Alpha Natural Resources

Latest Alpha Natural Resources News and Updates

Challenges before Peabody Energy’s US operations in fiscal 2015

The retirement of coal-fired power plants and the impact of new regulations proposed by the EPA present two major blows to the US thermal coal industry.Consumer Must-know: Why Peabody Energy fell 1.9% on July 22

Wall Street analysts’ consensus estimate for loss per share was $0.289.

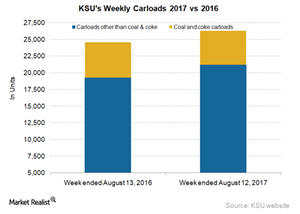

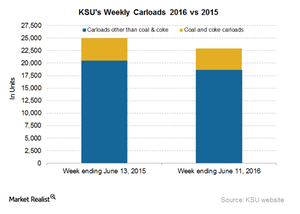

Kansas City Southern: Did Coal Push Volumes in Week 32?

Kansas City Southern (KSU), a US-Mexico railroad, is the smallest Class I railroad in the US.

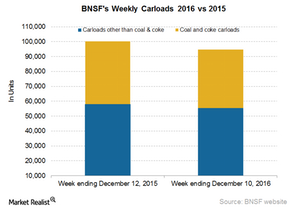

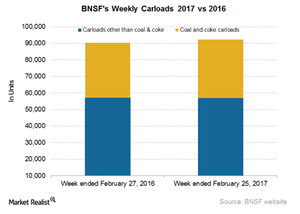

How BNSF’s Carloads Compared to Rival Union Pacific

BNSF Railway’s (BRK-B) total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units, compared to ~100,000 units on a year-over-year basis.

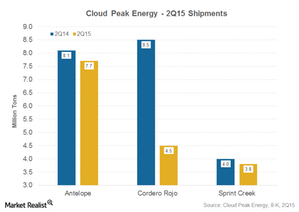

Cloud Peak Energy’s 2Q15 Shipments: Potential Risk Factors

Cloud Peak Energy (CLD) shipped 16.0 million tons of coal from its three owned and operated mines in the Powder River Basin (or PRB) in 2Q15.

Westmoreland Coal’s Canadian Operations: An Overview

Westmoreland’s Canadian operations Westmoreland Coal (WLB) acquired seven surface mines in Alberta and Saskatchewan, a stake in an activated carbon plant, and a char plant in Canada from Sherritt International in 2014. As of January 1, 2016, WLB’s Canadian operations are grouped as one entity, Prairie Mines & Royalty ULC. Its Canadian operations hold total […]Materials Must-know: ANR’s thermal coal business in 3Q14

ANR produces thermal coal from its mines in the Appalachian and Powder River Basin (or PRB). The company had around three billion tons of thermal coal reserves.

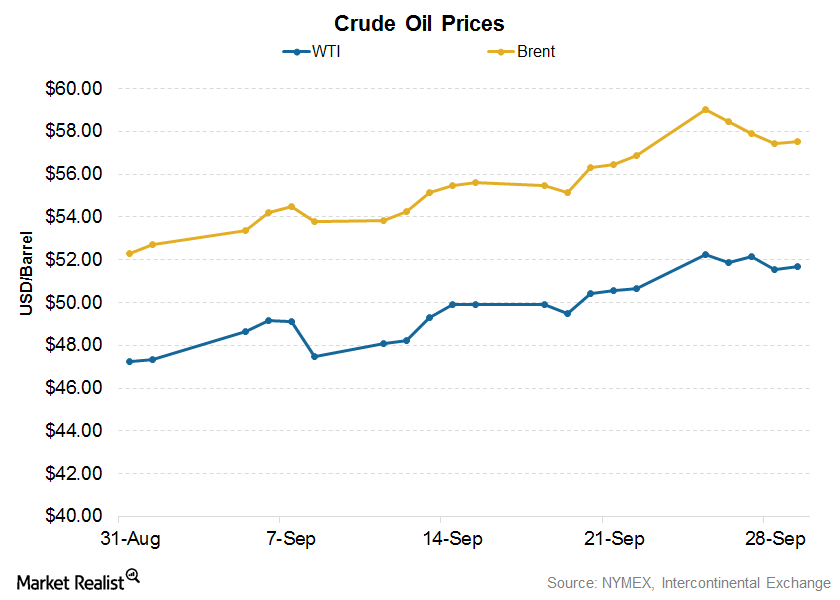

How Crude Oil Indirectly Impacts Coal Prices

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

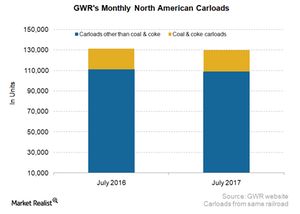

How Genesee and Wyoming’s Volumes Trended in July 2017

In July 2017, Genesee and Wyoming recorded a slight decline in its North American traffic YoY (year-over-year).

Your Guide to BNSF Railway’s Latest Carload Data

BNSF’s total railcars for the week ended February 25, 2017, rose 2.3% YoY to more than 92,000 units.

Kansas City Southern’s Carloads, and What They Have to Do with Mexico

In the week ending June 11, 2016, Kansas City Southern’s (KSU) total railcars declined by 8.1% YoY (year-over-year).

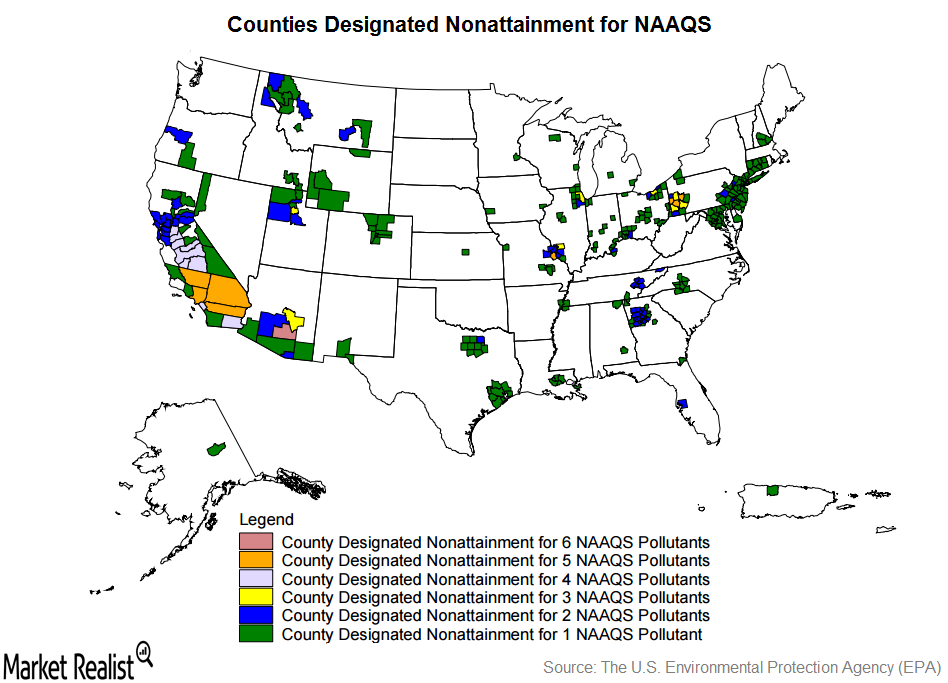

How Developments in the Clean Air Act Will Impact Coal Mining

The Clean Air Act is a national air pollution control policy that regulates the emission of hazardous pollutants from stationary and mobile sources in the United States.

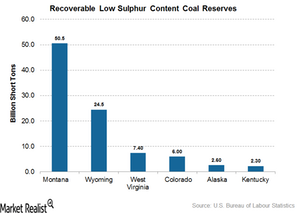

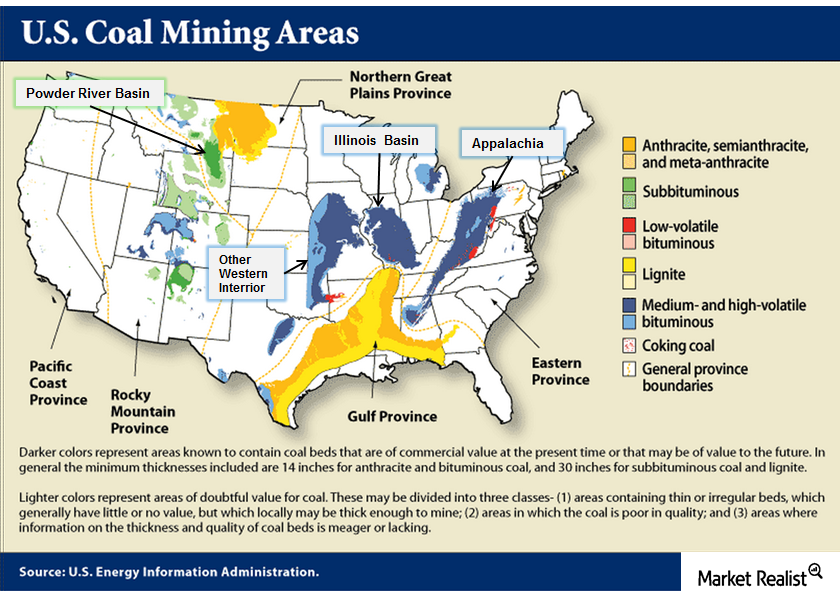

Where Are the Low Sulphur Content Coal Mines in the US?

According to the EIA, low sulphur content coal is defined as having less than 0.60 pounds of sulphur per million British thermal units.

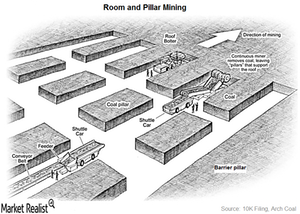

How Is Coal Mined in the US?

According to the World Coal Association, there are two main underground mining methods in the US.

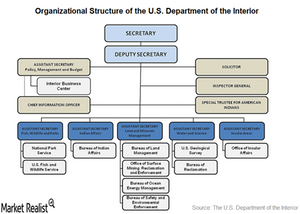

How Does the Land Ownership Pattern in the US Affect Miners?

Land ownership in the US can be broadly divided into the following categories: federally owned land, state-owned land, privately owned land, and Native American land.

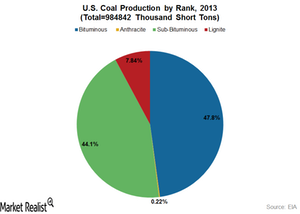

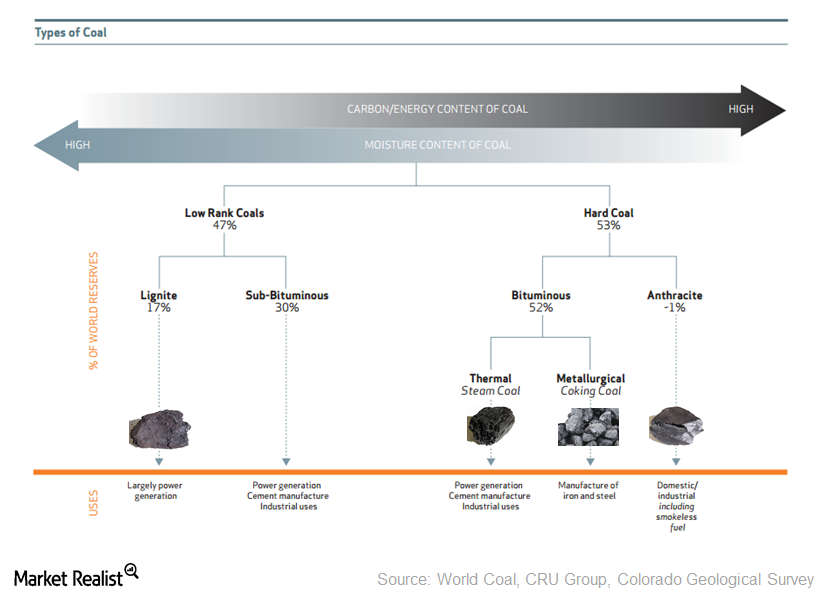

What Are the Different Types of Coal?

Coal types differ from each other as a result of the difference in their organic matter content and maturity.

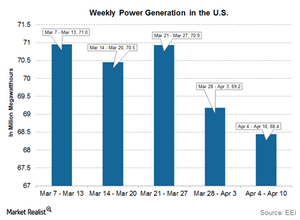

US Electricity Production Falls for the Second Straight Week

Electricity storage is expensive. Most of the produced electricity is consumed instantaneously. As a result, electricity generation mirrors consumption.

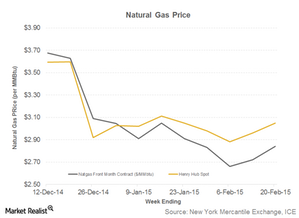

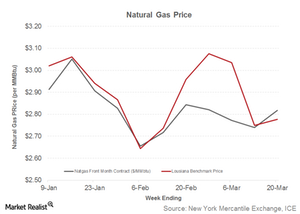

Why A Marginal Rise in Natural Gas Prices Helped Coal

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices rise, coal gains market share.

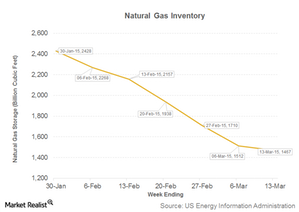

The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.

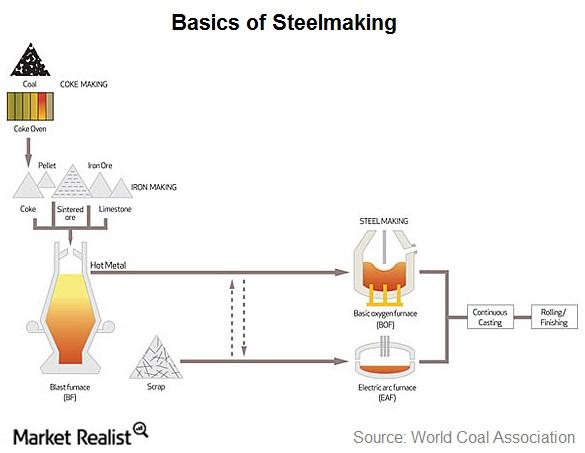

SunCoke Energy’s presence in the steelmaking process

Coke is used in the iron making process, which in turn is used in the steelmaking process. SunCoke Energy produced 4.2 million tons of coke in 2013.

How does coke fit into the steelmaking process?

Iron ore, steel scrap, and met coal are the main raw materials for steelmaking. SunCoke converts met coal to coke by driving out its impurities.

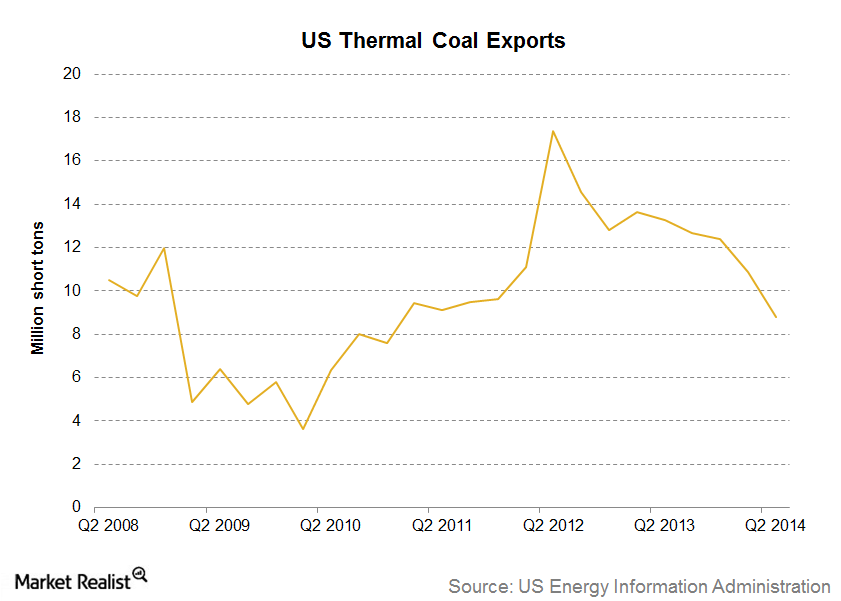

Must-know: US thermal coal exports are falling

US thermal coal exports were 19.6 million tons in the first half of 2014—down from 26.9 million tons during same period in 2013. The drop was mainly driven by falling demand from Europe.

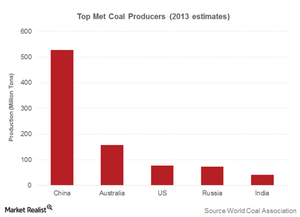

Who are the swing met coal producers in the global market?

In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest of the met coal producers. It’s the largest met coal exporter.

Why Davidson Kempner initiates new position in Brunswick Corp.

Brunswick is a leading global designer, manufacturer, and marketer of recreation products including marine engines, boats, fitness equipment, and bowling and billiards equipment.

Must-know: The US coal mining areas and coal specifications

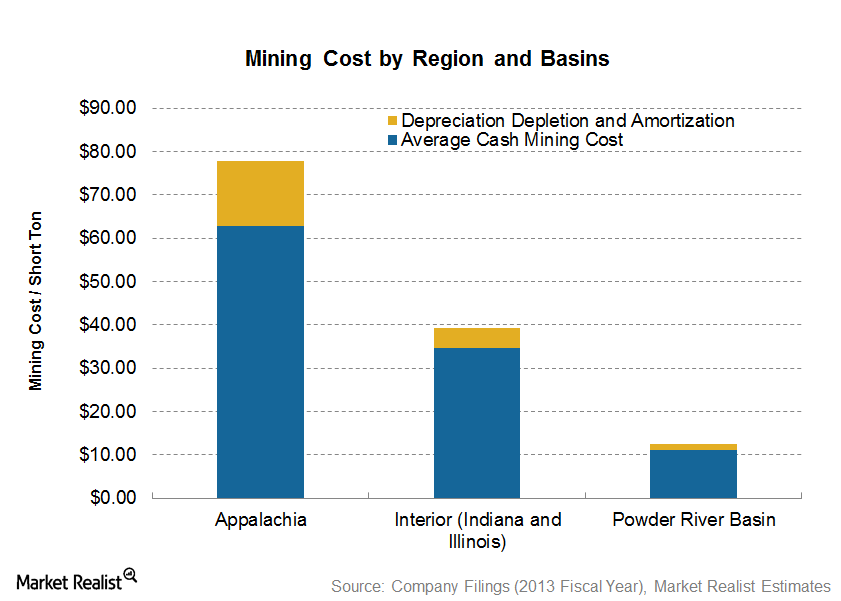

Coal mining in the U.S. can be segregated into three main areas: Appalachia, Interior, and West.

Why underground mines cost higher compared to surface coal mines

Underground mining is more expensive because it’s more capital intensive. Coal companies have to drill more, and use more expensive and complicated machines.

The “buried sunshine”—the coalification process and coal types

Coal is often called the “buried sunshine” because it developed from the remains of plants and greens that existed as long as 400 million years ago.