EV Energy Partners LP

Latest EV Energy Partners LP News and Updates

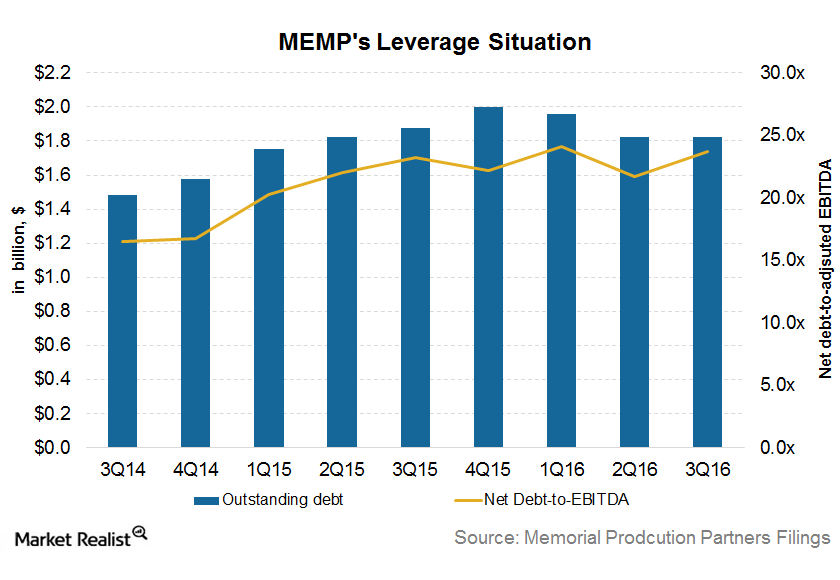

What Led to Memorial Production Partners’ Bankruptcy?

MEMP’s earnings improved in the recent quarter, but prior shortfalls were high and couldn’t be covered without a restructuring under Chapter 11 bankruptcy.

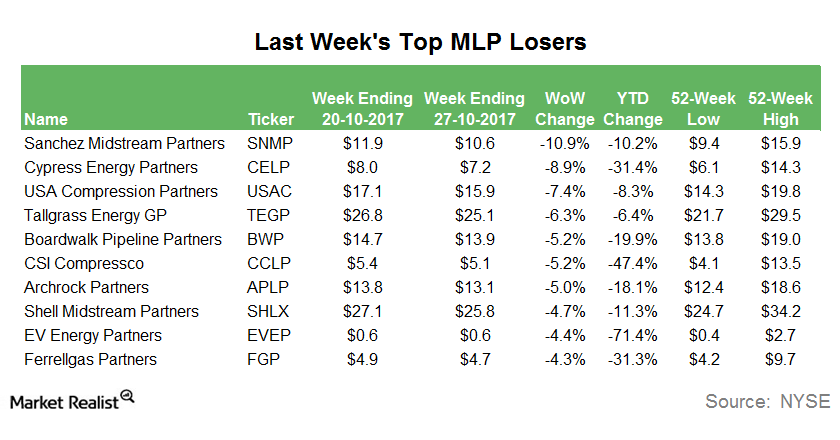

Last Week’s Biggest MLP Losers

Sanchez Production Partners (SNMP), the midstream MLP involved mainly in natural gas gathering, compression, and processing, was the biggest MLP loser last week.

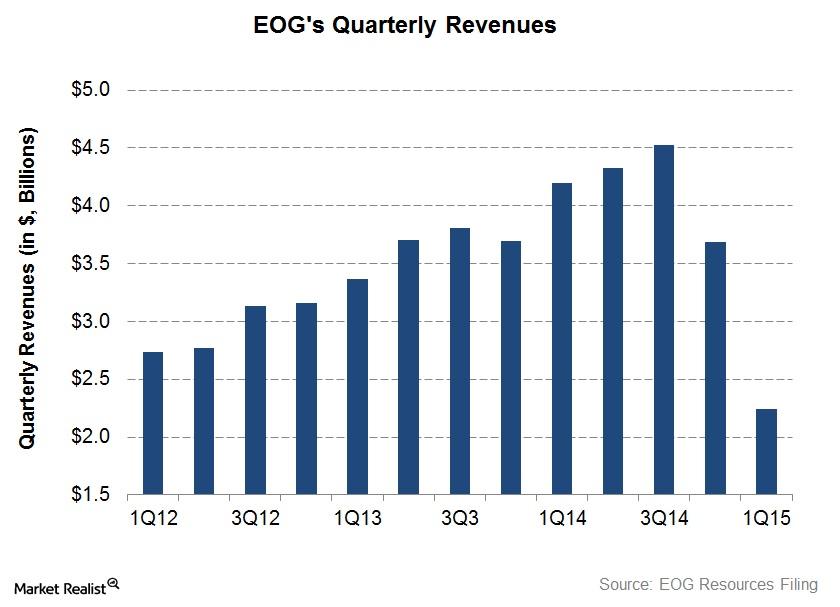

EOG Resources: Growing Revenue Is Battered by the Crude Oil Slump

EOG Resources’ 1Q15 adjusted revenue fell 39% quarter-over-quarter. This was mainly a result of the fall in crude oil and natural gas prices starting in 2H14.