Murphy Oil Corp

Latest Murphy Oil Corp News and Updates

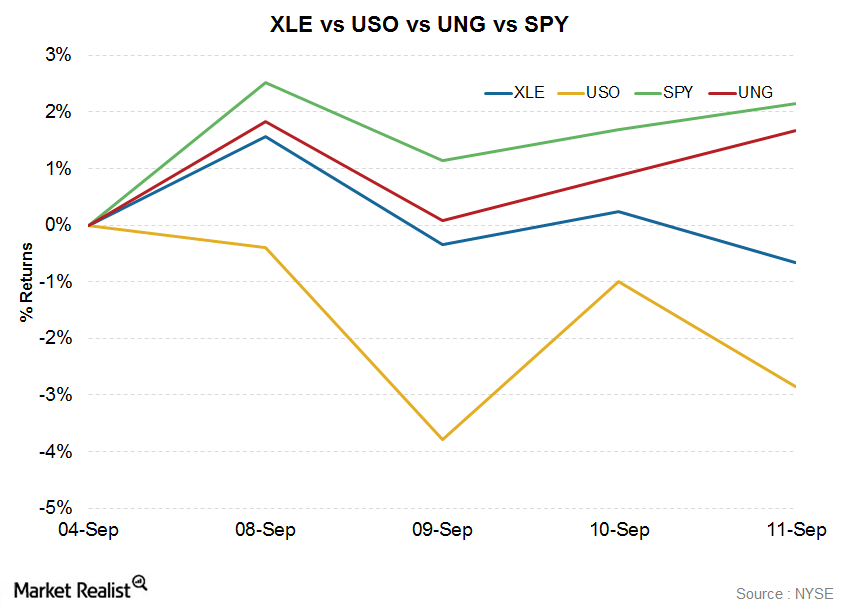

XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

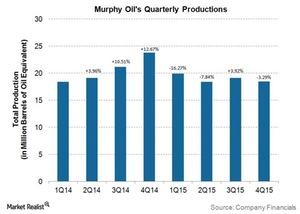

Murphy Oil’s 4Q15 Operational Performance, Management Strategies

Along with its 4Q15 earnings, Murphy Oil announced the divestiture of its Montney midstream assets located in Canada. The transaction includes the sale of existing infrastructure capable of processing up to 320 million cubic feet per day.

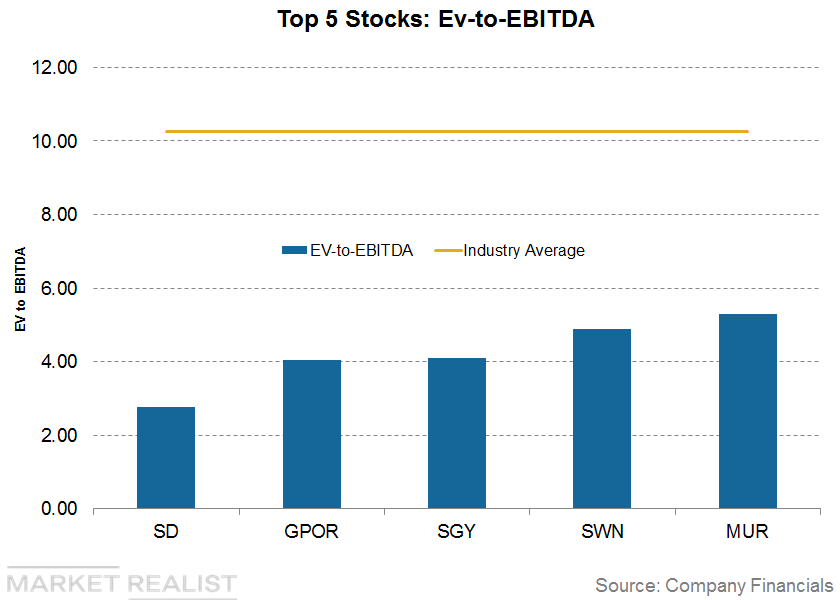

Upstream Companies with the Lowest EBITDA Multiples

As of the first quarter, Sandridge Energy’s (SD) EV-to-adjusted EBITDA ratio was ~2.77x. The company has a market capitalization of $529.83 million.Financials Why the inverted head and shoulder pattern is formed

The inverted head and shoulder pattern is the reverse of the head and shoulder pattern. It’s formed at the bottom of the downtrend.

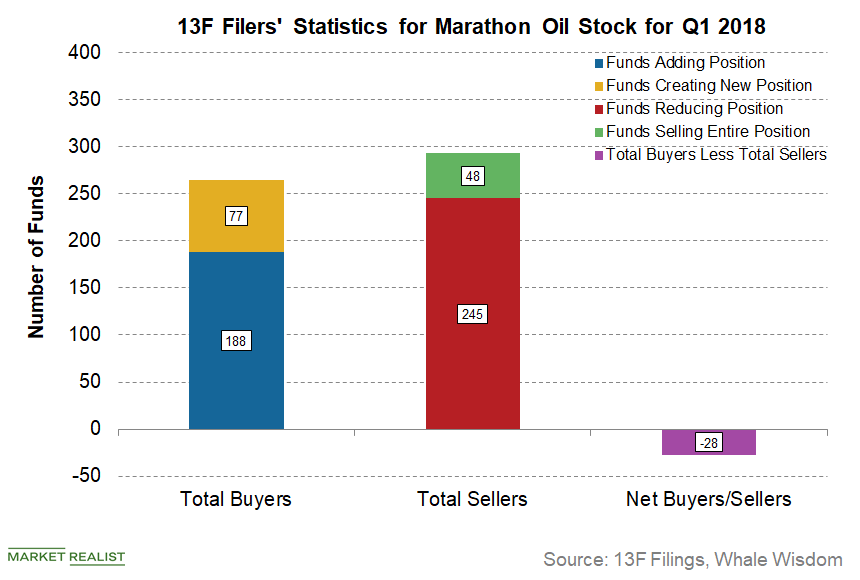

Are Institutional Investors Selling Marathon Oil Stock?

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

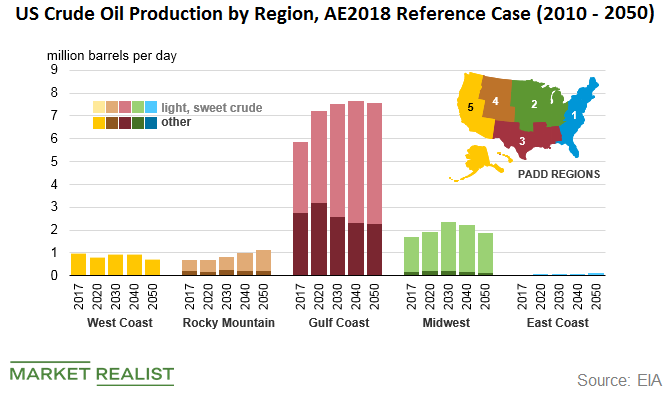

Light Sweet Crude Oil Drives US Crude Oil Production Growth

According to the EIA (U.S. Energy Information Administration), recent growth in US crude oil production has been driven primarily by light, sweet crude oil.

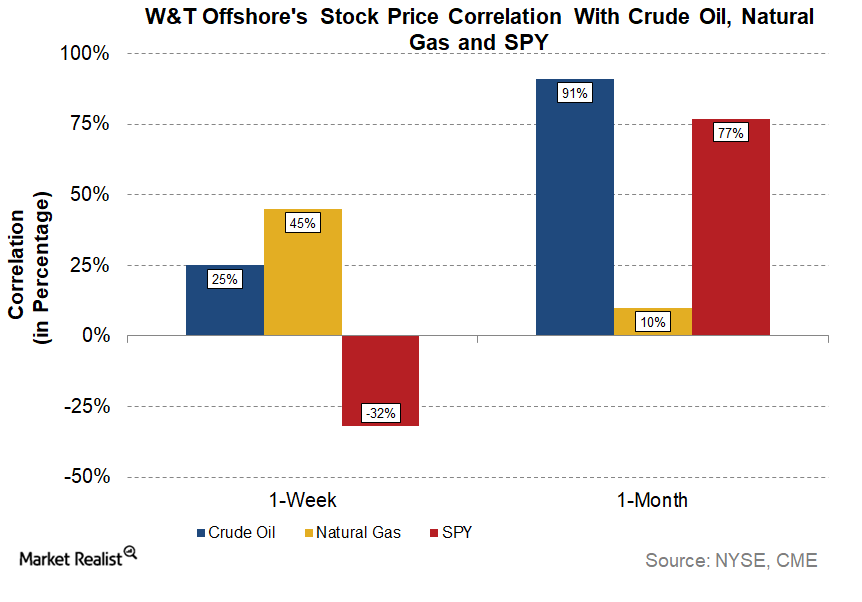

What Really Moved W&T Offshore Stock Last Week?

W&T Offshore (WTI) stock rose ~7% last week (ended September 29), while crude oil and the SPDR S&P 500 ETF (SPY) rose ~2% and ~0.7%, respectively.

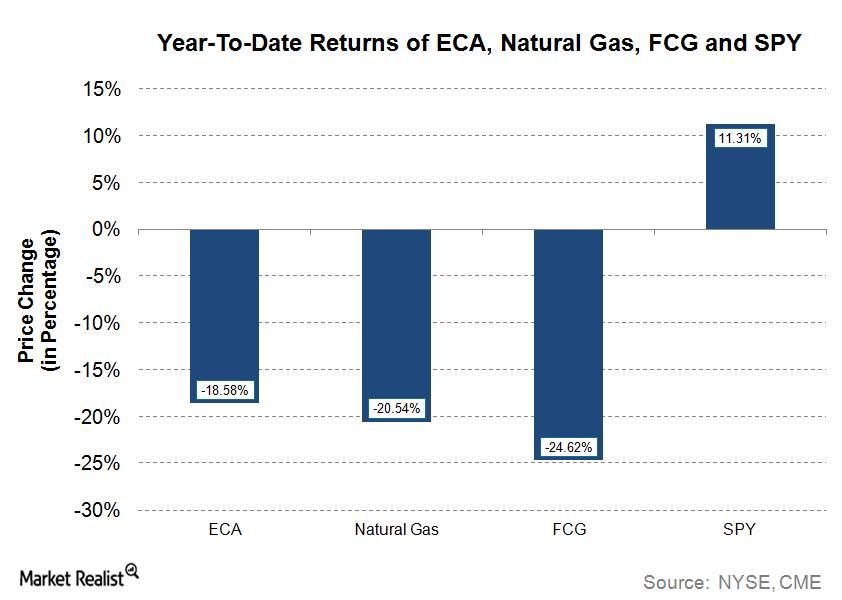

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

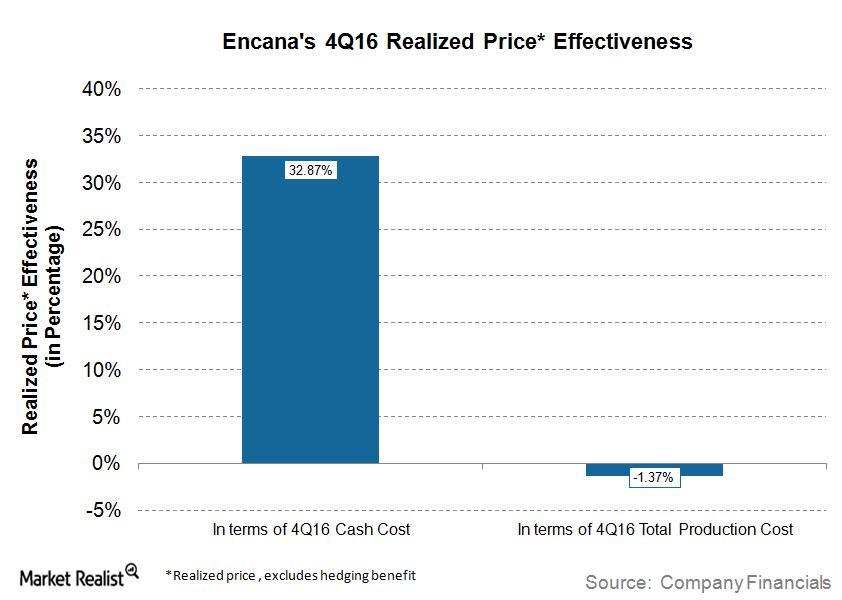

Analyzing Encana’s Realized Price Effectiveness

Encana’s (ECA) production cash cost has increased on a year-over-year basis. For 4Q16, Encana’s production cash cost was $17.92 per boe, higher than $17.74 per boe in 4Q15.

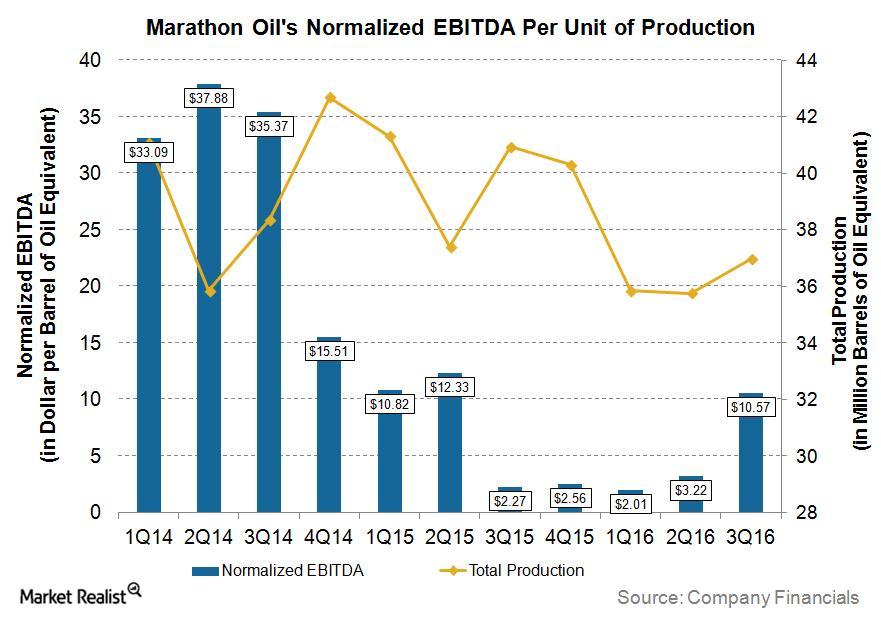

Understanding Marathon Oil’s EBITDA Normalized to Production

In 3Q16, Marathon Oil (MRO) reported normalized EBITDA per unit of production of ~$10.57 per boe, which was ~366% higher than in 3Q15.

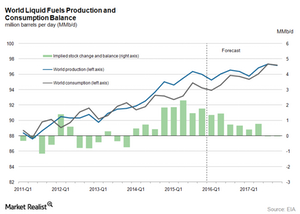

Why Is There a Crude Oil Supply and Demand Gap in 2016 and 2017?

The EIA estimates the global crude oil supply and demand gap to average 1 MMbpd in 2016 and 0.2 MMbpd in 2017. It reported that global consumption should grow 1.2 MMbpd in 2016 and 1.5 MMbpd in 2017.

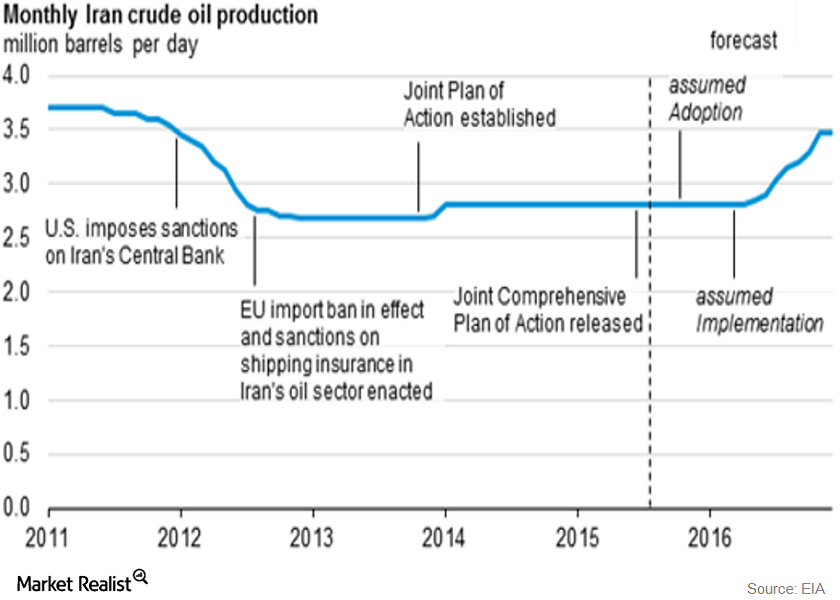

Iran’s Oil Sanctions Lifted: Brent Oil Prices Feel the Heat

Thus, Iran’s Western oil sanctions were lifted on Saturday, January 16, 2016. On Sunday, January 17, Iran stated that it would increase its crude oil production by 500,000 bpd (barrels per day) as soon as possible.

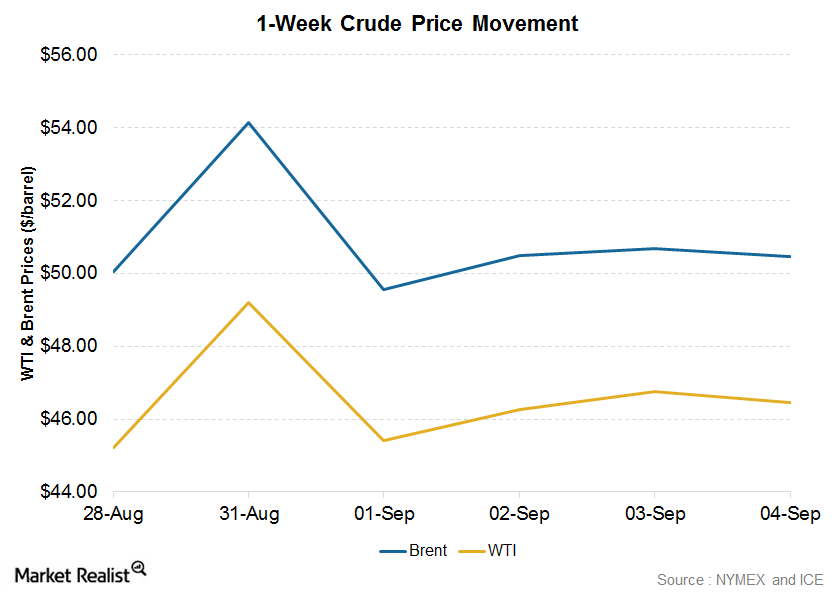

A Volatile Week for Crude Oil Prices: Analyzing the Key Reasons

WTI crude oil prices closed 1.83% higher on a weekly basis at $46.05 per barrel in the week ended September 4. Brent crude fell by 0.87% on a weekly basis, closing at $49.61 on September 4.

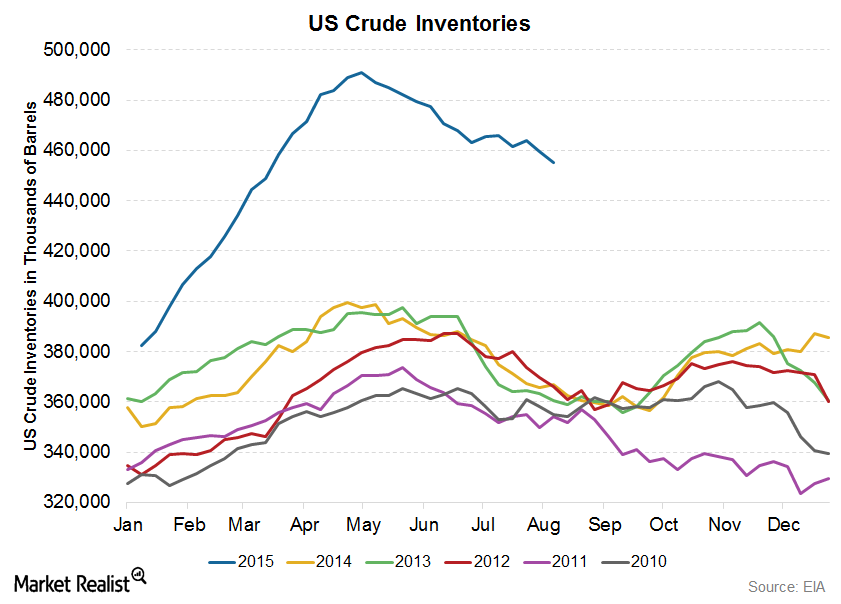

Crude Oil Inventories Fell, but Why Did WTI Crude Prices Slump?

The U.S. Energy Information Administration reported a decrease of 4.4 million barrels in crude oil inventories for the week ended July 31.