Mike Sonnenberg

Mike Sonnenberg currently covers autos, industrials, and ride-sharing companies at Market Realist. Mike has been working with Market Realist since 2014 as has covered various industries, economies, and asset classes over the years.

Prior to joining Market Realist, Mike worked with India's biggest credit rating agency, handling end-to-end rating process for corporate clients.

Mike is an avid traveler and has lived in five different countries in Asia. Mike believes that travelling has helped him be a better analyst.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Mike Sonnenberg

Why the Nasdaq and S&P 500 Are Down Today

The S&P 500 Index was down 0.49% at 11:52 AM ET while Tesla (TSLA) was leading Nasdaq’s (QQQ) 0.76% drop at the same time.

Are Microsoft Teams and Facebook Workplace Gaining on Slack?

On Thursday, a Microsoft executive said that Microsoft Teams, its answer to Slack, had crossed 13 million daily active users in June.

No Fanfare for Virgin Galactic–Social Capital Hedosophia Deal?

On Tuesday, Virgin Galactic and investment company Social Capital Hedosophia announced that they would merge in an $800 million deal.

Chinese and Indian Indexes Fall as Trade Talks Resume

On Tuesday, US and Chinese officials resumed trade talks over the phone days after they announced a trade truce.

China Wants Huawei Ban Lifted, Trump Talks 5G with India

Discussing 5G with India could be part of President Trump’s mind game before his meeting with President Jinping.

How NZ50, ASX, Singapore, KOSPI Indexes Fared Today

Australia’s ASX200 lost marginally today. Although the index was trading higher until noon, it erased those gains afterward. 70 stocks gained, while 118 fell. BHP Group (BHP) outperformed the index with marginal gains, while Rio Tinto (RIO) gained 0.64%.

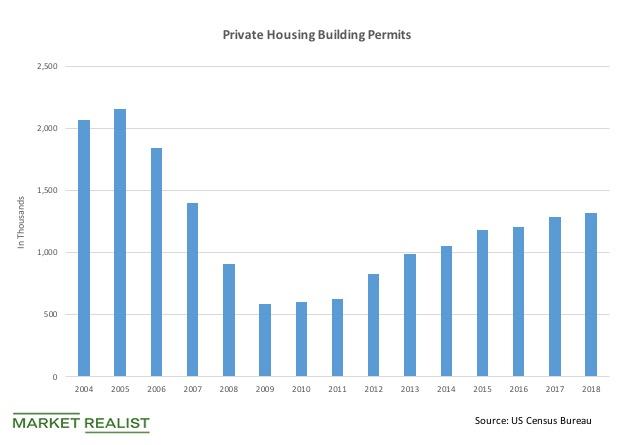

How Building Permits and the Housing Market Can Predict Trends

When real estate developers or REITs like AvalonBay (AVB) are confident about the economy, they build more in anticipation of future demand from consumers.

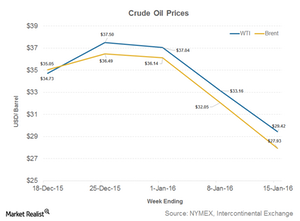

Crude Oil Fell below $30: Positive or Negative for Coal?

Crude oil prices dropped significantly during the week ended January 15, 2016. WTI (West Texas Intermediate) crude oil prices closed at $29.42 per MMBtu on January 15, 2016.

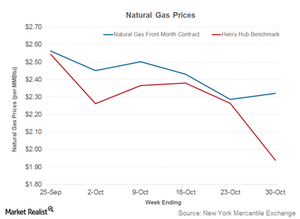

Coal under Pressure as Natural Gas Prices Remain Subdued

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation.

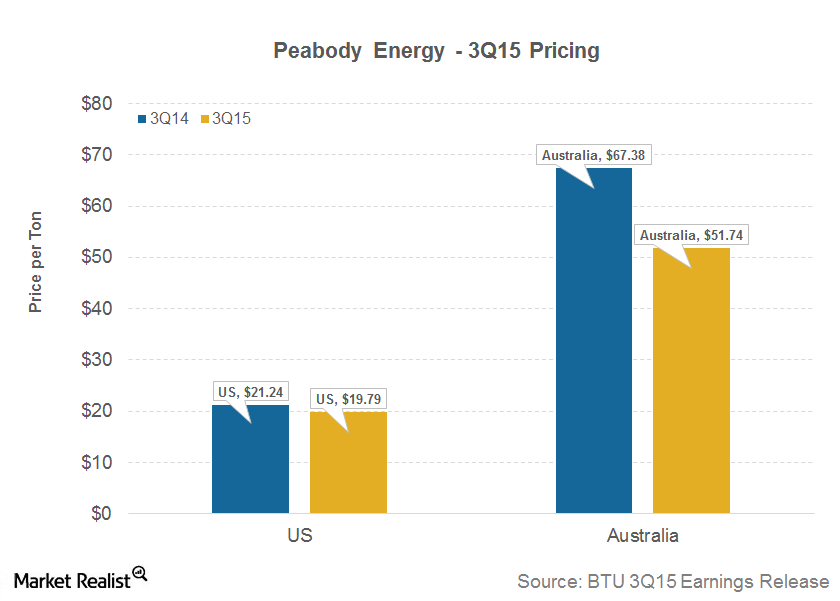

Lower Shipments and Pricing Hampered Peabody’s 3Q15 Revenues

Peabody Energy’s (BTU) US operations posted revenue per ton of $19.79 in 3Q15, down from $21.24 in 3Q14.

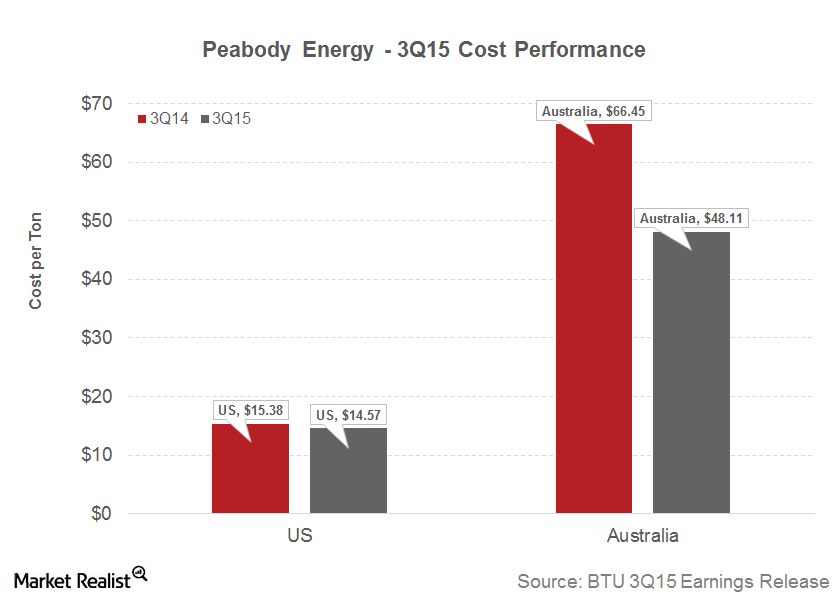

Will Peabody Energy’s Impressive 3Q15 Cost Performance Help?

Peabody Energy (BTU) reported Midwest production costs of $32.51 a ton in 3Q15, compared to $34.56 a ton in 3Q14.

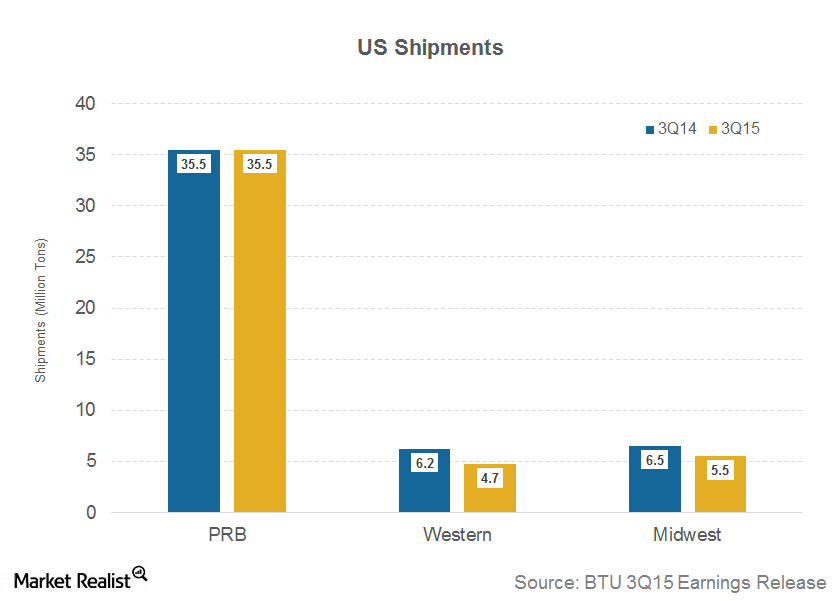

Natural Gas Weighed Heavily on Peabody Energy’s US Shipments

Peabody Energy’s (BTU) US operations sold 45.7 million tons of thermal coal (KOL) in 3Q15, 5.2% lower than 3Q14’s 48.2 million tons.

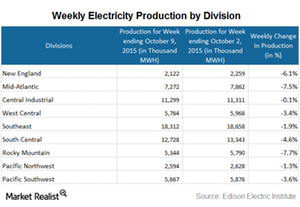

Electricity Generation Falls in All Census Divisions

the electricity generation in the US fell by 3.5% to 71.1 million mWh. Electricity generation fell in all of the nine census divisions during the week ended October 9.

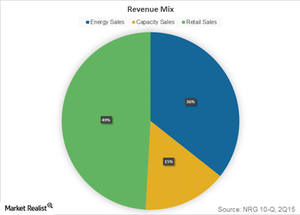

How Does NRG Energy Earn Its Revenues?

NRG Energy (NRG) earns revenues in three primary ways across its segments: energy sales, capacity sales, and retail sales.

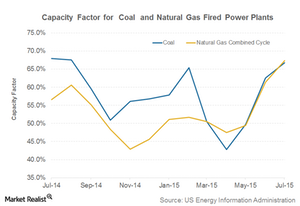

Capacity Factors Still Indicate Shift from Coal to Natural Gas

Capacity factors for coal-fired plants fell YoY and rose substantially for natural gas-fired power plants. This shows a shift from coal to natural gas as a fuel for electricity generation.

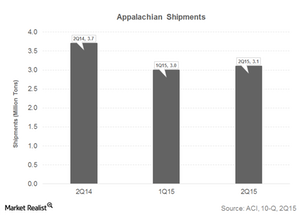

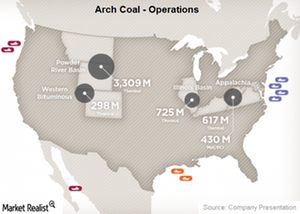

Arch Coal’s Appalachian Shipments Remain under Pressure in 2Q15

In 2Q15, Arch Coal’s (ACI) Appalachia segment shipped 3.1 million tons of coal, down from 3.7 million tons in 2Q14, but up from 1Q15’s 3.0 million.

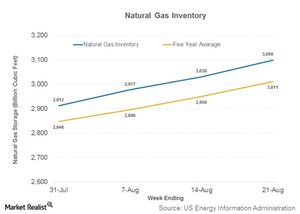

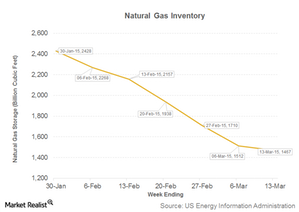

Natural Gas Inventory Figure Puts Pressure on Coal

The EIA’s natural gas inventory report for the week ended August 21 came in at 3,099 billion cubic feet, compared to 3,030 Bcf a week earlier. Natural gas is stored underground to save the fuel for peak demand during the winter.

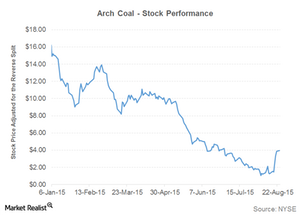

Why Arch Coal Rallied During a Bad Week for the S&P 500

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21.

Why Arch Coal Is in the News for Debt Exchange

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE.

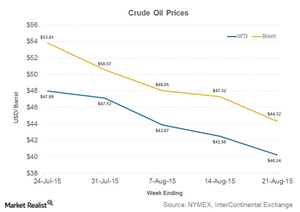

Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

Will Coal Rise on Falling Crude Oil Prices?

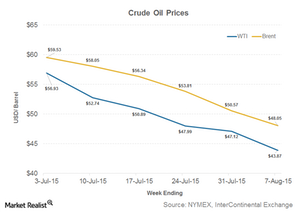

WTI crude oil prices fell by over $3 per barrel during the week ended August 7 and averaged below $50 per barrel for the third consecutive week.

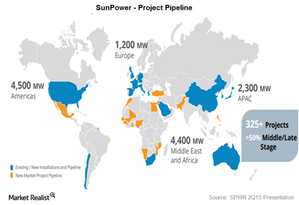

What Does the Future Hold for SunPower?

In 3Q15, SunPower (SPWR) expects to generate $400 million to $450 million in revenues and net losses of $0.50 to $0.60 per share.

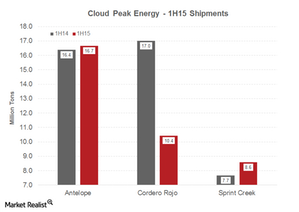

Cloud Peak Energy’s 1H15 Results Affected by Lower Shipments

Cloud Peak Energy shipped 35.7 million tons coal during the first half of 2015 against 41.0 million tons during the same period in 2014.

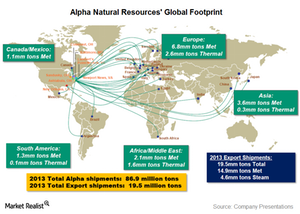

Alpha Natural Resources May Be Preparing for Bankruptcy

On July 15, 2015, the Wall Street Journal reported that “Alpha Natural Resources Inc. is in talks to obtain financing for potential bankruptcy.”

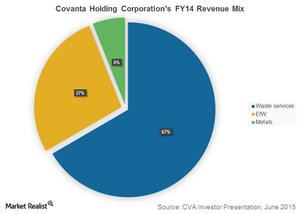

An Overview of Covanta Holding’s Business Model

Covanta Holding Corporation (CVA) generates revenues through waste collection and services, energy from waste, and metal recycling.

What Happens to Waste? The Basics of Municipal Waste Management

In simple terms, municipal solid waste is trash or garbage discarded by households and commercial establishments.

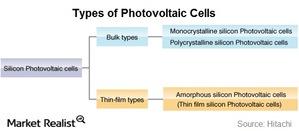

SunPower’s Solar Components Business Model: How Does It Work?

SunPower uses solar cells to produce solar panels at its facilities in the Philippines, Mexico, and France. It has a total solar panel capacity of 1.7 GW.

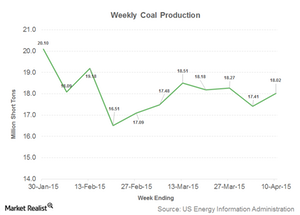

East and West Coal Shipments Rose during the Week Ending April 10

During the week ending April 10, US coal shipments increased to 18.01 million tons—compared to 17.41 million tons during the week ending April 3.

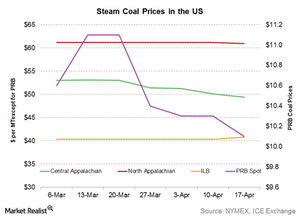

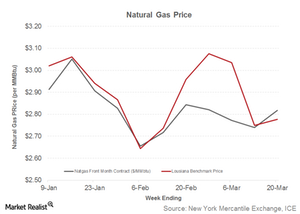

Coal Prices Dropped as Natural Gas Prices Rose

Central Appalachian thermal coal prices came in at $49.40 per ton for the week ending April 17—down from $50.10 per ton the previous week.

Rocky Mountain Division Sees a Large Drop in Electricity Generation

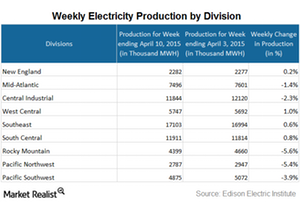

Out of nine divisions, electricity generation increased in four divisions and decreased in five divisions for the week ending April 10.

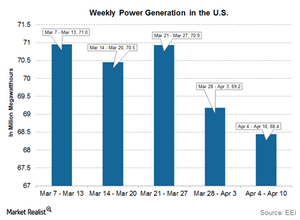

US Electricity Production Falls for the Second Straight Week

Electricity storage is expensive. Most of the produced electricity is consumed instantaneously. As a result, electricity generation mirrors consumption.

Why A Marginal Rise in Natural Gas Prices Helped Coal

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices rise, coal gains market share.

The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.

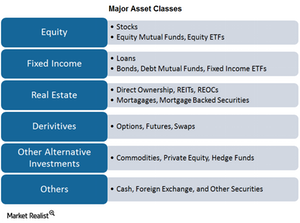

Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.

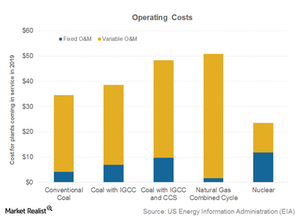

Nuclear power plants are cheaper to operate

Nuclear power plants have the lowest variable costs among the three fuel types, at $11.8 per MWh (for plants coming online in 2019).

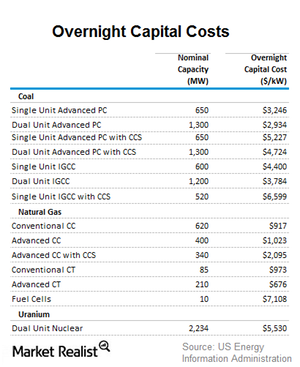

Natural gas–fired power plants are cheaper to build

Natural gas–fired power plants are clearly the cheapest to build due to lower land requirements and faster, cheaper construction.

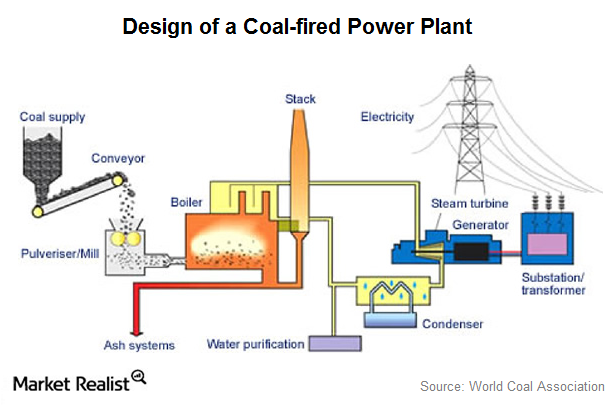

Industry structure analysis: Coal-fired power generation equipment

Coal (KOL) has fired much of the development in the US and other OECD economies in the 20th century. It’s firing growth in economies like China and India.

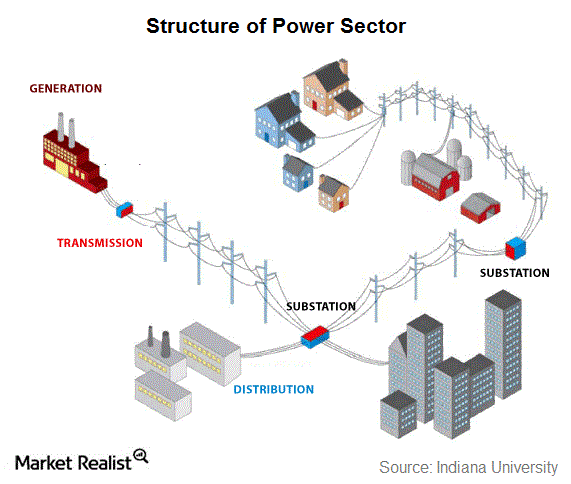

Understanding the structure of the global power sector

While the power sector differs country by country, the operational structure of the sector across the world is pretty much the same.

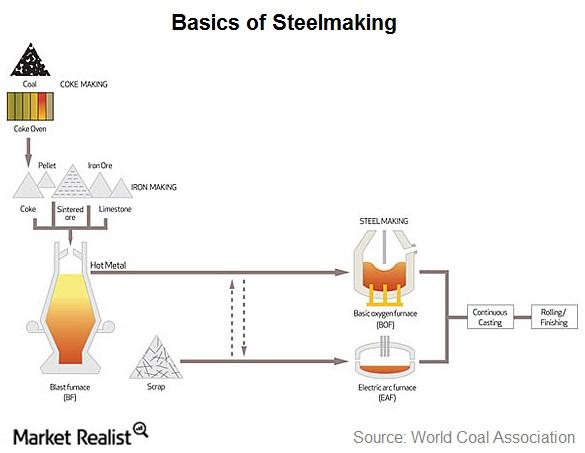

SunCoke Energy’s presence in the steelmaking process

Coke is used in the iron making process, which in turn is used in the steelmaking process. SunCoke Energy produced 4.2 million tons of coke in 2013.

How does coke fit into the steelmaking process?

Iron ore, steel scrap, and met coal are the main raw materials for steelmaking. SunCoke converts met coal to coke by driving out its impurities.

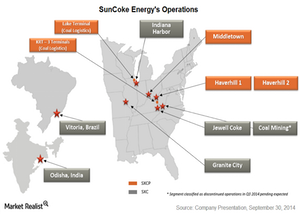

A quick look at SunCoke Energy’s US operations

SunCoke Energy (SXC) is the largest independent manufacturer of coke, which is used in steelmaking. It runs five coke making plants in the United States.

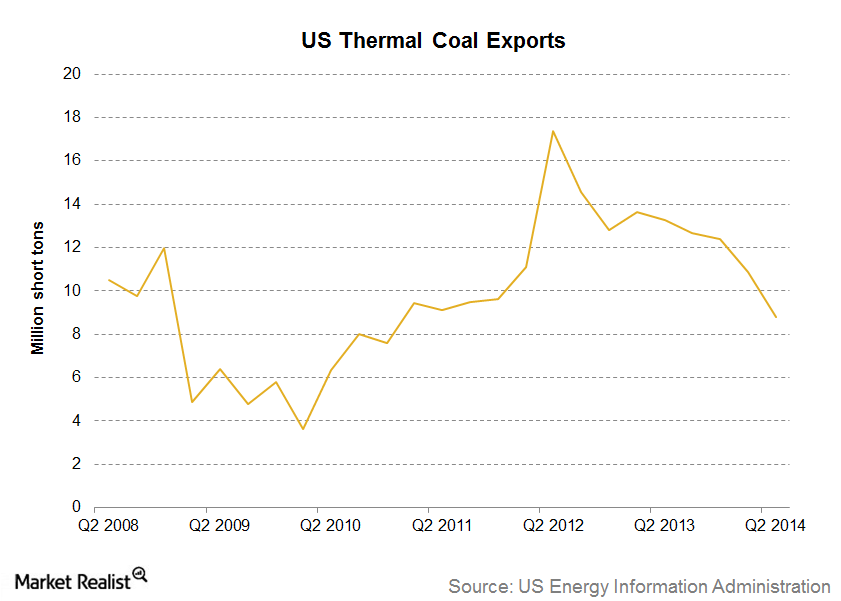

Must-know: US thermal coal exports are falling

US thermal coal exports were 19.6 million tons in the first half of 2014—down from 26.9 million tons during same period in 2013. The drop was mainly driven by falling demand from Europe.

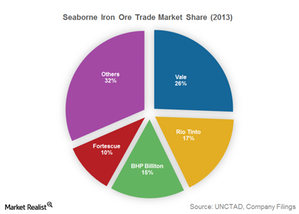

VALE, RIO, and BHP can swing the global iron ore prices

With over 65% exports going to China, China is the real swinger in global iron ore prices. A slowdown in China caused panic among all major commodity exporters.

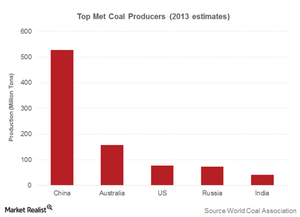

Who are the swing met coal producers in the global market?

In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest of the met coal producers. It’s the largest met coal exporter.

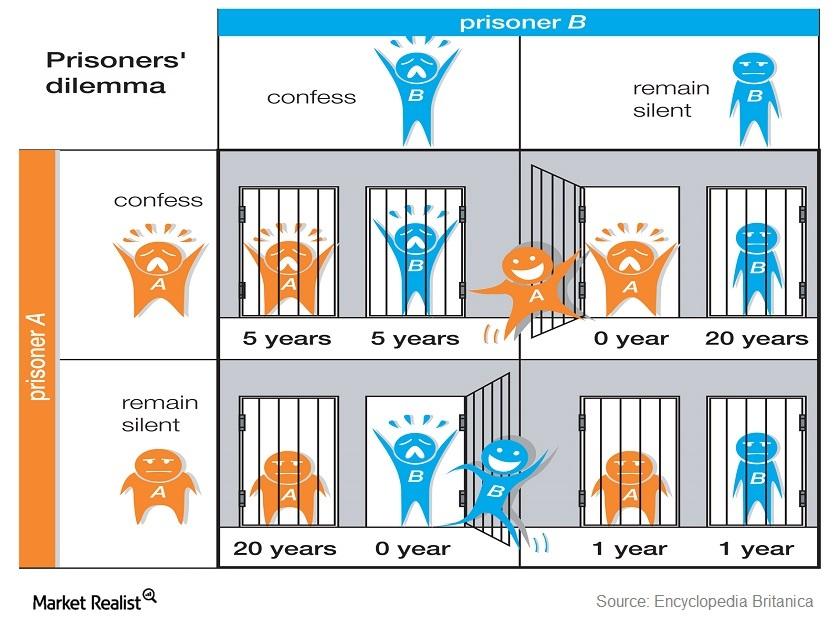

Falling commodity prices and the prisoner’s dilemma

There’s mistrust in the global commodity markets. From crude oil to met coal and iron ore, producers haven’t cut production. They’re waiting for others to do it first.Consumer Must-know: An overview of Appalachian coal

The Appalachian coal region is the oldest coal producing region in the U.S.—geologically and commercially. The Appalachian’s coal seams are ~300 million years old. They’re the oldest coal seams in the U.S. Appalachian coal fueled most of the Industrial Revolution after the Civil War in the 19th Century.

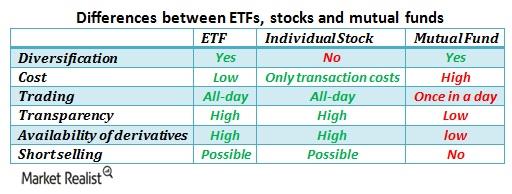

Overview: Key difference between ETFs and mutual funds

While actively managed ETFs are more expensive than passively managed ETFs, they tend to be less expensive than mutual funds due to structural differences between these two products. In the case of mutual funds, the investor interacts with the company while buying and selling mutual fund units.