How Is Cabot Oil & Gas Dealing with Its High Debt?

On February 26, 2016, in an attempt to deal with falling earnings and high debt, Cabot Oil & Gas (COG) closed a public offering of 44 million shares of its common stock.

March 31 2016, Updated 12:08 p.m. ET

Cabot Oil & Gas: Low cash, high debt

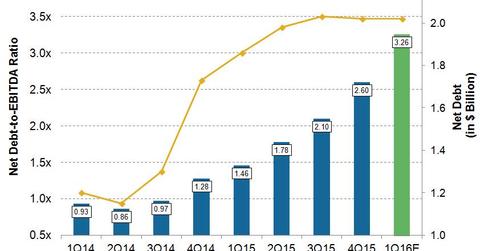

As of December 31, 2015, Cabot Oil & Gas’s (COG) total debt stood at ~$2.03 billion. With only ~$0.5 million in cash and cash equivalents, COG’s net debt was ~$2.02 billion at the end of 4Q15.

COG’s net debt-to-EBITDA

Net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) is a debt ratio that shows how many years it would take for a company to pay back its debt under the current earnings situation. As you can see in the above graph, as of 4Q15, Cabot Oil & Gas’s net debt-to-EBITDA was ~2.6x. It was ~0.9x in 1Q14. An increase over the last two years can be attributed to rising debt and falling EBITDA due to lower natural gas prices. In 4Q15, COG’s EBITDA was ~60% lower year-over-year at ~$154 million.

Below are some other upstream companies and their net debt-to-EBITDA ratios:

- Diamondback Energy (FANG): 1.1x

- Consol Energy (CNX): 5.7x

- Pioneer Natural Resources (PXD): 1.5x

- Chesapeake Energy (CHK): 3.5x

Movements in natural gas prices also affect the VelocityShares 3X Long Natural Gas ETN (UGAZ) and the VelocityShares 3x Inverse Natural Gas ETN (DGAZ).

COG’s 1Q16 net debt-to-EBITDA estimate

For 1Q16, Wall Street analysts expect COG to report adjusted EBITDA of ~$111 million, which is lower by ~59% when compared to 1Q15 adjusted EBITDA of ~$270 million. Lower adjusted EBITDA estimates can be attributed to expectations for continued lower natural gas (UNG) prices. For 1Q16, assuming net debt remains unchanged, COG’s net debt-to-EBITDA ratio estimate is ~3.3x. That’s the highest in two years and far above COG’s two-year average of ~1.5x.

Equity offering: Cabot’s access to cash

On February 26, 2016, in an attempt to deal with falling earnings and high debt, Cabot Oil & Gas (COG) closed a public offering of 44 million shares of its common stock at a price to the public of $20 per share. COG plans to spend proceeds from this offering to reduce its debt, fund part of its capital program, and pay for general corporate expenses.

Next, let’s take a look at Cabot’s free cash flow situation.