How Do El-Niño and La-Nina Impact Natural Gas Prices?

When El-Niño occurs, it keeps the sea surfaces warmer. This causes milder-than-normal cold temperatures across the sea and some parts of the US.

April 22 2016, Published 11:26 a.m. ET

El-Niño and La-Nina

When El-Niño occurs, it keeps the sea surfaces warmer. This causes milder-than-normal cold temperatures across the sea and some parts of the US. In contrast, when La-Nina occurs, it keeps the sea surfaces colder. This causes colder-than-normal temperatures in the central Pacific Ocean and some parts of the US over a period of 10–12 months.

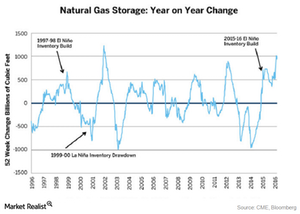

US natural gas inventory

The El-Niño weather pattern was predominant in 1997–1998 and 2015–2016. Milder-than-normal temperatures led to a rise in the inventory due to less heating needs during the winter seasons. This was followed by La-Nina in 1999. This pattern led to a decline in the natural gas inventory. The same situation could repeat in 2016 or 2017 after the 2015–2016 El-Niño. It led to near record US natural gas inventory during this period of the year. To learn more about the US natural gas inventory report, read the next part of the series.

Natural gas prices during El-Niño

The El-Niño period saw depressed natural gas prices in 1997–1998 and 2015. After El-Niño, natural gas prices rallied from $2 per MMBtu to $10 per MMBtu between January 2000 and October 2000. Will this happen again? We’ll discuss this more in the next part. The uptick in natural gas prices has a positive impact on natural gas producers’ margins like EV Energy (EVEP), Memorial Production (MEMP), Gulfport Energy (GPOR), Cabot Oil & Gas (COG), and Comstock Resources (CRK).