WPX Energy Inc

Latest WPX Energy Inc News and Updates

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

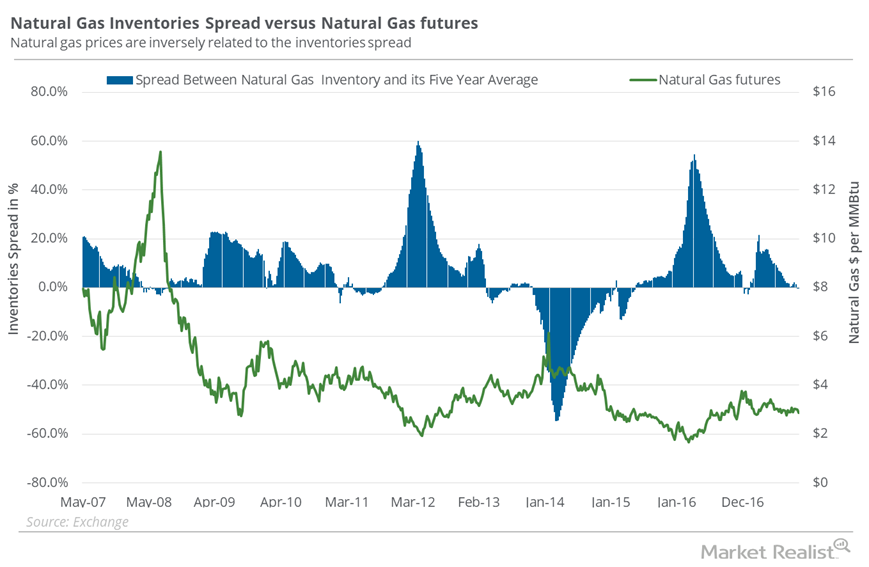

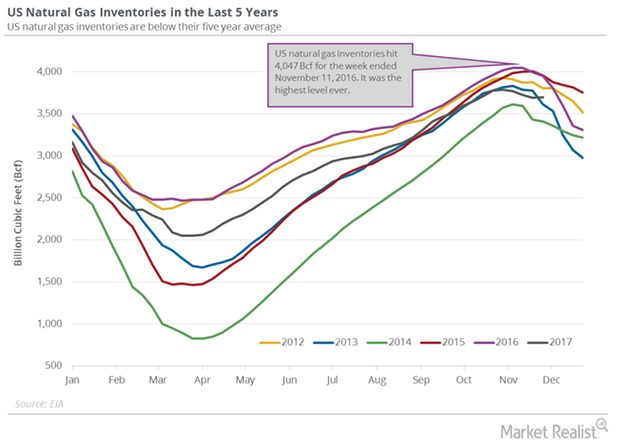

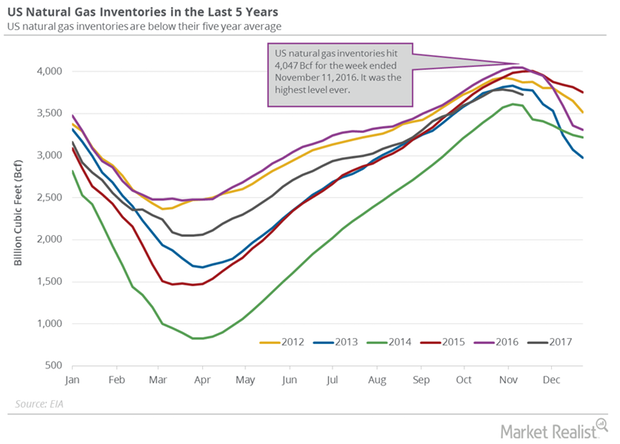

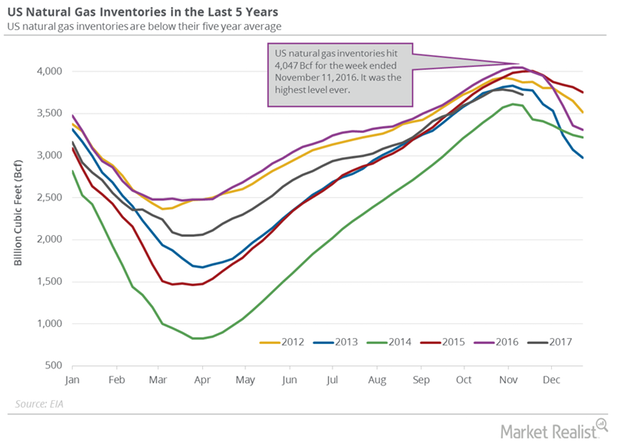

How the Inventory Spread Could Boost Natural Gas Prices

In the week ended October 6, natural gas inventories rose by 87 Bcf (billion cubic feet) to 3,595 Bcf—13 Bcf more than the market expected inventories to rise.

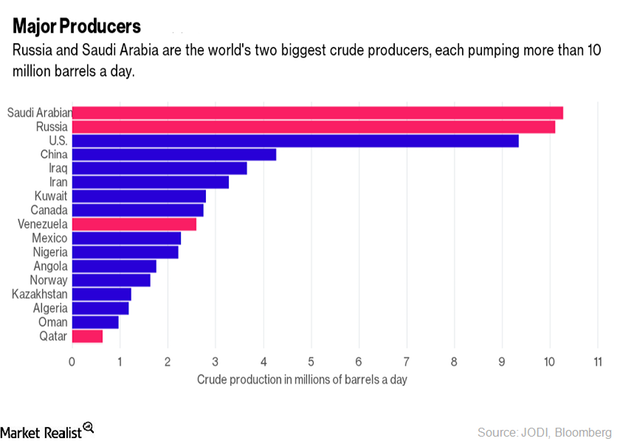

Will Oil Producers’ Meeting Support Crude Oil Prices in September?

OPEC producers will be meeting at an energy forum in Algeria from September 26–28, 2016. Crude oil prices are up by 16% so far in August 2016.

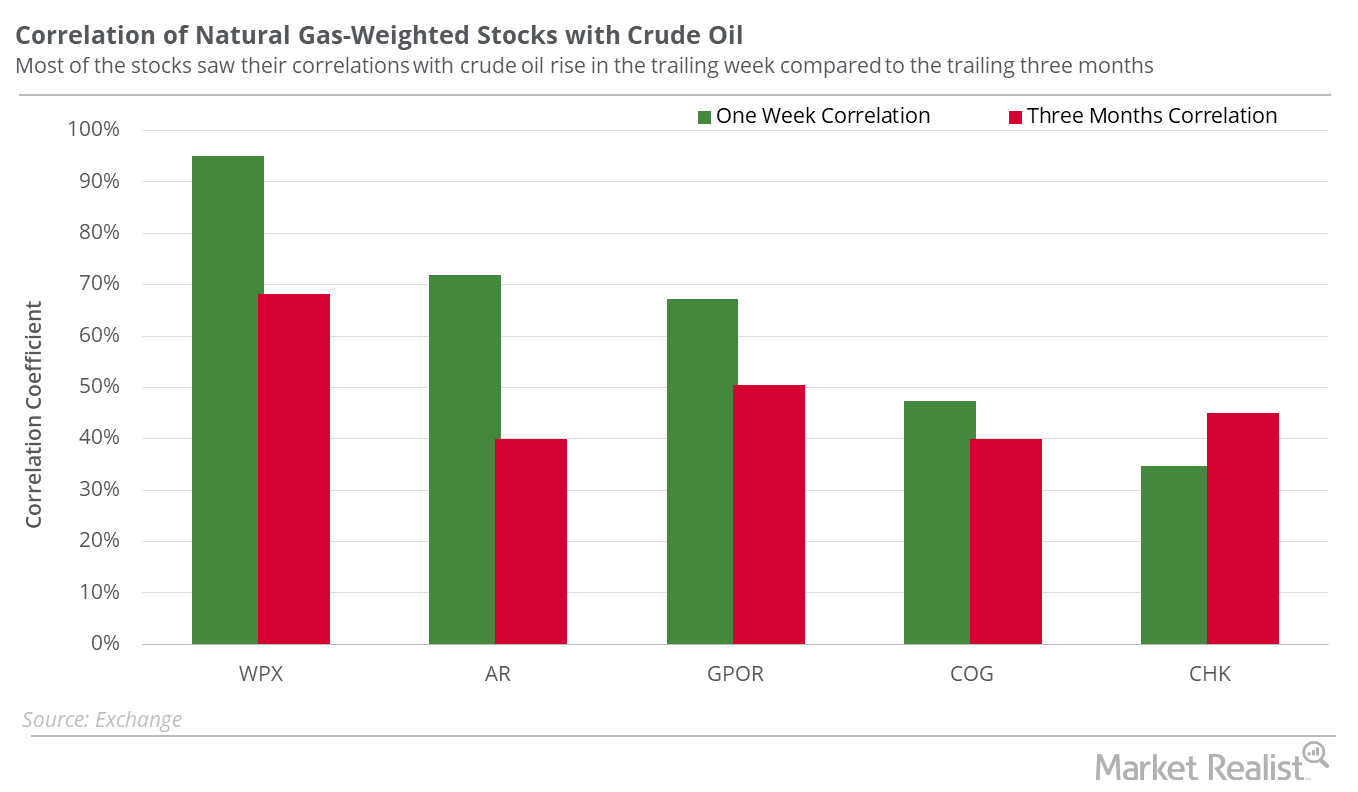

Which Natural Gas–Weighted Stocks Could Follow Oil?

WPX Energy had the lowest correlation with natural gas prices in the past five trading sessions. Southwestern Energy had among the highest correlations.

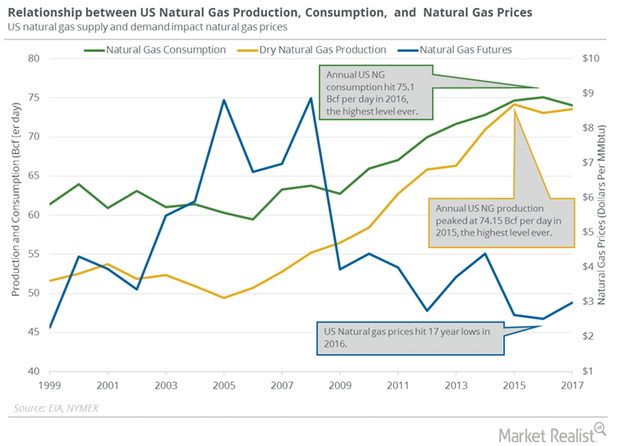

Decoding US Natural Gas Consumption Trends

PointLogic estimates that US natural gas consumption rose ~2.1% to 57.8 Bcf (billion cubic feet) per day from May 31 to June 6.

How Hedge Funds Feel about Natural Gas Right Now

On September 29, the CFTC (U.S. Commodity Futures Trading Commission) is slated to release its weekly “Commitment of Traders” report.

US Natural Gas Consumption Could Help the Prices

US natural gas consumption fell 0.17% to 57.1 Bcf/d (billion cubic feet per day) on October 12–18, 2017. It rose 3.1% from the same period in 2016.

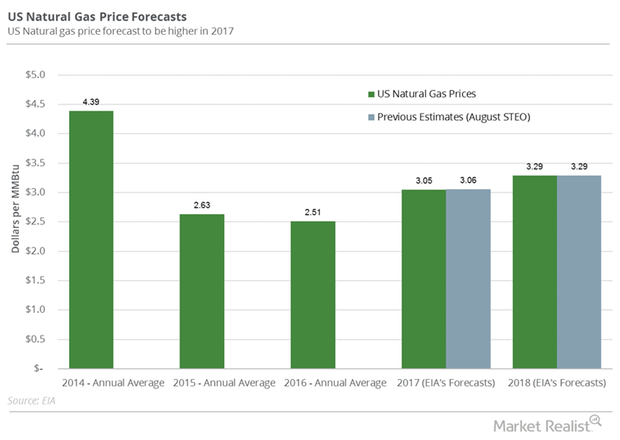

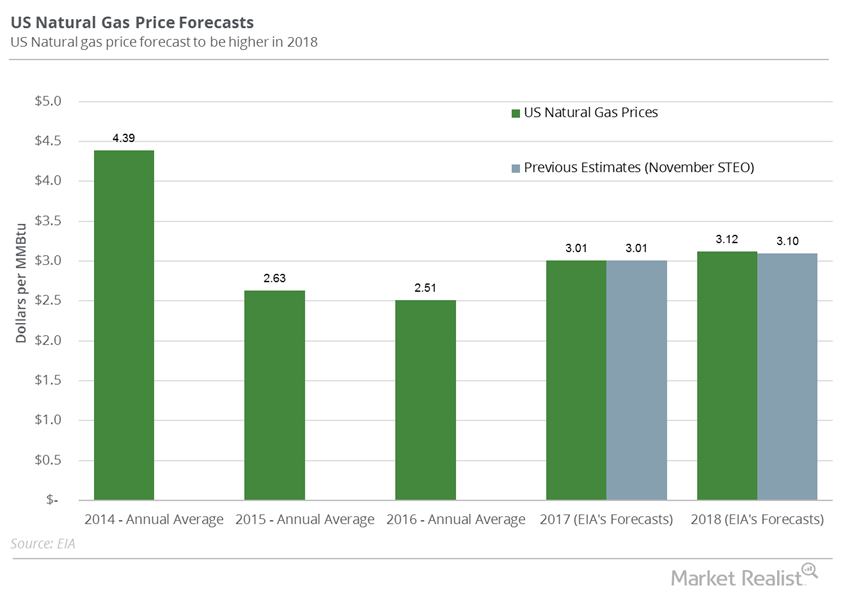

Will US Natural Gas Futures End 2017 on a Low Note?

January US natural gas (UGAZ) futures contracts were below their 100-day, 50-day, and 20-day moving averages on December 21, 2017.

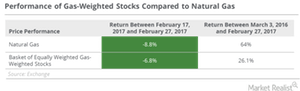

Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

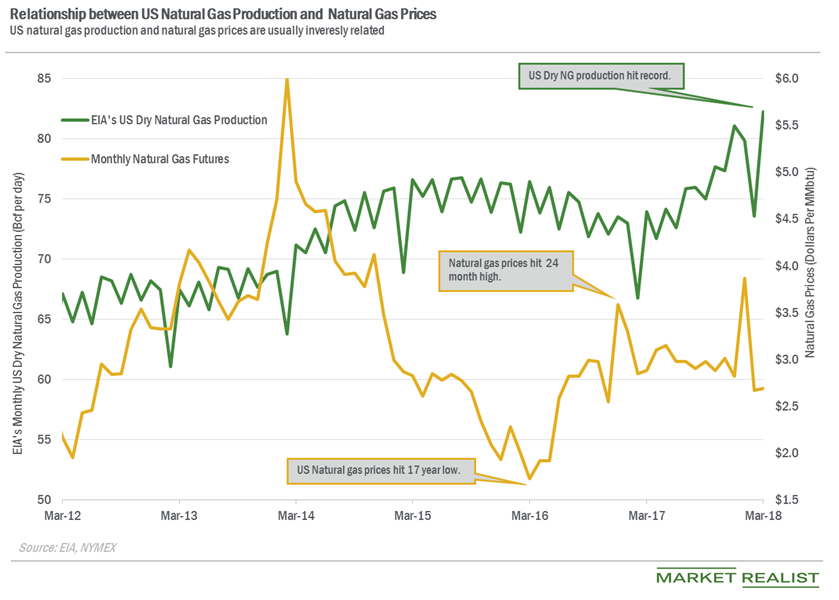

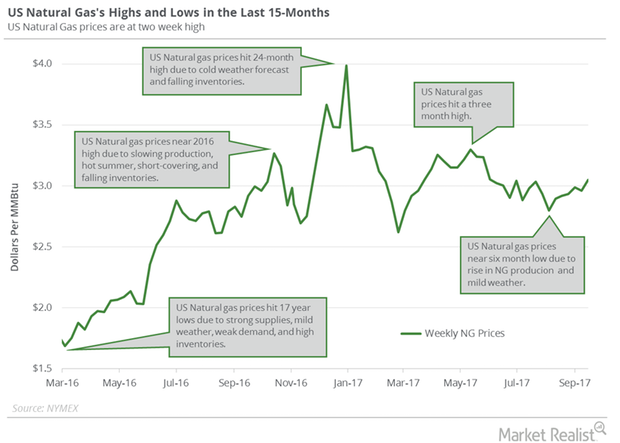

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.

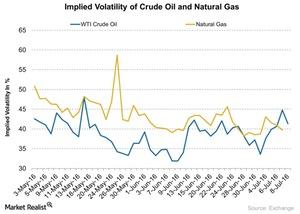

What Are the Implied Volatilities of Crude Oil and Natural Gas?

Crude oil’s (USO) (OIIL) implied volatility was 41.3% on July 8, 2016.

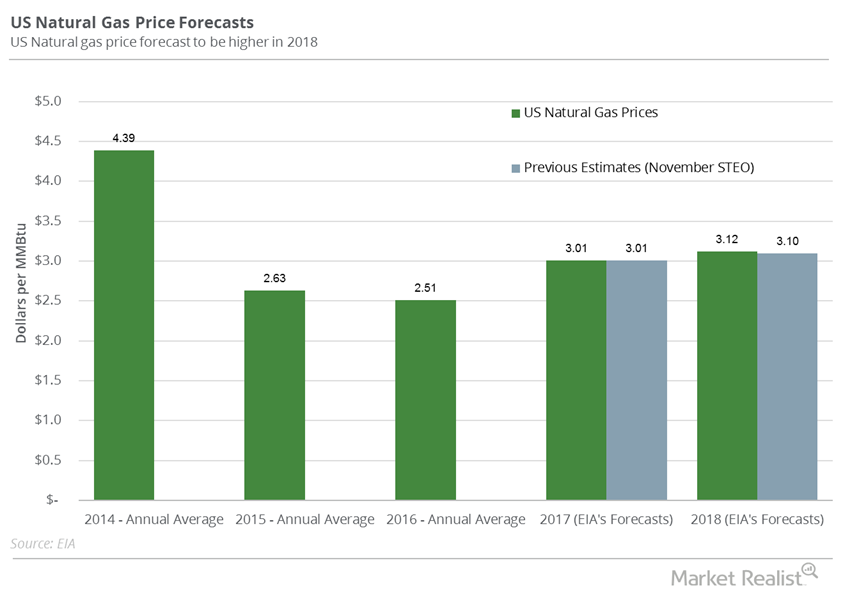

US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

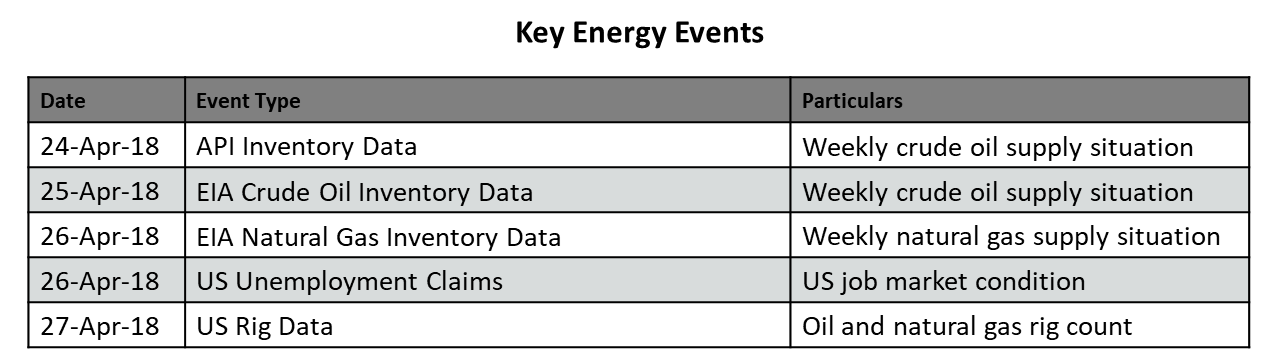

Key Energy Events This Week

The EIA’s crude oil and natural gas inventory data are scheduled to be released on April 25 and April 26, 2018, respectively.

US Natural Gas Production and Consumption Could Impact Prices

According to PointLogic, US dry natural gas production increased by 0.3 Bcf (billion cubic feet) per day to 75.7 Bcf per day on January 11–17, 2018.

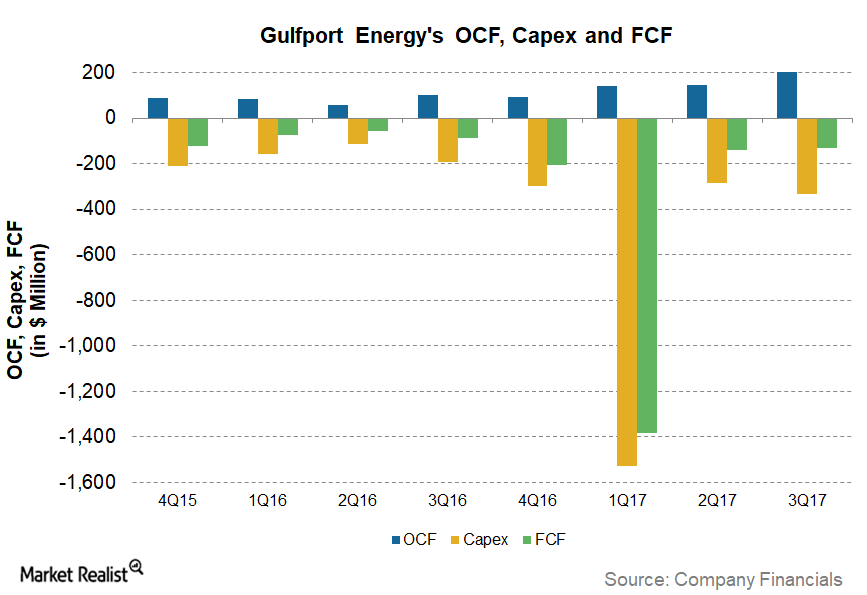

Is Gulfport Energy’s Normalized Free Cash Flow Trending Up?

For 9M17 (the first nine months of 2017), Gulfport Energy (GPOR) had normalized FCF (free cash flow) of -336%, the fourth lowest among the upstream producers we have been tracking.

Unexpected Rise in US Natural Gas Inventories

The EIA estimated that US natural gas inventories rose by 2 Bcf (billion cubic feet) to 3,695 Bcf on November 24–December 1, 2017.

US Natural Gas Future Fell after the Natural Gas Inventory Report

The EIA released its natural gas inventory report on November 30, 2017. US natural gas inventories fell by 33 Bcf to 3,693 Bcf on November 17–24, 2017.

US Natural Gas Inventories Have Fallen 8% from Last Year

The EIA estimated that US natural gas inventories fell by 46 Bcf (billion cubic feet) or 1.2% to 3,726 Bcf on November 10–17, 2017.

Why US Natural Gas Futures Hit a 2-Week High

US natural gas (DGAZ)(UGAZ)(UNG) futures contracts for October delivery rose 0.32% to $3.07 per MMBtu (million British thermal units) on Thursday, September 14.

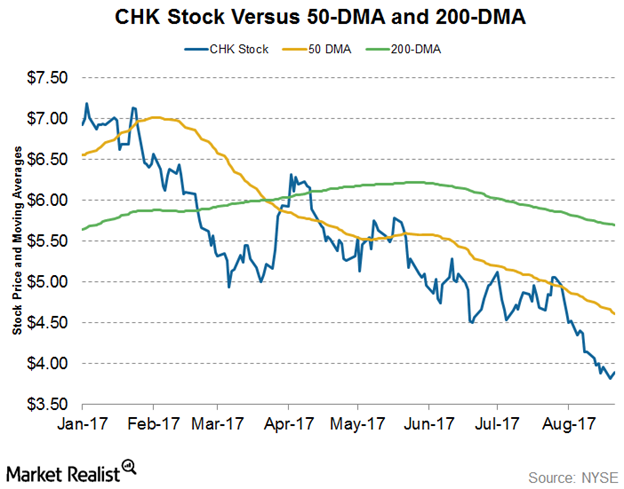

Can Chesapeake Energy Stock Rise from the Doldrums?

Chesapeake Energy stock (CHK) has fallen for most of this year. It picked up slightly in April but wasn’t able to hold those levels.

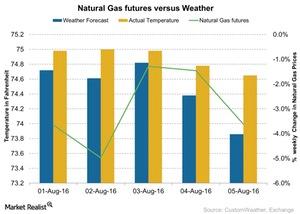

How Weather Could Impact Natural Gas Prices

In the week ended August 5, 2016, temperatures were higher than the forecast for the week. That boosted natural gas prices on August 3.

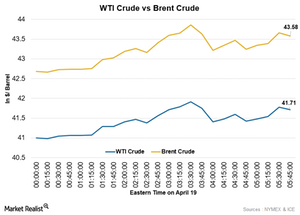

Why Did Oil Prices Rise This Morning?

Oil prices rose early today because of the oil workers’ strike in Kuwait. Here’s what you need to know.

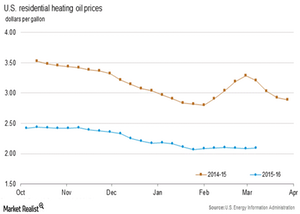

Why Did Heating Oil and Diesel Fuel Prices Rise?

US on-highway diesel fuel prices rose by 2% and were at $2.02 per on March 7, 2016. The current diesel prices are 46% lower than they were a year ago.

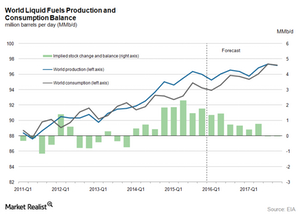

Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.

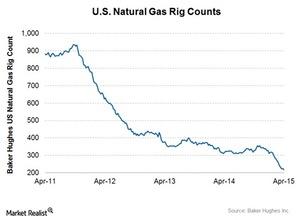

Natural Gas Rig Count Back to Downtrend in Week Ended April 17

There were 217 natural gas rigs operating in the week ended April 17, a loss of eight from the previous week. Natural gas rig count increased by three the previous week.