SunEdison Inc

Latest SunEdison Inc News and Updates

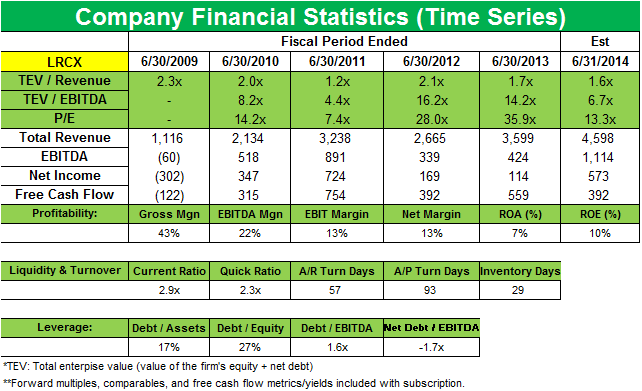

Why Greenlight started a new position in Lam Research Corporation

Greenlight disclosed a new position in Lam Research Corporation, which accounts for 1.01% of the fund’s 1Q 2014 portfolio.

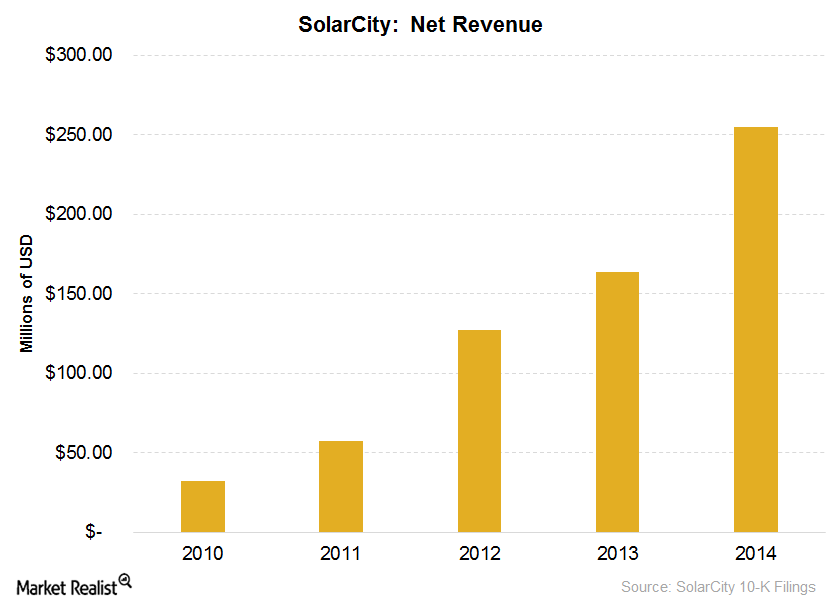

Introducing SolarCity, a Powerhouse in Solar Technology

SolarCity is a vertically-integrated solar company. Despite advancing technology and expanding reach, it has seen negative earnings most years since 2007.

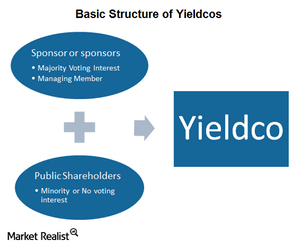

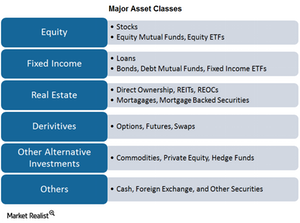

Yieldco: A Green Investment Option That Pays

While REITs started trading in 1951 and MLPs started off in 1981, the first yieldco was floated in 2005 by Seaspan Corporation, a shipping company.Financials Omega Advisors buys stake in IntercontinentalExchange

Omega Advisors opened a new 1.36% position in Intercontinentalexchange (ICE), a leading operator of global markets and clearing houses, in the fourth quarter.

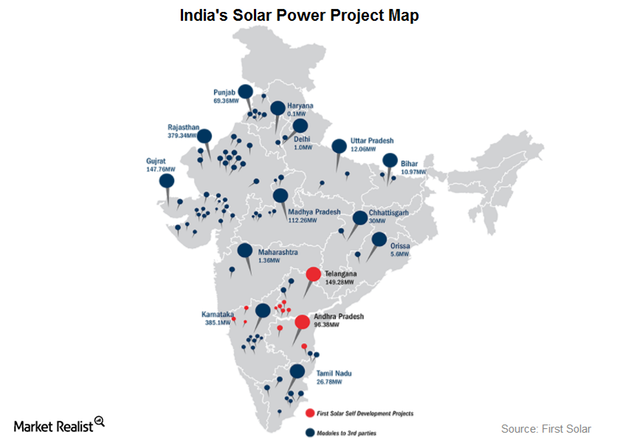

How India Became First Solar’s Second-Biggest Market

India’s rising electricity demand According to the EIA’s (U.S. Energy Information Administration) 2017 International Energy Outlook, India’s electricity generation is expected to increase by 3.2% per year through 2040, to meet increasing electricity demand in rural areas. Solar outlook Even though coal is the primary fuel used for electricity generation in India, the focus on renewable […]

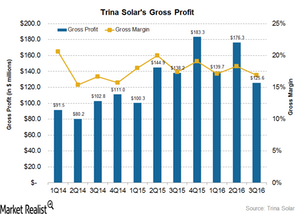

How Did Trina Solar’s Costs Affect Its Gross Margin in 3Q16?

In 3Q16, Trina Solar (TSL) reported a gross profit of $125.6 million compared to $176.3 million in 2Q16. On a YoY basis, the company’s gross profit fell nearly 9.0%.

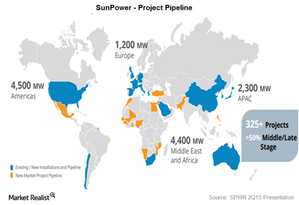

What Does the Future Hold for SunPower?

In 3Q15, SunPower (SPWR) expects to generate $400 million to $450 million in revenues and net losses of $0.50 to $0.60 per share.

Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.