Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.

March 23 2015, Updated 4:18 p.m. ET

A complicated world

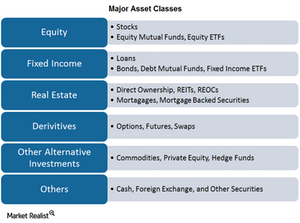

CMBS, RMBS, CDOs, CLOs, derivatives, and so on. Oh! Almost forgot the good old debt, equity, real estate, and gold.

The array of investment products is always growing. With financial innovation and technology, financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process. In fact, these products are there because somebody is ready to buy them. In today’s world, there’s a financial product suited to every individual need. But since our focus in this series is tax-efficient equity investment structures, we’ll begin by briefly looking at equity as an asset class.

Equity as an asset class

Put simply, equity refers to ownership interest in a corporation. When you buy shares of, say, Exxon Mobil (XOM) or Apple (AAPL), you’re actually buying an ownership interest in those companies, which gives you the right to say that you are one of the millions of Exxon Mobil or Apple owners. While equity can be private or public—traded on stock exchanges—we mean publicly traded equity when referring to “equity” in this series.

Equity sub-asset classes

Aside from owning company shares directly, you can also own them through pooled investment vehicles like ETFs and mutual funds. For example, instead of owning all of the shares in the S&P 500 Index in a given proportion, you can simply own the SPDR S&P 500 ETF Trust (SPY), which mirrors the index. Or you can invest in the Guggenheim Solar ETF (TAN), which is as good as investing in all major solar power companies including SunEdison (SUNE) and FirstSolar (FSLR). SUNE makes up 8.7% of TAN holdings, while FSLR makes up 8.2%.

In the next three parts of this series, we’ll move on to the three most prominent “special’’ types of shares.