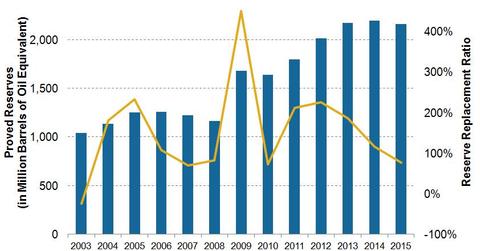

How Are Marathon Oil’s Proved Reserves Evolving?

As of December 31, 2015, the Marathon Oil’s (MRO) proved reserves totaled ~2163 MMboe, which is ~35 MMboe less than in December 31, 2014.

Oct. 3 2016, Updated 11:04 a.m. ET

Marathon Oil’s proved reserves

As of December 31, 2015, the Marathon Oil’s (MRO) proved reserves totaled ~2163 MMboe (million barrels of oil equivalent), which is ~35 MMboe less than in December 31, 2014.

Marathon Oil attributed the fall in estimated proved reserves to routine production as well as to negative revisions in the US totaling ~173 MMboe. The reductions to MRO’s capital development program have deferred proved undeveloped reserves beyond the company’s five-year plan. This fall was partially offset by increased reserves from the drilling programs in MRO’s US unconventional shale plays totaling ~246 MMboe as well as a positive revision of ~67 MMboe in OSM (oil sands mining).

As of December 31, 2015, ~72% of Marathon Oil’s proved reserves are PD (proved developed) and ~28% are PUD (proved undeveloped). As of December 31, 2015, ~40% of Marathon Oil’s proved reserves consisted of crude oil, ~32% of synthetic crude oil, ~19% of natural gas, and ~9% of natural gas liquids.

According to MRO’s 2015 annual report, the discounted value of its reserve base at the end of 2015 was ~$6.2 billion.

Marathon Oil’s reserve replacement ratio

Marathon Oil’s reserve replacement ratio also fell significantly in 2015. Marathon Oil’s reserve replacement ratio in 2015 was ~77.7%. The reserve replacement ratio indicates the number of barrels of oil equivalent a company adds to its reserve base in relation to the amount of oil and gas it produces.

Other upstream companies

As of December 31, 2015, upstream companies Denbury Resources (DNR), Pioneer Natural Resources (PXD), and Devon Energy (DVN) had proved reserves of ~289 MMboe, ~664 MMboe, and ~2,180 MMboe, respectively. Notably, the Energy Select Sector SPDR ETF (XLE) generally invests at least 95% of its total assets in oil and gas related equities from the S&P 500.