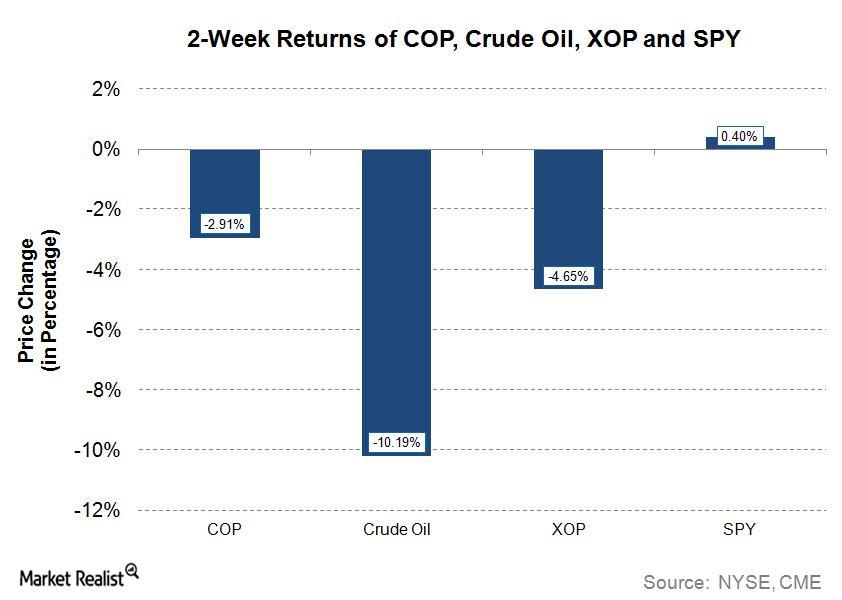

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

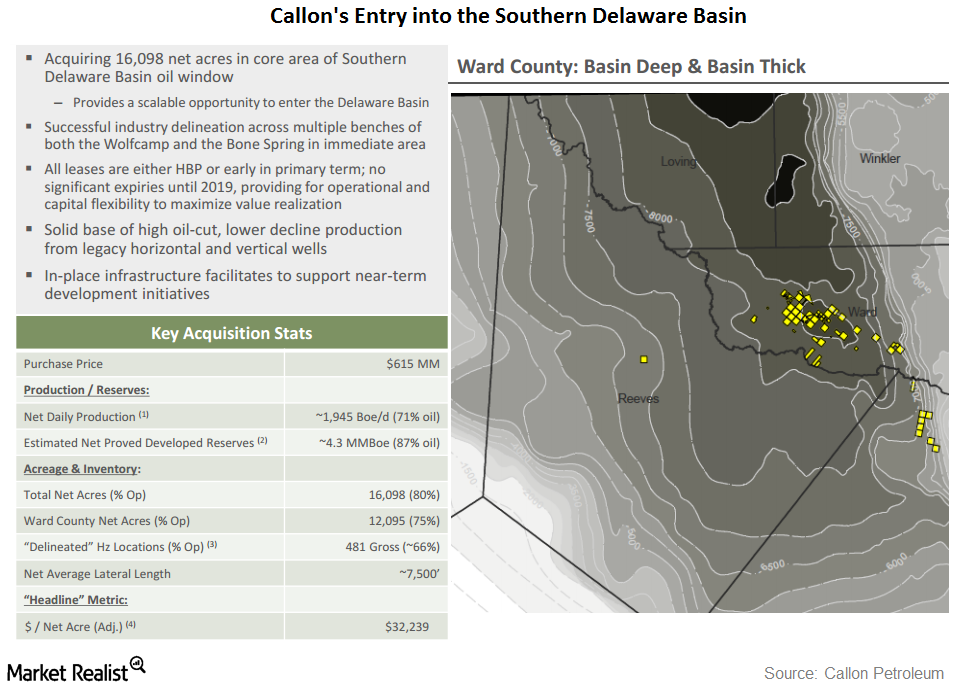

Callon Petroleum Makes Its First Delaware Basin Acquisition

On December 13, Callon Petroleum announced that it had agreed to acquire certain acreage positions and oil- and gas-producing properties from Ameredev.

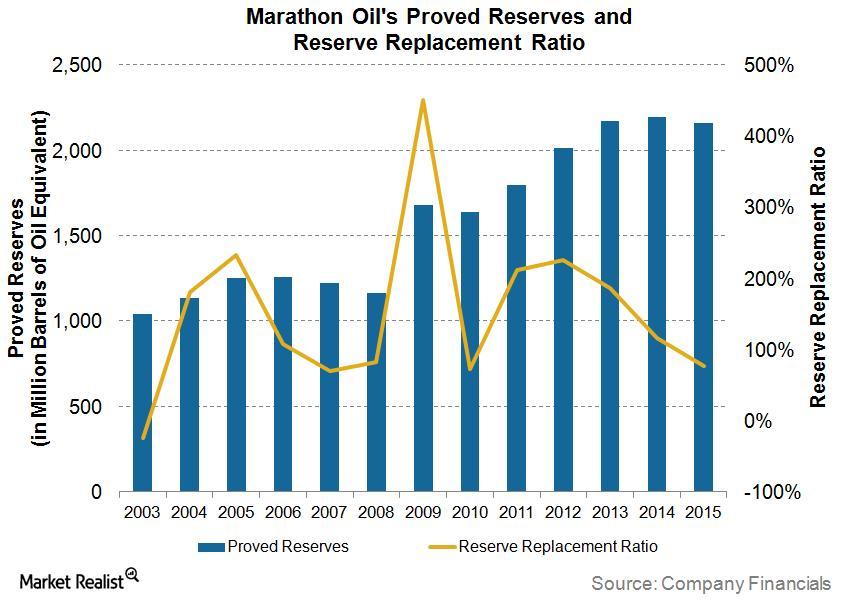

How Are Marathon Oil’s Proved Reserves Evolving?

As of December 31, 2015, the Marathon Oil’s (MRO) proved reserves totaled ~2163 MMboe, which is ~35 MMboe less than in December 31, 2014.

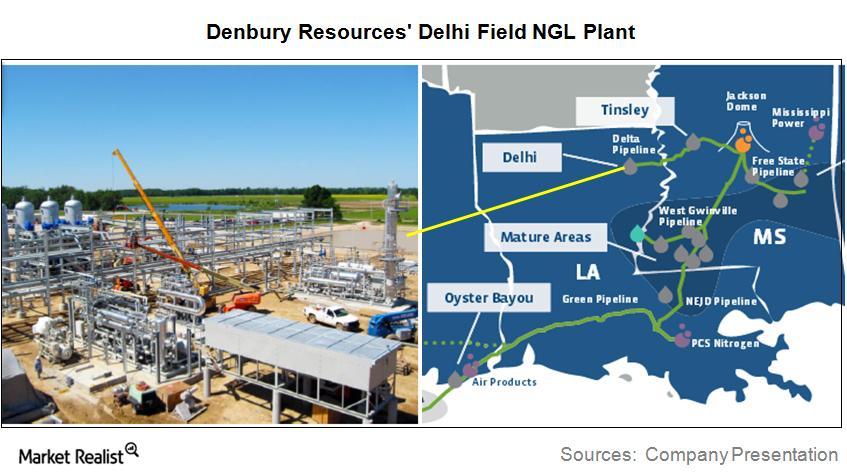

Why Denbury Resources’ Delhi Field Plant Is So Significant

Denbury Resources (DNR) is constructing an NGL (natural gas liquids) plant at its Delhi Field on the Gulf Coast.

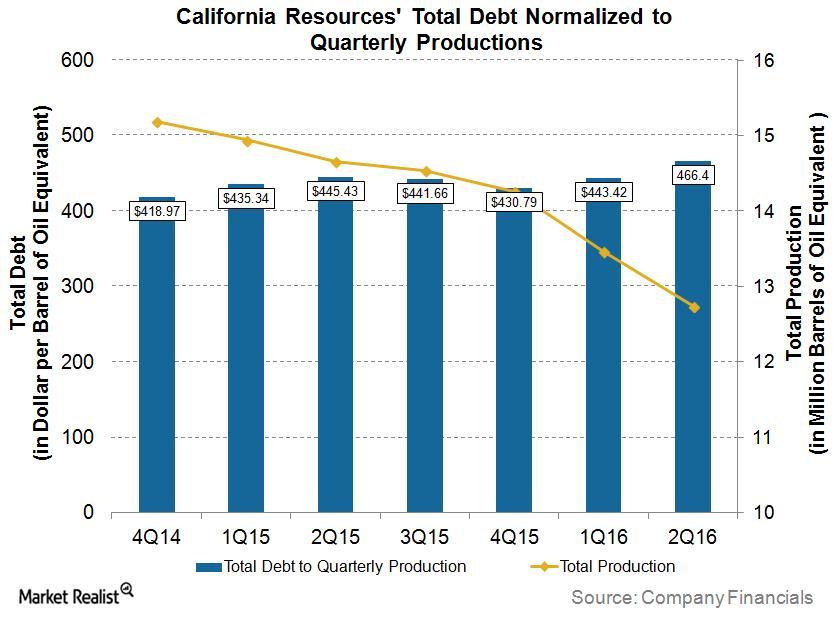

California Resources’ Debt and Production: Chart in Focus

For 2Q16, California Resources (MRO) reported total debt of ~$466 per boe (barrel of oil equivalent) of production.

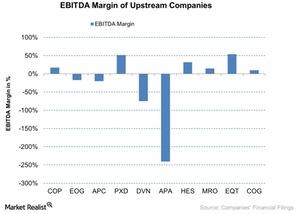

Operating Margins for Upstream Companies Rose

The operating margin of the US-based (SPY) upstream companies rose by an average of 16%.

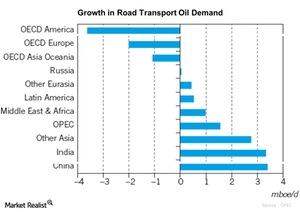

Crude Oil Demand Expected to Grow from Road Transportation

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.

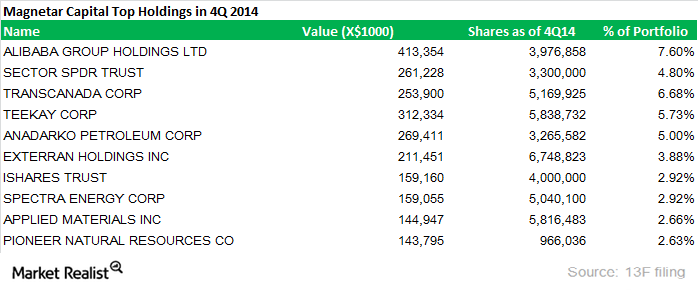

Magnetar Capital Initiated New Positions in 4Q14

Magnetar Capital was established in 2005 by Alec Litowitz and Ross Laser. Currently, the hedge fund manages assets in excess of $12 billion.

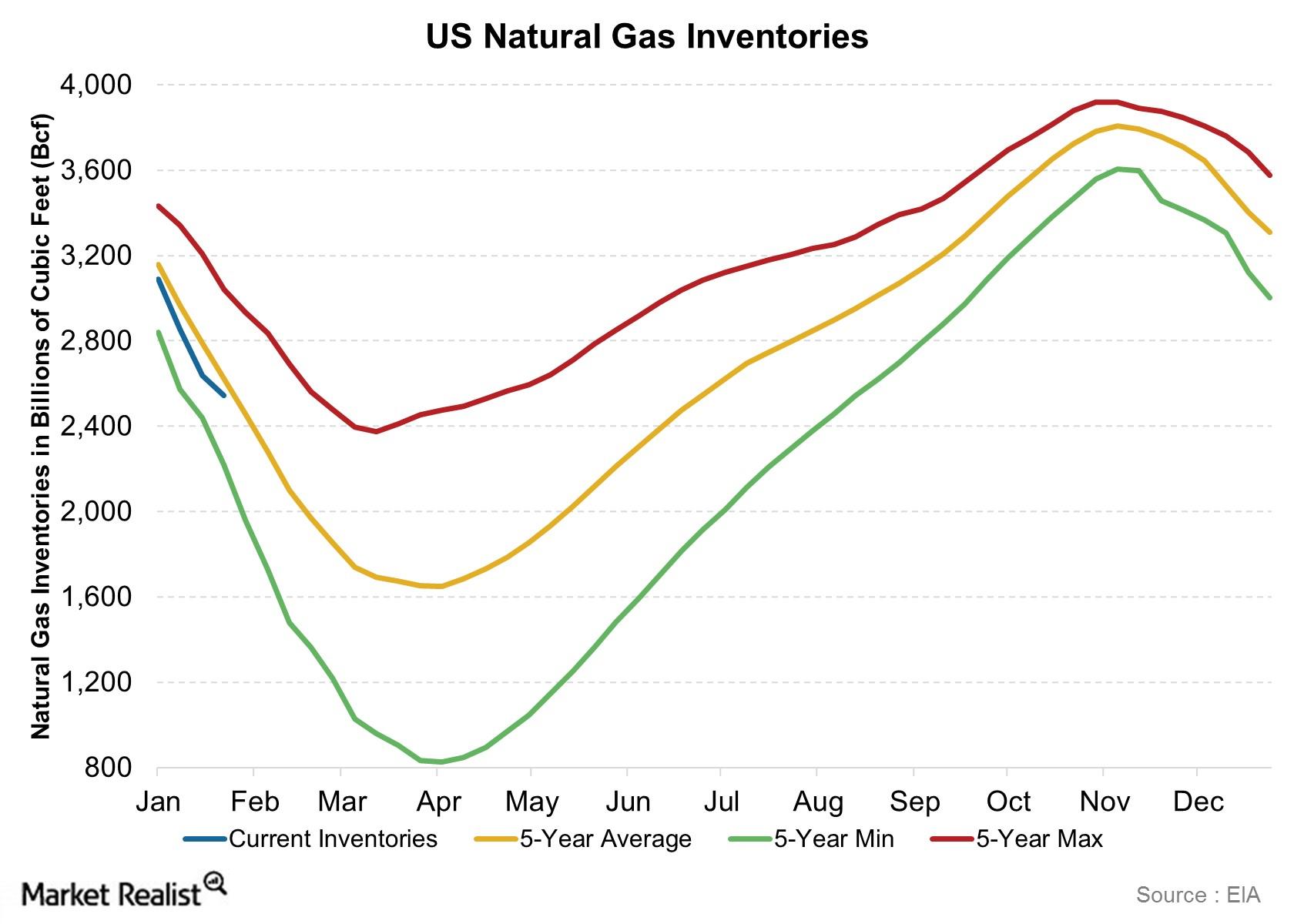

The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.

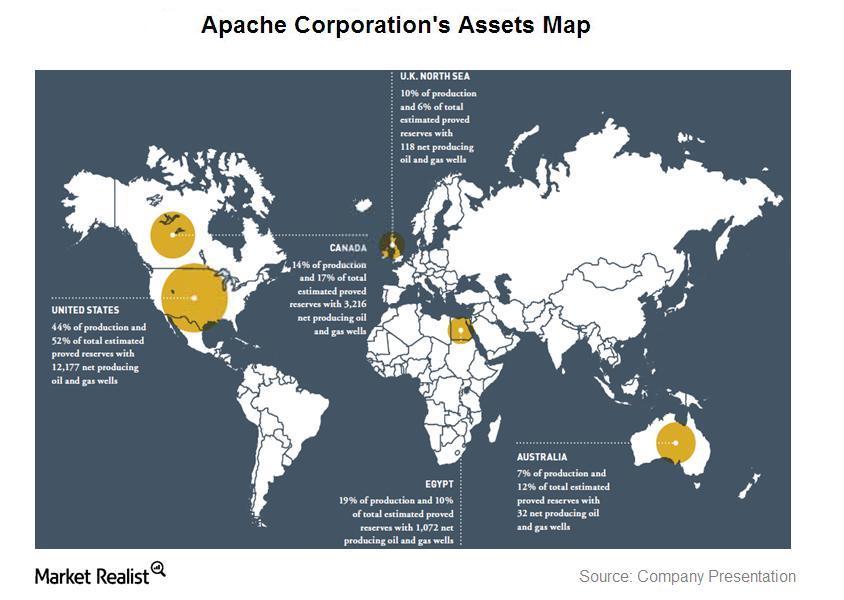

An overview of Apache Corporation’s oil and gas asset sales

Apache Corporation is planning asset sales of certain of its oil and gas operations. The company is focused on building onshore acreage instead.

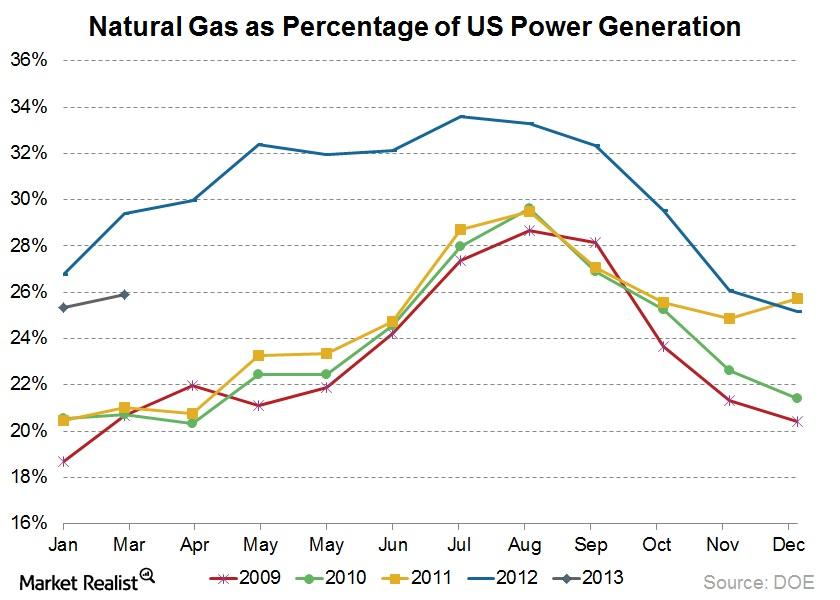

Why has natural gas gained popularity among power generators?

Natural gas has gained market share for use in power generation. Learn about the drivers of this trend and the consequences of increased natural gas use.