Guggenheim S&P 500® Equal Wt Energy ETF

Latest Guggenheim S&P 500® Equal Wt Energy ETF News and Updates

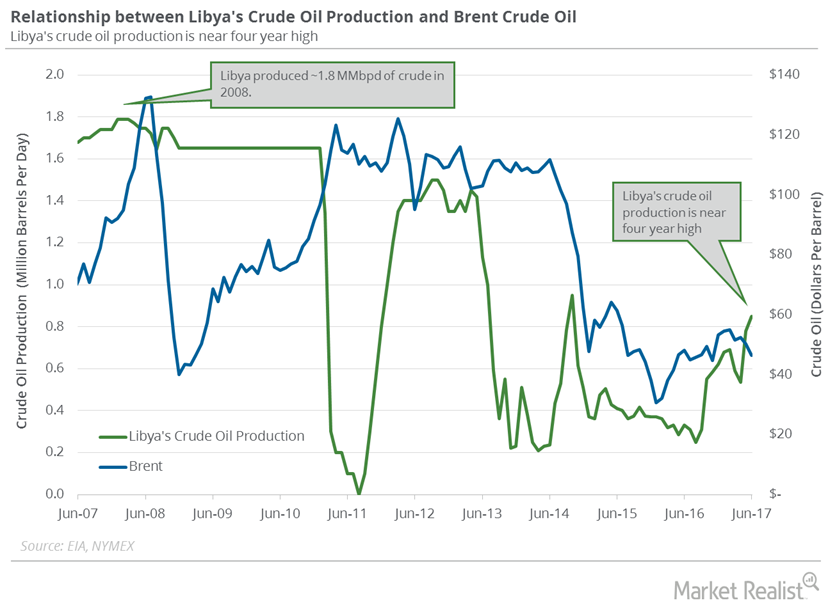

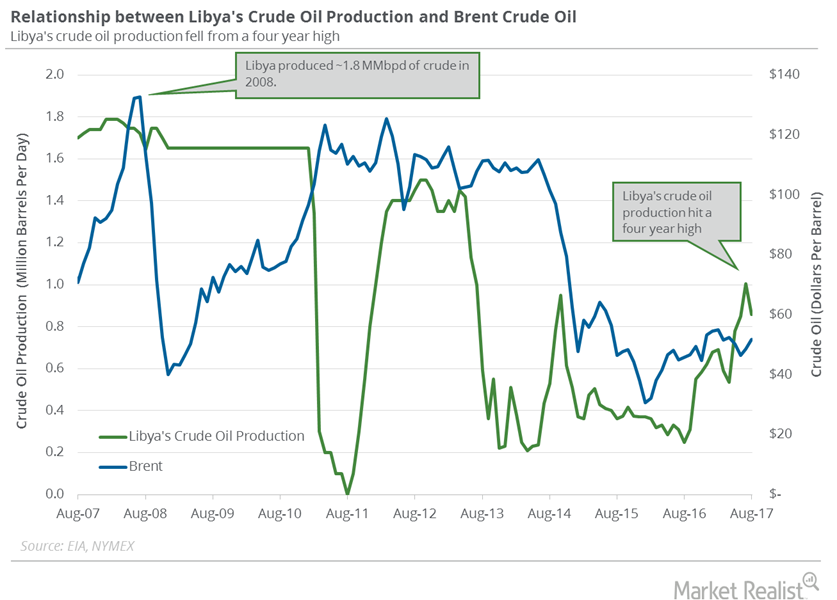

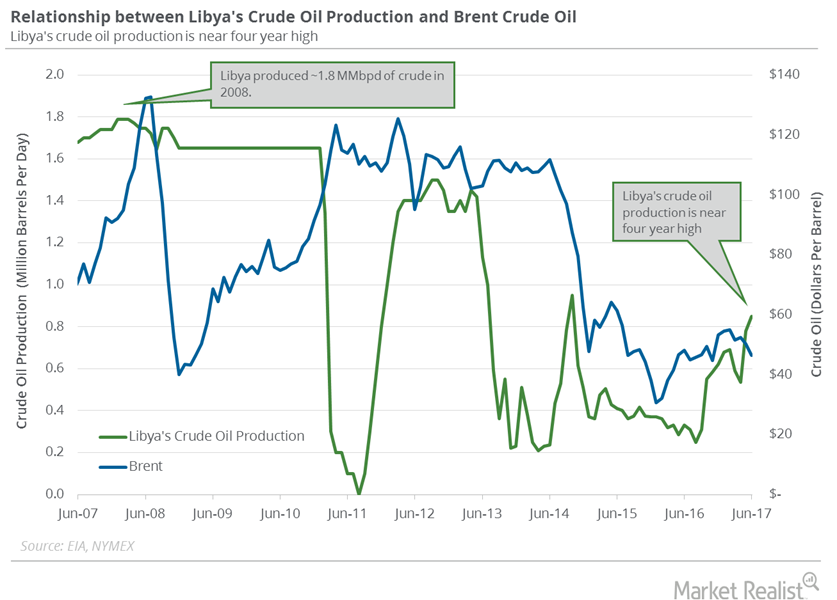

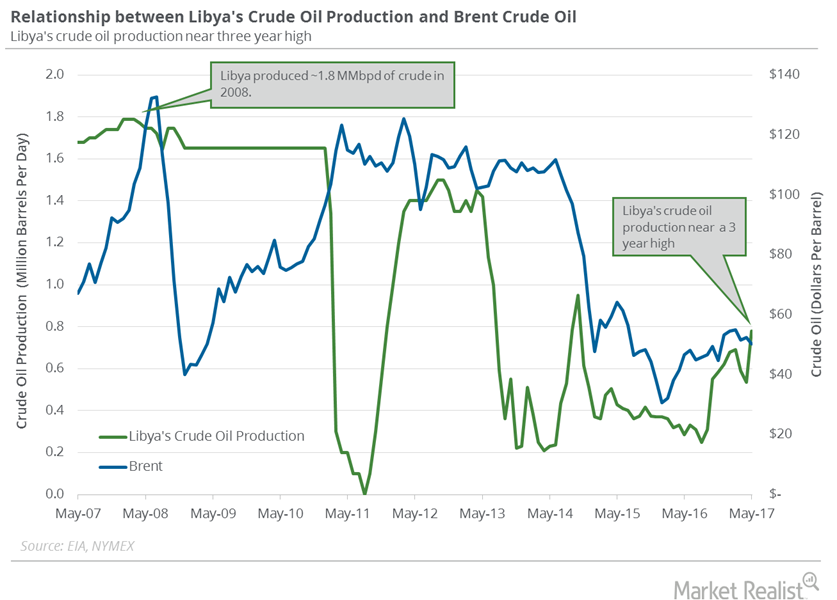

Libya’s Crude Oil Production: Bears Could Control Oil Prices

Libya’s crude oil production was at 1,030,000 bpd in July 2017. Production has risen ~60% from its levels in January 2017.

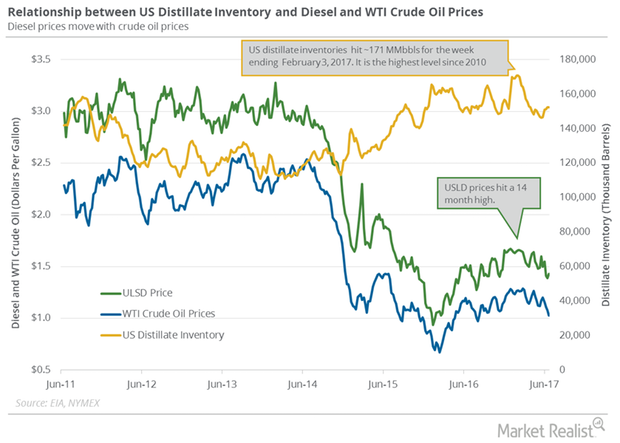

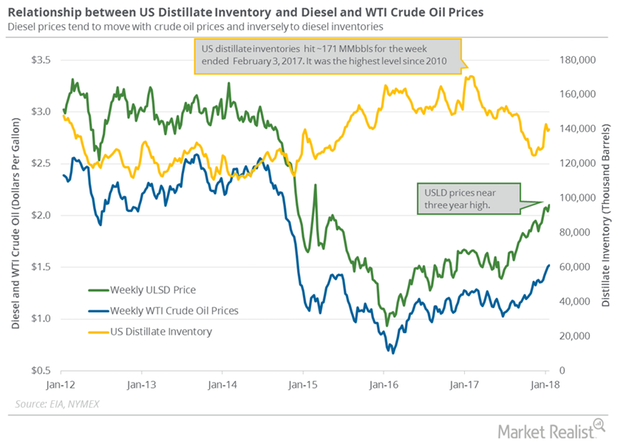

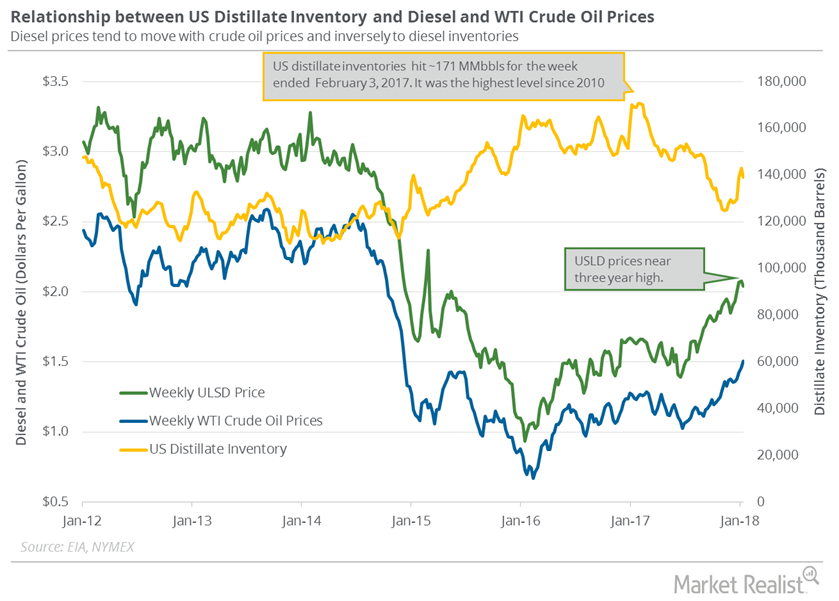

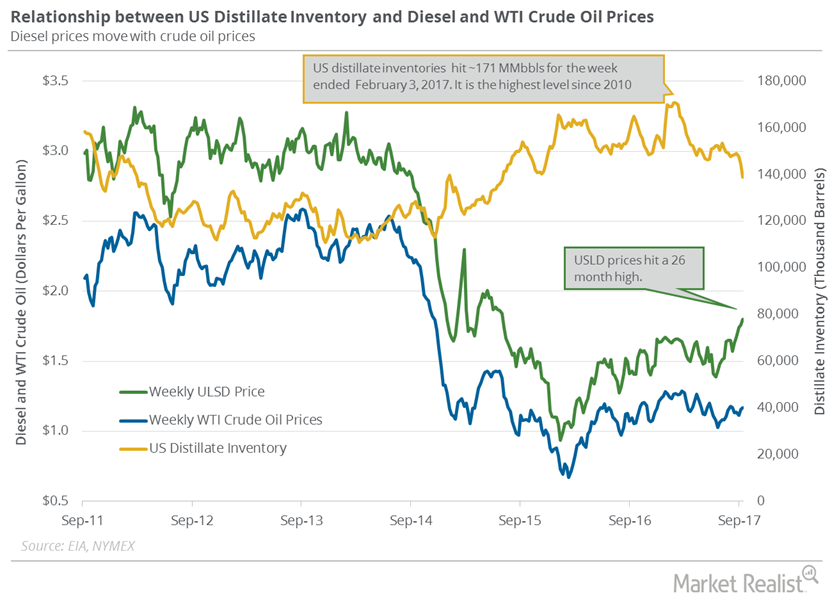

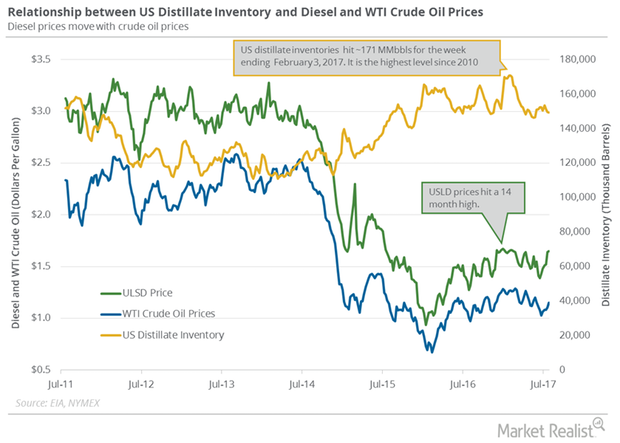

US Distillate Inventories Fell for the First Time in 5 Weeks

The fall in distillate inventories supported diesel and crude oil futures on June 28, 2017. US diesel futures rose 1.4% to $1.43 per gallon on June 28.

Will Oil Producers’ Meeting Support Crude Oil Prices in September?

OPEC producers will be meeting at an energy forum in Algeria from September 26–28, 2016. Crude oil prices are up by 16% so far in August 2016.

Crude Oil Futures Near 7-Week High

September US crude oil (RYE) (VDE) (BNO) futures contracts rose 3.3% to $47.8 per barrel on July 25, 2017.

What to Expect from Libya’s Crude Oil Production in September

The EIA estimates that Libya’s crude oil production fell by 145,000 bpd (barrels per day) to 860,000 bpd in August 2017—compared to the previous month.

Will US Crude Oil Futures Fall from 4-Month Highs?

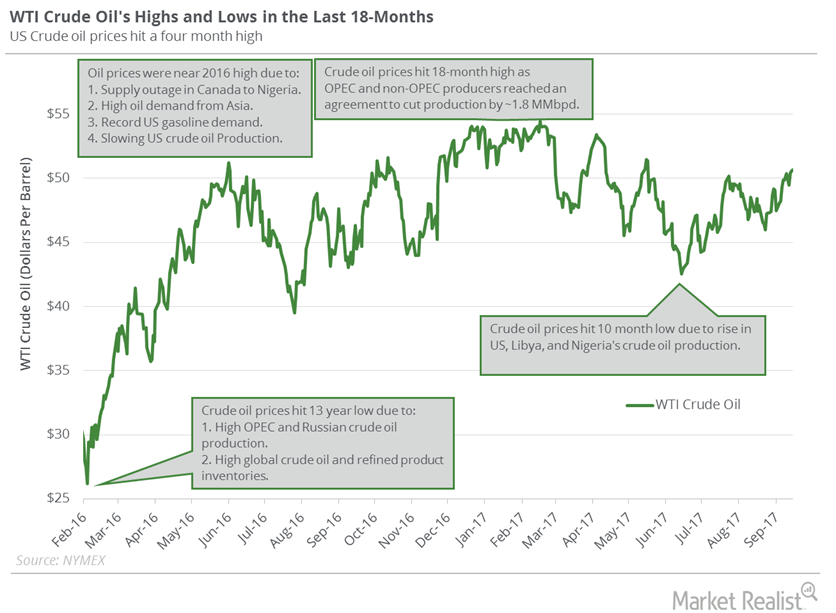

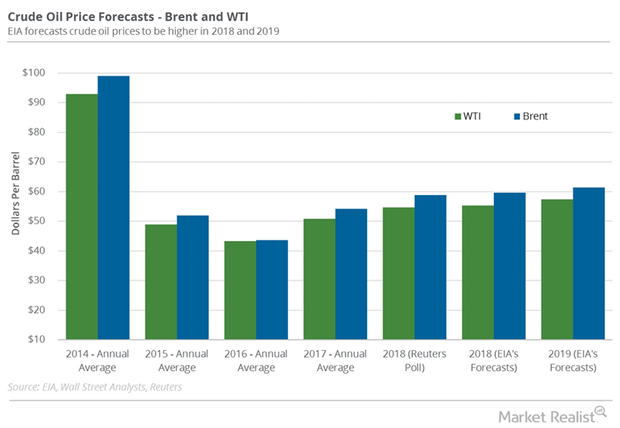

WTI (West Texas Intermediate) crude oil (RYE) (VDE) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than a decade.

OPEC and Non-OPEC Meeting Could Drive Crude Oil Futures

August US crude oil futures contracts rose 0.4% and closed at $44.4 per barrel on July 10. Brent crude oil futures rose 0.4% to $46.8 per barrel.

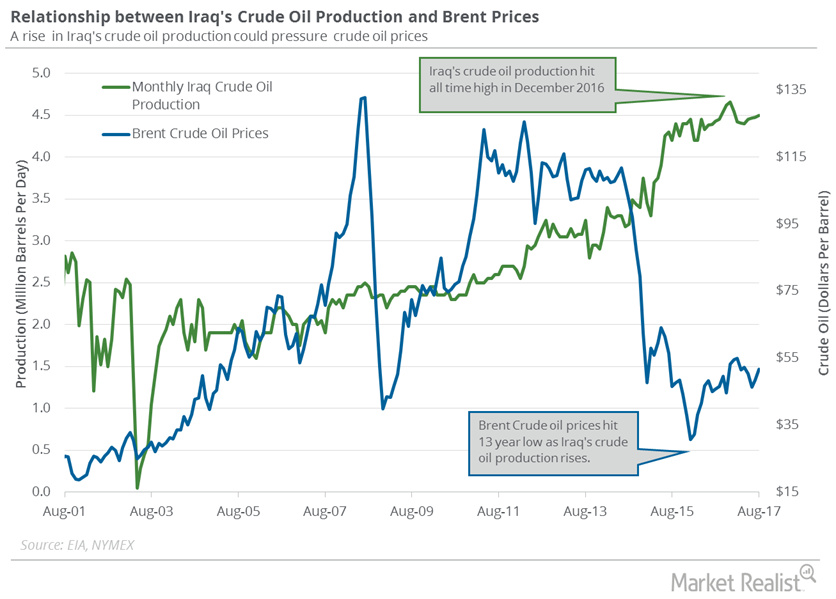

Geopolitical Tensions Impact Crude Oil Prices

On October 3, 2017, Iraq banned selling dollars to Kurdistan’s banks due to the vote in the referendum. Geopolitical tensions could impact crude oil prices.

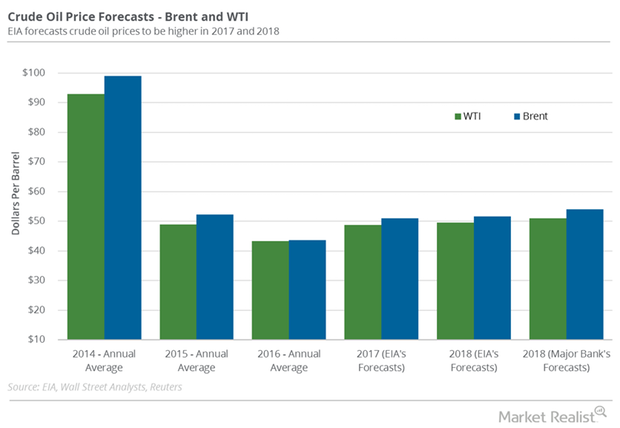

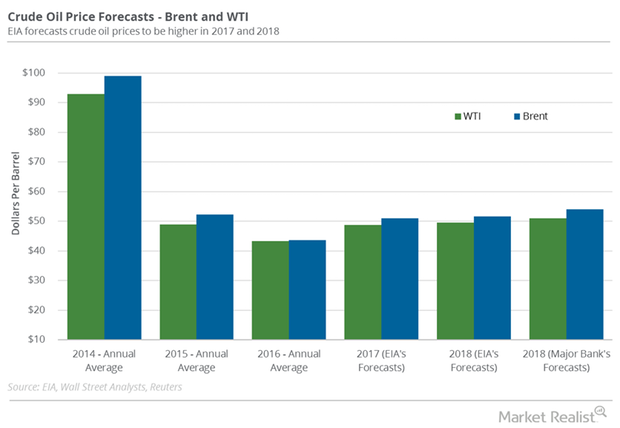

Will Brent and US Crude Oil Prices Rise in 2018?

November US crude oil (DWT)(UWT)(USO) futures are above their 20-day, 50-day, and 100-day moving averages at $49.25, $48.77, and $48.11 per barrel as of September 25.

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

Crude Oil Prices Rise: Is It Time for a Collapse?

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high.

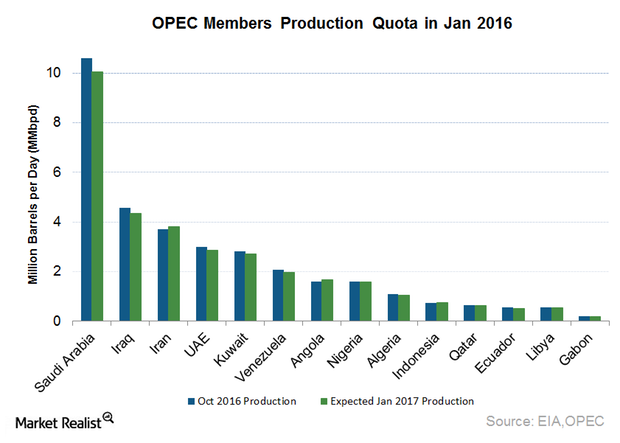

Decoding the Major Oil Producers’ Meeting in Algeria

OPEC producers’ meeting was held from September 26–28, 2016. Crude oil prices rose 12% in August 2016 due to speculation about the meeting’s outcome.

Libya’s Crude Oil Production Nears 4-Year High: What’s Next?

Libya is an OPEC member but was exempt from the production cut deal due to political and economic instability.

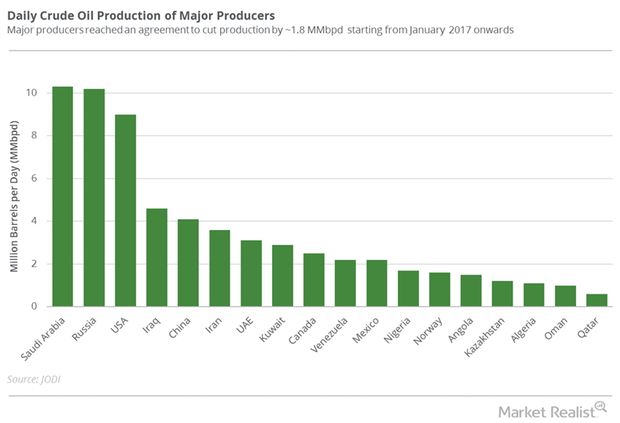

Crude Oil Prices Skyrocket as OPEC Agrees to Cut Production

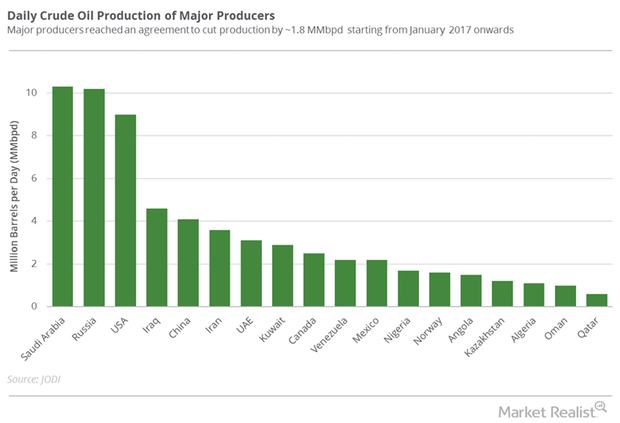

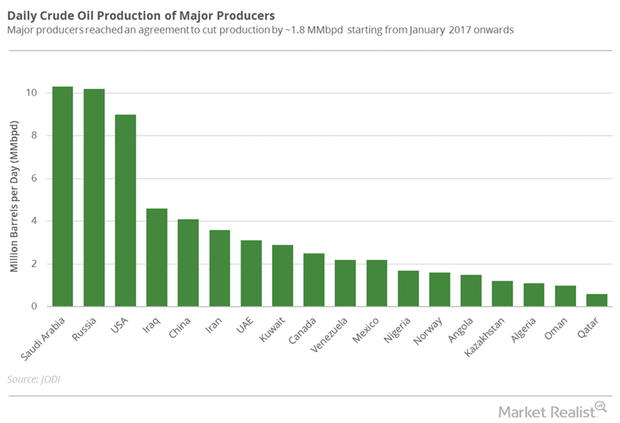

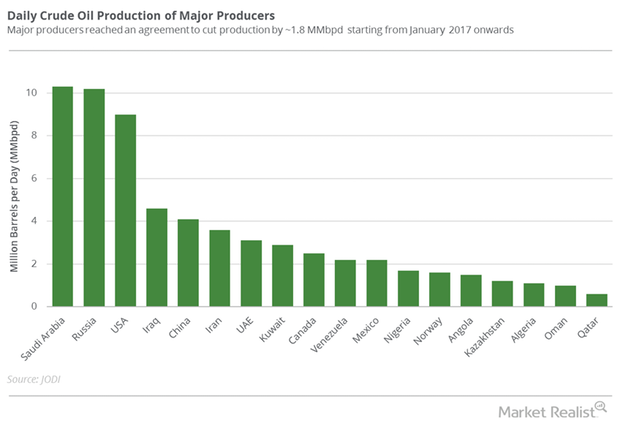

Crude oil prices hit a one-month high as OPEC reached an agreement to cut production by 1.2 MMbpd in its meeting in Vienna.

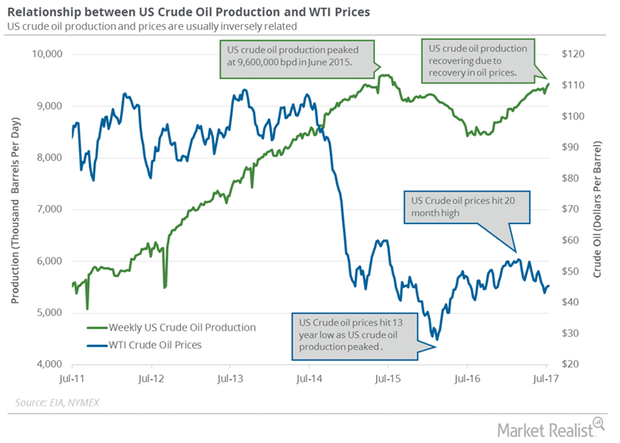

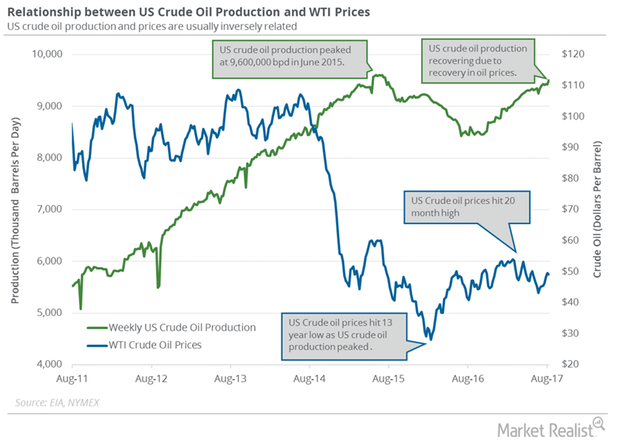

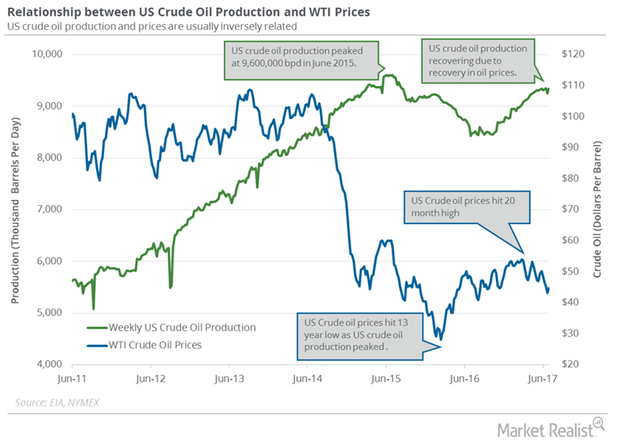

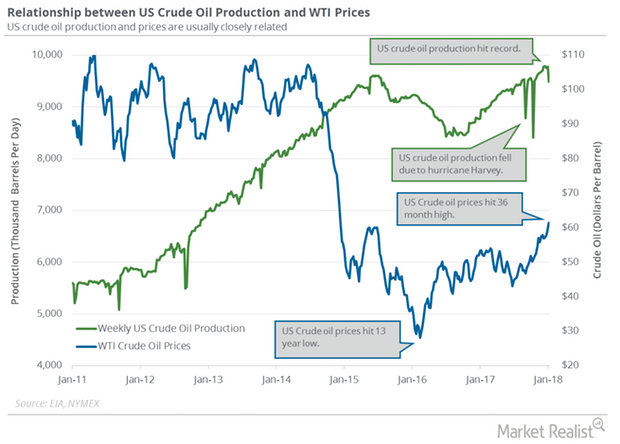

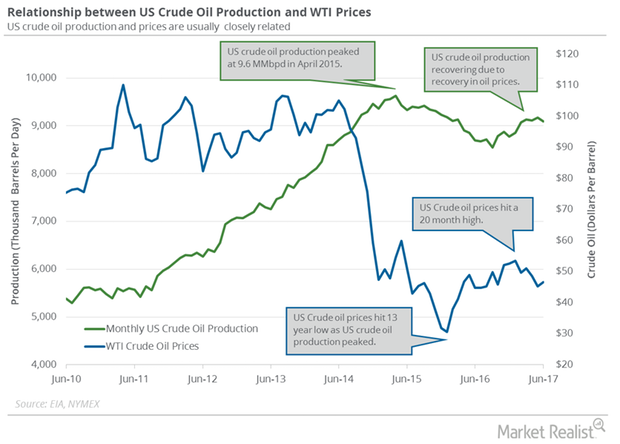

Why Is US Crude Oil Production at a 2-Year High?

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 79,000 bpd or 0.83% to 9,502,000 bpd on August 4–11, 2017.

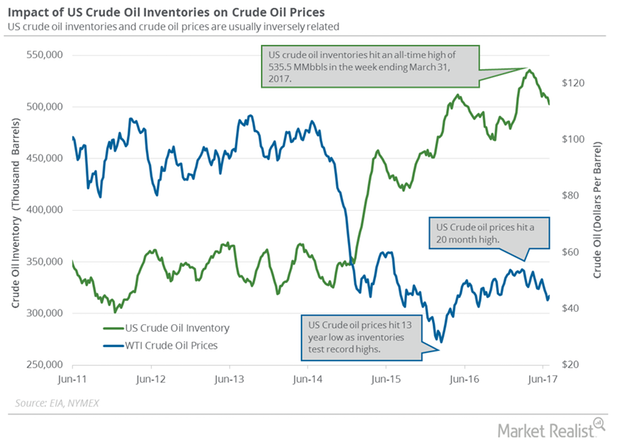

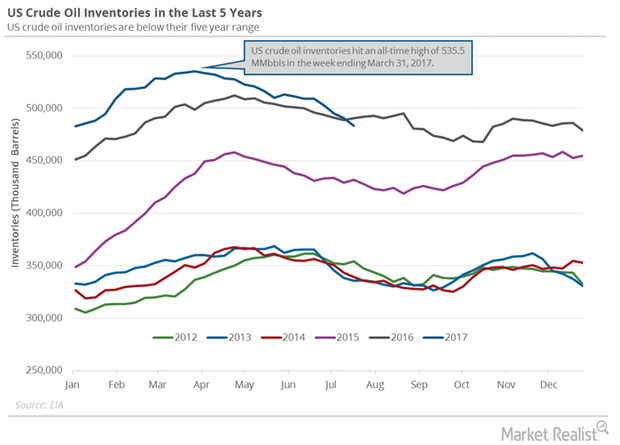

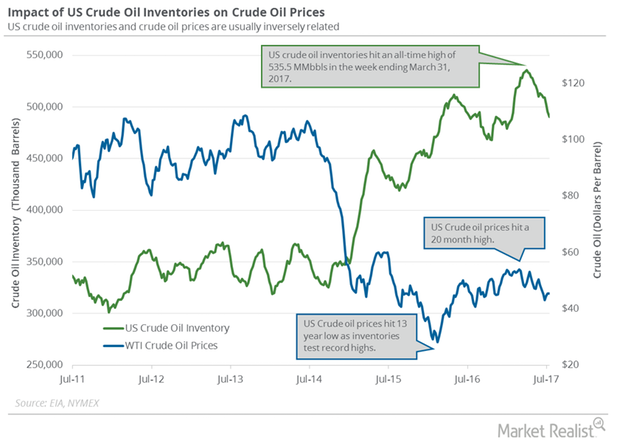

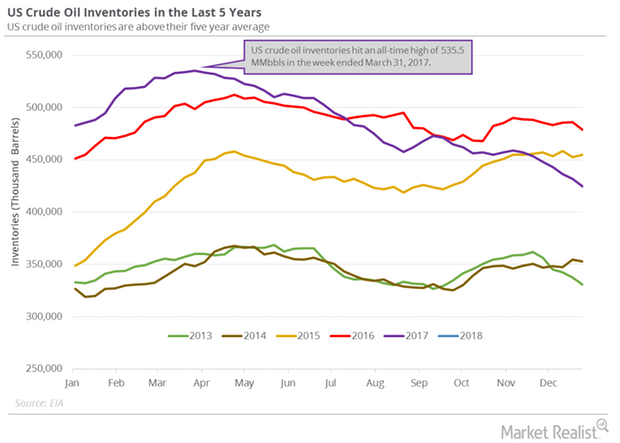

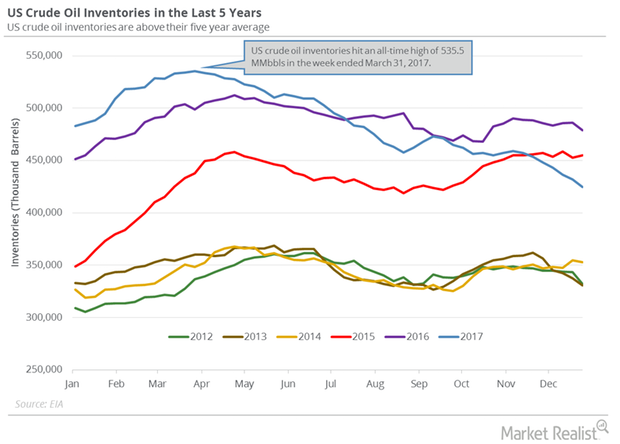

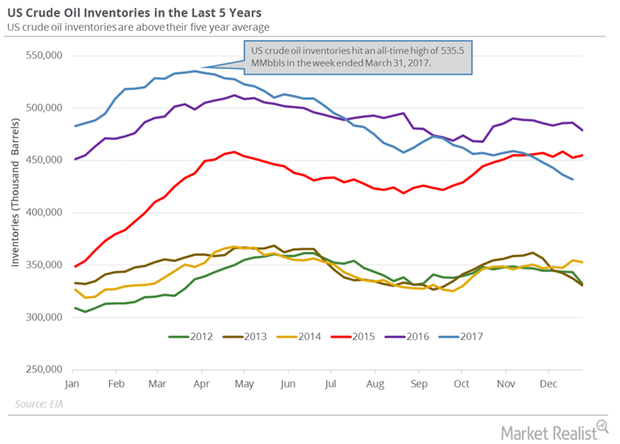

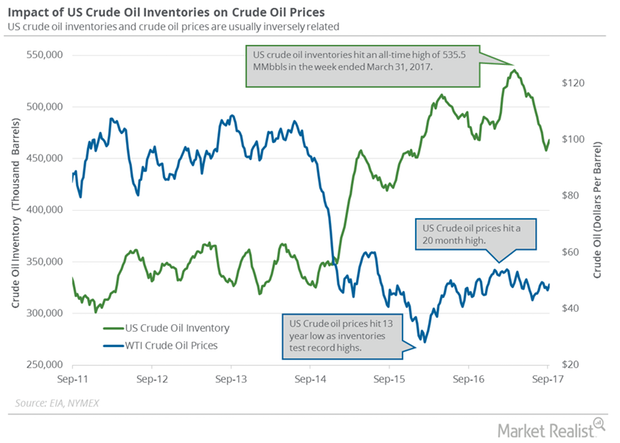

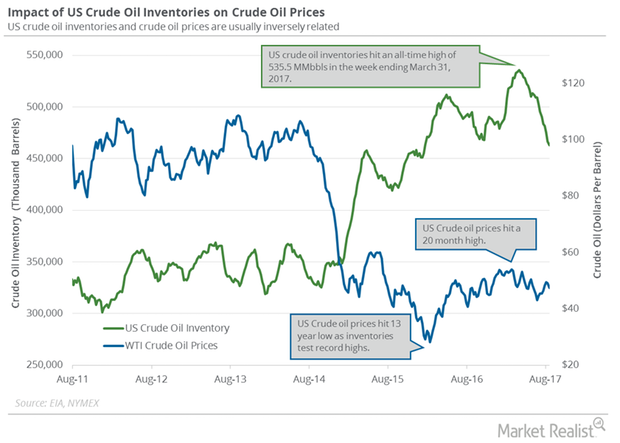

US Crude Oil Inventories Fell below the 5-Year Average

The EIA reported that US crude oil inventories fell by 7.2 MMbbls to 483.4 MMbbls on July 14–21, 2017. Inventories fell below the five-year range.

Crude Oil and Product Inventories Impact Crude Oil Futures

US crude oil futures have risen 6% from the ten-month low on June 21, 2017. Futures have also risen 2% in the last month.

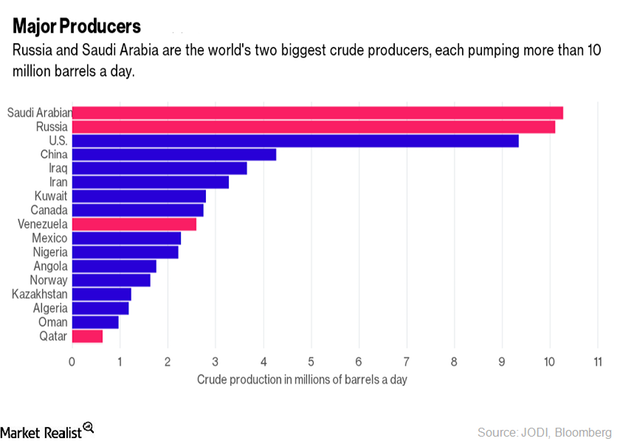

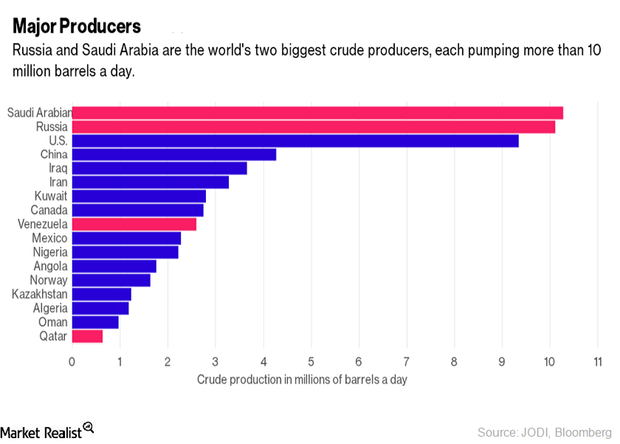

US Crude Oil Imports from Saudi Arabia Hit a 7-Year Low

US crude oil imports have fallen 4.5% YTD. US crude oil imports from Saudi Arabia are at a seven-year low at 524,000 bpd for the week ending July 14, 2017.

FOMC Meeting Could Surprise Crude Oil Traders

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017.

Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures?

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017.

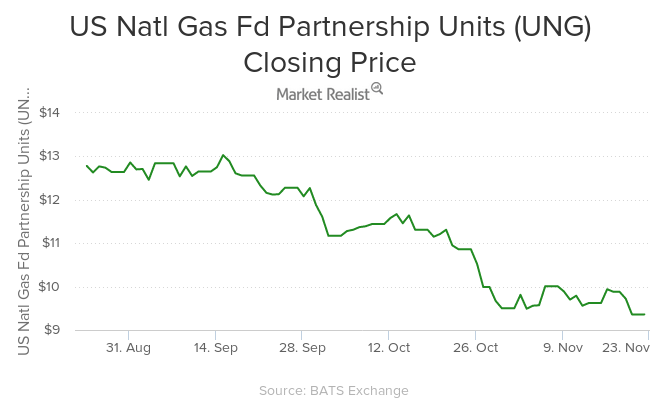

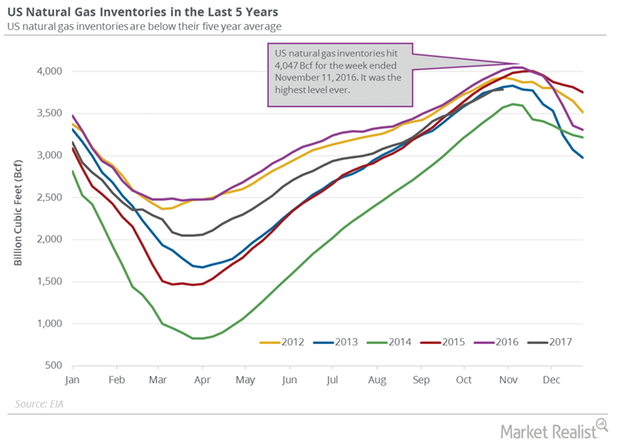

Natural Gas Prices Slump 9.4% for the Week

ETFs like the United States Natural Gas—UNG—ETF fell in the direction of natural gas prices on November 20, 2015. UNG fell by 4.7% on the day.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

Distillate Inventories: More Bullish News for Oil

The US Energy Information Administration (or EIA) released its weekly crude oil and gasoline inventory report on September 20, 2017.

Will OPEC and Russia Announce Deeper Production Cuts?

The OPEC and non-OPEC monitoring committee meeting will be held on July 24, 2017, in Russia. The meeting will discuss production cut deal compliance.

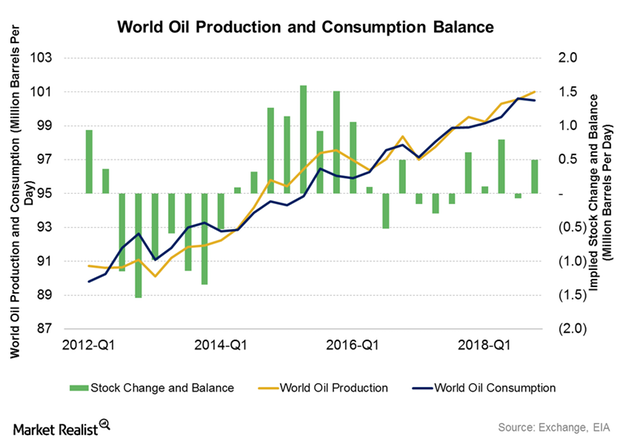

Inside the Global Crude Oil Supply-Demand Gap

The EIA estimated that the global crude oil supply-demand gap averaged 0.58 MMbpd (million barrels per day) in 1H16.

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.

US Distillate Inventories Fell for the Fourth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 1.72 MMbbls to 147.7 MMbbls on July 28–August 4, 2017.

OPEC, Russia, and the US Could Pressure Crude Oil Futures

US crude oil (RYE) (VDE) (SCO) futures contracts for August delivery fell 2.8% and settled at $44.23 per barrel on July 7. Prices are near a ten-month low.

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

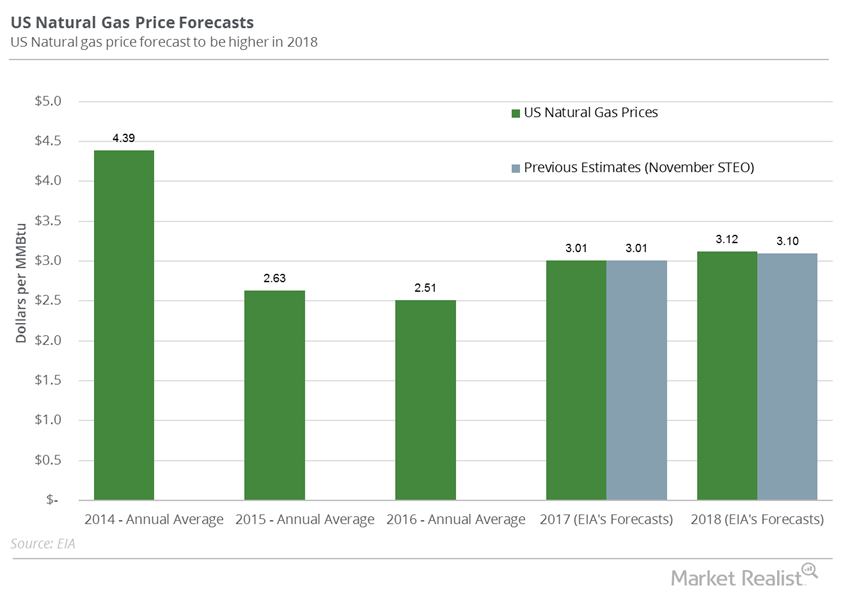

US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

Traders Could Start Booking a Profit in Crude Oil Futures

On January 16, 2018, Goldman Sachs said that crude oil prices could exceed its forecast in the coming months.

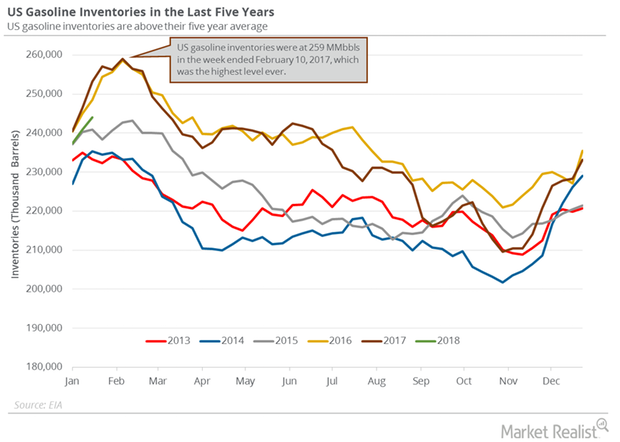

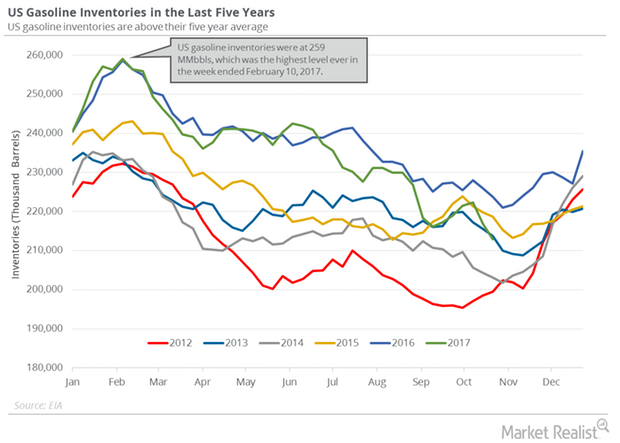

US Gasoline Inventories Could Threaten Crude Oil Prices

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018.

Massive Fall in Crude Oil Inventories Pushed Oil Prices Higher

US crude oil inventories fell by 4.9 MMbbls (million barrels) to 419.5 MMbbls between December 29, 2017, and January 5, 2018.

Crude Oil Inventories Fell, Refinery Utilization Hit 12-Year High

US crude oil futures contracts for February delivery fell 0.1% to $61.95 per barrel at 1:05 AM EST on January 5, 2018—the highest level since December 2014.

US Crude Oil Inventories Have Fallen ~10.6% in 2017

February WTI crude oil futures (DWT)(SCO) contracts rose 0.8% to $60.3 per barrel at 12:45 AM EST on December 29, 2017—the highest level since June 2015.

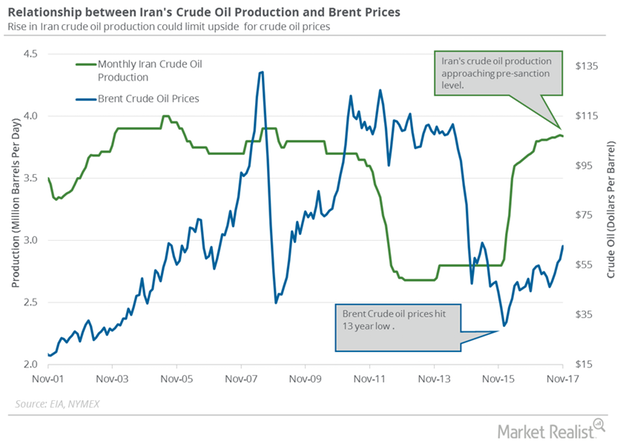

Iran’s Crude Oil Production Is near a 9-Year High

The EIA estimates that Iran’s crude oil production fell by 10,000 bpd or 0.3% to 3,840,000 bpd in November 2017—compared to the previous month.

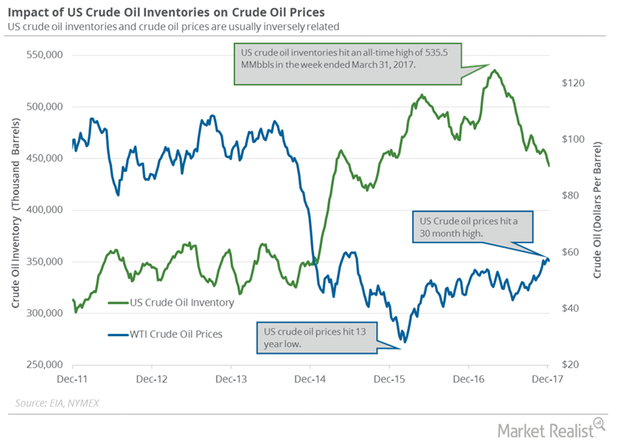

Will US Crude Oil Inventories Push Crude Oil Prices Higher?

US crude oil inventories fell 17.3% from their peak. So far, they have fallen 8.3% in 2017. Similarly, oil (DWT) (UCO) prices have risen ~9% in 2017.

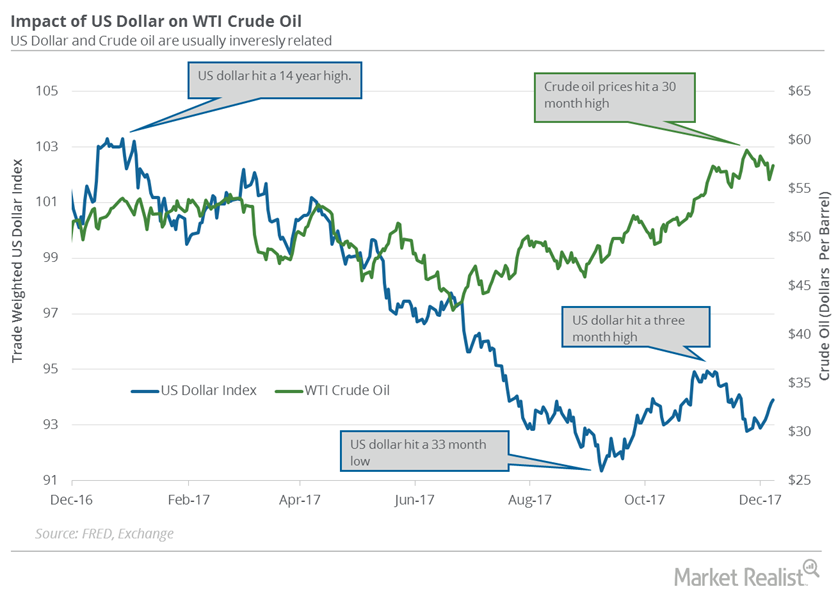

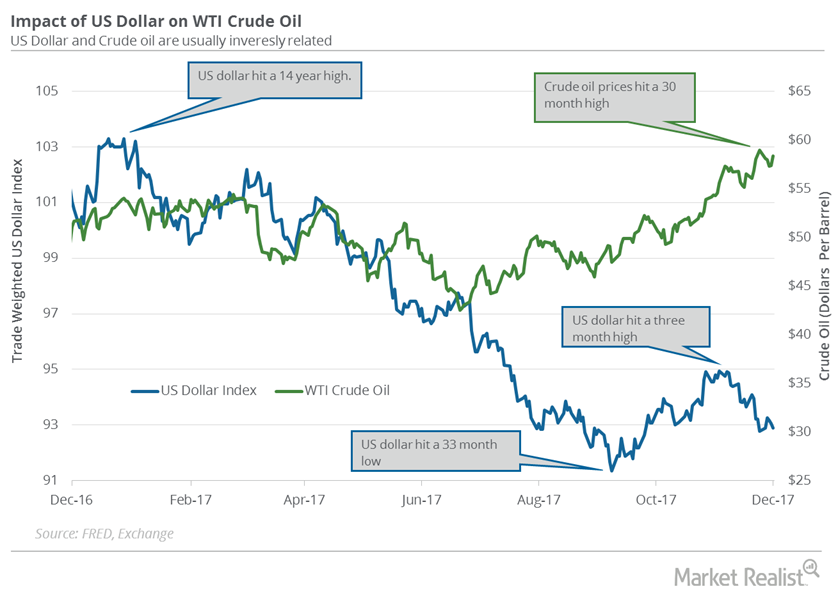

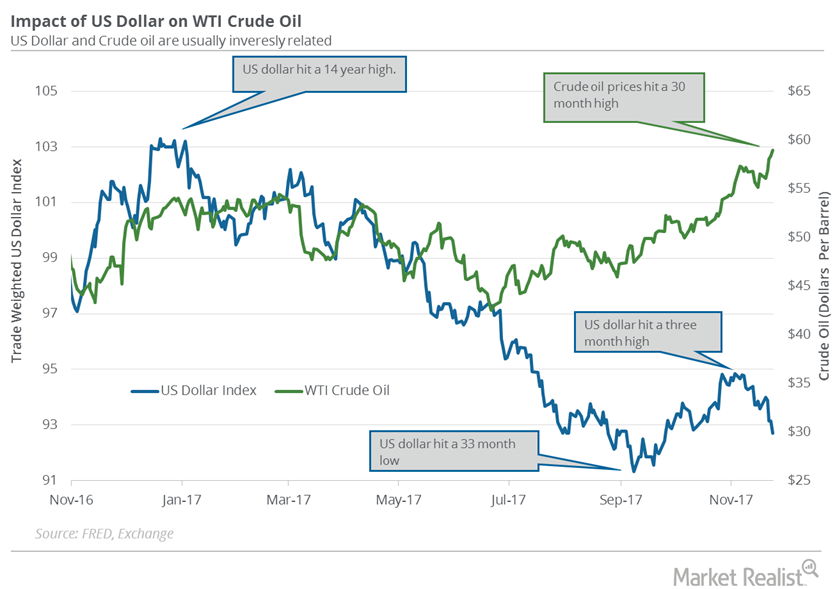

How Could US Tax Bill Affect Dollar and Crude Oil Prices?

The US Dollar Index advanced 0.1% to 92.8 last week. Consequently, it pressured oil prices during the week.

US Natural Gas Future Fell after the Natural Gas Inventory Report

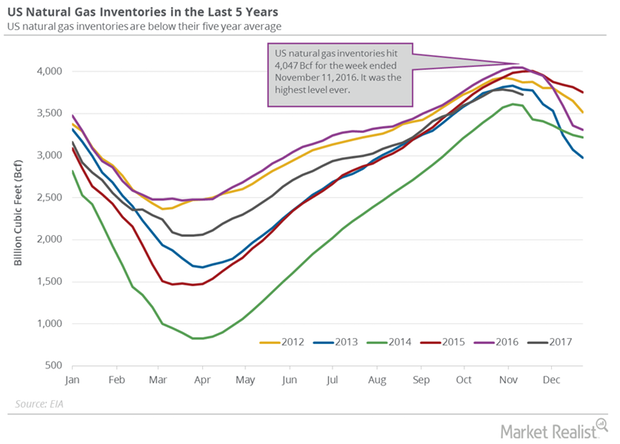

The EIA released its natural gas inventory report on November 30, 2017. US natural gas inventories fell by 33 Bcf to 3,693 Bcf on November 17–24, 2017.

US Dollar Is near a 2-Month Low

The US Dollar Index fell 0.5% to 92.7 on November 24, 2017—the lowest level in almost two months. The US dollar (UUP) fell 1.27% last week.

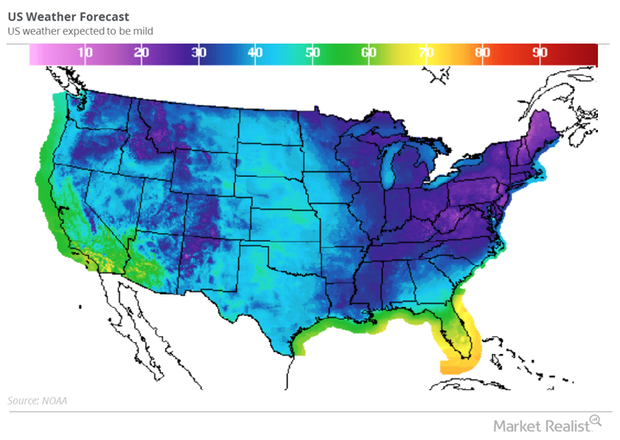

Weather Impacts the US Natural Gas Market

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu in electronic trading at 1:05 AM EST on November 24, 2017.

Are US Natural Gas Inventories Bullish for Natural Gas Futures?

The EIA estimates that US gas inventories rose by 15 Bcf (billion cubic feet) or 0.4% to 3,790 Bcf on October 27–November 3, 2017.

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

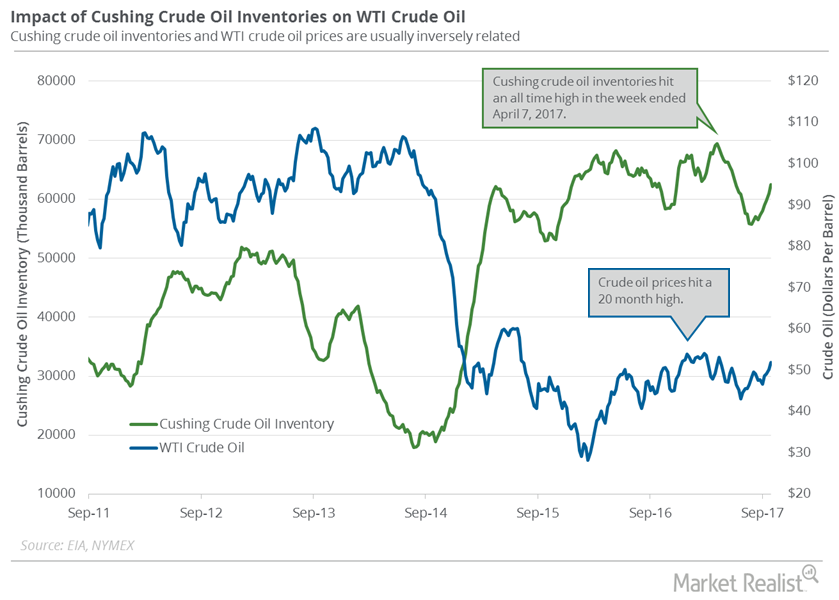

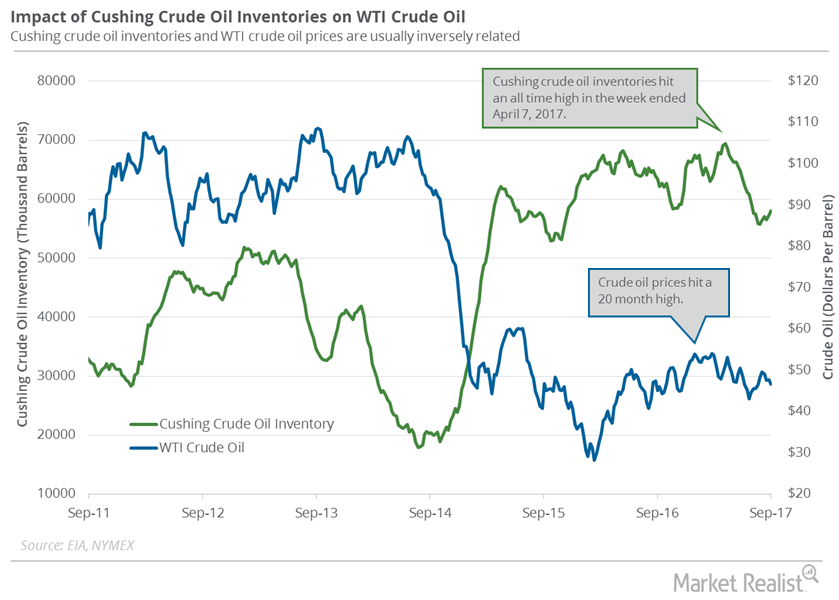

Cushing Inventories Are above Their 5-Year Average

Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

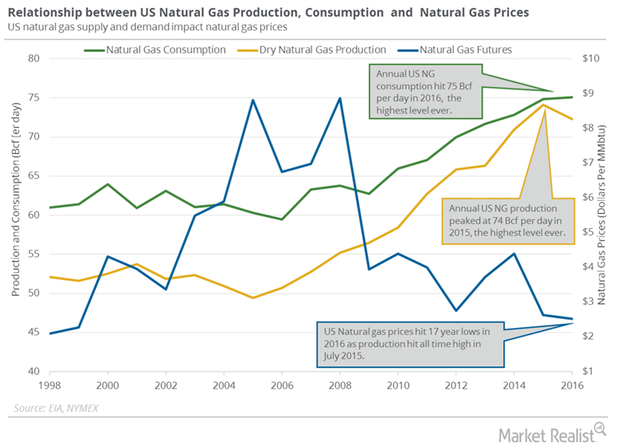

How US Natural Gas Production and Consumption Are Driving Prices

Market data provider PointLogic estimates that weekly US dry natural gas production fell by 0.2 Bcf (billion cubic feet) per day to 74.3 Bcf per day from September 21 to 27, 2017.

Hedge Funds Are Turning Bearish on US Crude Oil

Hedge funds reduced their net long positions in US crude oil futures and options by 12,094 contracts to 157,891 contracts on September 5–12, 2017.

Are US Crude Oil Supply and Demand Tightening?

WTI (West Texas Intermediate) crude oil (XLE)(XOP)(USO) futures contracts for October delivery rose 2.2% to $49.3 per barrel on September 13.

US Crude Oil Production Hit a 5-Month Low

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

Why Cushing Crude Inventories Rose for the 4th Time in 5 Weeks

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks.

Harvey and API Crude Oil Inventories: The Impact on Crude Futures

US crude oil futures contracts for October delivery fell 0.3% to $46.44 per barrel on August 29, 2017.