Chesapeake Energy Corp

Latest Chesapeake Energy Corp News and Updates

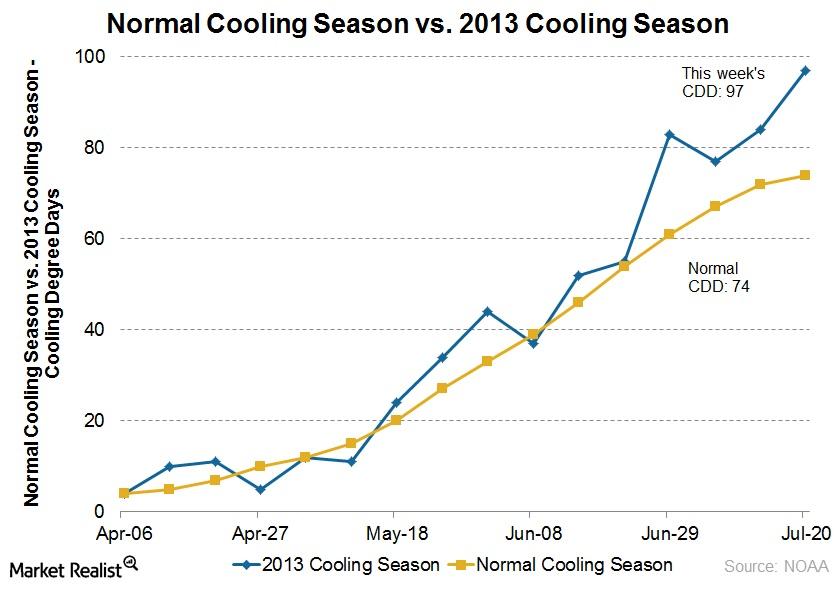

Why the summer heat wave supports natural gas prices

A heat wave that has persisted in the US has helped to lift natural gas prices.Materials Must-know: Why onshore rig counts are at a 2-year high

The U.S. onshore, or land-based, rig count increased by four rigs—from 1,865 to 1,869—during the week ending September 19. Land-based rigs include 13 inland water rigs. This is the highest onshore rig count in the past two years. It’s the highest rig count since August 17, 2012. This marks the eighth increase in the past ten weeks.

ConocoPhillips: Investors’ Confidence Is Rising

Since ConocoPhillips (COP) reported its fourth-quarter earnings results on January 31, the stock has fallen 1.7%.

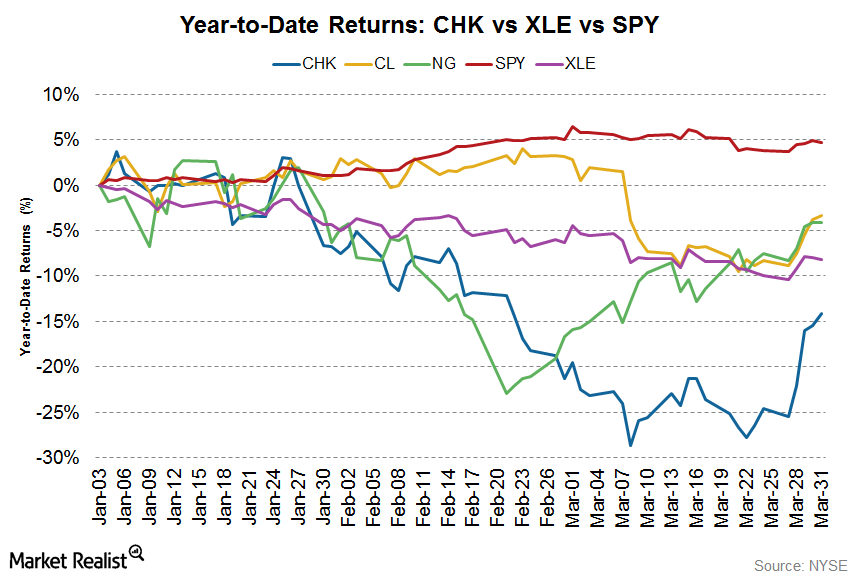

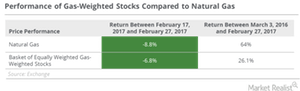

Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

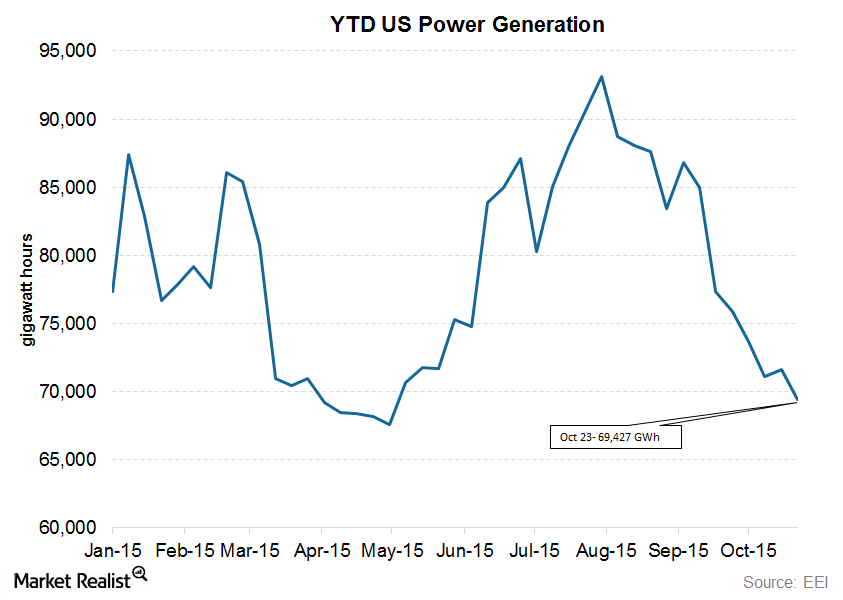

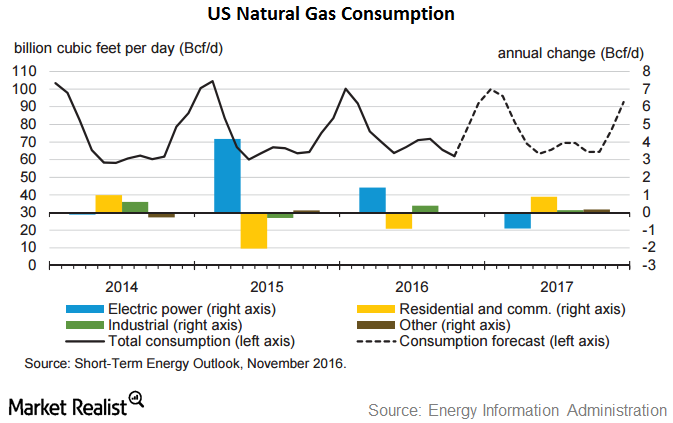

US Power Generation Down Again: An Analysis of Trends

An increase in US power generation numbers is expected for the week ended October 30, 2015.

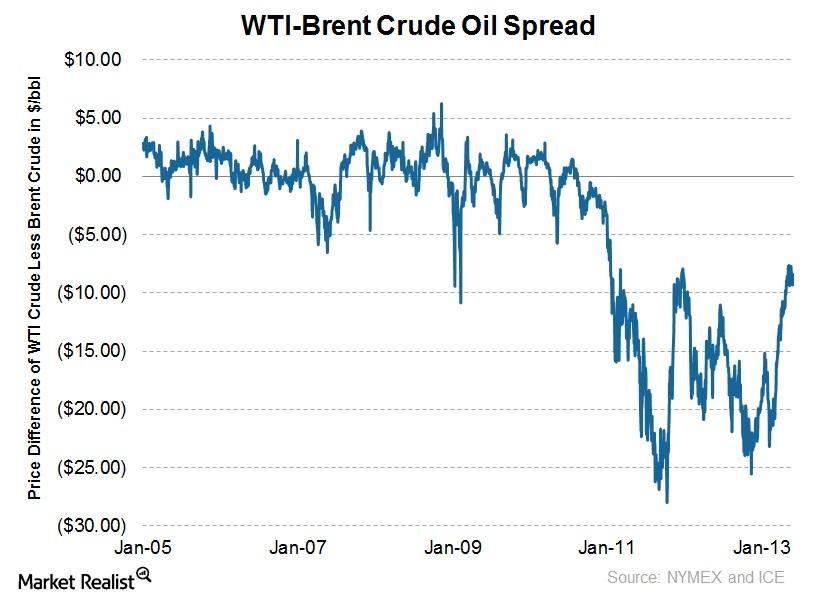

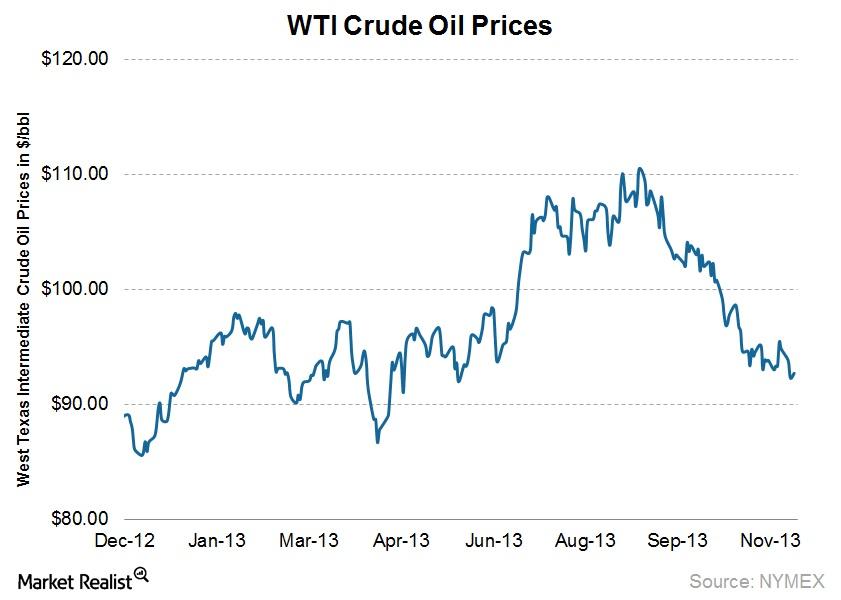

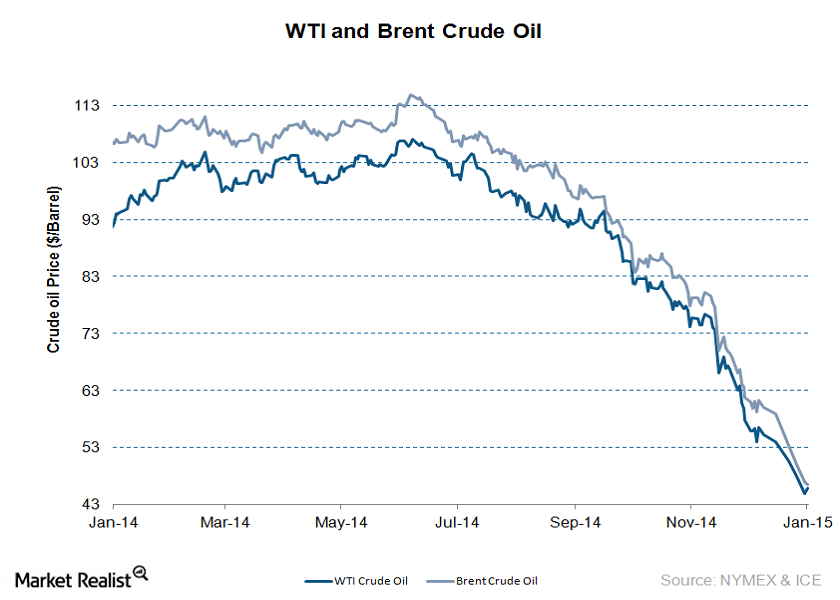

Spread between WTI crude oil and Brent oil has closed in significantly since YE2012

The WTI-Brent spread remained relatively unchanged last week, but has closed in significantly since year-end 2012.

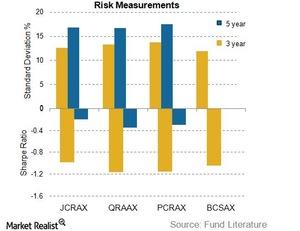

Volatility: Risks and Rewards Go Hand in Hand

The Sharpe ratio is calculated using standard deviation as its volatility measure.

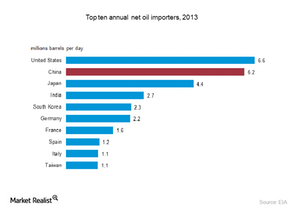

Who will drive crude oil consumption?

Current lower oil prices and growth from China, India, the United States and Asia Pacific countries will drive crude oil consumption in the long term.

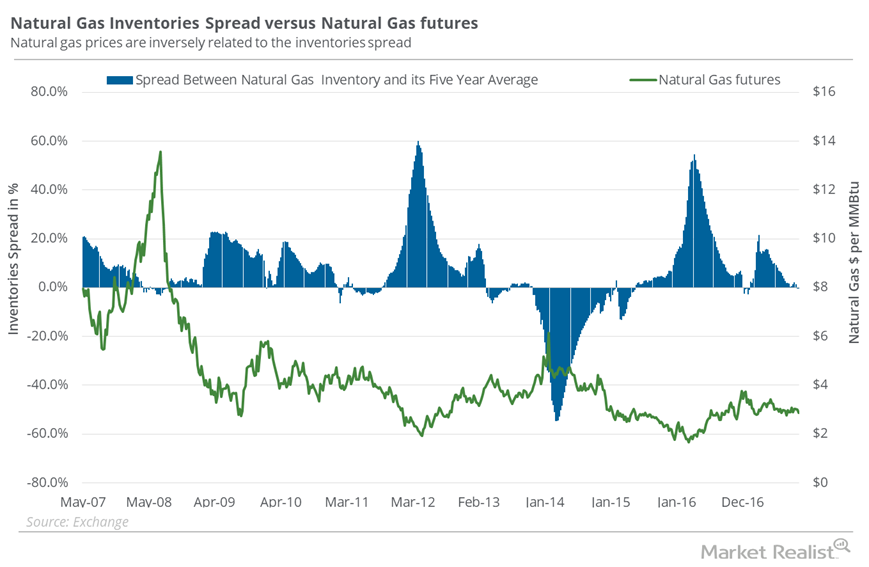

How the Inventory Spread Could Boost Natural Gas Prices

In the week ended October 6, natural gas inventories rose by 87 Bcf (billion cubic feet) to 3,595 Bcf—13 Bcf more than the market expected inventories to rise.

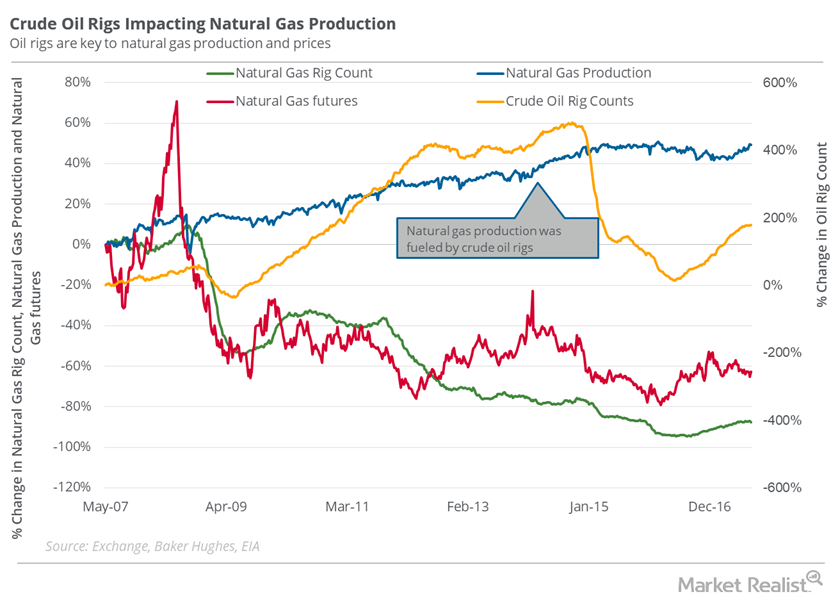

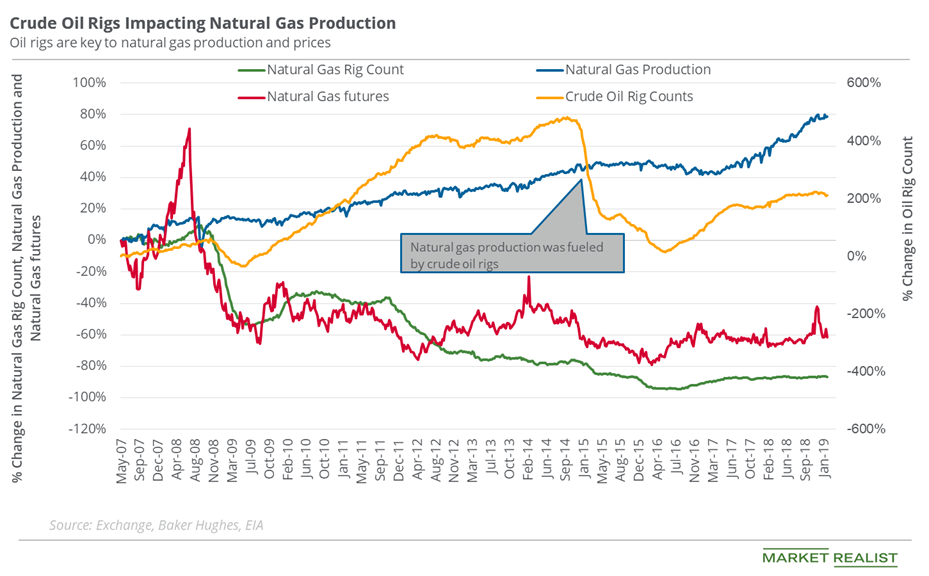

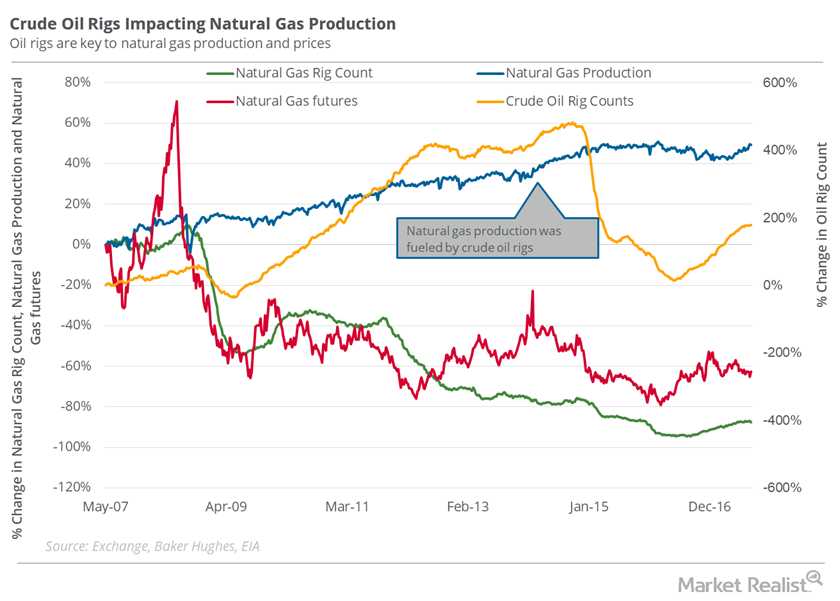

Will the Oil Rig Count Increase Natural Gas Downside Risk?

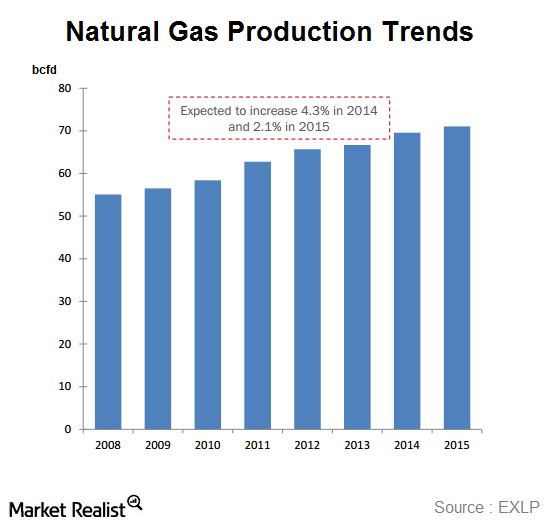

Since 2008, the natural gas rig count has fallen ~89% from its record high. But the fall was unable to stop the rise in natural gas supplies.

An overview of the natural gas compression industry

Natural gas compression is essential for transporting natural gas. Compression is used several times during the natural gas production and transportation cycle.

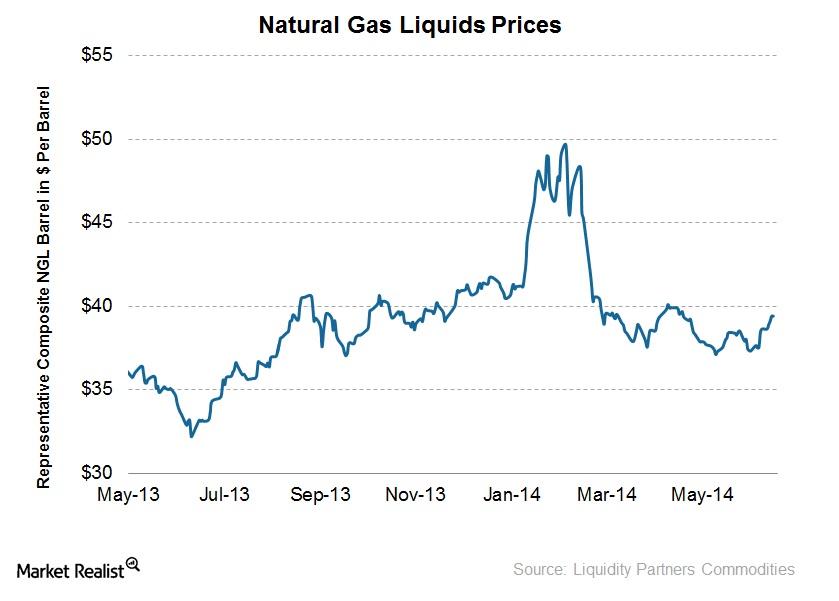

Natural gas liquids prices rise, boosted by propane prices

The representative NGL barrel reached highs of up to ~$50 per barrel in early February, given the strength in propane prices due to a cold winter as well as natural gas prices that pushed ethane prices up.

How Natural Gas Prices Have Supported Chesapeake Energy

2016 has been good for natural gas prices (UGAZ). Prices have risen ~34% year-over-year.

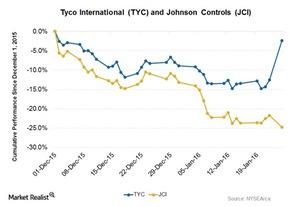

Tyco International to Tie Up with Johnson Controls

Tyco International (TYC) and Johnson Controls (JCI) revealed on Monday, January 25, 2016, that they are going to merge. The news raised TYC stocks that day, while JCI fell 3.9%.

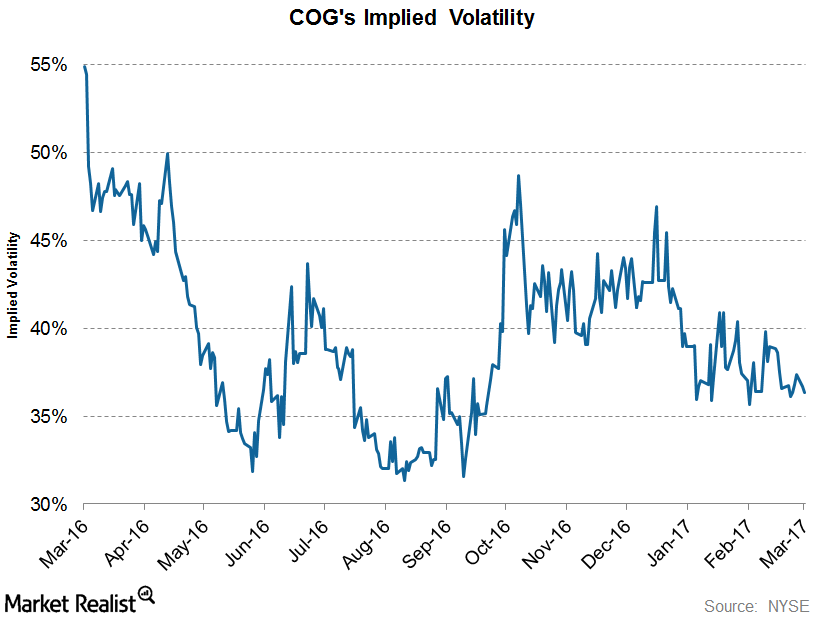

COG’s Implied Volatility Has Fallen Significantly since Early 2016

Cabot Oil and Gas’s (COG) current implied volatility is ~36.4%, ~3% lower than its 15-day average of 37.4%.

How Oil Rigs Impact Natural Gas Production

The natural gas rig count was at 187 last week. The natural gas rig count has fallen ~88.4% from its record level of 1,606 in 2008.

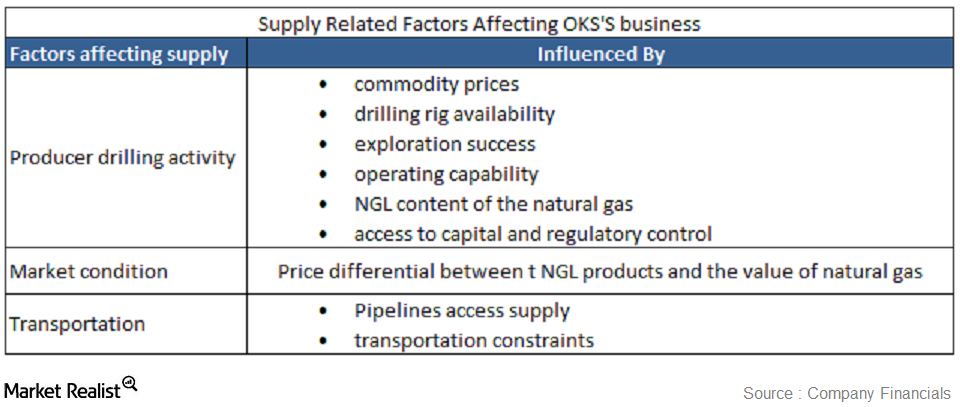

Must-know: Supply-related factors that affect ONEOK Partners

Natural gas, crude oil, and NGL (or natural gas liquid) supply is affected by several factors that could be supply related or demand related.

Will Natural Gas Rise This Week?

On April 18–26, natural gas active futures rose 1.8%. Natural gas to closed at $2.58 per MMBtu on April 26.Energy & Utilities Why the triple top and triple bottom patterns are important

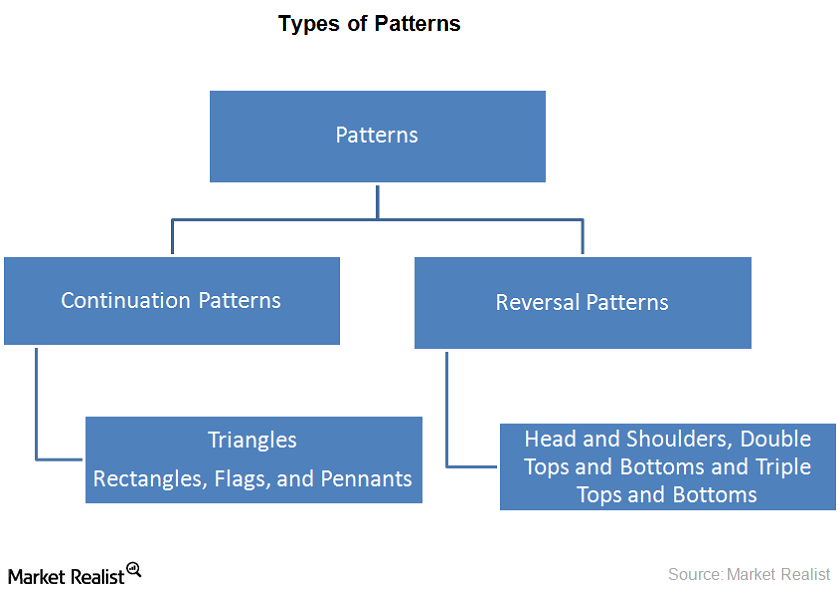

The triple top pattern is formed in the uptrend. In this pattern, three consecutive peaks are formed. The peaks have roughly the same price level.

Could Oil Rig Count Stop Natural Gas Fall?

In the week ended October 6, 2017, the natural gas rig count fell by two to 187.

Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.

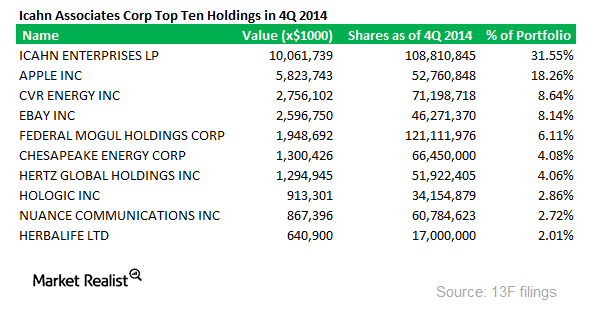

Analyzing Icahn Associates’ 13D and 4Q14 13F Filings

Icahn Associates’ 4Q14 positions were disclosed through a 13F filing in February. The size of the US long portfolio was down to $31.89 billion.

Natural Gas: Analyzing the Inventory Levels

In the week ending May 24, the inventories spread was -12.1%. The spread contracted by ~1.4 percentage points compared to the previous week.

Why WTI crude oil prices are down over 15% in 3 months

WTI crude oil prices continued to slide as U.S. crude inventories continued to grow, with domestic production surging.

Get Real: Breakups, Rallies, and Struggles Continue

In today’s Get Real newsletter, we looked at big tech breakup updates, another leaked Musk email, the Boeing and Airbus war, Slack’s outlook, and more.Financials What’s the Dow Theory?

The Dow Theory was developed by Charles Dow. It identifies and signals the change in the stock market trends. It’s useful for trading and investing. The Dow Theory has six components.Financials Technical indicators and the Relative Strength Index

The Real Strength Index (or RSI) is a measure of a stock’s overbought and oversold position. The commonly used RSI is a 14-day RSI. It refers to the 14-day stock price that’s used to calculate the RSI.

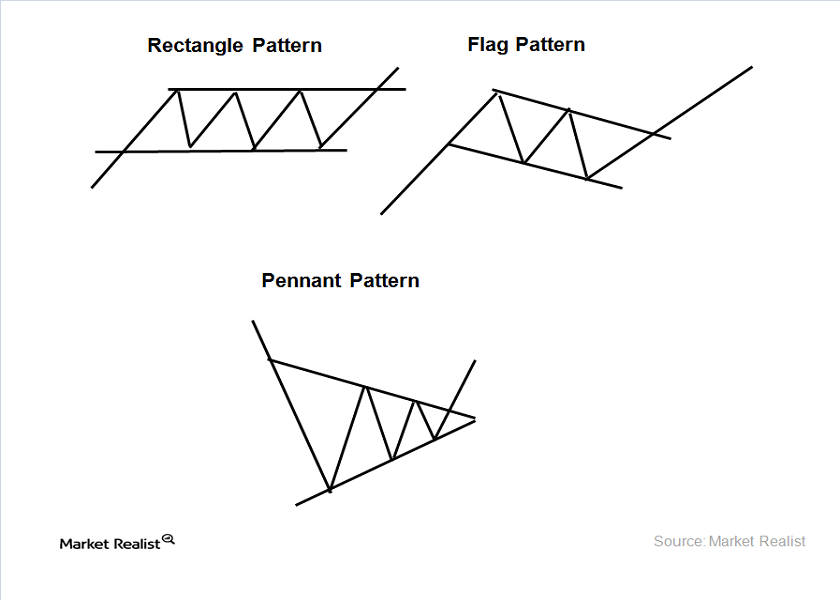

Technical analysis—the rectangle, flag, and pennant patterns

In the rectangle pattern, it’s advisable to buy stock at support and sell at resistance. This pattern is formed in the uptrend and downtrend.Financials Double top and double bottom patterns in technical analysis

The double top pattern forms in the uptrend. In this pattern, two consecutive peaks are formed. The peaks both have roughly the same price level.

Why technical analysis uses price patterns

Price patterns are trends that occur in stock charts. The charts are used in technical analysis. The pattern forms recognizable shapes. Price patterns are used to forecast the prices.

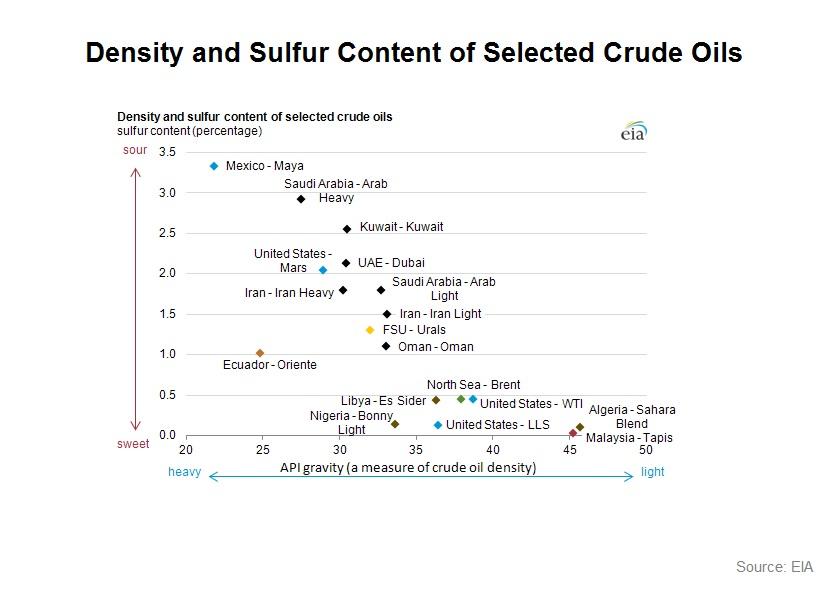

All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.

The crude oil market: An overview

Crude oil prices have been on a roller coaster ride in 2014. This series will help crude oil investors recognize key factors that are impacting oil prices.

Why it’s important to know the crude oil extraction process

Before learning the costs components of crude oil extraction, let’s take a look at how producers extract crude oil from the ground.

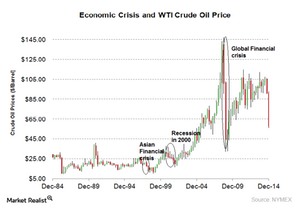

How an economic crisis affects the price of crude oil

The common factor during an economic crisis is that economic growth slows down. Demand declines, which has a negative impact on oil prices.

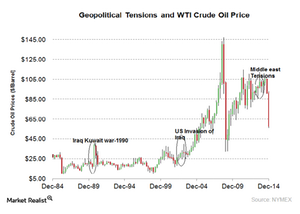

Must know: Geopolitical tensions impact oil prices

A glut in crude oil supply could mean that political tensions in the near term may not impact oil prices.

Get Real: Musk Confronts Criticism, Earnings Continue

In today’s Get Real, we saw Apple Watch’s performance and another loss for Boeing. Plus, Google’s Fitbit acquisition faces scrutiny from the EU.

Get Real: Big Tech Companies Dominate

In today’s Get Real, we saw updates on big tech companies’ latest happenings. Plus, more earnings results, projections, and expectations.

Why Natural Gas Prices Could Take a Hit Next Week

On October 24, natural gas prices rose 1.5% and settled at $2.32 per MMBtu. On the same day, the United States Natural Gas Fund LP rose 1.4%.

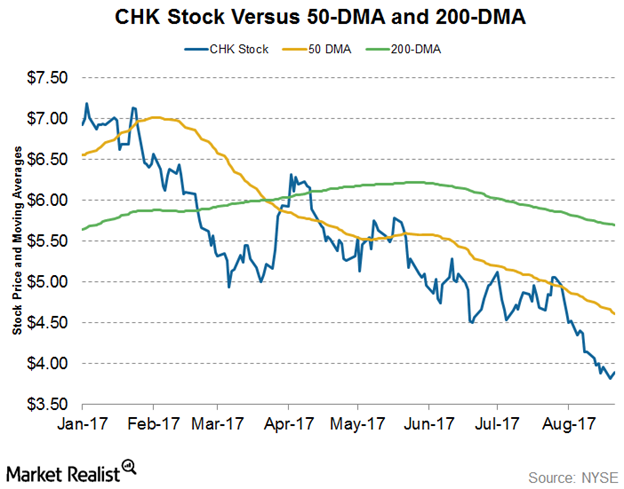

Chesapeake Energy: Recommendations, Moving Averages

Of the 25 analysts tracking Chesapeake Energy (CHK), only three recommended a “buy” on the stock and 40% have a “sell” recommendation.

Will API Inventory Data Impact Energy Stocks?

Today, the API plans to release its oil inventory data for the week ended August 30. Gasoline inventories are expected to fall by 1.8 MMbbls.

Analysts’ Price Targets for Cabot Oil & Gas’s Next 12 Months

Approximately 66.66% of analysts covering Cabot Oil & Gas (COG) recommend “buy,” and 33.33% recommend “hold.”

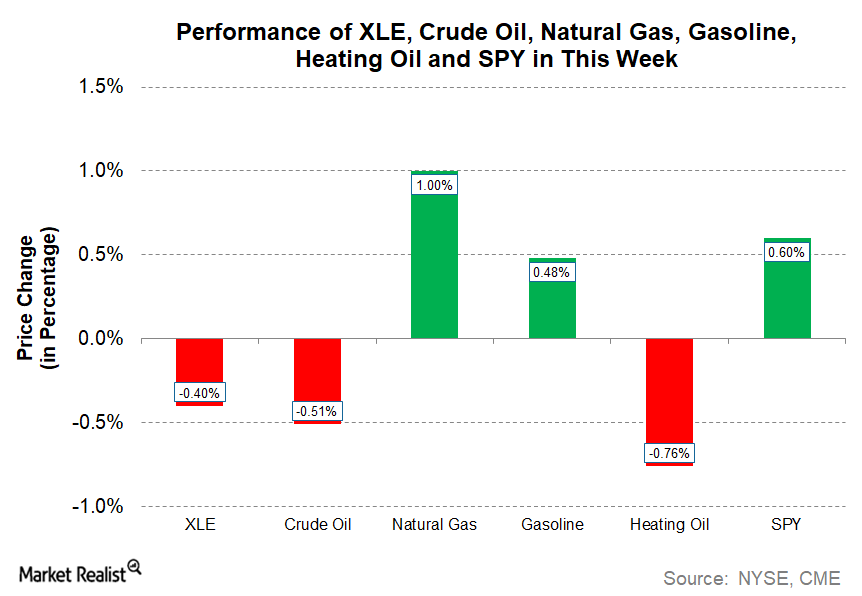

These Energy Commodities Rose This Week

With the mixed performance from energy commodities, energy stocks are down this week. As of January 17, the Energy Select Sector SPDR Fund (XLE) has fallen ~0.4% this week.

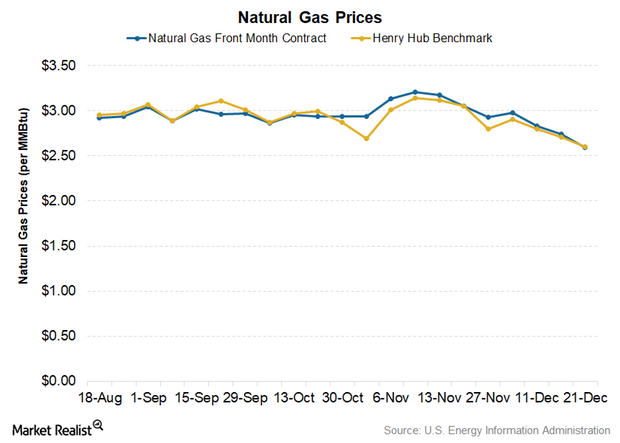

Natural Gas Prices Continue to Fall

In the EIA’s STEO report, it predicted that the Henry Hub natural gas benchmark price would average $3.12 per MMBtu in 2018.

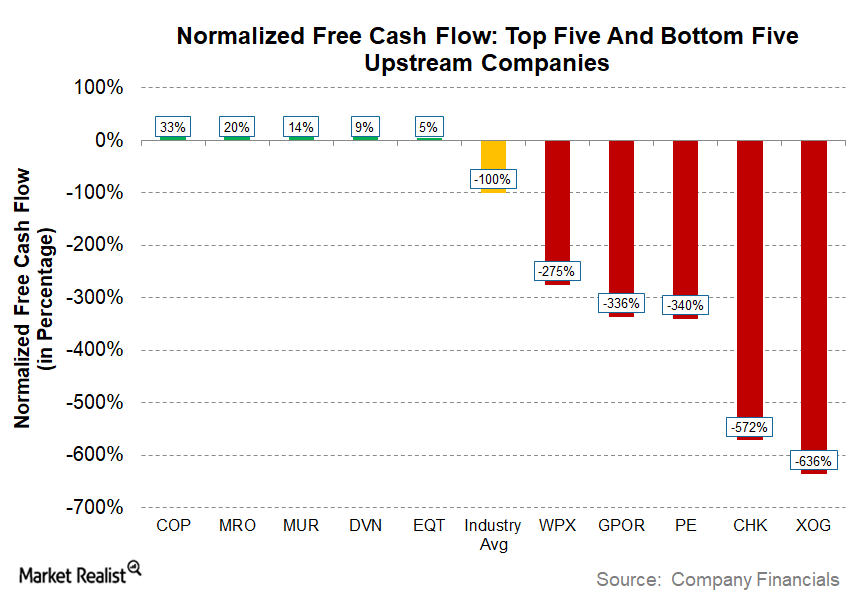

Upstream Energy’s Best and Worst Free Cash Flow Companies

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector.

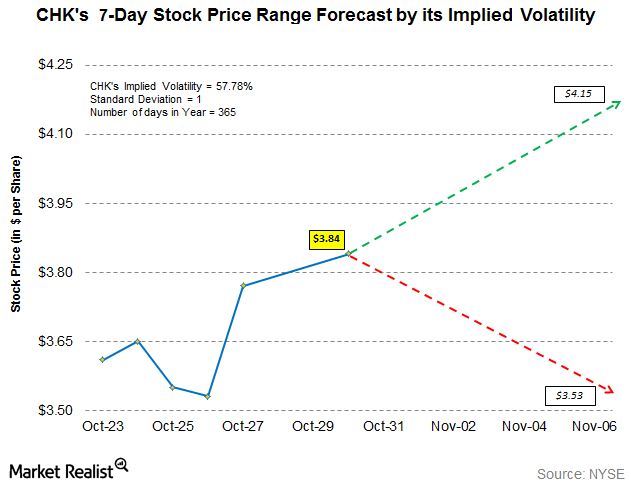

Chesapeake’s Implied Volatility: Stock Price Range Forecast

Chesapeake Energy’s (CHK) implied volatility as of October 30, 2017, was ~58%—9% higher than its 15-day average of ~53%.

Can Chesapeake Energy Stock Rise from the Doldrums?

Chesapeake Energy stock (CHK) has fallen for most of this year. It picked up slightly in April but wasn’t able to hold those levels.

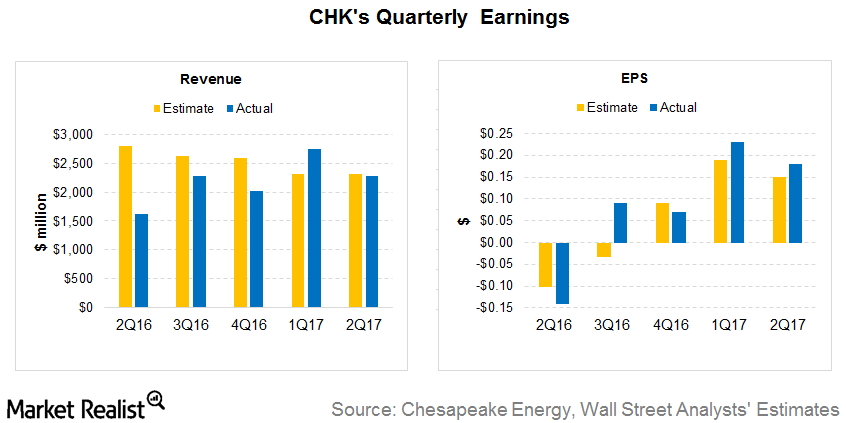

Analyzing Chesapeake’s 2Q17 Revenue and Earnings

On August 3, 2017, Chesapeake Energy (CHK) reported its 2Q17 earnings. The company reported revenue of ~$2.3 billion—in line with analysts’ estimates.

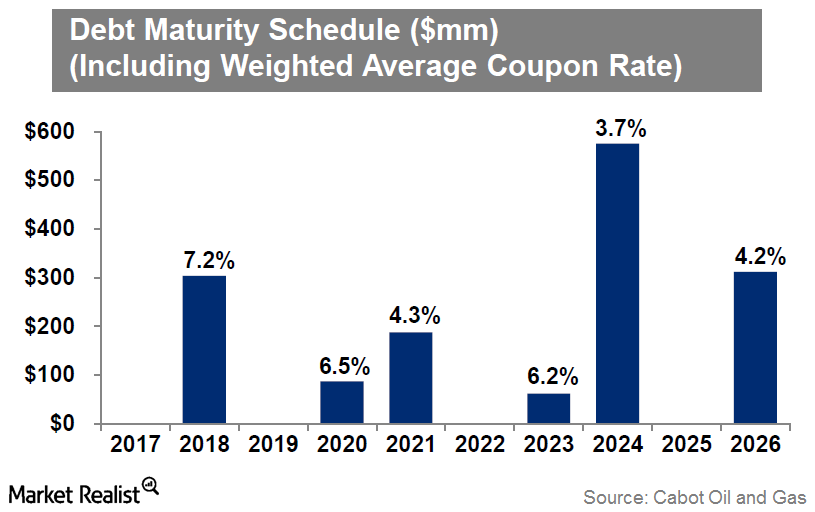

Analyzing Cabot Oil and Gas’s Debt Maturity Profile

Cabot Oil and Gas (COG) noted that it doesn’t have any debt maturing until 2018.

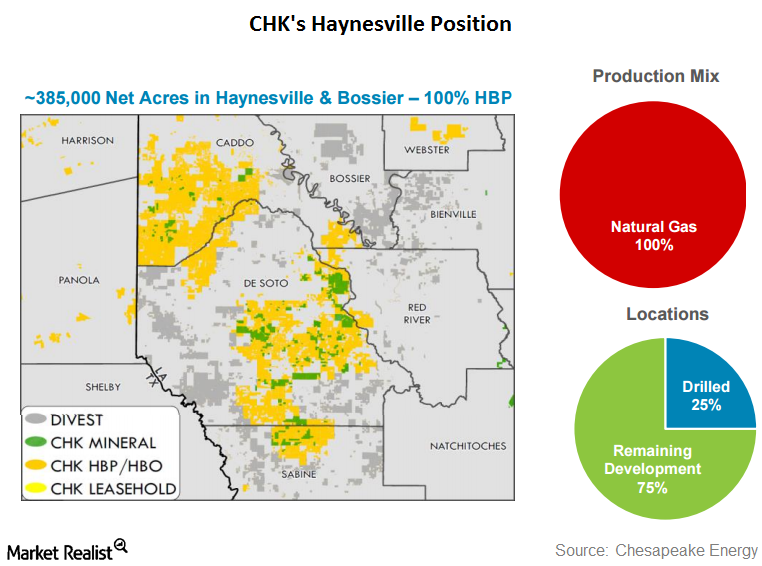

Chesapeake Energy Announces Haynesville Asset Divestiture

Chesapeake Energy (CHK) announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

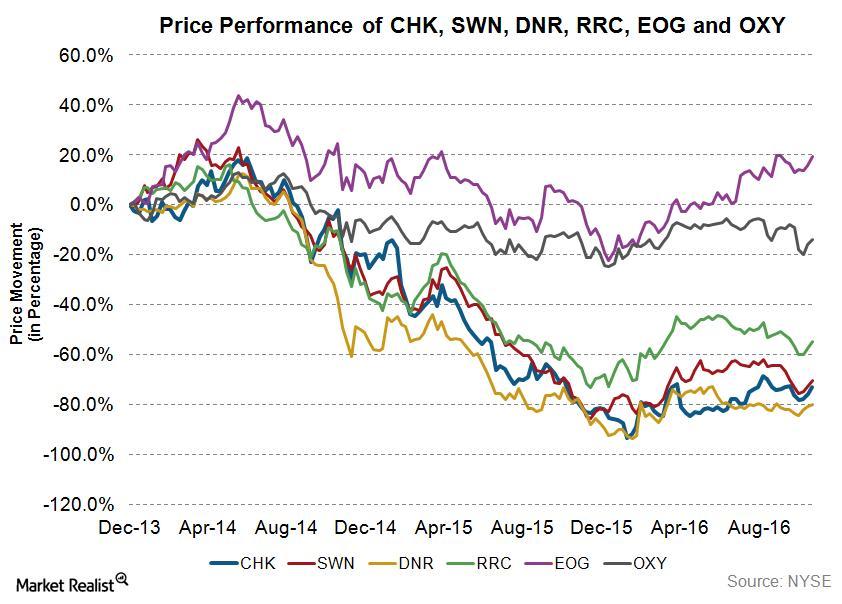

Are Companies That Have Done Acquisitions Outperforming?

Upstream companies’ performance In the last two parts of this series, we have seen that some upstream companies, namely Range Resources (RRC), EOG Resources (EOG), and Occidental Petroleum (OXY), have taken advantage of lower crude oil (USO) and natural gas (UNG) prices through acquisitions. In this part, we’ll see if these companies are outperforming Chesapeake […]