Arch Coal Inc.

Latest Arch Coal Inc. News and Updates

Challenges before Peabody Energy’s US operations in fiscal 2015

The retirement of coal-fired power plants and the impact of new regulations proposed by the EPA present two major blows to the US thermal coal industry.Consumer Must-know: Why Peabody Energy fell 1.9% on July 22

Wall Street analysts’ consensus estimate for loss per share was $0.289.

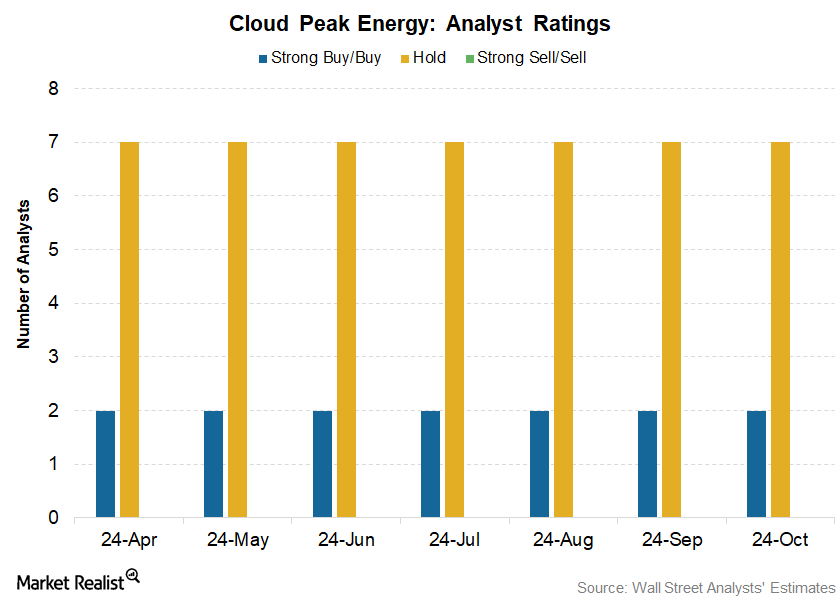

Why Most Analysts Recommend a ‘Hold’ for Cloud Peak Energy

Of the nine analysts covering Cloud Peak Energy (CLD), seven analysts rated its stock as a “hold,” and two gave CLD a “buy” or “strong buy” rating.

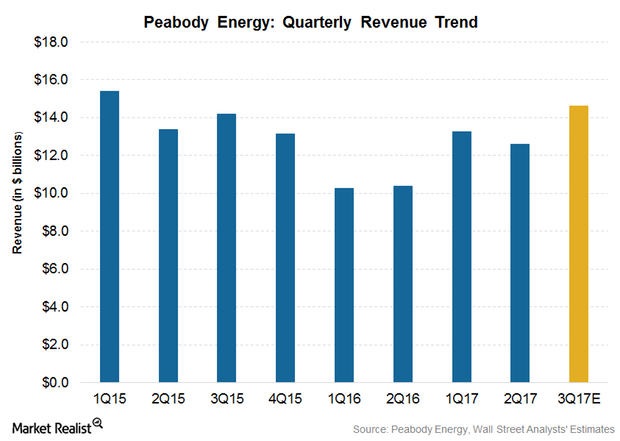

Analysts Expect Peabody Energy’s Revenues to Rise in 3Q17

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17.

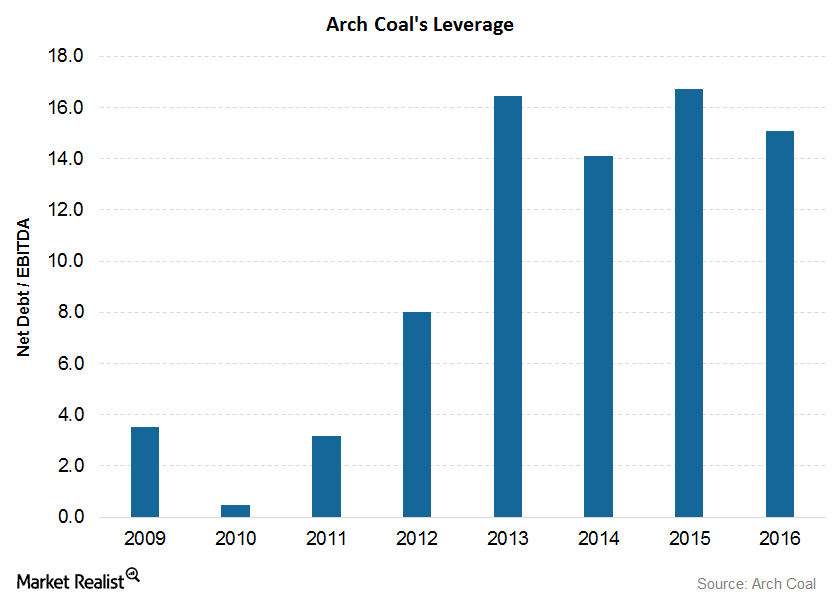

Understanding Arch Coal’s Financial Position

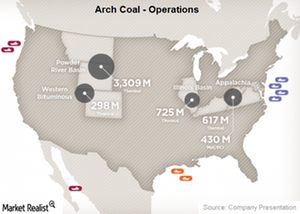

Arch Coal’s leverage On June 30, 2017, the book value of Arch Coal’s (ARCH) long-term debt was about $315.6 million, of which ~$297 million is due for payment in 2024. Arch Coal’s leverage, which is its net debt divided by EBITDA (earnings before interest, tax, depreciation, and amortization), has increased since the acquisition of International […]

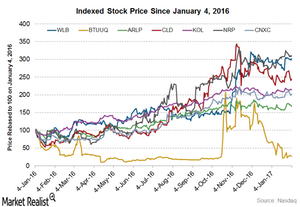

What Could Drive Arch Coal Stock in 2017?

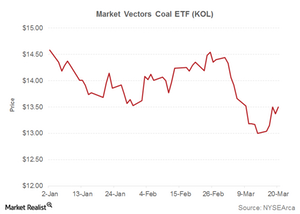

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016.

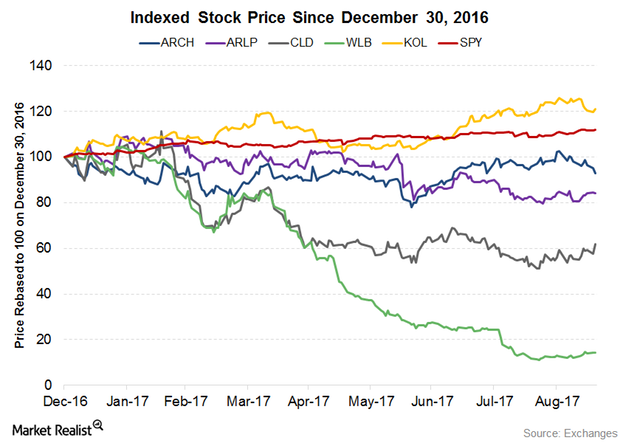

What Factors Could Drive Arch Coal Stock in 2H17?

1H17 in review Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017. On September 19, 2017, Arch Coal (ARCH) has fallen […]

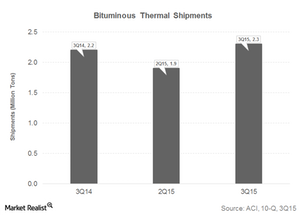

How Arch Coal’s Rise in Bituminous Thermal Coal Volumes Hurt Prices in 3Q15

Arch Coal’s Bituminous Thermal coal segment sold 2.3 million tons in 3Q15 compared to 2.2 million tons in 3Q14 and 1.9 million tons in 2Q15.

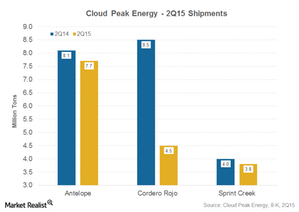

Cloud Peak Energy’s 2Q15 Shipments: Potential Risk Factors

Cloud Peak Energy (CLD) shipped 16.0 million tons of coal from its three owned and operated mines in the Powder River Basin (or PRB) in 2Q15.

Westmoreland Coal’s Canadian Operations: An Overview

Westmoreland’s Canadian operations Westmoreland Coal (WLB) acquired seven surface mines in Alberta and Saskatchewan, a stake in an activated carbon plant, and a char plant in Canada from Sherritt International in 2014. As of January 1, 2016, WLB’s Canadian operations are grouped as one entity, Prairie Mines & Royalty ULC. Its Canadian operations hold total […]Consumer Overview: Ambre Energy—a coal and oil shale export company

Ambre Energy was founded in June 2005. It’s an Australian-American coal and oil shale company. The company’s Australian headquarters are located at Brisbane. The head American office is located at Salt Lake City, Utah. The company operates in three business lines—U.S. coal export infrastructure, international coal marketing and trading, and U.S. thermal coal production.

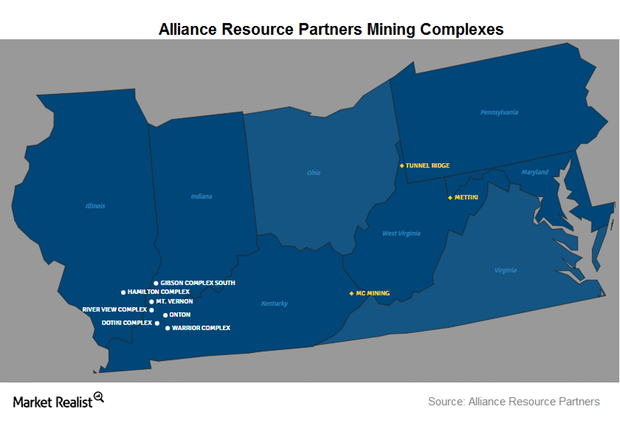

Inside Alliance Resource Partners’ Mining Operations

Alliance Resource Partners (ARLP) operates eight underground mining complexes in two regions: Illinois and Appalachia.

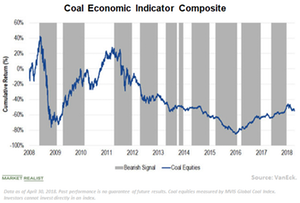

Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.

Why the RAAX ETF Has Reduced Its Exposure to Coal Equities

At launch, RAAX had a small weighting to coal, but in May, this exposure was completely eliminated based on falling coal equity prices and weakening supply and demand data.

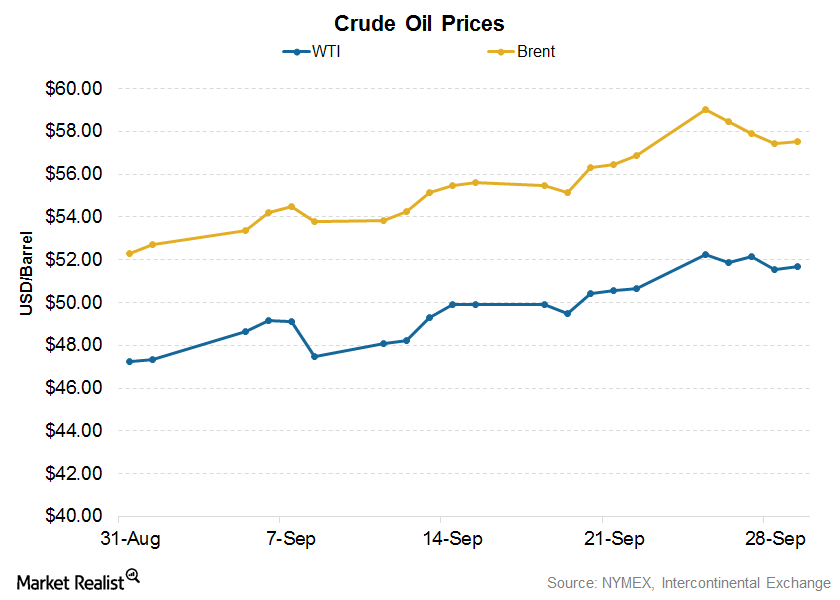

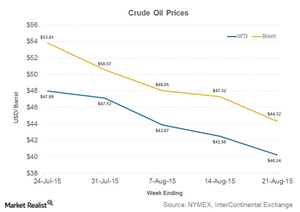

How Crude Oil Indirectly Impacts Coal Prices

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

The Key Risks Involved in Arch Coal’s Business

Commodity price risk Arch Coal (ARCH) has long-term coal supply agreements for their non-trading, thermal coal sales, hence managing commodity risk for thermal coal and also to a limited extent, through the use of derivative instruments. However, sales commitments in the metallurgical coal market are typically not long-term in nature and are subject to fluctuations […]

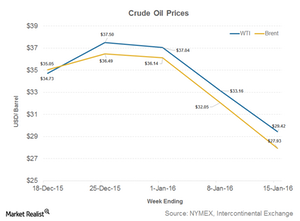

Crude Oil Fell below $30: Positive or Negative for Coal?

Crude oil prices dropped significantly during the week ended January 15, 2016. WTI (West Texas Intermediate) crude oil prices closed at $29.42 per MMBtu on January 15, 2016.

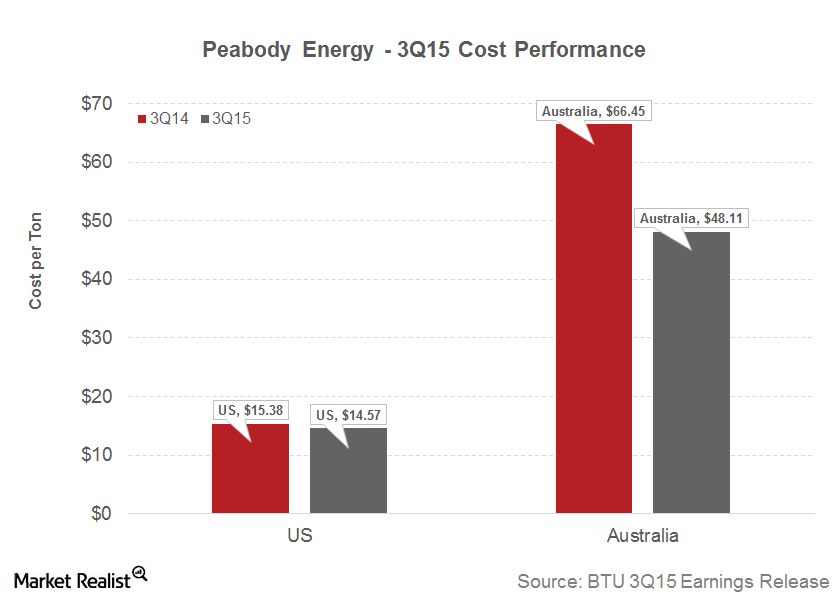

Will Peabody Energy’s Impressive 3Q15 Cost Performance Help?

Peabody Energy (BTU) reported Midwest production costs of $32.51 a ton in 3Q15, compared to $34.56 a ton in 3Q14.

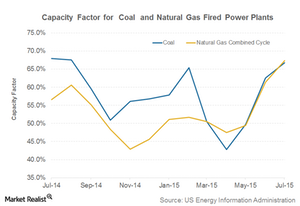

Capacity Factors Still Indicate Shift from Coal to Natural Gas

Capacity factors for coal-fired plants fell YoY and rose substantially for natural gas-fired power plants. This shows a shift from coal to natural gas as a fuel for electricity generation.

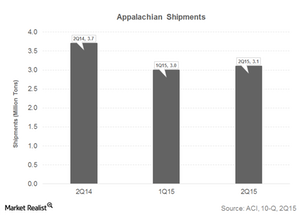

Arch Coal’s Appalachian Shipments Remain under Pressure in 2Q15

In 2Q15, Arch Coal’s (ACI) Appalachia segment shipped 3.1 million tons of coal, down from 3.7 million tons in 2Q14, but up from 1Q15’s 3.0 million.

Why Arch Coal Rallied During a Bad Week for the S&P 500

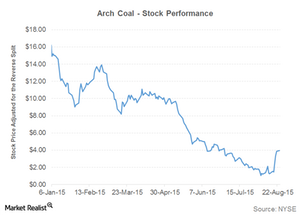

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21.

Why Arch Coal Is in the News for Debt Exchange

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE.

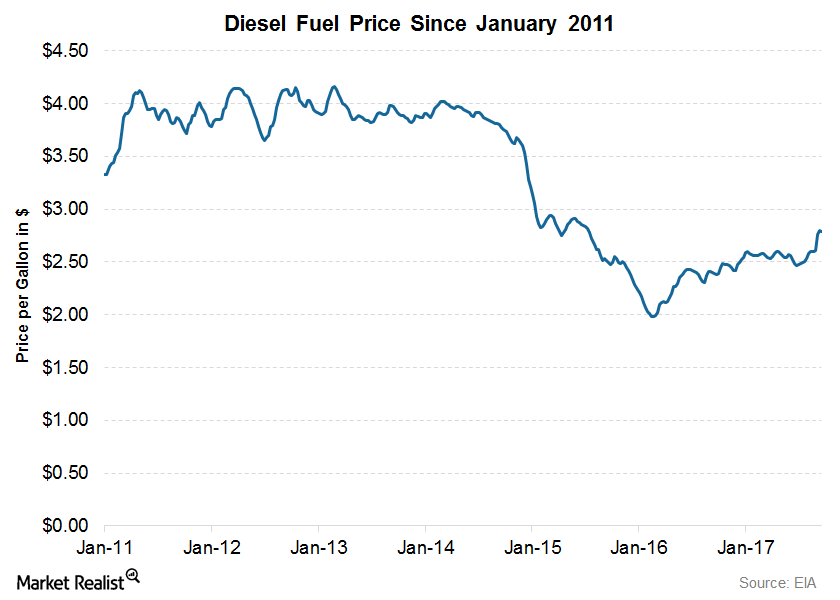

Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

Coal Prices Dropped as Natural Gas Prices Rose

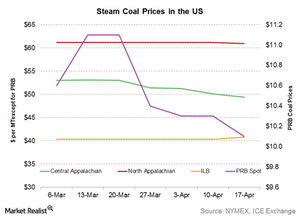

Central Appalachian thermal coal prices came in at $49.40 per ton for the week ending April 17—down from $50.10 per ton the previous week.

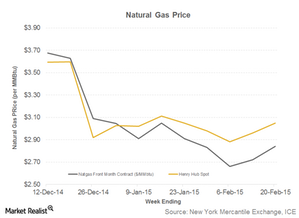

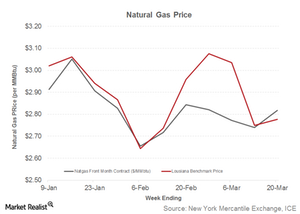

Why A Marginal Rise in Natural Gas Prices Helped Coal

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices rise, coal gains market share.

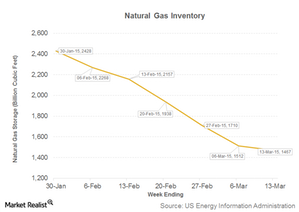

The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.

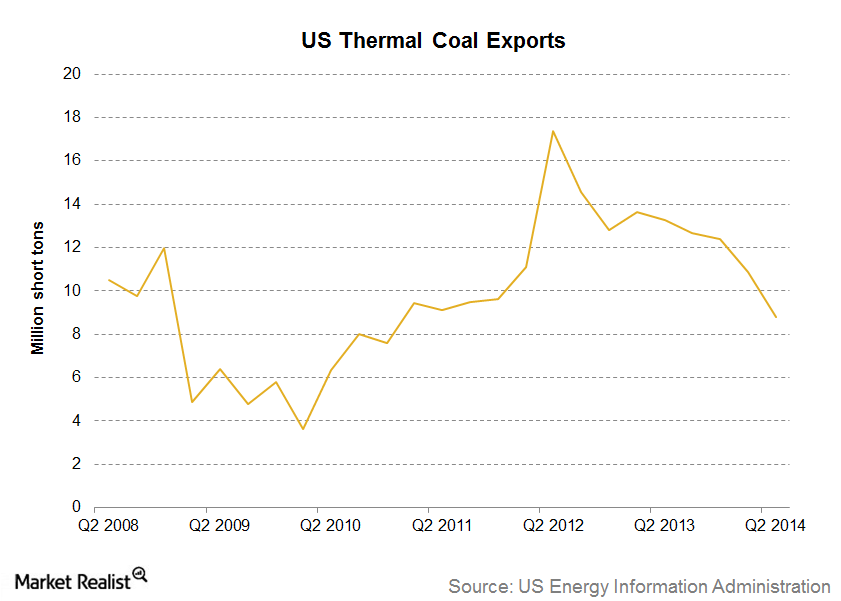

Must-know: US thermal coal exports are falling

US thermal coal exports were 19.6 million tons in the first half of 2014—down from 26.9 million tons during same period in 2013. The drop was mainly driven by falling demand from Europe.

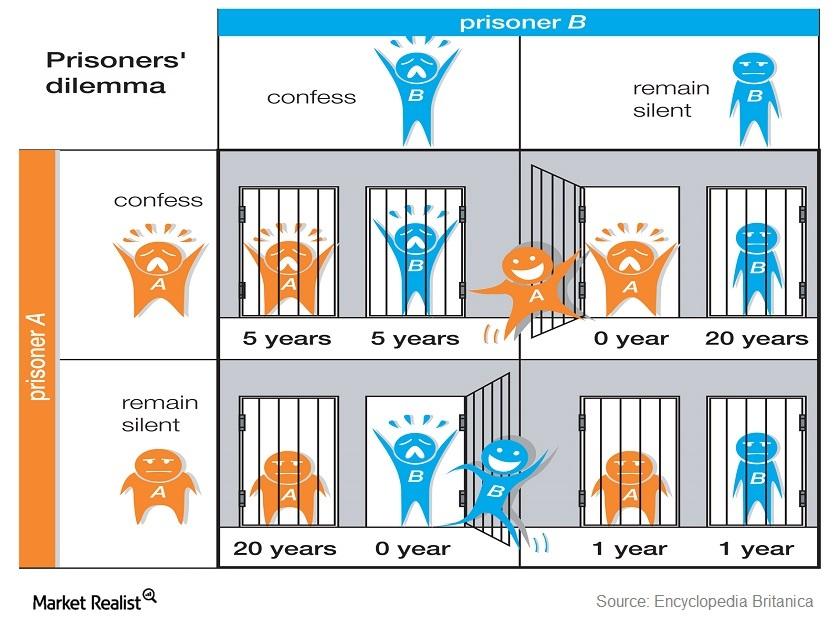

Falling commodity prices and the prisoner’s dilemma

There’s mistrust in the global commodity markets. From crude oil to met coal and iron ore, producers haven’t cut production. They’re waiting for others to do it first.Consumer Must-know: An overview of Appalachian coal

The Appalachian coal region is the oldest coal producing region in the U.S.—geologically and commercially. The Appalachian’s coal seams are ~300 million years old. They’re the oldest coal seams in the U.S. Appalachian coal fueled most of the Industrial Revolution after the Civil War in the 19th Century.

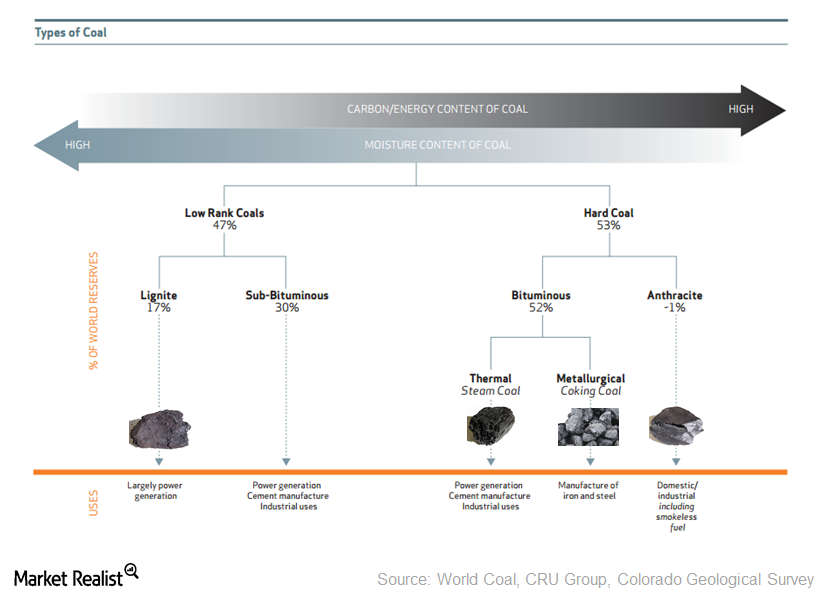

The “buried sunshine”—the coalification process and coal types

Coal is often called the “buried sunshine” because it developed from the remains of plants and greens that existed as long as 400 million years ago.