Are Hedge Funds Accumulating Southwestern Energy Stock?

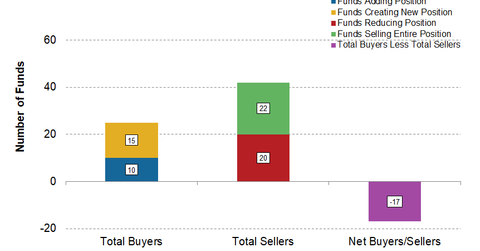

In 4Q17, 25 hedge funds were buyers of Southwestern Energy (SWN) stock, and 42 hedge funds were sellers.

Dec. 4 2020, Updated 10:53 a.m. ET

13F filers’ statistics for Southwestern Energy

In 4Q17, 25 hedge funds were buyers of Southwestern Energy (SWN) stock, and 42 hedge funds were sellers. That means that in 4Q17, total selling hedge funds outnumbered total buying hedge funds by 17. As of December 31, 2017, 54 hedge funds that filed Form 13F held SWN in their portfolios. Three of those hedge funds had SWN in their top ten holdings.

However, when looked at from the aggregate number of shares point of view, 13F filing hedge funds in 4Q17 increased their aggregate SWN holdings by 14.4%, or from 88.8 million shares to 101.6 million shares.

As of December 31, 2017, Southwestern Energy had 587 million common shares outstanding.

For context, in 4Q17, 13F filing hedge funds increased their aggregate holdings in oil and gas production companies Marathon Oil (MRO) and Occidental Petroleum (OXY) by 81.3% and 16.7%, respectively.

Form 13F is an SEC (U.S. Securities and Exchange) mandate that has to be submitted by all institutional investors who manage more than $100 million in assets. These institutional investors typically include hedge funds, insurance companies, banks, and investment advisors who have access to in-depth research and greater capital. Typically, when institutional investors buy a stock, there’s a chance that the stock could do well.