The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.

April 1 2015, Updated 9:05 a.m. ET

Natural gas inventory

Commodity prices are a function of demand and supply. If demand increases while supply remains constant, prices increase because more customers are chasing each unit of the commodity. In contrast, if supply increases for a given level of demand, prices drop because the commodity is available in abundance. So, natural gas inventory data is useful for getting a sense of natural gas prices.

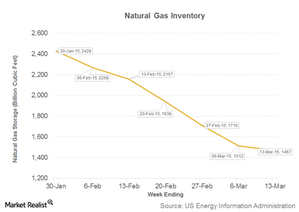

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday. The latest report covers the week ended March 13.

Natural gas inventory report

Throughout the year, natural gas is stored underground in order to save the fuel for the peak demand during the winter. For the week ended March 6, the inventory came in at 1,467 billion cubic feet, or Bcf. This reading was marginally higher than Wall Street analysts’ expectation of 1,464 bcf.

The inventory figure for the week was lower than the five-year average of 1,687 bcf. However, it remained higher than last year’s 953 bcf. Severe winter in 2014 caused a rapid inventory drawdown.

Impact on coal

The inventory data is neutral for coal producers (KOL), as it’s almost on par with expectations. If inventory is higher or lower than expected, it indicates higher- or lower-than-expected supply, pressuring natural gas prices. Weak natural gas prices are negative for thermal coal. A fall in natural gas prices during the last few months has hurt coal producers—especially the ones with operations in the east and the Midwest—including Alpha Natural Resources (ANR), Arch Coal (ACI), and Peabody Energy (BTU). Utilities (XLU) burn more natural gas when prices are low, taking away market share in electricity generation from coal.