Credit Suisse Nassau Branch

Latest Credit Suisse Nassau Branch News and Updates

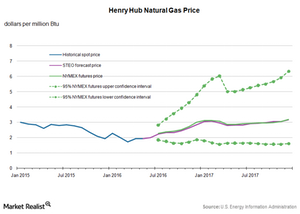

Natural Gas Prices Are Trading above Key Moving Averages

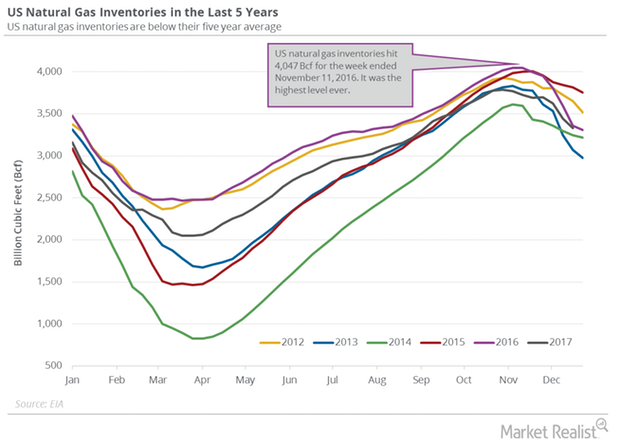

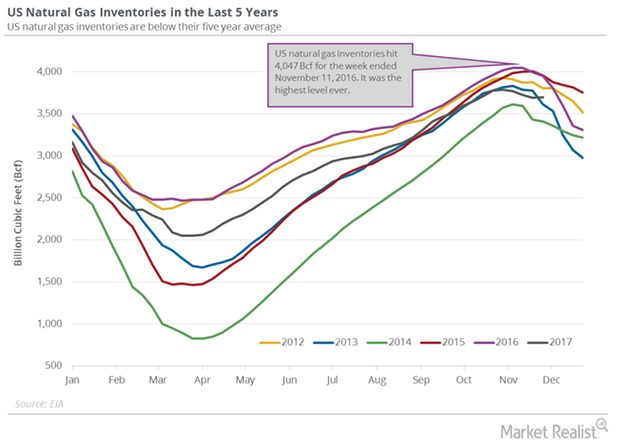

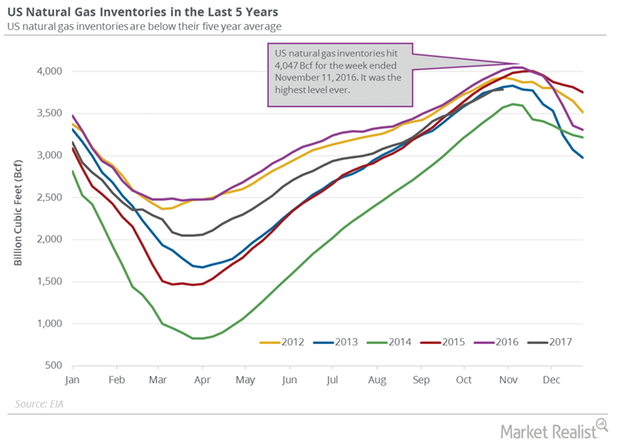

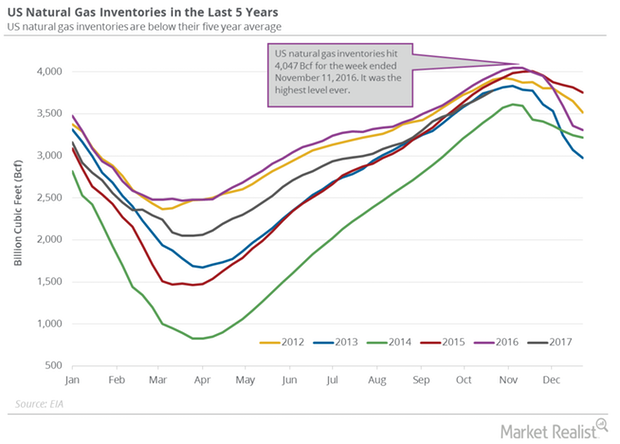

US natural gas inventories are 25% higher than their five-year average. High natural gas inventories could also limit the upside for US natural gas prices.

Will US Natural Gas Futures Fall More?

US natural gas (GASL) futures contracts for January delivery were below their 20-day, 50-day, and 100-day moving averages on December 14, 2017.

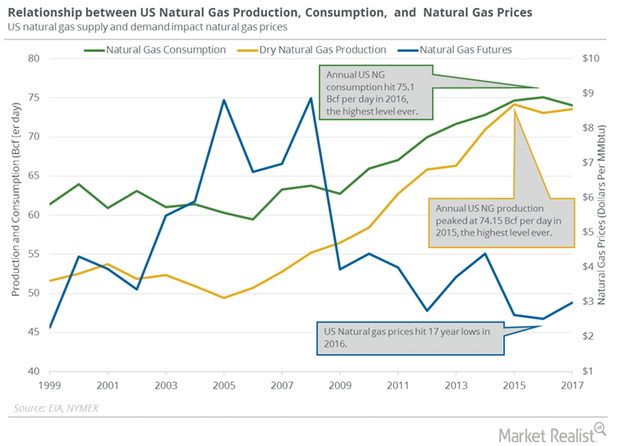

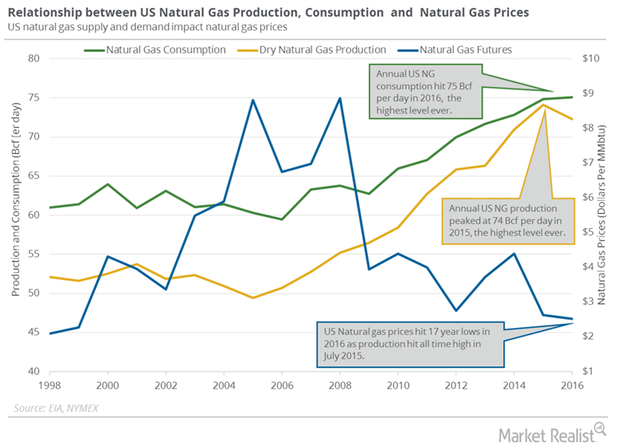

US Natural Gas Production and Consumption Could Impact Prices

According to PointLogic, US dry natural gas production increased by 0.3 Bcf (billion cubic feet) per day to 75.7 Bcf per day on January 11–17, 2018.

Natural Gas Inventories Could Help US Natural Gas Prices

A larger-than-expected withdrawal in US natural gas inventories compared to historical averages would help natural gas prices this week.

Unexpected Rise in US Natural Gas Inventories

The EIA estimated that US natural gas inventories rose by 2 Bcf (billion cubic feet) to 3,695 Bcf on November 24–December 1, 2017.

Are US Natural Gas Inventories Bullish for Natural Gas Futures?

The EIA estimates that US gas inventories rose by 15 Bcf (billion cubic feet) or 0.4% to 3,790 Bcf on October 27–November 3, 2017.

US Natural Gas Inventories Could Help Natural Gas Futures

The EIA reported that US natural gas inventories rose by 65 Bcf (billion cubic feet) to 3,775 Bcf on October 20–27, 2017.

How US Natural Gas Production and Consumption Are Driving Prices

Market data provider PointLogic estimates that weekly US dry natural gas production fell by 0.2 Bcf (billion cubic feet) per day to 74.3 Bcf per day from September 21 to 27, 2017.

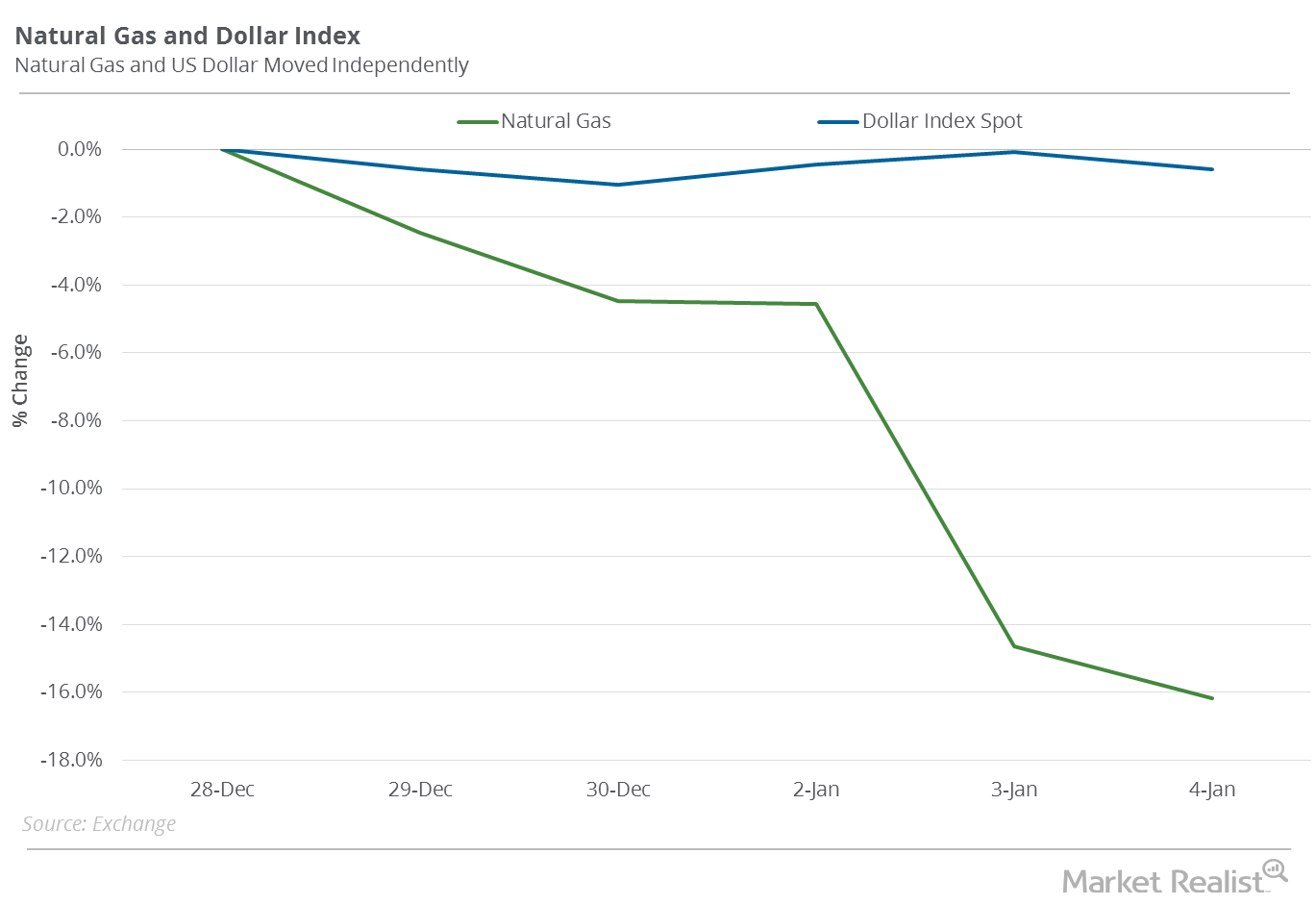

Does the US Dollar Impact Natural Gas Prices?

In the past four trading sessions, natural gas futures and the US Dollar Index moved in opposite directions one out of four times.

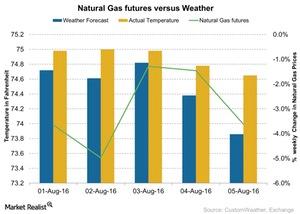

How Weather Could Impact Natural Gas Prices

In the week ended August 5, 2016, temperatures were higher than the forecast for the week. That boosted natural gas prices on August 3.

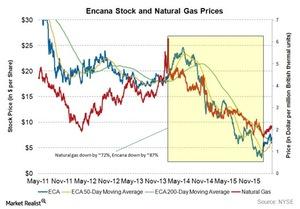

Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

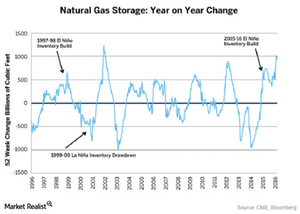

How Do El-Niño and La-Nina Impact Natural Gas Prices?

When El-Niño occurs, it keeps the sea surfaces warmer. This causes milder-than-normal cold temperatures across the sea and some parts of the US.

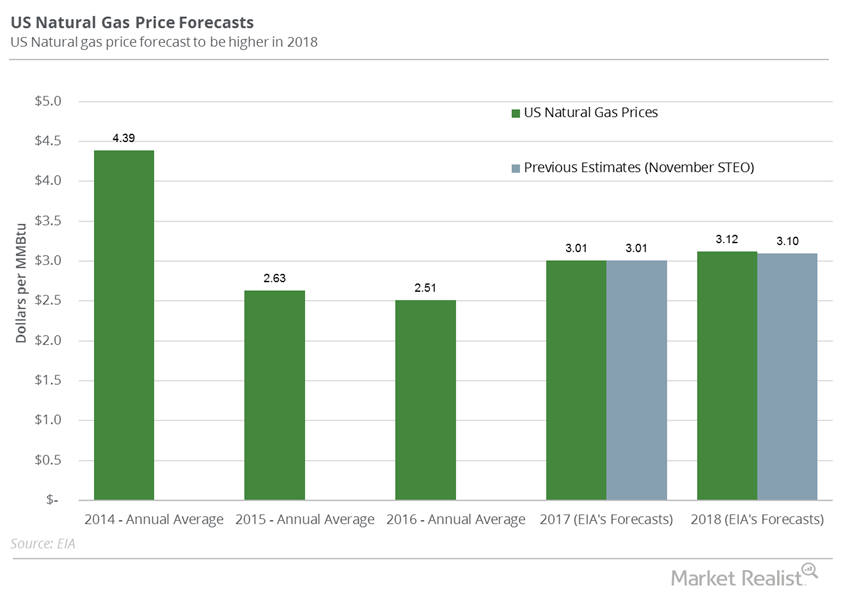

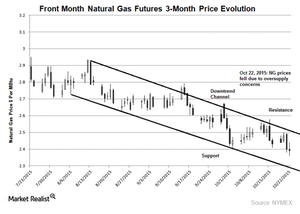

Will Natural Gas Prices Hit New Lows?

Cold winter weather could drive natural gas prices higher. But on the other hand, record natural gas stocks will push natural gas prices lower.