Mike Sonnenberg

Mike Sonnenberg currently covers autos, industrials, and ride-sharing companies at Market Realist. Mike has been working with Market Realist since 2014 as has covered various industries, economies, and asset classes over the years.

Prior to joining Market Realist, Mike worked with India's biggest credit rating agency, handling end-to-end rating process for corporate clients.

Mike is an avid traveler and has lived in five different countries in Asia. Mike believes that travelling has helped him be a better analyst.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mike Sonnenberg

The must-know dynamics of the global power industry

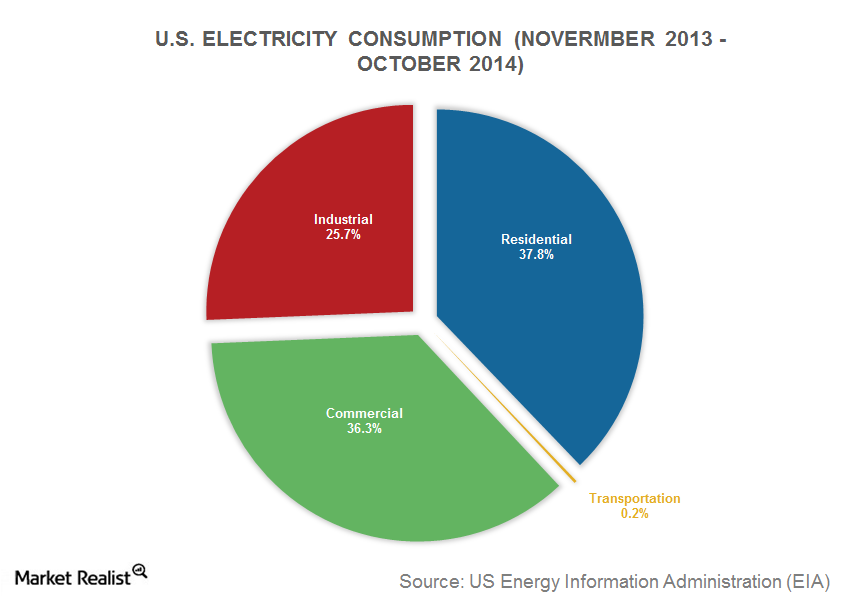

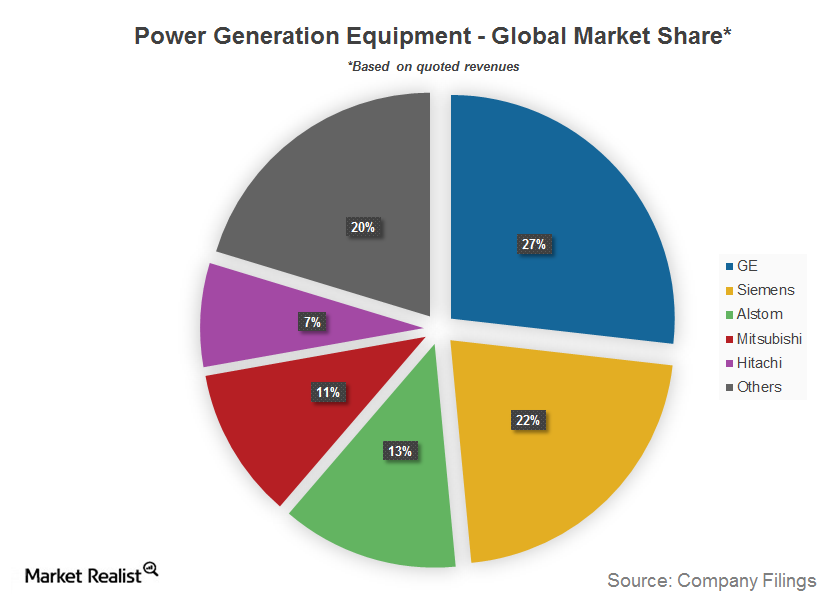

In this series, we’ll look at the structure of the thermal power industry before moving on to focus on the power generation equipment sector.

The major sub-industries of the global power equipment industry

The power generation equipment industry is made up of various sub-industries, each with a structure of its own.

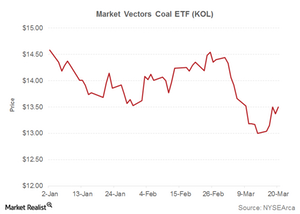

Challenges before Peabody Energy’s US operations in fiscal 2015

The retirement of coal-fired power plants and the impact of new regulations proposed by the EPA present two major blows to the US thermal coal industry.Consumer Must-know: Why Peabody Energy fell 1.9% on July 22

Wall Street analysts’ consensus estimate for loss per share was $0.289.

BYND Leads Alt-Meat Market, Faces New Competitors

On Friday, investment bank UBS started coverage on Beyond Meat Stock (BYND). At 10:08 AM ET today, the stock was trading 4.4% lower at $76.5.

2015: A Year of Bankruptcies in the Coal Sector

Arch Coal (ACI) has narrowly escaped bankruptcy in 2015 so far. However, it may happen anytime, considering the dilapidated situation of Arch Coal’s finances.

George Soros Buys Slack, Increases SPY Short Exposure

The 13F filing showed that George Soros bought almost 500,000 Slack (WORK) shares at an average price of $37.5 per share during the second quarter.Industrials Coal is losing its market share in China’s electricity generation

Coal is the cheapest fossil fuel, but it’s also the most polluting. With its massive electricity generation capacity—mainly coal-fired—China emits the most carbon dioxide in the world.

Elizabeth Warren Targets WeWork’s Layoffs and CEO

Last week, CNBC said that WeWork (WE) is firing 2,400 people. Supposedly, this will “create a more efficient organization.”

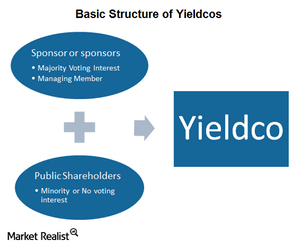

Yieldco: A Green Investment Option That Pays

While REITs started trading in 1951 and MLPs started off in 1981, the first yieldco was floated in 2005 by Seaspan Corporation, a shipping company.

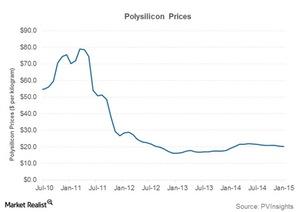

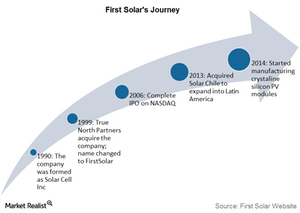

First Solar faces some must-know challenges

While First Solar has traditionally been manufacturing thin-film CdTe modules, which don’t require polysilicon, their prices have fallen in recent years.

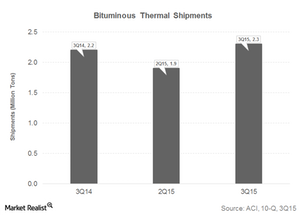

How Arch Coal’s Rise in Bituminous Thermal Coal Volumes Hurt Prices in 3Q15

Arch Coal’s Bituminous Thermal coal segment sold 2.3 million tons in 3Q15 compared to 2.2 million tons in 3Q14 and 1.9 million tons in 2Q15.

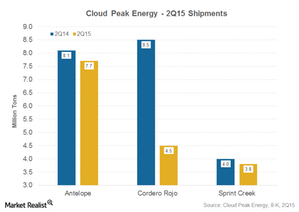

Cloud Peak Energy’s 2Q15 Shipments: Potential Risk Factors

Cloud Peak Energy (CLD) shipped 16.0 million tons of coal from its three owned and operated mines in the Powder River Basin (or PRB) in 2Q15.Consumer Overview: Ambre Energy—a coal and oil shale export company

Ambre Energy was founded in June 2005. It’s an Australian-American coal and oil shale company. The company’s Australian headquarters are located at Brisbane. The head American office is located at Salt Lake City, Utah. The company operates in three business lines—U.S. coal export infrastructure, international coal marketing and trading, and U.S. thermal coal production.

Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.

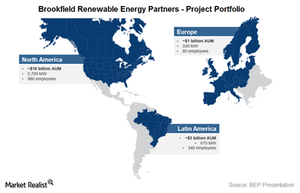

Brookfield Renewable Energy: Biggest Yieldco by Asset Base

With over 6,700 MW of hydro and wind capacity under operation, Brookfield Renewable Energy Partners (BEP) dwarfs all other yieldcos we’ve looked at.

Boeing-Embraer Deal on EU Radar: Is Trump to Blame?

Boeing and Embraer are pushing for a joint venture. In a $4.2 billion deal, Boeing is to buy 80% of Embraer’s commercial aircraft division.

Tesla Prepares for Gigafactory Opening in Germany

Tesla drafted a contract to buy 3 million square meters of land near Berlin. Last month, Tesla revealed its plans to build a Gigafactory in Germany.

Will Tesla and GM Get an EV Tax Credit Extension?

Tesla and General Motors are lobbying for the extension of the EV tax credit. With some GOP opposition, it may not be a done deal.

Tesla Wants Chinese Customers to Buy Model 3 Locally

Yesterday, Reuters said that Tesla might increase imported Model 3 prices in China. The increase might push Chinese customers to buy the cars locally.

China Auto Sales Fell in November, No Surprises

China’s auto sales fell 3.6% in November, which marked a decline for the 17th consecutive month. China is the world’s biggest auto market.

Is Tesla’s ATV a Strategy to Sell the Cybertruck?

On Saturday, Elon Musk tweeted about the Tesla (TSLA) all-terrain vehicle, the Cyberquad. The electric ATV is to fit into the Tesla Cybertruck.

Walmart Coin: A Bigger Deal than FB’s Libra and Bitcoin?

Retail giant Walmart (WMT) had applied for a digital coin patent. The news comes just as Facebook (FB) is pushing for its own cryptocurrency, Libra.

Boeing 737 NG: FAA Fine Might Drive Customers Away

The FAA said that Boeing knowingly certified 133 units of its 737 NG aircraft even though they were installed with faulty parts.

Boeing 777X versus Airbus A350: War Heats Up

Lately, the Boeing 777X (BA) has made headlines for the wrong reasons. Airbus might be winning the war against Boeing on more than one battlefield.

Will November Auto Sales Boost F, GM, FCAU Stocks?

US auto sales could rise by 4% in November. Higher incentives during the Thanksgiving weekend will be a key growth driver of US auto sales.

Boeing 797: Which Airlines Want It and Why?

For Boeing, most of 2019 has been about the 737 MAX. It’s curbed the decision about whether to build its 797 model until the 737 MAX crisis is resolved.Materials Must-know: ANR’s thermal coal business in 3Q14

ANR produces thermal coal from its mines in the Appalachian and Powder River Basin (or PRB). The company had around three billion tons of thermal coal reserves.

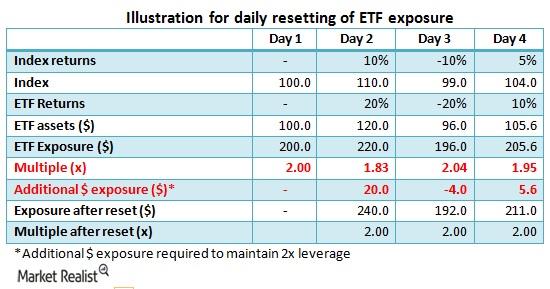

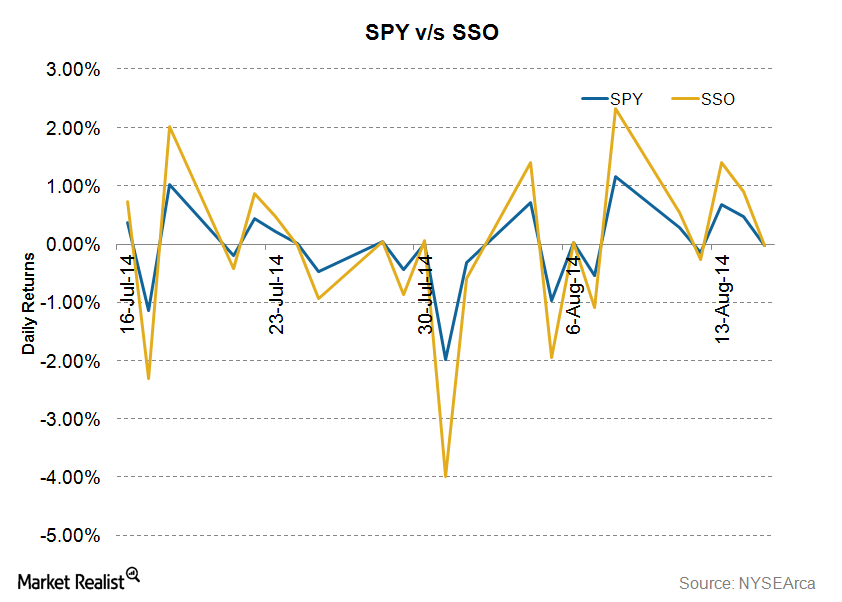

How daily re-balancing affects returns on leveraged ETFs

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily.

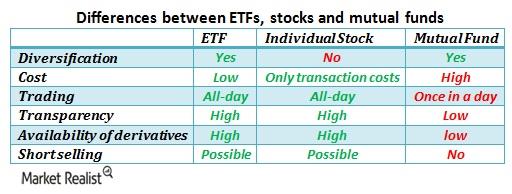

A closer look at the difference between ETFs and mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.Financials Must-know: The difference between high-yield and leveraged loans

Historically, high-yield securities have outperformed investment grade securities in good times and vice versa in hard times.

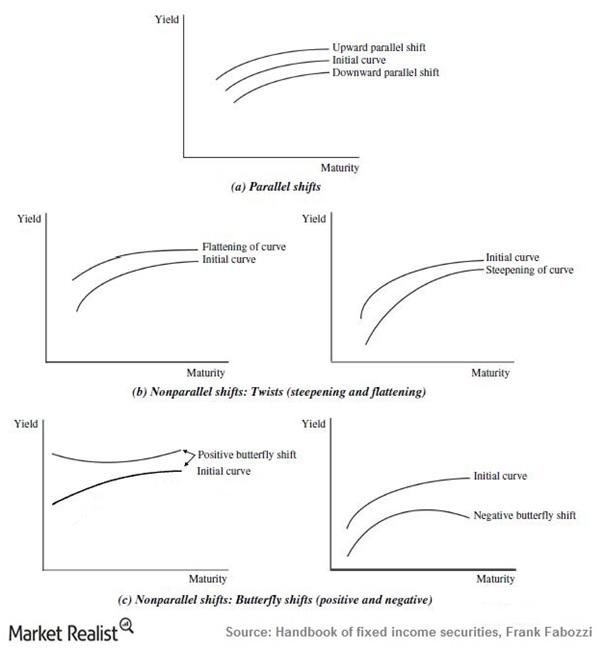

Why investors should follow shifts and twists in the yield curve

Yields on bonds don’t remain constant. When they change by the same magnitude across maturities, we call the change a “parallel shift.”Financials Key takeaways: Why is the yield curve normally upward-sloping?

In normal conditions, the yield curve is upward-sloping. As bonds pay only interest (the coupon) until maturity and pay face value at maturity, investors take longer to recover their principal.

Tesla Model 3 NYC Taxi Worries Uber and Lyft

Last week, Electrek reported that Tesla Model 3 (TSLA) became the first-ever electric vehicle to get approval to run as a taxi on New York City roads.

Will Uber Stock Fall to $25 on Earnings and Lockup Expiry?

Uber released its 3Q earnings yesterday after market hours. The company’s revenues rose 30% during the quarter. However, Uber stock still got hammered.

The Boeing 737 Curse: Qantas Grounds Three 737NGs

Australia’s Qantas Airways has completed the inspection of its 33 Boeing 737NG (Next Generation) planes and has grounded three of them.

How daily compounding works in case of inverse and leveraged ETFs?

If SPY rises 5% each on two consecutive days, SSO will rise 10% each day due to the 2x leverage achieved using derivative products and external borrowings. While the compounding works even for SPY, it’s magnified in SSO due to the 2x multiplier effect.

A November Stock Market Crash? Think Guns N’ Roses

Unofficial job numbers showed a slowdown in job creation. This hit the stock market hard. The S&P500 dropped 1.8% yesterday while Dow Jones fell 1.9%.

Trade War Hits Consumer Confidence, Stocks Retreat

Today, the Consumer Confidence Index data fell sharply to 125.1 in September from August’s 134.2. The reading was below the expected 133.5.

Delta Air Lines Is Waiting for the 797—Is Boeing Ready?

Last week, Delta Air Lines’ CEO told Bloomberg that the carrier is still hoping Boeing will build a new midmarket airplane, dubbed the Boeing 797.

Amazon’s Rivian Deal: Is the Musk-Bezos Rivalry in Play?

Jeff Bezos announced that Amazon had placed an order of 100,000 electric delivery vans from Michigan-based startup Rivian.

Could Boeing Benefit from Airbus’s ‘Back’ Pain?

Some airlines have been forced to keep the back seats empty on Airbus’s (EASDY) A320neos due to a problem similar to Boeing (BA) 737 Max 8’s

Boeing 777X Failed a Stress Test, More 737 MAX Concerns

In another setback, Boeing’s (BA) long-haul and wide-body 777X variant failed a stress test. The test was part of the FAA’s certification process.

Ford Earns Trump’s Ire by Siding with California

Last month, four automakers, including Ford, made a voluntary deal with California to make cars cleaner and more fuel efficient. Trump isn’t happy with the deal.

Dow Jones, Boeing, and GE Fall: Hard Landing Ahead?

On Wednesday, US stock indexes fell due to recession signals. The Dow Jones Industrial Average (DIA) was the worst performer with a 3.05% fall.

First Solar: A key player in the global solar power industry

First Solar was the first solar power company to join the S&P 500 (SPY). We’ll take a look at the company’s operations before moving on to greater details.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

Beyond Meat Stock Starting to Lose Some Steam

Although the S&P 500 and Nasdaq have recovered by 1.05% and 1.55% today, Beyond Meat stock (BYND) was down 9.6% this morning.

SoftBank’s Masayoshi Son: Japan’s Buffett Once Lost $70 Billion

What do Berkshire Hathaway’s (BRK.B) Warren Buffet and SoftBank’s Masayoshi Son have in common?

Microsoft, Apple Support Softbank’s $108 Billion AI Fund

On Friday, Softbank (SFTBY) announced the launch of AI-focused Vision Fund 2. The fund is expected to start with a capital of $108 billion.