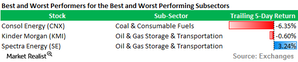

CNX Resources Corp

Latest CNX Resources Corp News and Updates

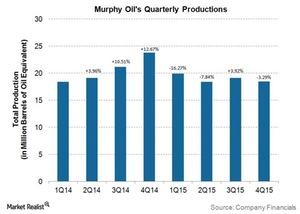

Murphy Oil’s 4Q15 Operational Performance, Management Strategies

Along with its 4Q15 earnings, Murphy Oil announced the divestiture of its Montney midstream assets located in Canada. The transaction includes the sale of existing infrastructure capable of processing up to 320 million cubic feet per day.

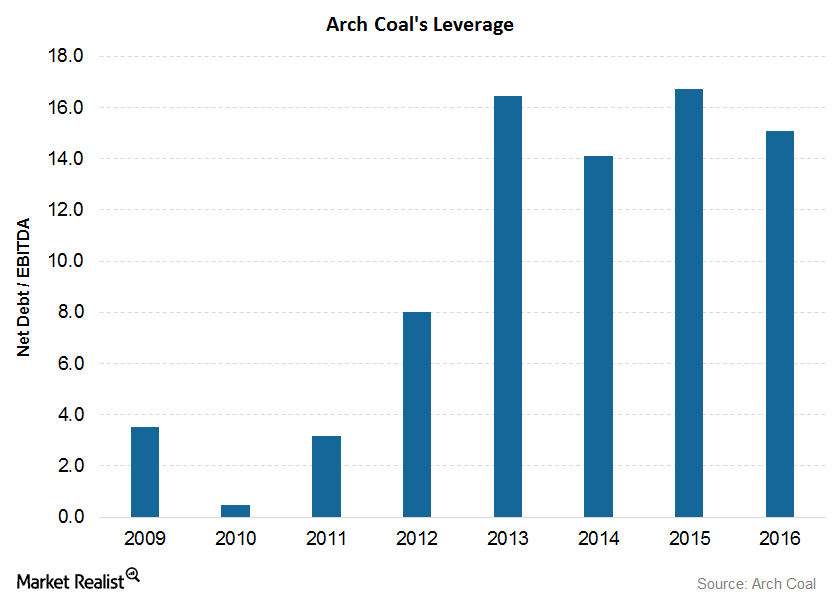

Understanding Arch Coal’s Financial Position

Arch Coal’s leverage On June 30, 2017, the book value of Arch Coal’s (ARCH) long-term debt was about $315.6 million, of which ~$297 million is due for payment in 2024. Arch Coal’s leverage, which is its net debt divided by EBITDA (earnings before interest, tax, depreciation, and amortization), has increased since the acquisition of International […]

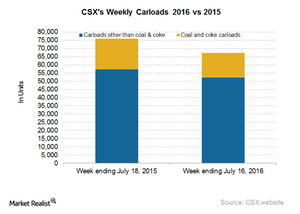

Why Did CSX’s Carloads Slump in the Week Ending July 16?

CSX (CSX) is a major operator in the Eastern US that competes with Norfolk Southern (NSC).

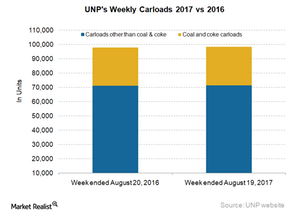

Comparing Union Pacific’s Freight Volumes with the Industry in Week 33

In week 33 of 2017, Union Pacific (UNP) recorded a marginal rise of 0.6% in its railcars, excluding intermodal.

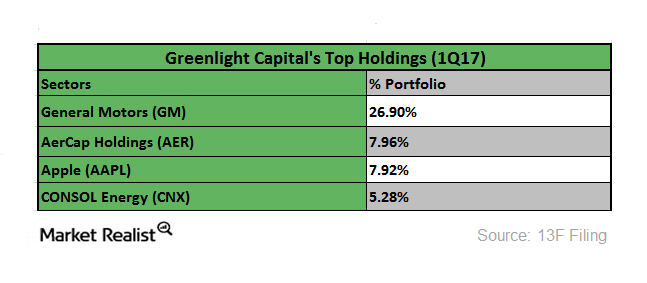

Inside Einhorn’s Greenlight Capital’s Top Holdings

Billionaire hedge fund manager David Einhorn is well known for his investment strategy, having advised long and short bets during different market scenarios.

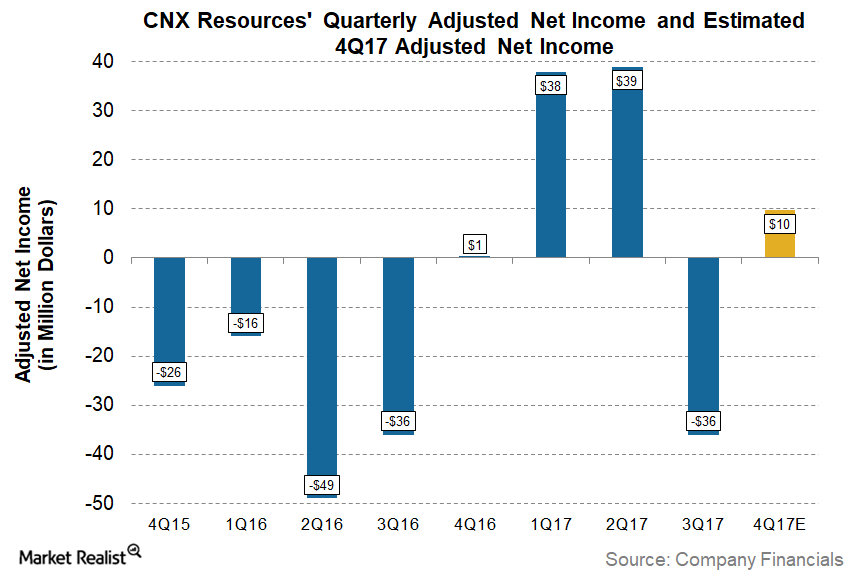

Can CNX Resources Report Higher Profits in 4Q17?

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. CNX is expected to report 1,000% higher profits YoY than 4Q16.

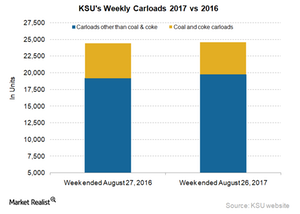

Kansas City Southern: What Led Volume Rise in Week 34?

Kansas City Southern (KSU), the smallest Class I railroad, reported a marginal volume gain in the week ended August 26, 2017.

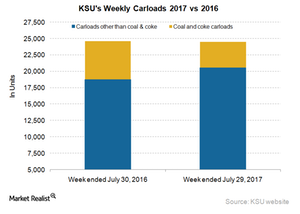

A Deep Dive into Kansas City Southern’s Shipments in Week 30

Kansas City Southern (KSU), the smallest Class I railroad in the US, also operates in Mexico.

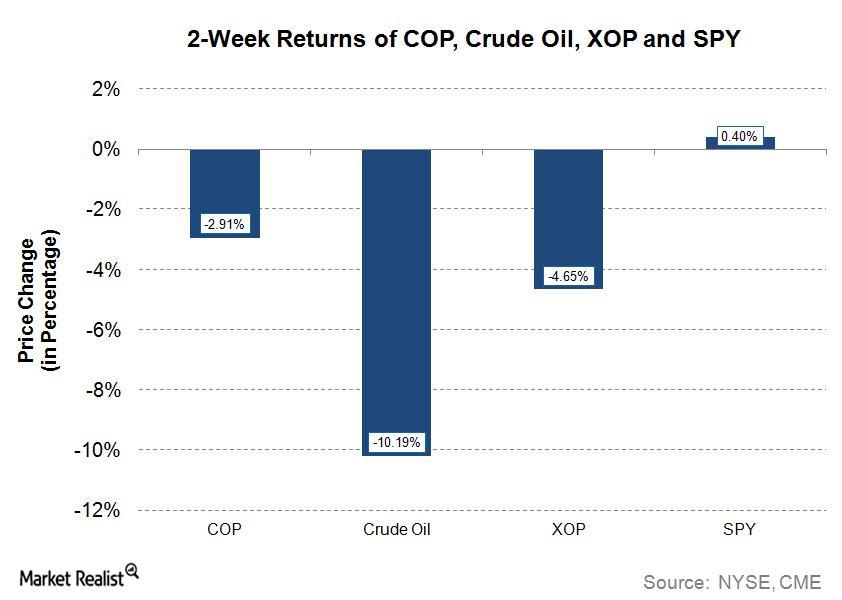

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

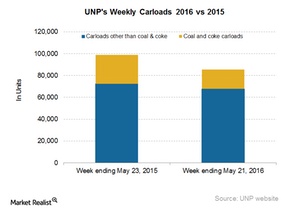

The Next Chapter in Union Pacific’s Carload Slump

In the week ending May 21, Union Pacific’s total railcars declined by 13.5% YoY to ~86,000 units, which was down from ~99,000 units one year previously.

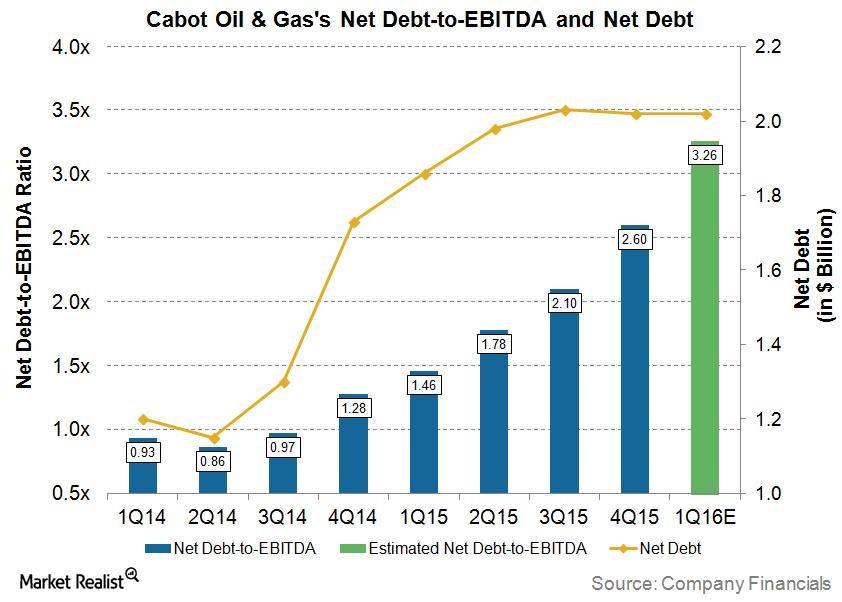

How Is Cabot Oil & Gas Dealing with Its High Debt?

On February 26, 2016, in an attempt to deal with falling earnings and high debt, Cabot Oil & Gas (COG) closed a public offering of 44 million shares of its common stock.

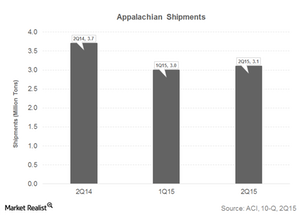

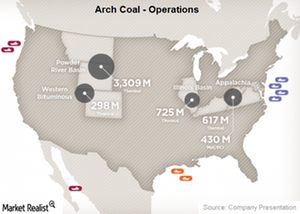

Arch Coal’s Appalachian Shipments Remain under Pressure in 2Q15

In 2Q15, Arch Coal’s (ACI) Appalachia segment shipped 3.1 million tons of coal, down from 3.7 million tons in 2Q14, but up from 1Q15’s 3.0 million.

Why Arch Coal Rallied During a Bad Week for the S&P 500

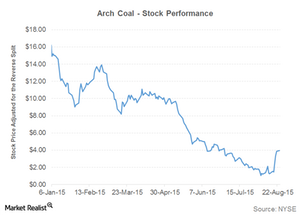

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21.

Why Arch Coal Is in the News for Debt Exchange

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE.

US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

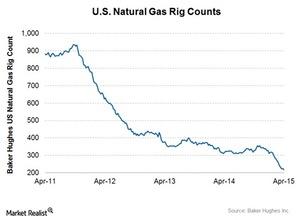

Natural Gas Rig Count Back to Downtrend in Week Ended April 17

There were 217 natural gas rigs operating in the week ended April 17, a loss of eight from the previous week. Natural gas rig count increased by three the previous week.