Why Arch Coal Rallied During a Bad Week for the S&P 500

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21.

Sept. 1 2015, Published 1:48 p.m. ET

Arch Coal rallies

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21, up from August 14’s $1.26. Speculation about a compromise on a debt deal led to the rally.

The stock has been under tremendous pressure for quite some time, and it traded below a dollar for much of 2Q15 and beyond until the reverse stock split. In fact, even after the last week’s rally, the stock would have remained below $0.40 if it weren’t for the reverse split. While the debt exchange deal—if it goes through—will reduce ACI’s leverage and interest costs, the company will still have around $4 billion of debt on its balance sheet. This is still a lot, considering that the company is still burning cash.

Stock performance

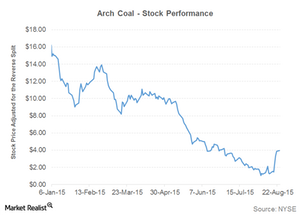

Arch Coal has lost 78% of its value since the beginning of 2015 as hopes of a price recovery in the coal (KOL) market continued to dwindle, mainly because natural gas prices remained subdued. The stock lost 44% in 1Q15 and another 66% in 2Q15. Thanks to the surge in the week ending August 21, the stock has partially recovered, gaining 16% from the end of 2Q15 up to August 24.

Peer performance

Cloud Peak Energy (CLD) has lost 64% since the start of the year up to August 24, as weak natural gas prices and a host of regulatory issues haunt even the low-cost Powder River Basin coal producer.

Peabody Energy (BTU) has lost 80% during the same period, as the company continues to battle with a weak met coal market, subdued natural gas prices, and regulatory issues that are affecting most American coal producers.

Consol Energy (CNX) has lost 65% as weak coal prices and subdued natural gas prices continue to affect the company’s coal and natural gas segments.

In the next few parts, we’ll take stock of Arch Coal’s 2Q15 operating and financial performance.