First Solar Inc

Latest First Solar Inc News and Updates

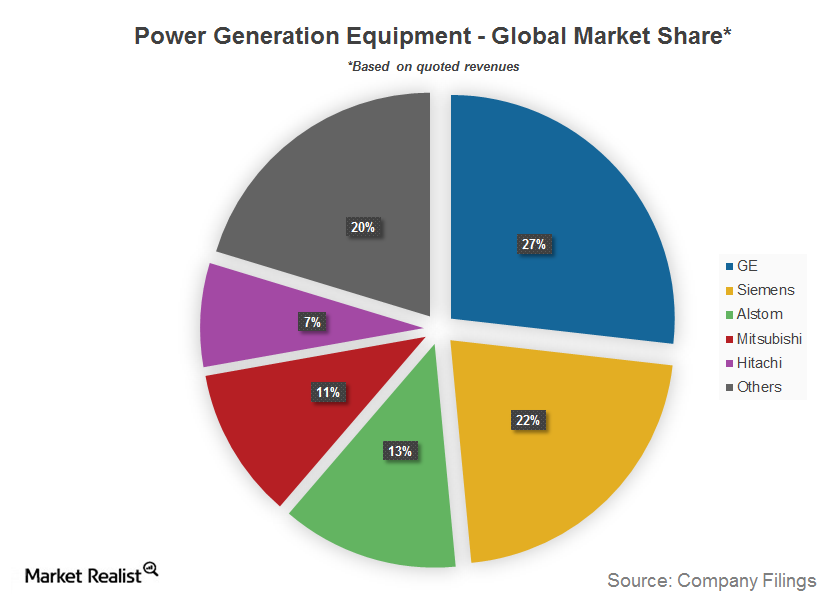

The major sub-industries of the global power equipment industry

The power generation equipment industry is made up of various sub-industries, each with a structure of its own.

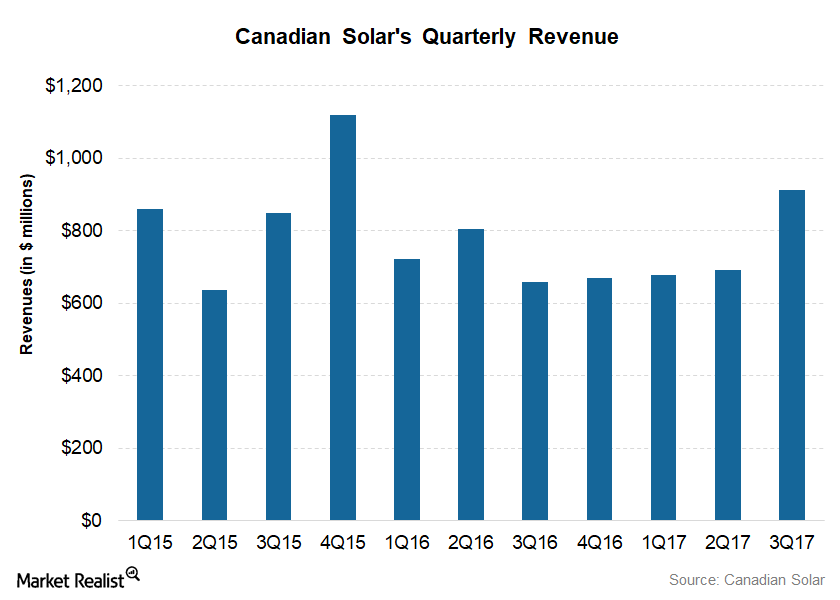

Canadian Solar Beat Analysts’ 3Q17 Revenue Estimates

Canadian Solar’s revenues from the sale of electricity in 3Q17 totaled $9.6 million, which was marginally lower than $9.8 million in 2Q17.

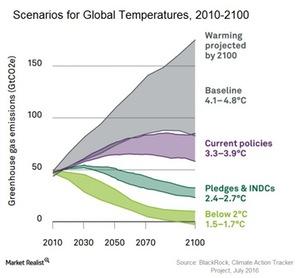

How the World Is Dealing with the Climate Challenge

Extreme climate change events hamper productivity, thus affecting industries such as agriculture, fishing, energy, trade, transportation, and tourism.

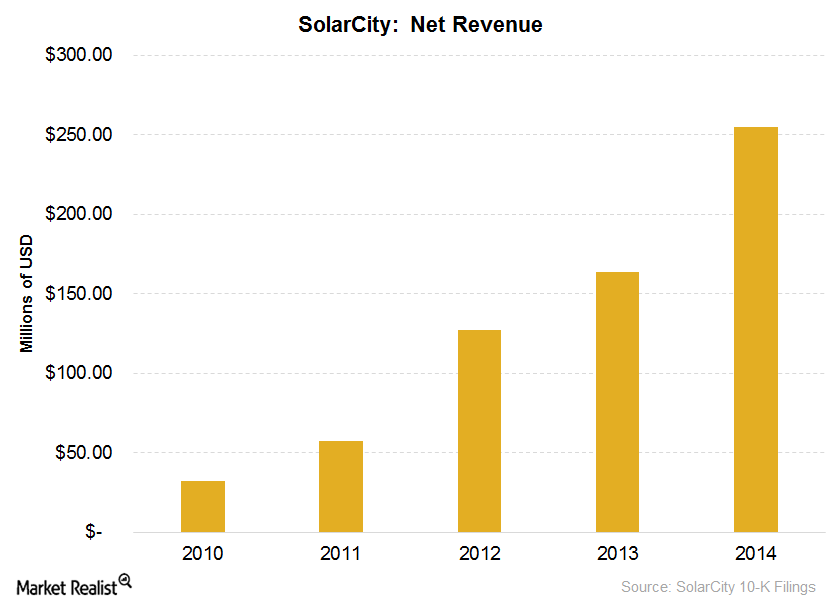

Introducing SolarCity, a Powerhouse in Solar Technology

SolarCity is a vertically-integrated solar company. Despite advancing technology and expanding reach, it has seen negative earnings most years since 2007.

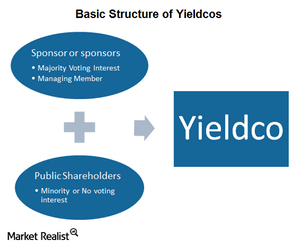

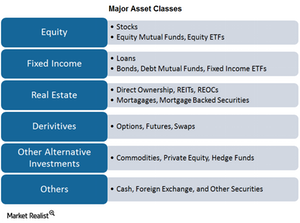

Yieldco: A Green Investment Option That Pays

While REITs started trading in 1951 and MLPs started off in 1981, the first yieldco was floated in 2005 by Seaspan Corporation, a shipping company.

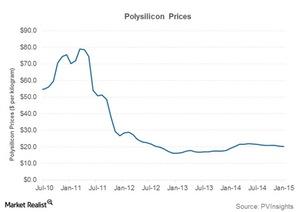

First Solar faces some must-know challenges

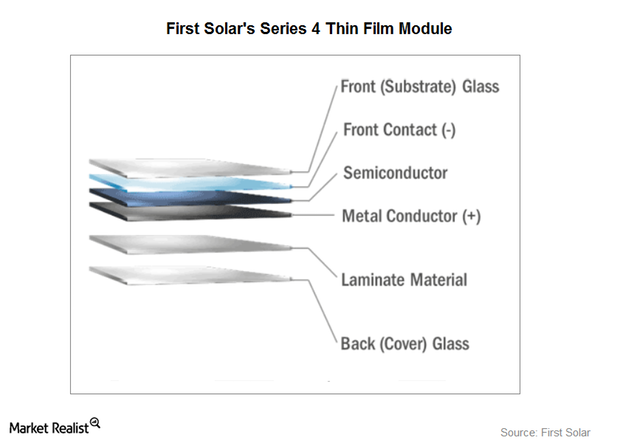

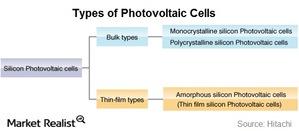

While First Solar has traditionally been manufacturing thin-film CdTe modules, which don’t require polysilicon, their prices have fallen in recent years.

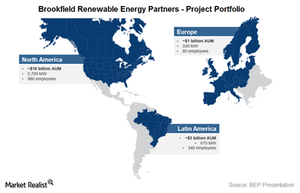

Brookfield Renewable Energy: Biggest Yieldco by Asset Base

With over 6,700 MW of hydro and wind capacity under operation, Brookfield Renewable Energy Partners (BEP) dwarfs all other yieldcos we’ve looked at.Energy & Utilities Why net capacity additions are important

Capacity is defined as the potential power output that power plants can generate. Each power plant has a shelf life. After the shelf life, they’re replaced with new power plants.

Where First Solar Stock Might Go from Here

First Solar stock has an EV-to-EBITDA valuation of 6.4x its estimated earnings for the next 12 months. The industry’s mean valuation is greater than 11x.

Will Solar Tech Power Self-Driving Cars?

In this video interview, Ben Lenail of Alta Devices talks about the future of solar power in next-generation vehicles and beyond.

Solar Stocks with Bright Upside Potential: FSLR, ENPH

Solar stocks have had a great run this year. Strong demand, falling costs, and higher corporate investments have supported these renewables in 2019.

Why First Solar Stock Could Continue to Climb

Top solar stock First Solar (FSLR) has surged about 10% in September. FSLR is trading close to its 52-week high and might continue to march upward.

Enphase Energy Stock Looks Strong, 600% 2019 Gain

Solar microinverter company Enphase Energy (ENPH) has rallied more than any other stock in the space this year with a more-than-600% gain.

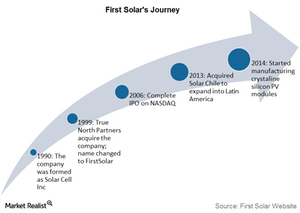

First Solar: A key player in the global solar power industry

First Solar was the first solar power company to join the S&P 500 (SPY). We’ll take a look at the company’s operations before moving on to greater details.

First Solar Disappoints in Q2 but Raises Guidance

First Solar (FSLR) reported its second-quarter earnings results yesterday. It reported EPS of -$0.18 for the quarter.

How’s First Solar Stock Placed Compared to Its Peers?

First Solar stock is trading at a forward PE ratio of 18x. On average, solar stocks (TAN) are trading at a forward valuation multiple of 14x.

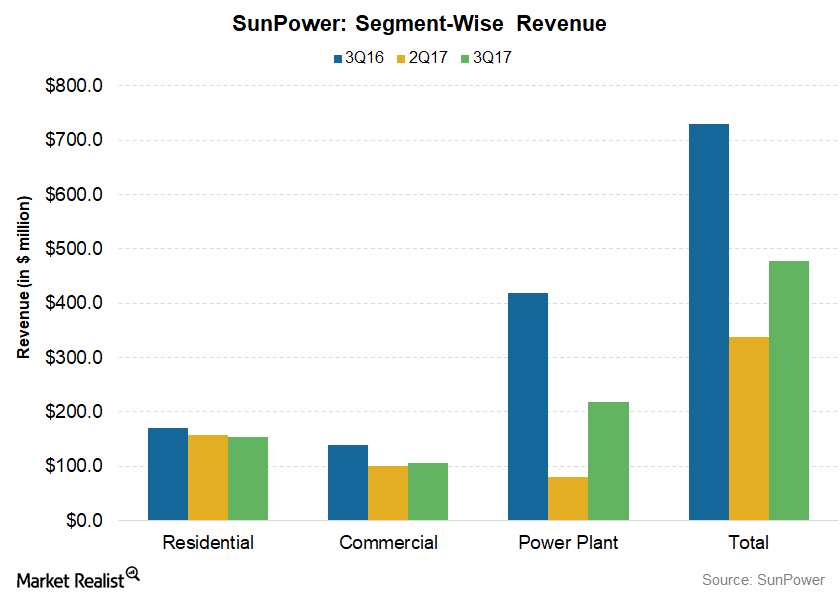

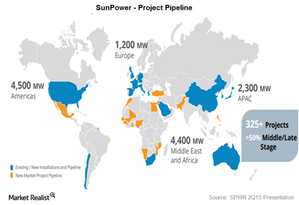

Why SunPower Reported Lower 3Q17 Revenues

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments.

First Solar: A Key Player in the Global Solar Power Industry

First Solar (FSLR) produces solar energy equipment. In this series, we’ll look at its performance and the outlook for the industry.

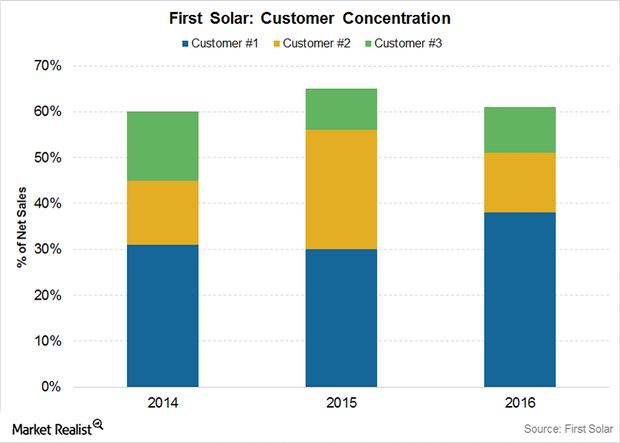

Southern and Nextera Energy: First Solar’s Key Customers

High customer concentration In 2016, First Solar (FSLR) sold solar modules to customers in the United States, India, and the United Arab Emirates. Approximately 23% of its total revenue was from third-party module sales. The majority of First Solar’s customer base is in the United States, which makes up to more than 80% of total […]

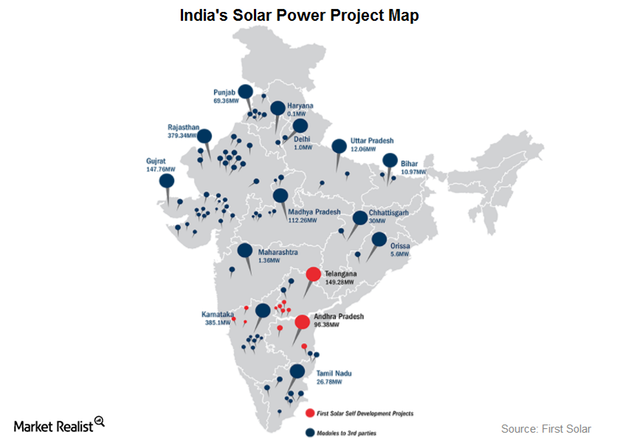

How India Became First Solar’s Second-Biggest Market

India’s rising electricity demand According to the EIA’s (U.S. Energy Information Administration) 2017 International Energy Outlook, India’s electricity generation is expected to increase by 3.2% per year through 2040, to meet increasing electricity demand in rural areas. Solar outlook Even though coal is the primary fuel used for electricity generation in India, the focus on renewable […]

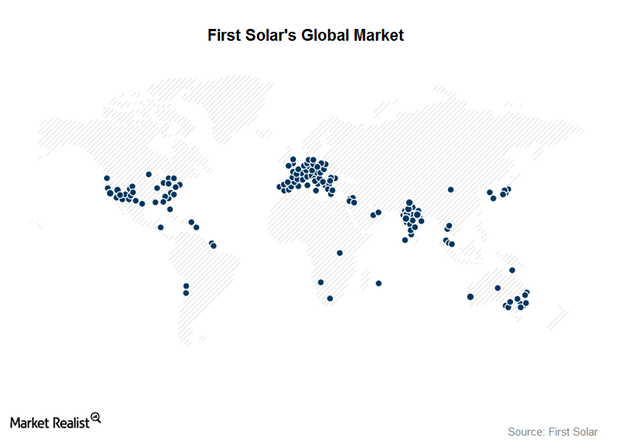

First Solar’s Global Market Strategy

The Americas The US PV (photovoltaic) market made up ~83% ($2.9 billion) of First Solar’s (FSLR) revenue. The United States has typically been First Solar’s largest market, and where many of its prominent projects and customers are located. First Solar has completed the construction of Del Sur, a 26 MW (megawatt) solar project in Honduras. It commenced […]

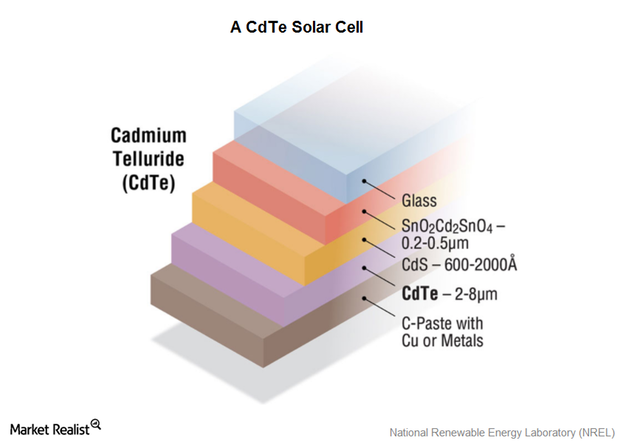

Behind First Solar’s Operations

Operating segments Previously, we looked at First Solar’s (FSLR) history. The photovoltaic module manufacturer operates two business segments: Components and Systems. The Components segment First Solar is a manufacturer of solar (TAN) photovoltaic (or PV) modules. First Solar also designs and sells these modules. They manufacture thin-film PVs, in which the semiconductor material used is […]

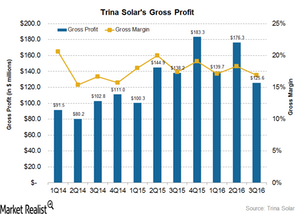

How Did Trina Solar’s Costs Affect Its Gross Margin in 3Q16?

In 3Q16, Trina Solar (TSL) reported a gross profit of $125.6 million compared to $176.3 million in 2Q16. On a YoY basis, the company’s gross profit fell nearly 9.0%.

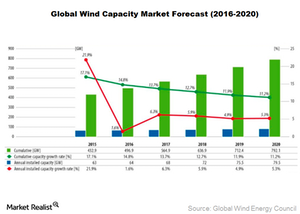

What’s the Rationale behind GE’s Proposed Acquisition?

In this article, we’ll go through the rationale behind GE’s planned acquisition of LM Wind Power. According to the GWEC, worldwide wind capacity is expected to nearly double in the next five years.

Southern Company Is a Diversified Utility Company

Southern Telecom is a telecommunications subsidiary of Southern Company. It provides dark fiber optic solutions to various businesses.

What Does the Future Hold for SunPower?

In 3Q15, SunPower (SPWR) expects to generate $400 million to $450 million in revenues and net losses of $0.50 to $0.60 per share.

SunPower’s Solar Components Business Model: How Does It Work?

SunPower uses solar cells to produce solar panels at its facilities in the Philippines, Mexico, and France. It has a total solar panel capacity of 1.7 GW.

Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.