Chesapeake Energy Corp

Latest Chesapeake Energy Corp News and Updates

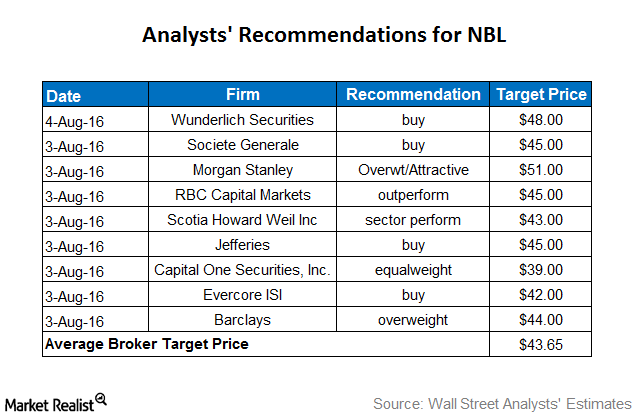

What Analysts Recommend for Noble Energy after Its 2Q16 Earnings

Approximately 63% of analysts rate Noble Energy (NBL) a “buy,” and 34% rate it a “hold.” The remaining ~3% rate it a “sell.”

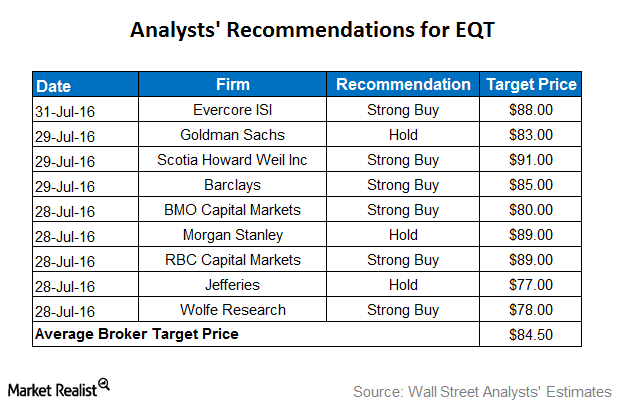

What Analysts Recommend for EQT after 2Q16 Earnings

Approximately 65% of analysts rate EQT (EQT) a “buy,” and 30% rate it a “hold.” The remaining 5% rate it a “sell.”

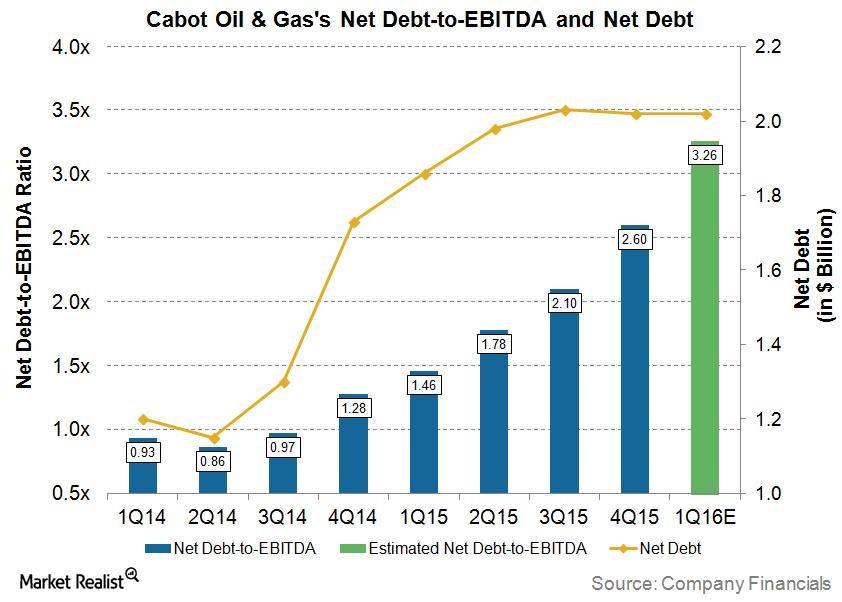

How Is Cabot Oil & Gas Dealing with Its High Debt?

On February 26, 2016, in an attempt to deal with falling earnings and high debt, Cabot Oil & Gas (COG) closed a public offering of 44 million shares of its common stock.

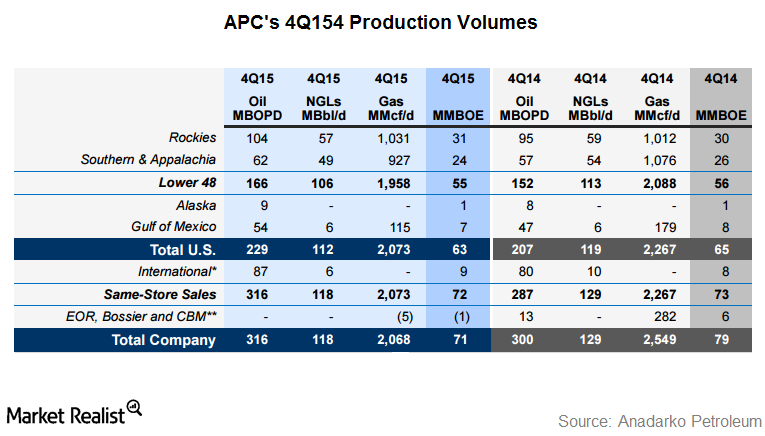

Anadarko Petroleum Slashes Its 2016 Capital Expenditure Budget

Anadarko Petroleum’s preliminary capex (capital expenditure) budget for 2016 is $2.8 billion—nearly 50% less than 2015 levels.

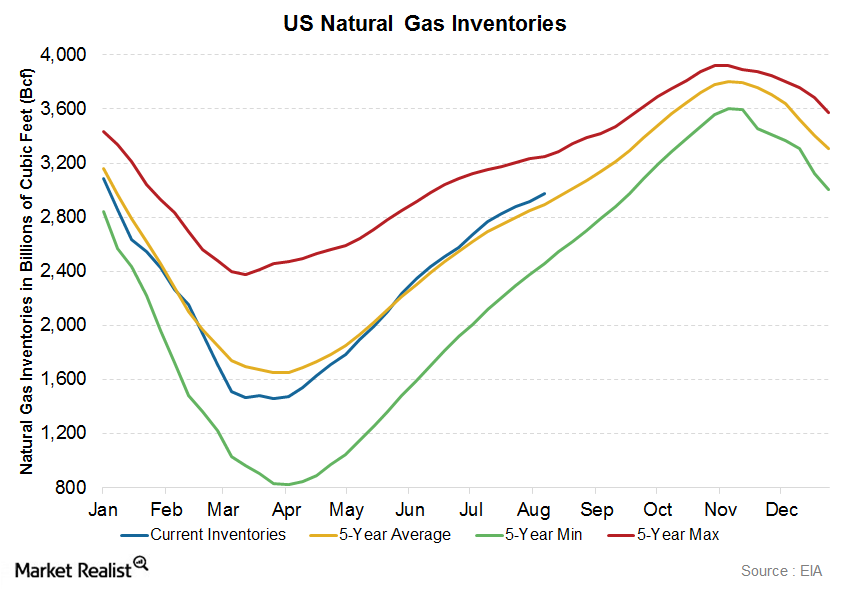

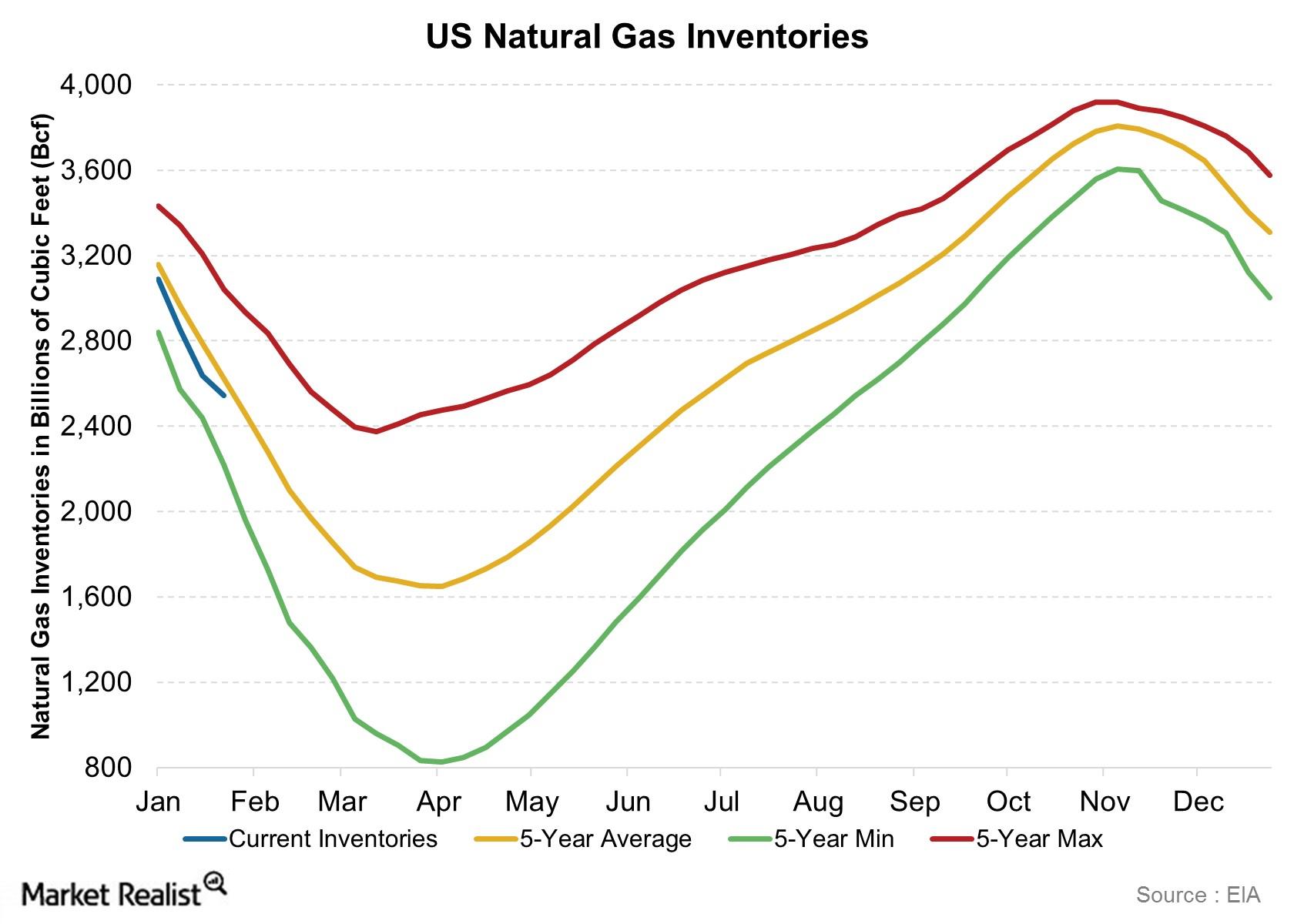

Natural Gas Inventories Beat Expectations: How Will Prices React?

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7.

The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.

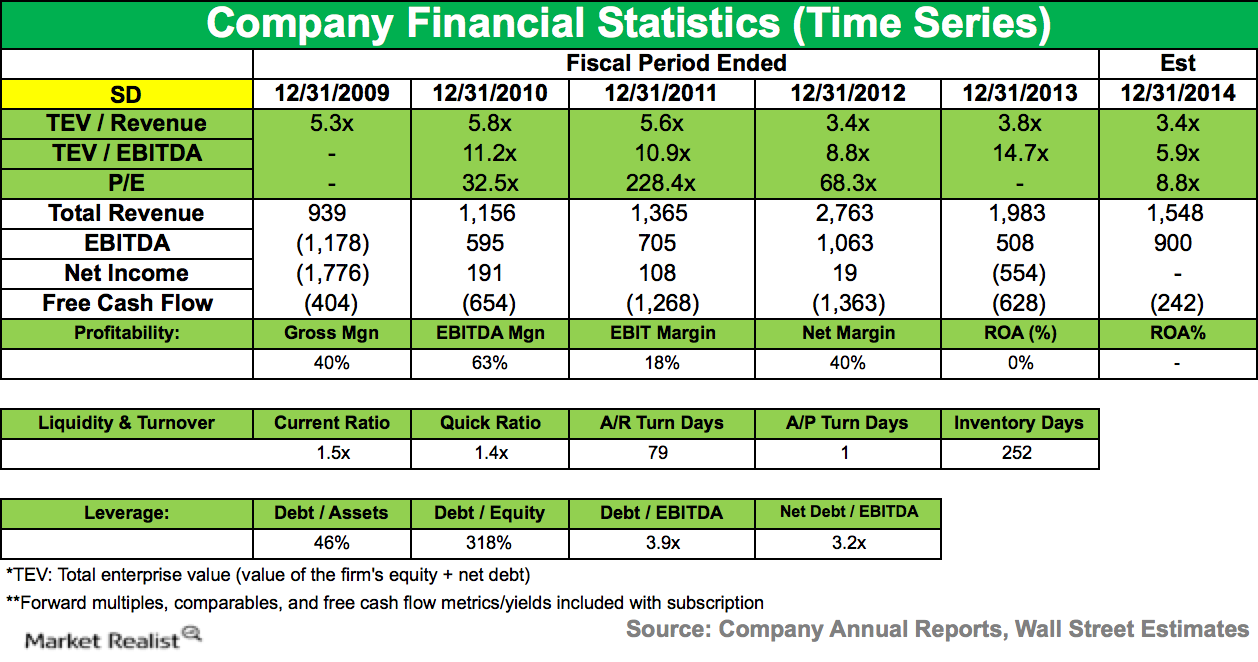

Overview of SandRidge Energy

SandRidge is expanding its low-cost multilateral program and is successfully extending its mid-continent resource base with Chester and Woodford production.

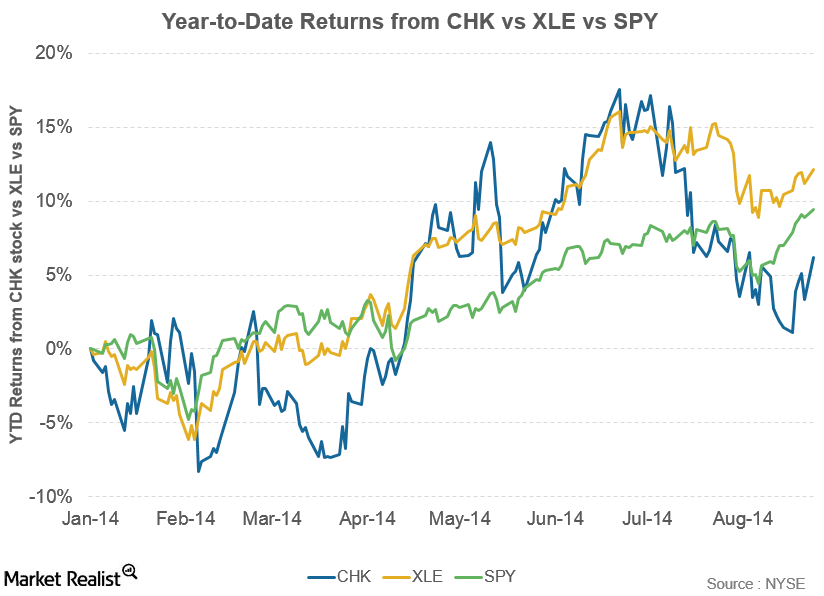

An investor’s must-read introduction to Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.

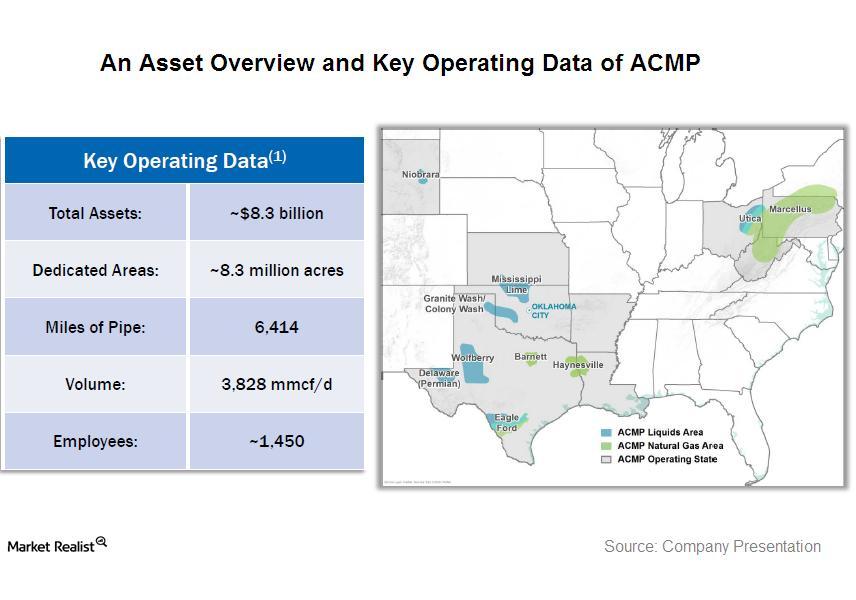

An introduction to Access Midstream Partners’ business and assets

Access Midstream Partners is a master limited partnership, which owns, operates, develops and acquires natural gas, NGLs, and oil gathering systems and other midstream energy assets.

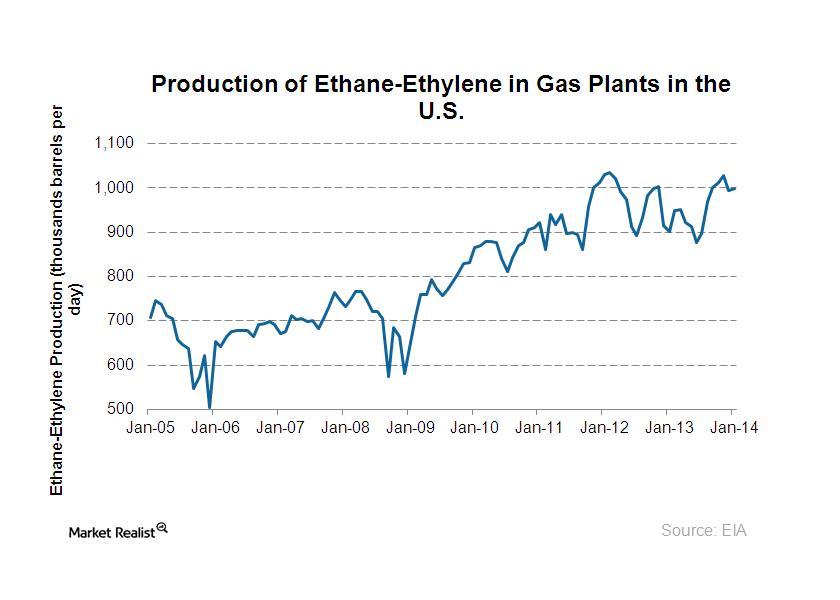

Why ethane production has increased a lot over the past few years

Ethane is the largest component of the natural gas liquids stream, and the increased wet gas production caused a large increase in ethane production.

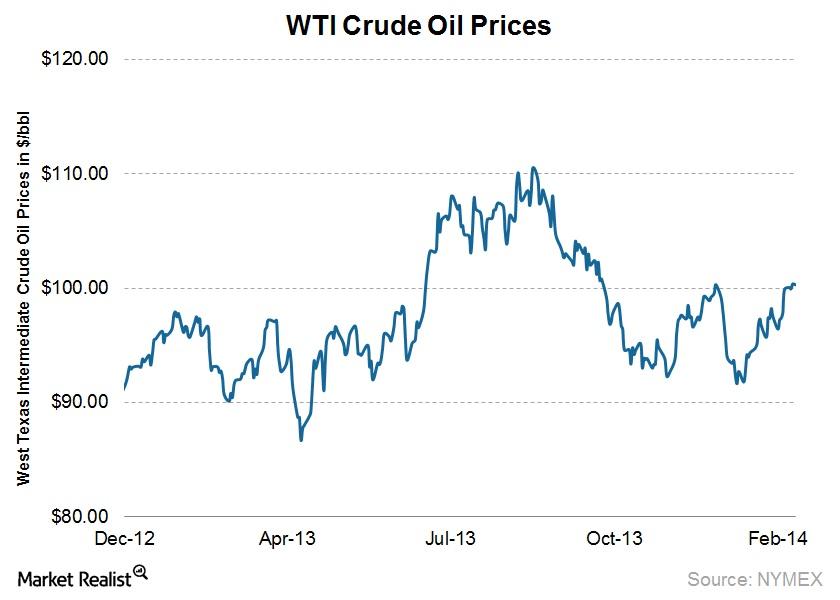

WTI crude prices break $100 per barrel for the 1st time in 2014

WTI traded flat last week, but firstly traded up $100 per barrel since December 27. This past week’s upward movement in prices was a short-term positive for the sector.

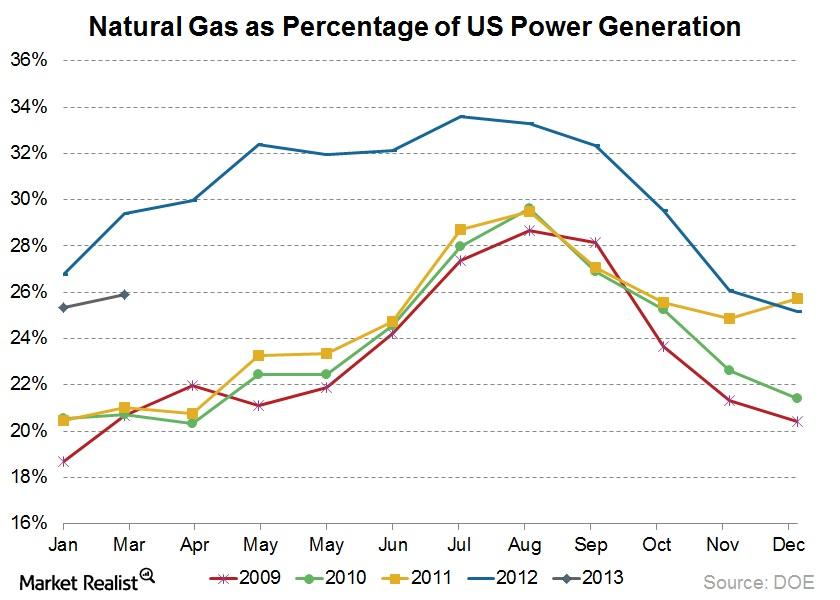

Why has natural gas gained popularity among power generators?

Natural gas has gained market share for use in power generation. Learn about the drivers of this trend and the consequences of increased natural gas use.

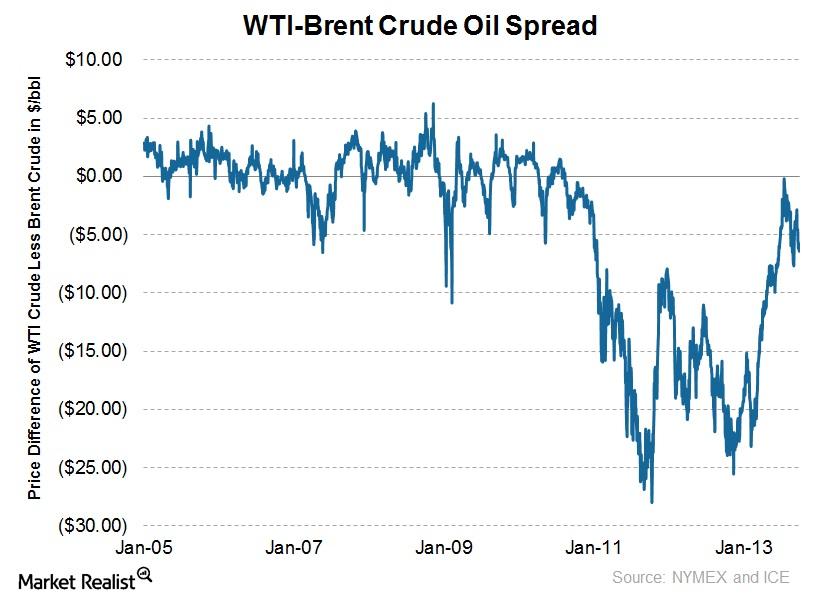

Why the spread between WTI and Brent oil drifted wider

The spread between WTI and Brent closed through most of 2013, but it has experienced some volatility in recent months, given events in Libya and Syria.