Alliance Resource Partners LP

Latest Alliance Resource Partners LP News and Updates

Understanding Arch Coal’s Financial Position

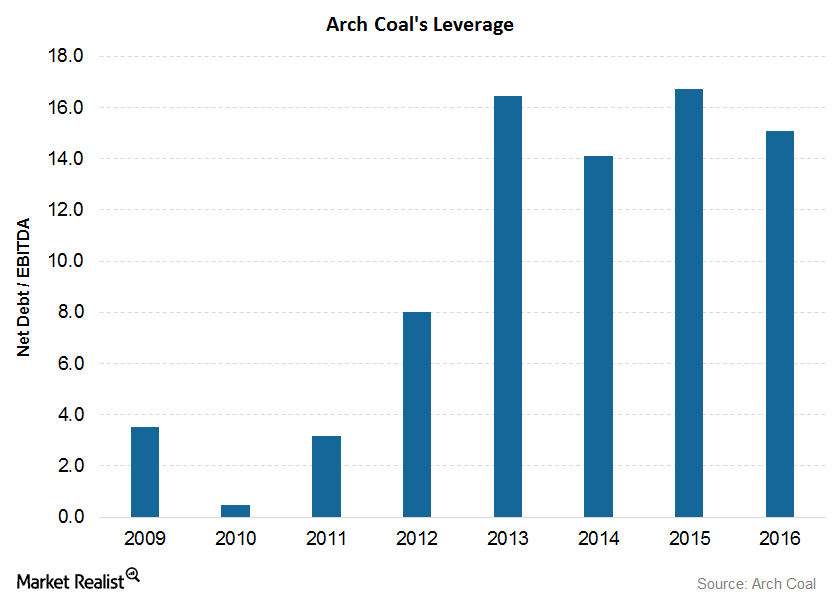

Arch Coal’s leverage On June 30, 2017, the book value of Arch Coal’s (ARCH) long-term debt was about $315.6 million, of which ~$297 million is due for payment in 2024. Arch Coal’s leverage, which is its net debt divided by EBITDA (earnings before interest, tax, depreciation, and amortization), has increased since the acquisition of International […]

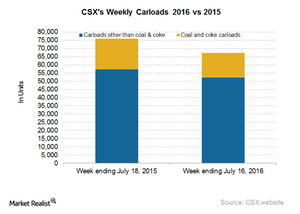

Why Did CSX’s Carloads Slump in the Week Ending July 16?

CSX (CSX) is a major operator in the Eastern US that competes with Norfolk Southern (NSC).

What Could Drive Arch Coal Stock in 2017?

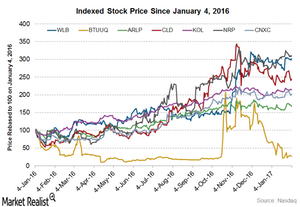

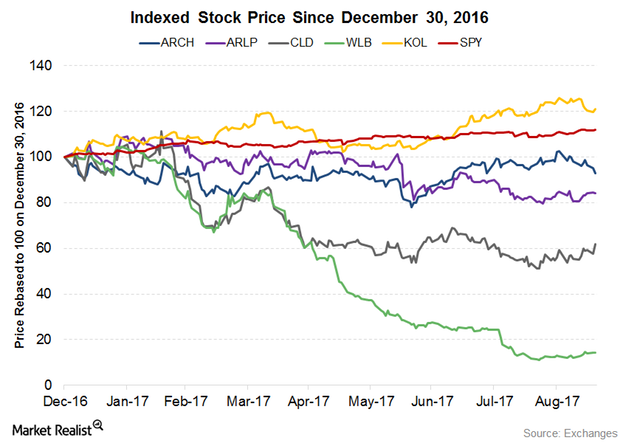

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016.

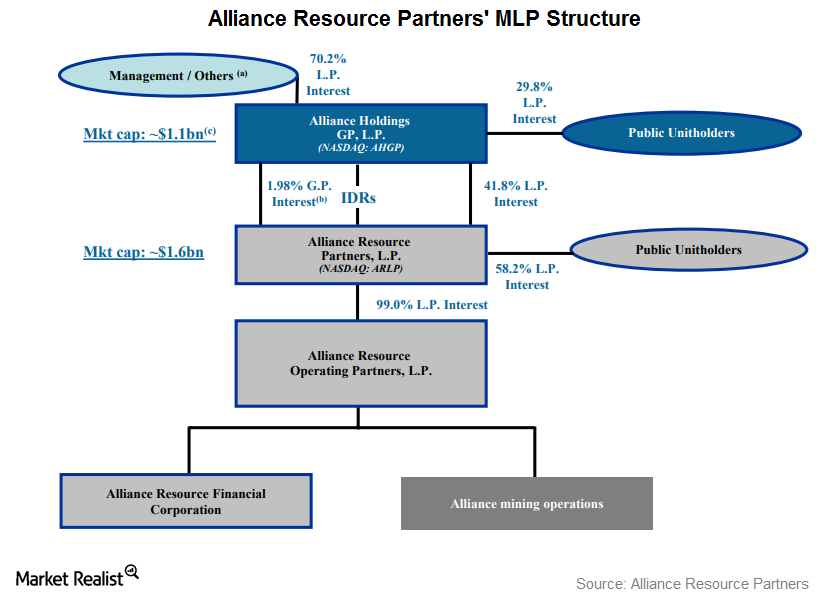

Understanding the Master Limited Partnership Structure of Alliance Resource Partners

As of December 31, 2016, Alliance Resource Partners was being managed by its MGP, which is 100% owned, directly and indirectly, by AGHP.

What Factors Could Drive Arch Coal Stock in 2H17?

1H17 in review Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017. On September 19, 2017, Arch Coal (ARCH) has fallen […]

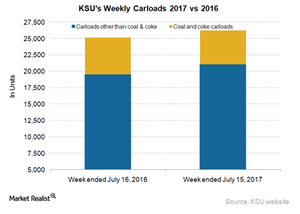

Why Kansas City Southern’s Freight Traffic Just Rose

Kansas City Southern reported a YoY (year-over-year) 4.4% rise in railcars in the week ended July 15, 2017.

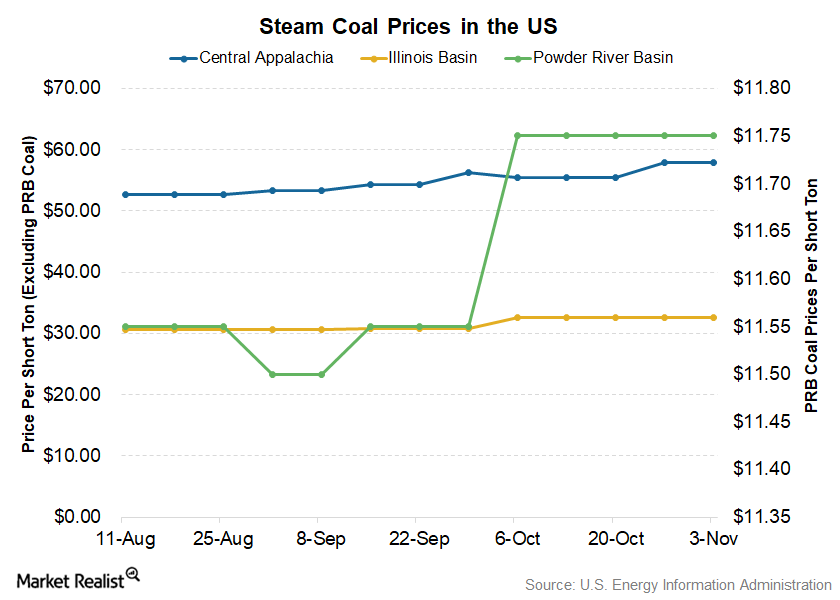

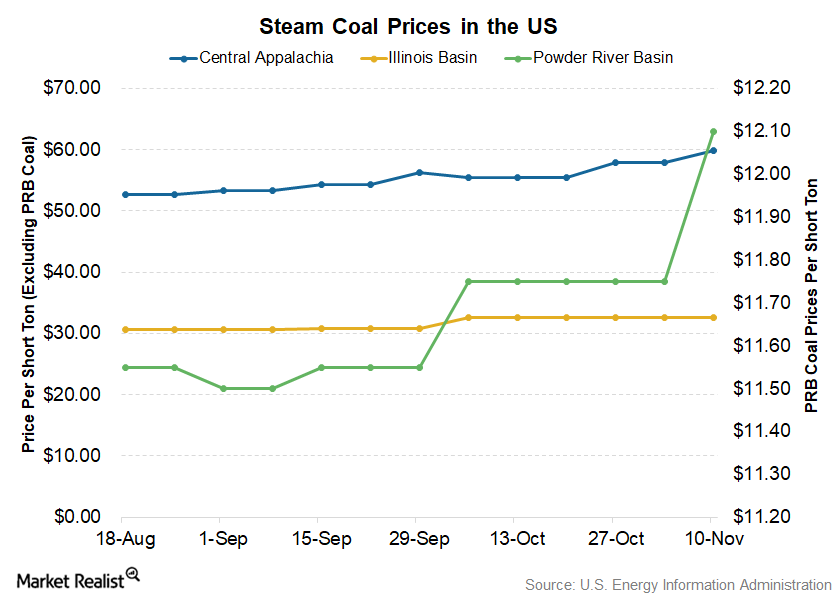

Spot Coal Prices Remained Flat in the Week Ending November 3

Powder River Basin coal settled at $11.75 per short ton, while Illinois Basin spot coal prices closed at $32.60 per short ton.

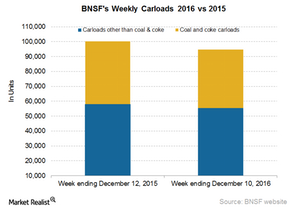

How BNSF’s Carloads Compared to Rival Union Pacific

BNSF Railway’s (BRK-B) total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units, compared to ~100,000 units on a year-over-year basis.

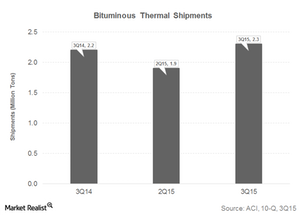

How Arch Coal’s Rise in Bituminous Thermal Coal Volumes Hurt Prices in 3Q15

Arch Coal’s Bituminous Thermal coal segment sold 2.3 million tons in 3Q15 compared to 2.2 million tons in 3Q14 and 1.9 million tons in 2Q15.

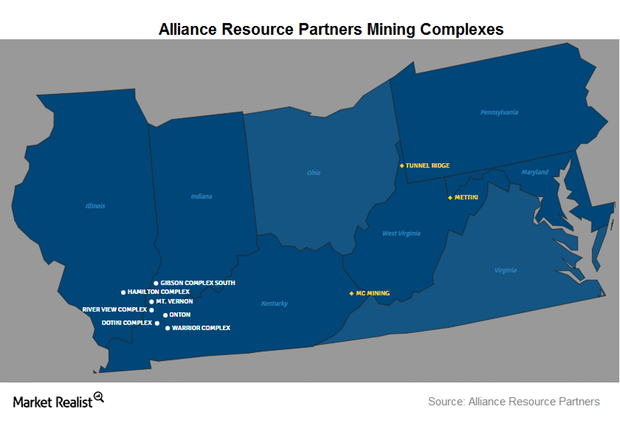

Inside Alliance Resource Partners’ Mining Operations

Alliance Resource Partners (ARLP) operates eight underground mining complexes in two regions: Illinois and Appalachia.

Powder River Basin Coal Spot Prices Recovered Sharply

During the week ended November 10, 2017, PRB coal closed at $12.10 per short ton, which was ~3% higher than $11.75 per short ton that coal maintained for the past five weeks.

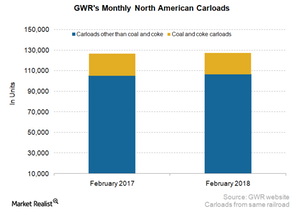

How GWR’s North American Carloads Trended in February

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis.

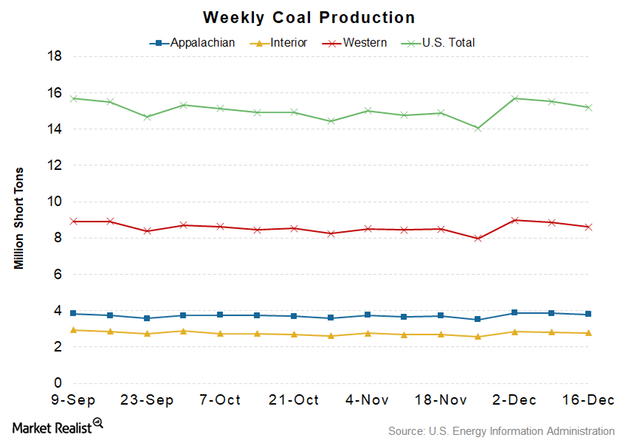

Coal Production Continues to Fall

On December 21, the EIA released the estimate of the coal volumes produced in the US for the week ending December 16.

The Key Risks Involved in Arch Coal’s Business

Commodity price risk Arch Coal (ARCH) has long-term coal supply agreements for their non-trading, thermal coal sales, hence managing commodity risk for thermal coal and also to a limited extent, through the use of derivative instruments. However, sales commitments in the metallurgical coal market are typically not long-term in nature and are subject to fluctuations […]Company & Industry Overviews An Overview of Westmoreland Coal

In this series, we’ll analyze Westmoreland Coal’s (WLB) business model. We’ll explore how the company has expanded its business, and evaluate its key operational metrics and financial position.

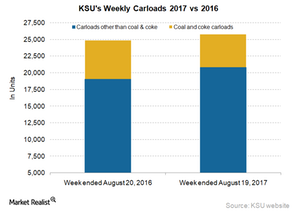

Kansas City Southern: Behind the Freight Volume Rise in Week 33

Kansas City Southern hauled ~26,000 railcars in the same week compared with close to 25,000 units in the week ended August 20, 2016.

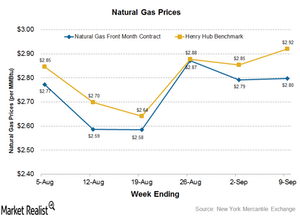

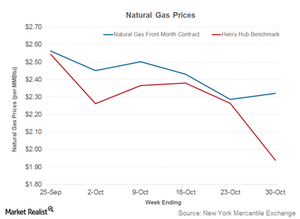

Cleaner Natural Gas Production Continuing to Hurt Coal Miners

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu for the week ended September 9, 2016, compared to $2.85 per MMBtu for the previous week.

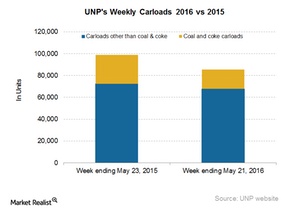

The Next Chapter in Union Pacific’s Carload Slump

In the week ending May 21, Union Pacific’s total railcars declined by 13.5% YoY to ~86,000 units, which was down from ~99,000 units one year previously.

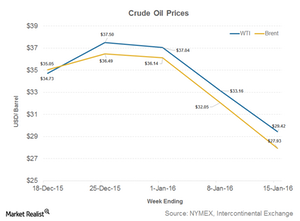

Crude Oil Fell below $30: Positive or Negative for Coal?

Crude oil prices dropped significantly during the week ended January 15, 2016. WTI (West Texas Intermediate) crude oil prices closed at $29.42 per MMBtu on January 15, 2016.

Coal under Pressure as Natural Gas Prices Remain Subdued

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation.

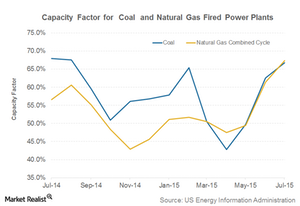

Capacity Factors Still Indicate Shift from Coal to Natural Gas

Capacity factors for coal-fired plants fell YoY and rose substantially for natural gas-fired power plants. This shows a shift from coal to natural gas as a fuel for electricity generation.

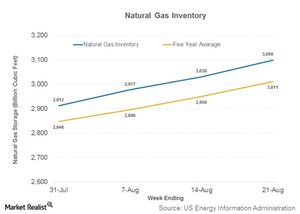

Natural Gas Inventory Figure Puts Pressure on Coal

The EIA’s natural gas inventory report for the week ended August 21 came in at 3,099 billion cubic feet, compared to 3,030 Bcf a week earlier. Natural gas is stored underground to save the fuel for peak demand during the winter.

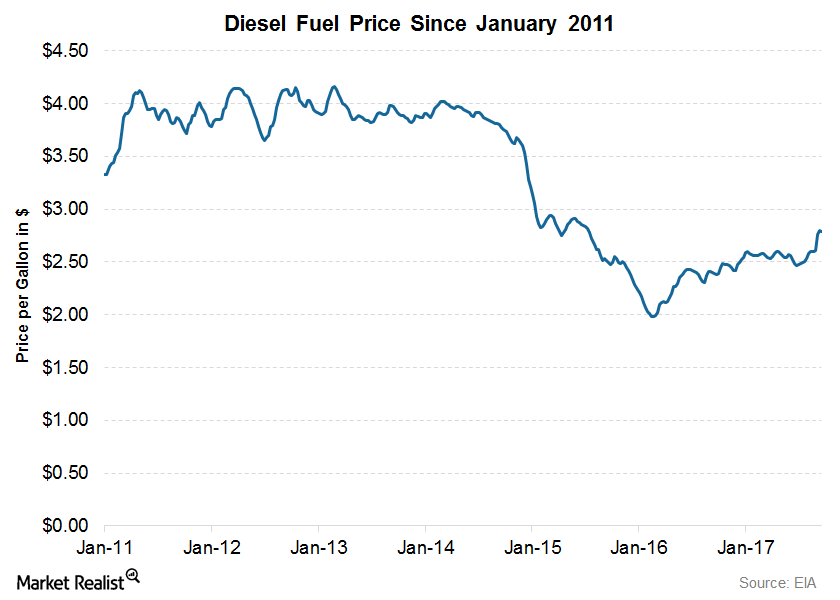

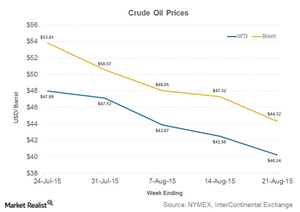

Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

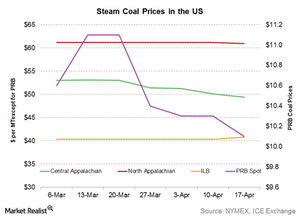

Coal Prices Dropped as Natural Gas Prices Rose

Central Appalachian thermal coal prices came in at $49.40 per ton for the week ending April 17—down from $50.10 per ton the previous week.