Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

Aug. 27 2015, Updated 2:07 p.m. ET

Crude oil prices

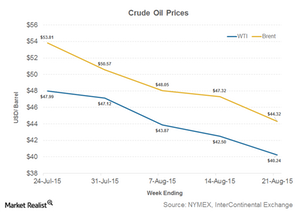

WTI (West Texas Intermediate) crude oil prices fell for the eighth straight week during the week ended August 21. They averaged below $50 per barrel for the fifth consecutive week. WTI averaged $40.24 per barrel during the week ended August 21 compared to $42.50 during the week ended August 14. WTI crude oil ended below $40 a barrel on Friday, a six-year low. The US Energy Information Administration (or EIA) estimated that the US crude oil production continued to exhibit year-over-year growth.

The average Brent crude oil price dropped by $3.0 to $44.32 per barrel for the week ended August 21. Concerns over China’s growth led the slump.

Why are crude oil prices important for coal producers?

While coal and crude oil don’t directly compete with each other as fuels, it’s important for coal investors to track crude oil prices. Coal producers (KOL) like Alliance Resource Partners (ARLP), Arch Coal (ACI), Peabody Energy (BTU), and Cloud Peak Energy (CLD) are affected in various ways by falling crude oil prices.

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs. Weakness in crude oil prices may encourage US crude oil producers to cut down production, pressuring freight rates. Plus, if crude oil production falls, there would be more railcars available to transport coal. Coal producers based in the Powder River Basin faced severe rail availability issues in 2014.

On the other hand, energy stocks, including coal stocks, generally follow crude oil prices. The fall in crude oil prices in 2H14 pulled all energy-related stocks down.

For utilities (XLU), the impact of oil prices isn’t significant, as oil isn’t a major fuel that powers electricity generation in the United States.