East and West Coal Shipments Rose during the Week Ending April 10

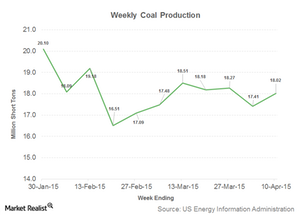

During the week ending April 10, US coal shipments increased to 18.01 million tons—compared to 17.41 million tons during the week ending April 3.

April 22 2015, Updated 9:12 a.m. ET

Coal shipments rise

According to EIA (U.S. Energy Information Administration) estimates, during the week ending April 10, US coal shipments increased to 18.01 million tons—compared to 17.41 million tons during the week ending April 3. Out of the total shipments, 7.50 million tons were recorded in the east while the remaining 10.51 million tons were recorded in the west.

Why it’s important

Every week, the EIA publishes shipments based on coal railcar loadings. Coal is an important commodity for railroad companies—like Union Pacific (UNP) and CSX (CSX). However, coal’s importance in freight is decreasing due to the emergence of shale oil. It’s also decreasing because of competition from other commodities.

Coal producers mine coal on demand. As a result, the EIA’s shipment estimates mirror production. Shipments are a function of demand and other factors—like rail underperformance and competition from other commodities.

Impact on coal producers

Weekly coal shipment data can be misleading. It can be distorted by factors like unavailability of railcars, bad weather, and supply issues—apart from genuine demand-side issues. A sustained increase or decrease in coal shipments over a few weeks—compared to the previous year—is a positive or negative indicator for coal producers (KOL)—like Peabody Energy (BTU), Alpha Natural Resources (ANR), Arch Coal (ACI), and Cloud Peak Energy (CLD).

Correction: When this article was originally published, it stated that coal shipments dropped to 18.01 million tons. Coal shipments actually increased to 18.01 million tons. We have updated the post with this revision. We regret this error.