Upstream Energy’s Best and Worst Free Cash Flow Companies

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector.

Dec. 22 2017, Updated 1:25 a.m. ET

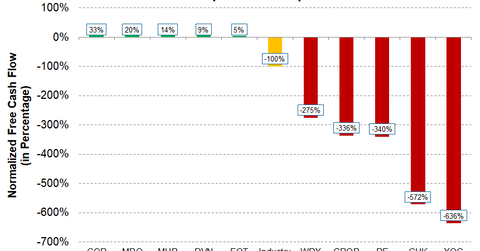

Normalized free cash flow

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector. FCF is calculated by subtracting capex from operating cash flow (or OCF). However, within the upstream space, free cash flow for each company varies greatly depending on the size of the company’s upstream operations, operating revenues, operating margins, operating cash flows, and capex. Thus, in order to rank the upstream companies in the US using FCF, we have normalized FCF in 9M17 (the first nine months of 2017) by dividing it by the 9M17 OCF. So essentially, the normalized FCF is the percentage of operating cash flow turned into free cash flow.

The above chart shows the top five and bottom five normalized 9M17 FCF generating companies from the oil and gas production sector in the US for 2017. We have considered only oil and gas producers in the US with market capitalizations of greater than $500 million and a 30-day average volume greater than 1,000,000 shares.

The best free cash flow generators

The list is topped by ConocoPhillips (COP), which has normalized 9M17 FCF of ~33%. ConocoPhillips, with a market capitalization of ~$61 billion, is the largest upstream company from the SPDR S&P 500 ETF (SPY). The other top normalized 9M17 FCF generating companies are Marathon Oil (MRO), Murphy Oil (MUR), Devon Energy (DVN), and EQT Corporation (EQT). MRO, MUR, DVN, and EQT have normalized 9M17 FCFs of ~20%, ~14%, ~9%, and ~5%, respectively.

Except for EQT, all other top five normalized 9M17 FCF companies are primarily crude oil (USO) producers. EQT is a natural gas (UNG) producer.

The worst free cash flow companies

The bottom five normalized 9M17 FCF generating companies are led by Extraction Oil & Gas (XOG) with a normalized 9M17 FCF of -636%. On the list of bottom five normalized 9M17 FCF generating companies, XOG is followed by Chesapeake Energy (CHK), Parsley Energy (PE), Gulfport Energy (GPOR), and WPX Energy (WPX). CHK, PE, GPOR, and WPX have a normalized 9M17 FCF of -572%, -340%, -336%, and -275%, respectively.

In this series

In the rest of this series, we’ll delve into the details of free cash flow and normalized free cash flow trends of these companies. We’ll also look at what Wall Street analysts are saying about these companies.