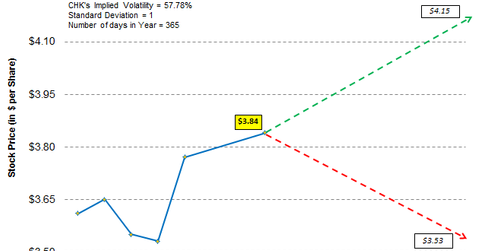

Chesapeake’s Implied Volatility: Stock Price Range Forecast

Chesapeake Energy’s (CHK) implied volatility as of October 30, 2017, was ~58%—9% higher than its 15-day average of ~53%.

Nov. 1 2017, Updated 1:55 p.m. ET

Implied volatility trends

Chesapeake Energy’s (CHK) implied volatility as of October 30, 2017, was ~58%—9% higher than its 15-day average of ~53%. In contrast, Noble Energy (NBL) and Cabot Oil & Gas (COG) have implied volatilities of ~27% and 30%, respectively.

Stock price forecast

Assuming a normal distribution of stock prices with a standard deviation of one and using Chesapeake Energy’s implied volatility of ~58%, we can estimate that Chesapeake Energy stock could close between $3.53 and $4.15 in the next seven days. Chesapeake Energy stock should stay within this range ~68% of the time.