Parsley Energy Inc Class A

Latest Parsley Energy Inc Class A News and Updates

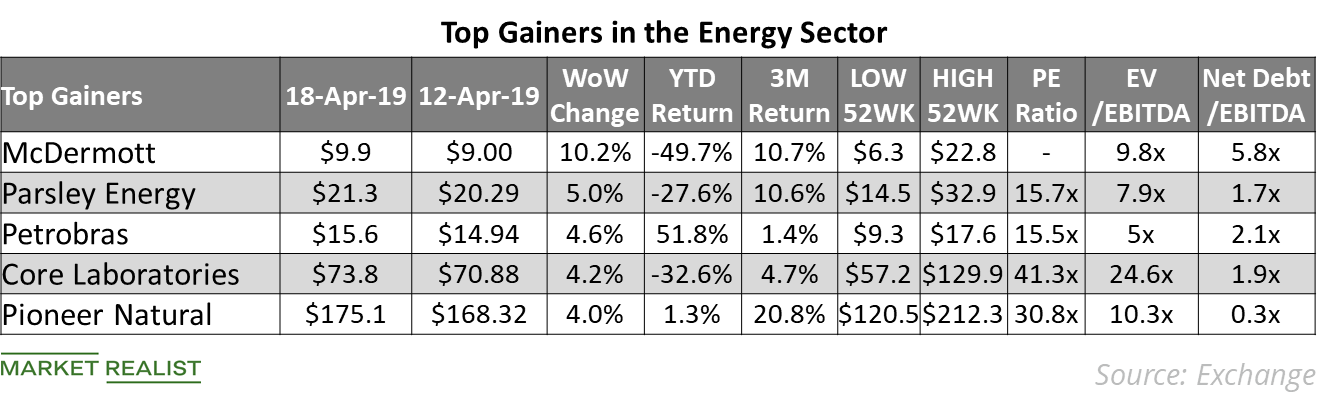

Top Energy Gains Last Week

On April 16, McDermott International announced that it will release its first-quarter earnings results on April 29.

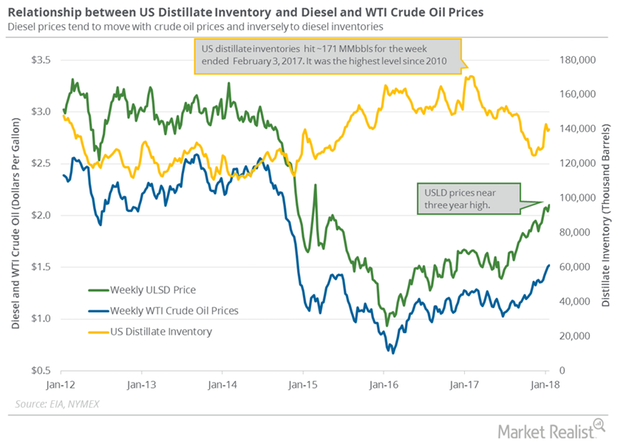

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

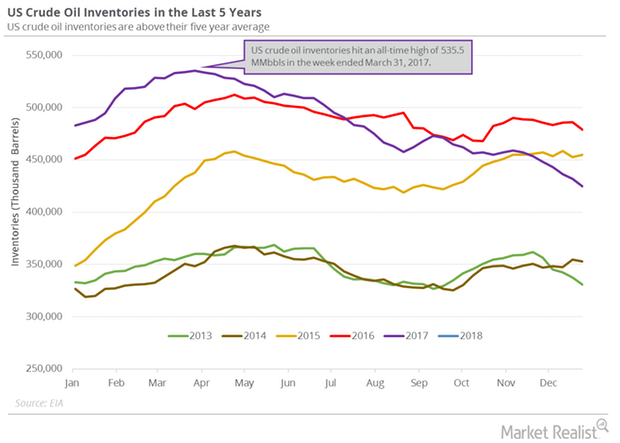

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

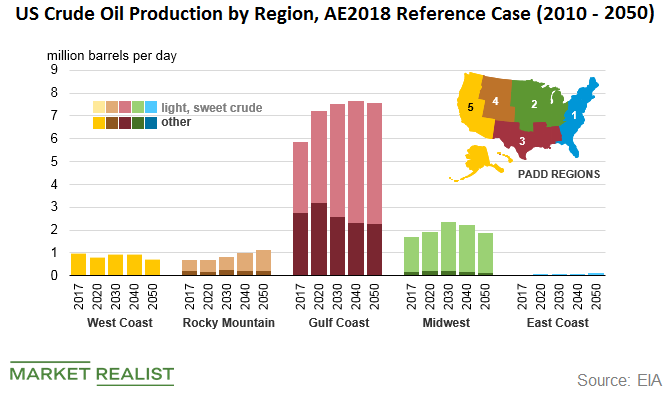

Light Sweet Crude Oil Drives US Crude Oil Production Growth

According to the EIA (U.S. Energy Information Administration), recent growth in US crude oil production has been driven primarily by light, sweet crude oil.

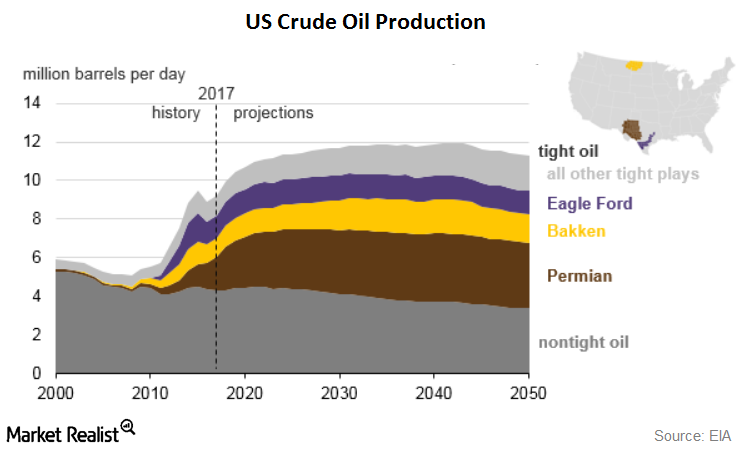

Tight Oil Contribution to Rise to 70%: Key Permian Basin Driver

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040.

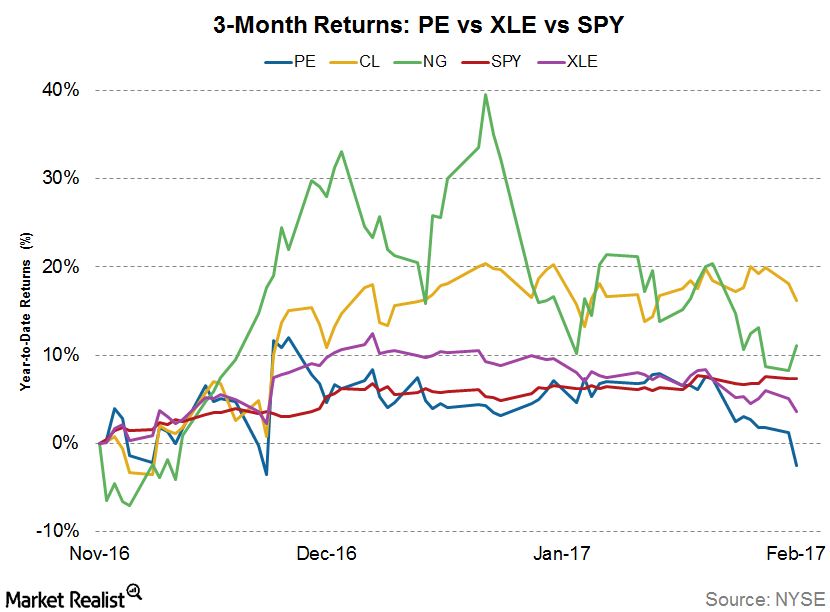

How Did Parsley Energy’s Stock React to Acquisition News?

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017.